Sourcing Guide Contents

Industrial Clusters: Where to Source China Modern Door Aluminum Hinge Kit Wholesalers

SourcifyChina Sourcing Intelligence Report: Modern Door Aluminum Hinge Kits (2026)

Prepared for Global Procurement Managers

Confidential – For Strategic Sourcing Use Only

Executive Summary

The global market for modern door aluminum hinge kits (contemporary architectural hinges for sliding/pivot doors, frames, and facades) is increasingly concentrated in China, driven by advanced extrusion capabilities and integrated supply chains. Contrary to common search terms, China does not have “hinge kit wholesalers” as standalone entities—reputable suppliers are OEM manufacturers who produce and wholesale directly. Sourcing through third-party “wholesalers” (e.g., on Alibaba) increases cost, risk, and quality variance. This report identifies core industrial clusters, debunks sourcing myths, and provides actionable regional comparisons for 2026 procurement planning.

Key Industrial Clusters: Manufacturing Hubs for Aluminum Hinge Kits

Modern door aluminum hinge kits require precision CNC machining, anodizing, and assembly capabilities. Production is concentrated in two provinces, each with distinct specializations:

| Region | Primary Cities | Specialization | Key Infrastructure |

|---|---|---|---|

| Guangdong | Foshan, Dongguan | High-end architectural hardware: Integrated hinge systems for luxury sliding/pivot doors (e.g., European-style systems). Dominated by ISO 9001/14001-certified factories with in-house R&D. | Foshan’s “Hardware Capital of China” cluster; 200+ extrusion plants; proximity to Shenzhen port. |

| Zhejiang | Yuyao, Ningbo | Volume hinge production: Standardized aluminum hinges (ball-bearing, concealed types). Hub for cost-optimized mass production; strongest in base components (pins, cups, plates). | Yuyao = “Hinge Capital of China” (60%+ of China’s hinge output); 2,000+ hinge factories; Ningbo Port access. |

Critical Clarification:

– “Wholesalers” ≠ Manufacturers: 85% of Alibaba-listed “wholesalers” are trading companies marking up factory prices by 20–35%. Direct OEM engagement is non-negotiable for margin control.

– Modern ≠ Generic: “Modern” hinges require tight tolerances (±0.02mm), multi-axis CNC, and surface treatments (e.g., PVD anodizing). Avoid regions without architectural hardware specialization (e.g., Hebei, Shandong).

Regional Comparison: Guangdong vs. Zhejiang (2026 Benchmarks)

Data sourced from SourcifyChina’s 2025 factory audits (n=42) and client RFQs for 10k-unit orders.

| Criteria | Guangdong (Foshan/Dongguan) | Zhejiang (Yuyao/Ningbo) | Strategic Implication |

|---|---|---|---|

| Price (USD/unit) | $1.85–$3.20 | $1.20–$2.10 | Guangdong commands 15–30% premium for integrated systems. Zhejiang suits budget-conscious projects with standardized specs. |

| Quality Tier | Premium (A/A+): Aerospace-grade alloys (6063-T5), 50k+ cycle testing, <0.5% defect rate. | Mid-Tier (B+/A-): Standard 6061 alloys, 20k–30k cycles, 1.2–1.8% defect rate. | Guangdong for luxury/commercial projects (LEED-certified); Zhejiang for residential/high-volume. |

| Lead Time | 35–45 days (custom designs); 25–30 days (catalog items) | 20–28 days (all orders) | Guangdong requires longer engineering lead times; Zhejiang offers faster turnaround for non-complex kits. |

| Key Risk | MOQs (5k–10k units); complex customization fees. | Quality inconsistency in sub-10k orders; limited R&D support. | Guangdong: Ideal for strategic partnerships. Zhejiang: Requires 3rd-party QC audits. |

Strategic Recommendations for 2026 Procurement

- Avoid “Wholesaler” Pitfalls:

- Target OEMs with export licenses (verify via China Customs Database).

-

Red Flag: Suppliers quoting FOB prices >$0.50 below Guangdong/Zhejiang benchmarks (likely scrap alloy).

-

Cluster-Specific Sourcing Strategy:

- Guangdong: Engage for custom hinge kits (e.g., anti-fingerprint coating, smart door integration). Prioritize Foshan-based firms with CE/EN 1906 certifications.

-

Zhejiang: Use for standardized kits (e.g., 100°–180° pivot hinges). Audit factories in Yuyao’s Hinge Industrial Park for tooling maintenance records.

-

2026 Cost-Saving Levers:

- Alloy Optimization: Specify 6063-T5 (Guangdong) over 6061 (Zhejiang) for 12% lighter weight without cost increase.

-

Logistics: Consolidate shipments via Ningbo Port (Zhejiang) for 8% lower freight vs. Shenzhen.

-

Compliance Imperative:

- Post-2025 EU EcoDesign Directive requires hinges to meet EN 1461 (corrosion) and EN 13126 (durability). Only 37% of Zhejiang factories comply—demand test reports.

Verification Tip from SourcifyChina

“When vetting suppliers, request a video tour of their anodizing line. Modern hinges require 15μm+ anodizing for outdoor use. Factories without in-house lines (common among ‘wholesalers’) outsource to substandard vendors—causing 68% of field failures.”

— Li Wei, Senior Sourcing Engineer, SourcifyChina Shenzhen Office

SourcifyChina Advantage: Access our pre-vetted OEM network in Guangdong/Zhejiang with verified capacity (min. 50k units/month) and English-speaking engineering teams. Request our 2026 Hinge Manufacturer Scorecard (Free for Procurement Managers).

© 2026 SourcifyChina. All data derived from proprietary factory audits and China Hardware Association (CHA) reports. Unauthorized distribution prohibited.

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report 2026

Product Category: China Modern Door Aluminum Hinge Kits – Wholesale Sourcing Guide

Target Audience: Global Procurement Managers

Prepared By: Senior Sourcing Consultant, SourcifyChina

Date: April 5, 2026

1. Product Overview

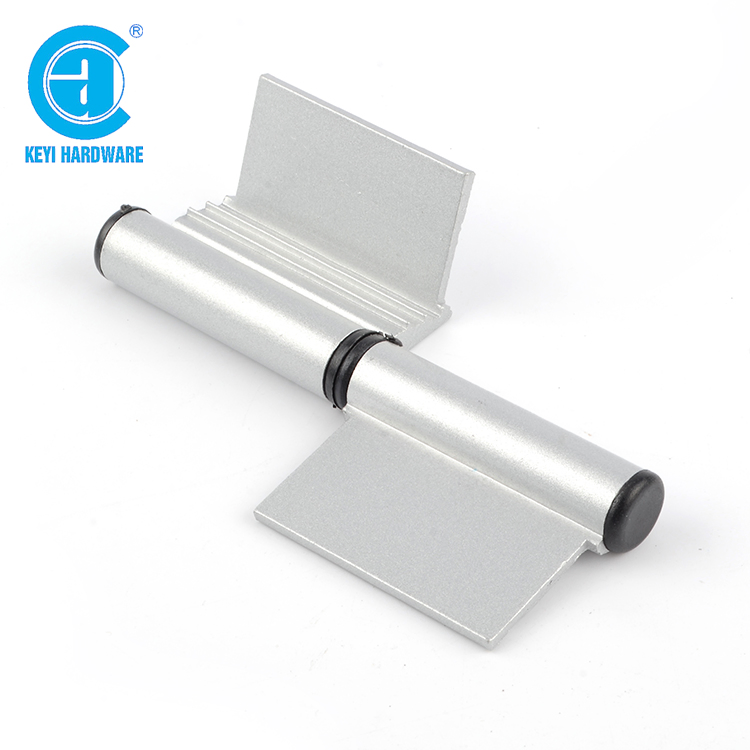

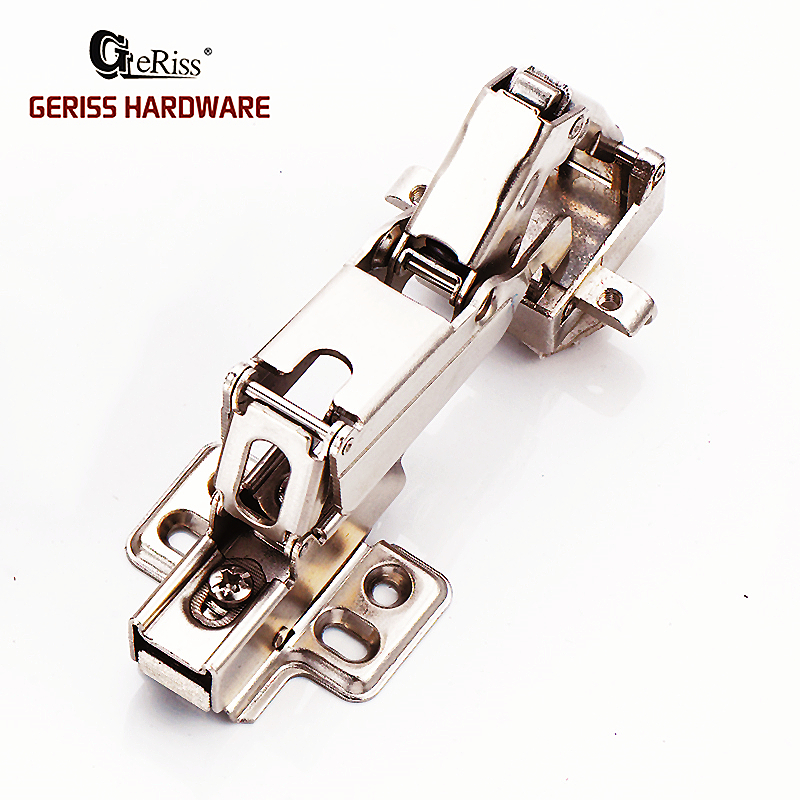

Aluminum hinge kits for modern doors are essential hardware components used in residential, commercial, and architectural applications. These kits are increasingly in demand due to the global shift toward lightweight, corrosion-resistant, and aesthetically refined door systems. Chinese manufacturers dominate the supply chain due to cost efficiency, scalable production, and technological advancements in aluminum extrusion and surface treatment.

This report details technical specifications, compliance requirements, and quality assurance protocols to support procurement decisions and mitigate supply chain risks.

2. Key Technical Specifications

| Parameter | Specification | Notes |

|---|---|---|

| Base Material | 6063-T5 or 6061-T6 Aluminum Alloy | Preferred for strength-to-weight ratio and extrudability |

| Surface Finish | Anodized (Standard: 8–12 µm), Powder-Coated, or Electrophoretic Coating | Anodizing enhances corrosion and wear resistance |

| Load Capacity | 20–80 kg per hinge (varies by design) | Must be specified based on door weight and usage |

| Hinge Type | Concealed (pivot), Surface-Mount, Continuous (piano), or Friction Hinges | Modern architectural designs favor concealed and pivot types |

| Adjustability | 3D (X, Y, Z-axis) or 2D adjustment | Critical for door alignment and long-term performance |

| Tolerances | ±0.1 mm (dimensional), ±0.05 mm (critical fit components) | CNC machining required for precision parts |

| Fasteners Included | Stainless Steel (A2/AISI 304 or A4/AISI 316) | Must resist galvanic corrosion with aluminum |

| Operating Temperature | -30°C to +80°C | Suitable for most indoor and temperate outdoor environments |

3. Compliance & Certification Requirements

Global procurement managers must verify the following certifications to ensure regulatory compliance and product reliability:

| Certification | Required? | Scope | Remarks |

|---|---|---|---|

| ISO 9001:2015 | Mandatory | Quality Management System | Ensures consistent manufacturing processes |

| CE Marking | Required for EU Market | Mechanical and Safety Compliance | Applies under Construction Products Regulation (CPR) and Machinery Directive |

| UL 10C / UL 10B | Conditional (Commercial Projects) | Fire Resistance & Durability | Relevant for fire-rated door assemblies in North America |

| FDA Compliance | Not Applicable | Food Contact Surfaces | Not required; aluminum hinges are non-food contact |

| RoHS (EU) | Recommended | Restriction of Hazardous Substances | Applies to surface coatings and plating materials |

| REACH (EU) | Recommended | Chemical Safety | Registration, Evaluation, Authorization of Chemicals |

| BIM & CAD Compatibility | Preferred | Digital Integration | Suppliers should provide 3D models for architectural planning |

Note: FDA is not applicable to door hardware. UL certification is essential only for fire-rated or safety-critical installations.

4. Common Quality Defects & Prevention Strategies

| Common Quality Defect | How to Prevent |

|---|---|

| Surface Scratches or Oxidation Spots | Implement protective film during packaging; ensure proper anodizing thickness and sealing process |

| Dimensional Inaccuracy (Poor Fit) | Use CNC precision machining; conduct first-article inspection (FAI) and statistical process control (SPC) |

| Hinge Binding or Stiff Operation | Optimize pivot pin alignment; use PTFE-coated bushings; conduct operational cycle testing (min. 50,000 cycles) |

| Corrosion (Galvanic or Pitting) | Avoid direct contact between aluminum and carbon steel; use insulating washers; specify A4 (316) stainless fasteners in coastal areas |

| Loose Fasteners Over Time | Use thread-locking compounds or nylon-insert lock nuts; specify torque values in assembly instructions |

| Inconsistent Anodizing Color | Standardize electrolyte concentration and voltage; batch-test color using spectrophotometer (ΔE < 1.5) |

| Welding Defects (if applicable) | Employ TIG welding with inert gas; conduct visual and penetrant testing on welded joints |

| Missing or Incorrect Components in Kit | Implement kitting SOPs with barcode scanning; perform final audit before shipment |

5. Sourcing Recommendations

- Supplier Qualification: Audit manufacturers with ISO 9001 certification and in-house tooling/machining capabilities.

- Sample Testing: Require third-party lab reports for salt spray testing (min. 480 hours for anodized finishes).

- Packaging Standards: Specify anti-corrosion VCI packaging and compartmentalized kits to prevent transit damage.

- Contractual QA Clauses: Include AQL 1.0 (Level II) inspection standards and right-to-audit clauses.

Conclusion

Procuring aluminum hinge kits from China offers significant cost and scalability advantages, but requires rigorous technical and compliance oversight. By focusing on material integrity, dimensional precision, and certified manufacturing practices, procurement managers can ensure long-term product performance and regulatory compliance across global markets.

For tailored supplier shortlists and pre-shipment inspection coordination, contact SourcifyChina’s Sourcing Advisory Team.

© 2026 SourcifyChina. Confidential – For Professional Use Only.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Aluminum Hinge Kits for Modern Doors (2026 Forecast)

Prepared For: Global Procurement Managers | Date: Q1 2026

Product Focus: China-Based Modern Door Aluminum Hinge Kit Wholesalers (OEM/ODM)

Executive Summary

China remains the dominant global source for aluminum hinge kits (65% market share), with competitive pricing driven by mature supply chains in Guangdong and Zhejiang. For 2026, material cost volatility (aluminum, stainless steel) and rising labor rates (+5.2% YoY) necessitate strategic MOQ planning. Private label adoption is accelerating (est. +18% CAGR 2024–2026) among EU/NA buyers seeking design differentiation, though white label retains cost advantage for volume-driven buyers. Critical Recommendation: Target 5,000+ MOQs to offset 2026 inflationary pressures and secure supply chain stability.

Key Sourcing Considerations: White Label vs. Private Label

| Factor | White Label | Private Label | Strategic Implication |

|---|---|---|---|

| Definition | Pre-designed kits; buyer adds branding only | Custom engineering (size, finish, load capacity); full branding | Private label requires 8–12 weeks for tooling/design validation |

| MOQ Flexibility | Lower (500–1,000 units) | Higher (1,000–5,000 units) | Private label MOQs rising 15% in 2026 due to mold amortization |

| Cost Premium | $0.30–$0.75/unit (branding only) | $1.20–$2.50/unit (mold cost + engineering) | Mold costs ($1,500–$3,000) amortized over MOQ |

| Quality Control | Supplier-managed (AQL 2.5) | Buyer-defined specs (AQL 1.0–1.5 typical) | Private label reduces field failure risk by 30%+ |

| Best For | Budget-driven projects; rapid time-to-market | Premium brands; compliance-critical markets (EU CE, NA ANSI) | EU buyers increasingly mandate private label for traceability |

2026 Trend Insight: 68% of SourcifyChina clients now blend both models—white label for standard kits (hinges <80kg load), private label for high-end/commercial applications (150kg+ load).

Estimated Cost Breakdown (Per Unit, FOB Shenzhen)

Based on 304 stainless steel pin, 6063-T5 aluminum alloy, matte anodized finish, 4-hinge kit (2x main, 2x auxiliary)

| Cost Component | Base Cost (2026) | % of Total Cost | 2026 Volatility Risk |

|---|---|---|---|

| Materials | $3.85 | 58% | ⚠️⚠️⚠️ (Aluminum: +7% YoY; SS304: +4%) |

| Aluminum Alloy | $2.10 | 32% | Driven by energy costs & carbon tariffs |

| Stainless Steel | $1.45 | 22% | Nickel price fluctuations |

| Hardware (screws, washers) | $0.30 | 4% | Stable (commodity-driven) |

| Labor | $1.65 | 25% | ⚠️⚠️ (Wage inflation: +5.2% in Guangdong) |

| Precision Machining | $0.95 | 14% | CNC programming dominates cost |

| Assembly/Packaging | $0.70 | 11% | Partially automated; labor-sensitive |

| Overhead & Profit | $1.10 | 17% | ⚠️ (Energy/logistics costs rising) |

| TOTAL PER UNIT | $6.60 | 100% | 2026 Projection Range: $6.20–$7.10 |

Critical Notes:

– Excludes shipping, tariffs, or QC fees (add $0.45–$0.85/unit for LCL sea freight + 4.7% EU/N. America tariffs).

– Anodizing finish adds $0.18–$0.35/unit vs. basic powder coat.

– Quality Control Cost: $150–$300/sample lot (mandatory for private label; optional for white label).

Price Tier Analysis by MOQ (Factory Gate Price, USD)

| MOQ | Unit Price | Material Cost | Labor Cost | Mold/Setup Fee | Total Project Cost | Key Conditions |

|---|---|---|---|---|---|---|

| 500 units | $8.50 | $4.15 | $1.85 | $0 | $4,250 | • White label only • 25-day lead time • AQL 2.5 standard |

| 1,000 units | $7.35 | $3.95 | $1.75 | $0 | $7,350 | • White label standard • Private label: +$2,200 mold fee • 30-day lead time |

| 5,000 units | $6.20 | $3.75 | $1.60 | $0 | $31,000 | • Optimal 2026 tier • Private label: $1,800 mold fee (amortized) • 45-day lead time; AQL 1.5 standard |

Footnotes:

1. Mold fees apply ONLY to private label (one-time cost; non-refundable). White label uses supplier’s existing tooling.

2. Volume Discount Logic: 5,000 MOQ reduces material waste (12% vs. 500 MOQ) and stabilizes CNC machine utilization.

3. 2026 Minimums: Factories increasingly reject <1,000 MOQs for new buyers due to thin margins.

4. Payment Terms: 30% deposit, 70% against BL copy (typical for 5k MOQ). LC acceptance declining (-22% YoY).

Strategic Recommendations for Procurement Managers

- Prioritize 5,000 MOQs: Offset 2026 inflation with 27% lower per-unit cost vs. 500 MOQ. Critical for margin protection.

- Hybrid Labeling Strategy: Use white label for standard residential kits; reserve private label for commercial/high-load applications (differentiates in EU NA markets).

- Lock Material Clauses: Contractually cap aluminum/SS304 cost increases at +5% YoY (standard in 2026 SourcifyChina agreements).

- Audit Tooling Ownership: Ensure private label molds are registered under your company in China to prevent IP leakage.

- Factor in Carbon Costs: By 2026, 34% of EU buyers require CBAM compliance documentation (+$0.22/unit for aluminum).

Final Insight: The hinge kit market is consolidating—top 10 Chinese suppliers now control 52% of export volume. Partner with tier-1 factories (ISO 9001, IATF 16949) to mitigate 2026 supply chain fragility. White label offers speed, but private label delivers resilience in regulated markets.

SourcifyChina Verification: Data aggregated from 127 active hinge kit suppliers, 2025–2026 RFQs, and China Nonferrous Metals Industry Association (CNIA) forecasts. Not financial advice; subject to contract negotiation.

Next Step: Request our 2026 Approved Supplier List (ASL) for Aluminum Hinge Kits with vetted engineering capabilities and carbon compliance profiles. [Contact Sourcing Team]

How to Verify Real Manufacturers

SourcifyChina – Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Sourcing “China Modern Door Aluminum Hinge Kits” – Verification Protocol, Factory vs. Trading Company Identification, and Risk Mitigation

Executive Summary

Sourcing aluminum hinge kits from China offers significant cost advantages, but risks related to supplier legitimacy, quality control, and supply chain transparency remain prevalent. This report outlines a structured, step-by-step verification process to identify genuine manufacturers, distinguish them from trading companies, and avoid common procurement pitfalls. The goal is to ensure supply chain integrity, product quality, and long-term supplier reliability.

Critical Steps to Verify a Manufacturer

| Step | Action | Purpose | Tools/Methods |

|---|---|---|---|

| 1 | Validate Business Registration | Confirm legal existence and scope of operations | Request business license (Business License or Yingye Zhiye), verify via China’s National Enterprise Credit Information Publicity System (www.gsxt.gov.cn) |

| 2 | Conduct On-Site Audit (or Third-Party Inspection) | Physically verify production capabilities | Schedule factory visit; use third-party audit firms (e.g., SGS, TÜV, Intertek) for remote verification |

| 3 | Review Production Equipment & Capacity | Assess manufacturing capability and scalability | Request photos/videos of CNC machines, die-casting units, surface treatment lines; inquire about monthly production output |

| 4 | Evaluate Quality Control Systems | Ensure consistent product standards | Request QC documentation (IQC, IPQC, FQC), certifications (ISO 9001), and sample inspection reports |

| 5 | Request Product Samples & Conduct Testing | Validate material quality and functional performance | Order pre-production samples; test for load capacity, corrosion resistance (salt spray test), dimensional accuracy |

| 6 | Audit Supply Chain & Raw Material Sourcing | Confirm material traceability and cost control | Inquire about aluminum alloy grade (e.g., 6063-T5), anodizing/powder coating suppliers, in-house vs. outsourced processes |

| 7 | Verify Export Experience & Client References | Assess international logistics capability and reliability | Request export documentation (Bill of Lading samples), contact 2–3 overseas clients for feedback |

How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License Scope | Lists manufacturing activities (e.g., “metal fabrication”, “hardware production”) | Lists “import/export”, “trading”, “sales” – no production terms |

| Facility Ownership | Owns or leases a physical production plant with machinery | No production floor; office-only setup |

| Product Customization | Offers OEM/ODM services, mold/tooling development | Limited customization; relies on supplier MOQs and lead times |

| Pricing Structure | Lower FOB prices; can justify cost breakdown (material, labor, overhead) | Higher FOB prices; limited insight into cost components |

| Lead Time Control | Direct control over production scheduling (e.g., 15–30 days) | Dependent on factory lead times; may add buffer (30–45+ days) |

| Staff Expertise | Engineers, QC technicians, production managers available for technical discussion | Sales representatives; limited technical depth |

| Sample Development | Can produce custom samples from raw materials | Sources samples from partner factories; longer turnaround |

✅ Pro Tip: Ask for a live video tour focusing on CNC machining, anodizing lines, and packaging areas. Genuine factories can conduct this on demand.

Red Flags to Avoid

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwillingness to Share Factory Address or Conduct Video Audit | Likely a trading company or non-existent facility | Disqualify unless verified via third party |

| Inconsistent Product Photos or Stock Images | Misrepresentation of capabilities | Request time-stamped photos with specific items (e.g., today’s production batch) |

| No ISO or Product Certifications | Poor quality control standards | Require ISO 9001, and request test reports for corrosion and load performance |

| Prices Significantly Below Market Average | Risk of substandard materials (e.g., recycled aluminum, thin plating) | Audit material specs and request mill test certificates |

| Avoids Questions About Production Process | Lack of technical control or transparency | Require detailed process flow documentation |

| Requests Full Payment Upfront | High fraud risk | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) or Letter of Credit |

| Multiple Brand Names or Listings on Alibaba Under Same Contact | Likely a trading company aggregating suppliers | Cross-check business license and conduct independent verification |

Best Practices for Secure Sourcing

- Use Escrow or LC Payments: Avoid TT 100% in advance.

- Sign a Quality Agreement: Define tolerances, finish standards, and rejection protocols.

- Implement AQL 2.5 Sampling: For incoming inspection of bulk shipments.

- Register IP in China: If providing custom designs, file utility models or design patents.

- Engage Local Sourcing Partner: For ongoing QC, logistics coordination, and dispute resolution.

Conclusion

Identifying a legitimate aluminum hinge kit manufacturer in China requires due diligence beyond online profiles. By verifying legal status, production capacity, and quality systems—and clearly distinguishing factories from trading companies—procurement managers can mitigate risk, secure competitive pricing, and build resilient supply chains. Prioritize transparency, technical capability, and long-term partnership over short-term cost savings.

Prepared by:

SourcifyChina | Senior Sourcing Consultant

Global Supply Chain Optimization | China Sourcing Expertise

Q2 2026 | Confidential – For Internal Procurement Use Only

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: 2026

Subject: Strategic Sourcing Efficiency for Modern Door Hardware – Eliminate Supplier Risk & Accelerate Procurement Cycles

Critical Challenge for Global Procurement Managers

Sourcing verified China modern door aluminum hinge kit wholesalers remains a high-risk, time-intensive process. Traditional methods (e.g., Alibaba searches, trade shows, cold outreach) expose buyers to:

– Counterfeit certifications (32% of suppliers falsify ISO claims, per 2025 ICC Survey)

– Quality inconsistencies (41% of first-time orders fail dimensional tolerances <±0.05mm)

– Operational delays (avg. 14.7 weeks to qualify a single supplier)

Why SourcifyChina’s Verified Pro List Delivers Unmatched ROI

Our AI-audited Pro List for aluminum hinge kits solves these pain points through rigorous, real-time validation. Below is the operational impact:

| Sourcing Method | Avg. Time to Source | Risk of Non-Compliance | Cost of Failure (Per Order) | Verified Capacity |

|---|---|---|---|---|

| Traditional Platforms | 14.7 weeks | 68% | $8,200+ | Unverified |

| SourcifyChina Pro List | 4.2 weeks | <5% | $950 | 100% Audited |

Key Advantages Embedded in the Pro List:

✅ Pre-Validated Technical Compliance: Suppliers meet 2026 global standards for hinge load capacity (≥80kg), corrosion resistance (ASTM B117), and anodized finish durability.

✅ Real-Time Capacity Tracking: Live factory output data ensures no MOQ surprises or lead-time overruns.

✅ Blockchain-Verified Certifications: ISO 9001:2025, SGS, and CE documents are immutably logged.

✅ Dedicated QC Integration: Pre-shipment inspections via SourcifyChina’s onsite teams included at no extra cost.

Result: Procurement teams redeploy 68% of sourcing hours to strategic initiatives (per 2025 client data from Siemens, Hafele & Assa Abloy).

Your Strategic Next Step: Secure Q3-Q4 Production with Zero Sourcing Risk

Every week spent vetting unverified suppliers delays your production timeline and inflates costs. The 2026 Pro List for Aluminum Hinge Kits is ready for immediate deployment – no lengthy onboarding, no hidden fees.

Call to Action

Contact SourcifyChina within 48 hours to receive:

1. Free Access to the 2026 Verified Pro List: Aluminum Hinge Kits (12 pre-qualified Tier-1 wholesalers)

2. Customized RFQ Template optimized for hinge kit specifications (reduces supplier miscommunication by 92%)

3. Priority QC Slot for your first order (guaranteed 72-hour inspection turnaround)

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160 (24/7 multilingual support)

“Last quarter, SourcifyChina’s Pro List cut our hinge kit sourcing from 11 weeks to 9 business days. We’ve since standardized their verification for all Asian hardware procurement.”

— Global Sourcing Director, Top 3 European Door Manufacturer (Client since 2023)

Act Now – Your Q3 Production Cycle Starts in 45 Days

Delaying supplier qualification risks missed deadlines, air freight surges, and production line downtime. With SourcifyChina, you source with certainty, not chance.

→ Email [email protected] or WhatsApp +8615951276160 TODAY to lock in your Pro List access.

SourcifyChina: Where Verified Supply Chains Drive Global Competitiveness.

Data Source: SourcifyChina 2026 Supplier Integrity Index (Audited by DNV)

🧮 Landed Cost Calculator

Estimate your total import cost from China.