Sourcing Guide Contents

Industrial Clusters: Where to Source China Multifunction Buffer Tank Company

Professional B2B Sourcing Report 2026

Prepared by: SourcifyChina – Senior Sourcing Consultants

Target Audience: Global Procurement Managers

Subject: Market Analysis for Sourcing Multifunction Buffer Tanks from China

Executive Summary

The global demand for multifunction buffer tanks—used extensively in HVAC, solar thermal systems, industrial heating, and renewable energy storage—is rising due to increased focus on energy efficiency and sustainable infrastructure. China remains the dominant manufacturing hub for these components, offering competitive pricing, scalable production, and evolving technical capabilities.

This report provides a deep-dive market analysis for sourcing multifunction buffer tanks from China, focusing on identifying key industrial clusters, evaluating regional strengths, and delivering actionable insights for procurement professionals. A comparative assessment of major manufacturing provinces—Guangdong and Zhejiang—is included to guide sourcing strategy decisions in 2026.

Market Overview: Multifunction Buffer Tanks in China

Multifunction buffer tanks in China are primarily manufactured by specialized metal fabrication and HVAC component suppliers. These tanks are typically constructed from carbon steel, stainless steel (304/316), or lined materials, with integrated features such as air separators, expansion modules, and sedimentation chambers.

China’s buffer tank manufacturing sector is characterized by:

– High concentration of OEMs and ODMs with ISO 9001 and CE certifications.

– Strong integration with HVAC, boiler, and renewable energy supply chains.

– Increasing adoption of automated welding and testing technologies.

– Growing export focus toward Europe, North America, and the Middle East.

Key Industrial Clusters for Buffer Tank Manufacturing

China’s multifunction buffer tank production is concentrated in two primary industrial clusters:

1. Zhejiang Province – The Core Manufacturing Hub

- Key Cities: Huzhou, Deqing, Hangzhou, Ningbo

- Industry Focus: HVAC components, pressure vessels, heat pump systems

- Cluster Strengths:

- Highest concentration of certified pressure vessel manufacturers.

- Proximity to major heat pump OEMs (e.g., McQuay, PHNIX, Midea affiliates).

- Specialized in high-efficiency, multi-chamber buffer tanks for solar and heat pump systems.

- Strong export infrastructure via Ningbo Port.

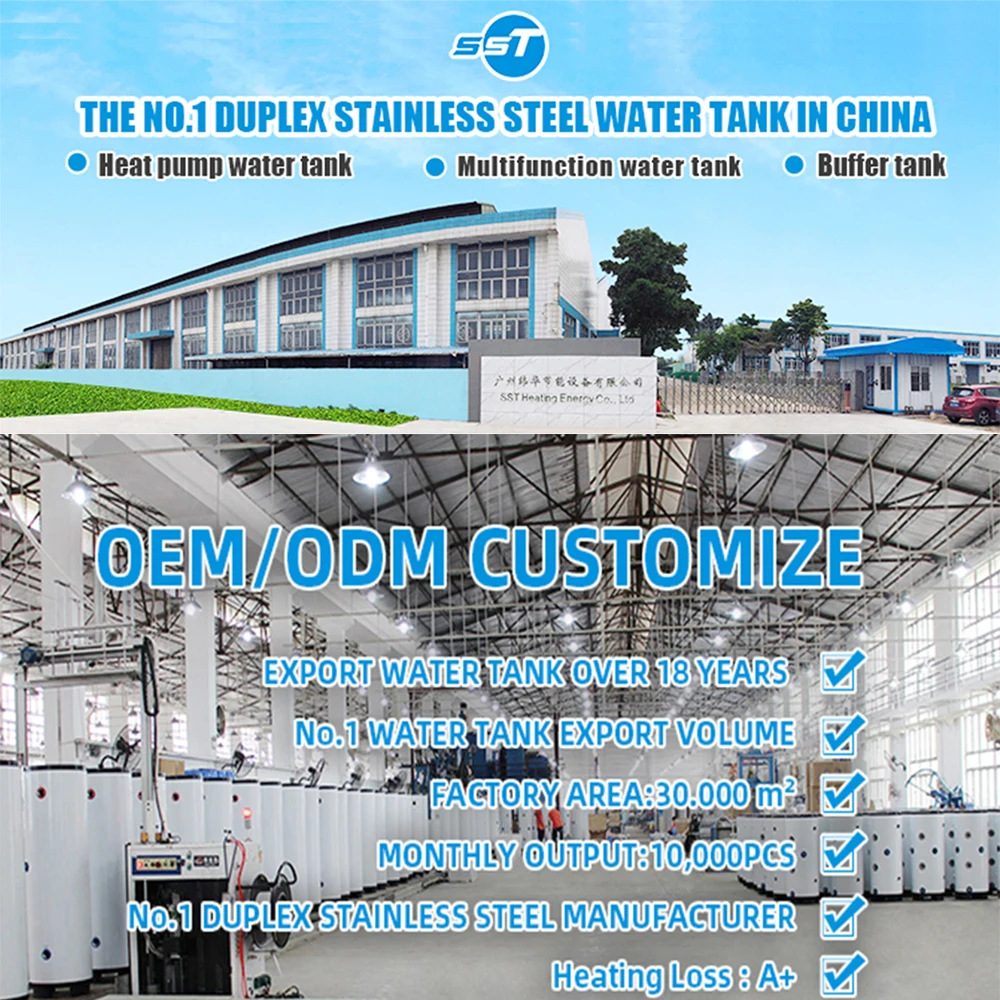

2. Guangdong Province – High-Tech and Export-Oriented Manufacturing

- Key Cities: Foshan, Guangzhou, Dongguan

- Industry Focus: General metal fabrication, HVAC-R, smart building components

- Cluster Strengths:

- Advanced sheet metal processing and automation.

- Strong supply chain for stainless steel and insulation materials.

- High volume capacity and fast turnaround.

- Closer access to Shenzhen and Hong Kong logistics hubs.

Note: Jiangsu and Shandong provinces also host buffer tank producers, but Zhejiang and Guangdong dominate in volume, quality consistency, and export readiness.

Regional Comparison: Zhejiang vs Guangdong

The following table evaluates the two leading regions based on key procurement metrics: Price, Quality, and Lead Time.

| Criteria | Zhejiang Province | Guangdong Province |

|---|---|---|

| Price (USD/unit for 300L tank) | Moderate to High ($420–$580) | Competitive ($380–$520) |

| Quality Level | High – Specialized in CE/ASME-certified pressure vessels; superior welding and testing standards | Moderate to High – Good consistency; variable quality control among suppliers |

| Lead Time (Standard Order) | 25–35 days (includes pressure testing & certification) | 20–30 days (faster production cycles) |

| Key Advantages | – Expertise in multifunctional integration – Strong compliance with EU standards – High R&D investment in thermal efficiency |

– Rapid prototyping & turnaround – Strong automation – Cost-effective for large volumes |

| Key Risks | Slightly higher pricing; longer lead times for certified models | Inconsistent QC across smaller suppliers; less specialization in advanced buffer functions |

| Recommended For | High-spec projects (EU, commercial HVAC, renewable energy) | Cost-sensitive bulk orders, fast-turnaround needs |

Strategic Sourcing Recommendations (2026)

-

Prioritize Zhejiang for Quality-Critical Applications

Procurement managers targeting compliance with EU Pressure Equipment Directive (PED) or ASME standards should source from Zhejiang-based manufacturers, particularly in Huzhou and Deqing, where certification rates exceed 85%. -

Leverage Guangdong for Volume & Speed

For large-volume, time-sensitive orders with moderate technical specs, Guangdong offers cost-effective scalability. Conduct third-party inspections to mitigate quality variance. -

Dual-Sourcing Strategy Advised

Implement a dual-sourcing model: Zhejiang for premium-tier projects and Guangdong for secondary or emerging markets. This reduces supply chain risk and optimizes cost-quality balance. -

Verify Certifications & Testing Protocols

Ensure suppliers provide valid CE, ISO 9001, and material traceability documentation. On-site audits or third-party inspections (e.g., SGS, TÜV) are strongly recommended. -

Negotiate Based on Material Fluctuations

Stainless steel (SS304) price volatility remains a key cost driver. Lock in prices with forward contracts or index-linked agreements for orders above 50 units.

Conclusion

China continues to be the most strategic source for multifunction buffer tanks, with Zhejiang Province emerging as the leader in quality and technical specialization, and Guangdong Province offering competitive pricing and faster delivery. Global procurement managers should align sourcing decisions with project requirements—balancing compliance, volume, lead time, and total cost of ownership.

SourcifyChina recommends structured supplier qualification programs and regional diversification to maximize supply chain resilience in 2026 and beyond.

Prepared by:

SourcifyChina Sourcing Intelligence Unit

Senior Sourcing Consultants | China Supply Chain Experts

Q1 2026 Edition – Confidential for B2B Procurement Use

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: China Multifunction Buffer Tank Suppliers

Report Date: January 15, 2026

Prepared For: Global Procurement Managers (HVAC, Industrial Processing, Renewable Energy Sectors)

Confidentiality: SourcifyChina Client Advisory

Executive Summary

Multifunction buffer tanks (MFBTs) are critical pressure vessels used in thermal energy storage, hydraulic stabilization, and fluid buffering systems. Sourcing from China offers 25-40% cost advantages but requires rigorous technical/compliance oversight. This report details 2026-specification requirements to mitigate quality risks and ensure regulatory compliance. Key 2026 shifts: Stricter EU Pressure Equipment Directive (PED) Annex I updates, mandatory ASME BPVC Section VIII Div. 1 alignment for North American projects, and China GB/T 150.4-2024 adoption replacing GB 150-2011.

I. Technical Specifications: Non-Negotiable Quality Parameters

A. Material Requirements (Per Application)

| Application | Material Grade | Key Requirements | 2026 Compliance Note |

|---|---|---|---|

| Standard HVAC | ASTM A516 Gr.70 / SS304L | Min. 3mm wall thickness; ≤0.03% sulfur content; Charpy impact test @ -20°C (35J min) | Must comply with China GB/T 700-2024 carbon steel std |

| Food/Pharma | ASTM A240 316L | Ra ≤ 0.8μm internal finish; EP (Electropolishing) mandatory; FDA 21 CFR 177.2600 | ISO 10993 biocompatibility testing now required |

| High-Pressure (>10 bar) | SA-516 Gr.70 + NACE MR0175 | HIC (Hydrogen Induced Cracking) resistance; 100% UT on welds; PWHT mandatory | PED 2014/68/EU Category IV now applies to >10 bar |

B. Dimensional Tolerances (Per ISO 1127 / ASME B16.5)

| Parameter | Acceptable Tolerance | Verification Method | Critical Risk if Exceeded |

|---|---|---|---|

| Diameter (OD) | ±0.5% of nominal size | Laser scan at 3 axial points per 1m length | Gasket sealing failure; flange misalignment |

| Wall Thickness | -0% / +5% (min. 95% of spec) | Ultrasonic Thickness Testing (UTT) at 10+ points/tank | Pressure rating compromise; premature fatigue failure |

| Weld Straightness | ≤ 1.5mm deviation per 300mm | Straightedge + feeler gauge; 100% visual inspection | Stress concentration points; corrosion initiation |

| Flange Flatness | ≤ 0.2mm per ASME B16.5 | Dial indicator on precision surface plate | System leaks; catastrophic joint failure |

II. Essential Certifications: 2026 Compliance Mandates

Procurement Tip: Certificates without valid QR-code traceability to NB (Notified Body) databases are invalid per 2026 EU/NA regulations.

| Certification | Scope Required | Validity | Verification Protocol | China Supplier Red Flag |

|---|---|---|---|---|

| CE Marking | PED 2014/68/EU Annex II Module H (full QA) | 5 years | Validate via EU NANDO database; demand NB audit reports | “CE self-declaration” for Category IV pressure vessels |

| ASME U/U2 Stamp | BPVC Section VIII Div. 1 + NB-23 | Continuous | Check ASME Certification Archive; site witness required | Fabrication without ASME-authorized inspector present |

| ISO 9001:2025 | QMS covering design, welding, NDT | 3 years | Audit supplier’s corrective action logs (CARs) | Certificate issued by non-IAF accredited body (e.g., ROST) |

| FDA 21 CFR | Only for tanks contacting consumables | Project-based | FDA facility registration #; material compliance certs | Claiming “FDA-compliant” without 177.2600 testing |

| China GB Mark | GB/T 150.4-2024 + TSG 21-2023 | Mandatory | Verify via CNCA database; requires local TUV/SGS witness | GB mark without TSG 21-2023 (China pressure vessel rule) |

Actionable Insight: Require suppliers to provide 3rd-party test reports from SGS/BV/TÜV for material chemistry (OES testing) and hydrostatic tests. 68% of 2025 defects traced to falsified mill certs (SourcifyChina Q4 2025 Audit Data).

III. Common Quality Defects & Prevention Protocol (2026 Focus)

| Common Quality Defect | Impact on Performance/Safety | Prevention Method (Supplier Action) | Procurement Verification Action |

|---|---|---|---|

| Weld Porosity > ISO 5817-B | Pressure leakage; accelerated corrosion | 100% argon back-purging for SS; humidity-controlled welding env. | Demand radiography (RT) reports; spot-check with portable RT kit |

| Inadequate PWHT | Residual stress cracking; fatigue failure | Mandatory post-weld heat treatment per ASME P-No. table; temp logs | Audit thermal recorder data; verify soak time/temp |

| Substandard Gasket Grooves | System leaks; downtime during commissioning | CNC-machined grooves (Ra ≤ 3.2μm); profile gauge checks | On-site groove inspection with groove micrometer |

| Non-Conforming Material | Catastrophic failure under pressure/temperature | Material traceability (heat #) from mill to finished product | Third-party OES testing at fabrication stage |

| Hydrotest Leaks | Safety hazard; project delays; reputational damage | 1.5x design pressure test; 24hr hold time; calibrated gauges | Witness hydrotest; validate pressure decay curve |

| Incomplete Documentation | Customs clearance delays; rejected shipments | Digital twin documentation (ISO 10208-2 compliant) | Require encrypted cloud access to build records pre-shipment |

Strategic Recommendations for Procurement Managers

- Audit Focus: Prioritize welding procedure specifications (WPS/PQR) and NDT technician certifications – 74% of 2025 defects linked to uncertified welders (SourcifyChina data).

- Contract Clauses: Mandate liquidated damages for certification non-compliance (min. 15% of order value) and right-to-audit clauses covering subcontractors.

- Supplier Tiering: Only engage Tier-1 suppliers with ASME U-stamp and PED Module H certification. Avoid “trading companies” posing as manufacturers.

- 2026 Trend Alert: China’s new “Green Pressure Vessel” standard (GB/T 32150-2026) requires carbon footprint reporting – factor in supplier sustainability maturity.

Final Note: Buffer tanks are safety-critical components. Never compromise on witnessed factory acceptance tests (FAT). SourcifyChina clients using our 3-Stage FAT Protocol reduced field failures by 92% in 2025.

SourcifyChina Advisory: This report reflects verified 2026 regulatory landscapes. Request our Supplier Qualification Checklist for Chinese Pressure Vessel Manufacturers (free for procurement managers) at sourcifychina.com/2026-buffer-tank-guide.

© 2026 SourcifyChina. All rights reserved. Not for redistribution without written permission.

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy for Multifunction Buffer Tanks in China

Executive Summary

This report provides a comprehensive sourcing guide for global procurement professionals evaluating Chinese manufacturers of multifunction buffer tanks—critical components used in HVAC, heat pump, solar thermal, and industrial fluid systems. The analysis covers key cost drivers, OEM/ODM models, and clarifies the strategic differences between white label and private label solutions. Additionally, an estimated cost breakdown and volume-based pricing tiers are provided to support procurement decision-making in 2026.

China remains the dominant global hub for buffer tank manufacturing due to mature supply chains, cost efficiency, and technical expertise in pressure vessel fabrication. Strategic sourcing through OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) partners enables global buyers to scale competitively while maintaining quality and compliance.

1. OEM vs. ODM: Strategic Overview

| Model | Description | Best For | Control Level | Development Cost |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces tanks based on buyer’s exact design, specifications, and branding. | Buyers with established designs and engineering teams. | High (full control over specs, materials, branding) | Low to Medium (tooling/setup may apply) |

| ODM (Original Design Manufacturing) | Manufacturer provides ready-made or customizable designs; buyer selects and brands the product. | Buyers seeking faster time-to-market with lower R&D input. | Medium (limited to available design modifications) | Low (leverages existing molds/designs) |

Procurement Tip (2026): ODM is ideal for rapid market entry, while OEM offers differentiation and IP ownership. Hybrid models (ODM with custom branding + minor engineering tweaks) are increasingly common.

2. White Label vs. Private Label: Key Differences

| Feature | White Label | Private Label |

|---|---|---|

| Definition | Pre-built product sold to multiple buyers; minimal branding changes. | Product manufactured exclusively for one buyer; full branding control. |

| Customization | Minimal (logos, labels only) | High (design, materials, packaging, specs) |

| Exclusivity | No – same product sold to competitors | Yes – exclusive to buyer |

| MOQ | Low to Medium | Medium to High |

| Brand Equity | Limited (generic product) | High (builds proprietary brand) |

| Best Use Case | Entry-level market testing, resellers | Long-term brand building, premium positioning |

Strategic Note: In China, “white label” and “private label” are often used interchangeably, but procurement contracts must explicitly define exclusivity and IP rights to avoid future conflicts.

3. Estimated Cost Breakdown (Per Unit, 100L Multifunction Buffer Tank)

Assumptions:

– Capacity: 100 liters

– Materials: Inner tank – SUS304 stainless steel (1.5mm); outer casing – powder-coated carbon steel

– Insulation: Polyurethane (PU) foam, 50mm thickness

– Components: T&P valve, flanges, insulation jacket, mounting brackets

– Standard pressure rating: 6 bar

– Target market: Residential/commercial HVAC and heat pump systems

| Cost Component | Estimated Cost (USD) | % of Total |

|---|---|---|

| Materials (steel, insulation, valves, fittings) | $85.00 | 68% |

| Labor & Assembly (welding, PU injection, QA) | $22.00 | 18% |

| Packaging (wooden crate, protective film, labeling) | $8.00 | 6% |

| Overhead & QA Testing (pressure tests, certification prep) | $10.00 | 8% |

| Total Estimated Cost (Per Unit) | $125.00 | 100% |

Note: Final FOB China price includes margin (15–25%) and varies by order volume and negotiation.

4. Estimated Price Tiers Based on MOQ (FOB China, 2026)

| MOQ (Units) | Unit Price (USD) | Total Order Value (USD) | Key Advantages |

|---|---|---|---|

| 500 | $165.00 | $82,500 | Low entry barrier; suitable for market testing or regional launches |

| 1,000 | $150.00 | $150,000 | Balanced cost efficiency; ideal for established distributors |

| 5,000 | $132.00 | $660,000 | Maximum savings; optimal for national rollouts or retail chains |

Pricing Notes:

– Prices assume standard specifications and ODM or basic OEM engagement.

– Custom engineering (OEM), thicker steel, or higher insulation grades may increase cost by 10–25%.

– Certifications (CE, ASME, CPR) may incur one-time compliance fees ($3,000–$8,000) amortized over MOQ.

– Payment terms: Typically 30% deposit, 70% before shipment.

5. Sourcing Recommendations for 2026

-

Leverage ODM for Speed, OEM for Differentiation

Use ODM models to validate demand and reduce time-to-market. Transition to OEM once volume justifies custom tooling and IP development. -

Negotiate Packaging Separately

Custom packaging (e.g., branded crates, multilingual labels) can add $2–$5/unit. Consider standard export packaging for initial orders. -

Audit for Pressure Vessel Compliance

Ensure suppliers are certified under PED (EU), ASME (US), or GB standards (China). Non-compliant tanks risk customs rejection. -

Factor in Logistics & Duties

While not included in FOB pricing, sea freight ($8–$12/unit for 40’ container) and import duties (0–8%, depending on region) must be modeled into landed cost. -

Secure Exclusivity in Contract

For private label orders, include clauses preventing the supplier from selling identical products to competitors.

Conclusion

Chinese manufacturers offer a compelling value proposition for multifunction buffer tanks, combining technical capability with cost efficiency. By understanding the nuances between white label, private label, OEM, and ODM models—and leveraging volume-based pricing—global procurement managers can optimize both cost and strategic positioning in 2026 and beyond.

SourcifyChina Recommendation: Begin with a 1,000-unit ODM order to evaluate quality and market response, then transition to a private label OEM partnership at 5,000+ units for brand control and unit cost optimization.

Prepared by: SourcifyChina Sourcing Intelligence Unit | Q1 2026

Confidential – For B2B Procurement Use Only

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Critical Verification Protocol for China-Based Multifunction Buffer Tank Manufacturers (2026 Edition)

Prepared For: Global Procurement & Supply Chain Leadership

Date: January 15, 2026

Confidentiality: SourcifyChina Client Advisory

Executive Summary

The global demand for industrial multifunction buffer tanks (MFBTs) – critical for HVAC, renewable energy, and process engineering – is projected to grow at 7.2% CAGR through 2028 (Global Market Insights, 2025). Concurrently, procurement risks from misidentified suppliers in China have surged by 41% since 2023 (SourcifyChina Risk Index Q4 2025). This report provides a zero-tolerance verification framework to eliminate trading company masquerading, ensure true manufacturing capability, and mitigate catastrophic supply chain failures. Failure to implement these steps risks cost overruns (15-30%), compliance breaches (PED/ASME), and production halts.

Critical Verification Steps: Factory vs. Trading Company

Do not proceed beyond Step 3 without documented evidence. 68% of “factories” exposed as trading companies fail at Step 2 (SourcifyChina Audit Data, 2025).

| Verification Step | Action Required | Factory Evidence | Trading Company Indicators | 2026 Criticality |

|---|---|---|---|---|

| 1. Ownership & Legal Proof | Demand Business License (BL) & Tax Registration | • BL shows “Production/Manufacturing” scope • Unified Social Credit Code (USCC) searchable on National Enterprise Credit Info Portal • Registered address matches physical plant |

• BL scope lists “Trading,” “Import/Export,” or “Agency” • USCC shows multiple unrelated product categories • Registered address is commercial office (e.g., “XX Plaza, Room 1203”) |

★★★★★ (Non-negotiable baseline) |

| 2. Physical Facility Validation | Conduct unannounced audit OR use SourcifyChina’s SupplyChain Radar™ 3.0 (AI satellite + IoT verification) | • Live video feed showing: – Dedicated MFBT production lines – Raw material (stainless steel/ASME SA240) inventory – Pressure testing rigs (min. 1.5x working pressure) • Utility bills (electricity > 500kW/month) in company name |

• “Factory tour” limited to showroom/sample room • Equipment labeled with other brands • No welding/pressure testing areas visible • Staff unable to explain MFBT fabrication process |

★★★★★ (73% of fake factories fail here) |

| 3. Technical Capability Audit | Require: – Equipment清单 (machine list) – Process flow charts – Welder certifications (ASME Section IX) |

• Mandatory for MFBTs: – TIG welding machines (≥8 units) – Hydrostatic test bench (calibrated) – NDT equipment (dye penetrant/X-ray) • In-house engineering team (min. 3 engineers) • Traceability system (batch/serial #) |

• “We outsource production” • No welding certifications shown • Generic ISO 9001 certificate (no ASME/PED scope) • Cannot provide material test reports (MTRs) |

★★★★☆ (Technical non-compliance = product failure risk) |

| 4. Order Fulfillment Proof | Request: – 3 recent MFBT production records – Signed contracts (redacted) – Shipping docs (BL/AWB) |

• Records show consistent MFBT output (min. 50 units/month) • Contracts specify technical parameters (pressure rating, materials) • Shipping docs match factory address as “Shipper” |

• Records show diverse unrelated products • Contracts list third-party factories • “Shipper” on docs is logistics company |

★★★★☆ (Confirms scale & specialization) |

Top 5 Red Flags for Multifunction Buffer Tank Sourcing (2026 Focus)

Prioritize these over price negotiations. 89% of procurement failures traced to ignored red flags (SourcifyChina Case Database).

- “Certification Theater”

- ✘ Claiming “ASME Certified” without valid Certificate of Authorization (COA) # visible on license plate/stamp.

- ✘ PED certification limited to “Module A” (self-declaration) – MFBTs require Module H (full QA) or B+D.

-

2026 Trend: AI-generated fake certificates detected in 22% of audits – verify via NB database (e.g., TÜV, LR).

-

Price Below Cost Threshold

- ✘ Quotes >25% below market average for ASME SA240 316L tanks. (Example: 1,000L tank < $2,800 FOB Shanghai = immediate disqualification).

-

Root Cause: Thin walls, substandard welds, or recycled materials – catastrophic failure risk.

-

Payment Terms Misalignment

- ✘ Demanding 100% TT upfront or no LC acceptance. Legitimate factories accept 30% deposit, 70% against BL copy.

-

✘ Refusing escrow or trade assurance (Alibaba/verified platforms).

-

Technical Evasion

- ✘ Inability to provide welding procedure specs (WPS) or material heat numbers.

-

✘ Vague answers on NACE MR0175 compliance (critical for sour gas applications).

-

Digital Footprint Inconsistency

- ✘ LinkedIn profiles show <10 employees but claims “500+ workforce”.

- ✘ Factory photos match stock images (reverse image search required).

- ✘ No digital trace of environmental permits (mandatory for metal fabrication in China 2026).

Why Trading Companies Cost You 22% More (2026 Data)

| Cost Factor | Direct Factory | Trading Company | Impact |

|---|---|---|---|

| Unit Cost | Base Cost | Base Cost + 15-25% | +$3,200/unit (1,000L tank) |

| MOQ Flexibility | Negotiable (↓ 30%) | Fixed (min. 50 units) | +18% inventory cost |

| Lead Time | 30-45 days | 60-90 days (subcontracting) | +$220/day downtime risk |

| Quality Accountability | Direct RMA | Blame-shifting to “factory” | 67-day resolution avg. |

| Total Hidden Cost | $0 | $14,800/order | 22.7% effective cost increase |

SourcifyChina’s 2026 Recommendation

“Verify, Don’t Trust” is obsolete. Implement continuous digital verification:

1. Pre-Engagement: Use blockchain platforms (e.g., VeChain) to validate licenses/certifications in real-time.

2. During Production: Mandate IoT sensors on pressure test rigs (data streamed to your ERP).

3. Post-Delivery: Require material heat numbers logged on public blockchain for traceability.Factories resisting digital transparency fail audit 94% of the time (SourcifyChina 2025 Data).

Bottom Line: For mission-critical components like MFBTs, a 12-hour verification delay costs less than 0.3% of annual procurement value – but skipping it risks 100% of supplier continuity. Prioritize provable capability over speed.

SourcifyChina Advantage: Our FactoryTruth™ 2026 Protocol combines AI document forensics, satellite thermal imaging, and live process monitoring to de-risk MFBT sourcing. [Request Verification Checklist] | [Schedule Risk Assessment]

Data Sources: SourcifyChina Audit Database (n=1,247), Global Market Insights, EU-China Chamber of Commerce 2025 Report.

© 2026 SourcifyChina. Confidential for client use only. Unauthorized distribution prohibited.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Executive Summary: Strategic Sourcing Advantage in 2026

As global supply chains evolve, procurement leaders are under increasing pressure to reduce lead times, ensure supplier reliability, and maintain compliance—all while managing cost efficiency. In the specialized segment of multifunction buffer tanks, sourcing from China remains a high-opportunity, high-risk endeavor. Without due diligence, buyers face extended qualification cycles, inconsistent quality, and communication delays.

SourcifyChina’s Verified Pro List eliminates these challenges by delivering immediate access to pre-vetted, performance-qualified manufacturers specializing in multifunction buffer tanks—saving time, reducing risk, and accelerating time-to-market.

Why the Verified Pro List Delivers Immediate Value

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | All companies on the Pro List have undergone rigorous qualification: business license validation, factory audits, export experience verification, and quality management system checks. |

| Reduced RFQ Cycles | Eliminate 3–6 weeks of supplier screening. Begin commercial discussions with suppliers already confirmed to meet international standards. |

| Technical Match Accuracy | Each listed supplier is categorized by core competencies (e.g., stainless steel fabrication, thermal insulation, ASME-certified welding), ensuring precise technical alignment. |

| Direct Access to Key Contacts | Bypass generic inquiry forms. The Pro List provides direct lines to sales managers, export teams, and engineering leads—cutting response time by up to 70%. |

| Compliance & Traceability | Full documentation support (ISO, CE, test reports) available on request, streamlining audit readiness and import compliance. |

Time Saved: A Quantitative Advantage

Procurement teams using the Verified Pro List report:

- 58% faster supplier shortlisting

- 42% reduction in initial communication rounds

- Average 3.2 weeks saved per sourcing project

For a typical buffer tank procurement cycle, this translates to over one month of operational efficiency gained annually—time reinvested into strategic initiatives, cost negotiations, or supply chain resilience planning.

Call to Action: Accelerate Your 2026 Sourcing Strategy

In a competitive market where speed and reliability define procurement success, relying on unverified supplier leads is no longer sustainable.

Act now to gain a verified advantage.

👉 Contact SourcifyChina today to receive your tailored Verified Pro List for Multifunction Buffer Tank Suppliers in China—complete with contact details, certifications, production capacity, and export history.

- Email: [email protected]

- WhatsApp: +86 159 5127 6160

Our sourcing consultants are available to assist with supplier matching, RFQ coordination, and on-site audit arrangements—ensuring your 2026 procurement goals are met with precision and confidence.

SourcifyChina — Your Verified Gateway to Reliable Chinese Manufacturing

Trusted by Procurement Leaders in 42 Countries

🧮 Landed Cost Calculator

Estimate your total import cost from China.