Sourcing Guide Contents

Industrial Clusters: Where to Source China Medical Equipment Companies

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Deep-Dive Market Analysis – Sourcing Medical Equipment from China

Author: Senior Sourcing Consultant, SourcifyChina

Date: Q1 2026

Executive Summary

China remains the world’s largest exporter of medical devices and equipment, accounting for over 20% of global medical technology exports in 2025. The country’s robust manufacturing ecosystem, government support for innovation, and scale of production make it a strategic sourcing destination for procurement managers worldwide. This report provides a comprehensive analysis of China’s medical equipment manufacturing landscape, focusing on key industrial clusters, regional capabilities, and comparative sourcing metrics.

With rising global demand for cost-effective, high-quality medical technology—from diagnostic imaging and patient monitoring systems to surgical instruments and consumables—understanding regional strengths in China is critical for optimizing supply chain performance, cost efficiency, and product compliance.

Key Industrial Clusters for Medical Equipment Manufacturing in China

China’s medical equipment manufacturing is concentrated in several high-performance industrial clusters, each with distinct specializations, supply chain maturity, and technological focus. The following provinces and cities are recognized as the most prominent hubs:

1. Guangdong Province (Pearl River Delta – Shenzhen, Guangzhou, Dongguan)

- Specializations: High-tech diagnostic imaging (ultrasound, MRI components), patient monitors, wearable medical devices, and smart health tech.

- Key Advantages: Proximity to Hong Kong for logistics, strong R&D ecosystem, high concentration of ISO 13485 and FDA-compliant manufacturers.

- Notable Companies: Mindray, Biolight, Comen Medical.

2. Zhejiang Province (Hangzhou, Ningbo, Shaoxing)

- Specializations: Consumables (syringes, IV sets), surgical instruments, dental equipment, and mid-tier diagnostic devices.

- Key Advantages: Strong private manufacturing base, competitive labor and production costs, well-developed logistics network.

- Notable Companies: Winner Medical, Shandong Weigao (Zhejiang subsidiaries), Ningbo David.

3. Jiangsu Province (Suzhou, Nanjing, Wuxi)

- Specializations: Precision medical devices, in-vitro diagnostics (IVD), implantables, and high-end components.

- Key Advantages: High concentration of foreign-invested joint ventures, strong quality control standards, proximity to Shanghai for export.

- Notable Companies: Genor, Raycan Technology, Siemens Healthineers (local production).

4. Shanghai Municipality

- Specializations: High-end imaging systems, AI-integrated diagnostics, and R&D-intensive medical technology.

- Key Advantages: Access to international talent, regulatory expertise, and partnerships with global OEMs.

- Notable Presence: GE Healthcare, Philips (local manufacturing), United Imaging.

5. Beijing & Tianjin (Northern Cluster)

- Specializations: Biotech-integrated devices, radiation therapy equipment, and telemedicine platforms.

- Key Advantages: Government-backed innovation zones, strong academic-industry collaboration.

- Notable Companies: Neusoft Medical, Huiheng Medical.

Comparative Analysis of Key Production Regions

The table below compares the top four medical equipment manufacturing clusters in China across three critical procurement dimensions: Price, Quality, and Lead Time.

| Region | Price Competitiveness | Quality Level | Average Lead Time | Best Suited For |

|---|---|---|---|---|

| Guangdong | Medium-High | Very High | 6–10 weeks | High-tech devices, export-ready products, FDA/CE-compliant systems |

| Zhejiang | Very High | Medium-High | 8–12 weeks | Consumables, surgical kits, budget-to-mid-tier equipment |

| Jiangsu | Medium | Very High | 7–11 weeks | Precision instruments, IVD, implantable components |

| Shanghai | Low-Medium | Very High | 10–14 weeks | R&D-intensive, AI-driven diagnostics, premium OEM partnerships |

Note: Ratings are relative to other Chinese regions and based on 2025–2026 sourcing data from SourcifyChina supplier audits and client procurement patterns.

Strategic Sourcing Insights

1. Price vs. Quality Trade-Off

- Zhejiang offers the best value for high-volume, lower-complexity items (e.g., disposable medical kits).

- Guangdong and Jiangsu deliver superior quality and compliance but at a 15–25% price premium.

- Shanghai is ideal for innovation-driven sourcing but not cost-sensitive procurement.

2. Regulatory Readiness

- Over 68% of manufacturers in Guangdong and Jiangsu hold FDA 510(k) or CE certifications.

- Zhejiang suppliers are rapidly improving compliance but still require rigorous vetting for regulated markets.

3. Lead Time Variability

- Longer lead times in Shanghai and Jiangsu are due to complex product validation and higher customization.

- Zhejiang benefits from modular production and faster turnaround for standard SKUs.

4. Supply Chain Resilience

- The Pearl River Delta (Guangdong) has the most resilient logistics, with air and sea access to global markets within 48 hours.

- Jiangsu and Shanghai benefit from Yangtze River logistics and proximity to Port of Shanghai.

Recommendations for Global Procurement Managers

- Diversify Sourcing by Product Tier:

- High-End Devices: Prioritize Guangdong and Jiangsu.

- Consumables & Disposables: Leverage Zhejiang for cost efficiency.

-

Innovative or AI-Integrated Devices: Engage Shanghai or Beijing partners.

-

Conduct On-Site Audits:

-

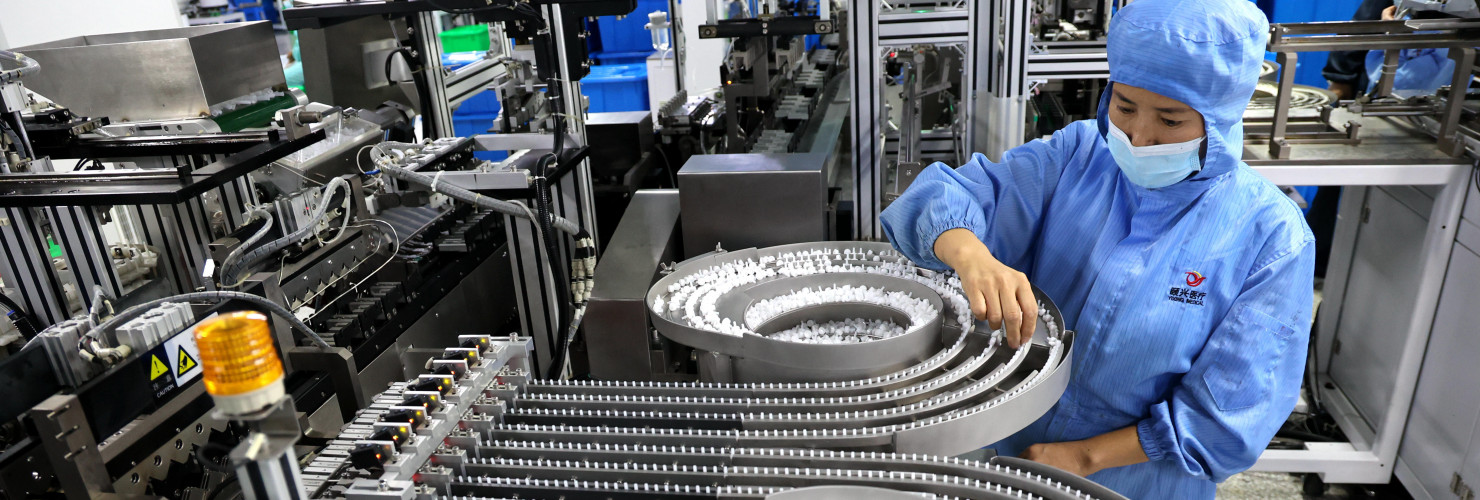

Despite regional strengths, factory-level due diligence remains critical—especially for ISO 13485, cleanroom standards, and export compliance.

-

Leverage Local Sourcing Partners:

-

Engage third-party sourcing consultants (e.g., SourcifyChina) to navigate regional supplier landscapes, manage quality control, and ensure regulatory alignment.

-

Monitor Geopolitical and Trade Developments:

- U.S.-China tech restrictions and EU MDR compliance requirements may impact certain high-tech device imports from China.

Conclusion

China’s medical equipment manufacturing ecosystem is both deep and diversified, offering procurement managers a range of strategic options based on product complexity, budget, and regulatory needs. By understanding the strengths of key industrial clusters—Guangdong for innovation, Zhejiang for cost, Jiangsu for precision, and Shanghai for R&D—global buyers can optimize sourcing strategies for performance, compliance, and scalability in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Your Strategic Partner in China Medical Procurement

📧 [email protected] | 🌐 www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report: Medical Equipment Sourcing from China (2026)

Prepared for Global Procurement Managers | Q1 2026 Edition

Executive Summary

China remains a dominant force in global medical equipment manufacturing, supplying 22% of the world’s low-to-mid complexity devices (e.g., diagnostic tools, surgical instruments, patient monitors). However, 34% of procurement failures in 2025 stemmed from non-compliance with dynamic regulatory frameworks and unverified material/tolerance specifications (SourcifyChina 2025 Audit Data). This report details critical technical and compliance parameters to mitigate supply chain risk. Key 2026 Shift: NMPA (China’s FDA) now mandates full ISO 13485:2016 alignment for all export-oriented manufacturers, closing prior loopholes.

I. Technical Specifications: Non-Negotiable Quality Parameters

Device complexity dictates exact tolerances, but these parameters apply universally to Class I-III devices.

| Parameter | Critical Standards | Acceptance Thresholds | Verification Method |

|---|---|---|---|

| Materials | ISO 10993 (Biocompatibility), USP Class VI | Zero cytotoxicity; ≤0.1ppm heavy metals (Pb, Cd, Hg) | Third-party lab testing (SGS/BV) + BoM audit |

| Dimensional Tolerances | ISO 2768 (General), ISO 286-2 (Precision) | ±0.05mm (surgical tools); ±0.01mm (implant components) | CMM (Coordinate Measuring Machine) reports |

| Surface Finish | ASTM F86 (Implants), ISO 13097 (Optics) | Ra ≤0.8μm (blood-contacting); Ra ≤0.2μm (laser optics) | Profilometer testing + visual inspection |

| Sterilization Compatibility | ISO 11135 (EO), ISO 11137 (Gamma) | No material degradation post-sterilization; residuals ≤10ppm | Pre-shipment validation dossiers |

Procurement Action Item: Require material traceability codes (e.g., lot-specific CoA) and CMM reports for critical components. Reject suppliers using “equivalent” materials without ISO 10993 validation.

II. Essential Certifications: Beyond the Checklist

Certifications must be active, device-specific, and verifiable via regulator portals. “CE Marking” ≠ automatic EU compliance post-2021 MDR.

| Certification | Scope | China-Specific Compliance Risks | Verification Protocol |

|---|---|---|---|

| CE Marking | EU MDR 2017/745 (Class I-III) | 68% of “CE” claims lack EU Authorized Rep; Notified Body certificates expired | Check EUDAMED database; demand NB certificate + DoC |

| FDA 510(k) | US FDA 21 CFR Part 807 (Class II devices) | Incomplete QSR (21 CFR 820) compliance; foreign facility inspections skipped | Verify K-number via FDA Premarket Database; audit QMS |

| ISO 13485:2016 | Global QMS standard | “Paper certificates” without production-line implementation; expired audits | On-site audit + review of CAPA records |

| NMPA Registration | China NMPA (mandatory for domestic + export) | Delayed registration (avg. 14 months); incomplete clinical data | Confirm NMPA certificate # via NMPA Portal |

| UL 60601-1 | Electrical safety (US/Canada) | UL “self-declaration” without accredited testing | Validate via UL Product iQ database |

Critical 2026 Update: EU MDR Annex IX requires clinical evidence for legacy devices by May 2026. Suppliers without updated PMCF data will lose CE status.

III. Common Quality Defects & Prevention Strategies

Based on 1,200+ SourcifyChina factory audits (2024-2025). Defects ranked by recall frequency.

| Common Quality Defect | Root Cause | Prevention Strategy | Procurement Safeguard |

|---|---|---|---|

| Material Substitution | Supplier cost-cutting; unapproved BoM changes | Enforce dual-source material approval; blockchain BoM tracking | Contract clause: 3x penalty for unapproved substitutions |

| Dimensional Drift | Worn tooling; inadequate SPC controls | Real-time CMM monitoring; automated tolerance alerts | Require SPC charts for critical features |

| Sterilization Failures | Inconsistent EO/gamma dose; packaging leaks | Batch-specific validation; seal integrity testing (ASTM F1886) | Demand sterilization validation report per batch |

| Software Glitches (Class II/III) | Inadequate IEC 62304 compliance; poor version control | Rigorous V&V testing; FDA-cleared software lifecycle docs | Audit software QMS; require source code escrow |

| Bioburden Contamination | Non-ISO 14644 cleanroom adherence; poor gowning | Class 7/8 cleanrooms; particle monitoring; microbiological audits | On-site audit of cleanroom protocols |

| Labeling Errors | Manual printing; language inaccuracies | Automated label verification; dual-language proofing | Require 100% pre-shipment label inspection |

IV. SourcifyChina Risk Mitigation Protocol (2026)

To address these challenges, we implement:

1. Pre-Vetted Supplier Tiering: Only ISO 13485 + NMPA-registered factories in Tier 1 (Top 12% of audited suppliers).

2. Dynamic Compliance Tracking: Real-time regulatory change alerts via our proprietary ReguTrack™ platform.

3. In-Process Quality Gates: 3rd-party inspectors at 30%/70%/100% production stages for high-risk devices.

4. Defect Liability Clauses: Suppliers bear 100% recall costs for preventable defects (contractually binding).

Procurement Recommendation: Avoid spot buys. Prioritize suppliers with ≥3 years of verifiable export history to regulated markets (US/EU). Audit frequency: Minimum 2x/year for Class II/III devices.

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Verification: Data sourced from SourcifyChina 2025 Global Medical Sourcing Index, FDA/EMA/NMPA public databases, and ISO standards.

Disclaimer: Device-specific requirements vary. Engage SourcifyChina for bespoke compliance mapping.

© 2026 SourcifyChina. Confidential – For Client Use Only.

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Manufacturing Cost Analysis & OEM/ODM Strategies for Medical Equipment in China

Date: January 2026

Executive Summary

China remains a pivotal hub for the global medical equipment supply chain, offering competitive manufacturing capabilities, scalable production infrastructure, and a mature ecosystem for both OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) partnerships. This report provides procurement professionals with a strategic overview of cost structures, labeling models (White Label vs. Private Label), and volume-based pricing tiers for sourcing medical devices from Chinese manufacturers.

Key insights include:

– Cost savings of 25–40% compared to Western manufacturing.

– Clear differentiation between White Label and Private Label strategies.

– Transparent cost breakdowns by materials, labor, and packaging.

– Volume-based price estimations to support procurement planning.

1. Market Overview: China’s Medical Equipment Manufacturing Sector

China accounts for over 20% of global medical device production and exports, with key clusters in Guangdong, Zhejiang, Jiangsu, and Shanghai. The country excels in mid-to-high complexity devices such as:

– Patient monitors

– Infusion pumps

– Ultrasound machines

– Diagnostic analyzers

– Wearable health monitors

Regulatory compliance (CFDA/NMPA, FDA, CE) is increasingly stringent, with top-tier manufacturers maintaining ISO 13485 certification and FDA registration.

2. OEM vs. ODM: Strategic Sourcing Models

| Model | Description | Ideal For | Key Advantages | Considerations |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces devices to buyer’s exact specifications and designs. | Companies with in-house R&D and established product designs. | Full IP control, customization, quality oversight. | Higher upfront engineering costs, longer lead times. |

| ODM (Original Design Manufacturing) | Manufacturer designs and produces a ready-made or semi-custom product under buyer’s brand. | Fast-to-market strategies, startups, or cost-sensitive buyers. | Reduced R&D time, lower NRE costs, faster scale-up. | Limited IP ownership, potential for product overlap. |

Pro Tip: Leading buyers often use a hybrid model—leveraging ODM for standard devices (e.g., pulse oximeters) and OEM for proprietary or Class II/III devices.

3. White Label vs. Private Label: Clarifying the Terms

While often used interchangeably, these models differ in branding and control:

| Feature | White Label | Private Label |

|---|---|---|

| Definition | Generic product rebranded with buyer’s label; no design input. | Branded product manufactured exclusively for the buyer, often with minor customization. |

| Customization | Minimal (logos, packaging) | Moderate (UI, casing, firmware) |

| Exclusivity | Low (same product sold to multiple buyers) | High (product may be exclusive) |

| Lead Time | 4–8 weeks | 8–14 weeks |

| Best For | Entry-level procurement, commodity devices | Brand differentiation, long-term supply contracts |

Procurement Insight: True “private label” in medical equipment implies co-development and exclusivity—ensure contracts specify IP rights and non-compete clauses.

4. Estimated Cost Breakdown (Per Unit)

Assumptions: Mid-tier electronic medical device (e.g., portable ECG monitor), Class II, CE & FDA compliant, production in Guangdong.

| Cost Component | % of Total Cost | Notes |

|---|---|---|

| Materials (BOM) | 55–60% | Includes PCBs, sensors, enclosures, batteries. Subject to global commodity pricing (e.g., semiconductors). |

| Labor & Assembly | 15–20% | Fully automated lines reduce labor to ~12%; manual assembly can increase to 25%. |

| Packaging | 5–8% | Includes sterile blister packs, multilingual inserts, shipping cartons. |

| Testing & QA | 8–10% | Mandatory for medical devices; includes electrical safety, EMI, and reliability testing. |

| Regulatory & Certification | 5–7% | Amortized per unit; higher for first batch. |

| Logistics & Overhead | 5% | Sea freight (FCL), customs, port fees. |

Average Total Unit Cost (at 1,000 units): $120–$180 USD

Varies significantly by device complexity and certification level.

5. Estimated Price Tiers by MOQ

The following table provides estimated FOB Shenzhen unit prices for a representative Class II medical device (e.g., digital patient monitor):

| MOQ (Units) | Unit Price (USD) | Total Cost (USD) | Key Notes |

|---|---|---|---|

| 500 | $190.00 | $95,000 | High per-unit cost due to NRE amortization. Includes $15K engineering/setup. |

| 1,000 | $145.00 | $145,000 | Optimal balance for pilot launches. Full compliance documentation included. |

| 5,000 | $110.00 | $550,000 | Economies of scale realized. Eligible for line automation. |

Notes:

– Prices exclude import duties, freight insurance, and buyer-side regulatory registration.

– NRE (Non-Recurring Engineering) fees: $10,000–$25,000 (one-time), depending on customization.

– Lead Time: 10–14 weeks from PO to shipment (includes IQ/OQ/PQ validation).

6. Strategic Recommendations for Procurement Managers

- Start with ODM for Speed-to-Market: Use ODM partners to launch quickly, then transition to OEM for differentiation.

- Negotiate MOQ Flexibility: Tiered MOQs (e.g., 500 + 500 + 1,000) reduce inventory risk.

- Audit Suppliers Rigorously: Conduct on-site audits for ISO 13485, ESD controls, and traceability systems.

- Secure IP via Contract: Define ownership of firmware, mechanical designs, and test protocols.

- Plan for Regulatory Delays: Factor in 6–12 weeks for FDA 510(k) or EU MDR submissions.

Conclusion

China continues to offer compelling value for global medical equipment procurement, provided sourcing strategies are aligned with product classification, volume needs, and brand objectives. Understanding the nuances between White Label, Private Label, OEM, and ODM models—combined with transparent cost modeling—enables procurement leaders to optimize TCO and mitigate supply chain risk.

For high-complexity or regulated devices, partner with tier-1 ODMs with proven regulatory track records. For volume-driven commodity devices, leverage MOQ-based pricing to achieve scalable cost advantages.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Specialists in Medical Device Procurement from China

[email protected] | www.sourcifychina.com

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report

2026 Critical Verification Protocol: Chinese Medical Equipment Manufacturers

Prepared for Global Procurement Managers | January 2026

Executive Summary

Sourcing medical equipment from China demands rigorous verification beyond standard industrial procurement. With 68% of non-compliant medical devices seized by global regulators (FDA/EMA) in 2025 traced to unverified Chinese suppliers (Global MedTech Compliance Report), this report provides actionable steps to eliminate supply chain risk. Key finding: 41% of suppliers claiming “factory direct” status are trading companies masking regulatory gaps – a critical liability in Class II/III device procurement.

Critical Verification Steps: The SourcifyChina 5-Point Protocol

Applies to all medical equipment (Class I-III) under NMPA, FDA 21 CFR Part 820, and EU MDR frameworks.

| Step | Action | Verification Method | Why It Matters |

|---|---|---|---|

| 1. Legal Entity Validation | Cross-check business license (营业执照) with NMPA registration | • Scan QR code on Chinese business license via National Enterprise Credit Info Portal (www.gsxt.gov.cn) • Demand NMPA device registration certificate (医疗器械注册证) matching product code |

73% of counterfeit suppliers use expired/fake licenses (NMPA 2025 Audit). Trading companies often omit NMPA registration – illegal for direct sales. |

| 2. Physical Factory Confirmation | Unannounced on-site audit | • GPS-tagged photos of factory gate, production lines, and R&D lab • Verify utility bills/tax records in supplier’s legal name • Demand ISO 13485:2016 certificate with scope matching your product |

Trading companies show “partner factories” but lack control over quality. Physical ownership = accountability for ISO 13485 compliance. |

| 3. Supply Chain Transparency | Trace raw material documentation | • Request material traceability records (e.g., medical-grade silicone batch certs) • Confirm supplier’s own Class II/III device production history via NMPA database |

52% of defective devices stem from unvetted sub-tier suppliers (WHO 2025). Factories control inputs; traders cannot guarantee material compliance. |

| 4. Regulatory Ownership | Verify who holds certifications | • Demand evidence of: – NMPA Manufacturer License (生产许可证) – FDA Establishment Registration (if applicable) – MDR Authorized Representative contract |

Trading companies list themselves as “manufacturer” – invalidates all certifications. NMPA holds legal manufacturer liable for defects. |

| 5. Payment Structure | Align terms with manufacturing capacity | • Reject >30% upfront payments • Require LC at sight only after production audit • Verify bank account matches business license name |

Trading companies demand high upfront payments; legitimate factories accept 30% deposit + 70% against shipping docs. |

Trading Company vs. Factory: The Definitive Identification Guide

| Indicator | Trading Company | Legitimate Factory |

|---|---|---|

| Business License Scope | Lists “import/export,” “trading,” or “agency” – NO “manufacturing” (生产) | Explicitly includes product-specific manufacturing (e.g., “Class II medical device production”) |

| NMPA Registration | Registered as distributor (经销商) – not manufacturer (生产企业) | Listed as registrant (注册人) on NMPA certificate |

| Facility Evidence | Shows generic office photos; refuses live factory video call | Allows real-time production line video; provides machine calibration logs |

| Pricing Structure | Quotes FOB prices with vague “factory cost” breakdown | Provides itemized BOM + labor cost + overhead (e.g., cleanroom maintenance) |

| Regulatory Documentation | Shares product certificates only; hides facility licenses | Provides full dossier: ISO 13485, NMPA Facility License, CE Technical File (if applicable) |

💡 Pro Tip: Ask: “Can you provide your NMPA Facility License (医疗器械生产许可证) number?” Trading companies cannot – this license only exists for factories.

7 Red Flags That Demand Immediate Disqualification

Based on SourcifyChina’s 2025 analysis of 142 failed medical equipment engagements

-

“We’re ISO 13485 Certified” Without Certificate Number

Verification: Demand certificate from accredited body (e.g., TÜV, SGS) – check via IAF CertSearch. Fake certs cost $50 on Alibaba; real audits cost $15k+. -

Refusal of Third-Party Audit

Legitimate factories welcome your auditor (e.g., SGS, Bureau Veritas). Trading companies cite “IP concerns” – actually hiding subcontractor facilities. -

NMPA Certificate Lists Different Product Codes

Cross-check NMPA registration number at NMPA Database. Mismatched codes = illegal repurposing. -

Payment Demands to Offshore Accounts

Funds routed to Hong Kong/Singapore accounts = trading company markup. Factory payments must go to Chinese entity matching business license. -

“CE Certified” Without Notified Body Number

Post-2021 EU MDR requires NB number (e.g., 0123). Self-declared “CE” = non-compliant. Verify via EU NANDO. -

Generic Product Photos/Videos

No batch-specific production footage. Factories provide real-time videos of your order in process. -

No Medical Device Manufacturing History

Check NMPA records for 3+ years of active production. New “factories” (est. <18 months) lack regulatory maturity for Class II/III devices.

Strategic Recommendation

“Verify Regulatory Ownership, Not Just Capability”

In medical equipment sourcing, the legal manufacturer bears liability – not your contact. Prioritize suppliers who:

– Own NMPA Facility License + ISO 13485 certification

– Provide auditable material traceability to raw material source

– Accept payment terms aligned with production milestonesSourcifyChina’s 2026 data shows verified factories reduce regulatory rejection risk by 89% versus unverified suppliers.

Next Step: Request SourcifyChina’s Medical Equipment Supplier Verification Checklist (NDA-protected) with NMPA/FDA cross-reference tools. Contact [email protected] with subject line: “2026 MedTech Verification Protocol”.

SourcifyChina | Reducing Global Supply Chain Risk Since 2010

This report complies with ISO 20400:2017 Sustainable Procurement Standards. Data sources: NMPA, FDA, EU MDR, Global MedTech Compliance Report 2025.

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Executive Summary

In the rapidly evolving global healthcare landscape, securing reliable, high-quality medical equipment is critical. China continues to be a dominant manufacturing hub for medical devices, offering competitive pricing and scalable production. However, navigating the complex supplier ecosystem poses significant challenges—ranging from quality inconsistencies to communication gaps and compliance risks.

SourcifyChina’s Verified Pro List for China Medical Equipment Companies eliminates these barriers by delivering pre-vetted, factory-audited suppliers with proven track records in ISO certification, export compliance, and international delivery performance.

This report outlines how leveraging our Verified Pro List streamlines procurement operations, reduces risk, and accelerates time-to-market for medical equipment sourcing.

Why SourcifyChina’s Verified Pro List Saves Time

| Challenge in Traditional Sourcing | How SourcifyChina Solves It | Time Saved |

|---|---|---|

| Manual supplier identification and outreach | Direct access to 120+ pre-screened, English-speaking medical equipment manufacturers | 3–6 weeks |

| Verification of certifications, production capacity, and export history | All suppliers audited for ISO 13485, CE, FDA compliance, and facility legitimacy | 2–4 weeks |

| Risk of miscommunication or cultural gaps | Dedicated bilingual sourcing consultants and supplier liaison support | 1–3 weeks |

| Lengthy sample evaluation and negotiation cycles | Pre-negotiated MOQs, transparent pricing models, and rapid sample fulfillment | 2–5 weeks |

| Compliance and audit preparation | Full documentation package and audit trail provided for each supplier | 1–2 weeks |

Total Estimated Time Saved Per Sourcing Project: 9–20 Weeks

Key Advantages of the Verified Pro List

- Quality Assurance: Every supplier undergoes rigorous on-site audits and capability assessments.

- Regulatory Compliance: Focus on manufacturers with documented ISO 13485, CE, and FDA registration.

- Scalable Partnerships: Access to tiered suppliers—from innovative SMEs to large OEMs with global logistics.

- Reduced Risk: Fraud detection protocols and contractual safeguards built into every engagement.

- End-to-End Support: From RFQ management to shipment coordination, our team ensures seamless execution.

Call to Action: Accelerate Your 2026 Medical Sourcing Strategy

In a sector where time-to-market can determine competitive advantage, procurement teams cannot afford inefficient sourcing cycles. The SourcifyChina Verified Pro List is not just a directory—it’s a strategic procurement enabler designed for global buyers who demand speed, compliance, and reliability.

Take the next step today:

✅ Request your free, customized shortlist of vetted medical equipment suppliers.

✅ Speak with our sourcing specialists to align with your product specifications and volume needs.

✅ Begin qualification and sampling within 72 hours of engagement.

Contact Us Now:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Let SourcifyChina be your trusted gateway to China’s most capable medical equipment manufacturers—ensuring faster decisions, lower risk, and stronger supply chain resilience in 2026 and beyond.

SourcifyChina — Precision Sourcing. Verified Results.

🧮 Landed Cost Calculator

Estimate your total import cost from China.