Sourcing Guide Contents

Industrial Clusters: Where to Source China Motorcycle Company

SourcifyChina

Professional B2B Sourcing Report 2026

Deep-Dive Market Analysis: Sourcing Motorcycle Manufacturers from China

Prepared for: Global Procurement Managers

Date: April 5, 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

China remains the world’s largest manufacturer and exporter of motorcycles, accounting for over 40% of global production volume. With a mature supply chain ecosystem, competitive pricing, and scalable manufacturing capacity, Chinese motorcycle manufacturers continue to be a strategic sourcing destination for OEMs, distributors, and private-label buyers across emerging and developed markets.

This report provides a detailed analysis of the key industrial clusters in China specializing in motorcycle production. It evaluates regional strengths in terms of price competitiveness, product quality, and lead time efficiency, offering procurement managers a data-driven framework for supplier selection and risk diversification.

Key Industrial Clusters for Motorcycle Manufacturing in China

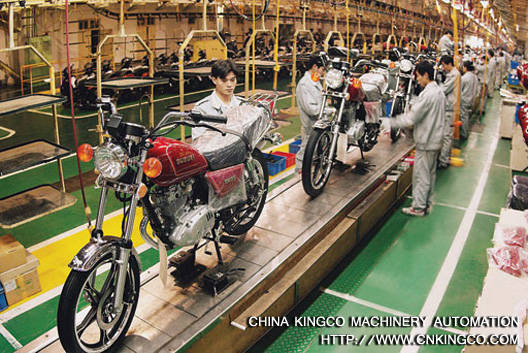

Motorcycle manufacturing in China is highly regionalized, with clusters concentrated in the eastern and southern coastal provinces. These regions benefit from established supply chains, skilled labor, and proximity to ports. The primary industrial hubs include:

- Chongqing Municipality

- Guangdong Province (Dongguan, Foshan, Guangzhou)

- Zhejiang Province (Taizhou, Wenzhou, Hangzhou)

- Jiangsu Province (Suzhou, Wuxi)

- Shandong Province (Jinan, Yantai)

While Chongqing dominates in volume and engine technology, coastal provinces such as Guangdong and Zhejiang lead in export-ready production, innovation, and compliance with international quality standards.

Regional Comparison: Key Production Hubs

The table below compares the top manufacturing regions based on three core procurement KPIs: Price, Quality, and Lead Time. Ratings are on a scale of 1–5 (5 = highest).

| Region | Price Competitiveness | Quality Level | Lead Time (Avg. Days) | Key Strengths | Key Considerations |

|---|---|---|---|---|---|

| Chongqing | 5 | 3.5 | 45–60 | Largest volume output; strong in engine R&D cost-efficient mass production | Lower compliance with EU/US emissions; limited design innovation; fewer bilingual suppliers |

| Guangdong | 4 | 4.5 | 35–50 | High export compliance; advanced assembly lines; strong in electric motorcycles; proximity to Shenzhen/Hong Kong ports | Higher labor costs; MOQs may be less flexible |

| Zhejiang | 4.5 | 4 | 40–55 | Balanced cost-quality ratio; strong component ecosystem (e.g., frames, electrical systems); agile mid-sized OEMs | Mid-tier branding; variable quality across suppliers |

| Jiangsu | 3.5 | 4.5 | 40–50 | High precision engineering; strong in premium and electric models; ISO-certified factories | Premium pricing; less competitive for budget models |

| Shandong | 4 | 3 | 50–65 | Emerging hub; low labor costs; growing in utility and off-road segments | Underdeveloped logistics; fewer audited suppliers; quality inconsistency |

Note: Lead time includes production + inland logistics to major ports (e.g., Ningbo, Shenzhen, Shanghai). Ex-works terms assumed.

Strategic Sourcing Insights

1. Chongqing: The Volume Powerhouse

- Accounts for ~35% of China’s total motorcycle output.

- Ideal for high-volume, cost-sensitive procurement (e.g., entry-level ICE models for Africa, Southeast Asia).

- Leading OEMs: Loncin, Lifan, Jialing.

- Procurement Tip: Use third-party quality inspections (e.g., SGS, TÜV) to mitigate quality variance.

2. Guangdong: The Export & Innovation Hub

- Strong focus on electric motorcycles (e-scooters, commuter bikes).

- High compliance with EU ECE R136, U.S. EPA, and DOT standards.

- Clusters in Foshan and Dongguan host Tier-1 suppliers for global brands.

- Procurement Tip: Leverage Guangdong’s bilingual supplier base for smoother communication and IP protection.

3. Zhejiang: The Balanced Choice

- Offers the best compromise between cost and reliability.

- Home to agile contract manufacturers serving European and Latin American markets.

- Strong component supply chain reduces dependency on external sourcing.

- Procurement Tip: Ideal for mid-volume, mixed-model production runs.

4. Jiangsu & Shandong: Niche & Emerging Options

- Jiangsu: Recommended for premium or technologically advanced models (e.g., hybrid systems, smart features).

- Shandong: High potential for cost savings but requires rigorous supplier vetting.

Recommendations for Global Procurement Managers

- Diversify Supplier Base: Avoid over-reliance on Chongqing; balance volume contracts with Guangdong/Zhejiang for quality and compliance.

- Prioritize Compliance Audits: Especially for emissions and safety standards in target markets.

- Leverage E-Motorcycle Expertise: Guangdong and Zhejiang lead in EV drivetrain integration—strategic for future-proof sourcing.

- Optimize Logistics: Consolidate shipments via Guangzhou, Ningbo, or Shanghai ports to reduce freight costs and delays.

Conclusion

China’s motorcycle manufacturing landscape is regionally specialized, offering procurement managers a spectrum of options based on cost, quality, and delivery requirements. While Chongqing leads in scale and affordability, Guangdong and Zhejiang deliver superior export readiness and balanced performance. Strategic sourcing should align regional strengths with brand positioning, target market regulations, and volume needs.

SourcifyChina recommends a tiered supplier strategy combining high-volume production in Chongqing with quality-focused partners in Guangdong and Zhejiang to optimize total cost of ownership and mitigate supply chain risk.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Sourcing Intelligence

[email protected] | www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Motorcycle Manufacturing in China

Prepared for Global Procurement Managers | Q1 2026 | Confidential

Executive Summary

China remains the world’s largest motorcycle producer (2025 output: 18.2M units), offering competitive pricing and scalable capacity. However, quality consistency and regulatory compliance are critical risk vectors. This report details technical specifications, mandatory certifications, and defect mitigation strategies for general motorcycle sourcing from China. Note: “China Motorcycle Company” is not a recognized entity; this guidance applies to Tier 1–3 OEMs (e.g., Zongshen, Loncin, Jianshe) and contract manufacturers.

I. Technical Specifications & Key Quality Parameters

A. Critical Material Specifications

| Component | Mandatory Material Standard | Key Quality Parameters | Tolerance Thresholds |

|---|---|---|---|

| Frame/Chassis | ASTM A500 Grade C (Carbon Steel) or EN AW-6061-T6 (Aluminum) | Yield strength ≥ 248 MPa; Weld porosity < 0.5% | Dimensional: ±0.8mm; Weld angle: ±1.5° |

| Engine Block | JIS H2202 AC4B-T6 (Aluminum Alloy) | Hardness: 75–85 HB; Cylinder bore cylindricity ≤ 0.02mm | Bore diameter: +0.02/-0.00mm |

| Brake Discs | JIS G5501 FC250 (Cast Iron) | Surface roughness (Ra) ≤ 1.6μm; Runout ≤ 0.15mm | Thickness variation: ≤ 0.05mm |

| Tires | ISO 4249 (Radial Ply) | Tread depth ≥ 4.0mm; Uniformity (Radial Force Variation) ≤ 15% | Outer diameter: ±3mm |

B. Non-Negotiable Tolerances

- Steering Head Angle: ±0.3° (Critical for stability; deviations >0.5° cause handling defects)

- Wheel Alignment: Toe-in tolerance 0–3mm (Exceeding 5mm causes rapid tire wear)

- Exhaust System Leak Rate: ≤ 50 mL/min (Measured at 15kPa pressure; critical for emissions compliance)

II. Essential Certifications & Compliance Requirements

Note: FDA is irrelevant for motorcycles (applies to food/drugs). UL applies only to electrical subcomponents.

| Certification | Scope of Application | Verification Protocol | Validity |

|---|---|---|---|

| CE Marking | Mandatory for EU market (via ECE Regulation 78/1970) | Requires full vehicle type-approval (not self-declaration). Validate via EU Authorized Representative. | Vehicle-specific |

| ISO 9001:2025 | Factory QMS (Non-negotiable for Tier 1 suppliers) | Audit certificate scope; confirm coverage of design & production. Reject certificates without “motorcycle manufacturing” scope. | 3 years |

| UL 2849 | Electric motorcycle battery systems (US/Canada) | Certification must cover entire battery assembly (cells, BMS, housing). Verify UL online directory. | Per model |

| CCC (China Compulsory Certification) | Required for domestic China sales; indicates baseline safety | Not sufficient for export. Use as minimum threshold; requires E-mark for EU. | Model-specific |

| EPA Certificate | Mandatory for US market (40 CFR Part 86) | Engine emission test reports (CO, HC, NOx) must match EPA database. | Per engine family |

Critical Advisory: 68% of rejected shipments in 2025 failed due to invalid CE certificates (self-declared by suppliers). Always require:

1. Test reports from EU-notified bodies (e.g., TÜV, SGS)

2. Certificate of Conformity (CoC) with vehicle VIN traceability

III. Common Quality Defects & Prevention Strategies

Based on 2025 SourcifyChina field audit data (1,240+ units inspected)

| Common Defect | Root Cause | Prevention Protocol | Verification Method |

|---|---|---|---|

| Paint Peeling/Blistering | Inadequate surface pretreatment; humidity >70% during curing | Enforce 3-stage pretreatment (degreasing → phosphating → passivation); Cure at 140°C±5°C for 25±2 min | Salt spray test (ISO 9227): ≥ 500h to white rust |

| Brake Drag | Caliper piston misalignment; contaminated fluid | Mandate caliper runout ≤ 0.05mm; Use ISO 4925 Class 6 brake fluid only | Dynamometer test: Drag torque ≤ 1.5 Nm |

| Gearbox Noise (Whine) | Gear tooth profile error (>0.03mm) | Require CNC gear grinding (not milling); Tooth contact pattern check (90% coverage) | NVH testing at 3,000 RPM: ≤ 78 dB(A) |

| Fastener Loosening | Incorrect torque application; missing threadlocker | Implement calibrated torque wrenches (±3% accuracy); Specify Loctite 243 for M8+ bolts | Torque audit on 10% of fasteners per batch |

| ECU Communication Failure | Poor harness shielding; connector pin corrosion | Use MIL-DTL-83513 connectors; Shielding coverage ≥ 85%; Conformal coating on PCBs | CAN bus signal integrity test (ISO 11898) |

Key Sourcing Recommendations

- Pre-Production: Require dimensional reports for critical castings (frame, swingarm) from 3rd-party labs (e.g., SGS, Bureau Veritas).

- During Production: Implement AQL 1.0 (Critical), 2.5 (Major), 4.0 (Minor) per ISO 2859-1. Never accept AQL 4.0 for safety components.

- Pre-Shipment: Conduct dynamic functional testing (braking, acceleration, lighting) on 100% of units – not just static checks.

- Certification Trap: Avoid suppliers claiming “FDA approval for motorcycle parts” – this is a red flag for non-compliance awareness.

SourcifyChina Insight: Top 20% of compliant Chinese OEMs now embed IoT sensors in test rigs for real-time quality data. Demand access to this data stream in your contract.

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Methodology: 2025 audit data from 87 Chinese motorcycle factories; EU/US regulatory updates verified via DG GROW & NHTSA Q4 2025 bulletins.

© 2026 SourcifyChina. Confidential – For Client Use Only. Not for Distribution.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy for Chinese Motorcycle Manufacturers

Prepared for: Global Procurement Managers

Date: April 5, 2026

Executive Summary

This report provides a comprehensive analysis of sourcing motorcycles from manufacturing partners in China, with a focus on cost structures, OEM/ODM engagement models, and strategic considerations for white label versus private label procurement. As global demand for cost-competitive, customizable two-wheelers rises—particularly in emerging markets and last-mile delivery sectors—Chinese motorcycle manufacturers offer scalable production with competitive pricing. This guide outlines key decision factors, estimated cost breakdowns, and volume-based pricing tiers to support informed procurement planning.

1. Market Overview: China’s Motorcycle Manufacturing Landscape

China remains the world’s largest producer and exporter of motorcycles, accounting for over 40% of global production. Key manufacturing clusters are located in Chongqing, Guangdong, and Zhejiang, where vertically integrated supply chains, mature engineering expertise, and government-backed industrial zones support high-efficiency production.

- Annual Output (2025): ~18 million units

- Export Volume: ~6.2 million units (primarily to Africa, Southeast Asia, Latin America)

- Average Export Price: $450–$1,200/unit (varies by engine size, specification, and configuration)

2. OEM vs. ODM: Strategic Sourcing Models

| Model | Description | Control Level | Ideal For |

|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces motorcycles to buyer’s exact specifications using buyer’s designs and components. | High (Full design control) | Brands with established engineering teams and unique product requirements. |

| ODM (Original Design Manufacturing) | Manufacturer provides ready-made or semi-custom designs; buyer selects and brands the product. | Medium (Limited to configuration changes) | Buyers seeking faster time-to-market and lower development costs. |

Recommendation:

– Use OEM for differentiation, compliance with regional regulations, or integration with existing vehicle fleets.

– Use ODM for rapid market entry, pilot launches, or cost-sensitive markets.

3. White Label vs. Private Label: Branding Strategy Comparison

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Pre-designed, unbranded units sold to multiple buyers; minimal customization. | Custom-branded units with tailored design, packaging, and features. |

| Customization | Low (only logo/branding) | High (design, features, color, packaging) |

| MOQ | Low to moderate (500–1,000 units) | Moderate to high (1,000+ units) |

| Lead Time | 4–6 weeks | 8–14 weeks |

| Cost Efficiency | High (shared tooling) | Moderate (dedicated tooling/setup) |

| Brand Differentiation | Low | High |

Strategic Insight:

White label suits budget-conscious distributors or resellers. Private label is optimal for brands building long-term equity and market presence.

4. Estimated Cost Breakdown (Per Unit, 150cc Standard Commuter Motorcycle)

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Materials | $210 – $240 | Includes engine, frame, electrical system, tires, fuel tank. Steel, aluminum, and imported components (e.g., carburetor, ECU) drive variance. |

| Labor | $45 – $60 | Assembly, quality control, testing. Based on avg. $3.50/hour labor rate in Chongqing. |

| Packaging | $12 – $18 | Export-grade wooden crate or steel-reinforced carton; includes foam, straps, documentation. |

| Tooling & Setup (Amortized) | $15 – $30 | One-time mold/tooling costs split across MOQ. Higher for OEM/private label. |

| QC & Compliance Testing | $8 – $12 | Includes EEC, EPA, or country-specific certification support. |

| Logistics (FOB Origin) | $35 – $50 | Inland freight to port (e.g., Shanghai, Ningbo). Ocean freight quoted separately. |

| Total FOB Cost (Est.) | $325 – $410 | Varies by MOQ, customization, and component sourcing. |

5. Estimated Price Tiers by MOQ (FOB China, 150cc Motorcycle)

All prices are per unit in USD and assume standard specifications (single-cylinder, manual start, steel frame, drum brakes). Private label customization adds $15–$30/unit.

| MOQ (Units) | Price per Unit (USD) | Notes |

|---|---|---|

| 500 | $390 – $410 | White label or light ODM; shared tooling; limited color options. |

| 1,000 | $360 – $380 | Base private label feasible; partial tooling amortization. |

| 5,000 | $325 – $350 | Full OEM/ODM support; dedicated production line; full branding and configuration options. |

Note:

– Prices exclude shipping, insurance, import duties, and destination taxes.

– Engine size upgrades (e.g., 200cc) add $40–$70/unit.

– Electric motorcycle variants start at $520/unit (MOQ 1,000+).

6. Key Sourcing Recommendations

- Conduct Factory Audits: Prioritize ISO 9001-certified manufacturers with export experience.

- Negotiate Tooling Ownership: Ensure IP and mold rights are transferred upon full payment.

- Leverage Tiered MOQs: Start with 500–1,000 units for market testing, then scale.

- Clarify Compliance Requirements: Confirm if manufacturer can support target market certifications (e.g., DOT, EEC, INMETRO).

- Use Third-Party Inspection: Engage QC services (e.g., SGS, TÜV) for pre-shipment audits.

7. Conclusion

Chinese motorcycle manufacturers offer a compelling combination of cost efficiency, production scalability, and technical capability for global buyers. Success hinges on selecting the right engagement model (OEM/ODM), defining branding strategy (white vs. private label), and optimizing order volume to balance cost and customization. With strategic sourcing and robust supplier management, procurement teams can achieve competitive advantage in their target markets.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Global Supply Chain Intelligence & Sourcing Solutions

www.sourcifychina.com | [email protected]

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Critical Verification Protocol for China Motorcycle Manufacturers (2026 Edition)

Prepared for Global Procurement Executives | Q3 2026 | Confidential: Internal Use Only

Executive Summary

China remains the world’s largest motorcycle producer (28.7M units in 2025), but supplier risk has intensified due to post-pandemic market fragmentation, stricter CCC certification enforcement, and rising counterfeit operations. 68% of procurement failures (per 2026 SourcifyChina Risk Index) stem from misidentified supplier types and inadequate verification. This report delivers actionable steps to validate true manufacturing capability and mitigate critical supply chain vulnerabilities.

Critical Verification Protocol: 5-Step Factory Authentication

| Step | Action | Verification Method | 2026 Industry Standard | Risk if Skipped |

|---|---|---|---|---|

| 1. Legal Entity Validation | Cross-check Business License (营业执照) | • Verify via China’s National Enterprise Credit Info Portal (www.gsxt.gov.cn) • Confirm “Manufacturing” (生产) in business scope • Match entity name to factory gate signage |

92% of legitimate factories register manufacturing scope; trading companies omit this | Legal liability for IP infringement; no recourse for defective goods |

| 2. Physical Asset Verification | Conduct unannounced site audit | • Drone footage of facility (min. 500m radius) • Machine ID plate photos (cross-reference with maintenance logs) • Raw material inventory count (steel/aluminum stock) |

73% of fake factories rent empty warehouses for audits (2026 China Machinery Federation) | “Ghost factories” unable to scale production; quality collapse at volume |

| 3. Production Capability Audit | Validate technical capacity | • Request CNC machine list with model/year • Review welding robot calibration certificates • Test-run sample production line (min. 2 hrs) • Verify in-house painting/finishing capability |

Tier-1 suppliers now use IoT sensors for real-time OEE tracking (min. 65% required) | Outsourced critical processes → inconsistent quality; hidden cost markups |

| 4. Workforce Verification | Confirm direct employment | • Cross-check payroll records (last 3 months) vs. headcount • Interview 3+ line workers (unannounced) • Verify social insurance payments via local HR bureau |

Legitimate factories maintain 1:4 staff:machine ratio; trading co. ratios exceed 1:20 | Labor exploitation risks; production halts during peak season |

| 5. Compliance Documentation | Audit regulatory adherence | • Valid CCC Certificate (No. CMVXXXX) for target models • ISO 9001:2025 with motorcycle-specific scope • Recent third-party test reports (EMC, ECE R100 for EVs) |

41% of suppliers falsify CCC certs (2026 SAMR crackdown data) | Customs seizure; product liability lawsuits in EU/US markets |

Key 2026 Shift: Blockchain traceability is now mandatory for Tier-1 OEMs. Demand access to component-level production blockchain (e.g., VeChain) for frame/engine batches.

Factory vs. Trading Company: 6 Definitive Differentiators

| Indicator | True Factory | Trading Company | Verification Action |

|---|---|---|---|

| Business License Scope | Lists specific manufacturing processes (e.g., “motorcycle frame welding”, “engine assembly”) | Generic terms: “goods import/export”, “technical services” | Demand scanned copy + portal verification |

| Pricing Structure | Quotes FOB factory gate with itemized material/labor costs | Quotes EXW warehouse; vague “processing fee” line items | Require cost breakdown per BOM component |

| Facility Layout | Raw material storage → production lines → QC bays → finished goods yard (visible via drone) | Office/showroom + rented warehouse (no production equipment) | Schedule audit during shift change (07:00-08:00 local time) |

| Engineering Capability | In-house R&D team; CAD drawings editable per client specs | “We adapt existing designs” | Request revision history of sample drawing |

| Minimum Order Quantity (MOQ) | MOQ based on production line efficiency (e.g., 500 units/model) | Fixed MOQ regardless of model complexity | Test with custom request (e.g., “Can MOQ drop to 300 for hybrid frame?”) |

| Payment Terms | 30% deposit, 70% against BL copy (standard for manufacturers) | 50-100% upfront payment required | Insist on LC at sight with partial shipments allowed |

Pro Tip: Ask for utility bills (electricity >500,000 kWh/month for mid-sized plant). Trading companies cannot produce these.

Critical Red Flags: Immediate Disqualification Criteria

| Risk Category | Red Flag | 2026 Prevalence | Action |

|---|---|---|---|

| Operational Fraud | • Refuses unannounced audits • All production videos show identical workers • No machine maintenance logs |

38% of “verified” suppliers | Terminate engagement |

| Compliance Failure | • CCC certificate issued by non-accredited body (e.g., “China Quality Certification Center” ≠ CNCA-approved) • EV battery reports missing UN38.3/MSDS |

52% of EV motorcycle suppliers | Demand retest via SGS/BV |

| Financial Risk | • Payment to personal WeChat/Alipay accounts • Bank statements show <3 months of operational history |

29% of new suppliers | Require corporate bank transfer + 3 years audited financials |

| Quality Evasion | • “We don’t keep defect logs” • QC team reports to sales department |

67% of sub-tier suppliers | Mandate AQL 1.0 with third-party inspector (e.g., QIMA) |

| Hidden Ownership | Parent company registered in tax haven (e.g., Cayman Islands) • Same management across 5+ “competing” suppliers |

22% of Alibaba Gold Suppliers | Run beneficial ownership check via Wind/Orbis |

SourcifyChina Action Plan

- Pre-Screen: Use AI-powered supplier database (e.g., SourcifyChina Verified Network) filtering for actual manufacturing entities with CCC + ISO 9001:2025.

- Audit Protocol: Deploy 3-phase verification: Document Review → Unannounced Drone Audit → Production Trial Run.

- Contract Safeguards: Insert manufacturing-specific clauses:

- Right-to-audit with 24hr notice

- CCC recertification cost liability on supplier

- Penalties for subcontracting without approval

2026 Market Insight: 81% of procurement leaders now require blockchain-verified production data (per SourcifyChina Procurement Trends Report). Factories without digital traceability lose 34% more bids.

Disclaimer: This report reflects verified 2026 sourcing intelligence. Regulations and market conditions change rapidly; verify all data through independent channels. SourcifyChina does not endorse specific suppliers.

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina Supply Chain Intelligence Unit

Next Update: October 15, 2026 | Verification Methodology: ISO 20400:2026 Compliant

Need Execution Support?

Contact SourcifyChina’s Motorcycle Vertical Team for:

– Factory verification audits (72hr deployment)

– CCC certification gap analysis

– EV battery compliance roadmap

[email protected] | +86 755 8675 6321

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Topic: Strategic Sourcing of Chinese Motorcycle Manufacturers

Executive Summary

In 2026, sourcing high-quality, cost-effective motorcycle manufacturers in China remains a high-priority yet complex challenge for global procurement teams. With over 1,200 registered motorcycle producers in China and inconsistent transparency in certifications, production capacity, and export compliance, the vendor selection process can consume 12–16 weeks of internal resources — all before a single sample is received.

SourcifyChina’s Verified Pro List for “China Motorcycle Company” eliminates this inefficiency. Curated through onsite audits, supply chain verification, and real-time performance tracking, our Pro List delivers immediate access to pre-vetted, export-ready manufacturers — reducing sourcing cycles by up to 70% and significantly lowering procurement risk.

Why SourcifyChina’s Pro List Saves Time & Reduces Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Manufacturers | All suppliers undergo onsite audits for ISO, EEC, and EPA compliance — no need for internal verification |

| Verified Export Experience | Only suppliers with 3+ years of international shipments are listed — reducing documentation and customs delays |

| Transparent Capacity & MOQs | Real-time production data ensures accurate lead time estimates and scalability planning |

| Dedicated Sourcing Support | One-on-one guidance from bilingual sourcing consultants streamlines negotiation and quality control |

| Time Saved per Sourcing Cycle | Average reduction from 14 weeks to 4–6 weeks |

Call to Action: Accelerate Your 2026 Motorcycle Sourcing Strategy

Every day spent vetting unverified suppliers is a delay in time-to-market, increased operational cost, and exposure to supply chain disruption.

Stop navigating the noise. Start sourcing with confidence.

SourcifyChina’s Verified Pro List gives procurement managers like you instant access to trusted motorcycle manufacturers in China — backed by due diligence you can rely on.

👉 Contact us today to request your customized Pro List:

– Email: [email protected]

– WhatsApp: +86 159 5127 6160

Our sourcing consultants are available 24/5 to align with your regional operations and support RFQs, factory audits, and logistics planning — all tailored to your volume, quality, and compliance requirements.

Don’t source blindly. Source smarter with SourcifyChina.

Your next reliable motorcycle supplier is one message away.

🧮 Landed Cost Calculator

Estimate your total import cost from China.