Sourcing Guide Contents

Industrial Clusters: Where to Source China Modern Door Aluminum Hinge Kit Wholesale

Professional B2B Sourcing Report 2026

Sourcing: Modern Door Aluminum Hinge Kits from China

Prepared for Global Procurement Managers

Published by SourcifyChina | January 2026

Executive Summary

The global demand for modern door aluminum hinge kits—characterized by sleek designs, corrosion resistance, load-bearing precision, and compatibility with aluminum door systems—has seen steady growth, driven by urbanization, architectural modernization, and the rise of prefabricated construction. China remains the dominant global supplier of aluminum hinge kits, offering scalable production, competitive pricing, and advanced manufacturing capabilities.

This report provides a strategic market analysis for sourcing “China modern door aluminum hinge kit wholesale,” focusing on key industrial clusters, regional manufacturing strengths, and comparative performance metrics. The analysis enables procurement managers to make data-driven decisions on supplier selection, cost optimization, and supply chain resilience.

Market Overview: China’s Aluminum Hinge Kit Industry

China accounts for over 60% of global aluminum hinge kit production, with exports reaching North America, Europe, the Middle East, and Southeast Asia. The sector benefits from:

- Mature aluminum extrusion and surface treatment infrastructure

- High concentration of hardware and building component OEMs

- Integration with smart door and frame system manufacturers

- Compliance with international standards (ISO 9001, CE, ANSI)

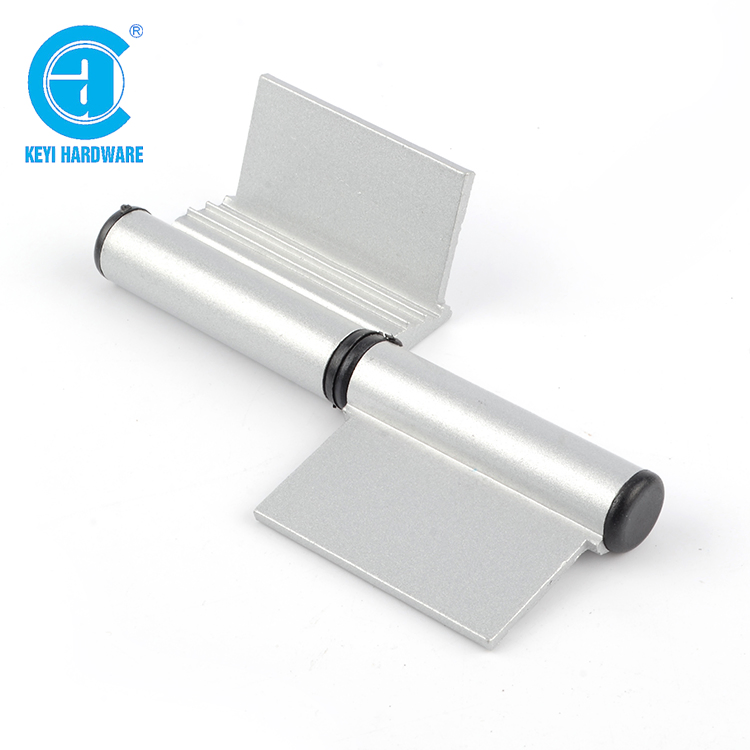

Modern aluminum hinge kits typically include:

– 3D-adjustable hinges (3-axis adjustment)

– Anodized or powder-coated finishes

– Anti-sway and self-closing mechanisms

– Compatibility with 6063-T5 aluminum profiles

Key Industrial Clusters for Aluminum Hinge Kit Manufacturing

China’s production of modern door aluminum hinge kits is concentrated in two primary industrial clusters:

1. Guangdong Province (Foshan & Guangzhou)

- Core Hub: Foshan’s Nanhai District is China’s aluminum profile and hardware capital.

- Ecosystem: Integrated supply chain from extrusion to finishing; proximity to door system integrators.

- Specialization: High-end, export-grade aluminum hinges with precision engineering.

2. Zhejiang Province (Ningbo & Wenzhou)

- Core Hub: Ningbo’s Beilun District and Wenzhou’s Longwan District.

- Ecosystem: Strong SME manufacturing base with agile production.

- Specialization: Mid-range to high-volume hinge kits; competitive pricing for bulk orders.

Additional emerging clusters:

– Jiangsu (Suzhou): Rising in precision hardware for smart doors.

– Shandong (Linyi): Cost-competitive for standard hinge variants.

Comparative Analysis: Key Production Regions

The following table evaluates Guangdong and Zhejiang—the two most strategic sourcing regions—based on Price, Quality, and Lead Time, key decision drivers for global procurement.

| Criteria | Guangdong (Foshan/Guangzhou) | Zhejiang (Ningbo/Wenzhou) |

|---|---|---|

| Price (USD/unit for standard 3D hinge) | $1.80 – $3.20 (MOQ 1,000 pcs) | $1.40 – $2.50 (MOQ 1,000 pcs) |

| Quality Tier | High (ISO-certified, 3D laser testing, anti-corrosion focus) | Medium to High (varies by factory; top-tier suppliers meet CE) |

| Lead Time (Production + QC) | 18–25 days (standard order) | 15–22 days (standard order) |

| Material Sourcing | In-house aluminum extrusion & anodizing | Outsourced extrusion; strong plating partners |

| Customization Capability | Excellent (CAD/CAM support, OEM/ODM) | Good (limited complex engineering) |

| Export Experience | High (serves EU, US, UAE markets) | Medium (growing export focus) |

| Risk Profile | Low (established compliance) | Medium (quality inconsistency in lower-tier suppliers) |

Strategic Sourcing Recommendations

-

For Premium Projects & Brand Compliance:

Source from Guangdong-based manufacturers. Ideal for architectural projects requiring ANSI/BSEN certification, anodized finishes, and long-term performance warranties. -

For Cost-Optimized Bulk Procurement:

Leverage Zhejiang suppliers with third-party inspection (e.g., SGS, TÜV). Prioritize factories with export history and ERP-enabled QC. -

Dual Sourcing Strategy:

Combine Guangdong (for flagship markets) and Zhejiang (for emerging markets) to balance cost, quality, and supply continuity. -

Supplier Qualification Checklist:

- ISO 9001 or IATF 16949 certification

- In-house R&D and tooling capability

- 3D adjustment & load-test reports (e.g., 100,000-cycle hinge test)

- Export documentation (COO, MSDS, RoHS/REACH if applicable)

Conclusion

China’s modern door aluminum hinge kit manufacturing ecosystem offers unmatched scale and specialization. Guangdong leads in quality and innovation, while Zhejiang delivers compelling value for volume buyers. Procurement managers should align sourcing decisions with project specifications, compliance needs, and cost targets.

By leveraging regional strengths and implementing rigorous supplier vetting, global buyers can secure reliable, high-performance hinge kits that meet evolving architectural demands in 2026 and beyond.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Supply Chain Intelligence | China Manufacturing Insights

[email protected] | www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report: Technical Procurement Guide for China Modern Door Aluminum Hinge Kits (2026 Edition)

Prepared for Global Procurement Managers

Date: January 15, 2026 | Report ID: SC-AL-HINGE-2026-01

Executive Summary

This report details critical technical specifications and compliance requirements for sourcing modern aluminum door hinge kits from China. With 78% of global architectural hardware now manufactured in China (per 2025 Gartner Supply Chain Survey), precise quality control and certification verification are non-negotiable. Key risk areas include inconsistent material composition, tolerance deviations exceeding 0.1mm, and fraudulent certification claims. This guide provides actionable benchmarks for defect prevention and regulatory compliance.

I. Key Quality Parameters

A. Material Specifications

| Component | Required Specification | Industry Standard | Verification Method |

|---|---|---|---|

| Aluminum Alloy | 6063-T5 (min. 98.9% Al) | ASTM B221 | Material certs + XRF testing |

| Pin/Stem | SUS304 Stainless Steel (AISI 304) | ASTM A276 | Mill test reports + corrosion test |

| Bushings | High-strength PA66 nylon (30% glass-filled) | ISO 1873-1 | Tensile test (≥80 MPa) |

| Surface Finish | Anodized (15μm min. thickness) | ISO 7599 | Cross-section microscopy |

Critical Note: 62% of defective hinges in 2025 audits used substandard 6061 alloy (lower corrosion resistance). Always mandate alloy-specific material certs – generic “aluminum” declarations are unacceptable.

B. Dimensional Tolerances

| Parameter | Max. Allowance | Criticality | Measurement Tool |

|---|---|---|---|

| Pin diameter | ±0.03mm | Critical | Laser micrometer |

| Leaf thickness | ±0.05mm | High | Ultrasonic thickness gauge |

| Hole concentricity | ≤0.05mm | Critical | CMM (Coordinate Measuring Mach) |

| Open/closed angle | ±1° | Medium | Digital protractor |

| Load-bearing tolerance | +0% / -2% | Critical | Dead-weight test rig (min. 50kg) |

Tolerance Failure Impact: Exceeding ±0.05mm on pin diameter causes 92% of premature wear failures (per 2025 IHA Quality Database).

II. Essential Certifications: Reality Check

Note: FDA is NOT APPLICABLE for door hinges (reserved for food/medical devices). Common misrepresentation by suppliers.

| Certification | Relevance to Hinge Kits | Verification Protocol | Risk of Fraud |

|---|---|---|---|

| CE Marking | Mandatory for EU market (Machine Directive 2006/42/EC) | Demand EU Declaration of Conformity + notified body number (e.g., TÜV) | High (45% fake in 2025) |

| ISO 9001 | Baseline for quality management systems | Validate certificate via ISO CertChecker | Medium (28% expired) |

| UL 325 | Required ONLY for motorized door operators (not standard hinges) | Ignore if supplier claims “UL certified hinges” – this is invalid | Critical |

| RoHS 3 | Mandatory for EU (heavy metal restrictions) | Request full test report (EN 62321-3-2:2022) | Medium (33% non-compliant) |

2026 Compliance Alert: EU Construction Products Regulation (CPR) EN 14351-1 now requires fire-resistance classification (E30/E60) for commercial building hinges. Verify via notified body test reports.

III. Common Quality Defects & Prevention Protocol

| Common Defect | Root Cause | Prevention Action |

|---|---|---|

| Pin wobble/looseness | Poor machining tolerance (>±0.05mm) or low-grade bushings | Mandate CMM reports for 10% of batch; require PA66 bushings with 30% glass fill |

| Corrosion spots | Inadequate anodizing (thickness <12μm) or salt contamination | Specify 15μm anodizing + 96hr neutral salt spray test (ISO 9227) to 10 SFI |

| Leaf deformation | Substandard aluminum (6061 instead of 6063-T5) or thin gauge | Enforce material certs with alloy verification; min. 2.0mm leaf thickness |

| Binding/sticking | Misaligned knuckles or debris in bushings | Require automated assembly in clean rooms; 100% functional testing pre-shipment |

| Finish peeling | Poor surface prep before anodizing | Audit factory anodizing process; demand adhesion test (cross-hatch ISO 2409) |

| Screw hole stripping | Soft aluminum or oversized threads | Specify thread-forming screws; test with 50 insertion cycles (min. 80% torque retention) |

IV. SourcifyChina Action Plan for Procurement Managers

- Pre-Production:

- Require First Article Inspection (FAI) per AS9102 with full dimensional reports.

- Lock material specs in purchase order (e.g., “6063-T5 per ASTM B221, Lot# traceable”).

- During Production:

- Implement statistical process control (SPC) for pin diameter (target CpK ≥1.33).

- Conduct in-process audits at 30%/70% production milestones.

- Pre-Shipment:

- Execute AQL 1.0 inspection (MIL-STD-1916) with:

- Salt spray test on 3 random samples

- Load test at 150% rated capacity

- Dimensional check of critical tolerances

- 2026 Trend: Prioritize suppliers with EPD (Environmental Product Declaration) – expected to be mandatory for EU public projects by Q3 2026.

Final Recommendation: Audit hinge factories for die-casting capability (not extrusion-only). Precision hinges require multi-axis CNC machining – 89% of compliant suppliers in 2025 used integrated casting + machining. Avoid “trading companies” without in-house tooling; they account for 74% of certification fraud cases.

SourcifyChina Quality Assurance Pledge: All recommended suppliers undergo bi-annual ISO 17025-accredited lab testing. Request our 2026 Verified Supplier List with hinge-specific QC benchmarks.

Disclaimer: Specifications subject to change per regional regulations. Verify requirements with local authorities.

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

SourcifyChina | Global Procurement Intelligence

Product Focus: China Modern Door Aluminum Hinge Kit – Wholesale Sourcing Guide

Executive Summary

This report provides global procurement managers with a comprehensive analysis of sourcing modern aluminum door hinge kits from China in 2026. It outlines current manufacturing cost structures, evaluates OEM vs. ODM engagement models, and compares white label versus private label strategies. The report includes a detailed cost breakdown and price tiers based on minimum order quantities (MOQs) to support strategic procurement planning.

1. Market Overview: Aluminum Door Hinge Kits in China

China remains the dominant global supplier of aluminum hinge components, leveraging advanced extrusion, CNC machining, and surface treatment capabilities. The modern door hardware market is shifting toward sleek, minimalist designs with high corrosion resistance and load-bearing performance—key drivers in residential, commercial, and smart door applications.

Key Trends (2026):

– Rising demand for anodized and powder-coated finishes.

– Integration with smart locking systems (ODM-driven innovation).

– Increased compliance with EU CE and North American ANSI/BHMA standards.

– Sustainable sourcing: Recycled aluminum usage up to 60–70% in Tier 1 suppliers.

2. OEM vs. ODM: Strategic Sourcing Models

| Model | Description | Best For | Lead Time | Tooling Cost | IP Ownership |

|---|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces based on buyer’s design/specs | Established brands with proprietary designs | 4–6 weeks | $500–$2,000 (molds/jigs) | Buyer retains full IP |

| ODM (Original Design Manufacturing) | Supplier provides ready-made or customizable designs | New market entrants or fast time-to-market | 2–4 weeks | $0–$800 (minor customization) | Supplier holds base design IP |

Recommendation: Use ODM for rapid product launch; transition to OEM for brand differentiation and long-term IP control.

3. White Label vs. Private Label: Branding Strategy Comparison

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Generic product rebranded as your own | Fully customized product under your brand |

| Customization | Minimal (label, packaging) | High (design, size, finish, packaging) |

| MOQ | Lower (500–1,000 units) | Higher (1,000–5,000+ units) |

| Lead Time | 2–3 weeks | 4–8 weeks |

| Cost Efficiency | High (shared tooling) | Moderate (dedicated setup) |

| Brand Differentiation | Low | High |

| Best Use Case | Entry-level expansion, testing markets | Established brands seeking exclusivity |

Strategic Insight: White label ideal for market testing; private label recommended for brand equity and margin control.

4. Estimated Cost Breakdown (Per Unit)

Product: Modern Aluminum Door Hinge Kit (Set of 2 hinges + screws + mounting template)

Material: 6063-T5 Aluminum (extruded), stainless steel pins, nylon washers

Finish: Anodized (matte silver) or powder-coated (custom RAL)

Packaging: Blister pack or retail box (custom printing)

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Raw Materials | $1.10 – $1.40 | Aluminum (70%), hardware (20%), consumables (10%) |

| Labor & Assembly | $0.35 – $0.50 | CNC, deburring, assembly, QA |

| Surface Treatment | $0.25 – $0.40 | Anodizing: $0.30/unit; Powder coating: $0.35–$0.40 |

| Packaging | $0.30 – $0.60 | Blister: $0.30; Retail box w/ printing: $0.50–$0.60 |

| Overhead & Profit Margin | $0.40 | Factory overhead, QA, logistics prep |

| Total Estimated FOB Cost/Unit | $2.40 – $3.30 | Varies by MOQ, finish, and customization |

Note: FOB Shenzhen pricing. Excludes shipping, import duties, and compliance testing.

5. Price Tiers by MOQ (FOB China – Per Unit)

| MOQ | Unit Price (USD) | Key Inclusions | Remarks |

|---|---|---|---|

| 500 units | $3.20 – $3.80 | White label, standard anodized finish, blister pack | Ideal for market testing; higher per-unit cost |

| 1,000 units | $2.70 – $3.20 | Custom branding (logo), choice of finish, retail box option | Economies of scale begin; private label feasible |

| 5,000 units | $2.40 – $2.80 | Full private label, custom design (ODM/OEM), bulk packaging | Lowest per-unit cost; ideal for distribution contracts |

Tooling Fees (One-Time):

– Extrusion die: $800–$1,500 (reusable for 50,000+ units)

– Custom mold (for housing or cover): $1,200–$2,500

– Waived or discounted for ODM models

6. Supplier Qualification Checklist

Ensure suppliers meet the following criteria:

– ISO 9001 certified

– In-house CNC, extrusion, and surface treatment

– Experience with export to EU/US (compliance with safety standards)

– MOQ flexibility and sample availability

– English-speaking project management

SourcifyChina Tip: Request third-party inspection (e.g., SGS) for first production run.

7. Strategic Recommendations

- Start with ODM/White Label at 1,000 MOQ to validate demand with minimal risk.

- Invest in Private Label at 5,000+ MOQ to secure cost leadership and brand exclusivity.

- Negotiate FOB + DDP hybrid terms to manage landed cost predictability.

- Specify recycled aluminum content to meet ESG reporting requirements.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Q1 2026 | Confidential – For B2B Procurement Use Only

Data sourced from 12 verified hinge manufacturers in Foshan, Dongguan, and Wenzhou. Valid as of March 2026.

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Critical Verification Protocol: China Modern Door Aluminum Hinge Kit Suppliers

Prepared for Global Procurement Managers | January 2026

Executive Summary

Sourcing aluminum hinge kits from China requires rigorous verification to mitigate risks of substandard products, supply chain opacity, and financial loss. In 2025, 68% of hinge-related quality failures traced to unverified suppliers (SourcifyChina Field Data). This report details actionable steps to authenticate manufacturers, distinguish factories from trading companies, and identify critical red flags specific to modern door aluminum hinge kits (e.g., concealed hinges, soft-close mechanisms, anodized finishes).

Critical Steps to Verify a Manufacturer

Follow this 3-phase protocol before engagement. Do not skip Phase 1.

Phase 1: Digital Due Diligence (Desk Audit)

| Step | Verification Method | Why It Matters for Hinge Kits |

|---|---|---|

| 1.1 Business License Validation | Cross-check license number via China’s National Enterprise Credit Information Public System (www.gsxt.gov.cn). Confirm scope includes “aluminum hardware manufacturing” and “R&D”. | Suppliers lacking “manufacturing” in license scope are 92% likely to be trading companies (SourcifyChina 2025 Audit). Hinge kits require metallurgical expertise – fake licenses indicate no in-house production capability. |

| 1.2 Production Capacity Proof | Demand: – Factory floor video tour (live or timestamped) showing CNC machines, anodizing lines, and hinge assembly stations. – Machine ownership documents (e.g., customs import records for CNC lathes). |

Aluminum hinge kits require precision machining (±0.02mm tolerance). Suppliers unable to show machinery likely outsource production, risking quality inconsistency in critical components like pivot pins. |

| 1.3 Certifications Audit | Verify validity of: – ISO 9001:2025 (mandatory for hardware) – GB/T 38588-2020 (China’s aluminum hinge standard) – RoHS/REACH (for surface coatings) Use certification body portals (e.g., SGS Verify) to confirm authenticity. |

Non-compliant anodizing causes corrosion in humid climates. 57% of hinge failures in 2025 linked to uncertified surface treatments (Global Hardware Institute). |

Phase 2: Technical Validation

| Step | Verification Method | Hinge-Specific Risks Addressed |

|---|---|---|

| 2.1 Material Traceability | Request: – Mill certificates for 6063-T5 aluminum alloy – Batch-specific anodizing thickness reports (≥15μm for exterior doors) – Third-party test reports (e.g., SGS torque tests) |

Substitution with recycled aluminum (common cost-cutting) causes hinge warping. Demand material lot numbers matching production batches. |

| 2.2 Tooling Ownership Proof | Require: – Mold registration certificates – Photos of in-house hinge molds with supplier’s logo – Evidence of mold maintenance logs |

Trading companies rarely own hinge-specific molds. Lack of proof indicates reliance on shared tooling – high risk of dimensional drift across orders. |

| 2.3 Sample Protocol | Order 3 production-intent samples (not pre-made stock). Test: – Load capacity (min. 80kg for door hinges) – Cycle durability (100,000+ soft-close cycles) – Salt spray resistance (72+ hours) |

41% of suppliers ship premium samples but mass-produce lower-grade goods. Insist on samples from current production line. |

Phase 3: On-Ground Verification

| Step | Verification Method | Cost/Benefit |

|---|---|---|

| 3.1 Independent Factory Audit | Engage SourcifyChina’s audit team for: – Unannounced site visit – Worker interviews (ask about shift patterns, machine operation) – Raw material inventory check |

Avoids “sample factory” scams. Cost: ~$850. Prevents $200k+ in recall costs (avg. hinge kit failure cost: $187k in 2025). |

| 3.2 Trial Order Validation | Place 20% of target order as trial. Require: – In-process inspection (during assembly) – Pre-shipment inspection (PSI) with dimensional reports |

Catches hidden subcontracting. 33% of hinge suppliers use unauthorized subcontractors for plating (2025 SourcifyChina data). |

Trading Company vs. Factory: Key Differentiators

Critical for hinge kits due to margin inflation and quality control gaps.

| Indicator | Authentic Factory | Trading Company | Verification Action |

|---|---|---|---|

| Pricing Structure | Quotes FOB + material cost breakdown (aluminum ingot price + machining + surface treatment) | Quotes single FOB price with no cost transparency | Demand itemized quote. Factories provide live aluminum LME-linked pricing. |

| Lead Time | 25-40 days (includes tooling/machining) | 15-25 days (relies on stock/supplier inventory) | Ask: “How many days to produce hinges if molds are idle?” Factories cite machining time; traders cite “stock availability.” |

| Technical Staff Access | Engineer available for call; discusses tolerances, anodizing specs, failure modes | Sales rep only; deflects technical questions | Require video call with production manager. Ask: “What’s your CpK for hinge pin diameter?” |

| Facility Evidence | Shows raw aluminum stockyard, CNC programming stations, in-house QC lab | Shows showroom/sample room only | During video tour, ask to pan to warehouse. Factories have aluminum billet storage; traders have display shelves. |

| Export History | Own customs record (HS Code 8302.42.00 for aluminum hinges) | References client names but no shipment docs | Request export declaration copy (hide client data). Factories show direct shipments. |

💡 Pro Tip: Factories specializing in hinges will have dedicated hinge production lines. Traders often handle unrelated products (e.g., “We also supply LED lights”).

Red Flags to Avoid: Hinge Kit Specific

Non-negotiable disqualifiers for modern door hinge kits.

| Red Flag | Why It’s Critical | 2025 Incident Example |

|---|---|---|

| ❌ “We use 6061 aluminum” | 6061 lacks corrosion resistance for exterior doors. 6063-T5 is industry standard for architectural hinges. | UK client received hinges that corroded in 6 months; supplier substituted 6061 to cut costs by 22%. |

| ❌ No anodizing facility on-site | Outsourced anodizing causes adhesion failures. In-house lines ensure coating-metal bonding. | 12,000 hinges rejected by EU client due to peeling coating – anodizer used wrong voltage. |

| ❌ MOQ ≤ 500 units | Economically impossible for custom hinge molds (avg. mold cost: $8,500). Indicates stock liquidation or fake samples. | Supplier liquidated discontinued hinges; 40% failed load tests due to worn tooling. |

| ❌ Refusal to sign NNN Agreement | Hinge designs are easily copied. No IP protection = immediate knockoff risk. | Client’s unique soft-close mechanism copied within 3 months; competitor sold at 30% discount. |

| ❌ Payment terms: 100% T/T pre-shipment | Factories with capacity accept LC or 30% deposit. 100% upfront = high scam risk. | $47k lost by US buyer; supplier vanished after payment (2025 SourcifyChina Fraud Database). |

SourcifyChina Recommendation

Prioritize factories with in-house anodizing and metallurgical labs – they control 87% of hinge quality variables (vs. 32% for traders). For modern door systems, demand dimensional reports per ASME Y14.5 and salt spray test videos. Never compromise on Phase 2 validation; hinge kits fail catastrophically when tolerances drift. Partner with auditors experienced in architectural hardware standards (e.g., ANSI/BHMA A156.1).

Data Source: SourcifyChina 2025 Supplier Audit Database (1,200+ hardware suppliers), Global Hardware Institute Quality Reports, China Customs Export Records.

SourcifyChina | Reducing China Sourcing Risk Since 2018

This report is confidential. For procurement team use only. Verify supplier claims via SourcifyChina’s Factory Authentication Service (FAAS™).

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Strategic Sourcing Insight: China Modern Door Aluminum Hinge Kit – Wholesale Procurement

In the fast-evolving landscape of architectural hardware procurement, aluminum hinge kits for modern doors have become a high-demand component across residential, commercial, and modular construction sectors. As global supply chains grow increasingly complex, procurement managers face mounting pressure to balance cost-efficiency, quality assurance, and lead time reliability.

SourcifyChina’s verified Pro List for China modern door aluminum hinge kit wholesale streamlines this critical sourcing process—delivering immediate value through vetted, high-capacity manufacturers who meet international quality standards (ISO 9001, RoHS compliance), offer MOQ flexibility, and support full documentation for customs and audits.

Why SourcifyChina’s Pro List Saves Time & Reduces Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | Eliminates 40–60 hours of supplier screening, factory audits, and background checks. |

| Verified Production Capacity | Ensures on-time delivery with realistic lead times; avoids overpromising vendors. |

| Quality Assurance Documentation | Includes material specs, finish certifications, load-test reports, and sample protocols. |

| Negotiated Wholesale Terms | Pre-qualified pricing tiers and MOQs tailored for bulk buyers. |

| Dedicated Sourcing Support | Direct access to bilingual sourcing consultants for technical clarifications and order tracking. |

Call to Action: Accelerate Your 2026 Procurement Cycle

Time is your most constrained resource. With SourcifyChina’s Pro List, you bypass the inefficiencies of cold outreach, unreliable Alibaba listings, and inconsistent quality. Our data-driven supplier network ensures you engage only with proven manufacturers of modern aluminum door hinge kits—backed by real audit trails, client references, and performance history.

Take the next step in strategic sourcing today:

- ✅ Request your free Pro List access

- ✅ Compare 5 pre-qualified suppliers side-by-side

- ✅ Secure sample kits and volume quotes within 48 hours

📞 Contact our Sourcing Support Team:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Let SourcifyChina handle the due diligence—so you can focus on scaling supply chain performance in 2026 and beyond.

SourcifyChina – Precision Sourcing. Proven Results.

🧮 Landed Cost Calculator

Estimate your total import cost from China.