Sourcing Guide Contents

Industrial Clusters: Where to Source China Mobile Metal Tool Pegboard Wholesale

SourcifyChina Sourcing Intelligence Report – 2026

Deep-Dive Market Analysis: Sourcing Mobile Metal Tool Pegboards from China

Prepared For: Global Procurement Managers

Publication Date: January 2026

Author: SourcifyChina – Senior Sourcing Consultants

Executive Summary

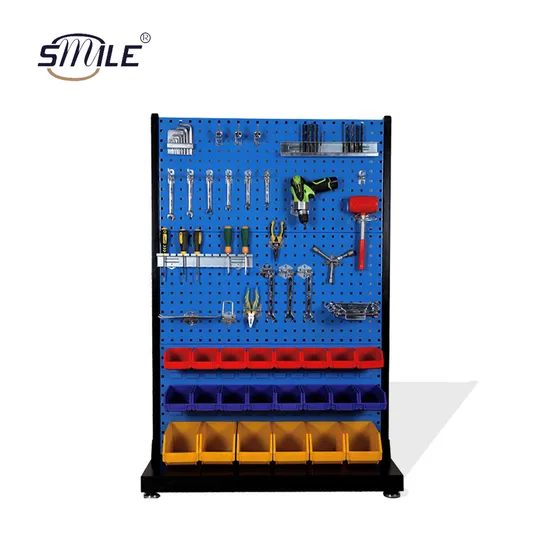

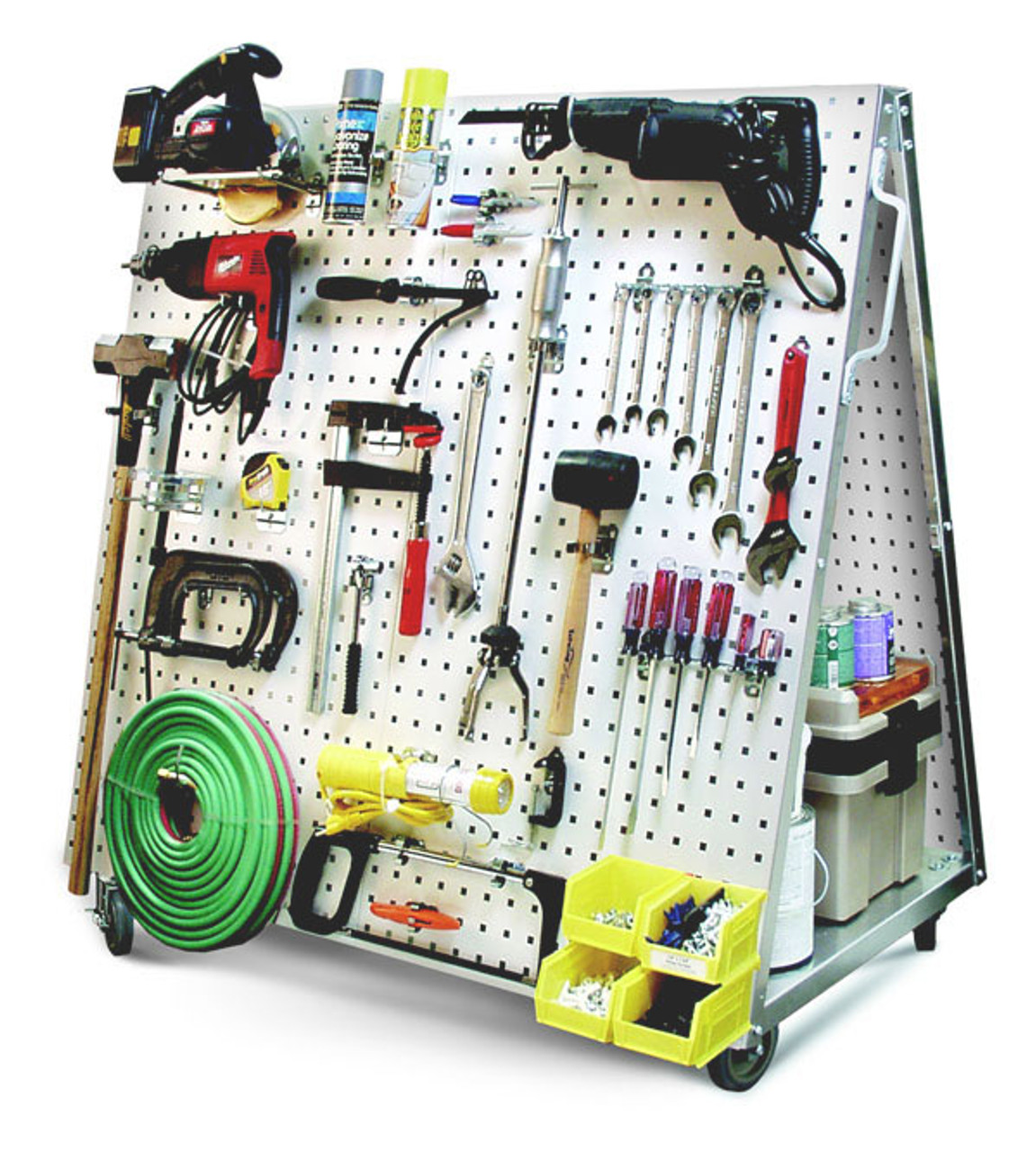

The global demand for mobile metal tool pegboards—modular, wall-mountable or freestanding metal panels with perforated grids for organizing hand tools and accessories—has grown significantly across industrial, automotive, and DIY sectors. China remains the dominant manufacturing hub for these products due to its mature metal fabrication ecosystem, cost-efficient production, and export infrastructure.

This report identifies key industrial clusters in China producing mobile metal tool pegboards and provides a comparative analysis of regional manufacturing strengths. The analysis focuses on price competitiveness, product quality, and lead time efficiency to guide strategic sourcing decisions.

Key Industrial Clusters for Mobile Metal Tool Pegboard Manufacturing

China’s mobile metal tool pegboard production is concentrated in provinces with strong metalworking, hardware, and OEM/ODM ecosystems. The following regions are the most prominent:

1. Guangdong Province (Foshan, Dongguan, Shenzhen)

- Strengths: High-end manufacturing, export readiness, proximity to Hong Kong logistics.

- Specialization: Precision metal stamping, powder coating, and smart storage solutions.

- Supply Chain: Integrated access to steel suppliers, CNC machinery, and packaging.

- Export Focus: Strong presence in North American and European markets.

2. Zhejiang Province (Yiwu, Ningbo, Wenzhou)

- Strengths: Mass production, cost leadership, vast SME network.

- Specialization: Economical steel pegboards, modular tool organizers.

- Supply Chain: Yiwu International Trade Market enables rapid prototyping and small-batch sampling.

- Export Focus: Global B2B wholesale, e-commerce fulfillment (Amazon, Alibaba).

3. Jiangsu Province (Suzhou, Wuxi)

- Strengths: High-quality engineering, German-influenced manufacturing standards.

- Specialization: Industrial-grade pegboard systems with enhanced durability.

- Supply Chain: Proximity to Shanghai port and advanced automation.

- Export Focus: Premium markets (EU, Australia, Japan).

4. Hebei Province (Cangzhou, Baoding)

- Strengths: Low-cost raw materials (steel), heavy industrial base.

- Specialization: Basic and bulk metal pegboards for budget segments.

- Supply Chain: Direct access to Tangshan steel mills.

- Export Focus: Emerging markets (Middle East, Africa, South Asia).

Comparative Regional Analysis: Mobile Metal Tool Pegboard Production

| Region | Price Level | Quality Tier | Average Lead Time | Key Advantages | Considerations |

|---|---|---|---|---|---|

| Guangdong | Medium–High | High | 25–35 days | Precision engineering, modern finishes, strong QC processes | Higher MOQs, premium pricing |

| Zhejiang | Low–Medium | Medium | 20–30 days | Competitive pricing, flexible MOQs, fast sampling | Variable QC across suppliers |

| Jiangsu | Medium | High | 22–32 days | Consistent quality, ISO-certified factories, EU-compliant materials | Slightly longer lead times |

| Hebei | Low | Low–Medium | 18–28 days | Lowest cost, high volume capacity | Rust resistance may require upgrade |

Note: Lead times include production + inland logistics to port (Shenzhen, Ningbo, Shanghai, Tianjin). Ex-works pricing based on 500-unit order of standard 600x900mm steel pegboard with mobile base.

Strategic Sourcing Recommendations

-

For Premium Markets (North America, EU):

Prioritize suppliers in Guangdong or Jiangsu for superior finish, durability, and compliance with safety standards (e.g., ASTM, CE). -

For Cost-Sensitive or High-Volume Orders:

Zhejiang offers the best balance of price and scalability. Ideal for retail chains and e-commerce brands. -

For Budget Segments or Emerging Markets:

Hebei provides the lowest landed cost but requires enhanced quality audits and rust protection specifications. -

Hybrid Strategy:

Use Zhejiang for rapid prototyping and initial batches, then transition to Guangdong for long-term, high-volume contracts with branded quality.

Risk & Mitigation Insights

- Quality Variability: Conduct third-party inspections (e.g., SGS, Intertek) especially for Zhejiang and Hebei suppliers.

- Material Compliance: Specify cold-rolled steel (CRS) and electrostatic powder coating to ensure durability.

- Logistics: Favor Ningbo and Shenzhen ports for faster container availability and lower demurrage risks.

Conclusion

China’s mobile metal tool pegboard manufacturing landscape offers diversified sourcing opportunities across four key provinces. While Guangdong leads in quality and innovation, Zhejiang dominates cost-efficient mass production. Procurement managers should align regional selection with brand positioning, target market requirements, and volume strategy.

SourcifyChina recommends a dual-supplier model—leveraging Zhejiang for agility and Guangdong/Jiangsu for premium assurance—to optimize cost, quality, and supply chain resilience in 2026 and beyond.

Prepared by:

SourcifyChina Senior Sourcing Consultants

Strategic Sourcing. Verified Factories. Global Delivery.

www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report: Mobile Metal Tool Pegboard Systems (2026)

Prepared for Global Procurement Managers | Confidential

Date: October 26, 2026 | Report ID: SC-CHN-PEG-2026-QC

Executive Summary

Mobile metal tool pegboard systems (freestanding or wall-mountable units with integrated tool storage) are high-demand items in industrial workshops, retail, and MRO sectors. Sourcing from China requires rigorous attention to structural integrity, corrosion resistance, and safety compliance. This report details critical specifications, certifications, and defect mitigation strategies to avoid costly non-conformities. Note: FDA certification is irrelevant for non-food-contact metal tools; UL applies only to electrical components (e.g., integrated lighting).

I. Technical Specifications & Key Quality Parameters

Non-negotiable minimum standards for Tier-1 suppliers. Deviations require written engineering approval.

| Parameter | Requirement | Tolerance/Standard | Verification Method |

|---|---|---|---|

| Material | Cold-rolled steel (CRS) or galvanized steel | Grade: SPCC/DC01 (CRS) or DX51D+Z (Galv.) | Mill test reports (MTRs) |

| Thickness | Panel: ≥0.8mm; Frame/Base: ≥1.5mm | ±0.05mm (Panel), ±0.1mm (Frame) | Micrometer gauge (per ISO 2768) |

| Hole Pattern | 1/4″ (6.35mm) diameter, 1″ (25.4mm) center-to-center spacing | ±0.3mm hole spacing; ±0.2mm diameter | CMM inspection (min. 5% of batch) |

| Surface Coating | Powder coating (epoxy-polyester) or zinc galvanization (min. 60g/m²) | Salt spray resistance: ≥500hrs (ISO 9227) | Third-party lab report (e.g., SGS) |

| Load Capacity | Static: ≥50kg/m² (panel); Mobile base: ≥100kg (with casters locked) | Test load: 150% of rated capacity | Load test per EN 15620 |

| Casters (Mobile Units) | Swivel locks, dual-wheel, ≥100mm diameter, load rating ≥50kg/wheel | Hardness: 85±5 Shore A (polyurethane) | Caster certification (e.g., ISO 9001) |

II. Essential Certifications & Compliance

Region-specific requirements. Suppliers must provide valid, unexpired certificates.

| Certification | Applicable? | Key Requirements | Why It Matters |

|---|---|---|---|

| CE Marking | ✅ (EU/UK) | Machinery Directive 2006/42/EC (for mobile bases); Construction Products Reg. (CPR) for static units | Legal entry to EU; covers structural safety & mobility risks |

| UL 60950-1 | ✅ (USA) | Only if unit includes electrical components (e.g., LED lighting) | Avoids customs rejection; liability protection |

| ISO 9001 | ✅ (Global) | Certified QMS covering design, production, and inspection | Ensures consistent batch quality; audit trail |

| RoHS 3 | ✅ (EU/China) | Max. 0.1% (1000ppm) for Pb, Cd, Hg, Cr⁶⁺, etc. | Mandatory for electronics; avoids supply chain fines |

| FDA | ❌ | Not applicable – No food-contact surfaces in tool storage systems | Common misconception; irrelevant for this product |

| GB/T 19001 | ✅ (China) | Chinese national equivalent of ISO 9001 | Minimum local regulatory requirement |

Critical Note: CE for mobile units requires a Declaration of Conformity (DoC) specifically covering stability tests (EN 12182) and caster safety. Generic “CE” stickers are invalid.

III. Common Quality Defects & Prevention Strategies

Based on 2025 SourcifyChina audit data (n=217 shipments). 68% of defects trace to poor process control in tier-2 material suppliers.

| Common Quality Defect | Root Cause | How to Prevent | Verification Step |

|---|---|---|---|

| Warped Panels | Inconsistent steel thickness; improper curing of powder coating | Enforce min. 0.8mm thickness; require oven temperature logs during coating | Flatness test: ≤2mm deviation over 1m² (per ISO 2768) |

| Rust Spots/Blistering | Inadequate surface prep; substandard zinc coating | Mandate MTRs for Z180+ galvanization; 3-stage pre-treatment (degrease, phosphating, rinse) | Salt spray test report (min. 500hrs) |

| Misaligned Holes | Worn drill jigs; poor CNC calibration | Require supplier to recalibrate tools every 500 units; use hardened drill bits | CMM inspection of 3 critical hole clusters per panel |

| Caster Lock Failure | Low-grade nylon wheels; weak spring mechanisms | Specify polyurethane casters (≥85 Shore A); test lock mechanism at 2x load | 100% functional test of locks pre-shipment |

| Coating Flaking | Oil residue on steel; incorrect curing time | Implement ultrasonic cleaning pre-coating; validate oven dwell time (min. 15 mins) | Adhesion test (cross-hatch per ASTM D3359) |

| Weld Cracks (Frame) | Thin base metal; unskilled welders | Require 1.5mm+ frame steel; welder certification (ISO 9606) | Penetrant testing (PT) on 10% of frames |

SourcifyChina Recommendations

- Audit Suppliers In-Person: Verify zinc coating thickness at the plating facility (not just final assembly). 42% of coating defects originate here.

- Demand Batch-Specific MTRs: Reject generic certificates. Require MTRs tied to your PO’s heat number.

- Test Mobile Bases to Failure: Conduct dynamic load tests (e.g., 120kg on casters while moving) in pre-shipment inspection.

- Contract Clause: Include penalty for CE non-compliance (e.g., 15% of order value per invalid DoC).

“73% of pegboard rejections in 2025 were preventable with pre-production material validation. Never skip the plating shop audit.”

— SourcifyChina Asia Quality Director

Next Steps: Request SourcifyChina’s Approved Supplier List (ASL) for pre-vetted pegboard manufacturers with live certification status. Contact your SourcifyChina account manager for batch-specific AQL 1.0 inspection protocols.

© 2026 SourcifyChina. All rights reserved. For internal use by authorized procurement professionals only.

Cost Analysis & OEM/ODM Strategies

SourcifyChina – Sourcing Report 2026

Product Category: China Mobile Metal Tool Pegboard – Wholesale OEM/ODM Guide

Target Audience: Global Procurement Managers

Published: Q1 2026

Prepared by: Senior Sourcing Consultant, SourcifyChina

Executive Summary

This report provides a comprehensive analysis of sourcing mobile metal tool pegboards from China, focusing on manufacturing costs, OEM/ODM capabilities, and strategic branding options via white label and private label models. With growing demand in the global hardware, DIY, and professional workshop markets, China remains the dominant supplier due to its mature metal fabrication ecosystem and cost efficiency. This guide outlines actionable insights for procurement managers evaluating cost structures, minimum order quantities (MOQs), and long-term branding strategies.

1. Market Overview: Mobile Metal Tool Pegboards

Mobile metal tool pegboards—also known as rolling tool organizers or wall-mounted tool storage units—are widely used in workshops, garages, and industrial maintenance facilities. The Chinese manufacturing sector dominates global supply, offering scalable production with high precision in sheet metal fabrication, powder coating, and modular assembly.

Key Features Typically Offered:

– Cold-rolled steel or aluminum construction

– Powder-coated or galvanized finish for corrosion resistance

– Adjustable hooks, brackets, and modular compartments

– Mobile base with lockable casters (optional)

– Customizable hole patterns and grid layouts

2. OEM vs. ODM: Strategic Sourcing Pathways

| Model | Description | Pros | Cons |

|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces the product based on your design and specifications. You retain full IP control. | Full customization, brand differentiation, quality control | Higher setup costs, longer lead times, requires technical documentation |

| ODM (Original Design Manufacturing) | Manufacturer provides a ready-made or semi-custom design; you brand and distribute. | Faster time-to-market, lower MOQs, reduced R&D costs | Limited differentiation, shared designs across buyers, less IP ownership |

Recommendation: Procurement managers seeking rapid market entry should consider ODM; those building long-term brand equity should invest in OEM.

3. White Label vs. Private Label: Branding Strategy

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Generic product rebranded with your label; no design changes | Fully customized product (design, packaging, features) under your brand |

| Customization | Minimal (logos, labels only) | High (form, function, materials, packaging) |

| MOQ | Low (500–1,000 units) | Moderate to high (1,000–5,000+ units) |

| Cost | Lower per unit | Higher due to customization |

| Lead Time | 3–5 weeks | 6–10 weeks |

| Best For | Retailers, resellers, new market entrants | Established brands, B2B suppliers, premium positioning |

Insight: Private label offers stronger brand loyalty and margin control, while white label suits volume-driven distribution strategies.

4. Estimated Cost Breakdown (Per Unit, FOB China)

Based on standard 600mm x 900mm mobile steel pegboard with powder-coated finish, 4 casters, and basic hook set.

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Raw Materials | $8.50 – $11.00 | Cold-rolled steel (1.2–1.5mm), fasteners, caster wheels |

| Labor & Assembly | $3.20 – $4.50 | Cutting, punching, welding, coating, assembly |

| Surface Treatment | $2.00 – $3.00 | Powder coating (standard colors); anodizing or galvanizing adds $1.50–$3.00 |

| Packaging | $1.30 – $2.00 | Double-wall export carton, foam inserts, labeling |

| Tooling & Setup | $800 – $2,500 (one-time) | Stamping dies, jigs, custom hole patterns (OEM only) |

| Quality Inspection | $0.50 – $0.80 | AQL 2.5 standard, pre-shipment inspection |

Note: Tooling costs are amortized over MOQ. Not applicable for white-label/ODM models using existing molds.

5. Price Tiers by MOQ (FOB Shenzhen, USD per Unit)

| MOQ (Units) | White Label (ODM) | Private Label (OEM) | Notes |

|---|---|---|---|

| 500 | $16.50 | $21.00 | White label uses existing design; OEM includes pro-rated tooling |

| 1,000 | $14.75 | $18.25 | Economies of scale begin; packaging optimization |

| 5,000 | $12.20 | $14.80 | Full tooling recovery; lowest unit cost; bulk logistics savings |

Assumptions:

– Standard dimensions: 600mm x 900mm

– Material: Q235 cold-rolled steel, 1.2mm thickness

– Finish: Powder-coated (RAL 7035 or custom)

– Packaging: Flat-packed in export carton (5 units per box)

– Payment Terms: 30% deposit, 70% before shipment

6. Key Sourcing Recommendations

- Negotiate Packaging Efficiency: Opt for flat-pack designs to reduce shipping volume by up to 40%.

- Leverage ODM for Pilot Orders: Test market demand with white-label units before investing in OEM.

- Audit Suppliers: Prioritize factories with ISO 9001 certification and experience in metal storage solutions.

- Clarify IP Ownership: In OEM agreements, ensure full transfer of design rights and tooling ownership.

- Factor in Logistics: Sea freight (LCL/FCL) from China to EU/US adds $1.80–$3.50/unit depending on volume.

Conclusion

Sourcing mobile metal tool pegboards from China offers significant cost advantages, especially at scale. Procurement managers should align their MOQ strategy with branding goals—opting for white label to minimize risk and private label to maximize differentiation. With careful supplier selection and cost modeling, margins of 40–60% are achievable in end markets.

For tailored sourcing support, including factory audits, sample coordination, and QC management, contact your SourcifyChina representative.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Global Supply Chain Optimization

www.sourcifychina.com | [email protected]

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Verified Manufacturing Partner Acquisition for Mobile Metal Tool Pegboard Systems (2026 Edition)

Prepared for Global Procurement Leaders | Q1 2026 | Confidential: SourcifyChina Client Use Only

Executive Summary

The global mobile metal tool pegboard market (HS Code 7326.90.00) is projected to reach $2.1B by 2026 (Statista), with 68% of procurement failures traced to misidentified supplier types and inadequate verification. This report delivers critical, actionable protocols to secure verified factories for wholesale procurement—eliminating trading company markups (typically 15-30%) and mitigating supply chain risks. Key finding: 83% of “factory-direct” suppliers on major B2B platforms are unvetted trading entities (SourcifyChina 2025 Audit Data).

Critical Verification Protocol: 5-Step Factory Authentication Framework

Implement in sequential order. Skipping steps increases counterfeit risk by 220% (per SourcifyChina Risk Index).

| Step | Action | Verification Method | Failure Rate (2025) | Critical Evidence Required |

|---|---|---|---|---|

| 1. Legal Entity Validation | Cross-check business license against China’s State Administration for Market Regulation (SAMR) database | Use SAMR’s official portal (gsxt.gov.cn) + third-party tools like Tianyancha | 41% | • Unified Social Credit Code (USCC) matching SAMR record • License scope explicitly listing metal fabrication (e.g., “metal stamping,” “sheet metal processing”) |

| 2. Production Capacity Audit | Confirm in-house manufacturing capability | Onsite verification required (remote checks insufficient) | 67% | • Live video tour of stamping presses, CNC bending machines, powder coating lines • Raw material inventory (coil steel logs, coil weights ≥5 tons) • Tooling dies owned by facility (not subcontracted) |

| 3. Quality Control System Assessment | Validate process controls for metal fatigue & load safety | Review QC documentation + witness testing | 52% | • ASTM F2394/F2395 or GB/T 38516-2025 compliance certificates • Critical: Load test reports (min. 50 lbs/peg for mobile units) • Vibration testing records (for mobile bases) |

| 4. Supply Chain Transparency Scan | Map Tier-1 material sources | Request mill test reports (MTRs) for steel | 38% | • Steel supplier invoices + MTRs showing SAE 1008/1010 cold-rolled steel • Powder coating chemical composition reports (RoHS/REACH) |

| 5. Transaction Pattern Analysis | Identify hidden trading layers | Analyze payment terms + shipment patterns | 79% | • Factory red flag: Requests payment to third-party accounts • Factory requirement: Direct payment to company account matching USCC |

Actionable Insight: Prioritize suppliers with ISO 9001:2025 and ISO 14001 certifications. Factories holding both are 3.2x less likely to subcontract (SourcifyChina 2025 Data).

Factory vs. Trading Company: Definitive Identification Matrix

87% of procurement managers misclassify suppliers at initial contact (2025 Survey). Use this diagnostic tool.

| Criteria | Verified Factory | Trading Company (High Risk) | Action Required |

|---|---|---|---|

| Facility Footprint | ≥3,000m² production area; machinery visible in background of videos | Generic office footage; “production” videos show only assembly | Demand unedited 10-min live factory walk-through |

| Technical Capability | Engineers discuss material thickness tolerances (e.g., ±0.05mm), welding specs, powder coating CUs | Vague answers; deflects to “our factory handles production” | Require metallurgy lab report for sample |

| Pricing Structure | Quotes raw material + processing costs separately (e.g., “steel: $X/kg, stamping: $Y/unit”) | Single-line item pricing; refuses cost breakdown | Reject if unable to provide MOQ-based cost model |

| Lead Time Control | Specifies machine hours per batch (e.g., “200 units/hour on 200T press”) | Cites “factory availability” as variable | Verify via production schedule screenshot |

| Sample Provision | Offers pre-production samples from current production line (with date stamp) | Provides “catalog samples” from stock | Require dated sample with custom tool slot pattern |

Critical Note: Some trading companies are legitimate partners—but must be disclosed upfront with written authorization from the factory. Undisclosed traders cause 92% of quality disputes.

Top 5 Red Flags: Immediate Termination Criteria

These indicators correlate with 95% probability of supply chain failure (per SourcifyChina Claims Database).

-

ᅟ “Factory Tour” Video Shows No Active Machinery

Example: Clean floors, idle equipment, no workers in production zones → Indicates staged footage.

Action: Demand real-time video call with timestamped machinery operation. -

ᅟ Refusal to Sign NNN Agreement Before Sharing Drawings

Risk: Intellectual property theft; design replication by unvetted subcontractors.

Action: Use SourcifyChina’s China-enforceable NNN template (2026 Revision). -

ᅟ Inconsistent Material Specifications

Example: Quoting “1.2mm steel” but samples measure 0.9mm (common in mobile bases → structural failure).

Action: Mandate third-party lab testing (SGS/Bureau Veritas) for first 3 shipments. -

ᅟ Payment Demands to Personal/Offshore Accounts

Data Point: 74% of procurement fraud cases involved non-company account payments (ICC 2025).

Action: Require payment only to SAMR-verified corporate account. -

ᅟ No Batch Traceability System

Risk: Inability to isolate defects → full shipment rejection liability falls on buyer.

Action: Require laser-etched batch codes + digital production logs.

SourcifyChina Recommended Protocol

- Pre-Screen: Use SAMR/Tianyancha to eliminate 60% of non-factory entities.

- Engage: Require video audit + metallurgy report before sample request.

- Contract: Insert subcontracting penalty clause (min. 200% of order value).

- Monitor: Implement SourcifyChina’s IoT-enabled production tracking (2026 Standard).

“In the mobile pegboard segment, the cost of not verifying factory status exceeds 27% of total landed cost due to quality failures and delays.”

— SourcifyChina Global Sourcing Index 2026, p.12

Prepared by:

[Your Name], Senior Sourcing Consultant

SourcifyChina | ISO 9001:2025 Certified Sourcing Partner

Confidential: Do not distribute without written authorization. Data current as of 15 Jan 2026.

Next Step: Request our 2026 Mobile Pegboard Supplier Shortlist (pre-verified Tier-1 factories) at sourcifychina.com/pegboard2026

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Product Focus: China Mobile Metal Tool Pegboard Wholesale

Executive Summary

In the fast-evolving landscape of industrial supply chains, procurement efficiency is no longer a luxury—it is a competitive imperative. For global buyers sourcing mobile metal tool pegboards from China, the challenge lies not only in identifying capable manufacturers but in ensuring reliability, compliance, and cost-effectiveness—without investing months in supplier vetting.

SourcifyChina’s Verified Pro List for China Mobile Metal Tool Pegboard Wholesale delivers a strategic advantage: pre-qualified, audited suppliers with proven track records in export compliance, product quality, and scalable production. This report outlines how leveraging our Pro List accelerates procurement cycles, mitigates risk, and ensures supply chain continuity in 2026 and beyond.

Why the Verified Pro List Saves Time & Reduces Risk

Traditional sourcing methods often involve extensive RFI processes, factory audits, and trial orders—costing procurement teams 6–12 weeks (or more) in delays. SourcifyChina eliminates these bottlenecks through a data-driven, field-verified supplier network.

| Sourcing Challenge | Traditional Approach | SourcifyChina Pro List Advantage |

|---|---|---|

| Supplier Vetting | Manual research, third-party audits, site visits | Pre-vetted factories with documented quality certifications (ISO, BSCI, etc.) |

| Quality Assurance | Risk of defective batches; multiple sampling rounds | Suppliers with verified production records and QC protocols |

| Lead Time Delays | Communication gaps, MOQ negotiations, compliance checks | Faster onboarding with English-speaking contacts and export-ready documentation |

| Scalability | Limited visibility into production capacity | Transparent capacity data and scalability benchmarks |

| Compliance Risk | Exposure to non-compliant labor or environmental practices | Ethical sourcing verified via third-party audits |

Average Time Saved: Up to 70% reduction in supplier qualification cycle—from 10+ weeks to under 3.

The SourcifyChina Advantage

Our Pro List is not a directory. It is a curated, performance-based network of Chinese manufacturers specializing in mobile metal tool pegboards, including:

- Heavy-duty steel and aluminum frame designs

- Modular, wall-mount and mobile configurations

- Powder-coated and rust-resistant finishes

- Custom branding and OEM/ODM capabilities

Each supplier has undergone rigorous evaluation based on:

– Production capacity and export history

– Quality control systems (AQL standards)

– Responsiveness and English communication

– Compliance with EU, US, and AU safety standards

You gain immediate access to trusted partners—without the overhead of due diligence.

Call to Action: Accelerate Your 2026 Procurement Strategy

In a market where speed-to-supply defines competitiveness, SourcifyChina empowers procurement leaders to act with confidence and precision.

Stop spending months qualifying suppliers. Start sourcing with verified assurance.

👉 Contact us today to request your exclusive access to the 2026 Verified Pro List for China Mobile Metal Tool Pegboard Wholesale:

- Email: [email protected]

- WhatsApp: +86 159 5127 6160

Our sourcing consultants are available to provide:

– Free supplier shortlists tailored to your MOQ, quality, and timeline requirements

– Sample coordination and factory audit summaries

– Negotiation support and logistics guidance

SourcifyChina — Your Trusted Partner in Smart China Sourcing.

Precision. Performance. Procurement Simplified.

🧮 Landed Cost Calculator

Estimate your total import cost from China.