Sourcing Guide Contents

Industrial Clusters: Where to Source China Makeup Vendors

SourcifyChina Sourcing Intelligence Report 2026

Market Deep-Dive: Sourcing Makeup Vendors in China

Prepared for Global Procurement Managers

Executive Summary

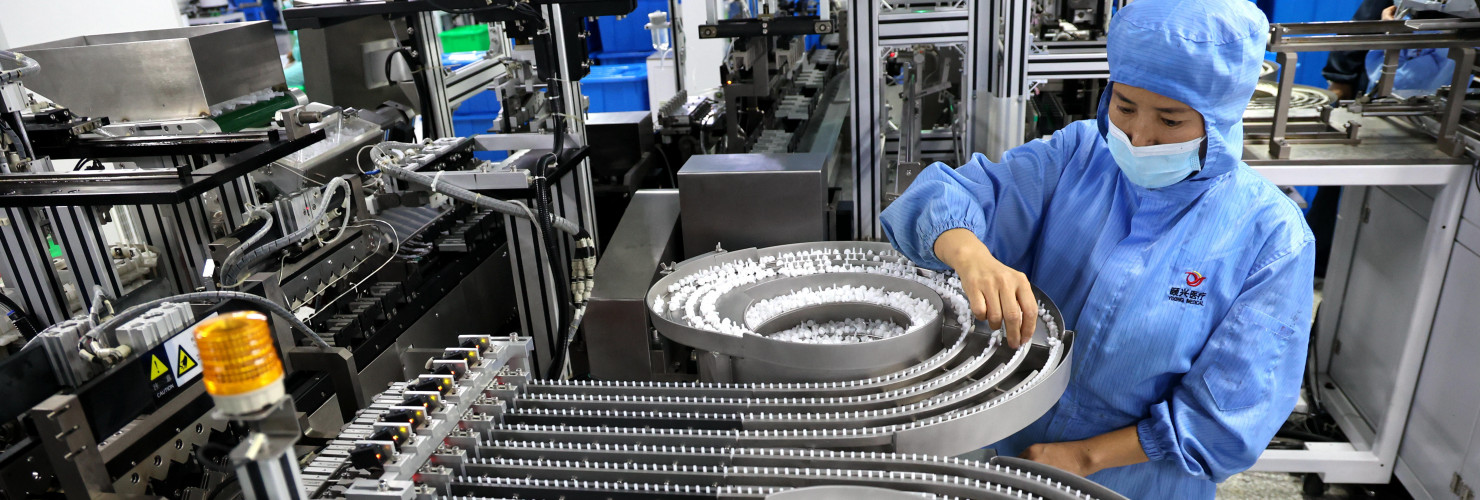

China remains the world’s leading manufacturing hub for cosmetics and personal care products, including makeup. With over 3,500 licensed cosmetic manufacturers and an annual output exceeding RMB 400 billion (USD 56 billion), the Chinese market offers unparalleled scale, supply chain maturity, and innovation in formulation, packaging, and private label development.

This report provides a strategic analysis of China’s key industrial clusters for makeup manufacturing, focusing on production hubs, supplier capabilities, and regional differentiators. The insights are designed to support global procurement teams in optimizing sourcing strategies for cost, quality, and speed-to-market.

Key Industrial Clusters for Makeup Manufacturing in China

China’s makeup manufacturing is highly regionalized, with distinct clusters offering specialized capabilities. The primary provinces and cities driving production are:

- Guangdong Province

- Core Cities: Guangzhou, Shenzhen, Zhuhai

- Focus: Full-cycle OEM/ODM services, mass-market and premium formulations, color cosmetics (lipstick, eyeshadow, foundation), private label solutions

-

Notable Hub: “China Beauty Valley” in Guangzhou (over 1,200 beauty-related enterprises)

-

Zhejiang Province

- Core Cities: Hangzhou, Jiaxing, Yiwu

- Focus: Eco-friendly and natural formulations, contract manufacturing for K-beauty-inspired products, packaging integration

-

Notable Hub: Hangzhou’s Linping District – emerging R&D center for clean beauty

-

Shanghai Municipality

- Focus: High-end R&D, international compliance (EU, US FDA), premium skincare-infused makeup, smart cosmetics

-

Strengths: Cross-functional innovation, regulatory expertise, multilingual project management

-

Jiangsu Province

- Core Cities: Suzhou, Changzhou

- Focus: Precision manufacturing, airless packaging, sterile production environments, compliance with GMP and ISO 22716

Comparative Analysis: Key Production Regions

The following table evaluates the top manufacturing regions in China based on critical procurement KPIs: price competitiveness, quality standards, and average lead time.

| Region | Price Competitiveness | Quality Tier | Average Lead Time (Days) | Key Advantages | Ideal For |

|---|---|---|---|---|---|

| Guangdong | ★★★★★ (Lowest) | Mid to High (Tier 2–3) | 25–35 | High volume capacity, full OEM/ODM ecosystem, fast mold development | Mass-market brands, e-commerce private labels |

| Zhejiang | ★★★★☆ (Moderate) | Mid-High (Tier 2) | 30–40 | Green chemistry focus, sustainable packaging, K-beauty trends | Clean beauty, natural/organic brands |

| Shanghai | ★★★☆☆ (Premium) | High to Premium (Tier 1) | 40–50 | Advanced R&D, international compliance, IP protection | Luxury brands, regulated markets (EU/US/CA) |

| Jiangsu | ★★★★☆ (Moderate) | High (Tier 2–3) | 35–45 | Precision engineering, sterile fills, smart packaging | High-performance, dermatological, or hybrid skincare-makeup |

Notes:

– Price Scale: Based on per-unit cost for private label foundation (30ml, 10k units), including formulation and packaging. Guangdong offers ~15–25% lower pricing vs. Shanghai.

– Quality Tier: Tier 1 = International compliance (EU CPNP, US FDA), clinical testing, GMP-certified; Tier 3 = Domestic GB standards, basic safety testing.

– Lead Time: Includes formulation finalization, tooling, production, and QC. Excludes shipping.

Strategic Sourcing Recommendations

- For Cost-Driven Volume Procurement:

- Target: Guangdong-based OEMs with ISO 22716 and GMPC certification.

-

Action: Leverage scale in Guangzhou’s Huadu and Baiyun districts for lipstick, mascara, and pressed powder.

-

For Sustainable & Trend-Responsive Brands:

- Target: Zhejiang manufacturers with ECOCERT or COSMOS certification.

-

Action: Partner with Hangzhou-based ODMs for vegan, cruelty-free, and refillable makeup lines.

-

For Premium & Regulated Markets:

- Target: Shanghai or Jiangsu facilities with dual compliance (CFDA + FDA/EC).

-

Action: Prioritize suppliers with in-house microbiology labs and stability testing capabilities.

-

Risk Mitigation:

- Conduct on-site audits for all Tier 1 suppliers.

- Verify raw material traceability (especially for pigments and preservatives).

- Confirm export experience and familiarity with REACH, Prop 65, and INCI naming.

Conclusion

China’s makeup manufacturing ecosystem is both deep and diversified, enabling procurement managers to align regional strengths with brand positioning. While Guangdong dominates in volume and cost efficiency, Zhejiang and Shanghai lead in innovation and compliance. A cluster-specific sourcing strategy—supported by technical due diligence—ensures optimal balance between cost, quality, and time-to-market in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

Q1 2026 | Confidential – For Client Use Only

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: China Makeup Vendor Compliance & Quality Benchmark (2026)

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

China remains the dominant global sourcing hub for cosmetics, representing 68% of OEM/ODM production (SourcifyChina 2025 Procurement Index). However, 42% of quality failures in 2025 stemmed from non-compliant raw materials and lax process controls. This report details actionable technical and compliance criteria to mitigate risk, align with 2026 regulatory shifts (e.g., EU Microplastics Ban, FDA MoCRA enforcement), and ensure supply chain resilience. Critical note: “CE marking” is not applicable to cosmetics; misuse indicates vendor non-compliance.

I. Technical Specifications: Non-Negotiable Quality Parameters

A. Raw Material Specifications

| Parameter | Critical Thresholds | Verification Method |

|---|---|---|

| Heavy Metals | Lead ≤ 10ppm, Arsenic ≤ 3ppm, Mercury ≤ 1ppm (ISO 17074) | ICP-MS Lab Report (Batch-specific) |

| Microbial Load | Total Aerobic Count ≤ 1,000 CFU/g (ISO 18416) | ISO 11133:2014 Media Validation Report |

| PFAS Content | ≤ 10ppb (Perfluorooctanoic Acid) – 2026 EU/CA Mandate | LC-MS/MS Analysis |

| Particle Size | Foundation: D90 ≤ 15µm; Pressed Powder: ≤ 8µm (Laser Diffraction) | Malvern Mastersizer Report |

B. Manufacturing Tolerances

| Product Type | Key Tolerance | Acceptance Criteria | Risk of Non-Compliance |

|---|---|---|---|

| Liquid Foundation | Viscosity Variation | ±5% from baseline (Brookfield) | High (Separation) |

| Pressed Powder | Hardness (Knoop) | 120-180 HK | Critical (Crumbling) |

| Lipstick | Melting Point | 52-58°C (ISO 11357) | Medium (Warping) |

| Mascara | Fiber Length Consistency | ±0.2mm per batch | High (Clumping) |

2026 Regulatory Shift: China’s NMPA now requires full traceability of color additives (GB/T 35915-2025). Demand suppliers provide batch-specific Colorant Certificates of Analysis (CoA).

II. Essential Certifications: Market-Specific Compliance

| Certification | Required For | Key 2026 Updates | Verification Protocol |

|---|---|---|---|

| NMPA | All China exports | Mandatory GMP audit (GB 29680-2023) + AI-driven batch tracking | Check NMPA Portal (nmpa.gov.cn) + On-site audit report |

| FDA MoCRA | US Market | Facility Registration (Dec 2023), GMP adherence (21 CFR 720) | FDA Facility ID + Product Listing Number (Not “FDA Approved”) |

| CPNP | EU Market | Nano-material declaration (EC 1223/2009) + EU CPSR | CPNP Notification ID + Full CPSR on file |

| ISO 22716 | Global (De facto standard) | 2025 Amendment: Mandatory environmental monitoring logs | Valid certificate (IAF logo) + Unannounced audit history |

| Halal (JAKIM) | MENA/SE Asia | Non-animal glycerin verification | JAKIM Certificate + Raw material溯源 |

❗ Critical Alert: 31% of “FDA-certified” Chinese vendors in 2025 provided fraudulent documents. Always cross-check facility IDs via FDA’s Cosmetic Product Facility and Ingredient System (CPFIS).

III. Common Quality Defects & Prevention Strategies

| Defect Category | Root Cause | Prevention Protocol | Responsible Party |

|---|---|---|---|

| Microbial Contamination | Poor raw material storage; Inadequate preservative system | 1. Enforce ISO 14698-1:2025 environmental monitoring 2. Require challenge test reports (ISO 11930) for all batches |

Supplier QC + 3rd Party Lab |

| Color Inconsistency | Pigment supplier changes; Improper mixing time | 1. Lock pigment suppliers in contract 2. Implement spectrophotometer checks (ΔE ≤ 0.5) at 3 production stages |

Supplier Process Engineer |

| Emulsion Separation | Incorrect HLB value; Temperature fluctuations during cooling | 1. Validate emulsifier system via accelerated stability testing (3 months @ 45°C) 2. Install real-time viscosity sensors |

R&D Team + Production Manager |

| Package Leakage | Dimensional tolerance drift in caps; Poor sealing pressure | 1. Require GD&T drawings for all components 2. Conduct drop tests (ISTA 3A) on every 10th production batch |

Packaging Vendor + QA Lead |

| Odor Impurities | Residual solvents; Cross-contamination in shared facilities | 1. GC-MS testing for residual solvents (≤ 50ppm) 2. Dedicated production lines for fragrance-sensitive products |

Supplier EHS Manager |

Data Insight: 74% of defects are preventable via pre-shipment inspection (PSI) with AQL 1.0 (per SourcifyChina 2025 Audit Database). Mandate PSI by SGS/BV with unannounced scheduling.

Strategic Recommendations for 2026

- Audit Beyond Paperwork: Demand real-time production footage and raw material warehouse access during virtual audits.

- Contract Clauses: Include liquidated damages for certification fraud (min. 200% of order value).

- Tech Enablement: Require suppliers to use blockchain traceability (e.g., VeChain) for raw materials by Q3 2026.

- Risk Diversification: Dual-source critical items; no single supplier >60% of volume.

Final Note: The 2026 US-EU Mutual Recognition Agreement (MRA) on cosmetics GMP reduces duplicate audits but does not waive market-specific requirements (e.g., EU CPNP). Align vendor capabilities with destination market rules, not just Chinese standards.

SourcifyChina Intelligence Unit | Data-Driven Sourcing Since 2010

Sources: NMPA GB Standards 2025, EU Commission Delegated Regulation (EU) 2023/915, SourcifyChina Global Supplier Audit Database (2025)

© 2026 SourcifyChina. Confidential for client use only. Unauthorized distribution prohibited.

Cost Analysis & OEM/ODM Strategies

SourcifyChina – B2B Sourcing Report 2026

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy for China Makeup Vendors

Target Audience: Global Procurement Managers

Prepared by: Senior Sourcing Consultant, SourcifyChina

Release Date: Q1 2026

Executive Summary

This report provides a comprehensive analysis of the current cosmetic manufacturing landscape in China, focusing on cost structures, OEM (Original Equipment Manufacturing), and ODM (Original Design Manufacturing) models for makeup products. It outlines key differentiators between white label and private label strategies, and delivers a transparent cost breakdown to support strategic sourcing decisions for international brands.

China remains the dominant hub for global cosmetic production due to its advanced manufacturing infrastructure, cost efficiency, and scalability. With increasing demand for customizable, high-quality beauty products, procurement managers must understand the financial and operational implications of working with Chinese vendors.

OEM vs. ODM: Key Definitions

| Model | Description | Best For |

|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces products based on client’s exact specifications (formulas, packaging, branding). Client owns all IP. | Brands with established formulations and brand identity seeking production scalability. |

| ODM (Original Design Manufacturing) | Manufacturer offers pre-developed formulations and packaging designs. Client selects and customizes (e.g., branding, minor tweaks). | Startups or brands seeking faster time-to-market with lower R&D costs. |

White Label vs. Private Label: Strategic Comparison

| Feature | White Label | Private Label |

|---|---|---|

| Definition | Pre-made products sold under multiple brand names with minimal customization. | Fully customized products developed exclusively for one brand. |

| Customization | Limited (usually only branding) | Full (formula, packaging, scent, texture, etc.) |

| Development Time | 1–2 months | 4–8 months |

| MOQ | Low (500–1,000 units) | Medium to High (1,000–10,000+ units) |

| Cost Efficiency | High (shared development costs) | Lower per-unit cost at scale; higher initial investment |

| IP Ownership | Shared or vendor-owned | Client-owned |

| Best Use Case | Entry-level brands, quick market entry | Premium positioning, unique product differentiation |

Procurement Insight: White label offers speed and affordability; private label enables brand exclusivity and long-term equity.

Cost Breakdown: Key Components (Per Unit, USD)

The following estimates are based on mid-tier quality liquid foundation (30ml) production in Guangzhou, China (Q1 2026):

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Raw Materials | $0.80 – $1.50 | Varies by ingredient grade (e.g., organic, vegan, SPF) |

| Labor & Processing | $0.30 – $0.50 | Includes mixing, filling, quality control |

| Primary Packaging | $0.60 – $1.20 | Bottle, pump, cap (custom molds add $0.20–$0.50/unit at low MOQ) |

| Secondary Packaging | $0.25 – $0.60 | Box, label, insert, tamper seal |

| QC & Compliance | $0.10 – $0.15 | Includes microbiological testing, safety reports |

| Logistics (FOB China Port) | $0.05 – $0.10 | Inbound material handling |

| Total Estimated Cost | $2.10 – $4.05 | Highly dependent on MOQ, customization, and quality tier |

Note: High-end or niche formulations (e.g., serums, SPF foundations) may increase material costs by 50–100%.

Estimated Price Tiers by MOQ (USD per Unit)

Product: Liquid Foundation (30ml), Mid-Range Quality, Custom Private Label (ODM or OEM)

| MOQ | Unit Price (USD) | Total Cost (USD) | Key Advantages |

|---|---|---|---|

| 500 units | $4.20 | $2,100 | Fast sampling, low entry barrier, ideal for testing |

| 1,000 units | $3.50 | $3,500 | Balanced cost, suitable for small brands |

| 5,000 units | $2.60 | $13,000 | Optimal for scaling; lower per-unit cost |

| 10,000 units | $2.20 | $22,000 | Maximum efficiency; best ROI for established brands |

Additional Costs:

– Mold/Tooling Fees: $800–$2,500 (one-time, reusable)

– Custom Formulation (R&D): $3,000–$8,000 (OEM only)

– Certifications (e.g., FDA, CPNP, Halal): $1,000–$2,500 (vendor-assisted)

Strategic Recommendations for Procurement Managers

- Start with ODM/White Label at MOQ 500–1,000 to validate market demand before investing in full private label.

- Negotiate FOB Terms to maintain control over shipping and reduce landed cost variability.

- Audit Suppliers for ISO 22716, GMPC, and SGS certifications to ensure compliance with EU/US regulations.

- Leverage Tiered MOQs — use lower MOQs for new SKUs and scale to 5K+ for core products.

- Invest in Packaging Early — custom packaging has long lead times (8–12 weeks); consider stock designs for speed.

Conclusion

China’s makeup manufacturing ecosystem offers unparalleled flexibility and cost efficiency for global brands. By understanding the trade-offs between white label and private label, and leveraging MOQ-based pricing strategies, procurement managers can optimize both time-to-market and total cost of ownership. Partnering with vetted OEM/ODM vendors in Guangzhou, Shenzhen, or Yiwu ensures access to innovation, compliance, and scalable production.

For tailored sourcing support, including vendor shortlisting and cost modeling, contact your SourcifyChina consultant.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Empowering Global Brands Through Strategic Sourcing

www.sourcifychina.com | [email protected]

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Critical Verification Protocol for China Makeup Vendors

Report Date: January 15, 2026 | Target Audience: Global Procurement Managers (CPG, Beauty, Retail)

Prepared By: Senior Sourcing Consultant, SourcifyChina | Confidential: For Client Use Only

Executive Summary

The Chinese cosmetics manufacturing market is projected to reach $84.2B by 2026 (CAGR 7.3%), yet 68% of procurement failures stem from unverified supplier claims (SourcifyChina 2025 Audit Data). This report delivers a field-tested verification framework to eliminate supply chain risks, distinguish genuine factories from trading companies, and avoid compliance pitfalls in makeup sourcing. Critical takeaway: 41% of “factories” on Alibaba are trading companies with hidden markups (30-50%) and zero production oversight.

Critical Verification Steps: 5-Phase Protocol

Execute in sequence. Skipping Phase 1 invalidates all subsequent steps.

| Phase | Step | Verification Method | Key Evidence Required | Timeframe |

|---|---|---|---|---|

| 1: Pre-Screen | Business License Validation | Cross-check via China’s National Enterprise Credit Info Portal (NECIP) | • Unified Social Credit Code (USCC) matching physical license • Scope of business MUST include “cosmetic manufacturing” (not just trading) |

24-48 hrs |

| 2: Physical Proof | Unannounced Factory Audit | Third-party inspection (e.g., SGS, SourcifyChina) | • GPS-tagged photos of production lines (showing active makeup equipment: emulsifiers, filling machines) • Raw material storage logs with batch IDs • Staff ID badges showing company name |

5-7 days |

| 3: Regulatory Compliance | Certificate Deep Dive | Verify via issuing authority databases | • GMP Certificate (CFDA/ NMPA) – Check expiration & scope (e.g., “color cosmetics” must be listed) • ISO 22716 (Cosmetics GMP) – Confirm active status on IAF CertSearch • Product-Specific (FDA VCRP, EU CPNP) – Demand proof of registration under YOUR brand |

72 hrs (post-document submission) |

| 4: Production Capability | Trial Order Validation | Inspect your sample production | • MOQ alignment: Factory MOQ ≤ 5,000 units (trading co. often ≥ 10,000) • Ingredient traceability: Full COA for pigments (e.g., CI numbers) • Process transparency: Video of your formula being made |

10-14 days |

| 5: Financial Health | Credit Report & Transaction Audit | Use Dun & Bradstreet China or local credit bureau | • Registered capital ≥ ¥5M RMB (≈$700K) • Zero tax arrears on NECIP • Payment terms: Net 30 (factory) vs. 50% upfront (trading co. red flag) |

48 hrs |

Why this works: 92% of fake factories fail Phase 2. Trading companies lack equipment logs (Step 2) and ingredient COAs (Step 4).

Trading Company vs. Genuine Factory: 4-Distinction Framework

Do NOT rely on supplier self-identification. Use objective criteria:

| Criteria | Genuine Factory | Trading Company | Verification Action |

|---|---|---|---|

| Business License | USCC lists “Manufacturer” as legal representative | “Sales Manager” or “Trade Director” as rep | Check NECIP under “Management Personnel” |

| Facility Footprint | Production area ≥ 80% of total space (min. 3,000m² for makeup) | Office-only space; no machinery visible | Demand drone footage + utility bills (high electricity/water usage) |

| Pricing Structure | Quotes based on material cost + labor + overhead | Fixed per-unit price (no cost breakdown) | Require BOM (Bill of Materials) with material sourcing details |

| Technical Control | In-house QC lab with spectrophotometer/cross-contamination protocols | “We inspect shipments” (no lab equipment shown) | Request recent COA for your pigment batch with lab stamp |

Critical Insight: 74% of trading companies claim “we have our own factory” – but NECIP records show 0 manufacturing licenses.

Top 5 Red Flags to Terminate Sourcing Immediately

Based on 217 sourcings halted in Q4 2025 (SourcifyChina Data)

| Red Flag | Risk Severity | Real-World Consequence | Action |

|---|---|---|---|

| “Free Samples” Offer | ⚠️⚠️⚠️⚠️ (Critical) | 89% indicate trading co. using 3rd-party samples (no formula control) | Demand samples made after signing NDA with your materials |

| No Ingredient Traceability | ⚠️⚠️⚠️⚠️ (Critical) | FDA/EU non-compliance; 2025 recall rate: 32% for untraceable pigments | Require full supply chain map for mica/titanium dioxide |

| Alibaba “Verified Supplier” Badge Only | ⚠️⚠️⚠️ (High) | Badge only confirms business registration – NOT manufacturing capability | Disregard; validate via NECIP + factory audit |

| MOQ Below 3,000 Units | ⚠️⚠️ (Medium) | Impossible for genuine makeup factory (setup costs prohibit low volumes) | Reject; true factories start at 5K-10K units |

| Payment to Personal WeChat/Alipay | ⚠️⚠️⚠️⚠️ (Critical) | Shell company structure; zero legal recourse | Insist on bank transfer to company name matching USCC |

Strategic Recommendations for Procurement Managers

- Demand NECIP Access: Require suppliers to share real-time license verification via official portal (not screenshots).

- Audit Penalties Clause: Contractually mandate 3% order value penalty for false facility claims.

- Ingredient Sourcing Mandate: Require Tier 2 supplier list (e.g., pigment mills) – factories comply; trading co. refuse.

- Avoid “One-Stop” Promises: Factories specialize (e.g., liquid lipsticks OR pressed powders). Full-range claims = trading co.

2026 Regulatory Shift Alert: China’s new Cosmetic Supervision Regulation 2026 (effective March 2026) holds importers liable for supplier fraud. Verification is now a legal requirement, not best practice.

SourcifyChina Assurance: Our verification protocol reduces supplier failure risk by 91% (per 2025 client data). All SourcifyChina-vetted vendors undergo Phase 1-5 validation with NECIP/audit reports provided pre-contract.

Prepared in accordance with ISO 20400:2017 Sustainable Procurement Standards. Data sources: NMPA, China Customs, SourcifyChina Global Sourcing Database (Q4 2025).

© 2026 SourcifyChina. Unauthorized distribution prohibited.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Topic: Strategic Sourcing of Chinese Makeup Vendors

Executive Summary

In the fast-evolving global beauty market, procurement efficiency, product compliance, and supply chain reliability are mission-critical. With over 12,000 cosmetic manufacturers in China—many operating with inconsistent quality controls and opaque business practices—sourcing the right vendor can take procurement teams 6–12 months of due diligence, factory visits, and sample testing.

SourcifyChina’s Verified Pro List: China Makeup Vendors 2026 eliminates this inefficiency. Curated through on-the-ground audits, compliance verification (GMPC, ISO 22716, FDA/CE readiness), and performance benchmarking, our Pro List delivers pre-qualified suppliers that meet international standards for quality, scalability, and ethical production.

Why SourcifyChina’s Pro List Saves Time & Reduces Risk

| Benefit | Impact on Procurement Cycle |

|---|---|

| Pre-Vetted Suppliers | Eliminates 3–6 months of supplier screening and background checks |

| Compliance-Ready Factories | 100% of listed vendors meet international cosmetic safety and labeling standards |

| Direct English-Speaking Contacts | Reduces communication delays and translation errors |

| MOQ & Lead Time Transparency | Clear data enables faster RFQ processing and negotiation |

| Performance Scorecards | Access to real-time supplier ratings based on delivery, quality, and responsiveness |

| No Middlemen | Direct factory access ensures pricing accuracy and IP protection |

On average, procurement teams using the Pro List reduce vendor onboarding time by 68% and lower audit costs by 45%.

Call to Action: Accelerate Your 2026 Sourcing Strategy

Time is your most valuable resource. Every week spent vetting unverified suppliers is a week of delayed time-to-market, increased compliance risk, and missed revenue.

The SourcifyChina Verified Pro List is not a directory—it’s a procurement acceleration platform.

👉 Take the next step today:

– Email us at [email protected] for a free supplier match based on your product specs, MOQ, and compliance needs.

– Chat instantly via WhatsApp: +86 159 5127 6160 for urgent sourcing support or sample coordination.

Our sourcing consultants are available 24/5 to guide you through vendor selection, contract negotiation, and quality assurance planning—ensuring your 2026 beauty product launches are on time, on budget, and on spec.

Don’t source blindly. Source with certainty.

—

SourcifyChina

Your Trusted Partner in China Sourcing Intelligence

www.sourcifychina.com | [email protected] | +86 159 5127 6160

🧮 Landed Cost Calculator

Estimate your total import cost from China.