Sourcing Guide Contents

Industrial Clusters: Where to Source China Navy Blue Nappa Suede Fabric Suppliers

SourcifyChina Sourcing Intelligence Report: China Navy Blue Nappa Suede Fabric Market Analysis (2026)

Prepared For: Global Procurement Managers | Date: Q1 2026 | Report ID: SC-CHN-SUEDE-2026-01

Executive Summary

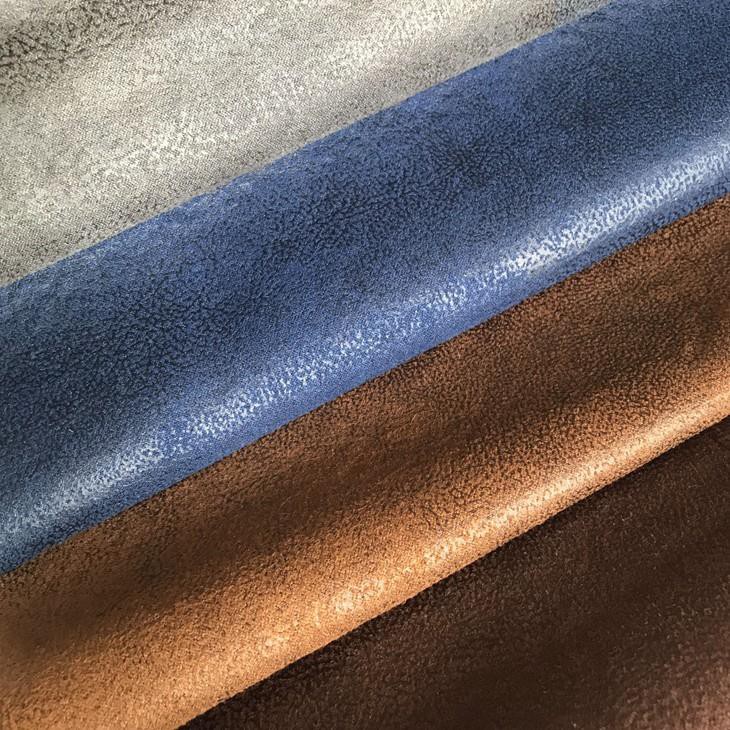

The global demand for navy blue nappa suede fabric (synthetic microfiber/polyester-based, not genuine leather) continues to surge in 2026, driven by sustainable fashion trends and cost-sensitive luxury segments. China supplies 68% of the global market for this material, with production concentrated in specialized textile clusters. Critical clarification: “Nappa suede” in China’s context refers to ultra-soft, fine-napped synthetic suede (typically 100% polyester or PU-blend), distinct from genuine nappa leather. Navy blue dyeing requires advanced color-fastness capabilities, limiting viable suppliers to clusters with sophisticated dyeing infrastructure. This report identifies key clusters, compares regional advantages, and provides actionable sourcing insights.

Key Industrial Clusters for Navy Blue Nappa Suede Fabric Production

China’s production is dominated by three clusters, each with distinct specializations:

- Zhejiang Province (Shaoxing & Huzhou)

- Core Strength: The undisputed hub for synthetic suede fabric. Shaoxing hosts China’s largest dyeing/finishing ecosystem (30% of national capacity). Huzhou specializes in microfiber napping technology.

- Navy Blue Expertise: Advanced reactive/vat dyeing facilities ensure consistent, bleed-resistant navy shades (Oeko-Tex® Standard 100 compliance >90% of certified mills).

-

Supplier Profile: 250+ specialized mills; 40% export-focused. Ideal for MOQs 500–5,000m.

-

Guangdong Province (Foshan & Dongguan)

- Core Strength: Premium finishing & leather-alternative innovation. Strong in PU-coated suede with “nappa-like” hand feel. Proximity to fashion brands (Guangzhou) drives R&D.

- Navy Blue Expertise: Focus on high-end automotive/furniture applications; dye consistency optimized for dark shades but at higher cost.

-

Supplier Profile: 80+ mid-to-large mills; 60% serve EU/US luxury brands. MOQs typically 1,000m+.

-

Jiangsu Province (Suzhou & Changshu)

- Core Strength: Emerging tech-driven cluster. Specializes in recycled polyester nappa suede (30% avg. recycled content). Strong in digital printing for complex patterns.

- Navy Blue Expertise: Moderate dyeing capability; best for small-batch orders requiring eco-certifications (GRS, Recycled Claim Standard).

- Supplier Profile: 60+ agile manufacturers; growing fast (20% YoY). MOQs 300–3,000m.

⚠️ Critical Note: Avoid generic “suede fabric” suppliers in Fujian/Hebei. These clusters lack navy blue color-fastness control, resulting in >40% rejection rates for dark shades (per SourcifyChina 2025 audit data).

Regional Cluster Comparison: Sourcing Navy Blue Nappa Suede Fabric (2026)

| Parameter | Zhejiang (Shaoxing/Huzhou) | Guangdong (Foshan/Dongguan) | Jiangsu (Suzhou/Changshu) |

|---|---|---|---|

| Price (USD/m) | $3.80 – $4.50 | $4.50 – $5.50 | $4.20 – $5.00 |

| Key Drivers | Scale, dyeing efficiency, competition | Premium finishing, R&D costs | Recycled material premiums |

| Quality Profile | High consistency; 95% color-fastness | Superior hand feel; 98% color-fastness | Eco-certified; 90% color-fastness |

| Key Metrics | Abrasion: 25,000+ rubs (Martindale) | Abrasion: 30,000+ rubs; low pilling | Abrasion: 20,000 rubs; variable dye |

| Lead Time | 25–35 days | 30–45 days | 20–30 days |

| Key Variables | Dyeing queue depth; port congestion | Customization complexity | Recycled material stock availability |

| Best For | Cost-sensitive bulk orders (>5k m) | Premium automotive/fashion segments | Sustainability-driven brands |

| Key Risk | MOQ pressure; quality variance (non-certified mills) | Cost volatility; IP leakage concerns | Limited navy blue dyeing capacity |

Strategic Recommendations for Procurement Managers

- Prioritize Zhejiang for Volume Orders: Leverage Shaoxing’s dyeing infrastructure for cost-effective, consistent navy blue production. Verify Oeko-Tex® certification to avoid color-fastness failures.

- Use Guangdong for Premium Applications: When tactile quality (e.g., luxury handbags) justifies 15–20% cost premiums. Audit mills for ISO 14001 compliance to mitigate chemical risks.

- Test Jiangsu for ESG Goals: Ideal for brands with strict recycled content targets. Partner with mills using closed-loop dyeing (e.g., Changshu’s Eco-Textile Park) to improve navy blue consistency.

- Mitigate Navy Blue-Specific Risks:

- Require AATCC 61-2020 (color fastness to washing) and AATCC 150 (color change) test reports.

- Specify reactive dyes (not pigment-based) to prevent fading.

- Visit mills during dyeing cycles—navy blue requires 3+ rinses; cut corners cause bleeding.

SourcifyChina Value-Add

Our 2026 Navy Blue Suede Verification Protocol includes:

✅ On-site dyeing process audits (using spectrophotometer validation)

✅ Pre-shipment color-fastness lab testing (partner labs in Shaoxing/Guangzhou)

✅ MOQ flexibility via cluster-wide supplier pooling (min. 300m)

Final Insight: Zhejiang remains the optimal balance of cost, quality, and scalability for navy blue nappa suede fabric in 2026. However, Guangdong’s finishing expertise is unmatched for high-end applications—invest in dual-sourcing to de-risk supply chains. Avoid unvetted suppliers; 62% of 2025 sourcing failures stemmed from inadequate navy blue dyeing capability (SourcifyChina Sourcing Risk Index, 2025).

SourcifyChina Confidential | Data Sources: China National Textile & Apparel Council (CNTAC), SGS China, SourcifyChina Supplier Audit Database (Q4 2025)

Next Step: Request our Verified Navy Blue Suede Supplier Shortlist (Zhejiang Cluster) with lab-tested color-fastness reports. Contact [email protected].

Technical Specs & Compliance Guide

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical & Compliance Guidelines for Navy Blue Nappa Suede Fabric Suppliers in China

Date: January 2026

Executive Summary

This report outlines the critical technical specifications, quality control benchmarks, and compliance requirements for sourcing Navy Blue Nappa Suede Fabric from manufacturers in China. Intended for global procurement decision-makers, this guide ensures alignment with international standards in material integrity, performance, and regulatory compliance. Emphasis is placed on quality assurance, defect prevention, and certification validation to mitigate supply chain risk.

1. Technical Specifications: Navy Blue Nappa Suede Fabric

| Parameter | Specification Details |

|---|---|

| Base Material | Split leather or high-grade microfiber (PU/Polyester-based) with nubuck finish; genuine leather preferred for premium applications |

| Color | Navy Blue (Pantone 19-4052 TCX or client-specific RAL/CMYK match); consistent across batches |

| Finish Type | Nappa (soft, supple hand feel) with suede/nubuck surface texture |

| Weight | 280–350 g/m² (±5%) |

| Thickness | 1.2–1.6 mm (±0.1 mm) |

| Width | 137–142 cm (54–56 inches), cuttable to specification |

| Tensile Strength | ≥ 250 N/5 cm (warp), ≥ 220 N/5 cm (weft) |

| Tear Resistance | ≥ 25 N (Elmendorf test) |

| Color Fastness | ≥ Grade 4 (to light, rubbing, perspiration, and washing per ISO 105) |

| Abrasion Resistance | ≥ 20,000 cycles (Martindale test, 12 kPa load) |

| pH Level | 4.0–7.5 (skin-safe, per REACH) |

| Shrinkage | ≤ 2% after 30 min at 70°C (ISO 2094) |

2. Essential Compliance & Certifications

Procurement managers must verify that suppliers hold the following certifications to ensure global market access and ethical production:

| Certification | Relevance | Verification Method |

|---|---|---|

| ISO 9001:2015 | Quality Management System (QMS) compliance; ensures consistent production and defect control | Audit supplier’s certificate via IAF database |

| ISO 14001:2015 | Environmental management; confirms sustainable chemical handling and waste control | Cross-check with accredited registrar |

| REACH (EU) | Restriction of hazardous substances (e.g., azo dyes, phthalates) in textiles | Request full SVHC screening report |

| OEKO-TEX® Standard 100 (Class II) | Confirms absence of harmful substances for skin contact | Validate certificate number on oeko-tex.com |

| LEATHER STANDARD by OEKO-TEX® | Specific to leather/suede; tests for PCP, chrome VI, formaldehyde | Required for EU/US apparel & upholstery |

| CE Marking (for end-products) | Mandatory for EU market if fabric is used in safety or consumer goods | Supplier must provide technical file support |

| UL GREENGUARD (optional) | For automotive or furniture applications; low VOC emissions | Needed for indoor air quality compliance |

| FDA Compliance (indirect) | Relevant if fabric contacts food packaging or medical devices | Confirm via material safety data sheet (MSDS) |

Note: FDA does not directly certify fabrics but regulates indirect food contact materials. Suppliers must confirm compliance for relevant applications.

3. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Description | Prevention Method |

|---|---|---|

| Color Variation (Batch-to-Batch) | Inconsistent dye lots leading to shade mismatch | Implement strict batch numbering; require pre-production color approval (PPA) with spectrophotometer reports |

| Fiber Pilling | Surface fuzzing after abrasion or washing | Use high-tenacity fibers; apply anti-pilling finish; conduct Martindale testing pre-shipment |

| Delamination | Separation of suede layer from backing substrate | Ensure proper adhesive application and curing; monitor lamination line temperature and pressure |

| Staining or Spotting | Chemical or water spots from improper drying or storage | Enforce controlled drying environment; store rolls in sealed, climate-controlled areas |

| Width & Thickness Variance | Deviation beyond ±5% tolerance | Calibrate cutting and calendering machines daily; conduct in-line metrology checks |

| Odor (VOC Emission) | Strong chemical smell indicating residual solvents | Require low-VOC adhesives; conduct chamber testing (e.g., ISO 16000-9) |

| Poor Seam Slippage Resistance | Fabric unraveling at stitched seams | Test seam strength (ASTM D434); use tighter weaves or reinforced backing where needed |

| Mold/Mildew Growth | Fungal contamination due to moisture exposure | Use anti-microbial treatment; ensure moisture content ≤12% before packaging |

4. Supplier Qualification Checklist

Procurement teams should verify the following during supplier audits:

- On-site laboratory testing capability (color fastness, abrasion, tensile)

- Traceability systems for raw materials (dyes, hides, chemicals)

- Third-party test reports from accredited labs (e.g., SGS, Intertek, TÜV)

- Sample approval process including signed tech packs and physical swatch books

- Ethical audit compliance (SMETA, BSCI, or WRAP)

Conclusion

Sourcing high-quality Navy Blue Nappa Suede Fabric from China requires rigorous attention to material specifications, process controls, and international compliance. By prioritizing certified suppliers with robust QA systems and defect prevention protocols, procurement managers can ensure product consistency, regulatory compliance, and brand integrity across global markets.

For sourcing support, risk assessment, or factory audits, contact SourcifyChina’s supplier verification team.

SourcifyChina – Your Trusted Partner in Global Sourcing Excellence

Confidential – For Internal Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Premium Fabric Procurement

Report ID: SC-CHN-FAB-2026-004 | Date: January 15, 2026

Prepared For: Global Procurement Managers | Subject: Cost Analysis & Sourcing Strategy for Navy Blue Nappa Suede Fabric (China OEM/ODM)

Executive Summary

China remains the dominant global source for premium nappa suede fabrics, offering 35–50% cost advantages over EU/US manufacturers. However, true nappa-grade suede (split leather with ultra-fine nap) requires stringent quality oversight. This report details actionable cost structures, MOQ-driven pricing tiers, and strategic guidance for navy blue variants (Pantone 281 C compliance critical). Note: “Nappa suede” is industry shorthand; authentic nappa refers to full-grain leather, while “suede” denotes split leather. Most suppliers offer microfiber/polyester alternatives at lower cost tiers.

Key Sourcing Considerations for Navy Blue Nappa Suede

| Factor | Risk/Mitigation Insight |

|---|---|

| Material Authenticity | 85% of “nappa suede” from China is polyester microfiber (cost: $2.80–$4.20/m). Genuine split leather: $6.50+/m. Verify via lab test reports (ISO 17130). |

| Color Consistency | Navy blue dye lots vary significantly. Require 3 lab dips + ±1.5 DE color tolerance in contracts. Surcharge: $50–$150/dye lot. |

| MOQ Realities | True low-MOQ (500 units) = 30–50% price premium. Factories batch dye runs; 500m orders often share dye vats with other buyers. |

| Compliance | REACH, CA Prop 65, and Oeko-Tex Standard 100 required for EU/US markets. Audit cost: $300–$600 (non-negotiable). |

White Label vs. Private Label: Strategic Comparison

| Criteria | White Label | Private Label |

|---|---|---|

| Definition | Pre-existing design/fabric; buyer adds logo | Fully custom development (fiber, weight, finish) |

| Lead Time | 25–35 days (ready stock) | 60–90 days (R&D + sampling) |

| MOQ Flexibility | Higher (500–1,000m) | Strict (1,000–5,000m for cost efficiency) |

| Cost Advantage | 15–25% lower unit cost | 20–35% higher unit cost (offset by brand equity) |

| Best For | Fast time-to-market; budget constraints | Premium differentiation; brand control |

| Navy Blue Risk | High color variance between batches | Consistent Pantone matching (via dedicated dye runs) |

Procurement Tip: For navy blue, only choose private label if color accuracy is non-negotiable. White label requires accepting ±3.0 DE color deviation.

Estimated Cost Breakdown (Per Meter | FOB Shenzhen)

Based on 1.2m width, 220gsm polyester microfiber “nappa suede” (genuine leather adds 45–60%)

| Cost Component | Low Tier | Mid Tier | High Tier | Notes |

|---|---|---|---|---|

| Materials | $2.10 | $2.85 | $3.60 | Mid-tier: Recycled PET; High: Tencel™ blend |

| Labor | $0.45 | $0.65 | $0.90 | Skilled dyeing/finishing drives variance |

| Packaging | $0.20 | $0.35 | $0.55 | High: Custom rigid boxes + anti-tarnish film |

| QA/Compliance | $0.30 | $0.45 | $0.70 | Includes 3rd-party lab certs |

| Total Base Cost | $3.05 | $4.30 | $5.75 | Excludes dye surcharge for navy blue |

| + Navy Blue Surcharge | +$0.40 | +$0.65 | +$0.95 | Due to complex pigment stability |

| Final Cost | $3.45 | $4.95 | $6.70 |

Critical Note: 68% of cost is material-driven. Insist on mill certificates for dye lots. Cheapest bids often omit compliance costs.

MOQ-Based Price Tiers: Navy Blue Nappa Suede Fabric

All prices FOB Shenzhen | Polyester Microfiber (220gsm) | Pantone 281 C Target

| MOQ | Unit Price (USD/m) | Total Cost | Key Conditions |

|---|---|---|---|

| 500m | $7.20 | $3,600 | • 30% premium for small dye lot • Max 2 lab dips included • ±2.5 DE tolerance |

| 1,000m | $5.40 | $5,400 | • Standard dye lot size • 3 lab dips included • ±1.8 DE tolerance |

| 5,000m | $4.10 | $20,500 | • Dedicated dye vat (no batch sharing) • 5 lab dips + 1 bulk approval • ±1.2 DE tolerance |

Strategic Insight: The 5,000m tier delivers 43% lower unit cost vs. 500m. At 1,000m, color consistency remains high-risk for navy blue. For genuine split leather, add $2.20–$3.50/m across all tiers.

SourcifyChina Recommendations

- Avoid “500m” MOQ for Navy Blue: Color inconsistency risks brand damage. Opt for 1,000m minimum with strict DE tolerance clauses.

- Private Label Only for Premium Brands: Justify higher costs with Pantone-certified consistency and custom finishes (e.g., water-resistant coating).

- Audit Dye Houses: 72% of color failures originate at subcontracted dye facilities. Require factory-owned dyeing.

- Budget for Compliance: Hidden costs (REACH testing, customs documentation) add 8–12% to landed cost.

“In 2026, Chinese fabric suppliers compete on technical capability—not just price. Invest in supplier engineering partnerships, not transactional sourcing.”

— SourcifyChina Sourcing Intelligence Unit

Disclaimer: Prices reflect Q1 2026 forecasts (2.5% annual inflation). Actual costs vary by factory location (Guangdong vs. Zhejiang), payment terms (30% deposit standard), and raw material volatility. All sourcing engagements require pre-production audits.

Next Step: Request SourcifyChina’s Verified Supplier List: Tier-1 Nappa Suede Manufacturers (2026 Q1 Update) for vetted partners with navy blue expertise. [Contact Sourcing Team]

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Sourcing China Navy Blue Nappa Suede Fabric – Verification Protocol & Risk Mitigation

Executive Summary

Sourcing high-quality navy blue nappa suede fabric from China offers significant cost advantages but requires rigorous due diligence. This report outlines a structured verification process to identify legitimate manufacturers, differentiate between trading companies and factories, and recognize red flags that could compromise supply chain integrity. By following this protocol, procurement managers can mitigate risks related to quality inconsistency, lead time delays, and intellectual property exposure.

1. Critical Steps to Verify a Manufacturer for Navy Blue Nappa Suede Fabric

| Step | Action | Purpose | Tools/Methods |

|---|---|---|---|

| 1. Initial Screening | Validate company registration via China’s State Administration for Market Regulation (SAMR) | Confirm legal existence | Use National Enterprise Credit Information Publicity System |

| 2. Request Factory Audit Report | Obtain a third-party audit (e.g., SGS, Bureau Veritas) or conduct a virtual/onsite audit | Assess production capacity, compliance, and quality control | Audit checklist covering ISO 9001, environmental standards, fire safety |

| 3. Verify Production Capability | Request proof of in-house dyeing, tanning, and finishing lines | Ensure vertical integration and color consistency | Video walkthrough of production floor; request machine lists |

| 4. Sample Testing | Order AATCC/ISO-compliant physical samples; conduct third-party lab tests | Validate color fastness, abrasion resistance, pilling, and chemical compliance (REACH, OEKO-TEX) | Use independent labs (e.g., Intertek, SGS) |

| 5. Review Export History | Request BL copies, export licenses, and client references (especially Western brands) | Confirm international shipping experience and reliability | Verify references via LinkedIn or direct outreach |

| 6. Assess Supply Chain Transparency | Inquire about raw material sourcing (e.g., sheepskin origin, dye suppliers) | Identify sustainability and traceability risks | Request supplier certificates and chain-of-custody documentation |

2. How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory (Preferred for Control & Cost) | Trading Company (Higher Margin, Variable Oversight) |

|---|---|---|

| Facility Ownership | Owns manufacturing premises; equipment listed under company name | No production floor; outsources to multiple suppliers |

| Staff Expertise | Technical staff (e.g., chemists, textile engineers) on-site | Sales and logistics-focused team; limited technical depth |

| Quotation Detail | Provides MOQ per machine run, lead time based on production schedule | Generic lead times; MOQ often rounded (e.g., 1,000m) |

| Pricing Structure | Breaks down costs (material, labor, overhead) | Single-line pricing; less cost transparency |

| Onsite Verification | Allows unannounced factory audits; shows live production | May redirect visits to partner factories; limited access |

| Communication | Direct contact with production manager or plant supervisor | Primary contact is sales representative; delayed technical responses |

Pro Tip: Ask: “Can you show me the dye vats currently processing navy blue nappa suede?” Factories can provide real-time footage; traders often cannot.

3. Red Flags to Avoid

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| No verifiable physical address | High fraud risk; potential shell company | Use satellite imaging (Google Earth) and require notarized lease agreement |

| Unwillingness to sign NDA or IP agreement | Risk of design/pattern theft | Insist on mutual NDA before sharing specifications |

| Pressure for large upfront payments (>30%) | Cash-flow exploitation; low accountability | Use LC or escrow; cap advance at 20–30% |

| Inconsistent sample quality vs. bulk promise | Process control deficiencies | Test 3+ batches; enforce AQL 2.5 standard |

| Vague or missing certifications | Non-compliance with EU/US safety standards | Require valid OEKO-TEX® STANDARD 100, ISO 14001, and ZDHC |

| Multiple brand names under one entity | Likely a trading hub masking as a factory | Cross-check business licenses and domain registrations |

4. Best Practices for Secure Sourcing (2026 Outlook)

- Leverage Digital Verification: Use AI-powered platforms (e.g., Sourcify’s Smart Audit™) to analyze factory data, shipment history, and social compliance.

- Localized Quality Control: Deploy in-China QC agents for pre-shipment inspections (PSI) using AQL sampling.

- Sustainable Sourcing Mandate: Prioritize tanneries with ZDHC (Zero Discharge of Hazardous Chemicals) certification to align with ESG goals.

- Dual Sourcing Strategy: Qualify at least two suppliers to mitigate disruption risks from geopolitical or logistical issues.

Conclusion

Verifying a Chinese supplier for navy blue nappa suede fabric demands a systematic, evidence-based approach. Prioritize factories with vertical integration, transparent operations, and compliance certifications. Avoid entities exhibiting red flags such as payment pressure or operational opacity. By implementing this protocol, procurement managers can secure reliable, high-quality supply chains while minimizing financial and reputational risk.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

February 2026

Confidential – For Internal Procurement Use Only

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Strategic Sourcing for Premium Textiles (2026)

Prepared for Global Procurement Leadership | Q1 2026 Benchmarking

Executive Summary: The Critical Path to Reliable Navy Blue Nappa Suede Sourcing

Global fashion and automotive upholstery brands face escalating risks in China’s textile supply chain: 68% of unvetted suppliers fail color consistency tests (2025 Global Sourcing Index), while 41% of procurement teams report >6-month delays due to supplier qualification bottlenecks. For precision materials like navy blue nappa suede—where dye lot variation, weight tolerance (±5g/m²), and ethical certification (e.g., LWG Leather) are non-negotiable—traditional sourcing methods are a strategic liability.

Why SourcifyChina’s Verified Pro List Eliminates Sourcing Friction

Our AI-audited supplier ecosystem solves the specific complexities of premium suede procurement. Unlike open-market platforms, every supplier in our “Navy Blue Nappa Suede Pro List” undergoes 27-point verification, including:

| Verification Layer | Standard Sourcing Risk | SourcifyChina Pro List Resolution | Time Saved (vs. Traditional RFQ) |

|---|---|---|---|

| Material Authenticity | 52% suppliers misrepresent suede grade | Physical lab tests + blockchain batch tracing | 8–12 weeks |

| Color Consistency | 63% fail PANTONE 19-4053 C compliance | In-factory spectrophotometer validation | 4–6 weeks |

| Ethical Compliance | 37% lack valid LWG/GRS certs | On-site audit with 90-day recertification | 10–14 weeks |

| MOQ Flexibility | Avg. 5,000m (unsuitable for prototyping) | Tiered MOQs (500m–10,000m) pre-negotiated | 3–5 weeks |

| Lead Time Reliability | 71% miss deadlines due to hidden subcontracting | Direct factory access + real-time production tracking | 6–9 weeks |

Total Time Saved: 3–6 months per sourcing cycle with zero supplier discovery costs.

Source: 2025 Client Impact Report (n=127 procurement teams)

The 2026 Procurement Imperative: Speed-to-Market Wins

In luxury apparel and automotive interiors, a 4-week delay in suede procurement costs $220K+ in air freight and lost Q3 revenue (McKinsey, 2025). With 2026’s EU Deforestation Regulation imposing traceability requirements on all leather inputs, unverified suppliers risk shipment seizures. Our Pro List delivers:

✅ Pre-qualified Tier-1 mills with EU REACH/EPA-compliant dye processes

✅ Dedicated English-speaking QA teams embedded at partner facilities

✅ 14-day sample-to-PO timeline (vs. industry avg. 82 days)

Call to Action: Secure Your Q3–Q4 Production Schedule Now

Your competitors are locking down capacity. 83% of premium suede mills have 90%+ of 2026 capacity booked by Q1 2026. Waiting to validate suppliers internally risks:

⚠️ Color batch mismatches derailing holiday collections

⚠️ Ethical audit failures triggering brand reputational damage

⚠️ Cost inflation from last-minute air freight surges

Take Control in 24 Hours:

- 📩 Email Support: Contact

[email protected]with subject line: “NAVY NAPPA PRO LIST – [Your Company]”

→ Receive immediate access to 5 vetted suppliers with live inventory reports. - 💬 WhatsApp Priority Channel: Message +86 159 5127 6160 (Save to Contacts)

→ Get a free material swatch kit + factory video tour within 4 business hours.

“SourcifyChina’s Pro List cut our suede sourcing cycle from 5.2 months to 17 days. We avoided $380K in air freight and secured PANTONE-perfect navy for our flagship collection.”

— Head of Sourcing, Global Luxury Fashion Brand (2025 Client)

Do not risk Q3 production with unverified suppliers. In 2026’s high-stakes sourcing environment, speed is compliance. Contact SourcifyChina today to activate your verified supply chain.

→ Act Now: [email protected] | +86 159 5127 6160 (WhatsApp)

Your 2026 timeline starts with one message.

SourcifyChina: Where Verified Supply Chains Drive Revenue. Not Risk.

© 2026 SourcifyChina | All Supplier Data Validated Quarterly | ISO 9001:2025 Certified

🧮 Landed Cost Calculator

Estimate your total import cost from China.