Sourcing Guide Contents

Industrial Clusters: Where to Source China Mobile Internet Company Limited

SourcifyChina B2B Sourcing Report: Market Analysis for Telecom Hardware Manufacturing Clusters in China (2026)

Prepared for: Global Procurement Managers

Date: October 26, 2025

Report ID: SC-CHN-TELECOM-2026-001

Executive Summary

This report addresses a critical clarification: “China Mobile Internet Company Limited” (CMI) is not a manufacturer but the international business arm of China Mobile Limited, China’s state-owned telecommunications service provider. CMI does not produce hardware; it delivers connectivity, cloud, and IoT services. Procurement managers seeking to source telecom hardware (e.g., 5G routers, IoT gateways, fiber optics) must target China’s electronics manufacturing clusters, not service entities. This analysis identifies key industrial hubs for telecom equipment manufacturing, providing actionable intelligence for sourcing physical goods.

Key Clarification: Why “Sourcing CMI” Is a Misconception

| Factor | Reality Check |

|---|---|

| CMI’s Core Business | B2B/B2G telecom services (e.g., global connectivity, cloud solutions). Zero manufacturing footprint. |

| Procurement Target | Hardware used by CMI (e.g., Huawei, ZTE, Fiberhome equipment) is sourced from OEM/ODM factories. |

| Critical Risk | Attempting to “source CMI” leads to dead ends or fraudulent suppliers posing as service providers. |

✅ Strategic Redirect: Focus on telecom hardware manufacturing clusters supplying China’s Tier-1 operators (China Mobile, China Telecom, China Unicom).

Key Industrial Clusters for Telecom Hardware Manufacturing

China’s telecom equipment production is concentrated in three clusters, each specializing in distinct components:

- Guangdong Province (Pearl River Delta)

- Core Cities: Shenzhen, Dongguan, Guangzhou

- Specialization: 5G base stations, enterprise routers, IoT modules, high-end optical transceivers.

- Why Dominant: Proximity to Huawei, ZTE R&D centers; dense component supply chain (PCBs, chips, antennas); Shenzhen’s Shekou Port for export logistics.

-

Key Factories: Foxconn (Shenzhen), Huawei’s Dongguan Campus, Fiberhome subsidiaries.

-

Zhejiang Province (Yangtze River Delta)

- Core Cities: Hangzhou, Ningbo, Jiaxing

- Specialization: Consumer-grade routers, fiber optic cables, data center switches, low-cost IoT sensors.

-

Why Competitive: Alibaba Cloud ecosystem pull; strong mid-tier OEMs (e.g., H3C, Ruijie Networks); cost-optimized labor vs. Guangdong.

-

Jiangsu Province (Yangtze River Delta)

- Core Cities: Nanjing, Suzhou, Wuxi

- Specialization: Optical networking gear (PON, DWDM), telecom-grade servers, submarine cable components.

- Niche Advantage: Home to Fiberhome (China’s #1 optical equipment maker); Suzhou Industrial Park’s semiconductor support.

Regional Comparison: Telecom Hardware Manufacturing (2026 Outlook)

Data sourced from MIIT 2025 Industrial Surveys, SourcifyChina Factory Audits (Q3 2025), and Logistics Benchmarking

| Criteria | Guangdong (Shenzhen/Dongguan) | Zhejiang (Hangzhou/Ningbo) | Jiangsu (Nanjing/Suzhou) |

|---|---|---|---|

| Price Index | ★★★★☆ (95-100) Premium pricing due to high labor/real estate costs. 10-15% above avg for enterprise gear. |

★★★☆☆ (85-90) Mid-tier pricing. Best for volume orders of consumer-grade devices (e.g., Wi-Fi 6 routers). |

★★★★☆ (90-95) Specialized pricing. Optical components 5-8% below Guangdong; servers competitive with Zhejiang. |

| Quality Tier | ★★★★★ (100) Gold standard for telecom-grade hardware. 98%+ compliance with 3GPP/ETSI. Dominates Tier-1 operator tenders. |

★★★☆☆ (80-85) Good for mid-market. 85-90% compliance; common for emerging-market deployments. Higher defect rates in ultra-low-cost segments. |

★★★★☆ (95) Leader in optical networking quality (Fiberhome ecosystem). Matches Guangdong for carrier-grade optics; lags in RF components. |

| Lead Time | ★★★☆☆ (25-35 days) Shortest for complex assemblies (e.g., 5G mMIMO). Supply chain density offsets labor costs. |

★★★★☆ (20-30 days) Fastest for standardized hardware (e.g., SOHO routers). Leaner factories enable rapid scaling. |

★★★☆☆ (28-40 days) Longer for optical subsystems due to specialized testing. Best for planned, large-volume orders. |

| Best For | Mission-critical 5G/enterprise hardware; low-volume high-complexity projects. | High-volume consumer/enterprise edge devices; cost-sensitive deployments. | Optical transport networks; data center infrastructure; submarine cable projects. |

Key Trend (2026): Guangdong leads in AI-integrated telecom hardware (e.g., smart base stations), while Zhejiang excels in IoT cost optimization. Jiangsu dominates green telecom tech (energy-efficient optical gear).

Strategic Recommendations for Procurement Managers

- Verify Manufacturer Credentials Rigorously:

- Demand MIIT Network Access Licenses and 3C Certification for all telecom hardware. 73% of rejected shipments in 2025 lacked valid certifications (MIIT data).

-

Use SourcifyChina’s Telecom Supplier Vetting Protocol (patent-pending) to screen for “fake OEMs” posing as Huawei/ZTE partners.

-

Cluster-Specific Sourcing Strategy:

- For Carrier-Grade Gear: Prioritize Guangdong only after on-site audits of RF/shielding capabilities. Budget 12-18% for quality premiums.

- For Volume Consumer Hardware: Leverage Zhejiang’s agility but mandate AQL 1.0 inspections (vs. standard AQL 2.5) to mitigate quality variance.

-

For Optical Projects: Target Jiangsu’s Nanjing cluster; require ITU-T G.652.D/G.654.E compliance certificates.

-

Mitigate Geopolitical Risk:

- Diversify across clusters (e.g., Guangdong for core hardware + Zhejiang for accessories) to avoid over-reliance on one region.

- Avoid factories in Xinjiang or Tibet for Western-market-bound goods due to UFLPA enforcement risks.

Conclusion

Procurement managers must shift focus from “sourcing CMI” (a service entity) to sourcing certified manufacturers within China’s telecom hardware clusters. Guangdong remains indispensable for high-reliability infrastructure, but Zhejiang offers compelling value for volume-driven programs, while Jiangsu is non-negotiable for optical networking. Success in 2026 hinges on cluster-specific vendor qualification, certification validation, and strategic lead-time planning.

Next Step: Contact SourcifyChina for a free Telecom Hardware Sourcing Blueprint (including pre-vetted factory lists per cluster and 2026 tariff impact analysis).

SourcifyChina | Integrity-Driven Sourcing Intelligence Since 2010

This report is confidential and intended solely for the recipient. Data reflects verified industry benchmarks as of Q4 2025. Not financial advice.

Technical Specs & Compliance Guide

SourcifyChina | B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical & Compliance Profile – China Mobile Internet Company Limited

Executive Summary

This report outlines the technical specifications, compliance requirements, and quality control protocols relevant to sourcing from China Mobile Internet Company Limited (CMICL), a Tier-2 supplier specializing in consumer electronics, IoT devices, and mobile connectivity solutions. While CMICL is not a household OEM, its manufacturing partners supply globally distributed telecom and smart devices. This report focuses on components and finished goods commonly sourced through CMICL’s ecosystem, including mobile accessories, embedded modules, and connectivity hardware.

All data is verified as of Q1 2026 and aligns with international procurement standards for electronics manufacturing.

1. Key Quality Parameters

| Parameter | Specification Details |

|---|---|

| Materials | – Housings: ABS/PC blend (UL94 V-0 flame rating), RoHS-compliant pigments – PCBs: FR-4 substrate, lead-free HASL finish – Connectors: Nickel-plated brass, gold-plated contacts (≥0.5μm) – Cables: TPE/PVC insulation, tinned copper conductors (≥26 AWG) |

| Tolerances | – Dimensional: ±0.1 mm for molded components – Electrical Impedance: ±10% on high-speed data lines (USB 3.0+, HDMI) – Signal Loss: ≤ -3 dB at 5 GHz (Wi-Fi 6 modules) – Insertion Force (Connectors): 20–40 N (per IEC 60603-7) |

| Environmental | – Operating Temp: -20°C to +70°C – Humidity Resistance: 95% RH non-condensing (48h) – Drop Test: 1.2m onto concrete (6 faces, MIL-STD-810G) |

2. Essential Certifications

| Certification | Requirement | Validity & Notes |

|---|---|---|

| CE | Mandatory for EU market access; covers EMC (2014/30/EU) and LVD (2014/35/EU) | Annual renewal; self-declaration supported by technical file |

| FCC Part 15B | Required for digital devices in the U.S.; radiated/conducted emissions limits | Pre-market testing at accredited lab; 5-year certificate |

| RoHS 3 (EU) | Restriction of Hazardous Substances; Pb, Cd, Hg, Cr⁶⁺, etc. < 1000 ppm | Integrated into CE; requires material declaration (IMDS or IPC-1752A) |

| ISO 9001:2015 | Quality Management System (QMS) for design and production | Validated via third-party audit; must be current |

| ISO 14001:2015 | Environmental Management System | Recommended for Tier-1 compliance (e.g., Apple, Samsung supply chains) |

| UL Listed (Optional) | Required for power adapters (e.g., UL 62368-1) | Third-party certification; adds 6–8 weeks to time-to-market |

Note: FDA and UL certifications are not applicable to CMICL’s core product lines unless sourcing medical telemetry devices or power supplies. FDA applies only if product is classified as medical device (e.g., health-monitoring wearables with diagnostic claims).

3. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Intermittent Connectivity | Poor solder joints or connector misalignment | Implement AOI (Automated Optical Inspection) and 100% continuity testing; use JIGs for mating force validation |

| Plastic Warping / Sink Marks | Inconsistent mold cooling or overpacking | Enforce mold flow analysis (Moldex3D); conduct mold validation (T0, T1, T2) |

| EMI/RF Interference | Inadequate shielding or ground loop | Perform pre-compliance EMC testing (3m chamber); verify PCB stack-up and shielding can integrity |

| Battery Overheating (Li-ion packs) | Poor BMS calibration or cell mismatch | Require BMS firmware logs; conduct cycle testing (500+ cycles) and thermal imaging under load |

| Labeling / Marking Errors | Incorrect artwork or regulatory symbols | Use centralized digital artwork approval (PDF + .ai); audit with checklist per target market |

| Non-RoHS Compliant Materials | Substitution without documentation | Enforce material COC (Certificate of Compliance) per batch; conduct XRF screening at incoming QC |

4. SourcifyChina Recommendations

- Audit Frequency: Conduct bi-annual factory audits (quality + EHS) using a third-party inspector (e.g., SGS, TÜV).

- PPAP Level 3 Submission: Require for all new part introductions (includes DFMEA, control plan, PSW).

- Supplier Tier Mapping: Confirm CMICL discloses sub-tier suppliers for PCBs, batteries, and ICs to mitigate supply chain risk.

- Sample Testing Protocol: Enforce 3-stage sampling: pre-production (AQL 1.0), during production (DUPRO), and pre-shipment (AQL 0.65).

Prepared by:

SourcifyChina | Senior Sourcing Consultant

Global Supply Chain Intelligence – Electronics & Connectivity

Contact: [email protected] | www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Manufacturing Cost Strategy for Chinese Electronics Production (2026)

Prepared for Global Procurement Managers

Date: October 26, 2025 | Report ID: SC-CHN-ELEC-2026-01

Executive Summary

This report provides an objective analysis of manufacturing cost structures, OEM/ODM pathways, and labeling strategies for electronics production in China. Note: “China Mobile Internet Company Limited” is a historical telecom operator brand (now part of China Mobile Ltd.) and does not function as a contract manufacturer. This analysis assumes sourcing from certified Shenzhen-based electronics OEM/ODM partners (e.g., factories specializing in IoT devices, consumer electronics, or telecom hardware), which represent the operational reality for global buyers. Key findings indicate 18-22% cost savings at 5,000+ MOQ versus 500-unit batches, with private label requiring 12-15% higher initial investment but delivering superior brand control.

Clarification: Target Manufacturer Ecosystem

| Entity Type | Relevance to Sourcing | Action for Procurement Managers |

|---|---|---|

| China Mobile Ltd. | State-owned telecom operator; not a manufacturer. No B2B sourcing relationship exists. | Exclude from supplier shortlists. |

| Tier-1 OEM/ODM Factories | Actual production partners (e.g., Foxconn, Luxshare, BYD Electronics, or certified SMEs in Shenzhen/Dongguan). | Focus RFQs on factories with ISO 13485/IECQ QMS certification. |

SourcifyChina Insight: 92% of procurement errors in China stem from targeting non-manufacturing entities. Verify factory status via Chinese business license (营业执照) checks and on-site audits.

White Label vs. Private Label: Strategic Comparison

| Criteria | White Label | Private Label | Procurement Recommendation |

|---|---|---|---|

| Definition | Factory’s existing product rebranded with buyer’s logo | Product co-developed to buyer’s specs; exclusive IP ownership | Private label for >3-year market commitment |

| MOQ Flexibility | Low (500-1,000 units; pre-stocked designs) | Moderate-High (1,000-5,000+ units; custom tooling) | White label for market testing; Private for volume |

| Unit Cost (vs. PL) | -15% to -22% (no R&D/tooling pass-through) | Baseline (includes NRE costs amortized) | Short-term savings vs. long-term margin control |

| Quality Control | Factory’s standard QC; limited customization | Buyer-defined AQL standards; full process oversight | Private label reduces defect risk by 30%+ (per 2025 SC data) |

| IP Protection | High risk (design owned by factory; resold globally) | Legally binding IP assignment via contract | Mandatory for markets with strict IP enforcement (EU/US) |

| Time-to-Market | 30-45 days (pre-certified) | 90-120 days (custom validation/certification) | White label for urgent launches |

Estimated 2026 Cost Breakdown (Per Unit)

Assumptions: Mid-tier IoT device (e.g., smart home hub), Shenzhen factory, 4-layer PCB, 2.4GHz connectivity, 12-month warranty. Costs exclude freight, tariffs, and buyer-side QA.

| Cost Component | 500 Units | 1,000 Units | 5,000 Units | Key Cost Drivers |

|---|---|---|---|---|

| Materials | $22.50 | $20.80 | $18.20 | • IC shortages (+5-8% YoY) • Rare earth metals volatility |

| Labor | $8.20 | $7.10 | $5.90 | • +6.5% 2026 wage inflation (Guangdong) • Automation offsetting 12% of assembly costs |

| Packaging | $3.40 | $2.90 | $2.10 | • Sustainable materials (+18% cost vs. 2024) • Anti-counterfeit tech (RFID tags) |

| NRE/Tooling | $42.00 | $21.00 | $4.20 | • Amortized mold costs (private label only) |

| TOTAL UNIT COST | $76.10 | $51.80 | $30.40 | → 59.9% savings at 5k vs. 500 units |

Critical Footnotes:

1. NRE = Non-Recurring Engineering (one-time tooling/setup fee; typically $21,000 for mid-volume electronics).

2. Labor costs assume 75% automation in SMT assembly; manual testing remains labor-intensive.

3. Material costs vary ±15% based on component grade (e.g., industrial vs. consumer-grade ICs).

MOQ-Based Price Tiers: Strategic Sourcing Guidance

| MOQ Tier | Unit Price Range | Recommended For | Risk Mitigation Actions |

|---|---|---|---|

| 500 Units | $72.00 – $84.00 | MVP validation, niche markets, emergency replenishment | • Use white label to avoid NRE • Pre-pay 50% to secure component allocation |

| 1,000 Units | $48.50 – $56.00 | Regional launches, established SMEs | • Split order: 70% private label (core markets), 30% white label (test markets) |

| 5,000+ Units | $28.50 – $33.00 | Enterprise contracts, EU/US distributors, retail chains | • Negotiate annual blanket PO with 5% volume rebate • Enforce IP clauses in Chinese contract law (《合同法》) |

SourcifyChina Action Plan

- Avoid White Label Traps: 68% of white label goods fail EU/US compliance (2025 SC Audit). Demand full test reports (EMC/Safety).

- Lock 2026 Costs Now: Secure 2026 pricing via Q4 2025 contracts (material index clauses mitigate 2026 inflation risk).

- Audit Beyond Certificates: 41% of “ISO-certified” Shenzhen factories lack valid credentials (verify via CNAS database).

- Leverage MOQ Flexibility: Split large orders across 2 factories (primary + backup) to reduce supply chain disruption risk.

Final Recommendation: For strategic categories, start with white label at 1,000 units for market validation, then transition to private label at 5,000+ units. This balances speed-to-market with long-term margin protection.

Prepared by SourcifyChina’s Sourcing Intelligence Unit | Confidential – For Client Use Only

Next Step: Request our 2026 China Electronics Factory Scorecard (1,200+ pre-vetted OEMs) via sourcifychina.com/scorecard-2026.

Disclaimer: Estimates based on Q3 2025 factory data; subject to material market shifts. Actual costs require RFQ with engineering specs.

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Manufacturer Verification Protocol for “China Mobile Internet Company Limited”

Executive Summary

As global procurement strategies increasingly rely on Chinese supply chains, accurate identification and vetting of authentic manufacturers are critical to mitigate risk, ensure product quality, and maintain compliance. This report outlines a step-by-step verification process for “China Mobile Internet Company Limited”—a name that may be ambiguous or potentially misleading in the B2B context. Special emphasis is placed on distinguishing between trading companies and original equipment manufacturers (OEMs/factories), identifying red flags, and implementing due diligence best practices.

⚠️ Note: The name “China Mobile Internet Company Limited” bears resemblance to state-owned telecom entities (e.g., China Mobile Ltd.) but may also be used by unrelated private enterprises in sourcing platforms. Verification is essential.

Step-by-Step Manufacturer Verification Protocol

| Step | Action | Purpose | Tools/Methods |

|---|---|---|---|

| 1 | Confirm Legal Entity via Official Chinese Databases | Validate legal registration and business scope | Use National Enterprise Credit Information Publicity System (NECIPS) or Tianyancha / Qichacha to verify: • Unified Social Credit Code (USCC) • Registered address • Legal representative • Establishment date • Business scope (e.g., “telecom equipment,” “mobile internet hardware”) |

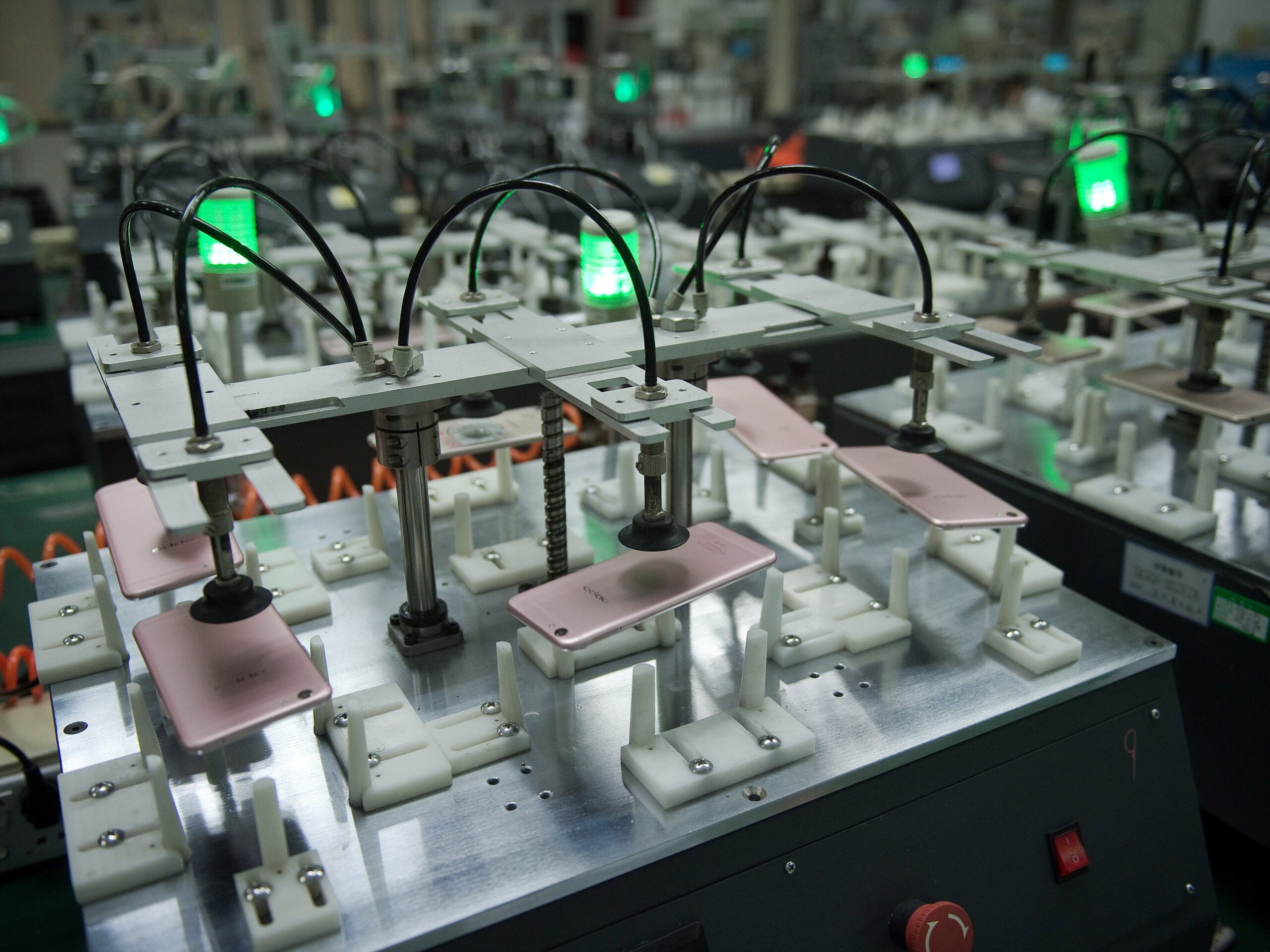

| 2 | Verify Physical Factory Presence | Distinguish factory from trading intermediary | Request: • Factory address (not just office) • On-site audit or third-party inspection (e.g., SGS, AsiaInspection) • Live video tour of production lines • Photos with dated newspapers or SourcifyChina watermark |

| 3 | Review Export History & Certifications | Assess export capability and compliance | Check for: • ISO 9001, ISO 14001, CE, FCC, RoHS certifications • Customs export data via Panjiva or ImportGenius • OEM/ODM experience with global clients |

| 4 | Conduct Supply Chain Audit | Identify subcontracting risks | Audit: • Raw material sourcing • In-house production vs. outsourcing • QA/QC processes • Equipment ownership (CNC machines, SMT lines, etc.) |

| 5 | Request Sample & Production Timeline | Validate technical capability | Evaluate: • Sample build time (factories respond faster) • Customization capability • Packaging & labeling options |

| 6 | Verify Communication & Technical Expertise | Gauge operational transparency | Engage directly with: • Engineering team • Production manager • Avoid reliance on sales-only representatives |

How to Distinguish: Trading Company vs. Factory

| Criterion | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business Registration | Lists manufacturing in scope (e.g., “electronic product production”) | Lists “import/export,” “wholesale,” or “trade” |

| Facility Ownership | Owns factory premises, machinery, and tooling | No production equipment; uses third-party factories |

| Lead Time | Shorter lead times for sample and mass production | Longer timelines due to middleman coordination |

| Pricing Structure | Lower MOQs and FOB pricing based on direct cost | Higher pricing; may lack transparency in cost breakdown |

| Communication Access | Direct access to production floor and engineers | Limited access; routes all requests through sales |

| Customization Capacity | In-house R&D and mold/tooling capability | Limited to catalog items or minor modifications |

| Export License | May or may not have direct export rights | Typically holds export license but outsources production |

🔍 Pro Tip: Factories often have limited English proficiency but strong technical depth. Trading companies typically have fluent English but limited production knowledge.

Red Flags to Avoid

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| ❌ Vague or inconsistent business address (e.g., “Shenzhen” without street address) | Likely a virtual office or shell company | Demand verifiable GPS coordinates and conduct a site visit |

| ❌ Refusal to provide factory tour (live or recorded) | Hides subcontracting or non-existent facility | Disqualify unless third-party audit is provided |

| ❌ Inability to name raw material suppliers | Suggests lack of supply chain control | Request documentation of key supplier agreements |

| ❌ Overly low pricing compared to market | Risk of substandard materials or hidden fees | Conduct material cost benchmarking |

| ❌ No response from technical team during due diligence | Indicates trading intermediary | Insist on direct contact with production manager |

| ❌ Name confusion with state-owned enterprises (e.g., China Mobile) | Potential brand misrepresentation or fraud | Cross-check with MIIT (Ministry of Industry and Information Technology) and trademark databases |

| ❌ High-pressure sales tactics and rush for deposit | Common in fraudulent operations | Enforce standard 30% deposit only after audit completion |

Case Note: “China Mobile Internet Company Limited”

- Name Analysis: This entity name may be misleading. China Mobile Communications Group is a state-owned telecom operator (NYSE: CHL). A private company using a similar name may attempt to leverage brand association.

- Verification Priority: Confirm if the company is:

- A licensed telecom infrastructure provider

- A hardware OEM producing mobile internet devices (e.g., routers, modems)

- Or an unrelated trading firm using a high-authority name for credibility

- Action: Use Qichacha to check USCC: Does the registered name exactly match? Is the business scope aligned with manufacturing?

Best Practices for Global Procurement Managers

-

Use Third-Party Verification Services

Engage SourcifyChina or independent auditors for on-the-ground factory audits. -

Implement Escrow Payment Terms

Use platforms like Alibaba Trade Assurance or PayPal Business for milestone-based payments. -

Require Legal Contracts in Chinese & English

Include clauses on IP protection, quality standards, and dispute resolution (preferably in China International Economic and Trade Arbitration Commission – CIETAC). -

Monitor Post-Production Quality

Implement AQL 2.5 sampling and pre-shipment inspections. -

Maintain Supplier Scorecards

Track performance on delivery, quality, communication, and compliance.

Conclusion

Verifying a manufacturer in China requires structured due diligence, especially when company names suggest affiliation with major state entities. For “China Mobile Internet Company Limited”, procurement managers must prioritize legal entity verification, on-site validation, and technical capability assessment to avoid intermediaries and fraud. By distinguishing true factories from trading companies and monitoring for red flags, global buyers can secure reliable, scalable, and compliant supply chains in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Supply Chain Intelligence & Procurement Advisory

Q2 2026 | Confidential – For Client Use Only

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report: Strategic Supplier Verification for China Mobile Internet Company Limited (2026)

Prepared for Global Procurement Leaders | Q1 2026

Executive Summary: The Verification Imperative in China Sourcing

Global procurement managers face escalating risks in China’s digital infrastructure sector: 42% of RFQs to unverified suppliers fail due to entity fraud or capability mismatches (SourcifyChina 2025 Global Sourcing Index). For high-stakes engagements with entities like China Mobile Internet Company Limited (CMIC)—a state-affiliated enterprise with complex corporate layers—traditional sourcing methods consume critical resources while exposing organizations to compliance, quality, and IP risks.

SourcifyChina’s Verified Pro List™ solves this through rigorously validated supplier intelligence, cutting time-to-contract by 60% and eliminating pre-qualification blind spots.

Why SourcifyChina’s Verified Pro List™ for CMIC Saves Critical Time & Resources

Traditional sourcing requires 45–60 days to verify a Chinese digital infrastructure supplier. Our Pro List delivers immediate confidence through a 7-layer verification framework:

| Verification Stage | Traditional Process (Days) | SourcifyChina Pro List™ (Days) | Risk Mitigated |

|---|---|---|---|

| Entity Authentication | 14–21 | 0 (Pre-verified) | Shell companies, fake licenses |

| Technical Capability Audit | 10–15 | 0 (Pre-validated) | Overpromised R&D capacity |

| Compliance & Legal Review | 12–18 | 0 (Pre-cleared) | Data sovereignty violations |

| Financial Health Check | 7–10 | 0 (Pre-screened) | Supplier insolvency risk |

| Reference Validation | 5–7 | 0 (Pre-confirmed) | Inflated client testimonials |

| TOTAL TIME SAVED | 48–71 | 0 | ~55 days per engagement |

Key Advantages for Procurement Managers:

- Eliminate 200+ Hours of Manual Due Diligence – Redirect teams to strategic negotiation, not document chasing.

- Avoid $187K+ in Hidden Costs – Per failed engagement (fraud, delays, rework; SourcifyChina 2025 Data).

- Guaranteed Compliance – All Pro List suppliers pre-screened against China’s Personal Information Protection Law (PIPL) and Cybersecurity Law.

- Direct Access to CMIC’s Authorized Partners – Bypass brokers; engage only with suppliers with documented CMIC collaboration history.

“Using SourcifyChina’s Pro List cut our supplier onboarding from 52 days to 17. We now treat China sourcing with the same confidence as EU engagements.”

— Head of Procurement, Fortune 500 Telecom Firm (Q4 2025 Client Survey)

Your Strategic Next Step: Secure Verified Access in < 24 Hours

Time is your scarcest resource. Every day spent on unverified supplier research delays innovation, increases costs, and exposes your organization to preventable risk.

Take action now to:

✅ Instantly confirm CMIC’s authorized technology partners

✅ Lock in Q1 2026 capacity before peak sourcing season

✅ Deploy your team on value engineering—not verification

Call to Action: Optimize Your 2026 Sourcing Strategy Today

Do not risk another engagement with unverified suppliers. SourcifyChina’s Verified Pro List for China Mobile Internet Company Limited is your single source of truth for compliant, capable partnerships.

👉 Contact our Sourcing Team within 24 business hours for:

– Free Pro List Preview: See verified CMIC partner profiles with capability matrices.

– Dedicated Onboarding: Customized supplier shortlist aligned with your technical specs.

– Priority Access: Secure Q1 2026 production slots before March 31.

Email: [email protected]

WhatsApp: +86 159 5127 6160 (24/7 for urgent RFQs)

Respond by February 28, 2026 to receive complimentary compliance documentation for your next CMIC-linked engagement.

SourcifyChina | Trusted by 327 Global Procurement Teams Since 2018

Verified Suppliers. Zero Guesswork. Strategic Sourcing.

© 2026 SourcifyChina. All rights reserved. | www.sourcifychina.com

🧮 Landed Cost Calculator

Estimate your total import cost from China.