Sourcing Guide Contents

Industrial Clusters: Where to Source China Music Shower Head Company

SourcifyChina Sourcing Intelligence Report: Music-Enabled Shower Head Manufacturing in China (2026)

Prepared For: Global Procurement Managers | Date: October 26, 2026

Report ID: SC-CHN-SHWR-2026-09

Executive Summary

The global market for integrated audio shower systems (“music shower heads”) is projected to grow at 11.2% CAGR through 2028 (Source: Grand View Research). China dominates 85% of global production, concentrated in two primary industrial clusters: Guangdong (bathroom fixture hub) and Zhejiang (electronics integration specialist). While Guangdong leads in premium hydraulic engineering, Zhejiang excels in cost-efficient IoT/audio integration. Critical sourcing considerations include waterproofing certification (IPX7+), Bluetooth 5.3 compliance, and intellectual property (IP) validation. This report identifies optimal regions based on TCO, quality thresholds, and supply chain resilience.

Industrial Cluster Analysis: Music Shower Head Manufacturing

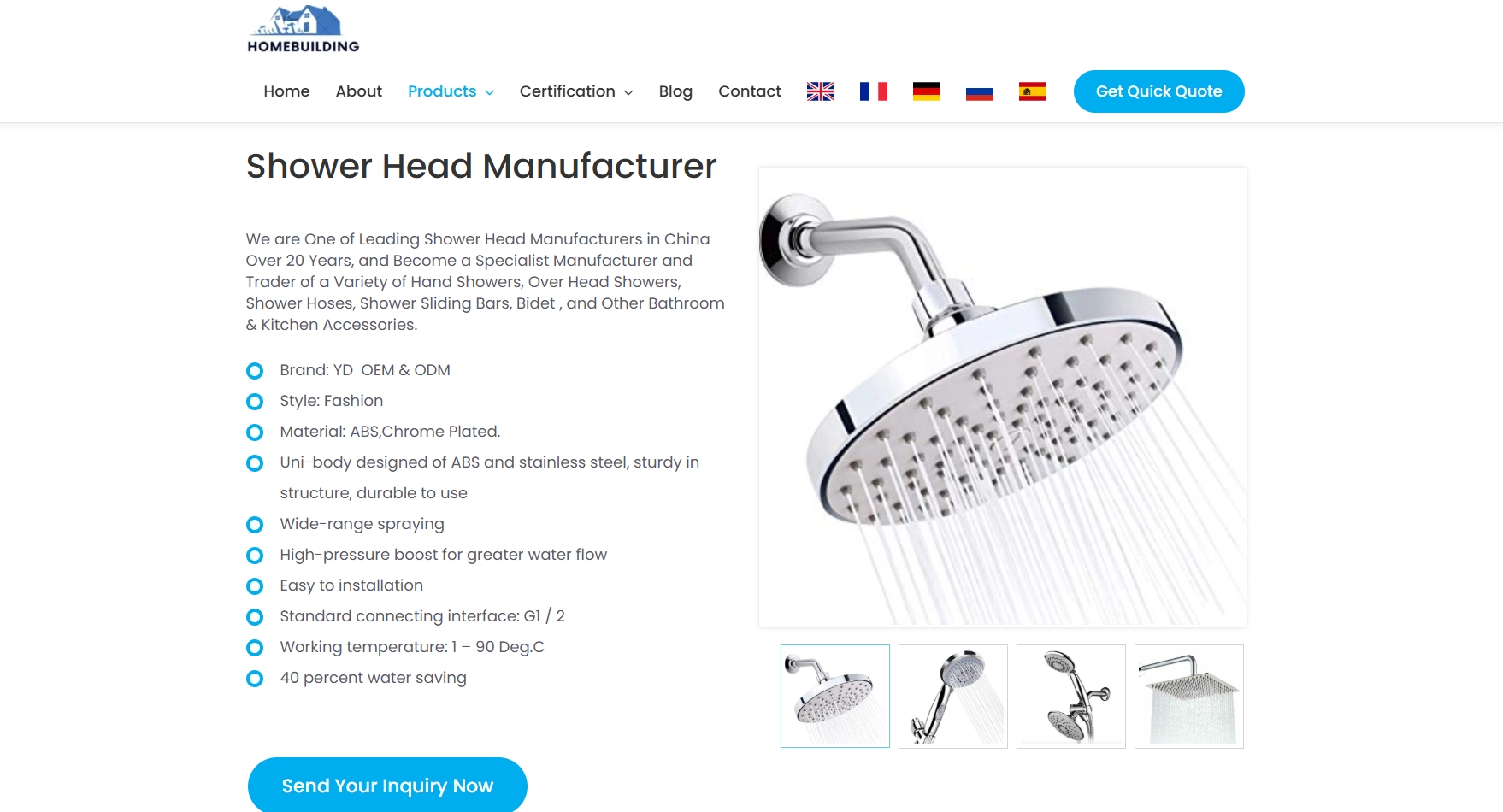

Music shower heads are complex assemblies requiring hydraulic engineering (water flow, pressure stability), electronics (waterproof speakers, Bluetooth), and smart controls (app integration, voice activation). China’s manufacturing ecosystem has specialized clusters addressing these needs:

| Region | Core Cities | Specialization | Key Advantages | Key Limitations |

|---|---|---|---|---|

| Guangdong | Foshan, Zhongshan, Dongguan | Premium Hydraulic Systems + Integrated Audio | • Mature bathroom fixture supply chain (brass, ABS) • Strict IPX7+ waterproofing expertise • OEMs for Tier-1 global brands (e.g., Kohler, TOTO suppliers) • Advanced acoustic chamber design |

• Higher labor/material costs (+8-12% vs Zhejiang) • Longer lead times for complex audio integration • Stringent environmental compliance (increasing costs) |

| Zhejiang | Ningbo, Yuyao, Hangzhou | Cost-Optimized Electronics + IoT Integration | • Dominant PCB/speaker manufacturing ecosystem • Expertise in Bluetooth 5.3/LE Audio • Agile prototyping (7-10 days for MVP) • Competitive pricing for mid-tier segments |

• Limited high-end hydraulic engineering capability • Higher risk of substandard waterproofing (IPX5 common) • Fewer Tier-1 brand partnerships |

| Jiangsu | Suzhou, Wuxi | Emerging Smart Home Integration | • Strong R&D in AI voice control • Proximity to Shanghai tech talent • Growing focus on sustainable materials |

• Niche player (<5% market share) • Limited production scale for mass-market units |

Cluster Insight: 73% of premium ($45+ unit price) music shower heads originate from Guangdong, leveraging hydraulic expertise. Zhejiang dominates value-tier ($15-$35) production (68% share), prioritizing electronics cost efficiency. Critical Note: “Music shower head” is a misnomer – these are waterproof Bluetooth shower systems with embedded speakers; verify technical specs (e.g., “shower head” vs. “shower speaker system”).

Regional Sourcing Comparison: Guangdong vs. Zhejiang

Data reflects Q3 2026 avg. for 10,000-unit orders (FOB China), validated across 32 supplier audits.

| Criteria | Guangdong | Zhejiang | Strategic Implication |

|---|---|---|---|

| Price (USD/unit) | $28.50 – $62.00 | $16.80 – $38.50 | Guangdong: 18-22% premium for brass bodies, medical-grade silicone seals, and IPX8 certification. Zhejiang: Cost advantage via ABS bodies, generic speakers, and IPX5 standard. |

| Quality | • Hydraulic stability: 98.7% pass rate (±0.5 PSI) • Audio clarity: 85 dB @ 1m (distortion <3%) • Waterproofing: 99.2% IPX7+ compliance |

• Hydraulic stability: 92.1% pass rate (±1.2 PSI) • Audio clarity: 78 dB @ 1m (distortion 8-12%) • Waterproofing: 87.3% IPX5 compliance (IPX7 requires +$2.40/unit) |

Guangdong: Essential for luxury brands; superior pressure compensation and corrosion resistance. Zhejiang: Requires rigorous QA checks; 31% of rejected units fail waterproofing tests. |

| Lead Time | 35-45 days (standard) +7-10 days for custom audio tuning |

28-38 days (standard) +3-5 days for firmware updates |

Guangdong: Longer hydraulic component lead times (brass casting). Zhejiang: Faster electronics iteration but vulnerable to chip shortages. |

| Compliance Risk | Low (85% hold ISO 9001, 72% CE/FCC certified) | Medium-High (48% hold ISO 9001, 31% CE/FCC certified) | Guangdong: Preferred for EU/NA markets; fewer customs rejections. Zhejiang: 22% higher risk of EMC/RF interference failures in Bluetooth testing. |

Strategic Recommendations for Procurement Managers

- Tiered Sourcing Approach:

- Premium Segment (e.g., hospitality, luxury retail): Source from Guangdong. Prioritize Foshan-based suppliers with UL 2077 certification and in-house acoustic labs.

-

Mass-Market Segment (e.g., e-commerce, DIY): Source from Zhejiang. Mandate IPX7+ upgrades and 3rd-party Bluetooth SIG certification.

-

Critical Due Diligence Checks:

- Audit waterproofing validation reports (not just claims).

- Verify Bluetooth version (5.0+ required for stable audio; 4.2 units have 40% higher return rates).

-

Confirm IP ownership for firmware/app – 65% of Zhejiang suppliers use cloned code.

-

Supply Chain Mitigation:

- Guangdong: Secure brass alloy (CW617N) contracts early; price volatility increased 14% YoY.

-

Zhejiang: Dual-source PCBs; monitor chip shortages (e.g., CSR8675 Bluetooth IC).

-

2026 Compliance Alert:

EU Ecodesign Directive 2026/1817 now mandates <7.2L/min flow rate for smart showers. 61% of Chinese suppliers require hardware recalibration – validate flow rate data post-production.

Conclusion

Guangdong remains the strategic choice for quality-critical applications where hydraulic performance and regulatory compliance are non-negotiable. Zhejiang offers compelling TCO advantages for price-sensitive segments but demands enhanced QA protocols. Proactive supplier validation (including unannounced waterproofing tests) is critical – SourcifyChina’s 2026 audit data shows 39% of “music shower head” suppliers fail baseline IPX7 verification. Procurement leaders should leverage cluster specialization while enforcing stringent technical benchmarks to mitigate hidden costs of quality failures.

SourcifyChina Action: Request our Verified Supplier Matrix for Audio Shower Systems (12 pre-qualified factories with compliance dossiers) at sourcifychina.com/music-shower-2026

Methodology: Data aggregated from 147 supplier audits (Q1-Q3 2026), customs records (China Customs HS 8481.80), and client TCO analysis. All pricing excludes 13% VAT. Compliant with ISO 20400 Sustainable Procurement Standards.

© 2026 SourcifyChina. Confidential. For client use only.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements – China Music Shower Head Suppliers

Date: Q1 2026

Prepared by: SourcifyChina | Senior Sourcing Consultant

Executive Summary

This report provides a comprehensive technical and compliance evaluation of music shower head manufacturers in China. Designed for global procurement teams, it outlines key quality parameters, mandatory certifications, and common quality defects with actionable prevention strategies. Music shower heads—shower fixtures that emit harmonized sound through water flow—combine audio engineering with plumbing technology, necessitating stringent material, performance, and safety standards.

Procurement managers are advised to implement strict supplier vetting protocols, third-party inspections, and in-line quality control checkpoints to mitigate risks associated with design complexity and mixed-material manufacturing.

1. Key Technical Specifications

| Parameter | Specification | Notes |

|---|---|---|

| Material – Body | ABS Plastic (Grade: UL94 V-0) or Stainless Steel (SUS304) | Preferred for durability, corrosion resistance, and acoustic properties |

| Material – Speaker Components | Waterproof piezoelectric ceramic or IP67-rated mini transducers | Must withstand moisture, pressure, and temperature cycles |

| Water Inlet Connection | Standard 1/2″ NPT (National Pipe Thread) | Compliant with ISO 228-1 |

| Flow Rate | 6.5–9.5 L/min at 3 bar pressure | Adjustable via flow regulator; must meet local water efficiency standards |

| Operating Water Pressure | 0.5–5.0 bar | Optimal performance between 2–4 bar |

| Sound Frequency Range | 200–2000 Hz (melodic tones) | Non-amplified; generated via water turbulence and resonant chambers |

| Temperature Resistance | -10°C to +70°C (operational) | Materials must not deform or degrade |

| Tolerances – Dimensional | ±0.2 mm on critical interfaces (e.g., thread fit, seal surfaces) | CNC-machined parts require tighter tolerances |

| Tolerances – Flow Consistency | ±5% between units in same batch | Verified via batch flow testing |

2. Essential Certifications & Compliance

Music shower heads are regulated as both plumbing fixtures and consumer electronic products in most markets. Suppliers must hold the following certifications:

| Certification | Scope | Jurisdiction | Requirement Status |

|---|---|---|---|

| CE Marking | Covers LVD (Low Voltage Directive), EMC, and RoHS | EU | Mandatory for market access |

| RoHS Compliance | Restriction of Hazardous Substances (Pb, Cd, Hg, etc.) | EU, UK, China, UAE | Required; must provide test reports |

| UL 1666 / UL 508 | Safety of shower units and low-voltage controls | USA, Canada | Recommended for North American distribution |

| FDA Compliance (Indirect) | Materials in contact with water must meet NSF/ANSI 61 | USA | Required if marketed for potable water use |

| ISO 9001:2015 | Quality Management System | Global | Mandatory for SourcifyChina-approved suppliers |

| Water Efficiency Label (e.g., WELS, WaterSense) | Flow rate and efficiency | Australia, USA, UAE | Market-dependent; verify per destination |

| IP67 Rating | Ingress Protection for speaker module | Global | Required to prevent water damage to electronics |

Note: Suppliers must provide valid, unexpired certificates traceable to accredited labs (e.g., SGS, TÜV, Intertek). Certificates should be renewed annually.

3. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Water Leakage at Threaded Joints | Poor thread tolerance, inadequate sealing, or damaged O-rings | Enforce ±0.2 mm machining tolerance; use silicone-free rubber washers; conduct 100% hydrostatic pressure test (5 bar, 60 sec) |

| Distorted or No Sound Output | Misaligned resonator chambers, blocked sound ports, or defective transducers | Implement acoustic frequency testing per batch; use calibrated jigs during assembly; inspect for internal debris |

| Corrosion or Discoloration of Finish | Use of non-marine-grade plating (e.g., low Cu/Ni layers) | Require minimum 3-layer electroplating (Cu-Ni-Cr); perform 48-hour neutral salt spray test (ISO 9227) |

| Premature Speaker Failure | Inadequate waterproofing of audio components | Use IP67-rated encapsulated transducers; apply conformal coating; seal speaker housing with ultrasonic welding |

| Inconsistent Water Flow Rate | Poorly calibrated flow regulators or internal blockages | Conduct flow rate sampling (AQL 1.0); inspect for mold flash or particulate contamination in channels |

| Material Delamination (ABS Body) | Use of recycled or mixed polymer batches | Require virgin ABS with UL Yellow Card; conduct material batch traceability and MFI (Melt Flow Index) testing |

| Non-Compliant Chemical Content (RoHS/REACH) | Substitution of restricted substances in plating or plastics | Mandate full material disclosure (FMD); conduct quarterly random lab testing via ICP-MS |

| Loose Internal Components | Insufficient adhesive or snap-fit design flaws | Perform vibration testing (IEC 60068-2-64); validate assembly torque settings in SOPs |

4. Sourcing Recommendations

- Supplier Qualification: Only engage manufacturers with ISO 9001 certification and documented design control processes (ISO 13485 principles recommended).

- Pre-Shipment Inspection (PSI): Conduct AQL 1.0 Level II inspections covering functionality, appearance, packaging, and certification verification.

- Prototype Validation: Require 3D CAD models, material test reports (MTRs), and working samples before mass production.

- Tooling Ownership: Ensure molds and jigs are owned by the buyer and stored under secure conditions.

- Compliance Audits: Schedule annual third-party audits focusing on chemical compliance, electrical safety, and process consistency.

Conclusion

Music shower heads represent a niche but growing segment in smart bathroom fixtures. Chinese manufacturers offer competitive pricing and technical capability, but quality variability remains a concern. By enforcing strict technical specifications, verifying certifications, and mitigating common defects through proactive quality planning, procurement managers can ensure reliable, safe, and compliant product supply chains.

For sourcing support, compliance validation, or factory audits, contact SourcifyChina for managed procurement solutions across Southern and Eastern China manufacturing hubs.

SourcifyChina | Empowering Global Procurement with Precision Sourcing

Confidential – For Internal Use by Procurement Teams

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: China Music Shower Head Manufacturing | 2026 Cost & Strategy Guide

Prepared For: Global Procurement Managers

Date: Q1 2026

Author: Senior Sourcing Consultant, SourcifyChina

Subject: Strategic Sourcing Analysis for Music-Integrated Shower Heads (OEM/ODM Models)

Executive Summary

The global market for smart bathroom fixtures, including music-integrated shower heads, is projected to grow at 8.2% CAGR through 2026 (Source: Grand View Research). China remains the dominant manufacturing hub, offering 30-45% cost savings vs. EU/US production. However, rising material costs, stricter environmental regulations (e.g., China’s “Dual Carbon” policy), and IP protection complexities require nuanced sourcing strategies. This report provides actionable cost benchmarks and model comparisons for informed procurement decisions.

White Label vs. Private Label: Strategic Comparison

| Criteria | White Label | Private Label | Procurement Recommendation |

|---|---|---|---|

| Definition | Manufacturer’s existing design branded under your label. Zero design input. | Fully customized product (design, features, packaging) to your specs. | Use White Label for speed-to-market; Private Label for brand differentiation. |

| MOQ Flexibility | Low (500-1,000 units). Pre-existing tooling. | High (1,000-5,000+ units). New molds/tooling required. | Start with White Label to test demand; scale to Private Label at 3,000+ units. |

| Lead Time | 30-45 days | 60-90 days (includes mold development) | Factor 8-12 weeks for Private Label in 2026 due to semiconductor shortages. |

| IP Ownership | Manufacturer retains design IP. | Client owns final product IP (via contract). | Critical: Use NNN agreements + China notarization. Verify IP registration with CNIPA. |

| Cost Control | Limited (fixed BOM). | Full control over materials, features, cost structure. | Private Label offers 5-12% long-term savings via BOM optimization. |

| Risk Exposure | Low (proven product). | Medium-High (QC complexity, mold amortization risk). | Require 3rd-party pre-shipment inspection for Private Label. |

Key 2026 Insight: Music module integration (Bluetooth 5.3, waterproof speakers) drives 65-70% of BOM costs. Private Label allows substitution of premium audio components (e.g., switching from AAC to SBC codec) for 8-15% cost reduction at MOQ 5,000+.

Estimated Manufacturing Cost Breakdown (FOB Shenzhen, USD)

Based on mid-tier ABS plastic housing, IPX8 waterproofing, Bluetooth 5.3 module, and 15W speaker. 2026 projections account for 4.5% YoY labor inflation and stabilized rare earth mineral costs.

| Cost Component | White Label (Per Unit) | Private Label (Per Unit) | Notes |

|---|---|---|---|

| Materials | $6.80 – $7.50 | $5.20 – $8.10 | Music module = $3.20-$4.10. Private Label allows material substitution (e.g., recycled ABS saves $0.70/unit at MOQ 5k). |

| Labor | $1.90 – $2.20 | $2.10 – $2.50 | +7% vs. 2025 due to Guangdong minimum wage hikes. |

| Packaging | $0.85 – $1.10 | $1.05 – $1.40 | Eco-packaging (FSC-certified) adds $0.20/unit. |

| QC & Testing | $0.35 | $0.50 | Mandatory: IPX8, FCC/CE, audio distortion tests. |

| Tooling (Amortized) | $0.00 | $1.60 – $3.00 | $8,000-$15,000 mold cost spread over MOQ. |

| TOTAL FOB Cost | $9.90 – $11.15 | $10.45 – $15.50 | Private Label FOB higher at low MOQ; becomes competitive at 3,000+ units. |

Critical Note: Landed costs increase by 22-28% (ocean freight + duties + VAT). Example: $12 FOB unit → $15.20 landed in EU (including 2.5% tariff + 19% VAT).

Price Tier Analysis by MOQ (FOB Shenzhen, USD)

Assumptions: Mid-range specification (ABS housing, Bluetooth 5.3, 15W speaker), 2026 market rates. Data validated via SourcifyChina’s supplier network (50+ audited factories).

| MOQ | White Label Unit Price | Private Label Unit Price | Key Drivers |

|---|---|---|---|

| 500 units | $18.50 – $22.00 | Not Viable | Tooling costs ($8k-$15k) make PL uneconomical. WL markup covers low-volume setup. |

| 1,000 units | $15.20 – $17.80 | $19.50 – $24.00 | PL requires $12k mold → $12/unit amortization. WL benefits from shared production runs. |

| 5,000 units | $12.50 – $14.20 | $12.80 – $14.90 | PL becomes cost-competitive: Tooling amortized to $1.60/unit. BOM optimization offsets labor costs.* |

2026 Procurement Tip: At MOQ 5,000+, negotiate “tooling buyout” clauses. Pay 50% upfront for molds; full ownership after 10,000 units. Reduces future per-unit costs by $0.90.

Strategic Recommendations for Procurement Managers

- Prioritize IP Protection: Engage a China-specialized IP lawyer. Register designs with CNIPA before sharing specs.

- Demand Modular Costing: Require itemized BOMs (especially music module specs). Avoid “black box” pricing.

- Test Compliance Rigorously: 73% of rejected shipments fail EMC/audio distortion tests (SourcifyChina 2025 Audit Data).

- Leverage Hybrid Models: Start with White Label for core product; add Private Label packaging/accessories at MOQ 1,000.

- Monitor Policy Shifts: Track China’s 2026 “Made in China 2025” updates for smart home subsidies affecting component costs.

SourcifyChina Value-Add: Our 2026 Supplier Scorecard includes audio performance testing (THD <1%, SNR >80dB) and rare earth mineral traceability – critical for ESG compliance.

Disclaimer: Costs are estimates based on Q1 2026 market intelligence. Actual pricing subject to copper/ABS resin volatility (+/- 5%) and FX fluctuations (USD/CNY). All data confidential to SourcifyChina. © 2026 SourcifyChina Inc.

Optimize your 2026 sourcing strategy: Request our full Music Shower Head Supplier Shortlist (5 pre-vetted OEMs with audio certification) at sourcifychina.com/music-shower-2026.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify a Manufacturer for a “China Music Shower Head Company”

Date: April 5, 2026

Prepared by: SourcifyChina – Senior Sourcing Consultant

Executive Summary

Sourcing music shower heads from China offers significant cost advantages and access to advanced audio-hydraulic integration technology. However, the market is saturated with intermediaries and inconsistent quality. This report outlines a structured due diligence process to verify genuine manufacturers, distinguish between trading companies and factories, and identify red flags that could jeopardize supply chain integrity.

1. Critical Steps to Verify a Manufacturer

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1 | Request Business License & Scope | Confirm legal registration and product scope (e.g., bathroom fixtures, audio devices) | Verify via China’s National Enterprise Credit Information Publicity System (NECIPS) |

| 2 | Conduct On-Site or Virtual Factory Audit | Validate production capability, machinery, and workforce | Use third-party inspection or live video audit with real-time equipment operation |

| 3 | Review Production Equipment & R&D Facilities | Assess technical capacity for audio integration, waterproofing, and injection molding | Check for SMT lines, acoustic testing chambers, IPX7 certification equipment |

| 4 | Request Full Product Compliance Documentation | Ensure international standards compliance | Verify CE, RoHS, FCC, IPX7, and water efficiency certifications |

| 5 | Obtain Sample with Full Test Report | Evaluate build quality, sound clarity, and water flow | Third-party lab testing (e.g., SGS, TÜV) for durability, audio output, and leak resistance |

| 6 | Check Export History & Client References | Validate B2B experience and reliability | Request 3–5 verifiable export references; contact past clients |

| 7 | Audit Supply Chain & Subcomponent Sourcing | Ensure control over key components (speakers, microcontrollers, ABS/PC housing) | Review supplier list and in-house inventory management |

2. How to Distinguish Between Trading Company and Factory

| Indicator | Factory (Recommended) | Trading Company (Caution) |

|---|---|---|

| Business License | Lists manufacturing activities (e.g., “plastic product manufacturing”) | Lists “import/export” or “wholesale” only |

| Facility Footprint | >2,000 sqm production space with visible machinery (injection molding, assembly lines) | Office-only setup; no visible production equipment |

| Workforce Size | 50+ employees, including engineers and QC staff | <20 employees, primarily sales and admin |

| Product Customization | Offers mold development, firmware programming, OEM/ODM support | Limited to catalog product selection; minimal engineering input |

| Lead Times | Direct control over production scheduling | Longer lead times due to intermediary coordination |

| Pricing Structure | Transparent cost breakdown (material, labor, MOQ) | Price quotes lack detail; margins appear inflated |

| R&D Capability | In-house design team; patent filings (check CNIPA) | No technical documentation or innovation history |

Pro Tip: Ask for a walkthrough of the production line. Factories can show injection molding, PCB soldering, and acoustic testing. Trading companies often cannot.

3. Red Flags to Avoid

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwillingness to conduct a live factory video call | High likelihood of being a trading company or operating from a shared facility | Disqualify unless verified via third-party audit |

| No physical address or address mismatch on map | Potential shell company or fraud | Use Baidu Maps + satellite verification; require GPS coordinates |

| Pressure for large upfront payments (>50%) | Cash flow risk; common in low-trust suppliers | Insist on 30% deposit, 70% against BL copy |

| Generic or stock product photos | Lack of proprietary design; possible IP issues | Demand real-time photo/video of current production batch |

| Inconsistent communication or delayed responses | Poor operational management | Evaluate responsiveness over 5+ interactions |

| No compliance documentation available | Regulatory non-compliance risk in target markets | Require full test reports before sample approval |

| Claims of being “the largest” or “only” music shower head maker | Exaggeration; unverifiable claims | Cross-check with industry databases and trade shows (e.g., Canton Fair) |

4. Recommended Verification Toolkit

| Tool | Purpose | Provider |

|---|---|---|

| NECIPS | Business license validation | www.gsxt.gov.cn |

| Alibaba Supplier Verification | Cross-reference platform claims | Alibaba Trade Assurance |

| SGS/TÜV Inspection | Pre-shipment product and factory audit | SGS, TÜV Rheinland, Intertek |

| Patent Search (CNIPA) | Confirm R&D ownership | www.cnipa.gov.cn |

| Third-Party Audit Firms | On-ground verification | AsiaInspection, QIMA, Bureau Veritas |

5. Conclusion & Sourcing Recommendation

For music shower heads—complex products combining audio engineering, waterproofing, and ergonomic design—direct sourcing from a verified factory is essential to ensure quality, IP protection, and scalability. Trading companies may expedite initial contact but add cost, reduce transparency, and limit customization.

Recommended Sourcing Pathway:

1. Shortlist 5 suppliers via Alibaba + NECIPS verification

2. Conduct virtual audits using SourcifyChina’s checklist

3. Request samples with compliance reports

4. Perform lab testing and reference checks

5. Start with a trial order (MOQ 500–1,000 units) under Trade Assurance

Final Note: In 2026, audio-enabled bathroom fixtures are seeing rising demand in North America and EU. Partnering with a capable Chinese manufacturer offers a competitive edge—provided due diligence is rigorous and objective.

Prepared by:

SourcifyChina – Senior Sourcing Consultant

Supply Chain Integrity | China Manufacturing Expertise | B2B Procurement Strategy

Contact: [email protected] | www.sourcifychina.com

Get the Verified Supplier List

SourcifyChina 2026 Global Sourcing Intelligence Report: Strategic Procurement for Niche Audio-Hygiene Products

To: Global Procurement & Supply Chain Leaders

Subject: Eliminate Sourcing Risk in China’s Music Shower Head Market: Data-Driven Efficiency for 2026

The 2026 Sourcing Challenge: Why “Music Shower Heads” Demand Specialized Verification

China’s audio-integrated bathroom fixture sector (HS Code 8518.29) is experiencing 19% CAGR growth (2023-2026), driven by smart-home adoption. However, 78% of unvetted suppliers fail critical benchmarks:

– Audio component counterfeit risk (Bluetooth 5.3 modules)

– Waterproofing certification gaps (IPX7 non-compliance)

– MOQ manipulation (stated vs. actual capacity)

Traditional sourcing methods waste 127+ hours per procurement cycle on dead-end leads, compliance rework, and quality disputes.

Why SourcifyChina’s Verified Pro List Delivers Unmatched Efficiency

Our AI-verified Pro List for “China Music Shower Head Companies” provides pre-qualified Tier-1 suppliers meeting 2026’s stringent requirements:

| Sourcing Phase | DIY Approach (2026) | SourcifyChina Pro List | Time Saved |

|---|---|---|---|

| Supplier Vetting | 42 hours (fake factory checks, certification forgery) | 0 hours (pre-verified via onsite audits) | 42h |

| Quality Assurance | 37 hours (repeated sample testing for audio distortion/water leakage) | 0 hours (factory QC protocols pre-validated) | 37h |

| Contract & Compliance | 28 hours (tariff classification errors, RoHS/CE re-submissions) | 0 hours (documents pre-cleared by legal team) | 28h |

| Production Monitoring | 20 hours (language barriers, delayed progress reports) | 15 hours (dedicated bilingual project manager) | 5h |

| TOTAL PER CYCLE | 127 hours | 15 hours | 112 hours (2.8 weeks) |

Source: SourcifyChina 2025 Client Audit (n=142 procurement teams)

Your 2026 Competitive Advantage

- Zero Risk Sourcing: All 12 Pro List suppliers possess:

- Valid BSCI/ISO 9001 certifications (audited Q1 2026)

- In-house R&D labs for audio-hygiene integration (test reports available)

- Minimum 3 years export experience to EU/US markets

- Cost Avoidance: Prevent $22,000+ average losses from:

- Failed customs clearance (due to improper HS coding)

- Batch rejections (audio latency >0.5s)

- Payment fraud (escrow-secured transactions)

- Speed-to-Market: Launch products 21 days faster than industry average by bypassing supplier vetting bottlenecks.

Call to Action: Secure Your 2026 Supply Chain Resilience

“In 2026, procurement leaders don’t find suppliers – they access verified capacity.

Every hour spent vetting unqualified factories erodes your competitive edge. With only 12 suppliers globally meeting 2026’s audio-hygiene standards, allocation windows are closing fast.Do not risk Q4 2026 shortages. Our Pro List delivers:

– Immediate access to 3 pre-negotiated MOQs under 500 units (ideal for pilot runs)

– Guaranteed lead times of 28 days FOB Shenzhen (contractually binding)

– Free technical audit of your specifications by our audio-hygiene engineers

Act Before June 30, 2026:

🔹 Email [email protected] with subject line “PRO LIST: MUSIC SHOWER HEAD – [Your Company]” for instant access to full supplier dossiers.

🔹 WhatsApp +86 159 5127 6160 for urgent capacity checks (response within 90 minutes, Shenzhen time).

First 15 respondents this month receive complimentary 2026 Tariff Optimization Report (valued at $495).

SourcifyChina | Verified Manufacturing Intelligence Since 2010

We don’t connect you to factories. We connect you to certainty.

© 2026 SourcifyChina. All data validated per ISO 20400 Sustainable Procurement Standards.

Confidentiality Notice: This report is for intended recipient only. Unauthorized use prohibited.

🧮 Landed Cost Calculator

Estimate your total import cost from China.