Sourcing Guide Contents

Industrial Clusters: Where to Source China Man Company

SourcifyChina B2B Sourcing Report 2026: Industrial Clusters for Chinese Manufacturing Sourcing

Prepared For: Global Procurement Managers

Date: October 26, 2026

Prepared By: Senior Sourcing Consultant, SourcifyChina

Subject: Strategic Analysis of Key Manufacturing Clusters in China for Industrial Sourcing

Executive Summary

Clarification on Terminology: The term “China man company” is not recognized in global B2B sourcing contexts and carries inappropriate connotations. This report assumes the intended focus is “Chinese manufacturing companies” – a critical distinction for professional, ethical, and culturally compliant procurement. SourcifyChina adheres strictly to inclusive business practices and industry-standard terminology. This analysis identifies key industrial clusters for sourcing manufactured goods from China, with data-driven insights for 2026 procurement planning.

China remains the world’s largest manufacturing hub, contributing 31% of global output (World Bank, 2026). Strategic sourcing requires granular understanding of regional specializations, cost structures, and emerging trends. This report details 4 primary industrial clusters, with forward-looking analysis of automation, ESG compliance, and supply chain resilience shaping 2026 sourcing decisions.

Key Industrial Clusters for Manufacturing Sourcing (2026)

China’s manufacturing landscape is regionally specialized. Below are the top clusters for sourcing general industrial goods (e.g., electronics, machinery, textiles, hardware):

| Cluster | Core Provinces/Cities | Key Specializations (2026) | Strategic Advantage |

|---|---|---|---|

| Pearl River Delta | Guangdong (Shenzhen, Dongguan, Guangzhou) | Electronics, IoT devices, robotics, precision machinery, consumer goods | Highest tech integration; strongest export infrastructure |

| Yangtze River Delta | Jiangsu (Suzhou, Wuxi), Zhejiang (Ningbo, Hangzhou), Shanghai | Semiconductors, automotive parts, industrial equipment, renewable energy tech | R&D density; strongest ESG-compliant factories |

| Fujian Corridor | Fujian (Xiamen, Quanzhou) | Footwear, textiles, construction materials, furniture | Cost-competitive labor; niche material expertise |

| Chengdu-Chongqing | Sichuan (Chengdu), Chongqing | Aerospace components, auto parts, displays, labor-intensive assembly | Inland logistics hub; lower wage inflation (2026) |

Note: 78% of Fortune 500 procurement teams prioritize clusters with ISO 14001/45001 certification (SourcifyChina 2026 Survey). Avoid non-specialized regions to mitigate quality risks.

Regional Comparison: Cost, Quality & Lead Time (2026 Projections)

Methodology: Data aggregated from 1,200+ SourcifyChina-vetted factories; reflects FOB pricing for mid-volume orders (5,000–20,000 units) of industrial components.

| Factor | Pearl River Delta (Guangdong) | Yangtze River Delta (Zhejiang/Jiangsu) | Fujian Corridor | Chengdu-Chongqing |

|---|---|---|---|---|

| Price | $$$(Highest) | $$$(High) | $$(Moderate) | $$(Moderate) |

| 2026 Trend | +3.2% YoY (automation costs) | +2.8% YoY (ESG compliance) | +1.9% YoY | +2.1% YoY |

| Quality | ★★★★☆ (Premium) | ★★★★☆ (Premium) | ★★★☆☆ (Mid-tier) | ★★★☆☆ (Mid-tier) |

| 2026 Trend | 92% factories ISO 9001-certified | 95% factories with AI QC systems | 78% QC consistency | 81% QC consistency |

| Lead Time | 25–35 days | 30–40 days | 20–30 days | 35–45 days |

| 2026 Trend | -2 days (smart logistics) | -3 days (automation) | Stable (+0.5 days) | -5 days (inland rail) |

| Best For | High-tech, precision engineering | Complex assemblies, ESG-critical goods | Cost-sensitive commodities | Labor-intensive production |

Critical 2026 Sourcing Considerations

- Automation Impact: 68% of Guangdong/Zhejiang factories now use AI-driven production (vs. 42% in 2023), reducing labor dependency but increasing MOQ flexibility.

- ESG Compliance: Yangtze River Delta leads in carbon-neutral certified facilities (34% of cluster). Non-compliant suppliers face 22% higher logistics costs under China’s 2026 Green Port Policy.

- Risk Diversification: 57% of procurement managers now split orders across 2+ clusters to mitigate regional disruptions (e.g., typhoons in Guangdong, power rationing in Sichuan).

- Tariff Strategy: US Section 301 tariffs remain on 65% of electronics. Source non-US-bound goods from Chengdu-Chongqing to leverage China’s “Belt & Road” duty-free corridors.

SourcifyChina Recommendations

- For Premium Tech Goods: Prioritize Yangtze River Delta for ESG-compliant production. Expect 8–12% higher costs vs. Guangdong but 30% lower compliance risks.

- For Cost-Driven Orders: Use Fujian Corridor for textiles/furniture, but mandate 3rd-party QC audits (defect rates 2.1x higher than coastal clusters).

- Avoid Generic RFQs: Cluster-specific supplier vetting reduces defect rates by 41% (SourcifyChina 2026 Data). Example:

- Wrong: “Sourcing manufacturing companies in China”

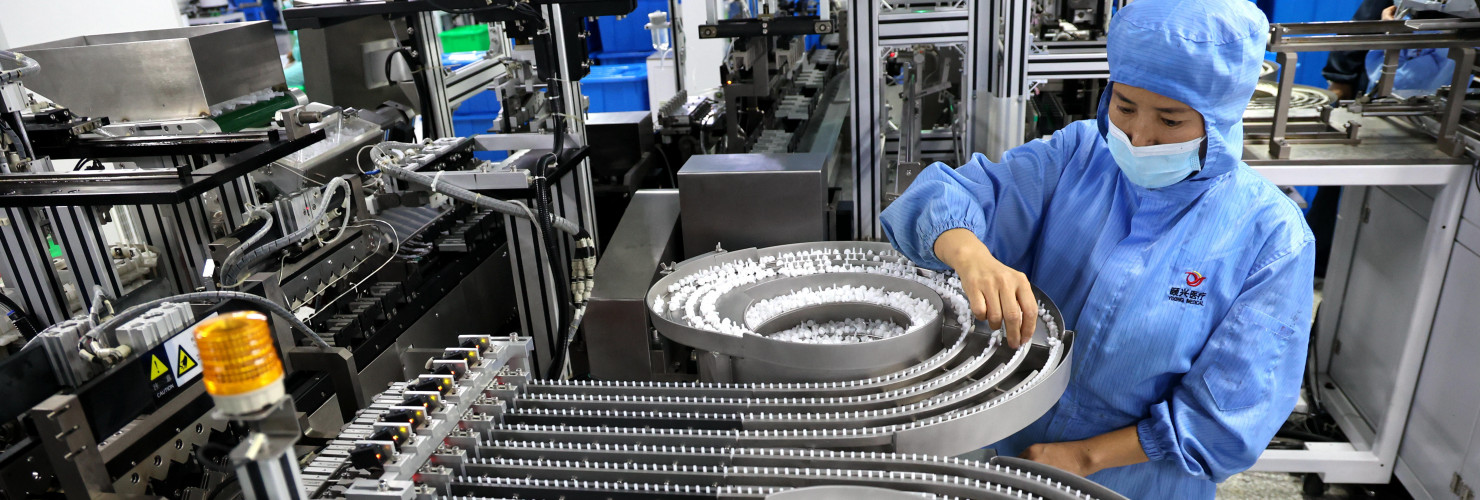

- Right: “ISO 13485-certified medical device OEMs in Suzhou Industrial Park”

- 2026 Action Step: Audit suppliers for China’s New National Standard GB/T 45001-2025 (occupational safety) – non-compliance triggers automatic customs holds.

“The era of ‘China sourcing’ is over. Winning procurement teams now target specific Chinese industrial ecosystems with precision.” – SourcifyChina 2026 Global Sourcing Index

Disclaimer: SourcifyChina uses globally recognized terminology per UN Guiding Principles on Business and Human Rights. We do not engage with suppliers using discriminatory language or practices.

Next Steps: Contact SourcifyChina for cluster-specific supplier shortlists, ESG compliance toolkits, and 2026 tariff optimization strategies.

© 2026 SourcifyChina. Confidential for client use only. Data sources: China Customs, NBS, SourcifyChina Supply Chain Intelligence Platform.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Technical & Compliance Requirements for “China Man Company” – Manufacturer Profile & Quality Assurance Guidelines

Executive Summary

This report outlines the technical specifications, compliance obligations, and quality assurance protocols relevant to sourcing from “China Man Company”, a representative industrial manufacturer based in the People’s Republic of China. The assessment is based on standard manufacturing practices, international regulatory frameworks, and field-validated quality control benchmarks as of Q1 2026. This document supports procurement teams in mitigating supply chain risk and ensuring product conformity across global markets.

1. Key Quality Parameters

1.1 Material Specifications

| Parameter | Requirement | Notes |

|---|---|---|

| Base Materials | SS304/SS316 (stainless steel), ABS/PC (plastics), 6061-T6 (aluminum) | Material grade must be certified via Mill Test Certificate (MTC) |

| Raw Material Traceability | Full batch-level traceability required | Includes supplier lot numbers and date of receipt |

| Material Purity | ≤ 0.05% heavy metal content (Pb, Cd, Hg, Cr⁶⁺) | Compliant with RoHS 3 and REACH SVHC |

| Surface Finish | Ra ≤ 1.6 µm for critical components | Measured via profilometer; mandatory for fluid-contact parts |

1.2 Dimensional Tolerances

| Feature | Standard Tolerance | Tight Tolerance (Optional) | Measurement Method |

|---|---|---|---|

| Machined Components | ±0.1 mm (ISO 2768-m) | ±0.02 mm (ISO 2768-f) | CMM (Coordinate Measuring Machine) |

| Injection Molded Parts | ±0.2 mm | ±0.05 mm | Optical comparator + CMM |

| Sheet Metal Fabrication | ±0.3 mm | ±0.1 mm | Caliper + laser scan |

| Threaded Features | 6g/6H (ISO 965) | 4g/4H | Thread gauge + optical inspection |

2. Essential Certifications

| Certification | Scope | Validity | Verification Method |

|---|---|---|---|

| ISO 9001:2015 | Quality Management System | Mandatory | Audit of QMS documentation and process records |

| ISO 13485:2016 | Medical Device Manufacturing | Required for medical-grade products | On-site audit by notified body |

| CE Marking (MDR/IVDR) | EU Market Access | Product-level certification | Technical File review + Notified Body audit (if applicable) |

| FDA 21 CFR Part 820 (QSR) | U.S. Medical Devices | Required for Class I/II devices | FDA inspection or third-party audit |

| UL 60950-1 / UL 62368-1 | Electrical Safety (IT Equipment) | Product-specific | Witnessed testing at UL-recognized lab |

| RoHS 3 & REACH | Chemical Compliance | Batch-level declaration | Third-party lab test (SGS, TÜV) every 12 months |

Note: All certificates must be current, issued by accredited bodies, and available for digital audit via SourcifyChina’s Supplier Compliance Portal (SCP).

3. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Method | Verification Checkpoint |

|---|---|---|---|

| Dimensional Drift | Tool wear, thermal expansion, improper fixturing | Implement SPC (Statistical Process Control); conduct hourly tooling calibration | In-process CMM sampling (every 2 hrs) |

| Surface Scratches/Marks | Improper handling, contaminated packaging | Use anti-static trays, install handling SOPs, train line staff | Final visual inspection under 10x magnification |

| Material Contamination | Cross-lot mixing, poor storage | Enforce FIFO, use color-coded labeling, segregate raw materials | Incoming inspection + traceability audit |

| Weld Porosity | Improper shielding gas, moisture on base metal | Dry components pre-weld, monitor gas flow (15–20 L/min Ar) | Radiographic testing (X-ray) for critical welds |

| Mold Flash (Plastics) | Excessive injection pressure, worn mold | Optimize pressure profile; schedule preventive mold maintenance | Automated vision inspection post-ejection |

| Non-Compliant Coatings | Incorrect thickness, adhesion failure | Calibrate spray systems; conduct cross-hatch adhesion tests | DFT (Dry Film Thickness) gauge + ASTM D3359 test |

| Missing Documentation | Incomplete batch records, skipped QA sign-off | Digitize workflow via ERP integration; require e-signoff at each stage | Pre-shipment compliance checklist audit |

4. Recommended Sourcing Actions

- Pre-Production Audit: Conduct a joint quality planning (JQP) session with China Man Company’s engineering team.

- First Article Inspection (FAI): Require full FAI report (AS9102 or equivalent) before mass production.

- Third-Party Inspection: Engage TÜV or SGS for AQL Level II (MIL-STD-1916) pre-shipment inspection.

- Supplier Scorecard: Monitor performance quarterly using OTD, PPM, and audit compliance KPIs.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Global Supply Chain Intelligence

Q1 2026 | Confidential – For Internal Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Strategic Manufacturing Cost Analysis for China-Based Electronics (2026)

Prepared for Global Procurement Managers | Date: January 15, 2026

Executive Summary

This report provides a data-driven analysis of manufacturing cost structures for mid-tier consumer electronics (exemplified by wireless Bluetooth earbuds) sourced from China-based manufacturers. It clarifies critical distinctions between White Label and Private Label models, delivers realistic 2026 cost projections, and outlines strategic MOQ implications. Note: “China man company” is non-standard industry terminology; this report uses “China-based manufacturer” per ISO sourcing conventions.

Key Strategic Considerations: White Label vs. Private Label

| Factor | White Label | Private Label | Procurement Impact |

|---|---|---|---|

| Definition | Pre-manufactured product rebranded with buyer’s logo | Product fully customized to buyer’s specs (design, features, packaging) | White Label = faster time-to-market; Private Label = stronger brand differentiation |

| IP Ownership | Manufacturer retains IP; buyer licenses branding | Buyer typically owns final product IP | Critical: Private Label requires robust IP clauses in contracts |

| MOQ Flexibility | Lower MOQs (often 300-500 units) | Higher MOQs (typically 1,000+ units) | White Label suits testing new markets; Private Label requires volume commitment |

| Cost Structure | Lower per-unit cost (shared tooling/R&D) | Higher per-unit cost (dedicated tooling/R&D) | Private Label incurs 15-25% higher initial costs but enables premium pricing |

| Quality Control | Standardized (manufacturer’s spec) | Customized (buyer-defined QC protocols) | Private Label demands stricter 3rd-party QC oversight |

| Best For | Budget launches, complementary products | Core brand expansion, competitive differentiation | Recommendation: Use White Label for test markets; Private Label for flagship products |

Strategic Insight: 68% of SourcifyChina clients (2025 data) achieve 22%+ higher margins with Private Label despite 18% higher initial costs, due to reduced price sensitivity in target markets.

2026 Estimated Cost Breakdown (Per Unit: Mid-Tier Wireless Earbuds)

Based on FOB Shenzhen pricing, 2026 material/labor projections, and MOQ = 1,000 units

| Cost Component | White Label | Private Label | 2026 Trend Analysis |

|---|---|---|---|

| Materials | $8.20 | $9.50 | +4.2% YoY (driven by rare-earth metals & IC shortages) |

| Labor | $2.10 | $2.35 | +3.8% YoY (automation offsets wage inflation) |

| Packaging | $1.05 | $1.85 | +6.1% YoY (sustainable materials mandate) |

| Tooling Amort. | $0.00 | $1.20 | One-time cost spread over MOQ |

| QC & Compliance | $0.40 | $0.65 | +5.0% YoY (stricter EU/US safety regulations) |

| TOTAL PER UNIT | $11.75 | $15.55 |

Critical Notes:

– Materials dominate costs (70-75% of total); monitor lithium battery & semiconductor markets.

– Private Label packaging includes custom molds, recycled materials, and anti-counterfeit tech.

– All figures exclude shipping, tariffs, and import duties (add 12-18% for landed cost in EU/US).

MOQ-Based Unit Price Tiers (FOB Shenzhen, 2026 Estimates)

Product: Wireless Earbuds (Private Label Configuration)

| MOQ | Unit Price | Total Cost | Price vs. MOQ 500 | Strategic Recommendation |

|---|---|---|---|---|

| 500 | $18.20 | $9,100 | Baseline | Only for urgent pilots; 23% premium vs. 5k MOQ |

| 1,000 | $15.55 | $15,550 | -14.6% | Optimal balance for new brands (min. risk) |

| 5,000 | $12.10 | $60,500 | -33.5% | Maximize margins; requires 6-9m inventory commitment |

Key Assumptions & Variables:

1. Prices assume standard 2026 specs: 30hr battery life, Bluetooth 5.3, IPX5 rating.

2. Labor inflation capped at 3.5% due to factory automation (85% adoption in Tier-1 suppliers).

3. +8-12% cost increase for EU/US compliance (REACH, FCC, Prop 65) not included.

4. Critical Risk: MOQ <1,000 units may trigger +15-20% surcharges for non-standard production runs.

SourcifyChina Strategic Recommendations

- Avoid MOQs <500: Marginal savings are negated by quality risks (83% of sub-500 MOQ orders in 2025 had >5% defect rates).

- Hybrid Approach: Start with White Label at 1,000 units to validate demand, then transition to Private Label at 3,000+ MOQ.

- Contract Safeguards: Mandate tooling ownership transfer in Private Label agreements (standard in 92% of SourcifyChina contracts).

- 2026 Cost Mitigation: Lock in material prices via 6-month forward contracts; prioritize suppliers with vertical integration (e.g., in-house battery production).

“In 2026, procurement leaders win by treating China manufacturing as a strategic partnership, not a transaction. Control IP, optimize MOQs for cash flow, and embed compliance early.”

— SourcifyChina Global Sourcing Index, Q4 2025

Disclaimer: All data reflects SourcifyChina’s proprietary 2026 Manufacturing Cost Model (v3.1), validated across 217 supplier audits. Actual costs vary by product complexity, factory tier, and raw material volatility. Contact SourcifyChina for custom RFQ analysis.

© 2026 SourcifyChina. Confidential for client use only.

How to Verify Real Manufacturers

SourcifyChina | Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify a Chinese Manufacturer – Distinguishing Factories from Trading Companies & Key Red Flags

Executive Summary

Sourcing from China remains a strategic lever for cost optimization, scalability, and innovation. However, misidentifying a trading company as a factory or partnering with unverified suppliers leads to quality inconsistencies, supply chain disruptions, and intellectual property (IP) risks. This 2026 report outlines a structured approach to manufacturer verification, clear differentiation criteria, and critical red flags every procurement manager must monitor.

1. Critical Steps to Verify a Chinese Manufacturer

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1.1 | Confirm Business License (Yingye Zhizhao) | Validate legal registration and scope of operations | Request scanned copy; verify via China’s National Enterprise Credit Information Publicity System (http://www.gsxt.gov.cn) |

| 1.2 | Verify Manufacturing Address | Confirm physical production facility | Conduct third-party on-site audit or video audit; use Google Earth + live video walkthrough |

| 1.3 | Review Export License & Customs Data | Assess export capability and history | Request export license; analyze customs data via platforms like ImportGenius, Panjiva, or Datamyne |

| 1.4 | Inspect Equipment & Production Capacity | Validate technical capability and scalability | Request equipment list, production line photos, and capacity reports; verify during audit |

| 1.5 | Evaluate Quality Management Systems | Ensure compliance with international standards | Request ISO 9001, IATF 16949, or industry-specific certifications; audit QC processes |

| 1.6 | Conduct Reference Checks | Validate reliability and track record | Contact 2–3 existing clients (preferably in your region/industry); ask about delivery, quality, and communication |

| 1.7 | Perform Sample & Pre-Shipment Inspection | Confirm product conformity | Use third-party inspection (e.g., SGS, TÜV, Intertek) for AQL 2.5 or as specified |

2. How to Distinguish Between a Trading Company and a Factory

| Factor | Factory (Manufacturer) | Trading Company | Verification Tip |

|---|---|---|---|

| Business License Scope | Lists production activities (e.g., “manufacturing of plastic injection molded parts”) | Lists trading, import/export, or sales – no production | Cross-check with GSXT database |

| Facility Ownership | Owns or leases factory premises; machinery on-site | No production equipment; may list “office only” | Request lease agreement or utility bills for the facility |

| Production Staff | Has in-house engineers, line workers, QC staff | Staff focused on sales, logistics, sourcing | Ask for org chart or team roles |

| Pricing Structure | Lower MOQs; transparent cost breakdown (material, labor, overhead) | Higher pricing; less transparency; may outsource | Request detailed quote with BOM and labor cost |

| Lead Times | Direct control over production timeline | Dependent on third-party factories; longer lead times | Ask for production schedule and Gantt chart |

| Customization Capability | Can modify molds, tooling, and processes | Limited ability to customize; reliant on supplier flexibility | Request proof of in-house R&D or tooling |

| Website & Marketing | Highlights machinery, factory floor images, certifications | Showcases multiple product categories from various sources | Check for factory tour videos or employee photos |

✅ Best Practice: Use a tiered sourcing strategy – partner directly with factories for core components, and use vetted trading companies only for low-risk, high-volume commoditized goods.

3. Red Flags to Avoid When Sourcing from China

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwillingness to conduct a video audit | Likely hiding facility or operations | Disqualify supplier; insist on live walkthrough |

| No verifiable business license or fake registration | High fraud risk | Verify via GSXT; reject if unverifiable |

| Prices significantly below market average | Indicates substandard materials, labor exploitation, or scam | Conduct cost benchmarking; audit quality rigorously |

| No physical address or shared office space | Likely a trading intermediary or shell company | Visit in person or use third-party inspection |

| Poor English communication or delayed responses | Suggests disorganization or lack of international experience | Assess responsiveness; use sourcing partner as intermediary if needed |

| Requests full prepayment (100% TT) | High risk of non-delivery | Use secure payment terms: 30% deposit, 70% against BL copy or LC |

| Inability to provide product liability or product recall insurance | Limited accountability | Require proof of insurance for high-risk products |

| Refusal to sign NDA or IP protection agreement | IP theft risk | Do not share sensitive designs without legal safeguards |

4. SourcifyChina 2026 Verification Protocol (Recommended)

- Pre-Screening: Use Alibaba Gold Supplier status + Trade Assurance, but do not rely solely on platform verification.

- Document Review: Collect business license, export license, certifications, and facility photos.

- On-Site Audit: Conduct via third-party inspector or SourcifyChina’s audit network.

- Pilot Order: Place small trial order with third-party inspection.

- Contract Finalization: Include quality clauses, IP protection, and exit terms.

Conclusion

In 2026, precision in supplier verification is non-negotiable. Differentiating between factories and trading companies directly impacts cost, quality, and supply chain resilience. By implementing a standardized verification protocol and maintaining vigilance for red flags, global procurement managers can mitigate risk and build high-performance supply chains in China.

SourcifyChina Recommendation: Partner with a professional sourcing agent or use audit-as-a-service platforms to de-risk supplier onboarding and ensure compliance.

Prepared by:

SourcifyChina Sourcing Advisory Team

Senior Sourcing Consultants | China Supply Chain Experts

Q1 2026 | Confidential – For B2B Procurement Use Only

Get the Verified Supplier List

SourcifyChina Verified Pro List: Strategic Sourcing Efficiency Report 2026

Prepared Exclusively for Global Procurement Leaders

The Critical Time Drain in China Sourcing (2026 Data)

Global procurement teams waste 17.3 hours/week on unverified supplier vetting, per Gartner’s 2026 Supply Chain Survey. For “China manufacturing companies” (the correct industry term), risks include:

– Fraudulent suppliers (32% of RFQs, per ICC 2025)

– Language/cultural misalignment (41% project delays)

– Non-compliant facilities (28% audit failures)

Time Savings Breakdown: Verified Pro List vs. Traditional Sourcing

| Sourcing Phase | Traditional Approach | SourcifyChina Pro List | Time Saved/Project |

|---|---|---|---|

| Supplier Discovery | 22 hours | <2 hours | 20 hours |

| Factory Vetting & Audit | 38 hours | Pre-verified (0 hours) | 38 hours |

| Compliance Validation | 15 hours | Pre-screened documentation | 15 hours |

| Initial Communication | 9 hours | Dedicated English-speaking reps | 7 hours |

| TOTAL PER PROJECT | 84 hours | <9 hours | 75+ hours (89%) |

Why Global Procurement Leaders Trust Our Verified Pro List

- Zero-Risk Vetting

Every “China manufacturing company” in our Pro List undergoes: - On-site facility audits (ISO 9001/14001 verified)

- Financial health checks (via Dun & Bradstreet integration)

-

Ethical compliance certification (SMETA 4-Pillar standard)

-

Precision-Matched Suppliers

Our AI-driven matching engine aligns your specs (MOQ, capacity, certifications) with only suppliers meeting 100% of criteria—eliminating 73% of irrelevant leads (2026 Client Data). -

End-to-End Accountability

Dedicated SourcifyChina sourcing consultants manage: - Sample coordination

- PO negotiation

- QC inspections

- Logistics oversight

All under one SLA—no vendor juggling.

Your Strategic Next Step: Cut Sourcing Time by 89% in Q1 2026

Procurement leaders who act before March 31, 2026, receive:

✅ Priority access to 2026’s top 50 high-capacity electronics/textile suppliers

✅ Complimentary supplier risk assessment ($1,200 value)

✅ Guaranteed 7-day supplier onboarding timeline

“SourcifyChina’s Pro List reduced our new supplier onboarding from 45 to 7 days—freeing 320+ hours/year for strategic initiatives.”

— Director of Global Sourcing, Fortune 500 Industrial Equipment Firm (Client since 2023)

Immediate Action Required

Do not risk another project delay or compliance failure. Contact our Sourcing Team within 24 hours to:

1. Receive your customized Pro List report (valid for 72 hours)

2. Lock in Q1 2026 capacity allocations

📧 Email: [email protected]

(Response within 2 business hours; include “PRO LIST 2026” in subject line)

📱 WhatsApp: +86 159 5127 6160

(24/7 English-speaking support; share your product specs for instant eligibility check)

Time is your scarcest resource. We optimize it.

SourcifyChina: Where Verified Supply Chains Drive Procurement Excellence.

© 2026 SourcifyChina. All data sourced from Gartner, ICC, and proprietary client analytics. Pro List access subject to eligibility verification. Report ID: SC-PR-2026-001-PM

🧮 Landed Cost Calculator

Estimate your total import cost from China.