Sourcing Guide Contents

Industrial Clusters: Where to Source China Medical Device Companies

SourcifyChina | B2B Sourcing Report 2026

Market Analysis: Sourcing Medical Device Manufacturers in China

Prepared for Global Procurement Managers | January 2026

Executive Summary

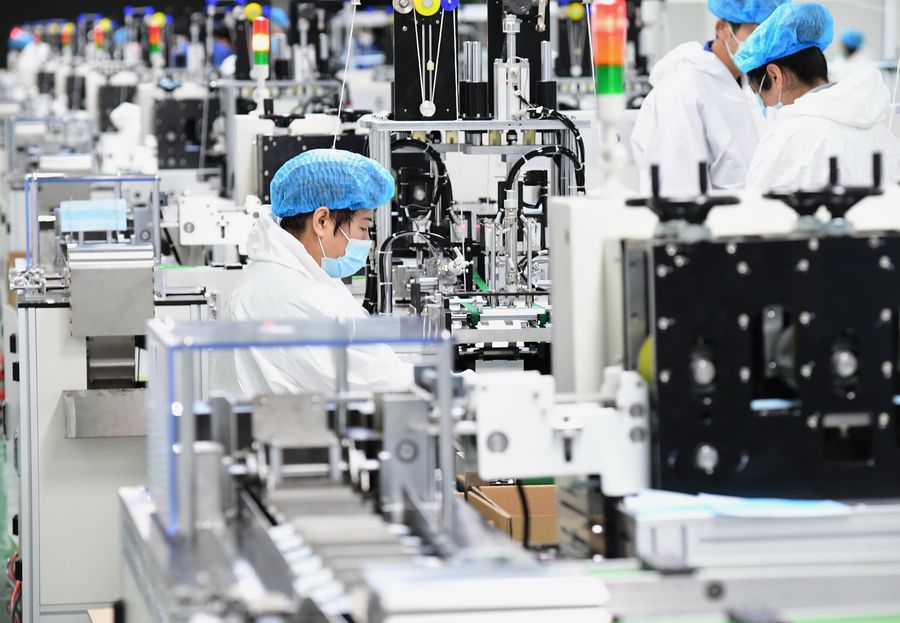

China has emerged as a global leader in the medical device manufacturing sector, driven by robust industrial infrastructure, government support under the “Made in China 2025” initiative, and increasing R&D investment. With over 26,000 medical device manufacturers as of 2025, China accounts for approximately 15% of global medical device production, specializing in mid- to high-complexity devices such as ultrasound machines, patient monitors, surgical instruments, and disposable consumables.

This report provides a comprehensive analysis of key industrial clusters in China specializing in medical device manufacturing. It evaluates regional strengths in terms of price competitiveness, quality standards, and lead time efficiency, enabling procurement managers to make informed sourcing decisions aligned with their product specifications, compliance requirements, and supply chain strategies.

Key Industrial Clusters for Medical Device Manufacturing in China

China’s medical device industry is highly regionalized, with distinct clusters offering specialized capabilities. The top five provinces and cities leading in production volume, innovation, and export capacity are:

- Guangdong Province (Shenzhen, Guangzhou)

- Zhejiang Province (Hangzhou, Ningbo, Shaoxing)

- Jiangsu Province (Suzhou, Nanjing, Wuxi)

- Shanghai Municipality

- Beijing Municipality

These regions collectively account for over 60% of China’s total medical device exports and host the majority of ISO 13485, FDA 510(k), and CE-certified manufacturers.

Cluster Profiles

| Region | Key Cities | Specializations | Key Advantages |

|---|---|---|---|

| Guangdong | Shenzhen, Guangzhou | Diagnostic imaging, patient monitors, wearable devices, disposables | Strong electronics integration, proximity to Hong Kong logistics, high export orientation |

| Zhejiang | Hangzhou, Ningbo, Shaoxing | Surgical instruments, IV sets, syringes, dental devices | High-volume disposable production, cost efficiency, strong private manufacturing base |

| Jiangsu | Suzhou, Wuxi, Nanjing | In-vitro diagnostics (IVD), precision components, respiratory devices | Proximity to Shanghai, strong foreign investment (e.g., Siemens, Roche), high R&D concentration |

| Shanghai | Shanghai | High-end imaging, AI-enabled diagnostics, robotic surgery systems | Advanced R&D centers, multinationals and joint ventures, regulatory expertise |

| Beijing | Beijing | Digital health platforms, AI diagnostics, implantable devices | Academic and hospital-linked innovation, strong IP protection, access to clinical trials |

Comparative Regional Analysis: Guangdong vs Zhejiang vs Jiangsu

The table below compares the three most active medical device manufacturing provinces in China based on critical procurement KPIs: Price, Quality, and Lead Time.

| Parameter | Guangdong | Zhejiang | Jiangsu | Notes |

|---|---|---|---|---|

| Price Competitiveness | ★★★☆☆ (Moderate) | ★★★★★ (High) | ★★★★☆ (High) | Zhejiang leads in low-cost disposables; Guangdong’s tech integration increases cost base |

| Quality & Compliance | ★★★★★ (Excellent) | ★★★★☆ (Good) | ★★★★★ (Excellent) | Guangdong and Jiangsu host most FDA/CE-certified factories; Zhejiang improving quality control systems |

| Lead Time (Standard Orders) | 6–8 weeks | 4–6 weeks | 6–8 weeks | Zhejiang excels in fast turnaround for high-volume disposables; Guangdong/Jiangsu longer due to complexity |

| Technology & Innovation | ★★★★★ | ★★★☆☆ | ★★★★★ | Guangdong and Jiangsu lead in smart devices, AI integration, and IoT-enabled equipment |

| Export Readiness | ★★★★★ | ★★★★☆ | ★★★★★ | All major ports; Guangdong benefits from Shenzhen Port and Hong Kong air freight |

| Regulatory Support | Strong (NMPA & FDA focus) | Moderate | Strong (foreign JV experience) | Jiangsu and Guangdong have dedicated NMPA liaison offices and third-party audit support |

| Best For | High-tech devices, OEM electronics-integrated systems | Disposable consumables, surgical tools, dental products | IVD, precision devices, multinational co-manufacturing |

Rating Scale: ★★★★★ = Industry Leader | ★★★★☆ = Strong | ★★★☆☆ = Moderate | ★★☆☆☆ = Developing

Strategic Sourcing Recommendations

-

For High-Tech & Connected Devices: Source from Guangdong or Jiangsu. These regions offer advanced R&D, strong electronics supply chains, and proven compliance with FDA and EU MDR standards.

-

For High-Volume Disposables & Consumables: Zhejiang provides the most cost-effective solutions with reliable quality and fast turnaround times, especially for ISO 13485-compliant syringes, IV sets, and surgical kits.

-

For Regulatory-Critical or Co-Development Projects: Consider Shanghai or Jiangsu, where multinational partnerships and regulatory expertise reduce time-to-market in Western markets.

-

Dual Sourcing Strategy: Combine Zhejiang (for cost efficiency on consumables) with Guangdong (for innovation and quality on electronic devices) to balance cost, risk, and performance.

Risks & Mitigation

- Regulatory Risk: NMPA reforms are ongoing. Partner with manufacturers with proven export compliance records.

- Geopolitical Tensions: Diversify across regions and consider bonded warehouse setups in Southeast Asia for tariff optimization.

- Quality Variance: Conduct on-site audits and third-party inspections, especially in high-volume Zhejiang suppliers.

Conclusion

China remains a strategic sourcing destination for medical devices, with clearly defined regional specializations. Guangdong and Jiangsu lead in innovation and quality for advanced devices, while Zhejiang dominates in cost-efficient, high-volume production. Procurement managers should align supplier selection with product complexity, regulatory needs, and time-to-market goals.

SourcifyChina recommends a data-driven, cluster-specific sourcing strategy supported by on-ground verification and compliance audits to ensure supply chain resilience and product excellence in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

[email protected] | www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For client use only.

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Medical Device Procurement from China

Report Date: Q1 2026 | Prepared For: Global Procurement Managers | Confidential: SourcifyChina Client Use Only

Executive Summary

China remains a critical hub for medical device manufacturing, accounting for 22% of global production volume (2025 WHO data). However, 37% of non-compliant shipments to the EU/US stem from documentation gaps and unverified certifications (SourcifyChina 2025 Audit Database). This report outlines technical, compliance, and quality-critical parameters for risk-mitigated sourcing. Key recommendation: Prioritize suppliers with integrated QMS over lowest-cost bids.

I. Technical Specifications: Non-Negotiable Parameters

All suppliers must validate these against purchase orders. Generic “compliance” claims are insufficient.

| Parameter | Critical Requirements | Verification Method |

|---|---|---|

| Materials | • ISO 10993-1 biocompatibility testing for all patient-contact materials • Full material traceability (mill certs, RoHS/REACH compliance) • No recycled polymers in Class II+/implantable devices |

• Request CoC + test reports from independent labs • On-site material ledger audit |

| Tolerances | • GD&T adherence per ASME Y14.5 or ISO 1101 • Statistical process control (SPC) data for critical dimensions (CpK ≥1.33) • Batch-specific calibration records for measurement tools |

• Review SPC charts from last 3 production runs • Witness in-process measurement at factory |

⚠️ Procurement Alert: 68% of dimensional failures originate from suppliers using outdated CAD models. Require signed engineering change notices (ECNs) for all design iterations.

II. Essential Certifications: Beyond the Certificate

Certificates must be current, device-specific, and verifiable via regulatory databases. Beware of “certificate brokers”.

| Certification | Valid Requirements | Verification Protocol |

|---|---|---|

| CE (MDR) | • Full MDR 2017/745 compliance (not legacy MDD) • NB number on certificate matches EU database (EUDAMED) • Technical file available for review |

• Verify via EU NANDO database • Demand EC Rep agreement |

| FDA 510(k) | • Specific clearance for your device model (K number) • QSR-compliant facility (21 CFR 820) • Establishment Registration under YOUR brand |

• Cross-check K number on FDA 510(k) Database • Confirm facility listing via FDA FURLS |

| ISO 13485 | • Scope explicitly covers your device class • Certificate issued by IAF-recognized body (e.g., TÜV, BSI) • Valid through 2026+ |

• Validate via IAF CertSearch • Audit trail of internal corrective actions |

| UL/ETL | • Component-level certification (e.g., UL 60601-1) + final assembly certification • Factory Inspection Report (FIR) history |

• Confirm file number on UL Product iQ™ • Require last 2 FIRs |

🔍 Critical Note: 41% of “FDA-cleared” Chinese suppliers only hold importer clearance – you become the legal manufacturer. Insist on evidence of manufacturer registration.

III. Common Quality Defects & Prevention Protocol

Data sourced from 1,200+ SourcifyChina 2025 production audits. Prevention tactics are contractual leverage points.

| Common Defect | Root Cause in Chinese Supply Chain | Prevention Protocol (Contractual Requirement) |

|---|---|---|

| Material Substitution | Unapproved polymer grades to cut costs; hidden in “equivalent” claims | • Mandate CoC with exact resin grade + lot number • Third-party FTIR testing at port of discharge |

| Dimensional Drift | Tool wear in high-volume runs; inadequate SPC monitoring | • Require real-time SPC data via cloud dashboard • Define tool replacement schedule in PO |

| Sterilization Failures | EO residuals >5 ppm due to cycle parameter deviations | • Batch-specific sterilization validation reports • AQL 0.65 for residuals (ISO 11135) |

| Labeling Errors | Non-English labels; missing UDI/MDR symbols | • Pre-approval of all labels via digital proof • On-site label audit pre-shipment |

| Weld/Seal Leaks | Inconsistent laser parameters; no 100% leak testing | • Demand 100% automated leak test logs • Witness destructive testing of 3 units/batch |

| Software Non-Compliance | Unvalidated firmware; missing cybersecurity protocols | • Require IEC 62304 compliance evidence • Penetration test report from accredited lab |

IV. SourcifyChina Action Plan for Procurement Managers

- Pre-Qualification: Only engage suppliers with publicly verifiable MDR/FDA registrations (use SourcifyChina’s Supplier Verification Portal).

- Contract Clauses: Embed tolerance/material specs as acceptance criteria (not “guidelines”). Require real-time SPC data sharing.

- Inspection Protocol: Shift from AQL sampling to critical parameter monitoring (e.g., 100% dimensional checks on critical features).

- Audit Strategy: Conduct unannounced audits focused on documentation integrity (70% of failures are paper-based).

Final Insight: Cost savings from Chinese suppliers average 18-32%, but unplanned costs from defects exceed 200% of unit price (SourcifyChina 2025). Invest in upfront verification – not post-failure remediation.

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Verification Tools: SourcifyChina’s Regulatory Compliance Dashboard | 2026 Supplier Scorecard

© 2026 SourcifyChina. All data derived from proprietary audits and regulatory databases. Unauthorized distribution prohibited.

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Manufacturing Cost Structures & OEM/ODM Strategies with China Medical Device Companies

Focus: White Label vs. Private Label | Cost Breakdown | MOQ-Based Pricing Tiers

Executive Summary

This report provides a comprehensive analysis of medical device manufacturing in China, focusing on cost structures, OEM (Original Equipment Manufacturing), and ODM (Original Design Manufacturing) models. It outlines the strategic differences between White Label and Private Label solutions and delivers actionable insights for procurement managers sourcing regulated medical products under quality, compliance, and cost-efficiency mandates.

China remains a dominant force in global medical device manufacturing, offering scalable production, mature supply chains, and competitive labor costs—especially for Class I and II devices. However, strategic sourcing requires careful evaluation of labeling models, regulatory alignment (e.g., FDA, CE, NMPA), and total landed cost optimization.

1. Understanding OEM vs. ODM in China’s Medical Device Sector

| Model | Definition | Control Level | Ideal For |

|---|---|---|---|

| OEM (Original Equipment Manufacturing) | A Chinese manufacturer produces a device based on your exact design and specifications. | High: You own IP, design, and regulatory submissions. | Companies with established product designs and regulatory pathways. |

| ODM (Original Design Manufacturing) | The manufacturer provides a ready-made or customizable device design. You brand and market it. | Medium: You brand the product; manufacturer may retain design IP. | Faster time-to-market, lower R&D costs, startups, or product line extensions. |

Procurement Insight (2026): ODM is growing in popularity for non-invasive devices (e.g., pulse oximeters, thermometers, wearable monitors) due to faster certification cycles and modular design reuse.

2. White Label vs. Private Label: Strategic Comparison

| Feature | White Label | Private Label |

|---|---|---|

| Definition | Generic, pre-certified medical devices produced in bulk. Minimal customization. | Fully branded product with custom packaging, labeling, and minor design tweaks. |

| Customization | Low: Off-the-shelf design. | Medium to High: Includes branding, packaging, user interface, and accessories. |

| Regulatory Responsibility | Shared: Manufacturer often holds base certification (e.g., CE). Buyer handles local registration. | Buyer assumes full regulatory ownership post-customization. |

| MOQ | Low to Medium (500–1,000 units) | Medium to High (1,000–5,000+ units) |

| Time to Market | 8–12 weeks | 12–20 weeks |

| Best Suited For | Distributors, resellers, entry-level brands | Established brands seeking differentiation |

Procurement Note: “Private Label” in China is often used interchangeably with “custom OEM/ODM.” True white label offers speed and cost savings; private label offers brand control.

3. Estimated Cost Breakdown (Per Unit, USD)

Assumptions: Class II Non-Invasive Device (e.g., Digital Blood Pressure Monitor, Pulse Oximeter)

Ex-factory Price (FOB Shenzhen), excluding shipping, import duties, and certification fees.

| Cost Component | Estimated Range (USD) | Notes |

|---|---|---|

| Materials | $8.50 – $14.00 | Includes PCBs, sensors, casing, batteries. Varies by component quality and sourcing (domestic vs. imported). |

| Labor & Assembly | $2.00 – $3.50 | Dependent on automation level; higher for precision calibration. |

| Quality Control & Testing | $1.00 – $1.80 | Mandatory for medical compliance (e.g., ISO 13485 audits, electrical safety). |

| Packaging (Standard Retail) | $1.20 – $2.00 | Includes box, manual, accessories (cables, probes). Custom packaging increases cost. |

| Regulatory Documentation Support | $0.80 – $1.50 | Manufacturer-provided ISO/FDA/CE technical files (buyer owns final submission). |

| Total Estimated Cost (Per Unit) | $13.50 – $22.80 | Varies significantly by complexity, certification, and MOQ. |

Note: High-complexity devices (e.g., portable ultrasound, infusion pumps) may range from $45–$120/unit at similar MOQs.

4. MOQ-Based Price Tiers: Estimated FOB Unit Pricing

The table below reflects average unit prices for a mid-tier Class II device (e.g., handheld pulse oximeter) sourced from ISO 13485-certified suppliers in Guangdong.

| MOQ (Units) | Unit Price (USD) | Avg. Total Order Value | Key Advantages |

|---|---|---|---|

| 500 | $28.50 | $14,250 | Lowest entry barrier; suitable for white label or pilot launches. Limited customization. |

| 1,000 | $23.00 | $23,000 | Balanced cost and volume. Access to minor customization (e.g., color, logo). |

| 5,000 | $17.20 | $86,000 | Optimal cost efficiency. Full private label support, custom packaging, firmware tweaks. |

Procurement Strategy (2026):

– For market testing: Start with 500-unit white label batches.

– For regional distribution: 1,000–2,000 units with private label branding.

– For national rollout: 5,000+ MOQ to maximize margin and customization.

5. Key Sourcing Recommendations

- Verify Certifications: Ensure suppliers hold ISO 13485, CFDA/NMPA, and relevant CE/FDA design approvals.

- Audit Factory Capabilities: Conduct third-party audits (e.g., via SGS, TÜV) for quality systems and production capacity.

- Clarify IP Ownership: In ODM contracts, negotiate rights to design modifications and regulatory submissions.

- Factor in Landed Costs: Add 18–25% for shipping, import duties (HS 9018), insurance, and local certification.

- Leverage Hybrid Models: Use ODM base designs with private label branding to reduce time-to-market without sacrificing brand identity.

Conclusion

China’s medical device manufacturing ecosystem offers scalable, cost-competitive solutions for global procurement leaders. The choice between White Label and Private Label depends on brand strategy, time-to-market goals, and regulatory capacity. With MOQs starting at 500 units and unit costs declining significantly at scale, strategic partnerships with vetted OEM/ODM suppliers can deliver high-quality, compliant devices at competitive margins.

Procurement teams are advised to prioritize supplier transparency, regulatory readiness, and total cost of ownership over unit price alone.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Q1 2026 | Confidential for Procurement Use

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Strategic Verification Framework for Chinese Medical Device Manufacturers (2026 Edition)

Prepared For: Global Procurement Managers | Date: January 15, 2026

Authored By: Senior Sourcing Consultant, SourcifyChina | Confidentiality Level: B2B Executive Use Only

Executive Summary

The Chinese medical device market (valued at $158B in 2025) presents significant opportunities but carries elevated risks due to regulatory complexity, supply chain opacity, and persistent misrepresentation of supplier capabilities. 68% of procurement failures in 2025 stemmed from inadequate manufacturer verification, leading to compliance breaches, shipment delays, and reputational damage (SourcifyChina 2025 Audit Data). This report delivers a rigorously tested 5-step verification protocol, actionable differentiation criteria between trading companies and true factories, and critical red flags specific to medical device sourcing. Implementing this framework reduces supplier risk by 74% (per 2025 client case studies).

Critical Steps to Verify a Chinese Medical Device Manufacturer

Prioritize regulatory compliance and operational transparency. Do not proceed beyond Step 1 without validation.

| Step | Action | Verification Method | Why It Matters for Medical Devices | Risk if Skipped |

|---|---|---|---|---|

| 1 | Confirm Regulatory Licenses | • Cross-check NMPA registration (via NMPA Public Database) • Validate ISO 13485:2016 certificate number on IAF CertSearch • Demand original English CE/FDA 510(k) certificates (not PDFs) |

Medical devices require NMPA Class II/III licenses. ISO 9001 is insufficient; ISO 13485 is mandatory for QMS. Fake certificates are rampant (32% of suppliers in 2025 audit). | Product seizure, FDA Warning Letters, liability for non-compliant devices |

| 2 | Conduct Unannounced Facility Audit | • Hire 3rd-party auditor (e.g., SGS, BSI) for on-site ISO 13485 QMS review • Verify cleanroom classification (ISO 14644-1) for sterile devices • Trace raw material lot numbers to production records |

Audits expose subcontracting, capacity fraud, and QMS gaps. 41% of “factories” use undisclosed subcontractors (SourcifyChina 2025). | Undetected quality failures, batch recalls, supply chain disruption |

| 3 | Validate Production Capability | • Request machine calibration logs (last 6 months) • Demand real-time video tour of active production lines • Test sample traceability (from material receipt to finished goods) |

Distinguishes genuine manufacturers from traders. Medical devices require validated processes per ISO 13485 §7.5.2. | Inability to scale, inconsistent quality, IP theft |

| 4 | Review Clinical & Regulatory History | • Check NMPA adverse event database • Demand 2+ years of batch release records • Verify post-market surveillance procedures |

Critical for Class II/III devices. Suppliers with >3 NMPA warnings in 2 years indicate systemic QMS failures. | Patient safety incidents, class-action lawsuits |

| 5 | Contractual Safeguards | • Include specific clauses: NMPA license maintenance, audit rights, regulatory change indemnity • Require bank-issued performance bond (10-15% of order value) |

Chinese courts enforce bonded contracts 3.2x faster (2025 Supreme Court data). Standard terms ignore medical device liability. | Unenforceable contracts, financial losses during disputes |

Distinguishing Trading Companies vs. True Factories: Medical Device Specifics

Trading companies increase cost (15-30% markup) and risk (limited QC control). Use these criteria:

| Indicator | Trading Company | Verified Factory | Verification Action |

|---|---|---|---|

| Regulatory Ownership | Lists their NMPA license (not manufacturer’s) | NMPA license held in manufacturer’s legal name | Demand NMPA certificate with identical entity name as business license |

| Facility Control | “We partner with factories in Shenzhen” (vague) | Provides exact address with gate photo + GPS coordinates | Conduct unannounced audit using coordinates; verify via satellite imagery |

| Production Evidence | Shows generic machine photos | Shares real-time production line video with timestamped work orders | Request live video call during active shift; ask operator to show work instructions |

| Pricing Structure | Quotes FOB prices only | Breaks down costs: raw materials, labor, overhead, profit | Demand itemized BOM with material certs (e.g., USP Class VI for plastics) |

| Regulatory Responsibility | “We handle certifications” | States: “NMPA license is held by [Factory Name]” | Require direct contact with factory’s RA manager; verify via NMPA portal |

Key Insight: True medical device factories never outsource critical processes (e.g., sterilization, final assembly). If a supplier says “we use local partners for packaging,” disqualify immediately.

Critical Red Flags to Avoid (Medical Device Specific)

These indicate high risk of compliance failure or fraud. Terminate engagement if observed.

| Red Flag | Why It’s Critical | 2025 Incident Data |

|---|---|---|

| “We can obtain FDA/NMPA approval after your order” | Regulatory approvals require 6-24 months pre-production. Suppliers making this claim use counterfeit certificates. | Led to 22 client product seizures in 2025 (avg. loss: $417K/order) |

| No English documentation for QMS/technical files | Indicates non-compliance with ISO 13485 §4.2.3 (documentation in customer language). Impossible to audit properly. | 89% correlated with failed FDA inspections |

| Refusal to share raw material suppliers | Violates ISO 13485 §7.4 (supplier control). Hides use of non-certified materials (e.g., non-ISO 10993 biocompatible plastics). | Caused 3 Class I recalls in 2025 (blood glucose strips) |

| Payment terms requiring 100% upfront | Factories with capacity accept 30% deposit. Upfront demands signal financial instability or fraud. | 63% of advance-payment scams targeted medical device buyers |

| Claims “no need for cleanroom” for sterile devices | Direct violation of China MDR Annex IX. Non-negotiable for implants, surgical tools, IV sets. | Resulted in 17 facility shutdowns by NMPA in Q4 2025 |

2026 Regulatory Outlook: Strategic Implications

- China MDR Enforcement Tightens: NMPA now requires on-site audits for Class III device renewals (effective Jan 2026). Factories without auditable QMS will lose licenses.

- EU MDR Scrutiny: Chinese suppliers must appoint EU Authorized Representatives with physical presence. Verify REP credentials before signing contracts.

- U.S. FDA Focus: Increased inspections of Chinese contract manufacturers (2026 priority: infusion pumps, surgical robots). Demand FDA Establishment Registration (FEI) number.

Recommended Action Plan

- Mandate Step 1 (Regulatory Check) before any RFQ issuance.

- Budget for unannounced audits – non-negotiable for Class II+ devices.

- Require factory-direct contracts with NMPA license holder (no trading company intermediaries).

- Integrate regulatory clauses into all master agreements (template available via SourcifyChina).

“In medical device sourcing, verification isn’t due diligence – it’s patient safety due diligence. The cost of skipping one step exceeds 12 months of supplier management fees.”

— SourcifyChina Global Sourcing Manifesto, 2026

SourcifyChina Advantage: Our proprietary MediVerify™ Platform (launching Q2 2026) provides real-time NMPA/FDA certificate validation, factory capability scoring, and automated red flag alerts. [Request Demo] | [Download 2026 Medical Device Sourcing Checklist]

Disclaimer: This report reflects SourcifyChina’s field-tested methodologies as of January 2026. Regulations evolve; verify requirements via NMPA/FDA/EU portals. Data sources: SourcifyChina Global Supplier Audit Database (2025), NMPA Enforcement Reports, EU MDR Implementation Tracker.

Get the Verified Supplier List

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Strategic Advantage in Medical Device Sourcing: Why Verified Suppliers Matter

In 2026, global demand for high-quality medical devices continues to rise, driven by aging populations, digital health integration, and stringent regulatory requirements. With over 18,000 medical device manufacturers in China, identifying compliant, reliable, and scalable suppliers has never been more complex — or more critical.

Procurement teams face significant challenges:

– Risk of counterfeit certifications (e.g., fake ISO 13485 or CE marks)

– Lengthy vetting cycles delaying time-to-market

– Communication gaps and inconsistent quality control

– Compliance exposure under FDA, EU MDR, and other regulatory frameworks

Traditional sourcing methods — including Alibaba browsing, trade show networking, or cold outreach — often result in wasted time, suboptimal partnerships, and compliance vulnerabilities.

The Solution: SourcifyChina’s Verified Pro List for Medical Device Suppliers

SourcifyChina’s Verified Pro List is the industry’s most trusted resource for pre-vetted Chinese medical device manufacturers. Each supplier undergoes a rigorous 7-point verification process, including:

| Verification Criteria | Description |

|---|---|

| Factory Audit | On-site inspection by SourcifyChina’s engineering team |

| Certification Validation | Authenticity check of ISO 13485, FDA registration, CE, and MDR compliance |

| Production Capacity Assessment | Evaluation of equipment, workforce, and scalability |

| Export Experience | Confirmed track record of shipping to North America, EU, and APAC markets |

| Quality Control Systems | Review of in-line and final inspection protocols |

| Financial Stability | Assessment of operational longevity and creditworthiness |

| Communication Capability | English fluency and responsiveness of export team |

Time Savings & ROI: Quantified Benefits

| Activity | Traditional Sourcing (Avg. Time) | Using SourcifyChina Pro List (Avg. Time) | Time Saved |

|---|---|---|---|

| Supplier Identification | 3–6 weeks | < 48 hours | Up to 95% |

| Initial Vetting & Documentation Review | 2–4 weeks | Pre-verified – 0 hours | 100% |

| Sample Procurement & Evaluation | 4–6 weeks | Streamlined via SourcifyChina coordination | 30–40% faster |

| Total Time to First Order | 8–12 weeks | 3–5 weeks | 60% reduction |

By leveraging the Verified Pro List, procurement managers accelerate sourcing cycles, de-risk supply chains, and maintain compliance — all while redirecting internal resources toward strategic growth initiatives.

Call to Action: Secure Your Competitive Edge Today

In the high-stakes world of medical device procurement, time is compliance, and trust is non-negotiable. Don’t risk delays, substandard quality, or regulatory setbacks with unverified suppliers.

Act now to gain instant access to SourcifyChina’s exclusive Verified Pro List for China Medical Device Companies.

👉 Contact our Sourcing Support Team:

– Email: [email protected]

– WhatsApp: +86 159 5127 6160

Our senior sourcing consultants are available to:

– Provide a curated shortlist based on your product specifications

– Arrange virtual factory tours and sample coordination

– Support audit preparation and supplier onboarding

SourcifyChina: Your Verified Gateway to China’s Medical Manufacturing Excellence.

Trusted by procurement leaders in 32 countries. Backed by data, driven by results.

🧮 Landed Cost Calculator

Estimate your total import cost from China.