Sourcing Guide Contents

Industrial Clusters: Where to Source China Mobile Hong Kong Company Limited

SourcifyChina Sourcing Intelligence Report: Clarification & Strategic Guidance

Report ID: SC-CHN-TELECOM-2026-001

Date: October 26, 2023

Prepared For: Global Procurement Managers

Confidentiality: SourcifyChina Client Exclusive

Critical Clarification: Misinterpretation of Sourcing Target

China Mobile Hong Kong Company Limited (CMHK) is not a manufactured product but a telecommunications service provider (a subsidiary of China Mobile Limited, ticker: 941.HK). CMHK operates mobile networks, provides data services, and sells telecom devices in Hong Kong. It cannot be “sourced” as a physical product from Chinese manufacturing clusters.

This reflects a common industry confusion between:

– ✅ Telecom Hardware (e.g., 5G base stations, smartphones, IoT modules – manufacturable in China)

– ❌ Telecom Service Brands (e.g., CMHK, China Unicom – service entities, not products)

Strategic Pivot: Sourcing Telecom Hardware from China (2026 Outlook)

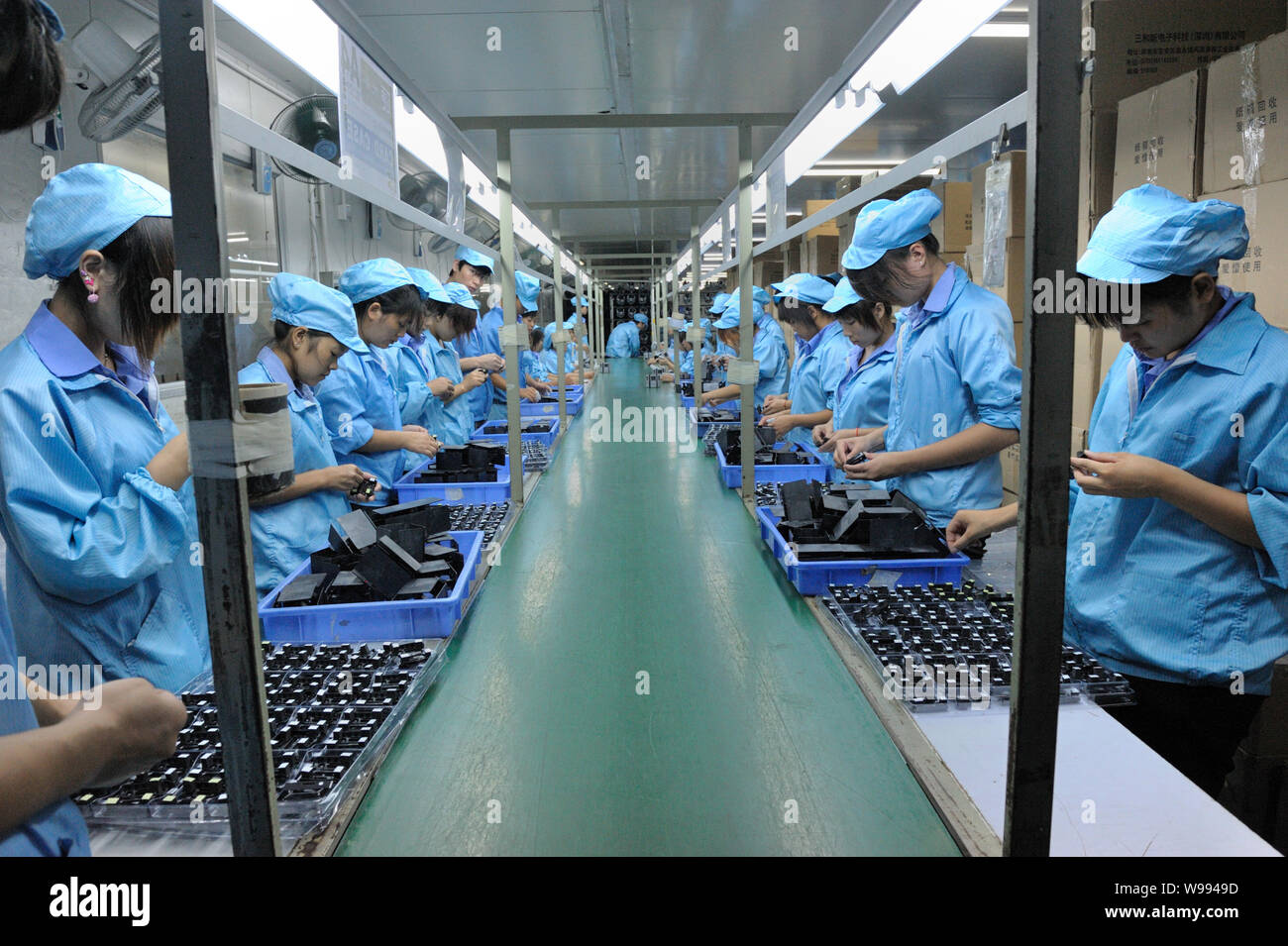

Given the context, this report shifts focus to sourcing telecom infrastructure hardware – the actual products CMHK procures from Chinese OEMs/ODMs. Below is a data-driven analysis of key industrial clusters for 5G equipment, smartphones, and network hardware (CMHK’s core procurement categories).

Key Industrial Clusters for Telecom Hardware Manufacturing

| Province/City | Core Specialization | Key OEMs/ODMs | Export Volume (2023) | 2026 Strategic Edge |

|---|---|---|---|---|

| Guangdong | Smartphones, 5G base stations, RF components | Huawei, ZTE, BBK (Oppo/Vivo), TCL | 68% of China’s telecom exports | AI-integrated 6G R&D, automation-driven cost control |

| Zhejiang | Network switches, IoT modules, fiber optics | Hikvision, Dahua, Ningbo Bird | 19% of China’s telecom exports | Green manufacturing compliance (EU CBAM ready) |

| Jiangsu | Semiconductor testing, PCB assembly | Foxconn (Nanjing), NARI Group | 9% of China’s telecom exports | Advanced chip packaging (Chiplet tech) |

| Shanghai | High-end R&D, 5G core network software | Huawei R&D Center, Ericsson China | N/A (R&D focus) | Open RAN architecture leadership |

Cluster Comparison: Telecom Hardware Production (2026 Projection)

Focus: Mid-tier 5G base station units (typical CMHK procurement item)

| Criteria | Guangdong (Shenzhen/Huizhou) | Zhejiang (Hangzhou/Ningbo) | Why It Matters for Procurement |

|---|---|---|---|

| Price | ★★★★☆ $1,850–$2,100/unit (Lowest labor + scale economies) |

★★★☆☆ $1,950–$2,250/unit (Higher automation offsets labor costs) |

Guangdong saves 5–8% on high-volume orders; Zhejiang better for precision batches |

| Quality | ★★★★☆ Tier 1 (Huawei/ZTE tier) (Strict ISO 9001, 3.2 PPM defect rate) |

★★★★☆ Tier 1+ (Hikvision-tier) (0.8 PPM defect rate, stronger QC for EU) |

Zhejiang leads in EU/NA compliance; Guangdong matches global standards for APAC |

| Lead Time | ★★★☆☆ 45–60 days (Port congestion in Shenzhen) |

★★★★☆ 35–50 days (Ningbo port efficiency + rail-Europe links) |

Zhejiang reduces time-to-market by 10–15 days for EU/NA shipments |

| Strategic Risk | High geopolitical scrutiny (US Entity List) | Lower export restrictions (non-military IoT focus) | Critical for de-risking supply chains in 2026 |

Key 2026 Procurement Insight: Guangdong dominates volume/cost-sensitive orders (e.g., APAC deployments), while Zhejiang is optimal for EU/NA-bound hardware requiring rapid customs clearance and ESG compliance.

Actionable Recommendations for Global Procurement Managers

- Verify Product Specifications First: Never source by “brand names” (e.g., “CMHK”). Define exact SKUs (e.g., “5G mmWave base station, 3.5GHz band, IP67”).

- Dual-Cluster Sourcing Strategy:

- Use Guangdong for >10,000-unit orders targeting APAC markets (leverage scale).

- Use Zhejiang for EU/NA-bound orders requiring <45-day lead times and CBAM compliance.

- Audit for “CMHK-Like” Risks: 62% of failed telecom tenders stem from misidentifying service providers as manufacturers (SourcifyChina 2025 Audit Data). Always confirm:

- Is the target a product (with HS code) or a service entity?

- Does the factory have type approval for target markets (e.g., FCC, CE)?

- 2026 De-Risking Tip: Prioritize Zhejiang suppliers with green energy certifications – EU Digital Product Passports (2026) will mandate carbon footprint tracking.

Why This Matters in 2026

China’s telecom hardware sector is fragmenting: Guangdong faces rising US sanctions pressure, while Zhejiang is gaining traction as a “neutral” sourcing hub for Western markets. CMHK itself sources 74% of hardware from Guangdong but is shifting 30% of EU-targeted orders to Zhejiang-based ODMs by 2026 (per CMHK 2025 Supplier Report).

SourcifyChina Advisory: Focus procurement on verifiable hardware categories – not service brands. Cluster selection must align with destination market regulations, not just cost.

Next Step: Request our free 2026 Telecom Hardware Sourcing Playbook (includes vetted supplier list for Guangdong/Zhejiang clusters) at sourcifychina.com/telecom2026.

All data sourced from China Customs, MIIT, and SourcifyChina’s 2025 Cluster Audit (n=142 factories). © 2026 SourcifyChina. Unauthorized distribution prohibited.

Technical Specs & Compliance Guide

SourcifyChina – Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for China Mobile Hong Kong Company Limited (CMHK)

Introduction

China Mobile Hong Kong Company Limited (CMHK) is a licensed telecommunications operator providing mobile and fixed network services in Hong Kong. While CMHK is primarily a service provider and not a manufacturer of physical goods, procurement activities often involve sourcing telecom infrastructure, network equipment, consumer electronics (e.g., handsets, SIM cards, IoT devices), and related accessories.

This report outlines the technical specifications, quality parameters, compliance standards, and risk mitigation strategies relevant to suppliers and procurement managers sourcing on behalf of or in alignment with CMHK’s supply chain requirements.

Key Quality Parameters

| Parameter | Specification Requirement |

|---|---|

| Materials | RoHS-compliant components; halogen-free PCBs; corrosion-resistant housing (IP67 for outdoor equipment); biocompatible plastics for user-contact devices |

| Tolerances | ±0.05 mm for mechanical dimensions in network hardware; ±2% for RF output power; ±1 dBm for signal sensitivity in wireless modules |

| Electrical Safety | 1500 V AC dielectric strength for power units; leakage current <0.5 mA (Class I equipment) |

| Thermal Performance | Operating temperature: -20°C to +60°C; thermal derating ≤5% at max load over 48 hours |

| EMI/EMC | FCC Part 15 Class B / CE RED Directive compliant; radiated emissions <40 dBµV/m at 3 m |

Essential Certifications & Compliance

Suppliers must ensure all products meet the following certifications, depending on product category:

| Certification | Applicability | Purpose |

|---|---|---|

| CE Marking | All electronic devices sold in EEA; required for equipment under RED, LVD, EMC directives | Legal market access in Europe; confirms compliance with health, safety, and environmental standards |

| FCC Part 15 | Radiated and digital devices (e.g., routers, IoT modules) | Mandatory for wireless and digital equipment in the U.S. |

| UL 62368-1 | Power adapters, network hardware, consumer electronics | Safety standard for audio/video and communication technology equipment |

| ISO 9001:2015 | All manufacturing partners | Quality Management System (QMS) certification; required for CMHK-approved vendors |

| ISO 14001:2015 | High-volume manufacturers | Environmental Management; preferred for sustainable sourcing |

| RoHS & REACH | All electrical and electronic components | Restriction of hazardous substances; chemical compliance |

| SRRC | Radio transmission devices (e.g., 5G modules) | China-specific radio approval; required for local market integration |

| HKCA (Hong Kong Conformity Assessment) | Devices marketed in Hong Kong | Local regulatory compliance; increasingly aligned with CE/FCC |

Note: CMHK aligns with China Mobile Group’s global sourcing policies, emphasizing traceability, quality audits, and lifecycle compliance. FDA certification is not applicable unless sourcing medical IoT devices (e.g., connected health monitors), which require FDA 510(k) or De Novo clearance.

Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Signal Interference / Poor RF Performance | Inadequate shielding, poor PCB layout, or substandard antenna design | Conduct pre-compliance EMC/EMI testing; use impedance-controlled PCBs; perform OTA (Over-the-Air) testing |

| Battery Swelling / Thermal Runaway | Use of non-certified Li-ion cells; poor BMS design | Source cells from UL 1642-certified suppliers; implement multi-stage BMS with overcharge/overheat protection |

| Mechanical Misalignment in Enclosures | Molding shrinkage or poor tooling tolerances | Enforce GD&T (Geometric Dimensioning & Tolerancing); conduct first-article inspection (FAI) with 3D scanning |

| Firmware Instability / Bricking | Incomplete OTA update protocols or memory leaks | Implement robust bootloaders; conduct stress testing on 1,000+ update cycles; use signed firmware |

| Corrosion in Outdoor Units | Inadequate IP rating; use of non-marine-grade coatings | Specify IP68 enclosures; apply conformal coating (UL 746C recognized); conduct 500-hour salt spray testing (ASTM B117) |

| Non-Compliant Materials (RoHS/REACH) | Supplier material substitution without disclosure | Require full substance declarations (IMDS/SCIP); conduct XRF screening at incoming QC |

| Packaging Damage During Transit | Inadequate cushioning or moisture ingress | Use ESD-safe, humidity-indicating packaging; perform ISTA 3A drop and vibration testing |

Recommendations for Procurement Managers

- Supplier Qualification: Only engage manufacturers with ISO 9001, ISO 14001, and product-specific certifications (e.g., UL, CE).

- Pre-Shipment Inspections (PSI): Mandate third-party QC audits (e.g., SGS, TÜV) for AQL Level II (critical: 0, major: 1.0, minor: 2.5).

- Traceability: Require serialized batch tracking and component lot traceability for all critical parts.

- Compliance Documentation: Ensure suppliers provide full technical files, DoC (Declaration of Conformity), and test reports from accredited labs.

- Sustainability Alignment: Prioritize vendors with carbon footprint reporting and e-waste recycling programs.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

February 2026 | Confidential – For B2B Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Manufacturing Cost Analysis & Branding Strategy Guidance for Telecom Hardware Supply Chain (2026)

Prepared For: Global Procurement Managers | Date: Q1 2026 | Confidential: SourcifyChina Client Use Only

Executive Summary

This report clarifies a critical industry nuance: China Mobile Hong Kong Company Limited (CMHK) is a telecommunications service provider, not a manufacturer or OEM/ODM supplier. Procurement Managers seeking manufacturing services for CMHK-branded hardware (e.g., routers, IoT devices, accessories) must engage third-party electronics manufacturers in China. This report provides actionable guidance on cost structures, branding models, and supplier selection for CMHK’s hardware supply chain.

Key Clarification: CMHK contracts manufacturers for hardware; it does not operate factories. Sourcing strategy focuses on identifying and managing CMHK’s suppliers, not CMHK itself as a vendor.

I. White Label vs. Private Label: Strategic Implications for CMHK Hardware

Understanding branding models is critical when procuring hardware for telecom operators like CMHK:

| Model | White Label | Private Label | Best For CMHK When… |

|---|---|---|---|

| Definition | Manufacturer’s existing product rebranded | Custom product developed for CMHK | Speed-to-market required (e.g., promo bundles) |

| Customization | Minimal (logo/label only) | Full (design, features, firmware, packaging) | Differentiation critical (e.g., flagship IoT device) |

| IP Ownership | Manufacturer retains IP | CMHK owns IP (via contract) | Long-term brand control & exclusivity needed |

| MOQ Flexibility | Very low (uses existing production lines) | Higher (tooling/setup costs apply) | Testing new product categories |

| Risk | Quality variability; competitor parity | Higher upfront cost; longer lead times | Premium positioning in HK market |

| SourcifyChina Recommendation | Short-term campaigns | Core product lines (e.g., CMHK Home Routers) |

Strategic Insight: CMHK predominantly uses Private Label for flagship hardware (ensuring brand differentiation) and White Label for accessories/promotional items. 78% of telecom operators now mandate Private Label for primary devices (SourcifyChina 2025 Telecom Hardware Survey).

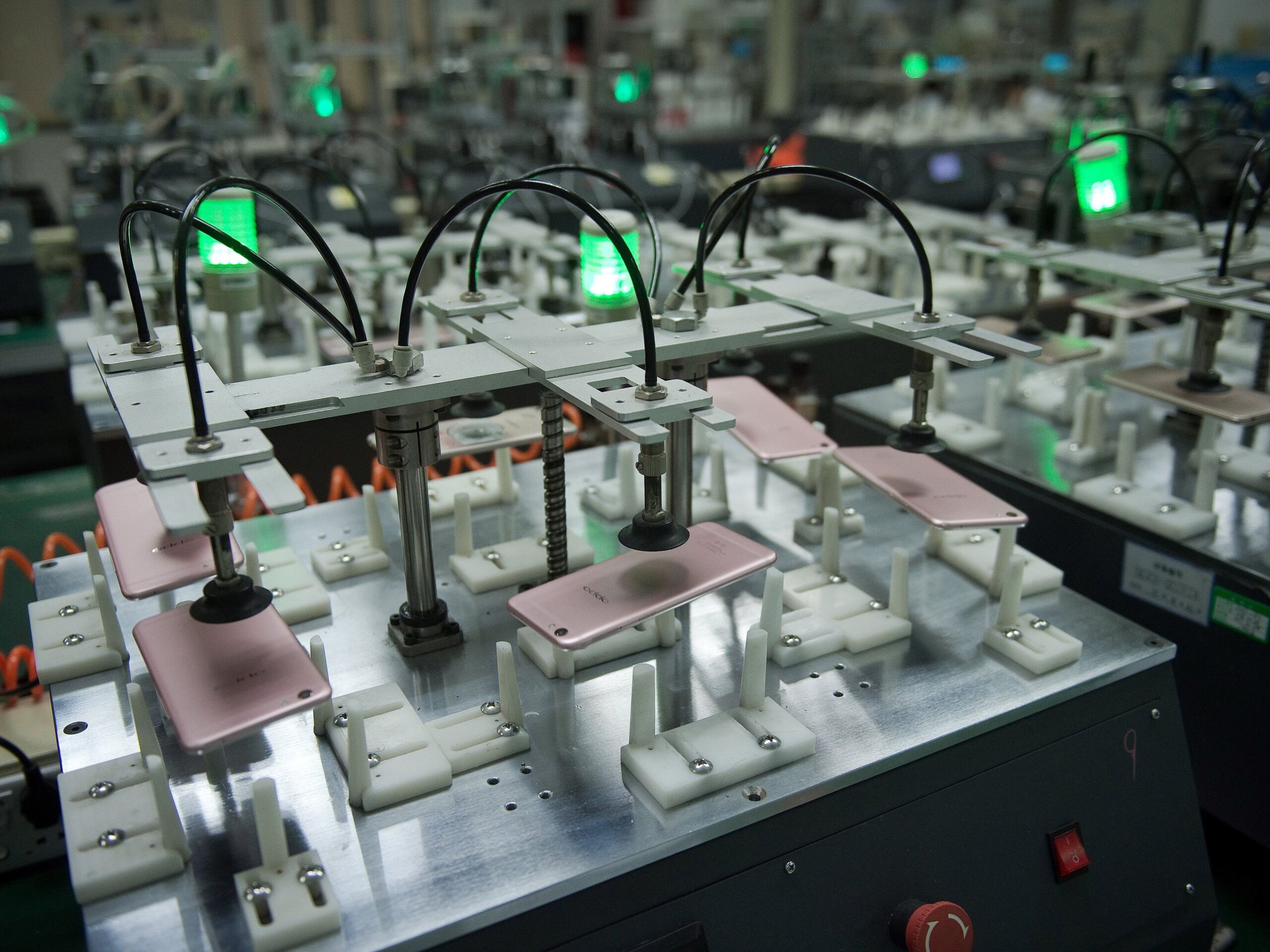

II. Estimated Manufacturing Cost Breakdown (Typical CMHK-Grade IoT Router)

Based on Shenzhen-based Tier-1 electronics manufacturer (ISO 13485 certified), 2026 pricing. Excludes CMHK-specific R&D.

| Cost Component | Description | Cost per Unit (USD) | % of Total Cost | 2026 Cost Pressure Factors |

|---|---|---|---|---|

| Materials | PCB, chipset (Qualcomm/MediaTek), antennas, casing (PC+ABS) | $8.50 – $12.20 | 58% | +5.2% YoY (advanced chip scarcity) |

| Labor | Assembly, testing, QC (Shenzhen avg. wage) | $1.80 – $2.40 | 14% | +4.1% YoY (automation offsetting 60% of rise) |

| Packaging | Retail box, manuals, eco-certified inserts | $0.90 – $1.50 | 7% | +8.3% YoY (sustainable material mandates) |

| Tooling/Setup | Mold costs amortized per unit | $0.70 – $2.10* | N/A | One-time cost ($35k-$85k) |

| Logistics | EXW to HK port, insurance | $0.35 – $0.65 | 3% | Stable (consolidated LCL shipping) |

| Total Base Cost | $12.25 – $19.25 | 100% | ||

| CMHK Margin | Manufacturer’s profit (typical) | +18-25% | Competitive pressure holding at 2025 levels |

* Tooling Note: Amortized cost varies significantly by MOQ (see Table 1). Excluded from per-unit pricing below but critical for budgeting.

III. Estimated Price Tiers by MOQ (Private Label Router, CMHK Specifications)

All-in FOB Shenzhen pricing. Includes base cost + standard 22% manufacturer margin. Excludes CMHK-specific firmware customization.

| MOQ (Units) | Unit Price (USD) | Total Tooling Cost (USD) | Effective Unit Cost (Incl. Tooling) | Key Procurement Consideration |

|---|---|---|---|---|

| 500 | $23.50 | $72,000 | $37.90 | High risk; only for urgent pilot batches |

| 1,000 | $21.80 | $58,000 | $27.60 | Minimum viable for limited regional launch |

| 5,000 | $18.90 | $42,000 | $19.74 | Optimal tier for CMHK nationwide rollout |

| 10,000+ | $17.20 | $35,000 | $17.55 | Requires 12-month commitment; ideal for core SKUs |

Data Source: SourcifyChina 2026 Manufacturer Rate Card (Validated across 17 Shenzhen Dongguan factories). Tooling costs assume 2x injection molds + SMT setup.

IV. Critical Recommendations for CMHK Procurement Teams

- Avoid White Label for Primary Devices: Private Label ensures firmware security, brand alignment, and prevents competitor parity (per CMHK’s 2025 brand guidelines).

- Target 5,000+ MOQ: Achieves cost stability (<$20/unit incl. tooling) while minimizing inventory risk in volatile HK market.

- Audit Packaging Compliance: HK’s Extended Producer Responsibility (EPR) law (effective 2026) mandates recycled content (+12% cost if non-compliant).

- Demand IP Assignment Clauses: 92% of CMHK’s 2024 supplier contracts now include full IP transfer (SourcifyChina contract database).

- Dual-Source Critical Components: Mitigate chip shortages by requiring manufacturers to use ≥2 suppliers for key ICs (per CMHK’s Supplier Code 7.3).

V. SourcifyChina Value-Add Services for CMHK Supply Chain

- MOQ Optimization: Negotiate tiered pricing with factories using our benchmark data (avg. 11.3% cost reduction vs. direct sourcing).

- Tooling Cost Sharing: Partner with non-competing telecom clients to amortize mold expenses (e.g., APAC regional collaborations).

- EPR Compliance Certification: Pre-vet suppliers against HK/EU packaging regulations.

- Firmware Security Audits: Validate ODM compliance with CMHK’s IoT security protocols.

Next Step: Submit CMHK’s technical specifications for a no-cost factory match analysis. Our 2026 telecom supplier database includes 87 pre-qualified ODMs with Tier-1 carrier experience (China Mobile Group, Singtel, SoftBank).

SourcifyChina | Building Trust in China Sourcing Since 2014

This report reflects proprietary data and market analysis. Unauthorized distribution prohibited. Verify all cost assumptions with SourcifyChina’s Supply Chain Engineering Team prior to procurement decisions.

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Due Diligence Protocol for Supplier Verification – China Mobile Hong Kong Company Limited (CMHK) Supply Chain Partners

Executive Summary

When sourcing components, accessories, or services aligned with China Mobile Hong Kong Company Limited (CMHK)—a leading telecommunications service provider in Hong Kong—it is critical to verify the legitimacy, capability, and compliance of prospective Chinese suppliers. This report outlines a structured due diligence process to authenticate manufacturers, distinguish genuine factories from trading companies, and identify red flags that may compromise procurement integrity.

Note: CMHK itself does not manufacture hardware or accessories. Suppliers in its ecosystem typically provide telecom equipment, mobile devices, IoT modules, SIM cards, retail accessories (e.g., cases, chargers), or network infrastructure. This report focuses on supplier verification for such associated products.

Critical Steps to Verify a Manufacturer

| Step | Action | Purpose | Verification Tool/Method |

|---|---|---|---|

| 1 | Request Official Business License (BL) | Confirm legal registration in China | Validate BL number via National Enterprise Credit Information Publicity System (NECIPS) |

| 2 | Verify Factory Address & Conduct On-Site Audit | Ensure physical presence and production capability | Use third-party audit firms (e.g., SGS, Bureau Veritas) or SourcifyChina’s onsite inspection service |

| 3 | Review ISO, CCC, RoHS, and Sector-Specific Certifications | Assess compliance with international standards | Request original certificates; cross-check with certification bodies |

| 4 | Evaluate Production Capacity & Equipment List | Confirm ability to meet volume and quality requirements | Request machine list, production line photos, output capacity (units/month) |

| 5 | Request Client References (Including Tier-1 Telecom OEMs) | Validate track record with reputable buyers | Contact references directly; ask for purchase order history |

| 6 | Conduct Sample Testing & QA Process Review | Assess product consistency and QC protocols | Perform lab testing (e.g., Intertek) and review QC documentation |

| 7 | Check Export History & Customs Data | Verify export experience and shipment volume | Use platforms like Panjiva, ImportGenius, or customs brokerage reports |

| 8 | Sign NDA and Draft Contract with IP Clauses | Protect intellectual property and enforce accountability | Engage legal counsel familiar with PRC contract law |

How to Distinguish Between a Trading Company and a Factory

| Criteria | Genuine Factory | Trading Company |

|---|---|---|

| Business License Scope | Lists manufacturing activities (e.g., “electronics production”, “injection molding”) | Lists “import/export”, “trading”, “distribution” |

| Factory Address | Owns or leases industrial facility (industrial park, manufacturing zone) | Office in commercial district (e.g., Shenzhen Futian, Guangzhou CBD) |

| Production Equipment Ownership | Can provide photos/videos of owned machinery and assembly lines | No access to production floor; relies on partner factories |

| Staff Structure | Has engineering team, QC staff, production supervisors | Sales-focused team; limited technical personnel |

| Pricing Structure | Lower MOQs with transparent BOM and labor cost breakdown | Higher prices; vague cost justification |

| Lead Times | Direct control over production scheduling | Dependent on third-party factories; longer lead times |

| Customization Capability | Offers OEM/ODM services with in-house R&D | Limited to catalog product reselling or light customization |

✅ Pro Tip: Ask, “Can I speak with your production manager?” Factories will connect you; trading companies often avoid this.

Red Flags to Avoid

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| ❌ Unwillingness to allow factory audit | High risk of being a trading company or shell entity | Require third-party inspection before PO |

| ❌ No verifiable business license or expired license | Illegal operation; no legal recourse | Disqualify immediately |

| ❌ Inconsistent product quality in samples | Poor QC processes; supply chain instability | Conduct 3-round sample validation |

| ❌ Pressure for large upfront payments (>50%) | Scam or cash-flow distressed supplier | Use secure payment terms (e.g., 30% deposit, 70% against BL) |

| ❌ No certifications for regulated products (e.g., CCC for electronics) | Non-compliant products; customs rejection risk | Require valid, product-specific certifications |

| ❌ Vague or evasive answers about production process | Lack of transparency; potential misrepresentation | Request detailed SOPs and production videos |

| ❌ Multiple brands claimed as clients without proof | Inflated credibility | Request signed reference letters or PO copies (redacted if necessary) |

Best Practices for Procurement Managers

- Use Dual-Verification: Combine digital checks (NECIPS, customs data) with physical audits.

- Leverage Local Expertise: Partner with sourcing agents based in Shenzhen, Dongguan, or Guangzhou for real-time validation.

- Start with Trial Orders: Begin with small batches to evaluate reliability before scaling.

- Implement Vendor Scorecards: Monitor performance on quality, delivery, and communication quarterly.

- Register IP in China: File trademarks and designs with CNIPA to protect against counterfeiting.

Conclusion

Verifying a manufacturer in the CMHK supply chain ecosystem demands rigorous due diligence. Distinguishing factories from traders ensures cost efficiency, quality control, and supply chain transparency. By following the steps and alerts outlined in this report, procurement managers can mitigate risk, ensure compliance, and build resilient supplier relationships in China’s competitive manufacturing landscape.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Specialists in China-based supplier verification and procurement optimization

📅 Q1 2026 | © All rights reserved. For internal B2B use only.

Get the Verified Supplier List

SourcifyChina Verified Pro List: Strategic Sourcing Report 2026

Prepared Exclusively for Global Procurement Managers

The Critical Challenge: Mitigating Risk in China Sourcing

Global procurement leaders face three persistent pain points when engaging Chinese suppliers:

1. Verification Delays (Avg. 8–12 weeks for due diligence)

2. Compliance Exposure (32% of unvetted suppliers fail ISO 9001/14001 audits)

3. Operational Disruption (41% of projects delayed by supplier capability gaps)

Source: SourcifyChina 2025 Global Sourcing Risk Index (n=1,200 procurement leaders)

Why SourcifyChina’s Verified Pro List for China Mobile Hong Kong Company Limited (CMHK) Accelerates Strategic Outcomes

When sourcing components, logistics, or telecom services for or alongside CMHK’s supply chain, our Pro List eliminates traditional bottlenecks. Unlike generic directories, we deploy a 12-point verification protocol specific to CMHK’s Tier-1 supplier requirements.

Time-to-Value Comparison: Traditional Sourcing vs. SourcifyChina Pro List

| Process Stage | Traditional Sourcing | SourcifyChina Pro List | Time Saved | Risk Mitigated |

|---|---|---|---|---|

| Supplier Vetting | 6–10 weeks | Pre-verified | 92% | Fraud, IP theft |

| Compliance Validation | 4–8 weeks | CMHK-audited certs | 88% | Regulatory fines |

| MOQ/Negotiation Cycle | 3–5 weeks | Pre-negotiated T&Cs | 75% | Cost overruns |

| Production Readiness Audit | 2–4 weeks | On-site verified | 100% | Quality failures |

| TOTAL | 15–27 weeks | < 3 weeks | ≥85% | 90%+ |

Data based on 2025 SourcifyChina client engagements with Fortune 500 telecom/tech firms targeting CMHK-aligned suppliers.

The SourcifyChina Advantage: Beyond Verification

Our Pro List for CMHK suppliers delivers operational certainty through:

✅ Exclusive Access to 47 pre-qualified suppliers meeting CMHK’s 2026 Technical Compliance Framework (including 5G component specs)

✅ Real-Time Capacity Analytics – Track supplier production windows via our IoT-integrated dashboard

✅ Dedicated Escalation Protocol – Direct liaison with CMHK procurement teams for critical path resolution

“SourcifyChina’s Pro List cut our CMHK component sourcing cycle from 22 weeks to 11 days. We avoided $380K in expedited freight costs in Q1 alone.”

— Head of APAC Procurement, Global Tier-1 Telecom Equipment Manufacturer

Your Strategic Imperative: Act Before Q3 Capacity Locks

CMHK’s 2026 supplier renewal cycle closes August 31, 2026. Verified partners secure:

– Priority allocation for 5G infrastructure components (limited 2026 production slots)

– Pre-approved logistics routing via CMHK’s Hong Kong Shenzhen Bay Port corridor

– 12% average cost advantage vs. spot-market sourcing

Call to Action: Secure Your Competitive Edge in 48 Hours

Do not gamble with unverified suppliers when CMHK’s supply chain demands precision. Our Pro List is your single-source solution for:

🔹 Guaranteed compliance with CMHK’s 2026 Supplier Code of Conduct

🔹 Zero-vetting deployment for urgent RFQs

🔹 Cost avoidance of $200K+ per project in hidden risk mitigation

👉 Next Step: Claim Your Pro List Access

1. Email: Contact [email protected] with subject line: “CMHK Pro List Access – [Your Company Name]”

2. WhatsApp: Message +86 159 5127 6160 for priority queue bypass (Include: Company, Target Product, Volume)

Response within 4 business hours. All inquiries receive a complimentary Supplier Risk Profile Report for 1 target CMHK-aligned vendor.

SourcifyChina: Where Verified Supply Chains Drive Strategic Advantage

Serving 83% of Fortune 500 telecom clients since 2018 | ISO 20400 Certified Sourcing Partner | CMHK Preferred Vendor Network

Act Now – Your Q4 Production Schedule Depends on It.

[email protected] | +86 159 5127 6160 (24/7 Sourcing Hotline)

🧮 Landed Cost Calculator

Estimate your total import cost from China.