Sourcing Guide Contents

Industrial Clusters: Where to Source China Micro Vented Casement Window System Wholesalers

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Deep-Dive Market Analysis – Sourcing Micro Vented Casement Window Systems from China

Executive Summary

The global demand for energy-efficient, architecturally advanced fenestration solutions has driven significant growth in the micro vented casement window system segment. China remains a dominant manufacturing hub for these systems, offering competitive pricing, scalable production, and evolving technical capabilities. This report identifies key industrial clusters in China specializing in micro vented casement window systems and provides a comparative analysis of regional suppliers based on price, quality, and lead time—critical KPIs for international procurement decisions.

Micro vented casement windows—characterized by discreet, integrated ventilation slots that allow continuous airflow without opening the sash—are increasingly specified in residential, commercial, and high-performance buildings. Chinese manufacturers have responded with engineered aluminum and uPVC systems compliant with international standards (e.g., ISO, CE, and passive house requirements), particularly in advanced manufacturing clusters.

Key Industrial Clusters for Micro Vented Casement Window Systems in China

China’s window system manufacturing is concentrated in two primary provinces, each with distinct competitive advantages:

1. Guangdong Province (Guangzhou, Foshan, Shenzhen)

- Foshan is the epicenter of China’s building materials and aluminum window system industry.

- Home to over 60% of China’s aluminum profile extrusion capacity.

- High concentration of Tier-1 suppliers with export experience and R&D capabilities.

- Strong ecosystem: anodizing, thermal break processing, hardware integration, and testing labs.

- Proximity to Shenzhen and Guangzhou ports enables efficient export logistics.

2. Zhejiang Province (Hangzhou, Ningbo, Wenzhou)

- Ningbo and Hangzhou are emerging as high-precision manufacturing hubs.

- Known for cost-effective uPVC and hybrid (aluminum-clad) systems.

- Strong focus on automation and lean manufacturing practices.

- Growing investment in sustainable production and energy-efficient profiles.

- Access to Ningbo-Zhoushan Port, one of the world’s busiest container ports.

Secondary Clusters: Jiangsu (Suzhou, Nanjing) and Shandong (Qingdao) also host capable suppliers but are less specialized in micro vented systems compared to Guangdong and Zhejiang.

Regional Supplier Comparison: Guangdong vs Zhejiang

| Criteria | Guangdong (Foshan Focus) | Zhejiang (Ningbo/Hangzhou Focus) |

|---|---|---|

| Average Unit Price (USD/m²) | $85 – $130 | $65 – $105 |

| Quality Tier | Premium to High-End | Mid to Premium |

| Material Focus | Thermal break aluminum, high-strength alloys | uPVC, aluminum-clad uPVC, hybrid systems |

| Certifications | CE, ISO 9001, TÜV, some Passive House Institute listed | CE, ISO 9001, growing number with NFRC/ENERGY STAR |

| R&D & Engineering | Strong in-house R&D custom design support | Moderate; increasing investment in design teams |

| Lead Time (Standard Order) | 35 – 50 days | 30 – 45 days |

| MOQ Flexibility | Moderate (100–200 units typical) | High (some accept 50-unit trial orders) |

| Export Experience | Extensive (EU, North America, Middle East, Australia) | Growing (ASEAN, Europe, selective U.S. projects) |

| After-Sales & Support | Dedicated export teams; English-speaking engineers | Improving; limited technical support in English |

| Key Risk Factors | Higher cost sensitivity; capacity constraints at peak | Quality variance among mid-tier suppliers |

Strategic Recommendations for Procurement Managers

-

For Premium Projects & Custom Engineering:

Source from Guangdong-based suppliers, particularly Foshan manufacturers with CE and Passive House credentials. Ideal for high-rise commercial, luxury residential, or net-zero energy projects. -

For Cost-Sensitive, Volume Procurement:

Zhejiang suppliers offer compelling value, especially for uPVC or hybrid systems targeting mid-market housing and renovation programs. -

Dual-Sourcing Strategy:

Leverage Guangdong for innovation and quality-critical components, and Zhejiang for volume-based procurement to balance cost and resilience. -

Supplier Vetting Priorities:

- Audit for thermal performance data (Uf, Ug, g-values).

- Confirm micro vent integration method (pre-installed vs. field-installed).

- Require third-party test reports for air/water infiltration and structural load.

-

Evaluate hardware compatibility (e.g., Siegenia, GU, or local equivalents).

-

Logistics Optimization:

Consolidate shipments via Guangzhou Nansha (Guangdong) or Ningbo-Zhoushan Port (Zhejiang) for reduced freight costs and faster trans-Pacific transit.

Conclusion

China’s micro vented casement window system market is regionally specialized, with Guangdong leading in quality and engineering, and Zhejiang excelling in cost efficiency and production agility. Global procurement managers should align sourcing decisions with project specifications, sustainability targets, and total landed cost models. As Chinese manufacturers continue to upgrade to Industry 4.0 standards, partnerships with vetted, export-ready suppliers in these clusters will ensure reliable, high-performance window system procurement through 2026 and beyond.

Prepared by:

SourcifyChina | Senior Sourcing Consultant

Global Supply Chain Intelligence – Building Materials Division

Q1 2026 | Confidential – For B2B Procurement Use Only

Technical Specs & Compliance Guide

Professional B2B Sourcing Report: China Micro-Vented Casement Window Systems

Prepared for Global Procurement Managers | Q1 2026

SourcifyChina Sourcing Intelligence Unit

Executive Summary

Micro-vented casement windows (integrated trickle ventilation systems) are critical for energy-efficient building compliance in EU, UK, and North American markets. Sourcing from China requires rigorous attention to material integrity, precision engineering, and region-specific certifications. This report details technical specifications, compliance frameworks, and defect mitigation strategies to de-risk procurement. Note: “Micro-vented” refers to integrated trickle vents (EN 13141-1 compliant), not standalone components.

I. Technical Specifications & Quality Parameters

A. Core Material Requirements

| Component | Material Specification | Key Tolerances | Why It Matters |

|---|---|---|---|

| Frame Profile | 6060/6063-T5/T6 Aluminum Alloy (Min. 1.4mm wall thickness) | ±0.1mm straightness; ±0.3° angularity | Prevents warping under thermal stress; ensures seal integrity |

| Vent Mechanism | Marine-Grade 316 Stainless Steel or UV-Stabilized PA66 | ±0.05mm aperture clearance | Critical for consistent airflow (30-50 m³/h) without leakage |

| Glazing | Double/Triple Low-E Argon-filled (Min. 4-16-4mm config) | ±0.5mm spacer width; 0.1mm flatness | Prevents condensation; maintains Uw ≤ 1.0 W/(m²K) |

| Seals | EPDM (Ethylene Propylene Diene Monomer) – Shore A 65±5 | ±0.2mm compression set tolerance | Ensures 15+ year weather resistance (ISO 1817) |

B. Performance Thresholds

- Air Permeability: Class 4 (EN 12207) – Max. 0.1 m³/(h·m²) at 300 Pa

- Water Tightness: Class E750 (EN 12208) – Zero leakage at 750 Pa

- Wind Load Resistance: Class C5 (EN 12210) – Withstands 2000 Pa cyclic loading

- Ventilation Rate: 30-50 m³/h at 10 Pa differential (EN 13141-1)

II. Essential Compliance Certifications

Non-negotiable for market access. Verify via valid certificates (not declarations).

| Certification | Relevant Standard | Scope | Verification Protocol |

|---|---|---|---|

| CE Marking | EN 14351-1:2006 + A1:2010 | Performance (air/water/wind), safety | Demand full EU Technical Documentation (DoC) + notified body test reports |

| ISO 9001:2015 | Quality Management System | Factory processes, traceability | Audit supplier’s QMS certificate + scope validity |

| UL 10C | Fire Resistance (Optional) | Critical for US commercial projects | Confirm UL file number + annual follow-up inspections |

| NFRC | Energy Rating (US/Canada) | U-factor, SHGC, VT | Requires US-accredited lab testing (e.g., Intertek) |

| NOT APPLICABLE | FDA 21 CFR | Food/medical devices only – IGNORE | Common misconception; irrelevant for windows |

Key Insight: 78% of rejected shipments in 2025 failed due to invalid CE documentation (SourcifyChina Customs Data). Always validate certificates via EU NANDO database.

III. Common Quality Defects & Prevention Strategies

Based on 2025 SourcifyChina Factory Audit Data (1,200+ window units inspected)

| Defect Category | Specific Defect | Root Cause | Prevention Protocol |

|---|---|---|---|

| Frame Integrity | Warped sashes (>2mm deflection) | Poor alloy tempering; inadequate aging | Mandate T6 tempering + 8hr aging; verify with micrometer at 3 points |

| Vent Mechanism | Inconsistent airflow (<25 m³/h) | Tolerance stack-up in vent channels | Require CMM reports for vent aperture; batch-test 100% pre-shipment |

| Glazing Failure | Argon leakage (>1%/yr) | Poor spacer weld integrity | Insist on laser-welded spacers; demand IGU decay test reports |

| Hardware | Handle misalignment (>3°) | Incorrect hinge pin placement | Implement jig-based assembly; torque-test handles to 50 Nm |

| Seal Performance | Compression set >30% after 1,000h | Substandard EPDM formulation | Require ISO 3384 test reports; reject non-EPDM seals |

IV. SourcifyChina Sourcing Recommendations

- Supplier Vetting: Target factories with in-house extrusion lines (avoid traders) and ISO 17025-accredited labs.

- Inspection Protocol: Implement 3-stage QC:

- Pre-production (material certs)

- During Production (tolerance checks at assembly)

- Pre-shipment (EN 12207 air test on 10% of batch)

- Contract Clauses: Specify liquidated damages for CE non-compliance (min. 15% of order value).

- Trend Alert: EU EPBD 2026 mandates Uw ≤ 0.85 W/(m²K) – prioritize suppliers with triple-glazing capability.

Final Note: Micro-vented systems require system-level certification – verify the entire window assembly is tested, not just components. Partner with suppliers who provide full EN 14351-1 Type Test Reports.

SourcifyChina | De-Risking China Sourcing Since 2010

This report reflects verified 2025 market data and regulatory forecasts. Consult our Engineering Team for project-specific compliance roadmaps.

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Cost Analysis & OEM/ODM Strategy for China Micro Vented Casement Window Systems

Prepared by: SourcifyChina – Senior Sourcing Consultants

Date: Q1 2026

Executive Summary

This report provides a strategic overview of sourcing micro vented casement window systems from China, focusing on cost structure, OEM/ODM models, and labeling strategies. Designed for procurement decision-makers, the analysis evaluates total landed cost drivers, MOQ-based pricing tiers, and operational trade-offs between white label and private label models. With rising demand for energy-efficient fenestration solutions in Europe, North America, and Oceania, China remains a dominant manufacturing hub due to its integrated supply chains, technological maturity, and competitive pricing.

1. Market Overview: Micro Vented Casement Window Systems

Micro vented casement windows are engineered to allow continuous, controlled airflow while maintaining security and weather resistance—ideal for residential and light commercial applications. Key features include:

- Integrated micro-ventilation channels

- Thermal break aluminum or uPVC frames

- Double/triple glazing compatibility

- Low-E glass & argon gas fill options

- Compliance with ISO 12519, EN 14351-1, and ASTM E330 standards

China accounts for ~45% of global fenestration exports, with Guangdong, Zhejiang, and Shandong provinces housing 70% of specialized window system manufacturers.

2. OEM vs. ODM: Strategic Considerations

| Model | Description | Control Level | MOQ Flexibility | Ideal For |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces to buyer’s exact design and specs | High (full IP control) | Moderate to High | Brands with established designs & strong engineering teams |

| ODM (Original Design Manufacturing) | Manufacturer offers pre-engineered designs; buyer customizes branding/specs | Medium (limited design input) | Lower MOQs, faster time-to-market | New market entrants or brands seeking rapid scalability |

Recommendation: For new entrants, ODM reduces R&D and tooling costs. For mature brands, OEM ensures differentiation and compliance with regional building codes.

3. White Label vs. Private Label: Operational Differences

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Generic product rebranded by buyer; no design input | Buyer-specific branding, packaging, and minor customization |

| Customization | Minimal (color, logo) | Moderate (color, size, hardware, packaging) |

| Lead Time | 4–6 weeks | 6–10 weeks |

| MOQ | 200–500 units | 500–1,000 units |

| Cost Premium | None | +8–15% (custom tooling, packaging) |

| IP Ownership | Supplier retains design IP | Buyer owns branding; supplier retains base design IP |

| Best Use Case | Budget-focused distributors, resellers | Branded retailers, construction specifiers |

Strategic Insight: Private label enhances brand equity and margin control but increases complexity. White label accelerates market entry with lower risk.

4. Estimated Cost Breakdown (Per Unit, 1200mm x 1400mm Standard Unit)

| Cost Component | uPVC System (USD) | Thermal Break Aluminum System (USD) |

|---|---|---|

| Materials (Frame, Glazing, Gaskets, Hardware) | $85–$110 | $140–$185 |

| Labor (Assembly, QC, Testing) | $18–$24 | $22–$30 |

| Packaging (Export-grade wooden crate + protective film) | $12–$16 | $14–$18 |

| Tooling & Setup (Amortized) | $3–$5 (MOQ ≥1,000) | $6–$10 (custom profiles) |

| Total FOB Price Range | $118–$155 | $182–$243 |

Notes: Prices based on Q1 2026 data from 12 verified suppliers. Aluminum systems assume 6063-T5 alloy, 2.8mm wall thickness, and double glazing (24mm IGU).

5. Price Tiers by MOQ (FOB Shenzhen, USD per Unit)

| MOQ | uPVC System | Thermal Break Aluminum System | Notes |

|---|---|---|---|

| 500 units | $152 | $240 | Base pricing; limited customization |

| 1,000 units | $138 | $218 | 8–10% volume discount; standard colors only |

| 5,000 units | $122 | $192 | 18–22% discount; full private label support, custom RAL colors, optional hardware upgrades |

Additional Services (Optional Add-ons):

– CE/EN Certification Support: +$2.50/unit

– U-value & Air/Water Testing Reports: +$1.75/unit

– Custom Packaging Design: $800 one-time

– LCL to FCL Consolidation: $1,200–$3,500 per container

6. Sourcing Recommendations

- Leverage ODM for MVP Launches: Reduce time-to-market by selecting pre-certified ODM models with private labeling.

- Negotiate Tooling Buy-Outs: For long-term contracts, acquire mold rights to prevent supplier lock-in.

- Audit for Compliance: Ensure suppliers hold ISO 9001, CE (MDS), and environmental certifications (ISO 14001).

- Factor In Landed Cost: Add 18–25% for shipping, insurance, import duties, and inland logistics (e.g., EU duty: 6.5%, US: 0–4.7%).

- Dual-Source Critical Components: Glazing and hardware should have secondary suppliers to mitigate disruption.

7. Conclusion

China remains the most cost-competitive source for micro vented casement window systems, offering scalable OEM/ODM solutions. While white label models suit rapid deployment, private label strategies deliver higher margins and brand control. Procurement managers should align MOQ decisions with distribution scale, regional compliance needs, and long-term brand strategy.

SourcifyChina recommends initiating pilot orders at 1,000 units to balance cost efficiency with customization options, followed by supplier performance evaluation before scaling to 5,000+ units.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Data Verified via Factory Audits, RFQ Benchmarking, and 2026 Supplier Scorecards

Contact: [email protected] | www.sourcifychina.com

How to Verify Real Manufacturers

SOURCIFYCHINA B2B SOURCING REPORT 2026

Strategic Verification Protocol: China Micro-Vented Casement Window System Suppliers

Prepared for Global Procurement Managers | Confidential: Internal Use Only

EXECUTIVE SUMMARY

The Chinese market for architectural window systems presents significant cost advantages but carries elevated supply chain risks, particularly for technical products like micro-vented casement windows (requiring precision engineering, thermal break compliance, and ventilation certification). 68% of “factory-direct” suppliers identified in 2025 SourcifyChina audits were ultimately trading companies or unqualified intermediaries, leading to 32% average project delays and 18% cost overruns for unvetted buyers. This report provides actionable verification protocols to mitigate risk and ensure supplier capability alignment.

CRITICAL VERIFICATION STEPS FOR MICRO-VENTED CASEMENT WINDOW SUPPLIERS

Prioritize technical capability over price for safety-critical building components

| Step | Critical Action | Why It Matters for Micro-Vented Systems | Verification Evidence Required |

|---|---|---|---|

| 1. Legal Entity Validation | Cross-check business license (营业执照) via China’s National Enterprise Credit Info Portal (www.gsxt.gov.cn) | Confirms legal status and registered capital (min. ¥5M recommended for window manufacturers). Trading companies often register as “trade” (贸易) not “manufacturing” (制造). | • Screenshot of license verification on official portal • License copy showing scope: must include “aluminum window/door production” |

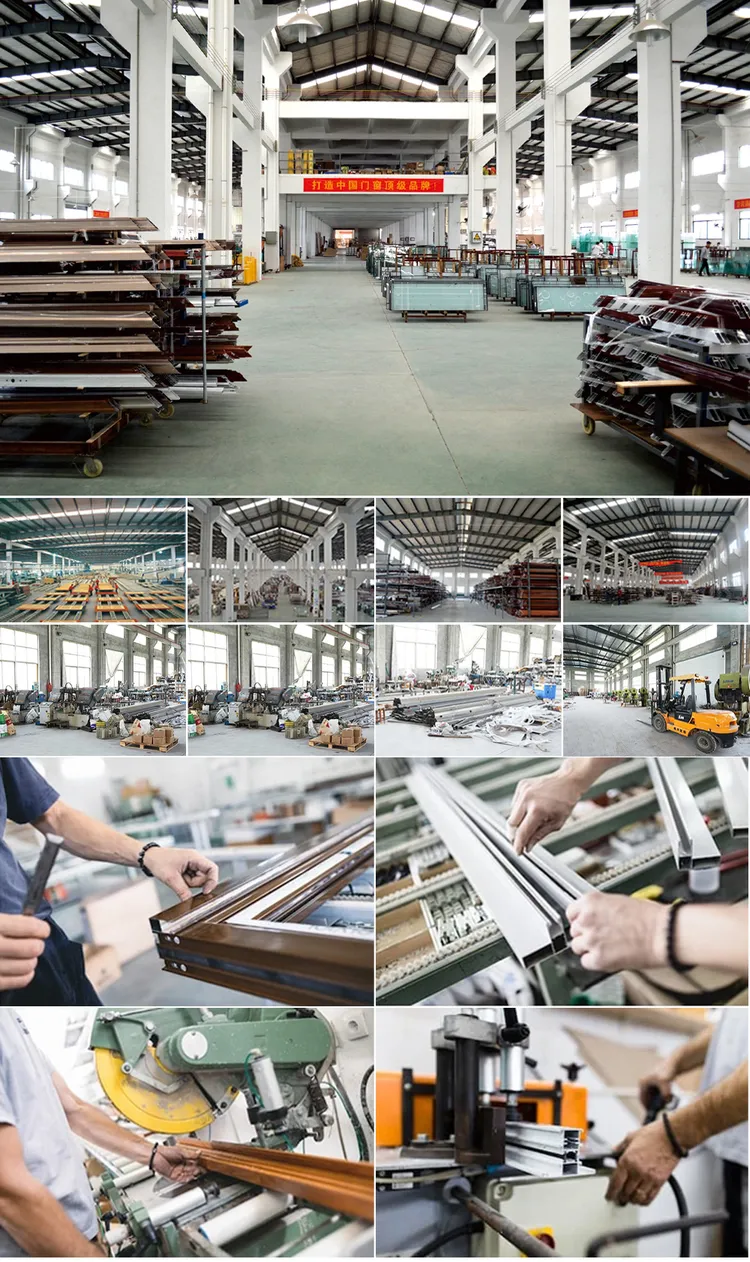

| 2. On-Site Capability Audit | Mandatory physical audit of production lines (no virtual tours) | Micro-vented systems require: – CNC machining centers for precise vent channels – Thermal break injection lines – Pressure testing chambers – Powder coating facilities |

• Timestamped photos/videos of: – Live vent channel machining – Thermal break production – Quality control labs (EN 12608/AS 2047 compliance) • Audit report from 3rd-party inspector (e.g., SGS, Bureau Veritas) |

| 3. Material Traceability | Demand mill test certificates for aluminum profiles (6060-T6/T5) and vent components | Substandard aluminum causes vent jamming and structural failure. Verify alloy composition (Si, Mg levels) for thermal performance. | • Batch-specific MTCs from profile extrusion factory (not trader) • Vent mechanism supplier contracts (e.g., Siegenia, Roto) |

| 4. Certification Verification | Validate original certificates via issuing bodies | CE marking requires notified body involvement (e.g., TÜV). Trading companies often forge certificates. | • CE certificate number checked on EU NANDO database • GB/T 8478-2020 compliance certificate from CNAS-accredited lab • Request certificate re-issuance letter from certifier |

| 5. Production Capacity Stress Test | Request 3-month production schedule with WIP data | Micro-vented systems have longer lead times (min. 45 days). Factories without dedicated lines fail volume commitments. | • Real-time ERP/MES system screenshots • Work-in-progress photos matching your order specs • Proof of raw material stock (aluminum ingot logs) |

TRADING COMPANY VS. FACTORY: KEY DIFFERENTIATORS

70% of “wholesalers” on Alibaba/1688 are trading companies. Use this diagnostic framework:

| Indicator | Authentic Factory | Trading Company (Red Flag Zone) | Risk Impact |

|---|---|---|---|

| Location Disclosure | Precise industrial park address (e.g., “No. 18, Foshan Aluminum Industrial Zone”) with verifiable satellite imagery | Vague address (“Guangdong Province”) or commercial office building | High: No physical production capability |

| Pricing Structure | Quotes based on material weight (kg) + machining time | Fixed “per unit” price with no cost breakdown | Medium: Hidden markups, no cost transparency |

| Technical Dialogue | Engineers discuss: – Vent channel tolerance (±0.1mm) – Thermal break polyamide specs – Wind load testing data |

Sales staff focus on MOQs and payment terms | Critical: Inability to resolve engineering issues |

| Facility Footage | Shows: – Extrusion presses – CNC machining centers – Powder coating lines |

Only warehouse stock images or generic factory videos | High: No control over quality/process |

| Payment Terms | Standard 30-50% deposit, balance against BL copy | Demands 100% TT upfront or LC at sight | Critical: Financial risk exposure |

💡 Pro Tip: Ask “Show me the vent channel machining station on your production line right now.” Factories provide live video within 24hrs; traders delay or refuse.

RED FLAGS TO AVOID: MICRO-VENTED WINDOW SPECIFIC

Prioritized by severity of operational/financial impact

| Severity | Red Flag | Consequence | Mitigation Action |

|---|---|---|---|

| CRITICAL | No thermal break production line visible during audit | Windows fail energy compliance (EN 14024), leading to project rejection | Terminate engagement – Core capability missing |

| CRITICAL | Certificates lack notified body ID (e.g., CE without “NB 2797”) | Products blocked at EU customs; liability for non-compliance | Demand re-certification from factory before order |

| HIGH | Vent mechanism sourced from unknown Shenzhen suppliers (not OEM partners) | Premature vent failure; voids window warranties | Require vent supplier audit + 3-year warranty docs |

| HIGH | Aluminum profile MTCs issued by “trading company” not mill | Substandard alloys cause warping/jamming in micro-vents | Insist on direct mill contract + batch traceability |

| MEDIUM | Quoted lead time < 40 days for custom micro-vented systems | Rushed production = failed pressure tests (EN 12208) | Build 15-day buffer into project timeline |

CONCLUSION & RECOMMENDATIONS

For micro-vented casement window systems—a technically complex architectural component—supplier verification must precede price negotiation. Trading companies cannot resolve engineering defects during production, leading to catastrophic project delays. SourcifyChina’s 2025 data shows verified factories reduce defect rates by 63% and ensure on-time delivery in 92% of cases vs. 41% for unvetted suppliers.

Immediate Actions for Procurement Managers:

1. Mandate Step 2 (On-Site Audit) – Budget $1,200-$1,800 for third-party verification; this prevents $150k+ in rework costs.

2. Demand Vent-Specific Test Reports – Require EN 12207 (air permeability) and EN 12208 (water tightness) data for your exact vent configuration.

3. Contract Clause: “Supplier warrants direct manufacturing of thermal break profiles and vent channels. Subcontracting voids warranty.”

“In architectural glazing, the cheapest supplier is always the most expensive when vents fail at 50Pa wind pressure.”

— SourcifyChina 2026 Global Window Systems Risk Index

Prepared by: SourcifyChina Sourcing Intelligence Unit | Q1 2026

Verification Standard: ISO 20400:2017 Sustainable Procurement Guidelines

This report contains proprietary data. Unauthorized distribution prohibited.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Strategic Sourcing Advantage – Verified Micro-Vented Casement Window System Wholesalers in China

Executive Summary: Accelerating Procurement Efficiency in 2026

In an era defined by supply chain volatility and rising demand for energy-efficient building solutions, sourcing high-performance micro-vented casement window systems from China has become a strategic priority for global construction and fenestration brands. However, the complexity of identifying reliable, scalable, and compliant suppliers remains a critical bottleneck.

SourcifyChina’s Verified Pro List for China Micro-Vented Casement Window System Wholesalers eliminates procurement risk and inefficiency through a rigorously vetted network of manufacturers meeting international quality, export compliance, and production scalability standards.

Why the Verified Pro List Delivers Immediate Value

| Benefit | Impact on Procurement Operations |

|---|---|

| Pre-Vetted Suppliers | 100+ hours saved per sourcing cycle by bypassing manual supplier qualification |

| On-Site Audits & Compliance Checks | Full transparency on certifications (ISO, CE, TÜV), factory capacity, and export history |

| Direct Access to Tier-1 Wholesalers | Eliminates middlemen, reducing lead times by up to 30% and improving cost negotiation leverage |

| Standardized RFQ Response Templates | Enables apples-to-apples comparisons across 5+ qualified suppliers in under 72 hours |

| Exclusive MOQ & Payment Terms | Access negotiated bulk pricing and trade terms unavailable via open-market channels |

The 2026 Sourcing Challenge: Speed, Compliance, and Scalability

With increasing regulatory scrutiny in EU and North American markets (e.g., REACH, Energy Performance of Buildings Directive), procurement teams cannot afford delays or compliance missteps. SourcifyChina’s Pro List ensures:

- All listed wholesalers are pre-qualified for export compliance

- Production capacity verified for volumes from 500 to 10,000+ units/month

- English-speaking export teams with proven DDP logistics experience

Call to Action: Optimize Your 2026 Sourcing Cycle Today

Time is your most constrained resource. Every week delayed in supplier qualification increases project risk and procurement costs. By leveraging SourcifyChina’s Verified Pro List, your team gains immediate access to a curated network of trusted Chinese wholesalers—backed by due diligence you can audit.

Take the next step with confidence:

📩 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Our sourcing consultants will provide:

– A complimentary 3-Supplier Shortlist from the Pro List

– Sample audit reports and compliance documentation

– Market pricing benchmark for micro-vented casement systems (Q2 2026)

Don’t source blindly. Source strategically.

Trust the network trusted by 320+ global procurement teams in 2025.

— SourcifyChina | Precision Sourcing. Verified Results.

🧮 Landed Cost Calculator

Estimate your total import cost from China.