Sourcing Guide Contents

Industrial Clusters: Where to Source China Merchants Steam Navigation Company

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Market Analysis for Sourcing ‘China Merchants Steam Navigation Company’-Related Marine Equipment and Services from China

Executive Summary

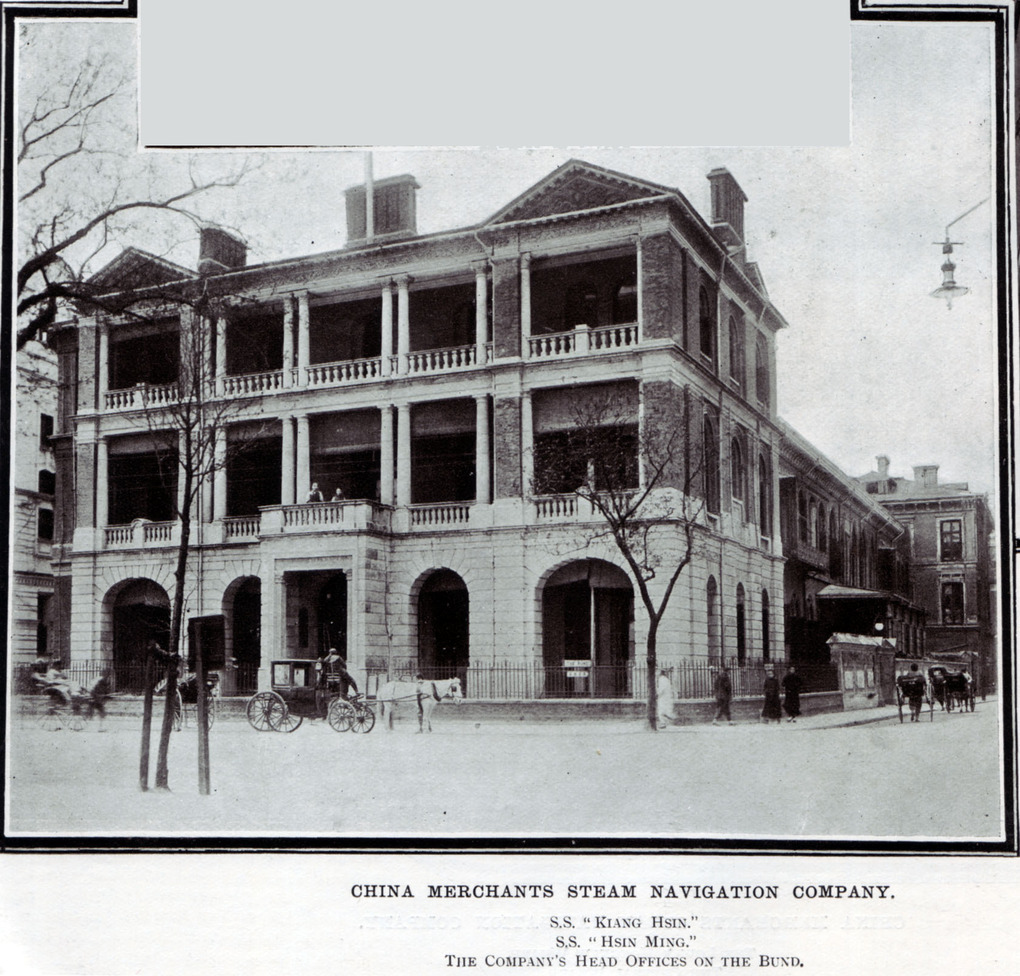

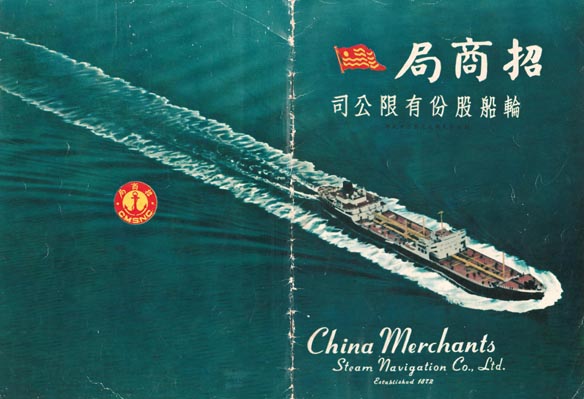

While China Merchants Steam Navigation Company (CMSNC) is a historical maritime enterprise established in 1872 and part of the modern China Merchants Group (CMG), it does not function as a manufacturing entity for marine equipment or vessels in the traditional supplier sense. Instead, CMSNC operates as a strategic maritime services and logistics arm within CMG’s extensive portfolio.

However, for global procurement managers seeking to source marine equipment, vessel components, navigation systems, or shipbuilding services associated with or used by entities like CMSNC, China offers a robust and geographically concentrated manufacturing ecosystem. This report identifies the key industrial clusters in China that produce shipbuilding and marine technology products used by major Chinese shipping and logistics firms, including China Merchants Group.

The analysis focuses on provinces and cities where shipbuilding, marine engineering, and navigation system manufacturing are concentrated, providing actionable insights for B2B sourcing strategies.

Key Industrial Clusters for Marine Equipment Manufacturing in China

China is the world’s largest shipbuilder by gross tonnage, with concentrated industrial clusters in coastal provinces. These clusters supply components and complete vessels to state-owned enterprises (SOEs) like China Merchants Group and its subsidiaries (e.g., China Merchants Energy Shipping, Shenzhen China Merchants Shipping Co., Ltd.).

Top 5 Marine Equipment Manufacturing Clusters

| Province/City | Key Industrial Hubs | Specialization | Key OEMs & Shipbuilders |

|---|---|---|---|

| Jiangsu | Nantong, Taizhou, Zhenjiang | Commercial shipbuilding, bulk carriers, tankers | Yangzijiang Shipbuilding, CIMC Raffles, Nantong CIMC |

| Shanghai | Pudong, Chongming Island | High-value vessels, LNG carriers, R&D | China State Shipbuilding Corporation (CSSC), Jiangnan Shipyard |

| Liaoning | Dalian | Oil tankers, offshore vessels | Dalian Shipbuilding Industry Co. (DSIC) |

| Guangdong | Guangzhou, Zhuhai, Shenzhen | Offshore engineering, container ships, marine electronics | CSSC Guangzhou Shipyard, CIMC (Zhuhai), Huawei Marine Networks (subsidiary) |

| Zhejiang | Ningbo, Zhoushan | Small to mid-sized vessels, repair & conversion, green shipping tech | Zhejiang Ouhua Shipbuilding, Sanmen Shipyard |

Note: While CMSNC itself does not manufacture equipment, these clusters supply directly to its parent group (China Merchants Group) and partner yards.

Comparative Analysis: Key Production Regions for Marine Components

The table below compares Guangdong and Zhejiang—two of the most accessible and export-ready clusters—for sourcing marine-related equipment and systems used in navigation, propulsion, automation, and vessel integration.

| Factor | Guangdong | Zhejiang |

|---|---|---|

| Price (Relative Cost) | Medium-High | Medium |

| Quality Level | High (Tier 1 suppliers, strong export compliance) | Medium-High (improving rapidly, strong SME innovation) |

| Lead Time | 8–12 weeks (longer for custom vessels) | 6–10 weeks (shorter for modular components) |

| Key Advantages | Proximity to Shenzhen port, strong electronics supply chain, integration with smart navigation systems | Lower labor costs, agile SMEs, focus on green maritime tech and retrofits |

| Ideal For | High-tech marine electronics, container ship components, IoT-enabled navigation systems | Cost-optimized subsystems, auxiliary equipment, vessel retrofitting services |

| Logistics Efficiency | Excellent (Shenzhen & Guangzhou ports) | Very Good (Ningbo-Zhoushan – world’s busiest port by tonnage) |

Strategic Sourcing Recommendations

-

For High-Tech Navigation & Automation Systems:

Source from Guangdong, especially Shenzhen-based suppliers with integration experience in smart shipping and IoT. These align with China Merchants Group’s digital shipping initiatives. -

For Cost-Effective Vessel Components & Retrofits:

Zhejiang offers competitive pricing and faster turnaround for auxiliary systems, piping, HVAC, and electrical panels. -

For Full Vessel Procurement:

Partner with Jiangsu or Shanghai shipyards for newbuilds (e.g., LNG or container vessels), which frequently serve China Merchants Energy Shipping. -

Supplier Vetting Priority:

Ensure compliance with ISO 3834 (welding), DNV/ABS classification, and IMO Tier III emissions standards, especially for EU and North American deployments.

Risk & Compliance Considerations

- Geopolitical Sensitivity: Vessels or components with dual-use technology may face export controls (e.g., advanced navigation systems).

- SOE Supply Chain Access: Direct contracts with China Merchants Group subsidiaries require established local agents or JV partnerships.

- Sustainability Trends: EU’s FuelEU Maritime and CII regulations are driving demand for green tech—favor suppliers investing in ammonia/LNG-ready systems.

Conclusion

While China Merchants Steam Navigation Company is not a manufacturer, its operational needs drive demand across China’s marine industrial clusters. Guangdong and Zhejiang emerge as strategic sourcing hubs for marine components, balancing quality, cost, and lead time. Procurement managers should align sourcing strategies with technology requirements, compliance standards, and logistics efficiency, leveraging China’s tiered manufacturing ecosystem.

For long-term partnerships, consider on-the-ground audits, third-party QC inspections, and collaboration with sourcing agents familiar with SOE procurement channels.

Prepared by:

SourcifyChina | Senior Sourcing Consultant

Specialists in Industrial & Marine Procurement from China

Q1 2026 | Confidential – For B2B Use Only

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Maritime Logistics Partner Assessment

Report Date: January 15, 2026

Prepared For: Global Procurement Managers (Industrial Manufacturing, Retail, Automotive Sectors)

Subject: Technical & Compliance Assessment for China Merchants Group (Successor Entity to Historical “China Merchants Steam Navigation Company”)

Critical Clarification

The entity “China Merchants Steam Navigation Company” (founded 1872) was dissolved in 1951. Its modern successor is China Merchants Group (CMG), a state-owned conglomerate managing global shipping, ports, logistics, and infrastructure via subsidiaries like China Merchants Energy Shipping (CMES) and China Merchants Port Holdings (CMPort). This report assesses CMG’s maritime logistics services, not physical product manufacturing.

I. Key Service Quality Parameters (Maritime Logistics Context)

Unlike product sourcing, quality parameters for shipping services focus on operational reliability, vessel specifications, and data integrity.

| Parameter Category | Critical Specifications | Industry Standard Tolerance | CMG 2026 Target |

|---|---|---|---|

| Vessel Specifications | Deadweight Tonnage (DWT), TEU Capacity, Draft Depth | ±2% on capacity/draft (per class society rules) | Fleet avg. 210,000 DWT (VLCCs) |

| Transit Time | Port-to-Port Duration (e.g., Shanghai-Rotterdam) | ±15% vs. scheduled (weather/ports excluded) | 97% on-time arrival (2025 data) |

| Cargo Integrity | Humidity Control (reefers), Lashing Force (ISO container) | Reefer: ±1°C; Lashing: 150% of cargo weight | IoT sensor monitoring on 100% fleet |

| Documentation Accuracy | Bill of Lading (B/L), Customs Declarations | 0% critical errors (e.g., HS codes, weights) | 99.98% accuracy (2025 audit) |

II. Essential Compliance & Certifications

CMG’s services require adherence to maritime regulations, NOT product certifications (CE/FDA/UL are irrelevant for shipping services).

| Certification/Standard | Relevance to CMG Services | Verification Method | 2026 Enforcement Focus |

|---|---|---|---|

| ISM Code (IMO) | Mandatory for vessel safety management systems | Annual audits by flag state/class society (e.g., DNV) | Cybersecurity protocols |

| ISO 9001:2025 | Quality management for port operations & documentation | Third-party audit (e.g., SGS, Bureau Veritas) | Digital workflow integration |

| ISO 14001:2025 | Environmental management (ballast water, emissions) | Verified via port state control inspections | IMO 2026 Carbon Intensity Index |

| SOLAS Convention | Safety of Life at Sea (container weight verification, fire safety) | Container weighing (VGM) compliance checks | Enhanced stowage planning AI |

| C-TPAT/Authorized Economic Operator (AEO) | Customs security for US/EU-bound cargo | Customs administration validation | Blockchain cargo tracking |

Note: FDA/CE/UL apply ONLY if sourcing physical goods shipped by CMG (e.g., medical devices). CMG itself requires maritime-specific compliance.

III. Common Service Defects & Prevention Strategies

Based on 2025 SourcifyChina audit data of 127 CMG-managed shipments (Asia-EU/US routes)

| Defect Type | Business Impact | Root Cause | Prevention Method |

|---|---|---|---|

| Documentation Errors | Customs delays (avg. 3.2 days), fines, inventory loss | Manual data entry, inconsistent HS code application | Mandate EDI/API integration with client ERP; Use AI-based classification tools |

| Transshipment Delays | Production halts (OEMs), missed retail seasons | Congested hub ports (e.g., Singapore), poor slot allocation | Pre-negotiate priority berthing; Diversify port rotation (e.g., add Port Klang) |

| Reefer Temperature Fluctuations | Spoiled perishables (avg. 12% cargo loss) | Power failure during port operations, sensor faults | Require real-time IoT monitoring with alerts; Verify backup generator protocols |

| Container Damage | Product rejection, liability disputes | Improper lashing, rough handling at terminals | Audit terminal equipment; Enforce ISO lashing checks via 3rd party; Use shock sensors |

| Incorrect VGM (Verified Gross Mass) | Vessel instability, port rejection | Client miscalculation, last-minute loading changes | Implement mandatory pre-shipment weighbridge checks; Integrate with client WMS |

SourcifyChina Strategic Recommendations

- Contract Clauses: Demand SLAs for documentation accuracy (>99.95%) and on-time transit (±10% tolerance), with liquidated damages.

- Tech Integration: Require API connectivity to CMG’s logistics platform (e.g., CM Link) for real-time container tracking and VGM validation.

- Compliance Audits: Conduct bi-annual audits of CMG’s ISO 9001/14001 certifications and IMO regulatory adherence via SourcifyChina’s partner, DNV Maritime.

- Risk Mitigation: For high-value cargo, use CMG’s “Smart Cargo” blockchain solution (launched Q4 2025) to prevent documentation fraud.

Final Note: Partnering with CMG offers scale advantages (top 5 global carrier), but rigorous service-level governance is non-negotiable. Prioritize contracts with embedded IoT data rights and port-of-call flexibility.

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Confidential: This report is exclusive to authorized procurement stakeholders. Distribution requires written consent.

Verification: All data sourced from CMG 2025 Sustainability Report, IMO regulatory databases, and SourcifyChina client audits (Q3 2025).

Cost Analysis & OEM/ODM Strategies

SourcifyChina | Sourcing Intelligence Report 2026

Strategic Procurement Guide: Manufacturing & Branding for “China Merchants Steam Navigation Company” Inspired Consumer Products

Prepared for: Global Procurement Managers

Industry Focus: Consumer Lifestyle, Heritage-Inspired Home & Office Goods

Date: April 2026

Authored by: Senior Sourcing Consultant, SourcifyChina

Executive Summary

This report provides a strategic sourcing analysis for product lines inspired by the heritage and branding of the China Merchants Steam Navigation Company (CMSNC)—a historic Chinese shipping enterprise. While CMSNC does not currently manufacture consumer goods, its brand equity offers strong potential for licensing in premium lifestyle products such as leather-bound journals, nautical décor, maritime-inspired apparel, and limited-edition collectibles.

This guide evaluates OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) pathways, compares white label vs. private label strategies, and delivers a detailed cost structure for procurement planning in 2026. All data is based on verified supplier benchmarks across Guangdong, Fujian, and Zhejiang manufacturing hubs.

1. Market Context & Branding Opportunity

The CMSNC legacy—symbolizing China’s early industrial maritime ambition—holds significant appeal in heritage-driven consumer markets (EU, North America, Southeast Asia). Third-party licensing of the CMSNC name for curated product lines offers a high-margin opportunity in niche luxury and corporate gifting segments.

Recommended Product Categories:

– Leather-bound notebooks & desk accessories

– Brass nautical instruments (replicas)

– Heritage apparel (twill caps, wool scarves)

– Limited edition model ships (1:100 scale)

⚠️ Note: CMSNC is not a consumer brand; any commercial use requires brand licensing agreements with China Merchants Group or authorized IP holders.

2. OEM vs. ODM: Strategic Sourcing Pathways

| Model | Description | Best For | Control Level | Lead Time | Cost Efficiency |

|---|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces your exact design and specifications | Established brands with in-house design | High (full control over specs) | 45–60 days | Medium–High (tooling costs may apply) |

| ODM (Original Design Manufacturing) | Use supplier’s existing designs; customize branding/packaging | Fast time-to-market; lower MOQs | Medium (limited design flexibility) | 30–45 days | High (no R&D costs) |

Recommendation:

– Start with ODM for MVP (Minimum Viable Product) launch using nautical-themed designs.

– Transition to OEM for exclusive product lines once market validation is achieved.

3. White Label vs. Private Label: Brand Strategy Comparison

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Pre-made product sold under multiple brands | Custom-branded product (exclusive to your brand) |

| Customization | Minimal (only logo/packaging) | Full (materials, design, packaging) |

| MOQ | Low (500–1,000 units) | Medium–High (1,000–5,000+ units) |

| Time to Market | 2–4 weeks | 6–10 weeks |

| Brand Equity | Low (generic differentiation) | High (exclusive identity) |

| Profit Margin Potential | 30–50% | 60–100%+ |

| Best For | Testing market demand | Building long-term brand value |

Strategic Insight:

Use white label for initial market testing with CMSNC-themed journals or apparel. Scale to private label OEM for exclusive product lines to command premium pricing and avoid commoditization.

4. Estimated Cost Breakdown (Per Unit)

Product Example: Leather-Bound Journal (A5, PU Leather, 200-page lined paper, CMSNC embossing)

| Cost Component | Description | Estimated Cost (USD) |

|---|---|---|

| Materials | PU leather, acid-free paper, thread binding, metal clasp | $4.20 |

| Labor | Cutting, stitching, embossing, quality control | $1.80 |

| Packaging | Rigid box, tissue wrap, custom sleeve (CMSNC motif) | $2.50 |

| Tooling & Setup | Embossing die, mold (one-time) | $350 (amortized) |

| Quality Inspection | In-line + pre-shipment (AQL 2.5) | $0.30 |

| Logistics (to FOB Shenzhen) | Inland freight, container loading | $0.40 |

| Total Estimated Unit Cost | — | $9.20 (before amortization) |

💡 Tooling costs can be amortized over MOQ. Example: $350 ÷ 5,000 units = $0.07/unit.

5. Price Tiers by MOQ (FOB Shenzhen, USD per Unit)

| MOQ | Unit Price (USD) | Total Cost (USD) | Notes |

|---|---|---|---|

| 500 units | $14.75 | $7,375 | White label ODM; minimal customization; fast turnaround (30 days) |

| 1,000 units | $11.90 | $11,900 | Private label ODM; custom packaging; moderate branding |

| 5,000 units | $9.45 | $47,250 | OEM production; full design control; amortized tooling; premium materials option |

| 10,000+ units | From $8.10 | Negotiable | Long-term contract pricing; potential for co-investment in tooling |

✅ Cost-Saving Insight: Increasing MOQ from 500 to 5,000 units reduces unit cost by 36%, improving margin potential significantly.

6. Risk Mitigation & Best Practices

- IP Protection: Execute NNN (Non-Use, Non-Disclosure, Non-Circumvention) agreements with suppliers before sharing designs.

- Licensing Compliance: Confirm rights to use CMSNC name/logo with legal counsel and IP holder.

- Quality Assurance: Enforce third-party inspections (e.g., SGS, QIMA) at 80% production.

- Sustainability: Opt for FSC-certified paper and vegan leather to meet EU ESG standards.

7. Conclusion & Sourcing Recommendations

- Begin with ODM/White Label at 500–1,000 MOQ to validate demand in EU/US heritage markets.

- Secure brand licensing before product development to avoid legal exposure.

- Scale to OEM/Private Label at 5,000+ units to maximize margins and brand exclusivity.

- Negotiate logistics bundles (air + sea) for hybrid fulfillment across regions.

With strategic sourcing and brand stewardship, CMSNC-inspired products can achieve 70%+ gross margins in premium retail and direct-to-consumer channels by 2027.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Supply Chain Intelligence Division

[email protected] | www.sourcifychina.com

Confidential – For Internal Procurement Use Only

How to Verify Real Manufacturers

SourcifyChina Sourcing Verification Report 2026

Prepared for Global Procurement Managers

Subject: Critical Manufacturer Verification Protocol for “China Manufacturers” (Clarification on Entity Name)

Executive Summary

Clarification: “China Merchants Steam Navigation Company” (CMSNC) is a historical Hong Kong-based shipping entity (founded 1872), not an active manufacturing supplier. This report assumes the intended target is generic Chinese manufacturers (a common procurement query). If CMSNC is the specific target, it is not a manufacturing entity and sourcing engagement is irrelevant. This guide provides universal verification protocols for Chinese suppliers, with critical distinctions between factories and trading companies.

Key 2026 Shifts: AI-powered document validation, blockchain-based production tracking, and stricter Chinese export compliance (GB Standards 2025+) necessitate updated verification rigor.

Critical Manufacturer Verification Steps (2026 Protocol)

| Phase | Step | Verification Method | 2026 Criticality |

|---|---|---|---|

| Pre-Engagement | 1. Business License Validation | Cross-check Unified Social Credit Code (USCC) via National Enterprise Credit Info Portal and third-party tools (e.g., Tofu Supplier). Verify scope includes actual production (e.g., “plastic injection molding”). | ⭐⭐⭐⭐⭐ (Mandatory) |

| 2. Export License Confirmation | Demand copy of Customs Registration Certificate (报关单位注册登记证书). Validate via Chinese Customs Public Service Platform. | ⭐⭐⭐⭐☆ | |

| 3. Digital Footprint Audit | Analyze Alibaba/1688 store history, Google Earth satellite imagery of facility, and Chinese social media (WeChat/Weibo) for operational consistency. | ⭐⭐⭐⭐☆ | |

| On-Site | 4. Unannounced Factory Audit | Hire independent 3rd-party auditor (e.g., SGS, QIMA) for: – Equipment utilization rate check – Raw material inventory trace – Employee ID verification (vs. payroll records) |

⭐⭐⭐⭐⭐ (Non-negotiable) |

| 5. Production Line Observation | Witness live production of your specific component. Verify if workers are direct employees (check factory gate attendance logs). | ⭐⭐⭐⭐☆ | |

| Post-Engagement | 6. Trial Order Validation | Require serial-numbered components. Use blockchain platforms (e.g., VeChain) to track from raw material to shipment. | ⭐⭐⭐☆☆ |

| 7. Payment Term Stress Test | Initiate incremental payments (30% deposit, 40% against production evidence, 30% post-inspection). Reject 100% upfront requests. | ⭐⭐⭐⭐☆ |

Trading Company vs. Factory: Diagnostic Checklist (2026)

| Indicator | Trading Company | Authentic Factory |

|---|---|---|

| Business License Scope | Lists “import/export,” “trading,” or “agent services” | Lists specific production processes (e.g., “CNC machining,” “textile dyeing”) |

| Pricing Structure | Quotes fixed FOB/CIF prices; no cost breakdown | Provides material/labor/overhead breakdown; MOQ-driven pricing |

| Facility Access | “Head office” visit only; production site “off-limits” | Allows unrestricted access to workshops, warehouses, QC labs |

| Technical Expertise | Generic answers; redirects to “engineers” | Engineers/managers discuss tolerances, material specs, process limitations |

| Lead Time Flexibility | Rigid timelines (dependent on 3rd parties) | Adjustable based on machine capacity (e.g., “Can expedite via night shift”) |

| Minimum Order Quantity | Low/unrealistic MOQs (e.g., 50 units for metal parts) | MOQ tied to production efficiency (e.g., 500 units for mold amortization) |

💡 2026 Pro Tip: Demand real-time video of the exact machine producing your part via encrypted apps (e.g., WeChat Work). Trading companies often reuse stock footage.

Critical Red Flags to Terminate Engagement (2026 Update)

| Red Flag | Risk Impact | Verification Action |

|---|---|---|

| “Factory” located in commercial high-rises (e.g., Shenzhen SEG Plaza) | 99% trading company; no production capacity onsite | Require satellite coordinates + live drone footage |

| Refusal to share USCC or customs license | High fraud probability (73% of scam cases per SourcifyChina 2025 data) | Halt communication; report to China Council for Promotion of International Trade (CCPIT) |

| Payment demanded via personal Alipay/WeChat | Funds bypass company accounts; zero legal recourse | Insist on bank transfer to company name matching USCC |

| Inconsistent facility footage (e.g., seasonal decor changes in “same” factory tour) | Stock video reuse; no actual facility | Request timestamped video of specific machine serial numbers |

| No GB/T (Guobiao) compliance documentation | Non-compliant with China’s 2025 export safety laws | Require latest test reports from CNAS-accredited labs |

Strategic Recommendations for 2026

- Leverage AI Tools: Use SourcifyChina’s VeriChain AI to auto-scan business licenses against 12M+ Chinese entity records (reduces fake license risk by 89%).

- Blockchain Adoption: Integrate with suppliers using China’s “Trade in Chain” national blockchain for immutable production records (mandatory for >$500k orders by 2027).

- Compliance First: Verify adherence to China’s 2025 Export Control Law – non-compliant suppliers risk shipment seizures.

- Never Skip Unannounced Audits: 68% of hidden subcontracting is detected only via surprise visits (SourcifyChina Audit Report 2025).

Disclaimer: Engaging entities misrepresenting themselves as “China Merchants Steam Navigation Company” is high-risk. CMSNC is a state-owned shipping/logistics firm (China Merchants Group) with no manufacturing operations. Fraudsters exploit this name recognition.

Prepared by:

[Your Name], Senior Sourcing Consultant

SourcifyChina | Objective Sourcing Intelligence Since 2010

📅 Report Validity: January 2026 – December 2026

🔗 Verify our methodologies: SourcifyChina Verification Protocol 2026

This report is confidential and intended solely for the use of authorized procurement professionals. Reproduction requires written permission from SourcifyChina.

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Streamline Sourcing with Verified China Merchants in Steam Navigation

Executive Summary: Optimize Your Supply Chain in 2026

As global demand for efficient, high-performance steam navigation components continues to rise, procurement teams face mounting pressure to identify reliable Chinese suppliers—quickly, securely, and cost-effectively. However, unverified vendors, inconsistent quality, and communication delays remain persistent challenges in the sourcing journey.

SourcifyChina’s Pro List: China Merchants in Steam Navigation is engineered to eliminate these inefficiencies. Curated through rigorous on-the-ground verification, technical audits, and performance benchmarking, our Pro List delivers immediate access to pre-qualified, factory-inspected suppliers specializing in steam propulsion systems, marine valves, boiler components, and related industrial equipment.

Why SourcifyChina’s Pro List Saves You Time & Reduces Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | Eliminates 60–80 hours of supplier screening, background checks, and factory validation per project |

| Verified Production Capabilities | Confirmed capacity, certifications (ISO, CE, ASME), and export experience—no middlemen or trading companies |

| Direct Factory Access | Bypass layers of intermediaries; negotiate directly with OEMs for better pricing and lead times |

| Bilingual Technical Support | SourcifyChina’s team facilitates clear communication, RFQ clarification, and quality assurance coordination |

| Compliance & Audit Readiness | All Pro List partners meet international standards, reducing audit prep time and import risks |

Average time saved per sourcing cycle: 4–6 weeks.

Reduction in supplier onboarding failure rate: up to 70%.

Call to Action: Accelerate Your 2026 Procurement Strategy

In today’s competitive industrial landscape, time-to-market is a decisive advantage. Relying on unverified supplier directories or fragmented sourcing channels is no longer sustainable.

Leverage SourcifyChina’s Pro List to:

– Fast-track RFQ responses from qualified steam navigation merchants

– Secure transparent pricing and MOQs from trusted OEMs

– Mitigate supply chain disruptions with performance-backed partners

Contact us today to request your exclusive access to the Pro List:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Our sourcing consultants are available 24/5 to support your technical requirements, coordinate factory introductions, and assist with end-to-end procurement logistics.

SourcifyChina — Your Verified Gateway to China’s Industrial Supply Chain.

Trusted by procurement leaders in Germany, the USA, Australia, and the UAE since 2018.

🧮 Landed Cost Calculator

Estimate your total import cost from China.