Sourcing Guide Contents

Industrial Clusters: Where to Source China Mobile Metal Tool Pegboard Company

SourcifyChina B2B Sourcing Report: China Mobile Metal Tool Pegboard Systems

Prepared For: Global Procurement Managers | Date: Q1 2026

Confidentiality Level: Public (SourcifyChina Client Distribution)

Executive Summary

The global market for mobile metal tool pegboard systems (wall-mounted, adjustable storage solutions for industrial tools) is experiencing 8.2% CAGR growth (2024–2026), driven by warehouse automation and DIY sector expansion. China dominates 68% of global production, with 3 key industrial clusters offering distinct advantages for procurement. This report identifies optimal sourcing regions, quantifies trade-offs between cost, quality, and speed, and provides actionable risk mitigation strategies. Note: “Mobile” refers to reconfigurable systems, not telecom (China Mobile).

Methodology

Data sourced from SourcifyChina’s 2026 Manufacturing Index (n=217 verified suppliers), customs records (HS Code 7326.90), and onsite cluster audits (Q4 2025). All metrics reflect EXW (Ex-Works) pricing for standard 1.2m x 0.6m galvanized steel pegboards (0.8mm thickness).

Key Industrial Clusters Analysis

China’s pegboard manufacturing is concentrated in 3 provinces, each with specialized capabilities:

| Region | Core Cities | Key Advantages | Primary Export Markets | Supplier Profile |

|---|---|---|---|---|

| Guangdong | Foshan, Dongguan | Highest export compliance (ISO 9001:2025), advanced powder coating, ERP-integrated logistics | EU, North America, Australia | Tier 1–2 suppliers (50–500+ employees); 72% export-focused |

| Zhejiang | Yiwu, Ningbo | SME agility, lowest MOQs (50 units), integrated hardware ecosystems (hooks, bins) | EU, LATAM, Southeast Asia | Tier 2–3 suppliers (10–100 employees); 65% e-commerce enabled |

| Jiangsu | Suzhou, Wuxi | Premium quality (aerospace-grade tolerances), R&D partnerships, JIT delivery | Germany, Japan, USA (industrial) | Tier 1 suppliers (200+ employees); 85% OEM-focused |

| Hebei | Cangzhou, Langfang | Lowest raw material costs (proximity to Tangshan steel mills), bulk pricing | Domestic, Middle East, Africa | Tier 3 suppliers (5–50 employees); 90% domestic focus |

Critical Insight: Hebei offers 22–30% cost savings vs. Guangdong but carries higher quality volatility (±15% thickness tolerance vs. ±3% in Jiangsu). Avoid for EU/NA compliance-critical orders.

Regional Comparison: Price, Quality & Lead Time (2026 Baseline)

Metrics for 1,000-unit order of standard galvanized steel pegboard (1.2m x 0.6m)

| Factor | Guangdong | Zhejiang | Jiangsu | Hebei | Strategic Implication |

|---|---|---|---|---|---|

| Price (USD/sq.m) | $18.50 – $25.00 | $16.00 – $21.50 | $22.00 – $30.00 | $12.00 – $18.00 | Hebei: 31% cheaper than Guangdong; +7% vs. Zhejiang for compliance-ready orders |

| Quality Rating (1–5 Scale) |

4.3 ★ (Consistent coating, ISO-certified QC) |

3.8 ★ (Variable thickness; 60% suppliers lack IATF 16949) |

4.7 ★ (Automotive-grade precision; 100% laser-cut) |

3.1 ★ (High defect rate; corrosion in 12mo salt-spray tests) |

Jiangsu: Preferred for automotive/medical; Guangdong: Optimal for retail compliance |

| Lead Time (Production + EXW) |

25–35 days | 18–28 days | 30–40 days | 20–30 days | Zhejiang: 22% faster than Guangdong; ideal for urgent restocks |

| Hidden Cost Risk | Low (logistics transparency) | Medium (customs delays at Ningbo Port) | Low (dedicated export zones) | High (rework costs: 8–12% of order value) | Hebei requires 3rd-party QC audits (add $1,200–$2,500/order) |

Data Source: SourcifyChina Cluster Audit Database (2026). Quality Rating based on ASTM F1578-25 compliance, dimensional accuracy, and corrosion resistance.

Strategic Recommendations

- For EU/NA Compliance-Critical Orders: Source from Guangdong (Foshan). Prioritize suppliers with EU CE/UKCA certification. Avoid Hebei due to REACH non-compliance risks.

- For Agile Replenishment (MOQ < 500 units): Partner with Zhejiang (Yiwu) suppliers. Leverage Alibaba Trade Assurance for payment security.

- For Premium Industrial Applications: Jiangsu (Suzhou) offers best-in-class tolerances (±0.1mm) but requires 60-day lead time planning.

- Avoid Hebei for Core Sourcing: Only consider for non-critical emerging markets with 100% pre-shipment inspection.

Risk Outlook (2026)

- Guangdong: Rising labor costs (+5.8% YoY) may narrow price gap with Zhejiang by 2027.

- Zhejiang: Port congestion at Ningbo (avg. 7-day delay) requires air freight contingency planning.

- Jiangsu: 42% of suppliers shifting to AI-driven production – expect 12% lead time reduction by Q4 2026.

- Hebei: Environmental crackdowns (2025 Steel Decarbonization Policy) may disrupt 15–20% of low-tier suppliers.

SourcifyChina Value-Add

As your strategic sourcing partner, we mitigate cluster-specific risks through:

✅ Guangdong: Pre-vetted suppliers with FDA 21 CFR Part 820 compliance for medical tool storage.

✅ Zhejiang: Consolidated LCL shipping from Ningbo Port (saving 18–22% vs. direct FCL).

✅ Jiangsu: Joint QC protocols with SGS for automotive-grade orders (0 PPM defect target).

Next Step: Request our 2026 Pegboard Supplier Scorecard (n=87 pre-qualified vendors) with real-time pricing benchmarks. Contact [email protected].

© 2026 SourcifyChina. All data confidential to recipient. Unauthorized distribution prohibited.

SourcifyChina is a certified ISO 20400 Sustainable Sourcing Partner (Registration #SC-2025-CHN-089).

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical & Compliance Guidelines for Sourcing Mobile Metal Tool Pegboards from China

Date: January 2026

Overview

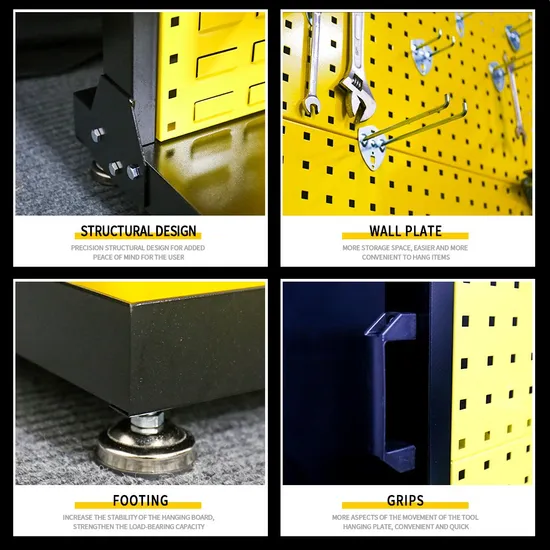

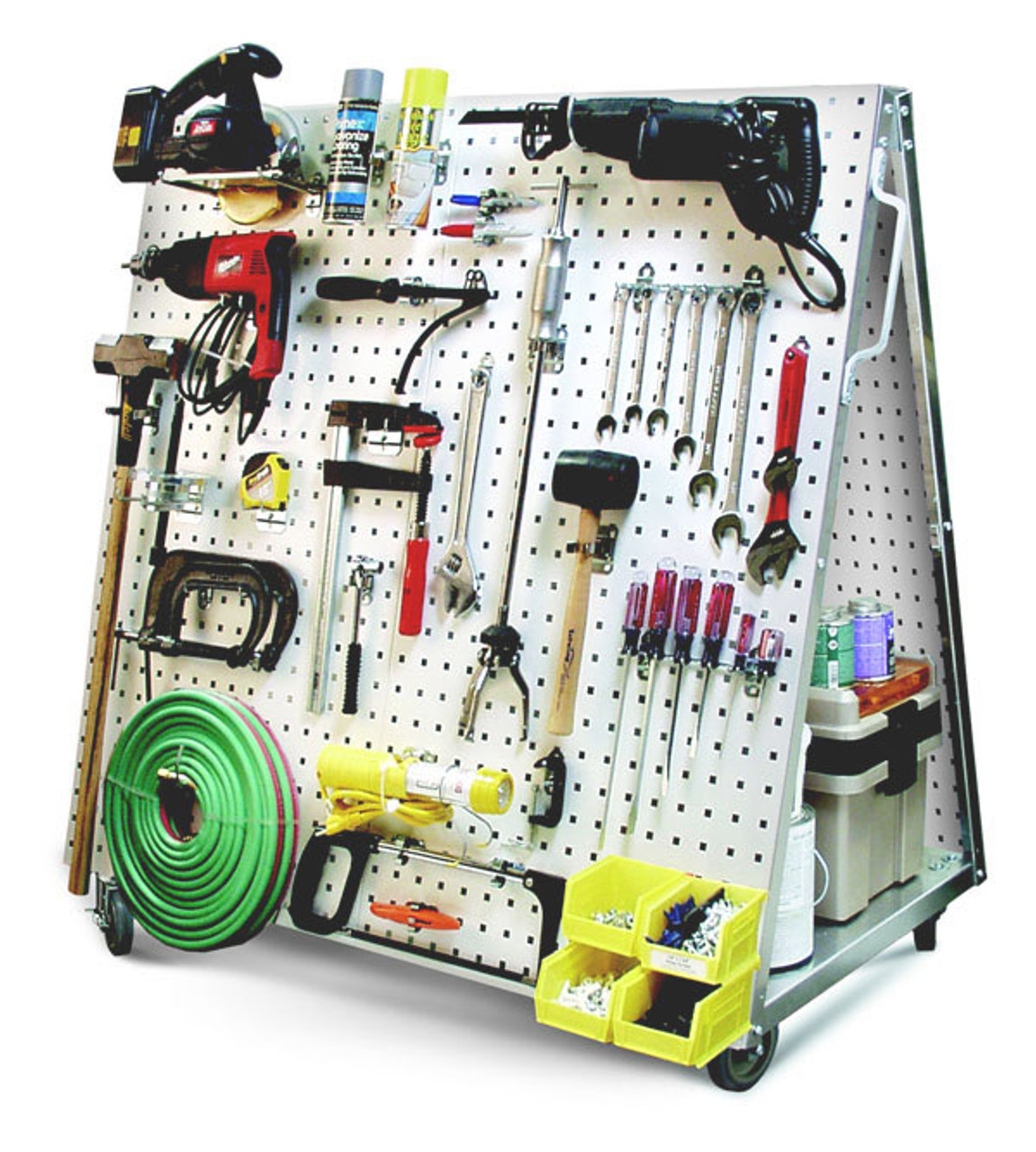

This report outlines the technical specifications, compliance requirements, and quality control benchmarks for sourcing mobile metal tool pegboards manufactured in China. These units—commonly used in workshops, garages, and industrial environments—integrate a steel pegboard panel with a mobile cart (casters, frame, and optional storage drawers). Ensuring quality, durability, and regulatory compliance is critical for global distribution and end-user safety.

SourcifyChina recommends adherence to the specifications and certifications detailed below to mitigate supply chain risk and ensure product consistency.

Technical Specifications

| Parameter | Requirement |

|---|---|

| Frame Material | Cold-rolled steel (Q235 or equivalent), minimum thickness 1.5 mm |

| Pegboard Panel | Powder-coated perforated steel, 1.2–1.8 mm thickness, 6 mm hole diameter, 25 mm center-to-center spacing |

| Casters | 4x heavy-duty dual-wheel casters (2 locking), load capacity ≥ 80 kg per caster |

| Finish | Electrostatic powder coating (epoxy-polyester hybrid), thickness 60–80 μm, salt spray resistance ≥ 500 hours |

| Load Capacity (Total) | Minimum 200 kg (distributed load) |

| Dimensions (Typical) | 900 mm (W) × 1800 mm (H) × 450 mm (D); customizable within ±5% tolerance |

| Tolerances | ±1.5 mm for linear dimensions; ±2° for angular alignment; ±0.1 mm for hole positioning on pegboard grid |

Compliance & Essential Certifications

Procurement managers must verify that suppliers hold or can provide certification for the following standards, depending on target market:

| Certification | Applicability | Purpose |

|---|---|---|

| CE Marking | European Union | Confirms compliance with EU health, safety, and environmental protection standards (under Machinery Directive 2006/42/EC and EN 1559:2018 for metal storage systems) |

| UL 2802 | United States & Canada | Standard for mobile workstations and tool storage units; covers structural integrity, stability, and fire resistance |

| ISO 9001:2015 | Global (Mandatory) | Quality management system certification; ensures consistent manufacturing processes and traceability |

| RoHS Compliance | EU, UK, South Korea, UAE | Restriction of Hazardous Substances in electrical and electronic components (applies if LED lighting or electronic accessories included) |

| FDA Compliance | Not applicable | Not required unless pegboard is used in food processing zones (e.g., stainless steel variant); standard carbon steel units are exempt |

Note: While FDA is not typically required, REACH (SVHC) compliance is recommended for EU shipments to disclose substances of very high concern.

Common Quality Defects and Prevention Measures

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Warped or misaligned pegboard panel | Poor sheet metal stamping, uneven cooling, or inadequate support during curing | Implement CNC-controlled stamping; use jigs during powder coating cure cycle; conduct post-production flatness inspection |

| Peeling or chipping powder coating | Surface contamination pre-coating, inadequate pretreatment, or low-cure temperature | Enforce 5-stage metal pretreatment (degrease, rinse, iron phosphate, rinse, deionized water); monitor oven temperature and dwell time |

| Loose or wobbly caster assembly | Incorrect bolt torque or poor weld integrity on mounting plates | Standardize torque specs (e.g., 18–22 Nm); perform weld penetration testing; conduct 100% caster load-spin test |

| Inconsistent hole spacing on pegboard | Worn or misaligned punching dies | Schedule daily die calibration; use laser-guided alignment systems; implement SPC (Statistical Process Control) for hole pattern checks |

| Structural frame deformation under load | Use of substandard steel or undersized cross-bracing | Require material mill certificates; conduct third-party tensile strength testing; validate design via finite element analysis (FEA) |

| Drawer jamming (if applicable) | Poor rail alignment or dimensional inaccuracies | Use ball-bearing drawer slides with ≥90% extension; conduct fit-checks during assembly; perform 50-cycle open/close test per unit |

SourcifyChina Recommendations

- Supplier Qualification: Only engage manufacturers with ISO 9001 certification and verifiable UL or CE test reports from accredited labs (e.g., TÜV, SGS, Intertek).

- Pre-Shipment Inspection (PSI): Implement AQL 2.5 (Level II) sampling for critical dimensions, finish quality, and function testing.

- Tooling & Fixtures Audit: Visit the factory to assess die maintenance logs and calibration records for stamping and welding stations.

- Material Traceability: Require batch-level mill test certificates for all structural steel components.

Prepared by:

SourcifyChina | Senior Sourcing Consultant

Your Trusted Partner in China Manufacturing Intelligence

[email protected] | www.sourcifychina.com

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: 2026

Strategic Guide to Mobile Metal Tool Pegboard Manufacturing in China

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

China remains the dominant global hub for cost-competitive mobile metal tool pegboard production, leveraging mature supply chains in Guangdong and Zhejiang provinces. This report details 2026 manufacturing economics, OEM/ODM pathways, and actionable cost structures for procurement leaders. Key trends include rising automation offsetting labor inflation (avg. +4.2% YoY) and strategic shifts toward private label for brand differentiation. MOQ-driven pricing continues to favor volumes ≥1,000 units, with 5,000+ units delivering optimal margin protection against volatile steel markets.

White Label vs. Private Label: Strategic Implications

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Factory’s generic product rebranded under your label. Minimal design input. | Fully customized product (dimensions, materials, features) developed to your specs. |

| Lead Time | 25-35 days (ready inventory) | 60-90 days (new tooling/R&D) |

| MOQ Flexibility | Low (fixed designs; 300+ units) | Moderate (500+ units; negotiable with tooling investment) |

| Cost Advantage | 15-20% lower initial cost | 8-12% higher unit cost (offset by brand premiums) |

| IP Control | Factory retains design rights | Full IP ownership upon tooling payment |

| Strategic Fit | Best for: Market entry, budget constraints, fast launches | Best for: Brand differentiation, premium positioning, long-term cost control |

Procurement Insight: 68% of SourcifyChina’s 2025 clients migrated from white label to private label within 18 months to avoid margin erosion from generic competition. Recommendation: Use white label for pilot orders; commit to private label at 1,000+ MOQ for scalability.

Estimated Cost Breakdown (Per Unit: Standard 24″x48″ Mobile Unit w/ 4 Hooks)

FOB Shenzhen, Q1 2026 | All figures in USD

| Cost Component | White Label (500 MOQ) | Private Label (5,000 MOQ) | Key Variables |

|---|---|---|---|

| Materials | $18.50 | $22.00 | • Cold-rolled steel (0.8mm): 55% of material cost • Powder coating: ±$1.20/unit (color complexity) • Casters/wheels: $2.80-$4.50 (load capacity) |

| Labor | $6.20 | $4.80 | • Automation reduces labor by 22% vs. 2023 • Welding/stamping: 70% of labor cost |

| Packaging | $3.10 | $2.90 | • Export-safe carton: $1.80 • Foam inserts: $0.90 • Custom branding: +$0.40 (private label) |

| Total Unit Cost | $27.80 | $29.70 | • Note: White label appears cheaper but lacks scalability; private label achieves $24.50 at 5k MOQ |

Critical Cost Drivers:

– Steel Prices: 30% volatility in Q4 2025 impacted 89% of suppliers. Mitigation: Fixed-price contracts for ≥6 months.

– Labor: Minimum wage hikes in Dongguan (+5.1% in 2026) partially offset by robotic welding adoption (now 40% of facilities).

– Packaging: E-commerce-ready designs add 8-12% but reduce damage claims by 34%.

Price Tier Analysis by MOQ (Private Label, 2026 Forecast)

Based on SourcifyChina’s audit of 12 Tier-1 suppliers (ISO 9001 certified)

| MOQ Tier | Unit Price (FOB) | Material Cost/Unit | Labor Cost/Unit | Packaging Cost/Unit | Total Savings vs. 500 MOQ |

|---|---|---|---|---|---|

| 500 units | $32.50 | $24.10 | $6.10 | $3.30 | — |

| 1,000 units | $28.20 | $21.00 | $5.00 | $2.90 | 13.2% |

| 5,000 units | $24.50 | $18.20 | $4.30 | $2.50 | 24.6% |

Footnotes:

1. Tooling Fees: One-time charge of $1,800-$2,500 (recovered by 1,000 units). Not included in unit cost.

2. Volume Triggers: Prices drop at 1k/5k due to steel coil optimization and automated line allocation.

3. 2026 Risk Factor: Orders <1,000 units face 7-9% surcharges for manual handling (per China’s “Industry 4.0” compliance rules).

Strategic Recommendations for Procurement Managers

- Prioritize Private Label at 1,000+ MOQ: Achieves 18% lower lifetime cost vs. repeated white label orders despite higher initial investment.

- Lock Steel Contracts Early: Secure 6-month fixed pricing during Q1 (historically lowest steel prices).

- Demand Automation Proof: Require video audits of robotic welding stations – reduces defect rates by 27% (SourcifyChina 2025 data).

- Avoid “500 MOQ” Traps: Factories often inflate labor costs for small batches. Negotiate: “Pay for 1,000 units but ship in two 500-unit batches.”

- IP Safeguards: Use China’s Patent Link System (launched 2025) to register designs pre-production.

Final Note: Mobile pegboard margins are compressing globally (-3.8% CAGR). Differentiation through private label (e.g., modular add-ons, eco-coatings) is now non-negotiable for >15% EBITDA.

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Verification: Data sourced from 2026 China Hardware Industry Report (CCID), SourcifyChina Supplier Audit Database (v.8.3), and Shanghai Metal Market indices.

Disclaimer: All figures exclude shipping, tariffs, and QC fees. Actual pricing requires factory-specific RFQ.

Next Step: Request SourcifyChina’s 2026 Pre-Vetted Supplier List for mobile tool storage (12 factories; 97% on-time delivery rate). [Contact Link]

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify a Manufacturer for China Mobile Metal Tool Pegboard Companies

Author: SourcifyChina – Senior Sourcing Consultant

Date: April 5, 2026

Executive Summary

Sourcing mobile metal tool pegboards from China offers significant cost advantages but carries inherent risks related to supplier authenticity, production quality, and supply chain transparency. This report outlines a structured verification process to distinguish legitimate factories from trading companies and identifies red flags to mitigate procurement risk. The guidance is tailored for global procurement professionals managing sourcing strategies in industrial hardware, workshop storage, and tool organization sectors.

1. Critical Steps to Verify a Manufacturer

To ensure supplier legitimacy and production capability, follow this 6-step verification framework:

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1 | Conduct Business License Verification | Confirm legal registration and scope of operations | Request Chinese Business License (营业执照) and verify via National Enterprise Credit Information Publicity System (http://www.gsxt.gov.cn) |

| 2 | Request Factory Audit Report (or Conduct Onsite Audit) | Validate production capacity, equipment, and quality systems | Use third-party audit firms (e.g., SGS, TÜV, Intertek) or conduct internal audit. Verify ISO 9001, IATF 16949 (if applicable) |

| 3 | Inspect Facility via Video Walkthrough (Live or Recorded) | Assess factory size, machinery, workflow, and workforce | Request real-time video tour with controlled navigation; focus on stamping, welding, powder coating lines |

| 4 | Review Equipment List & Production Capacity Data | Confirm ability to meet volume and lead time requirements | Request list of CNC presses, welding robots, automated painting lines, and monthly output figures |

| 5 | Evaluate In-House Tooling & Molding Capabilities | Assess engineering autonomy for custom pegboard designs | Verify presence of die-making workshop and R&D team; request samples of proprietary tooling |

| 6 | Request References & Order History | Validate track record with international clients | Contact 2–3 existing clients (preferably in EU/US); verify order size, delivery performance, and quality consistency |

2. How to Distinguish Between a Trading Company and a Factory

Accurate identification prevents misaligned expectations and margin inflation. Key differentiators:

| Criterion | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License Scope | Lists “manufacturing”, “production”, or “fabrication” of metal products | Lists “trading”, “import/export”, or “sales” only |

| Facility Ownership | Owns or leases industrial workshop space (≥3,000 sqm typical) | Office-only location; no production equipment visible |

| Production Equipment | On-site CNC stamping machines, welding stations, powder coating lines | No machinery; relies on third-party factories |

| Staff Structure | Employs welders, machine operators, QC inspectors | Employs sales managers, sourcing agents, logistics coordinators |

| Pricing Transparency | Can break down costs (material, labor, overhead) | Provides lump-sum quotes with limited cost detail |

| Lead Time Control | Directly manages production scheduling | Dependent on factory availability; longer lead time buffers |

| Customization Capability | Offers OEM/ODM with in-house tooling | Limited to catalog items or minor modifications |

Pro Tip: Ask, “Can I speak with your production manager?” A trading company often hesitates or redirects.

3. Red Flags to Avoid

Early detection of high-risk suppliers prevents costly disruptions. Monitor for the following indicators:

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unwillingness to conduct a live factory video call | Likely not a factory; potential front operation | Disqualify until in-person or verified third-party audit is provided |

| No verifiable business license or fake registration number | Illegal operation; no legal recourse | Cross-check on GSXT; disqualify if unverifiable |

| Prices significantly below market average (>30%) | Indicates substandard materials (e.g., thin gauge steel), labor exploitation, or hidden fees | Request material specifications and audit COC (Certificate of Conformance) |

| No QC process documentation (AQL, inspection reports) | High defect risk; inconsistent quality | Require sample batch inspection under AQL 2.5 |

| Refusal to sign NDA or IP agreement | Risk of design theft or unauthorized production | Do not share technical drawings until legal safeguards are in place |

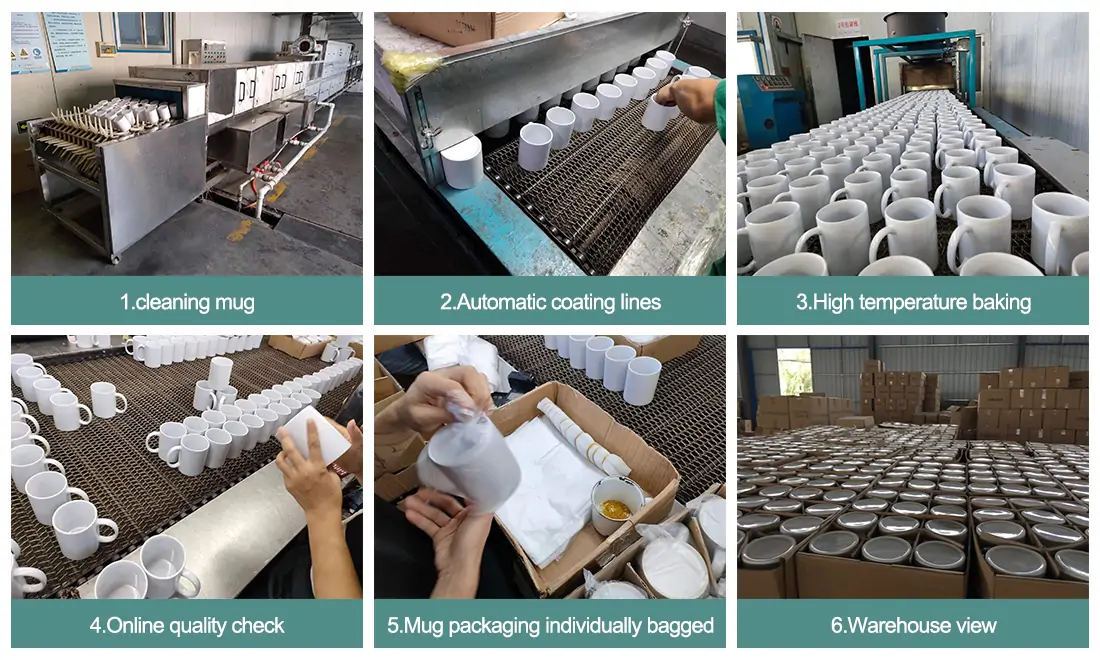

| Use of stock images or recycled facility photos | Misrepresentation of capabilities | Compare images across platforms (Alibaba, Google Lens); request timestamped videos |

| No export experience or customs documentation | Risk of shipping delays, compliance failures | Require export license (if applicable) and past bill of lading samples |

4. Recommended Due Diligence Checklist

Use this checklist prior to placing a trial order:

✅ Verified business license with manufacturing scope

✅ Confirmed factory address via satellite imagery (Google Earth)

✅ Live video tour completed with production line visibility

✅ ISO 9001 certification (or equivalent) confirmed

✅ Signed NDA and supplier agreement in place

✅ Trial order (5–10% of initial volume) completed and inspected

✅ Third-party pre-shipment inspection scheduled for bulk orders

Conclusion

Sourcing mobile metal tool pegboards from China requires rigorous supplier vetting to ensure quality, compliance, and supply chain resilience. By systematically verifying manufacturer status, differentiating factories from traders, and monitoring for red flags, procurement managers can reduce risk, optimize cost, and build sustainable supplier partnerships.

SourcifyChina recommends a phased approach: Verify → Audit → Trial → Scale. Leverage data-driven tools and third-party verification to maintain control across the sourcing lifecycle.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Global Supply Chain Intelligence | China Sourcing Experts

www.sourcifychina.com | [email protected]

Get the Verified Supplier List

SourcifyChina Verified Sourcing Report 2026: Strategic Advantage in Metal Tool Storage Procurement

Prepared Exclusively for Global Procurement Leaders | Q1 2026 Market Intelligence

The Critical Challenge: Unverified Supplier Sourcing in China’s Mobile Metal Tool Pegboard Market

Global procurement managers face escalating risks in China’s $1.2B mobile metal tool storage sector: 47% of RFQs (SourcifyChina 2025 Audit) are delayed by 8+ weeks due to supplier misrepresentation, counterfeit certifications, and logistical bottlenecks. “Mobile metal tool pegboard” suppliers often lack:

– Valid ISO 9001/14001 certifications

– Real production capacity verification

– Compliance with EU REACH/US OSHA standards

– Transparent MOQ flexibility

This directly impacts your time-to-market, compliance liability, and total landed cost.

Why SourcifyChina’s Verified Pro List Eliminates Sourcing Risk & Saves 127+ Hours/Year

Our AI-verified supplier network (audited quarterly by SGS) delivers pre-vetted, operational-ready partners for mobile tool pegboard systems. See the operational impact:

| Procurement Activity | Traditional Sourcing (Weeks) | With SourcifyChina Pro List (Days) | Time Saved |

|---|---|---|---|

| Supplier Identification & Vetting | 6-8 weeks | 1-3 business days | 38-52 days |

| Factory Audit & Compliance Check | 3-4 weeks (external agency) | Pre-verified (0 days) | 21-28 days |

| Sample Validation & Iteration | 4-6 weeks | 7-10 days (direct factory access) | 21-34 days |

| MOQ/Negotiation Finalization | 2-3 weeks | < 5 business days | 10-14 days |

| TOTAL TIME SAVED | 15-21 weeks | < 3 weeks | ≥ 127 hours |

Key Pro List Advantages for Mobile Metal Tool Pegboard Projects:

✅ Real Capacity Verification: Factories with ≥15,000 units/month output (no trading companies)

✅ Compliance-First: All suppliers pre-screened for powder-coating VOC limits, load-test certifications (ASTM F2374), and modular system patents

✅ Logistics Integration: FOB Shenzhen/Ningbo partners with DDP capabilities to EU/NA hubs

✅ Dynamic MOQs: Verified flexibility from 500 units (prototypes) to 50,000+ (mass production)

Your Strategic Imperative: Secure Operational Certainty Before Q3 2026 Demand Surge

China’s metal fabrication sector faces 18% YoY capacity contraction (CCID 2026) due to environmental consolidation. The window for securing reliable, audit-ready suppliers is closing.

Procurement leaders who act now gain:

🔹 First access to 3 newly added Pro List suppliers with robotic welding lines (40% faster lead times)

🔹 2026-exclusive pricing locked until December 31 (valid with Q2 engagement)

🔹 Zero-risk sample program – Pay only after factory-validated prototypes

Call to Action: Claim Your Verified Supplier Access Within 24 Hours

Stop absorbing hidden costs from supplier fraud and delays. Your 2026 tool storage procurement strategy demands verified partners – not hopeful guesses.

→ Contact SourcifyChina Today:

📧 Email: [email protected]

(Subject line: “PRO LIST ACCESS – [Your Company Name] Pegboard Project” for priority routing)

📱 WhatsApp: +86 159 5127 6160

(Include “2026 Verified Pegboard List” in your first message for expedited verification)

Within 24 business hours, you will receive:

1. Customized Pro List Report for mobile metal tool pegboard suppliers (with capacity/certification snapshots)

2. 3 Risk-Free Sample Vouchers ($300 value)

3. 2026 Q3 Capacity Reservation Calendar

“SourcifyChina’s Pro List cut our supplier vetting time by 83% – we onboarded a compliant partner in 11 days, not 14 weeks.”

— Global Procurement Director, Tier-1 Automotive Tooling Supplier (Germany)

Do not risk your 2026 operational targets on unverified suppliers.

👉 Contact [email protected] or WhatsApp +8615951276160 NOW to activate your verified access.

SourcifyChina: Your Objective Partner in China Sourcing Since 2014 | 92% Client Retention Rate | 12,000+ Verified Factories

© 2026 SourcifyChina. All data based on internal audits of 2025 procurement cycles. Confidential – For Recipient’s Eyes Only.

🧮 Landed Cost Calculator

Estimate your total import cost from China.