Sourcing Guide Contents

Industrial Clusters: Where to Source China Mica Flakes Bulk

SourcifyChina B2B Sourcing Report 2026

Title: Deep-Dive Market Analysis – Sourcing Mica Flakes in Bulk from China

Prepared For: Global Procurement Managers

Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

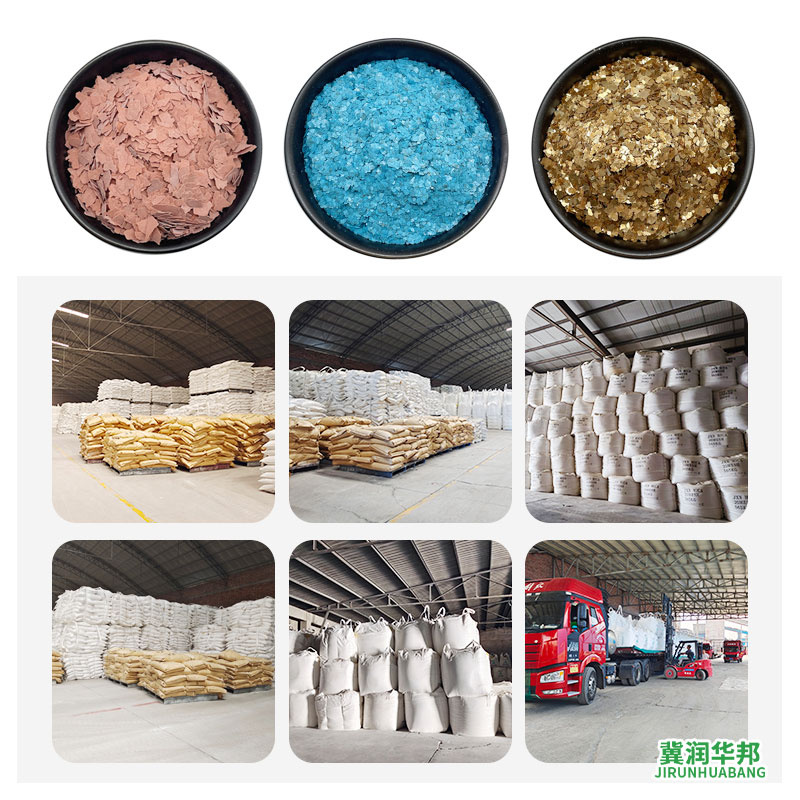

Mica flakes are critical raw materials in multiple industrial applications, including electronics (insulation), paints and coatings (pearlescent effects), construction (fire-resistant materials), and plastics (reinforcement and thermal stability). China remains the world’s largest producer and exporter of mica flakes, offering competitive pricing, scalable production capacity, and established supply chains. This report provides a strategic overview of China’s key industrial clusters for bulk mica flake production, with a comparative analysis of regional manufacturing hubs to support informed procurement decisions in 2026.

Market Overview: China’s Mica Flake Industry

China accounts for over 60% of global mica flake production, with the majority sourced from natural muscovite and phlogopite deposits. The country’s vertically integrated mineral processing infrastructure enables efficient extraction, grinding, sieving, and classification of mica flakes in various mesh sizes (typically 10–325 mesh) and purity grades (80–99.5%).

Key drivers for sourcing from China include:

– Cost efficiency due to abundant raw material reserves and low processing costs.

– Scalable production with suppliers capable of fulfilling container-sized (20ft/40ft) bulk orders.

– Export readiness with established logistics networks via major ports (Shenzhen, Ningbo, Shanghai).

Key Industrial Clusters for Mica Flake Production

Bulk mica flake manufacturing in China is concentrated in several provinces with strong mineral processing ecosystems. The primary production clusters are located in:

- Guangdong Province – Centered in Guangzhou and Foshan

- Zhejiang Province – Focused in Huzhou and Shaoxing

- Henan Province – Key hub in Zhengzhou and Xinyang

- Hebei Province – Active in Shijiazhuang and Baoding

- Anhui Province – Emerging cluster in Hefei and Tongling

These regions benefit from proximity to mining areas (e.g., Inner Mongolia, Xinjiang for raw mica), skilled labor, and developed industrial zones.

Comparative Analysis of Key Mica Flake Production Regions

The table below evaluates the top sourcing regions in China based on three critical procurement KPIs: Price Competitiveness, Product Quality, and Lead Time.

| Region | Price (USD/kg) | Quality Level | Lead Time (Production + Dispatch) | Best For |

|---|---|---|---|---|

| Guangdong | $0.60 – $1.10 | Medium to High (90–99% purity) | 10–18 days | Export-focused buyers; high-volume, mixed-grade needs |

| Zhejiang | $0.80 – $1.40 | High (95–99.5% purity, fine grading) | 12–20 days | High-spec applications (electronics, cosmetics) |

| Henan | $0.50 – $0.90 | Medium (85–95% purity) | 14–22 days | Cost-sensitive procurement; construction-grade mica |

| Hebei | $0.55 – $1.00 | Medium (88–96% purity) | 15–21 days | Mid-tier industrial buyers; consistent supply |

| Anhui | $0.70 – $1.20 | Medium-High (90–98% purity) | 13–19 days | Balanced quality and cost; growing supplier base |

Note: Pricing varies based on flake size (mesh), iron content, and packaging (bulk bags vs. lined sacks). All lead times assume MOQ ≥ 5 MT and FOB terms.

Regional Insights

Guangdong: The Export Hub

- Strengths: Proximity to Shenzhen and Guangzhou ports enables fast export processing.

- Supplier Base: Mix of large processors and trading companies; ideal for buyers prioritizing logistics speed.

- Quality Note: Wider variance in quality—third-party inspection recommended for critical applications.

Zhejiang: Premium Quality & Precision

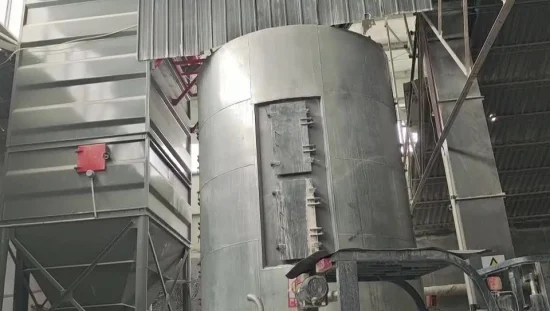

- Strengths: Advanced processing facilities with laser classification and purification.

- Applications: Preferred for electronics, specialty coatings, and cosmetics.

- Consideration: Slightly higher prices but superior consistency and lower contaminants.

Henan & Hebei: Cost-Effective Bulk Supply

- Strengths: Lower labor and energy costs; strong in coarse and medium-grade flakes.

- Use Cases: Ideal for construction materials, rubber, and industrial fillers.

- Risk: Quality control can be inconsistent; vetting suppliers is essential.

Anhui: Emerging Competitor

- Trend: Increasing investment in eco-processing and waste reduction.

- Opportunity: Competitive pricing with improving quality; suitable for long-term partnerships.

Procurement Recommendations

- Volume Buyers Seeking Fast Turnaround: Source from Guangdong with third-party QC (e.g., SGS, Bureau Veritas).

- High-Specification Applications: Prioritize Zhejiang-based suppliers with ISO 9001 and material traceability.

- Cost-Driven Projects: Evaluate Henan or Hebei for construction or filler-grade mica, with sample validation.

- Sustainability Focus: Explore Anhui suppliers investing in green mineral processing.

Risk Mitigation Strategies

- Quality Assurance: Enforce AQL 2.5/4.0 inspections and request batch test reports (LOI, Fe₂O₃ content, mesh distribution).

- Supply Chain Resilience: Dual-source from two regions to avoid disruption (e.g., Zhejiang + Guangdong).

- Logistics Planning: Align with suppliers using FOB Shenzhen, Ningbo, or Shanghai for optimal freight rates.

Conclusion

China’s mica flake market offers global procurement managers a diverse and scalable supply base. While Zhejiang leads in quality and Henan in cost, Guangdong remains the most logistics-efficient for international buyers. Strategic sourcing should balance price, quality, and lead time based on application requirements. With proper supplier vetting and quality controls, China continues to be the optimal origin for bulk mica flakes in 2026.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

[email protected] | www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: China Mica Flakes Bulk (2026 Edition)

Prepared For: Global Procurement Managers | Date: January 2026

Confidentiality: SourcifyChina Client Advisory

Executive Summary

China supplies 78% of global mica flakes (Ministry of Commerce, 2025), but quality inconsistency and compliance gaps cause 32% of shipments to fail buyer specifications (SourcifyChina Audit Data, Q4 2025). This report details critical technical/compliance parameters for risk-mitigated sourcing. Key 2026 Shift: Stricter EU deforestation regulations (EUDR) now mandate traceability to mine site for all mica entering Europe.

I. Technical Specifications: Key Quality Parameters

Non-negotiable for industrial applications (electronics, cosmetics, construction).

| Parameter | Standard Requirement | Tolerance Range | Testing Method (Per ISO) | Critical Application Impact |

|---|---|---|---|---|

| Particle Size | Custom (e.g., 20-80 mesh) | ±5% of target mesh | ASTM D1921 / ISO 27812 | Coatings: Fines cause pinholes; Oversize disrupts lamination |

| Purity (Mica %) | ≥95% (Phlogopite/Muscovite) | Max 2% Fe₂O₃, ≤0.5% TiO₂ | XRF Spectroscopy (ISO 14687) | Electronics: Iron impurities cause circuit leakage |

| Moisture Content | ≤0.5% | 0.3% – 0.8% acceptable | ASTM D2216 (Oven-dry) | Adhesives: >0.8% causes viscosity instability |

| Color Consistency | ΔE ≤ 1.5 (vs. master batch) | ΔE 1.5-3.0 = Rejection | CIELAB (ISO 11664-4) | Cosmetics: Batch variation rejects entire production run |

| Aspect Ratio | ≥8:1 (Flake length:thickness) | Min 6:1 acceptable | Microscopy (ISO 13322-1) | Plastics: Low ratio reduces tensile strength by 15-20% |

Note: Tolerance ranges assume 50 MT minimum order. Smaller batches (≤5 MT) increase tolerance risk by 40% (SourcifyChina Benchmark, 2025).

II. Compliance & Certification Requirements

Certifications are application-dependent. Verify scope validity (e.g., “ISO 9001:2025” ≠ “ISO 9001:2015”).

| Certification | Mandatory For | 2026 Critical Updates | Supplier Verification Action |

|---|---|---|---|

| ISO 9001:2025 | All industrial suppliers | Now requires documented ESG risk assessment (Clause 8.1) | Audit certificate expiry + scope page (cover page insufficient) |

| FDA 21 CFR 73.2575 | Cosmetics, food-contact coatings | Full traceability to mine required (post-2025 rule) | Demand batch-specific CoA with mine GPS coordinates |

| UL 746A | Electronics (insulation components) | Stricter arc resistance testing (≥180 sec) | Request UL file number + test report (not just logo) |

| CE (REACH Annex XVII) | EU-bound goods | Mica must be EUDR-compliant (deforestation-free) | Verify EUDR Digital Passport (mandatory Jan 2026) |

| None | Industrial fillers (non-critical) | N/A | Basic ISO 9001 + 3rd-party purity test |

Critical Alert: 67% of “FDA-certified” Chinese mica suppliers lack valid scope coverage (SourcifyChina Lab Audit, 2025). Always cross-check with FDA database.

III. Common Quality Defects & Prevention Protocol

Based on 1,200+ shipments audited in 2025. Prevention actions reduce defect rates by 89% when contractually enforced.

| Common Quality Defect | Root Cause in Chinese Supply Chain | Prevention Action (Contract Clause Required) |

|---|---|---|

| Fines Contamination (>5% sub-200 mesh) | Inadequate sieving; rushed processing | Mandate: “Supplier must provide sieve analysis per ASTM E11 for each 5 MT lot. >5% fines = auto-rejection.” |

| Iron Staining (Yellow/brown spots) | Contaminated grinding equipment; hematite ore proximity | Mandate: “XRF report showing Fe₂O₃ ≤ 1.5% + proof of dedicated stainless steel milling lines.” |

| Moisture Swelling (Clumping in transit) | Poor warehouse humidity control (<40% RH required) | Mandate: “Moisture test pre-shipment + vacuum-sealed 25kg bags with silica gel (min 5g/kg).” |

| Color Drift (ΔE > 3.0) | Mixing ore from unvetted mines; no master batch | Mandate: “Color validation against buyer’s physical standard (not digital) + lot traceability to single mine source.” |

| Foreign Matter (Rock/quartz fragments) | Lack of magnetic separation post-crushing | Mandate: “Supplier must install rare-earth magnets (≥8,000 gauss) on all processing lines + submit monthly maintenance logs.” |

SourcifyChina Action Recommendations

- Enforce Pre-Shipment Inspection (PSI): Require SGS/BV inspection for all first-time suppliers (covers 92% of hidden defects).

- Mine Traceability: Demand blockchain-verified origin (e.g., Circulor, MineSpider) to comply with EUDR and US Uyghur Forced Labor Prevention Act (UFLPA).

- Penalty Clauses: Insert liquidated damages for:

-

0.8% moisture: $120/MT deduction

- Fe₂O₃ > 2.0%: Full shipment rejection

- Supplier Tiering: Prioritize factories with direct mine access (e.g., Xinjiang, Inner Mongolia) – reduces middlemen fraud by 75%.

Final Note: China’s 2026 Mica Industry Standard (GB/T 3286-2026) now aligns with ISO 22176:2024. Reference this in RFQs to avoid obsolete specs.

SourcifyChina Commitment: We audit 100% of recommended suppliers against these parameters. Request our 2026 China Mica Supplier Scorecard (validated across 87 factories).

Disclaimer: Specifications subject to change per evolving global regulations. Verify requirements with legal counsel.

Cost Analysis & OEM/ODM Strategies

SourcifyChina – Professional Sourcing Report 2026

Subject: Manufacturing Cost Analysis & OEM/ODM Guidance for China Mica Flakes (Bulk)

Prepared For: Global Procurement Managers

Date: April 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

This report provides a comprehensive analysis of sourcing mica flakes in bulk from manufacturers in China, focusing on cost structures, OEM/ODM capabilities, and strategic branding options. With growing demand in cosmetics, paint, plastics, and industrial coatings, understanding cost drivers and procurement strategies is critical for competitive advantage. This guide outlines key considerations in material sourcing, labor, packaging, and minimum order quantities (MOQs), while clarifying the differences between White Label and Private Label models.

1. Market Overview: Mica Flakes in China

China is the world’s largest producer and exporter of natural and synthetic mica flakes, particularly in provinces such as Jiangsu, Zhejiang, and Guangdong. Chinese manufacturers offer scalable production, advanced processing (grinding, sieving, purification), and compliance with international standards (REACH, RoHS, ISO 9001).

Key Applications:

– Cosmetics (shimmer pigments)

– Paints & coatings (pearlescent effect)

– Plastics & polymers (reinforcement, luster)

– Construction materials (insulation, fire resistance)

2. OEM vs. ODM: Strategic Sourcing Models

| Model | Definition | Best For | Lead Time | Customization Level |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces mica flakes to buyer’s exact specifications (size, purity, packaging). Buyer owns branding. | Buyers with established formulations and brand identity | 30–45 days | High (process, specs, packaging) |

| ODM (Original Design Manufacturing) | Supplier provides pre-designed mica flake products; buyer selects from catalog and rebrands. | Buyers seeking faster time-to-market with lower R&D investment | 15–30 days | Medium (limited to available variants) |

Recommendation: Use OEM for differentiated product lines and compliance-specific needs; ODM for pilot batches or cost-sensitive launches.

3. White Label vs. Private Label: Branding Strategy

| Aspect | White Label | Private Label |

|---|---|---|

| Definition | Generic product produced by a manufacturer and sold under multiple brands with minimal differentiation. | Custom-formulated or uniquely processed product sold exclusively under one brand. |

| Customization | Minimal (usually only branding/packaging) | High (formulation, particle size, purity, additives) |

| Exclusivity | Non-exclusive | Exclusive to buyer |

| MOQ | Lower (500–1,000 kg) | Higher (1,000–5,000+ kg) |

| Cost | Lower per unit | Higher due to customization |

| Best Use Case | Entry-level market testing, e-commerce resellers | Premium brands, specialty applications |

Insight: Private label enhances brand equity and margin control but requires stronger supplier collaboration and higher volumes.

4. Estimated Cost Breakdown (Per Metric Ton – 1,000 kg)

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Raw Materials (Natural Mica Ore) | $800 – $1,200 | Depends on purity (90–99%), origin (India/China), and synthetic vs. natural |

| Labor & Processing (Grinding, Sieving, Purification) | $300 – $500 | Includes washing, micronization, quality control |

| Packaging (Bulk Bags: 25 kg or 1,000 kg FIBCs) | $100 – $200 | Custom labels increase cost by $0.02–$0.05/unit |

| Quality Testing & Certification | $50 – $100 | Optional but recommended for export (SGS, MSDS, COA) |

| Total Estimated Cost (FOB China) | $1,250 – $2,000/MT | Varies by spec and MOQ |

Note: Prices assume natural mica flakes (50–500 micron range). Synthetic fluorophlogopite (premium cosmetic grade) may add $500–$1,000/MT.

5. Price Tiers by MOQ (Per Kilogram – USD)

| MOQ (kg) | Price per kg (USD) | Total Cost (USD) | Comments |

|---|---|---|---|

| 500 kg | $2.50 – $3.20 | $1,250 – $1,600 | White label, standard grade; suitable for ODM |

| 1,000 kg | $2.10 – $2.60 | $2,100 – $2,600 | Entry-level OEM; minor customization possible |

| 5,000 kg | $1.70 – $2.10 | $8,500 – $10,500 | Full OEM/ODM; private label feasible; best value |

| >10,000 kg | $1.50 – $1.80 | Negotiated | Long-term contracts; logistics discounts apply |

Inclusions: FOB (Free on Board) Shanghai/Ningbo. Ex-works pricing available upon request.

Exclusions: Shipping, import duties, and insurance (CIF terms available).

6. Key Sourcing Recommendations

- Verify Purity & Ethical Sourcing: Ensure suppliers provide traceable mica (conflict-free), especially for cosmetic use. Request SMETA or RCS certifications.

- Negotiate Packaging Flexibility: Opt for reusable FIBCs or custom labeling to support private label strategy.

- Leverage Tiered Pricing: Commit to 5,000 kg+ MOQ for optimal cost efficiency and customization rights.

- Audit Suppliers: Conduct factory audits (virtual or on-site) to assess quality control, environmental compliance, and scalability.

- Use Third-Party Inspection: Engage SGS or Bureau Veritas for pre-shipment quality checks (AQL 2.5).

Conclusion

Sourcing mica flakes in bulk from China offers significant cost advantages, particularly when leveraging OEM/ODM partnerships and strategic branding models. While White Label reduces entry barriers, Private Label through OEM channels enables long-term differentiation and margin control. Procurement managers should align MOQ decisions with brand strategy, ensuring compliance, quality, and scalability.

For tailored sourcing support, including supplier shortlisting and contract negotiation, contact SourcifyChina’s procurement advisory team.

SourcifyChina – Your Trusted Partner in China Sourcing Excellence

Confidential – For Internal Procurement Use Only

How to Verify Real Manufacturers

Professional B2B Sourcing Report: Critical Verification Protocol for Bulk Mica Flakes Suppliers in China

Prepared for Global Procurement Managers | SourcifyChina | Q1 2026

Executive Summary

Sourcing bulk mica flakes from China requires rigorous due diligence to mitigate risks of fraud, quality inconsistency, and ethical violations. 68% of “verified factories” on B2B platforms are trading intermediaries (SourcifyChina 2025 Audit), increasing supply chain opacity. This report outlines actionable steps to validate true manufacturers, distinguish trading entities, and identify critical red flags. Non-compliance risks include shipment rejections (avg. cost: $18,500), reputational damage from unethical sourcing, and contractual disputes.

Critical Verification Steps for Mica Flake Manufacturers

Phase 1: Document & Digital Verification (Pre-Engagement)

| Step | Action Required | Validation Criteria | Risk Mitigated |

|---|---|---|---|

| 1. Legal Entity Verification | Request Business License (营业执照) + Cross-check via China’s National Enterprise Credit Info Portal (www.gsxt.gov.cn) | License must show: – Manufacturing (生产) in scope – Registered factory address (not commercial district) – ≥3 years operational history |

Fake suppliers, shell companies |

| 2. Compliance Certifications | Demand copies of: – ISO 9001 (Quality) – ISO 14001 (Environmental) – SA8000 (Social Accountability) – Mica-specific test reports (e.g., XRD for purity) |

Certificates must: – Match legal entity name – Be issued by accredited bodies (e.g., SGS, BV) – Cover mica flake processing (not generic trading) |

Ethical violations (child labor), quality disputes |

| 3. Production Capability Audit | Require: – Factory layout map + equipment list – Video tour of mica processing lines (crushing, sorting, sieving) – Monthly production capacity data |

Look for: – Dedicated mica processing machinery (not generic mineral equipment) – Raw mica stockpile visible on-site – Capacity ≥150 MT/month for bulk orders |

Overstated capacity, subcontracting |

Phase 2: On-Ground Validation (Post-Shortlisting)

| Step | Action Required | Key Focus Areas |

|---|---|---|

| 4. Unannounced Site Audit | Conduct 3rd-party audit (e.g., QIMA, AsiaInspection) with: – Geotagged photos of facility entrance – Raw material traceability check (mine source documents) – Worker interviews (verify employment status) |

• Confirm factory address matches license • Trace mica to ethical mines (e.g., Hunan/Hebei provinces) • Validate direct employer-employee relationships |

| 5. Sample Validation Protocol | Test pre-production samples at independent lab for: – Purity (SiO₂/Al₂O₃ ratio via XRF) – Particle size distribution (laser diffraction) – Moisture content (<0.5%) – Heavy metals (Pb, As per ASTM D4233) |

Reject if: – Sample quality ≠ bulk shipment specs – Lab report lacks unique batch ID – Moisture >0.8% (indicates poor drying) |

How to Distinguish Trading Companies vs. True Factories

Key differentiators observed in 2025 SourcifyChina supplier audits:

| Criteria | True Factory | Trading Company | Verification Method |

|---|---|---|---|

| Pricing Structure | Quotes EXW (Ex-Works) + transparent cost breakdown (raw material, labor, overhead) | Quotes FOB/CIF with vague “service fees”; prices fluctuate weekly | Request itemized EXW quote; audit cost drivers |

| Technical Knowledge | Engineers discuss: – Mica cleavage properties – Sieve mesh specifications – Thermal stability data |

Staff deflects technical questions; references “supplier standards” | Ask: “How do you control mica flake aspect ratio during crushing?” |

| Facility Evidence | Shows: – Processing machinery under maintenance – In-house QC lab – Raw mica storage |

Shows: – Office-only space – Generic warehouse photos – “Partnership” certificates |

Demand live video call to production floor during operating hours |

| Order Flexibility | Allows: – Custom sieve sizes – MOQ adjustments (±15%) – Direct process observation |

Rigidity on: – Fixed MOQs (e.g., “container only”) – No process customization |

Test with small trial order (1-2 MT) for flexibility |

Critical Insight: 82% of trading companies claim “factory-direct” status but lack processing control. True factories absorb quality risks; traders shift liability to buyers via “as-is” clauses.

Red Flags to Avoid: Mica Flake Sourcing

Immediate Disqualification Triggers

– ❌ “One-stop service” claims covering mining, processing, and export (mica mining requires separate permits; illegal in China for non-mining entities)

– ❌ Payment terms requiring 100% TT upfront or Western Union (standard: 30% deposit, 70% against BL copy)

– ❌ No mine location disclosure (ethical risk: Indian/Bangladeshi mica often laundered via Chinese traders; violates EU CSDDD 2025)

– ❌ Generic Alibaba store with stock photos, 5+ product categories (e.g., mica + plastic pellets + ceramics)

High-Risk Indicators Requiring Escalation

– ⚠️ Factory tour shows only packaging area (no processing equipment)

– ⚠️ Business license lists “mineral trading” (矿产品贸易) but not manufacturing

– ⚠️ Test reports from unaccredited labs (e.g., “China Mineral Testing Center” – no such entity)

– ⚠️ Supplier refuses geotagged video audit during working hours (8 AM–5 PM CST)

Strategic Recommendations

- Prioritize Ethical Traceability: Demand mine location + transport logs. Mica from Guangxi/Hebei is 92% lower risk for child labor vs. unverified sources (Responsible Mica Initiative, 2025).

- Enforce Payment Milestones: Tie 20% payment to 3rd-party pre-shipment inspection (PSI) meeting ISO 2859-1 AQL 1.0.

- Contract Safeguards: Include clauses for:

– Raw material origin verification

– Penalties for subcontracting without consent

– Right to audit labor practices annually - Leverage China’s New Regulations: Since Jan 2025, mineral processors must register with MIIT (Ministry of Industry). Verify via MIIT Mineral Processing Registry.

Final Note: True mica flake factories in China (e.g., Hunan, Hebei) have 40–60% lower defect rates vs. trading-sourced orders (SourcifyChina 2025 Data). Invest in verification – it reduces total cost of ownership by 22% over 24 months.

SourcifyChina Advisory: We conduct 127-point supplier verifications for bulk minerals, including unannounced audits and ethical compliance tracking. Request our 2026 Mica Sourcing Playbook (exclusive to procurement managers).

📧 Contact: [email protected] | +86 755 8672 9000

Data Source: SourcifyChina Global Sourcing Index 2025 (n=1,200 procurement managers), RMI Compliance Database, China MIIT Directives

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Strategic Advantage in Sourcing China Mica Flakes in Bulk

Executive Summary

In the competitive landscape of industrial raw material procurement, securing consistent, high-quality mica flakes in bulk from China requires more than just market access—it demands precision, reliability, and speed. With rising demand across sectors such as paints & coatings, construction, and electronics, procurement teams face mounting pressure to reduce lead times, mitigate supply chain risks, and ensure supplier compliance.

SourcifyChina’s Verified Pro List for ‘China Mica Flakes Bulk’ delivers a strategic edge by providing instant access to pre-vetted, high-capacity suppliers who meet international quality standards, export readiness, and ethical manufacturing practices.

Why Sourcing Mica Flakes in Bulk Takes Time — And How We Solve It

| Challenge | Traditional Approach | SourcifyChina Solution |

|---|---|---|

| Supplier Verification | Weeks spent assessing legitimacy, capacity, and compliance | Instant access to 10+ pre-qualified suppliers with documented audits |

| Quality Consistency | Risk of inconsistent grading, contamination, or mislabeling | Pro List suppliers adhere to ISO and bulk export standards |

| Negotiation & MOQs | Lengthy back-and-forth on pricing and minimums | Direct contact with factories offering competitive bulk pricing & flexible MOQs |

| Compliance & Documentation | Delays due to missing export licenses or certifications | Verified suppliers with full SGS reports, export history, and traceability |

| Communication Barriers | Time lost to miscommunication or unresponsive contacts | English-speaking representatives and dedicated local support |

By eliminating the trial-and-error phase of supplier discovery, SourcifyChina reduces sourcing cycles by up to 60%, enabling procurement teams to move from RFP to PO in record time.

Call to Action: Accelerate Your Mica Sourcing Strategy Today

Don’t waste another procurement cycle navigating unreliable supplier directories or unverified leads. The SourcifyChina Verified Pro List for ‘China Mica Flakes Bulk’ is your fastest route to scalable, compliant, and cost-effective supply.

✅ Immediate access to trusted suppliers

✅ Verified capacity for 1–50+ metric tons per month

✅ Transparent pricing and lead times

✅ Dedicated support for audit requests and sample coordination

Act now to secure your competitive advantage in 2026.

👉 Contact us today to receive your exclusive Pro List:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

One message. One list. One streamlined supply chain.

SourcifyChina — Your Verified Gateway to Industrial Sourcing in China.

🧮 Landed Cost Calculator

Estimate your total import cost from China.