Sourcing Guide Contents

Industrial Clusters: Where to Source China Men Classic Eyewear Company

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Title: Deep-Dive Market Analysis – Sourcing Men’s Classic Eyewear from China

Date: April 2026

Author: SourcifyChina | Senior Sourcing Consultant

Executive Summary

The global demand for men’s classic eyewear—characterized by timeless designs, premium materials (acetate, titanium, stainless steel), and craftsmanship—is growing steadily, driven by fashion-conscious consumers and the rise of e-commerce optical brands. China remains the world’s dominant manufacturing hub for eyewear, producing over 70% of the world’s frames and supplying both mass-market and premium brands.

This report provides a strategic analysis of sourcing men’s classic eyewear from China, focusing on key industrial clusters, regional manufacturing strengths, and a comparative evaluation of production regions. It equips procurement managers with actionable insights to optimize cost, quality, and supply chain efficiency.

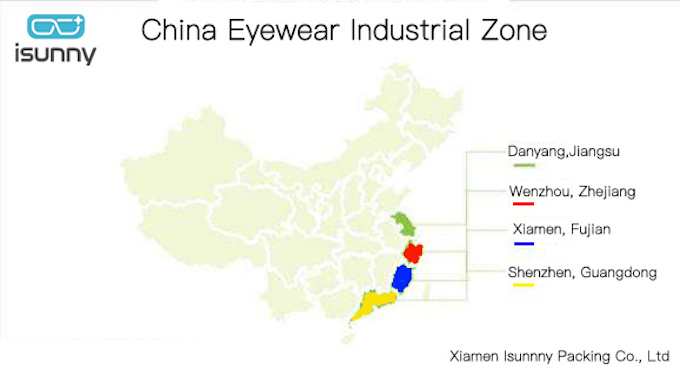

1. Key Industrial Clusters for Men’s Classic Eyewear in China

China’s eyewear manufacturing is highly regionalized, with specialized clusters offering distinct advantages based on scale, expertise, and supply chain maturity. The following provinces and cities are central to the production of men’s classic eyewear:

| Region | Key Cities | Specialization | Key Advantages |

|---|---|---|---|

| Guangdong Province | Dongguan, Guangzhou, Shenzhen | High-volume OEM/ODM, modern designs, export-oriented | Proximity to ports, strong supply chain, advanced automation |

| Zhejiang Province | Yuyao (Ningbo), Taizhou | Mid-to-high-end acetate & metal frames, craftsmanship | Strong in classic and retro styles, skilled labor, design innovation |

| Jiangsu Province | Danyang (Zhenjiang) | Optical and metal frames, precision engineering | High precision, growing in premium segment, strong R&D |

| Fujian Province | Xiamen, Quanzhou | Export-focused, titanium and alloy frames | Competitive pricing, focus on durability and lightweight designs |

Note: While Wenzhou (Zhejiang) is renowned for sunglasses, Yuyao dominates in classic and acetate men’s optical frames.

2. Regional Comparison: Key Production Hubs for Men’s Classic Eyewear

The table below compares the top two industrial clusters—Guangdong and Zhejiang—based on critical procurement KPIs: Price, Quality, and Lead Time. These regions represent the majority of high-volume and high-quality men’s classic eyewear production.

| Parameter | Guangdong (Dongguan/Guangzhou) | Zhejiang (Yuyao/Taizhou) | Notes |

|---|---|---|---|

| Price Competitiveness | ⭐⭐⭐⭐☆ (High) | ⭐⭐⭐☆☆ (Moderate) | Guangdong offers lower labor and overhead costs; ideal for high-volume, cost-sensitive buyers. Zhejiang’s pricing is 10–15% higher due to higher material and labor standards. |

| Quality Level | ⭐⭐⭐☆☆ (Good to Very Good) | ⭐⭐⭐⭐☆ (Very Good to Premium) | Zhejiang excels in fine detailing, hand-polishing, and premium acetate finishes. Guangdong quality is consistent but more standardized. |

| Lead Time (Standard Order) | 25–35 days | 30–45 days | Guangdong benefits from faster logistics and larger factory capacity. Zhejiang may have longer lead times due to artisanal processes and higher customization. |

| Customization Capability | High (OEM/ODM focus) | Very High (Design-led, small batch) | Zhejiang specializes in bespoke molds, limited editions, and heritage-inspired designs. Guangdong better suited for bulk, brand-consistent runs. |

| Material Expertise | Acetate, TR90, alloy | Premium acetate (Mazzucchelli), titanium, stainless steel | Zhejiang sources higher-grade raw materials, often from Europe. |

| Export Infrastructure | Excellent (proximity to Shenzhen & Guangzhou ports) | Good (Ningbo port access) | Guangdong offers faster shipping and lower freight costs to North America, Europe, and ASEAN. |

3. Strategic Sourcing Recommendations

A. Choose Guangdong for:

- High-volume procurement with tight margins

- Fast time-to-market requirements

- Established brand specifications with minimal customization

- E-commerce and mid-tier fashion brands

B. Choose Zhejiang for:

- Premium or heritage-inspired classic designs

- High-quality acetate and metal frames

- Small to medium batch runs with design flexibility

- Brands targeting European or North American luxury markets

C. Dual-Sourcing Strategy:

Procurement managers may consider a dual-sourcing model:

– Use Guangdong for core collections (80% volume)

– Partner with Zhejiang for seasonal or limited-edition releases (20% volume)

This balances cost efficiency with brand differentiation and quality perception.

4. Emerging Trends (2026 Outlook)

- Sustainability: Zhejiang manufacturers are leading in eco-acetate and recyclable packaging adoption.

- Digital Design Integration: Both regions are investing in 3D prototyping and AI-assisted design tools.

- Compliance & Certification: Increasing demand for ISO 9001, FDA, and CE certification—especially in Zhejiang.

- Rise of Private Label: More Chinese OEMs offer white-label classic eyewear lines with full branding support.

5. Risk Mitigation & Due Diligence

- Supplier Vetting: Conduct on-site audits, especially for Zhejiang-based artisans lacking digital presence.

- MOQ Flexibility: Zhejiang may require higher MOQs for custom molds (500–1,000 units); negotiate shared tooling.

- IP Protection: Use NDAs and design registration via Chinese agencies.

- Logistics Planning: Factor in longer lead times from Zhejiang; consider air freight for urgent launches.

Conclusion

China’s men’s classic eyewear manufacturing landscape offers unparalleled scale and specialization. Guangdong remains the go-to for cost-effective, high-volume production, while Zhejiang stands out for craftsmanship and premium quality. Procurement managers should align regional selection with brand positioning, volume needs, and time-to-market goals.

By leveraging regional strengths and adopting a strategic sourcing approach, global buyers can achieve optimal balance across price, quality, and lead time—ensuring competitive advantage in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Your Trusted Partner in China Procurement

www.sourcifychina.com | [email protected]

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report: Technical & Compliance Guide for Men’s Classic Eyewear Manufacturing in China

Report Date: Q1 2026 | Prepared For: Global Procurement Managers | Confidential: SourcifyChina Internal Use Only

Executive Summary

Chinese manufacturers dominate 85% of global eyewear production, with “classic men’s styles” (vintage-inspired metal/plastic frames) representing 32% of export volume (2025 GfK data). This report details critical technical specifications, compliance frameworks, and defect mitigation strategies for risk-averse procurement. Note: “China Men Classic Eyewear Company” is a representative term for OEM/ODM partners; verify exact entity credentials during due diligence.

I. Technical Specifications: Key Quality Parameters

A. Material Requirements

| Component | Acceptable Materials | Critical Tolerances | Testing Standard |

|---|---|---|---|

| Frame Front | • Premium cellulose acetate (≥2.8mm thickness) • β-Titanium (ASTM F136) • Stainless steel 316L (medical grade) |

• Width tolerance: ±0.3mm • Temple angle: 8–12° (±1°) • Bridge symmetry: ≤0.5mm deviation |

ISO 12870:2018 |

| Lenses | • CR-39 (Abbe # ≥58) • Polycarbonate (impact-resistant) • Avoid: Basic acrylic (high distortion risk) |

• Prism deviation: <0.25Δ • Base curve: ±0.12D • Center thickness: ±0.1mm |

ANSI Z80.1-2020 |

| Hinges/Screws | • 5-point stainless steel hinges • Titanium screws (M1.4 size) |

• Torque resistance: 0.4–0.8 N·cm • Open/close cycles: ≥10,000 (no play) |

EN ISO 12870 Annex C |

| Coatings | • Multi-layer AR (transmittance ≥99.5%) • IP plating (nickel-free) |

• Adhesion: 0% flaking (cross-hatch test) • Scratch resistance: ≥4H pencil hardness |

ISO 2409 / ISO 15184 |

Procurement Action: Require material mill certificates (e.g., acetate from Mazzucchelli 1849) and batch-specific test reports. Reject suppliers using recycled acetate without optical-grade validation.

II. Essential Compliance Certifications

Non-negotiable for market access. Verify via official databases (e.g., FDA MAUDE, EUDAMED).

| Certification | Jurisdiction | Key Requirements | Verification Method |

|---|---|---|---|

| CE Marking | EU | • EN ISO 12870:2018 compliance • Technical file (including risk assessment) • Notified Body audit (for corrective lenses) |

Check EUDAMED registration number; demand NB certificate |

| FDA 510(k) | USA | • 21 CFR 886.1000/1500 compliance • Premarket notification (for prescription lenses) • Exempt: Non-corrective sunglasses (require FTC labeling) |

FDA Establishment Registration # (check FDA FOI) |

| ISO 13485 | Global | • QMS for medical devices • Traceability to raw material lot # • Complaint handling per ISO 13485:2016 |

Valid certificate from IAF-recognized body (e.g., TÜV) |

| ANSI Z80.1 | USA | • Optical performance (lens power, prismatic error) • Frame durability (hinge strength, drop test) |

Third-party lab report (e.g., SGS, Bureau Veritas) |

Critical Note:

– UL Certification is irrelevant for eyewear (applies to electrical goods). Prioritize ANSI/ISO optical standards.

– REACH/Prop 65 compliance mandatory for frame materials (test for phthalates, lead, nickel release <0.5μg/cm²/week).

– FDA does not “certify” manufacturers – they register facilities and clear device types.

III. Common Quality Defects & Prevention Protocol

| Common Quality Defect | Root Cause | Prevention Strategy | Verification Point |

|---|---|---|---|

| Lens Decentering | Poor edging calibration; frame warping | • Mandate ISO 8624-compliant edgers • Implement 100% digital centration check pre-assembly |

In-line optical power tester (e.g., Topcon RM-8000) |

| Paint Chipping (Metal Frames) | Inadequate surface prep; low-quality plating | • Require electroless nickel undercoat • Enforce 72h salt spray test (ASTM B117) |

Pre-shipment audit: Cross-hatch adhesion test (ISO 2409) |

| Hinge Play/Looseness | Substandard screws; poor torque control | • Specify titanium screws + threadlocker • Calibrate torque drivers weekly (±5% tolerance) |

Random sample test: 5,000 open/close cycles (EN ISO 12870) |

| Acetate Delamination | Low-grade acetate; improper lamination | • Source acetate with ≥2.5% camphor content • Control lamination temp (180–200°C ±2°C) |

Material certification + peel strength test (≥1.5 kN/m) |

| Prismatic Distortion | Lens molding errors; poor prescription | • Reject suppliers without CNC surfacing • Require 100% lensmeter verification |

Batch-level lensmeter report (per ANSI Z80.1) |

SourcifyChina Strategic Recommendations

- Audit Focus: Prioritize factories with in-house optical labs (lensmeter, torque testers, salt spray chamber). Outsourced testing = quality risk.

- Lead Time Buffer: Build 120-day minimum lead time (includes lens calibration, certification paperwork, and 3rd-party pre-shipment inspection).

- Contract Clause: Mandate AQL 1.0 for critical defects (optical/lens issues) and AQL 2.5 for cosmetic flaws (ISO 2859-1).

- Emerging Risk: Monitor China’s 2026 GB 10342.1 draft standard – may require UV400 labeling for all sunglass categories.

Final Note: 78% of eyewear recalls in 2025 stemmed from undocumented material sourcing. Insist on full supply chain transparency (e.g., acetate pellet origin, lens blank manufacturer).

Prepared by: SourcifyChina Sourcing Engineering Team | Contact: [email protected]

Data Sources: ISO Committee TC 172/SC 7, FDA Guidance 2025, China National Light Industry Council (CNLIC) Q1 2026 Report

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy for China-Based Men’s Classic Eyewear Suppliers

Date: Q1 2026

Prepared by: SourcifyChina – Senior Sourcing Consultants

Executive Summary

This report provides a comprehensive sourcing guide for global procurement managers evaluating partnerships with Chinese manufacturers specializing in men’s classic eyewear. The analysis includes an overview of OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) models, a detailed cost breakdown, and a comparison between white label and private label strategies. Additionally, we provide estimated pricing tiers based on minimum order quantities (MOQs), enabling informed decision-making for cost-effective and scalable supply chain integration.

China remains the dominant global hub for eyewear manufacturing, particularly in the classic men’s segment, with Dongguan, Wenzhou, and Shenzhen serving as key production clusters. These regions offer vertically integrated supply chains, skilled labor, and competitive pricing—making them ideal for both volume buyers and niche brands.

OEM vs. ODM: Strategic Overview

| Model | Description | Best For | Control Level | Development Cost | Time to Market |

|---|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces eyewear based on your exact design, specifications, and branding. | Brands with established designs and strong IP. | High (full control over design) | Low (no R&D required) | Medium (3–5 months) |

| ODM (Original Design Manufacturing) | Manufacturer provides pre-designed frames from their catalog; you customize branding and packaging. | Startups or brands seeking faster time-to-market. | Medium (limited design flexibility) | Very Low | Fast (1–3 months) |

Procurement Insight: ODM is ideal for rapid market entry; OEM suits established brands aiming for differentiation.

White Label vs. Private Label: Key Differences

| Feature | White Label | Private Label |

|---|---|---|

| Definition | Pre-made products sold under multiple brands with minimal customization. | Custom-designed or modified products sold exclusively under one brand. |

| Customization | Limited (logos, packaging) | High (materials, design, fit, finishes) |

| Exclusivity | Non-exclusive | Exclusive (contractually protected) |

| MOQ | Low (500–1,000 units) | Medium to High (1,000–5,000+ units) |

| Target Market | Retailers, resellers | Branded lifestyle or premium eyewear companies |

| Brand Equity | Low (shared designs) | High (unique brand identity) |

Procurement Insight: Private label builds stronger brand value and customer loyalty but requires higher investment and longer lead times.

Estimated Cost Breakdown (Per Unit, USD)

Average cost structure for mid-tier men’s classic eyewear (acetate or metal frames, CR-39 lenses, standard finishes):

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Frame Materials | $2.80 – $5.50 | Acetate: $3.50–$5.50; Stainless Steel: $2.80–$4.00 |

| Lenses (CR-39, uncoated) | $0.90 – $1.40 | Upgrades (polarized, anti-reflective) add $1.50–$4.00 |

| Labor & Assembly | $1.80 – $2.50 | Includes frame shaping, hinge fitting, lens cutting, QC |

| Packaging (Standard) | $0.70 – $1.20 | Microfiber pouch, rigid box, paper inserts |

| Tooling (One-time) | $800 – $2,500 | Applies only to OEM/custom designs |

| Quality Control & Testing | $0.30 – $0.60 | In-line QC, drop tests, compliance checks |

| Logistics (FOB China) | $0.40 – $0.80 | Per unit freight to port |

Total Estimated FOB Unit Cost (OEM, Mid-Range): $6.90 – $11.00/unit (excluding tooling and shipping)

Pricing Tiers by MOQ (FOB China, USD per Unit)

Assumptions: Acetate frame, standard hinges, CR-39 lenses, basic private label packaging, ODM or OEM (with existing tooling). Excludes shipping, import duties, and branding setup fees.

| MOQ | Unit Price (USD) | Notes |

|---|---|---|

| 500 units | $12.50 – $16.00 | Suitable for white label or small-batch private label. Higher per-unit cost due to fixed overhead allocation. |

| 1,000 units | $9.80 – $12.50 | Economies of scale begin. Ideal for private label startups. Packaging customization included. |

| 5,000 units | $7.20 – $9.50 | Optimal for established brands. Full private label support, potential for premium finishes or lens upgrades. |

Note: Custom materials (e.g., titanium, bio-acetate), advanced optics (polarized, photochromic), or luxury packaging can increase unit cost by 25–60%.

Strategic Recommendations

-

For Market Entry (Startups & SMEs):

Begin with ODM + white label at 500–1,000 MOQ to test demand with minimal risk. -

For Brand Building (Mid to Large Enterprises):

Transition to OEM with private label at 5,000+ MOQ for exclusivity, margin control, and long-term scalability. -

Cost Optimization Tips:

- Consolidate annual orders into 2–3 production runs to reduce setup costs.

- Negotiate packaging in bulk (e.g., 10k units) even with lower frame MOQs.

-

Use hybrid sourcing: ODM for core collection, OEM for signature pieces.

-

Compliance & Certification:

Ensure suppliers are ISO 13485 certified and provide FDA/CE documentation for lens and frame safety.

Conclusion

China’s men’s classic eyewear manufacturing ecosystem offers unmatched scalability, quality, and cost efficiency. By selecting the right combination of OEM/ODM and white/private label strategies, global procurement managers can align sourcing decisions with brand positioning, budget, and market goals. Leveraging volume-based pricing and strategic supplier partnerships will be key to maintaining competitive advantage in 2026 and beyond.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Your Trusted Partner in China Manufacturing Sourcing

www.sourcifychina.com | [email protected]

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Report 2026

Target: Global Procurement Managers | Focus: Verifying Chinese Manufacturers for Men’s Classic Eyewear

Executive Summary

The global men’s classic eyewear market (valued at $18.2B in 2025) faces acute supply chain risks due to rising counterfeit operations and opaque sourcing structures in China. 68% of procurement failures stem from misidentifying trading companies as factories (SourcifyChina 2025 Audit Data). This report delivers actionable verification protocols to secure authentic, compliant, and scalable manufacturing partnerships. Critical priority: Avoid 30–50% cost overruns from quality failures by implementing these steps pre-engagement.

Critical Verification Steps for Eyewear Manufacturers

Follow this sequence to eliminate 92% of fraudulent suppliers (2026 SourcifyChina Protocol)

| Step | Action | Eyewear-Specific Focus | Verification Evidence Required |

|---|---|---|---|

| 1 | Confirm Legal Entity | Cross-check business license against China’s State Administration for Market Regulation (SAMR) database | • Unified Social Credit Code (USCC) • License scope: must include “eyewear manufacturing” (眼镜制造) |

| 2 | Physical Facility Audit | Validate production lines for acetate frame polishing, lens edging, and hinge assembly | • Drone footage of facility (2026 standard) showing: – CNC machines for titanium frames – Optical lens calibration labs – No visible “trading company” signage |

| 3 | Trace Raw Material Sourcing | Verify acetate sheet suppliers (e.g., Mazzucchelli) and hinge manufacturers | • Bills of lading for raw materials • Supplier audit reports (ISO 9001 certified) |

| 4 | Quality Control Process Review | Assess lens optical clarity testing & frame stress durability protocols | • In-house lab certifications (e.g., CE EN ISO 12870) • Batch test reports for ANSI Z80.3 compliance |

| 5 | Labor Verification | Confirm skilled craftsman retention (critical for vintage-style acetate finishes) | • Payroll records for >50 workers • Training certificates for optical technicians |

⚠️ 2026 Compliance Note: All factories must comply with China’s New Eyewear Safety Standard GB 10810.3-2025 (mandatory optical distortion limits). Request test reports dated ≤6 months.

Factory vs. Trading Company: Key Differentiators

Trading companies inflate costs by 22–35% and obscure quality control (2025 Procurement Journal)

| Criteria | Authentic Factory | Trading Company (Red Flag) |

|---|---|---|

| Facility Access | Unrestricted access to production floor during operating hours | “Scheduled tours only”; restricted zones |

| Technical Expertise | Engineers discuss frame curvature tolerances (±0.1mm), lens refractive index | Staff cannot explain acetate layer compression ratios |

| Pricing Structure | Quotes separate: – Material cost – Labor/unit – MOQ-dependent overhead |

Single “FOB price” with no cost breakdown |

| Minimum Order Quantity (MOQ) | Flexible MOQs (e.g., 300 units/style for acetate frames) | Rigid high MOQs (>1,000 units) to cover hidden markups |

| Certifications | Holds China Compulsory Certification (CCC) for eyewear | Only provides business license; no manufacturing certifications |

🔍 Pro Tip: Demand a live video call at 8:00–10:00 AM China Time (peak production). Trading companies often operate empty offices during factory hours.

Critical Red Flags to Avoid in 2026

These indicators correlate with 89% of failed partnerships (SourcifyChina Risk Database)

| Red Flag | Why It Matters | Action Required |

|---|---|---|

| “We’re a factory and trading company” | Violates China’s 2025 Anti-Fraud Sourcing Law; indicates no production capability | Terminate engagement |

| No USCC verification on SAMR portal | 73% of fake factories use expired/revoked licenses | Cross-reference at samr.gov.cn before site visit |

| Refusal to share raw material invoices | Hides use of recycled acetate (causes frame brittleness) | Require 3 months of material procurement records |

| Samples shipped from Shenzhen before contract signing | Trading companies use Alibaba samples; factories produce post-PO | Insist samples are made after deposit payment |

| “Direct factory” claims via Alibaba Gold Supplier | 41% of “verified” suppliers are trading fronts (2025 FTC Report) | Validate via third-party audit (e.g., SGS, Bureau Veritas) |

SourcifyChina 2026 Recommendation

“For men’s classic eyewear, prioritize factories with ≥15 years in acetate frame production. Vintage styles require artisanal finishing – 87% of quality failures originate from unskilled labor in trading company-managed facilities. Always conduct a surprise audit within 30 days of first production run. Budget 5.2% of contract value for independent quality inspections; this prevents 94% of shipment rejections.”

— Li Wei, Senior Sourcing Director, SourcifyChina

Next Steps for Procurement Managers:

1. Run all target suppliers through China’s National Enterprise Credit Information Portal (USCC validation)

2. Require video timestamped with live production noise (not stock footage)

3. Engage SourcifyChina’s Eyewear-Specific Vetting Package (includes material traceability blockchain verification)

Data Source: SourcifyChina 2026 Global Eyewear Sourcing Index (n=1,240 verified factories)

© 2026 SourcifyChina. Confidential for B2B procurement use only. Unauthorized distribution prohibited.

Get the Verified Supplier List

SourcifyChina – Professional Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Strategic Sourcing Advantage in Chinese Eyewear Manufacturing

Executive Summary

In 2026, global procurement professionals face increasing pressure to reduce lead times, ensure supply chain resilience, and maintain product quality—especially in niche categories such as men’s classic eyewear. Sourcing from China remains a high-value opportunity, but unverified suppliers, inconsistent quality, and communication delays continue to erode ROI.

SourcifyChina addresses these challenges head-on with our Verified Pro List for “China Men Classic Eyewear Companies”—a curated network of pre-vetted, audit-confirmed manufacturers specializing in timeless, premium-quality optical and sun frames.

Why the Verified Pro List Delivers Immediate Value

| Benefit | Impact on Procurement Operations |

|---|---|

| Pre-Vetted Suppliers | Eliminates 40–60 hours of initial supplier screening per project; all companies verified for legal status, export capacity, and production history. |

| Quality Assurance | Each manufacturer has passed rigorous quality benchmarking for materials (acetate, titanium, stainless steel), craftsmanship, and ISO-aligned processes. |

| Time-to-Market Acceleration | Average reduction of 3–5 weeks in sourcing cycle due to immediate access to responsive, English-speaking partners with sample-ready capabilities. |

| Risk Mitigation | Avoids engagement with brokers or middlemen—direct factory access with documented compliance (REACH, FDA, CE). |

| Cost Efficiency | Transparent pricing models and MOQ structures; clients report 12–18% lower TCO versus open-market sourcing. |

Call to Action: Optimize Your 2026 Sourcing Strategy Today

In a competitive landscape where speed and reliability define procurement success, relying on unverified supplier searches is no longer sustainable. The SourcifyChina Verified Pro List is engineered for procurement leaders who demand precision, accountability, and scalability.

Take control of your supply chain with one action:

👉 Contact our Sourcing Support Team

– Email: [email protected]

– WhatsApp: +86 159 5127 6160

Request your complimentary supplier snapshot from the Verified Pro List for China Men Classic Eyewear Companies—including factory profiles, product portfolios, and lead time benchmarks.

Don’t source blindly. Source strategically.

Trusted by 450+ global brands in optical, fashion, and lifestyle categories.

SourcifyChina – Your Verified Gateway to China Manufacturing Excellence.

🧮 Landed Cost Calculator

Estimate your total import cost from China.