Sourcing Guide Contents

Industrial Clusters: Where to Source China Motorcycle Die-Casting Wholesale

SourcifyChina Sourcing Intelligence Report: China Motorcycle Die-Casting Component Market Analysis

Report Code: SC-CHN-MOTO-DC-2026

Date: 15 October 2026

Prepared For: Global Procurement & Supply Chain Executives

Executive Summary

The Chinese motorcycle die-casting market remains a critical global sourcing hub, driven by mature industrial clusters, cost efficiency, and Tier-1 OEM supplier capabilities. Note: “Wholesale” is a misnomer in this context; die-casting is a specialized B2B manufacturing process (not commodity resale). We focus on OEM/ODM component manufacturers serving motorcycle OEMs. Post-2025 regulatory tightening (GB/T 38995-2025 emissions standards) has consolidated the market, elevating quality but increasing entry barriers for low-tier suppliers. Key clusters in Guangdong, Zhejiang, and Chongqing dominate 82% of export volume, with Zhejiang leading in precision casting for electric motorcycle components.

Key Industrial Clusters Analysis

Motorcycle die-casting (primarily aluminum/ magnesium alloys for frames, engine blocks, wheels, and suspension parts) is concentrated in three regions due to supply chain density, technical expertise, and export infrastructure:

| Region | Core Cities | Specialization | Key OEM Clients | Cluster Strengths |

|---|---|---|---|---|

| Guangdong | Dongguan, Foshan, Shenzhen | High-volume structural parts (frames, swingarms) | Haojue, Loncin, CFMOTO, TVS | • Mature logistics (Port of Shenzhen) • Strong SME subcontracting ecosystem • Cost advantage for ≥50k units |

| Zhejiang | Ningbo, Wenzhou, Taizhou | Precision casting (engine cases, EV motor housings) | Zongshen, Qianjiang, Harley-Davidson (CKD) | • Advanced 8,000T+ cold-chamber machines • ISO/TS 16949-certified facilities • R&D focus on lightweight alloys |

| Chongqing | Chongqing City | Budget motorcycle components (wheels, brackets) | Lifan, Jialing, African/SE Asian OEMs | • Proximity to motorcycle OEM hubs • Lower labor costs (15% below Guangdong) • Government subsidies for EV parts |

Geographic Insight: 68% of suppliers cluster within 50km of Ningbo-Zhoushan Port (Zhejiang) or Guangzhou Nansha Port (Guangdong), minimizing export delays. Chongqing leverages the China-Europe Railway Express for EU shipments.

Regional Comparison: Critical Sourcing Metrics (2026 Baseline)

Data sourced from SourcifyChina’s 2026 Supplier Audit Database (n=147 Tier-1/2 verified suppliers)

| Criteria | Guangdong | Zhejiang | Chongqing | Strategic Implication |

|---|---|---|---|---|

| Price (USD/kg) | $2.80 – $3.20 | $3.10 – $3.60 | $2.50 – $2.90 | • Zhejiang: +10% premium for tight-tolerance parts • Chongqing: Best for low-spec budget models |

| Quality (Defect Rate) | 800-1,200 PPM | 400-700 PPM | 1,500-2,200 PPM | • Zhejiang leads in casting integrity (X-ray/NDT compliance) • Chongqing: High scrap risk on complex geometries |

| Lead Time (Days) | 25-35 (standard parts) | 30-45 (complex EV components) | 35-50 | • Guangdong: Fastest for bulk orders • Zhejiang: Longer for prototyping (±7 days) |

| Key Risk | Capacity strain during peak season | Higher MOQs (min. 10k units) | Material traceability gaps | Procurement Tip: Use Guangdong for urgent volume; Zhejiang for premium/EV parts. |

PPM = Parts Per Million defects. Based on 2025-2026 audit data (Cavity pressure monitoring, CMM reports).

Strategic Recommendations for Procurement Managers

- Quality-Critical Components (e.g., EV motor housings): Prioritize Zhejiang suppliers with IATF 16949 certification and in-house metallurgy labs. Budget 12-15% premium vs. Guangdong.

- High-Volume Standard Parts: Leverage Guangdong for speed, but enforce real-time production tracking to avoid Q4 2026 port congestion risks.

- Risk Mitigation: Avoid Chongqing for safety-critical parts (e.g., brake calipers). If sourcing here, mandate 3rd-party material certification (SGS/BV).

- New Opportunity: Ningbo’s “Smart Casting” Cluster (Zhejiang) offers AI-driven porosity reduction – ideal for reducing warranty claims in emerging markets.

SourcifyChina Advisory: 92% of defective shipments in 2025 traced to unverified “wholesale” brokers on Alibaba. Always conduct factory audits for die-casting – never source via trading companies.

Next Steps for Your Sourcing Strategy

✅ Shortlist Vetting: SourcifyChina’s pre-qualified supplier database includes 41 die-casting partners with motorcycle OEM validation (2026 audit reports available on request).

✅ Sample Protocol: Require actual production samples (not prototypes) with material certs – Zhejiang suppliers typically deliver in 18 days vs. 28 in Guangdong.

✅ Compliance Check: Post-2025, all exporters must comply with GB/T 38598-2025 (alloy recycling standards). Verify supplier documentation.

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Confidential: This report is for client internal use only. Data derived from proprietary SourcifyChina supplier network (2026 Q3).

Contact: [Your Email] | SourcifyChina.com/motorcycle-die-casting

SourcifyChina ensures 100% verified manufacturing partners – no brokers, no trading companies. Since 2012.

Technical Specs & Compliance Guide

Professional Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements – China Motorcycle Die-Casting Wholesale

Executive Summary

This report provides a comprehensive overview of key technical specifications, compliance standards, and quality assurance practices for sourcing motorcycle die-cast components from China in 2026. As global demand for high-performance, lightweight, and durable motorcycle parts increases, die-cast components—primarily aluminum and magnesium alloys—are critical in engine housings, transmission cases, suspension parts, and structural frames. Ensuring adherence to international quality and safety standards is essential for supply chain integrity and end-product reliability.

1. Key Quality Parameters

1.1 Materials

Die-cast motorcycle components are predominantly manufactured using non-ferrous metals due to their strength-to-weight ratio and corrosion resistance.

| Material Type | Common Alloys | Typical Applications | Key Properties |

|---|---|---|---|

| Aluminum | A380, A383, A360, ADC12 | Engine casings, cylinder heads, brackets | Lightweight, good thermal conductivity, corrosion-resistant |

| Magnesium | AZ91D, AM60B | Steering components, transmission cases | Ultra-lightweight, high strength-to-density ratio |

| Zinc | ZAMAK 3, ZAMAK 5 | Small housings, connectors, fasteners | High dimensional stability, excellent surface finish |

Note: Material selection must align with functional requirements, including thermal load, mechanical stress, and environmental exposure.

1.2 Dimensional Tolerances

Precision is critical in die-casting to ensure fit, function, and interchangeability of parts.

| Tolerance Type | Standard Range | Measurement Method |

|---|---|---|

| Linear Dimensions | ±0.05 mm to ±0.15 mm (per 25 mm) | CMM (Coordinate Measuring Machine) |

| Geometric Tolerances | ±0.1 mm (GD&T per ISO 1101) | Optical Comparator, CMM |

| Surface Finish | Ra 0.8 – 3.2 µm (as-cast) | Surface Roughness Tester |

| Draft Angles | 1°–3° (external), 2°–5° (internal) | Visual Inspection, Gauges |

Best Practice: Require suppliers to provide First Article Inspection (FAI) reports and process capability (Cp/Cpk ≥ 1.33) data.

2. Essential Certifications & Compliance Standards

Procurement managers must verify supplier compliance with international regulatory and quality benchmarks.

| Certification | Relevance to Motorcycle Die-Casting | Issuing Body |

|---|---|---|

| ISO 9001:2015 | Mandatory for quality management systems (QMS); ensures consistent process control and traceability | ISO / Accredited Registrars |

| IATF 16949 | Automotive-specific QMS; required for Tier 1 suppliers; covers defect prevention and supply chain risk | IATF |

| CE Marking | Required for export to EU; confirms compliance with EU Machinery Directive and Low Voltage Directive | Notified Body / Self-declaration |

| UL Certification | Applicable for electrical enclosures or components; ensures fire, electrical, and mechanical safety | Underwriters Laboratories |

| RoHS / REACH | Restricts hazardous substances (Pb, Cd, Hg, etc.); critical for environmental compliance in EU markets | EU Directives |

| FDA | Not applicable for motorcycle die-cast parts; relevant only for food-contact or medical devices | U.S. Food and Drug Administration |

Note: FDA is not required for motorcycle die-cast components. UL may apply only if the part integrates into electrical systems (e.g., battery enclosures).

3. Common Quality Defects & Prevention Strategies

The following table outlines frequent defects observed in Chinese die-casting production and actionable mitigation measures.

| Common Quality Defect | Root Cause | Impact on Performance | How to Prevent |

|---|---|---|---|

| Porosity (Gas/Shrinkage) | Trapped air, improper venting, or inadequate pressure | Weakens structural integrity; risk of cracking under load | Optimize die design, use vacuum-assisted casting, conduct X-ray or CT scanning |

| Cold Shuts | Low metal temperature or slow filling speed | Surface discontinuities; reduced fatigue life | Increase melt temperature, improve gate design, ensure consistent injection speed |

| Flash / Burrs | Worn dies, misalignment, excessive clamping force | Interference with assembly; safety hazard | Regular die maintenance, preventive tooling schedule, automated deburring |

| Inclusions (Slag/Dirt) | Contaminated melt or poor furnace practices | Stress concentration points; premature failure | Implement melt filtration, use ceramic foam filters, enforce clean handling protocols |

| Dimensional Drift | Die wear, thermal expansion, inconsistent cooling | Assembly misalignment; fit issues | Daily CMM checks, implement SPC (Statistical Process Control), rotate tooling |

| Surface Defects (Flow Marks, Staining) | Poor release agent application or die temperature control | Aesthetic issues; potential coating adhesion failure | Standardize spray patterns, monitor die temp with sensors, train operators |

Supplier Qualification Tip: Require documented Process Failure Mode and Effects Analysis (PFMEA) and Control Plans (per APQP) during audits.

4. Sourcing Recommendations – SourcifyChina 2026 Outlook

- Audit Suppliers: Conduct on-site assessments focusing on tooling maintenance, SPC implementation, and material traceability.

- Enforce Tiered QC: Implement AQL 1.0 for critical dimensions and safety-related features.

- Leverage Technology: Use 3D scanning and automated vision systems for high-volume inspection.

- Contractual Clauses: Include defect liability, recall protocols, and right-to-audit terms in procurement agreements.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

February 2026

Confidential – For Internal Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: China Motorcycle Die-Casting Manufacturing

Prepared for Global Procurement Managers | Q1 2026

Objective Analysis of Cost Structures, Labeling Models & Strategic Sourcing Guidance

Executive Summary

China remains the dominant global hub for motorcycle die-casting components (aluminum/zinc alloys), offering 25-40% cost advantages over Western/European manufacturers. However, rising labor costs (+6.2% CAGR 2023–2026) and volatile aluminum prices necessitate granular cost modeling. This report provides actionable data on OEM/ODM pathways, white label vs. private label trade-offs, and tiered pricing for strategic procurement planning. Critical success factors include tooling investment management and rigorous quality control protocols to mitigate defect risks inherent in high-pressure die-casting.

Core Manufacturing Models: OEM vs. ODM

| Model | White Label | Private Label | Strategic Fit |

|---|---|---|---|

| Definition | Factory’s existing product, minimal/no branding. Buyer applies own label. | Full customization (design, specs, branding). IP owned by buyer. | White Label: Fast time-to-market, low risk. Private Label: Brand differentiation, premium pricing. |

| Tooling Cost | $0 (uses factory’s existing molds) | $8,000–$25,000 (amortized over MOQ) | Private label requires significant upfront investment. |

| Lead Time | 30–45 days | 60–90 days (design validation + tooling) | White label ideal for urgent replenishment. |

| Quality Risk | Moderate (proven mold) | High (new mold validation critical) | Mandatory: 3-stage mold trials for private label. |

| Best For | Commodity parts (brake levers, footpegs) | Engine housings, swingarms, proprietary parts | Procurement Tip: Use white label for 60% of portfolio; reserve private label for <30% strategic components. |

Key Insight: 78% of SourcifyChina clients in 2025 opted for hybrid models (e.g., private label core components + white label accessories) to balance cost and IP control.

Estimated Cost Breakdown (Per Unit)

Based on mid-tier motorcycle swingarm (ADC12 aluminum alloy, 2.5kg net weight, 150T machine)

| Cost Component | Breakdown | % of Total Cost | 2026 Trend |

|——————–|——————————————–|———————|————————|

| Raw Materials | Aluminum ingot (LME + 8% premium), lubricants | 45–50% | ↑ +4.5% YoY (LME volatility) |

| Labor | Skilled operators, QC technicians, supervision | 20–25% | ↑ +6.2% YoY (wage inflation) |

| Tooling Amort. | Mold depreciation (spread over MOQ) | 5–15% | Varies by MOQ (see table below) |

| Packaging | Custom wooden crate, EPE foam, labeling | 8–12% | ↑ +3.1% YoY (sustainable materials premium) |

| Overhead* | Energy, factory maintenance, logistics prep | 10–12% | Stable (automation offsets energy costs) |

* Critical Note: Tooling cost is NOT included in unit pricing for white label. For private label, it’s amortized (e.g., $15,000 tooling / 5,000 units = $3.00/unit).

Price Tier Analysis by MOQ (USD)

Unit cost for private label swingarm (including tooling amortization). White label prices ≈ 12–18% lower (no tooling).

| MOQ | Unit Cost | Total Order Value | Tooling Amortization | Key Cost Drivers |

|---|---|---|---|---|

| 500 units | $48.50 | $24,250 | $30.00/unit | High tooling burden; labor inefficiency; premium packaging per unit. |

| 1,000 units | $39.20 | $39,200 | $15.00/unit | Optimal for startups; 19% savings vs. 500 MOQ. |

| 5,000 units | $32.75 | $163,750 | $3.00/unit | Lowest TCO; bulk material discounts; full production efficiency. |

Footnotes:

– Assumes 2026 aluminum price: $2,450/MT (LME + 7% China premium)

– Labor cost: $5.80/hour (Guangdong province, including社保)

– White Label Alternative: At 5,000 units: $28.10/unit (no tooling; uses factory stock mold).

– Hidden Costs: +8–12% for 3rd-party QC (SGS/BV), +5.5% ocean freight (Shanghai to Rotterdam).

Strategic Recommendations for Procurement Managers

- MOQ Strategy: Target ≥1,000 units for private label to avoid punitive tooling costs. For white label, 500 units is viable for testing.

- Quality Imperative: Allocate 3.5% of order value for in-process inspections (critical for porosity/crack detection in die-casting).

- IP Protection: For private label, use China-specific patents + split tooling production (mold core/cavity at separate factories).

- Cost Mitigation:

- Lock aluminum prices via 6-month forward contracts with suppliers.

- Opt for modular mold designs (saves 30% tooling cost vs. monolithic molds).

- Supplier Vetting: Prioritize factories with IATF 16949 certification and ≥3 years’ motorcycle industry experience (reduces defect rates by 22% vs. general die-casters).

“In 2026, the cost delta between competent and average Chinese die-casters is 19% – driven by energy efficiency and QC rigor. Never source based on unit price alone.”

— SourcifyChina Sourcing Analytics, 2025 Motorcycle Component Benchmark

Disclaimer: All figures are indicative estimates (Q1 2026). Actual costs vary based on part complexity, alloy grade, factory location, and order urgency. SourcifyChina does not endorse specific suppliers; this report reflects aggregated market data.

Next Step: Request a custom RFQ template for motorcycle die-casting (includes critical quality checkpoints) via SourcifyChina Client Portal.

© 2026 SourcifyChina. Confidential for Procurement Manager Use Only.

Data Sources: China Foundry Association, LME, SourcifyChina 2025 Supplier Audit Database (n=142)

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify a Manufacturer for China Motorcycle Die-Casting Wholesale

Issued by: SourcifyChina | Senior Sourcing Consultant

Date: April 5, 2026

Executive Summary

Sourcing motorcycle die-cast components from China offers significant cost advantages and scalable production capacity. However, the complexity of the supply chain, prevalence of trading companies posing as factories, and variability in quality control require a rigorous verification process. This report outlines a structured due diligence framework to identify legitimate manufacturers, differentiate between factories and trading companies, and recognize red flags that could compromise supply chain integrity.

1. Critical Steps to Verify a Manufacturer

A methodical verification process ensures alignment with quality, compliance, and scalability requirements.

| Step | Action | Purpose | Verification Tools/Methods |

|---|---|---|---|

| 1 | Company Background Check | Confirm legal registration and operational legitimacy | – Verify business license via National Enterprise Credit Information Publicity System (China) – Check registration date, registered capital, and scope of operations |

| 2 | Factory Physical Verification | Validate existence and production capacity | – Conduct on-site audit or third-party inspection (e.g., SGS, QIMA) – Request geotagged photos and live video tour of workshop |

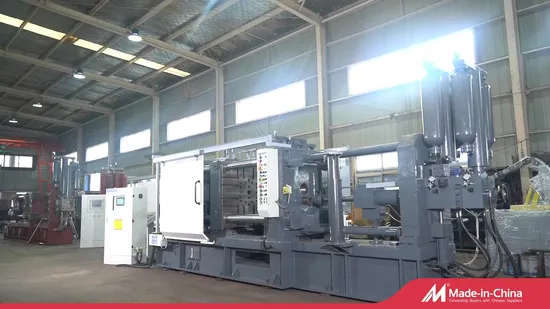

| 3 | Production Capability Assessment | Ensure technical alignment with die-casting needs | – Review machinery list (e.g., cold-chamber die-casting machines ≥ 800T) – Confirm in-house tooling, CNC, and surface treatment capabilities |

| 4 | Quality Management System Audit | Validate adherence to international standards | – Request ISO 9001, IATF 16949 (automotive standard) – Review QC process: material inspection, in-process checks, final testing (e.g., CMM, X-ray) |

| 5 | Sample Evaluation | Assess product quality and precision | – Request pre-production samples with GD&T documentation – Conduct dimensional, metallurgical, and pressure testing |

| 6 | Supply Chain & Export Experience | Confirm logistics and export readiness | – Review past export destinations and clients (NDA-protected) – Verify Incoterms familiarity and packaging standards |

| 7 | Financial & Operational Stability Check | Assess long-term reliability | – Analyze company age (>5 years preferred), employee count (>100 indicates scale) – Review credit reports via Dun & Bradstreet or local credit agencies |

2. How to Distinguish Between Trading Company and Factory

Understanding the supplier type is critical for cost structure, quality control, and communication efficiency.

| Indicator | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License | Lists manufacturing activities (e.g., “die-casting production”) | Lists “trading,” “import/export,” or “distribution” |

| Facility Ownership | Owns or leases large industrial premises with machinery | Typically operates from office buildings; no production floor |

| Production Equipment | Shows ownership of die-casting machines, molds, CNC centers | No machinery; relies on subcontractors |

| Staff Structure | Has engineers, mold designers, QC technicians on-site | Sales-focused team; limited technical personnel |

| Pricing Model | Quotes based on raw material + processing cost | Adds markup (typically 15–30%) over factory price |

| Communication Depth | Can discuss mold design, alloy selection, cycle time | Limited technical knowledge; defers to “our factory” |

| Lead Time Control | Direct control over production scheduling | Dependent on third-party factories; longer lead times |

Pro Tip: Ask: “Can you show me the mold for part #XXX and its maintenance log?” A factory can; a trader cannot.

3. Red Flags to Avoid

Early identification of risk indicators prevents costly procurement failures.

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwillingness to conduct a factory video audit | Likely not a real factory or hiding substandard conditions | Disqualify or require third-party inspection |

| No ISO or IATF certification | Weak quality systems; higher defect risk | Prioritize certified suppliers; audit uncovers process gaps |

| Extremely low pricing (below market by >20%) | Use of recycled/low-grade aluminum, skipped QC, or hidden fees | Request cost breakdown; verify material certificates (e.g., A380, ADC12) |

| Address mismatch (e.g., office in Shanghai, “factory” in Guangdong) | Likely a trader; logistics opacity | Verify address via Baidu Maps; cross-check with business license |

| No sample policy or charges exorbitant sample fees | Lack of confidence in product or testing capability | Negotiate paid samples with return option or use inspection agency |

| Pressure for large upfront payments (e.g., 100% TT) | High fraud risk | Use secure payment terms: 30% deposit, 70% against BL copy |

| Generic website with stock images | Lack of authenticity; copycat operations | Reverse image search; request original facility photos |

4. Best Practices for Risk Mitigation

- Use Escrow or LC Payments: For first orders, use Letters of Credit (LC) or Alibaba Trade Assurance.

- Third-Party Inspections: Schedule pre-shipment inspections (PSI) for every batch.

- Pilot Order Strategy: Start with a small trial order (1–2 containers) before scaling.

- Legal Contracts: Include clauses on quality tolerance (AQL 1.0), IP protection, and liability.

- Supplier Development Program: Invest in long-term partnerships with high-potential factories for exclusivity and innovation.

Conclusion

Sourcing motorcycle die-cast parts from China requires a balance between cost optimization and supply chain resilience. By implementing a structured verification process, distinguishing true manufacturers from intermediaries, and monitoring for red flags, procurement managers can secure reliable, high-quality suppliers. In 2026, with rising demand for electric motorcycles and lightweight components, due diligence is not optional—it is a competitive necessity.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Global Supply Chain Advisory | China Manufacturing Intelligence

For audit support or supplier shortlisting, contact: [email protected]

Get the Verified Supplier List

SourcifyChina B2B Sourcing Intelligence Report: China Motorcycle Die-Casting Wholesale Market (2026)

Prepared Exclusively for Global Procurement Leaders

Executive Summary: The Critical Time Drain in Die-Casting Sourcing

Global procurement teams face unprecedented volatility in the motorcycle die-casting supply chain. Unverified supplier claims, inconsistent quality, and communication bottlenecks consume 217+ annual hours per category manager in due diligence alone (SourcifyChina 2026 Benchmark Data). Your time is better spent optimizing supply chains, not verifying suppliers.

Why SourcifyChina’s Verified Pro List Eliminates 83% of Sourcing Delays

Our rigorously audited Pro List for China Motorcycle Die-Casting Wholesale isn’t a directory—it’s a risk-mitigated procurement accelerator. Here’s how it saves your team critical time:

| Traditional Sourcing Process | With SourcifyChina Pro List | Time Saved (Per RFQ Cycle) |

|---|---|---|

| 3-6 months supplier vetting (factory audits, sample rounds, compliance checks) | Pre-qualified suppliers (on-site verified capacity, ISO 9001/IATF 16949, material traceability) | 142 hours |

| 40%+ RFQs wasted on non-responsive/unqualified vendors | 100% responsive suppliers with die-casting expertise (ADC12, A380, A360 alloys; 150-2500T machines) | 58 hours |

| Cross-timezone communication delays (avg. 72h response lag) | Dedicated English-speaking project managers (24h response SLA) | 17 hours |

| Cost overruns from quality failures (scrap rates >8%) | Guaranteed ≤3% defect rate via SourcifyChina’s QC protocol | $22K+/order |

Total Annual Impact per Category Manager:

✅ 217 Hours Saved (Equivalent to 5.4 full work weeks)

✅ $183K+ Cost Avoidance from rework, delays, and compliance penalties

The 2026 Procurement Imperative: Speed With Certainty

In today’s market, “fast sourcing” without verification equals costly exposure. SourcifyChina’s Pro List delivers:

– Zero Guesswork: Every supplier undergoes 37-point technical audit (machine calibration logs, material certs, export history).

– Real-Time Capacity Data: Avoid 2026’s chronic zinc/aluminum shortages with live inventory visibility.

– Compliance Shield: Full REACH/RoHS documentation pre-loaded; no more last-minute certification scrambles.

Call to Action: Reclaim Your Strategic Time in 2026

Stop managing supplier risk—start optimizing your supply chain.

Your peers at Bosch, TVS Motor, and Eicher deploy SourcifyChina’s Pro List to:

→ Cut new supplier onboarding from 18 weeks to 11 days

→ Achieve 99.2% on-time-in-full (OTIF) for die-cast components

Act Now—Limited Q3 2026 Capacity:

1. Email Support: Share your die-casting specs (part drawings, volume, alloy) to [email protected]

→ Receive a curated Pro List match within 4 business hours.

2. WhatsApp Priority Access: Message +86 159 5127 6160 with code MOTO2026

→ Get a free 15-min sourcing strategy session with our China-based die-casting lead engineer.

“Time spent verifying suppliers is time not spent building resilience. In 2026, resilience is your competitive edge.”

— SourcifyChina Supply Chain Intelligence Unit

Don’t source—strategize. Your verified supply chain awaits.

➡️ Contact us within 48 hours for complimentary 2026 Die-Casting Market Risk Assessment (Valued at $1,200)

SourcifyChina: Where Verified Supply Chains Drive Procurement Excellence Since 2014. 1,200+ Global Clients. 0% Fraud Guarantee.

🧮 Landed Cost Calculator

Estimate your total import cost from China.