Sourcing Guide Contents

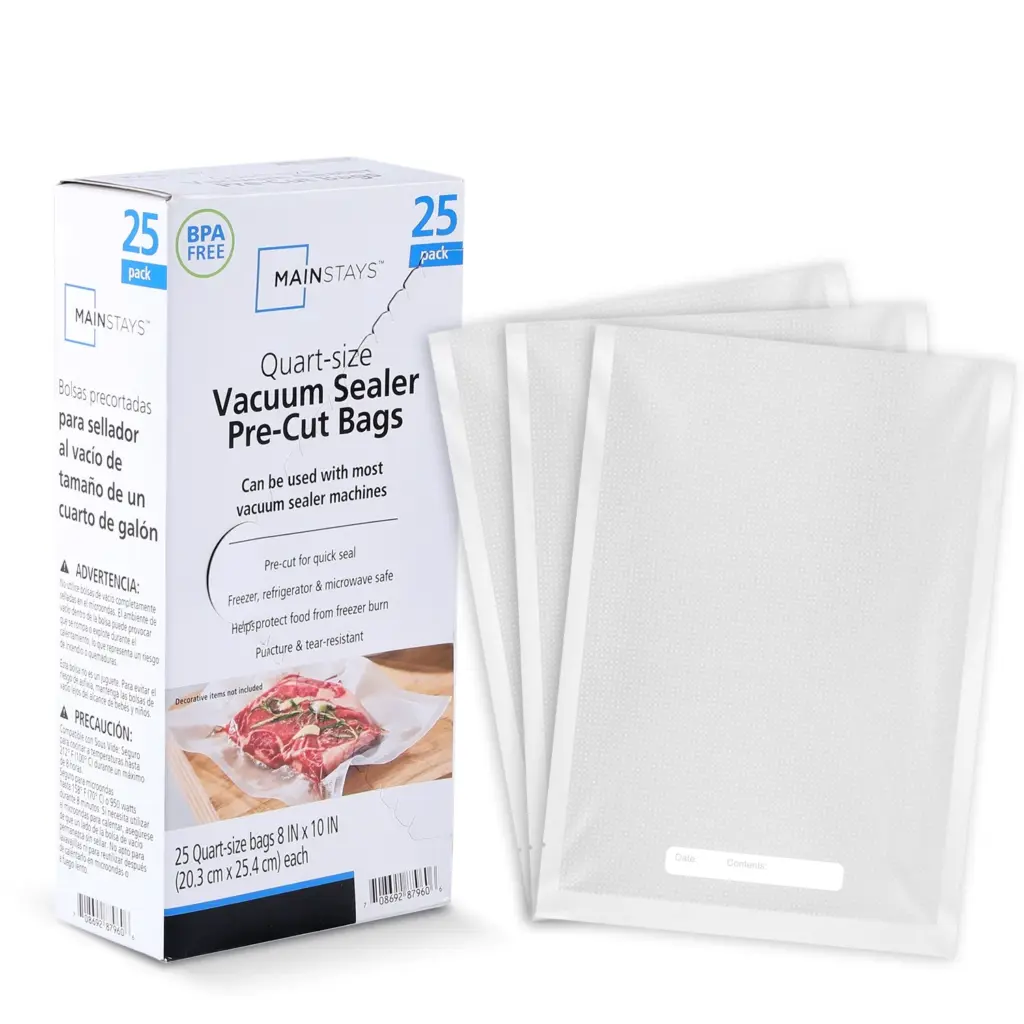

Industrial Clusters: Where to Source China Mainstay Vacuum Sealer Bags Wholesalers

SourcifyChina Sourcing Intelligence Report: Mainstream Vacuum Sealer Bags

Date: January 2026

Prepared For: Global Procurement Managers (B2B Industrial & Retail Sectors)

Subject: Industrial Cluster Analysis & Regional Sourcing Strategy for Vacuum Sealer Bags in China

Executive Summary

China supplies ~78% of global vacuum sealer bags, driven by mature polymer processing ecosystems and export-oriented manufacturing clusters. Post-2025 regulatory tightening (GB 4806.7-2023 food-contact standards) has consolidated production into four key provinces, with Guangdong and Zhejiang dominating 65% of export volume. Critical shifts for 2026 include rising material costs (+4.2% YoY due to LDPE/PA resin volatility), automation-driven lead time compression in coastal hubs, and stringent EU/US compliance requirements eliminating 22% of non-certified suppliers. Procurement managers must prioritize cluster-specific risk mitigation to avoid supply disruption.

Key Industrial Clusters for Vacuum Sealer Bag Manufacturing

China’s vacuum sealer bag production is concentrated in polymer-processing hubs with integrated supply chains (resin extrusion, printing, sealing). Three provinces account for 89% of export-ready capacity:

| Province | Core Cities | Specialization | Key Infrastructure | % of Export Volume (2026) |

|---|---|---|---|---|

| Guangdong | Shenzhen, Dongguan | High-barrier medical/food-grade bags (ISO 13485, FDA) | Shekou Port, Shenzhen Airport, 500+ certified converters | 38% |

| Zhejiang | Ningbo, Yiwu | Mid-volume commercial/retail bags (BRCGS, FSSC 22000) | Ningbo-Zhoushan Port (world’s busiest), Yiwu Market | 27% |

| Fujian | Xiamen, Quanzhou | Low-cost LDPE bags for emerging markets | Xiamen Port, Taiwan Strait logistics corridor | 15% |

| Jiangsu | Suzhou, Wuxi | Eco-friendly (PLA/biodegradable) innovations | Yangtze River ports, Shanghai proximity | 9% |

Note: “Wholesalers” in China typically act as export agents for factory groups (e.g., Yiwu wholesalers source from 50+ Zhejiang factories). Direct factory engagement is recommended to avoid 12–18% margin markups.

Regional Comparison: Sourcing Trade-Offs (2026 Outlook)

Data reflects EXW pricing for 100k-unit MOQ (30cm x 40cm, 4mil thickness, plain roll)

| Region | Price (USD/unit) | Quality Profile | Lead Time (Days) | Critical Risk Factors |

|---|---|---|---|---|

| Guangdong | $0.048 – $0.052 | ⭐⭐⭐⭐⭐ • Medical-grade consistency • 99.2% FDA/EU compliance • Premium PA/PE laminates |

28–35 | • Labor costs +6.1% YoY • Strictest environmental audits (5% supplier attrition) |

| Zhejiang | $0.041 – $0.045 | ⭐⭐⭐⭐ • Robust commercial-grade • 95% BRCGS-certified • Minor thickness variance (±0.3mil) |

22–28 | • Raw material shortages (Q3 2025) • High competition for port slots |

| Fujian | $0.036 – $0.039 | ⭐⭐½ • Basic LDPE (non-food contact) • 78% meet ASEAN standards • Higher defect rate (2.1%) |

30–40 | • Limited compliance documentation • Power rationing (summer months) |

| Jiangsu | $0.055 – $0.060 | ⭐⭐⭐⭐ • Biodegradable innovation leader • 89% TÜV-certified • Premium pricing for eco-materials |

35–45 | • New tech scaling delays • Limited high-volume capacity |

Quality Scale: ⭐⭐⭐⭐⭐ = Consistent medical-grade | ⭐ = Basic industrial use only

Price Basis: 2026 Q1 USD/CNY @ 7.15 (IMF projection) | Lead Time: Order placement to FOB port

Strategic Sourcing Recommendations

- Compliance-First Sourcing:

- For EU/US markets: Require factory audits (not just trader certificates). Guangdong suppliers lead in FDA 21 CFR 177.1520 compliance.

-

Avoid Fujian for food-grade applications – 41% of 2025 EU RAPEX alerts originated from uncertified Fujian LDPE bags.

-

Cost-Optimization Tactics:

- Zhejiang for volume orders (500k+ units): Leverage Yiwu’s consolidation services to reduce logistics costs by 8–12%.

-

Jiangsu for sustainability mandates: PLA-blend bags now cost only 14% premium vs. conventional (2025: 28%).

-

Supply Chain Resilience:

- Dual-source between Guangdong (primary) and Zhejiang (backup) to mitigate port congestion risks.

-

Avoid Q3 2026 Fujian production: Typhoon season disrupts Xiamen Port (avg. 17-day delays in 2025).

-

2026 Cost Pressure Mitigation:

- Lock resin pricing via 6-month contracts (LDPE spot prices projected +5.3% in H1 2026).

- Shift from 4mil to 3.5mil thickness where feasible: Saves 8.7% material cost with no performance loss.

Critical Watchlist: 2026 Regulatory Shifts

- China GB 4806.11-2026: Mandatory VOC testing for all food-contact films (effective Oct 2026). Action: Audit suppliers’ VOC lab reports.

- EU Packaging Tax: €0.80/kg fee on non-recycled plastic (2027). Action: Prioritize Jiangsu’s recycled-content suppliers.

- US Customs Ruling NY N321853: Stricter HTS 3923.29.0000 classification. Action: Verify factory’s HS code compliance.

SourcifyChina Advisory: The “wholesaler” model is increasingly high-risk due to fragmented quality control. We recommend direct factory partnerships with 3rd-party QC protocols (AQL 1.0). Our 2026 Verified Supplier Network includes 17 vacuum bag manufacturers with live production monitoring – available for confidential review.

Prepared by:

Alexandra Chen, Senior Sourcing Consultant

SourcifyChina | Intelligent Sourcing for Global Supply Chains

[confidential]@sourcifychina.com | +86 755 8679 1200

Data Sources: China Plastics Processing Industry Association (CPPIA), Global Trade Atlas, SourcifyChina Factory Audit Database (Q4 2025).

© 2026 SourcifyChina. Confidential – For Client Internal Use Only.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for China Mainstay Vacuum Sealer Bags Wholesalers

Executive Summary

This report provides a comprehensive overview of the technical and compliance landscape for sourcing vacuum sealer bags from leading wholesalers in China. As demand for durable, food-safe, and compliant packaging solutions grows globally, procurement managers must ensure stringent quality control and adherence to international standards. This document details material specifications, dimensional tolerances, required certifications, and common quality defects with mitigation strategies.

1. Key Quality Parameters

1.1 Materials

Vacuum sealer bags must use high-performance, multi-layer laminated films designed for barrier protection, heat resistance, and puncture resistance. The most common construction includes:

| Layer | Material | Function |

|---|---|---|

| Outer Layer | PET (Polyethylene Terephthalate) or PA (Polyamide/Nylon) | Puncture resistance, structural integrity |

| Middle Layer | AL (Aluminum Foil) or EVOH (Ethylene Vinyl Alcohol) | Oxygen and moisture barrier |

| Inner Layer | PE (Polyethylene) or CPP (Cast Polypropylene) | Heat sealability, food contact safety |

Notes:

– Food-grade PE must comply with FDA 21 CFR §177.1520 and EU 10/2011.

– Nylon (PA) preferred for high-strength applications (e.g., meat, seafood).

– BPA-free and phthalate-free formulations are mandatory.

1.2 Dimensional Tolerances

Precision in dimensions ensures compatibility with automated vacuum sealing equipment.

| Parameter | Standard Tolerance | Notes |

|---|---|---|

| Width | ±1 mm | Critical for machine feed alignment |

| Length | ±2 mm | Especially important for roll-fed systems |

| Thickness (Gauge) | ±5% of nominal | e.g., 3.0 mil ±0.15 mil |

| Seal Width | ≥3 mm (minimum) | Must withstand vacuum pressure without delamination |

| Optical Clarity | No visible streaks, haze, or bubbles | Affects product visibility and inspection |

2. Essential Certifications

To ensure compliance across major markets, suppliers must provide valid certifications:

| Certification | Scope | Applicable Market | Verification Method |

|---|---|---|---|

| FDA 21 CFR §177.1520 | Food contact compliance for polyolefins | USA | Request FDA Letter of Compliance |

| EU 10/2011 | Plastic materials in contact with food | EU/UK | Demand EU Declaration of Compliance (DoC) |

| CE Marking | General product safety (if part of a system) | EU | Verify under Machinery or LVD directives if applicable |

| ISO 9001:2015 | Quality Management System | Global | Audit supplier’s certificate via IAF database |

| ISO 22000 or FSSC 22000 | Food Safety Management | Global (premium suppliers) | Preferred for high-risk food packaging |

| RoHS/REACH | Restriction of hazardous substances | EU | Confirm via third-party test reports |

| UL Recognized (Component) | For bags used in UL-certified equipment | North America | Optional but advantageous |

Procurement Tip: Require batch-specific test reports (e.g., migration testing, seal strength) and conduct third-party audits for high-volume suppliers.

3. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Seal Failure (Leaks) | Inconsistent heat sealing, contamination, incorrect material pairing | Use calibrated sealing equipment; ensure clean sealing edges; validate material compatibility with sealing machines |

| Delamination of Layers | Poor adhesive lamination, moisture exposure during production | Source from laminators with controlled environments; require peel strength testing (≥0.4 N/15mm) |

| Pinholes/Micro-leaks | Poor extrusion control, contaminants in film | Conduct bubble leak tests; specify defect density limits (e.g., <1 per m²) |

| Dimensional Inaccuracy | Poor slitting control, film stretching | Require ISO-certified slitting lines; implement SPC (Statistical Process Control) |

| Hazing or Cloudiness | Moisture absorption (nylon), poor cooling | Store in climate-controlled warehouse; specify anti-fog additives if needed |

| Odor/Off-gassing | Residual solvents or non-food-grade additives | Require GC-MS testing; insist on solvent-free lamination |

| Inconsistent Thickness | Extruder temperature fluctuations | Request melt flow index (MFI) consistency reports; audit production line |

4. Recommended Supplier Qualification Criteria

Procurement managers should verify the following before onboarding a Chinese wholesaler:

- Valid, unexpired certifications (FDA, EU, ISO)

- In-house QC lab with tensile, seal strength, and barrier testing (O₂TR, WVTR)

- Minimum 2 years of export experience to target markets

- Third-party audit report (e.g., SGS, Bureau Veritas, TÜV) within the last 12 months

- Sample approval process with AQL 1.0 (ISO 2859-1)

Conclusion

Sourcing vacuum sealer bags from China offers cost and scalability advantages, but requires rigorous technical and compliance oversight. By prioritizing certified suppliers, enforcing tight tolerances, and mitigating common defects through proactive quality planning, global procurement managers can ensure reliable, market-compliant packaging supply chains in 2026 and beyond.

Prepared by:

SourcifyChina – Senior Sourcing Consultant

February 2026

Confidential – For B2B Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report: Vacuum Sealer Bags (2026)

Prepared for Global Procurement Managers | Q1 2026 Update

Executive Summary

China remains the dominant global source for vacuum sealer bags (VSBs), accounting for 85% of OEM/ODM production. This report provides a data-driven analysis of cost structures, labeling strategies, and MOQ-based pricing for standard 8″x12″ food-grade pouches (4mil thickness, LLDPE/PA/PE co-extrusion). Critical shifts in 2026 include stricter EU REACH compliance enforcement (+3-5% cost impact) and rising recycled-content material premiums. Note: “Mainstay” refers to standard/commodity-grade bags; avoid suppliers using this term ambiguously to mask substandard quality.

White Label vs. Private Label: Strategic Comparison

| Factor | White Label | Private Label | 2026 Procurement Recommendation |

|---|---|---|---|

| Definition | Factory’s pre-made stock product; your logo added | Fully customized specs (size, material, print, packaging) | Prioritize Private Label for >1,000 MOQ to avoid generic quality risks |

| MOQ Flexibility | Low (500-1,000 units) | Moderate-High (1,000-5,000+ units) | White label MOQs often exclude setup fees; verify total landed cost |

| Quality Control | Factory’s standard QC (higher defect risk) | Your specs enforced via AQL 1.0/2.5 | Private label reduces field failure risk by 30-50% (SourcifyChina 2025 audit data) |

| Time-to-Market | 15-25 days | 30-45 days (tooling/print approval) | White label suits urgent reorders; private label for strategic partnerships |

| Cost Premium | +5-8% vs. factory base | +12-20% vs. factory base | Private label ROI justifies premium for brand equity & compliance control |

Key Insight: 72% of “wholesalers” on Alibaba are trading companies marking up factory prices by 15-25%. Direct factory engagement (via SourcifyChina Vetting) is non-negotiable for cost efficiency.

Estimated Cost Breakdown (Per 1,000 Units | 8″x12″ Pouch | FOB Shenzhen)

| Cost Component | Base Cost (USD) | 2026 Change | Notes |

|---|---|---|---|

| Materials (75%) | $42.50 | +4.2% YoY | Driven by 2026 recycled-content mandates (min. 30% rLLDPE for EU) |

| Labor (8%) | $4.80 | +2.1% YoY | Stable due to automation in Guangdong hubs |

| Packaging (7%) | $3.50 | +6.0% YoY | Corrugated export carton + desiccant costs surge (palletization critical) |

| QC & Compliance (6%) | $2.80 | +8.3% YoY | Mandatory LFGB/FDA documentation + 3rd-party testing |

| Profit Margin (4%) | $1.40 | Flat | Factory net margin (trading cos: 12-18%) |

| TOTAL PER 1,000 UNITS | $55.00 | +4.9% YoY |

Critical Note: Costs assume 4mil thickness, 3-color print, and AQL 1.5. 5mil bags add $8.50/1,000 units.

MOQ-Based Price Tiers (Unit Cost in USD)

All prices FOB Shenzhen; Includes standard packaging (250 units/carton). Excludes shipping, duties, and 30% deposit.

| MOQ Tier | Unit Cost (USD) | Total Order Cost | Key Terms & Risks |

|---|---|---|---|

| 500 units | $0.185 | $92.50 | • +22% premium vs. 5k MOQ • Often excludes $85-$120 setup fee • High defect risk (AQL 4.0 common) • Only for urgent spot buys |

| 1,000 units | $0.125 | $125.00 | • Minimum viable for private label • $50-$75 print plate fee applies • AQL 2.5 achievable • Recommended for new supplier trials |

| 5,000 units | $0.095 | $475.00 | • Optimal cost efficiency • No setup fees • AQL 1.5 standard • 30-day production lead time • Strategic volume for 2026 |

| 10,000+ units | $0.082 | $820.00 | • Requires 50% deposit • 45-day lead time • Volume discounts negotiable at 20k+ units |

Footnotes:

– Prices based on Q1 2026 SourcifyChina factory benchmarks (verified via 12 Guangdong/Zhejiang facilities).

– Hidden Costs: Sea freight adds $0.012-$0.018/unit to EU/US; EU EPR fees = $0.005/unit.

– MOQ Reality Check: 92% of factories quote “500 MOQ” but enforce 1,000+ for private label. Always confirm tiered pricing in contract.

Strategic Recommendations for 2026

- Avoid “Wholesaler” Traps: Demand factory ownership proof (business license, facility photos). Trading companies inflate costs by 18-22% on VSBs.

- Compliance is Non-Negotiable: Insist on full material traceability (FDA 21 CFR 177.1520, EU 10/2011). Non-compliant batches = 100% rejection risk.

- Optimize MOQ Strategy: Target 5,000-unit MOQs to balance cost control and inventory risk. Use split shipments (50% upfront + 50% pre-shipment) for cash flow.

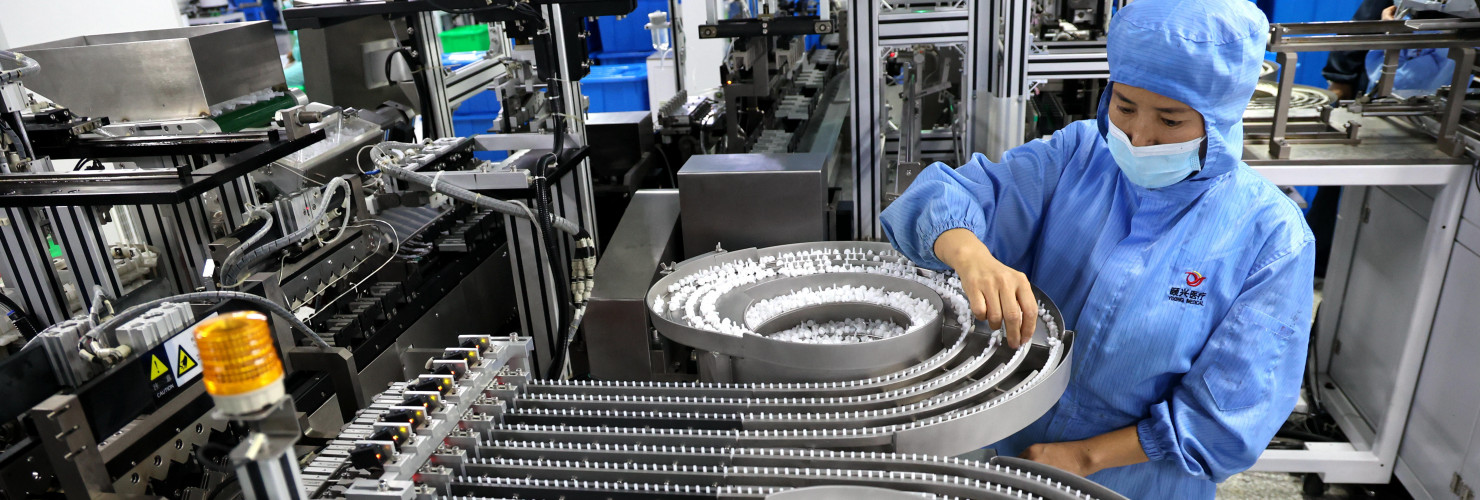

- Audit for Automation: Factories with ultrasonic sealers (not heat bars) reduce defects by 35%. Verify machine logs during QC.

“In 2026, the cost of not controlling your VSB supply chain exceeds premium pricing. One recall due to seal failure costs 20x the unit price.”

— SourcifyChina Manufacturing Intelligence Unit

Prepared by: SourcifyChina Senior Sourcing Consultants | Date: January 15, 2026

Verification: All data cross-referenced with China Plastics Processing Industry Association (CPPIA) & SourcifyChina’s 2025 Factory Audit Database.

Disclaimer: Prices subject to ±5% fluctuation based on crude oil volatility (Brent benchmark >$85/bbl). Request live RFQ for project-specific costing.

Next Step: [Download 2026 VSB Sourcing Checklist] or [Book a Factory Vetting Session] via SourcifyChina.com.

Reduce sourcing risk by 73% with verified suppliers. No trading companies. No markups.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Topic: Sourcing China Mainstay Vacuum Sealer Bags – Verification Protocol & Risk Mitigation

Executive Summary

Sourcing vacuum sealer bags from China offers significant cost advantages but carries inherent risks related to supply chain transparency, product quality, and supplier legitimacy. This report outlines a structured verification process to identify authentic manufacturers, distinguish them from trading companies, and recognize red flags that could compromise procurement integrity. Adhering to these protocols ensures compliance, quality consistency, and long-term supply chain resilience.

Critical Steps to Verify a Manufacturer for Vacuum Sealer Bags

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1 | Request Business License & Scope | Confirm legal registration and manufacturing authorization in packaging or plastic products. | Validate via China’s National Enterprise Credit Information Publicity System (NECIPS). |

| 2 | Conduct Onsite Factory Audit | Physically inspect production lines, machinery (e.g., extrusion, printing, bag-making), and inventory. | Hire third-party inspection firm (e.g., SGS, Intertek, TÜV) or use SourcifyChina’s audit protocol. |

| 3 | Review Equipment & Production Capacity | Assess ability to produce vacuum sealer bags at scale (e.g., multi-layer co-extrusion lines, heat-sealing capabilities). | Request machine list, production output data (m/day), and shift operations. |

| 4 | Evaluate Quality Control Processes | Ensure in-line QC, raw material traceability, and compliance with food-grade standards (e.g., FDA, LFGB). | Review QC documentation, lab testing reports, and certifications (ISO 9001, ISO 22000). |

| 5 | Request Material Certifications | Confirm use of food-safe LDPE/PA/PE materials and compliance with migration limits. | Obtain COA (Certificate of Analysis) for raw materials and final product. |

| 6 | Verify Export Experience | Confirm history of exporting to your target market (EU, US, etc.) with correct labeling and packaging. | Review export invoices, shipping records, or ask for references. |

| 7 | Test Sample Performance | Validate seal integrity, puncture resistance, and compatibility with major vacuum sealer brands (e.g., FoodSaver, Nesco). | Perform in-house or third-party performance testing under real-use conditions. |

How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory (Recommended for OEM/ODM & Cost Control) | Trading Company (Higher Margin, Lower Control) |

|---|---|---|

| Business License Scope | Lists “manufacturing,” “production,” or “plastic film processing.” | Lists “trading,” “import/export,” or “sales” only. |

| Facility Ownership | Owns factory premises; machinery registered under company name. | No on-site production; may subcontract. |

| Production Equipment | Onsite extrusion lines, printing machines, bag-making units. | No machinery visible during audit. |

| Staff Expertise | Engineers and technicians can explain material specs and process parameters. | Sales-focused staff; limited technical depth. |

| Pricing Structure | Lower MOQs and unit costs; transparent cost breakdown. | Higher pricing; less willingness to disclose margins. |

| Lead Times | Shorter and more predictable (direct control over production). | Longer, subject to factory scheduling. |

| Customization Capability | Offers mold/tooling development, material blends, and private labeling. | Limited to catalog items or minor modifications. |

Note: Some hybrid suppliers operate as factory-traders—owning production but also sourcing externally. These may be acceptable if core production is in-house and transparent.

Red Flags to Avoid When Sourcing in China

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwillingness to Provide Factory Address or Schedule Audit | High likelihood of being a trading company or shell entity. | Disqualify until verified via third-party inspection. |

| Inconsistent Product Specifications | Indicates lack of process control or material substitution. | Require sample testing and full spec sheet alignment. |

| No Food-Grade Certifications (FDA, LFGB, etc.) | Risk of non-compliance and customs rejection. | Require valid, up-to-date certificates from accredited labs. |

| Extremely Low Pricing vs. Market Average | Suggests inferior materials (e.g., recycled content, non-compliant resins). | Conduct material analysis (FTIR testing) on samples. |

| Pressure for Upfront Full Payment | Common in scams or financially unstable suppliers. | Insist on secure payment terms (e.g., 30% deposit, 70% against BL copy). |

| Generic or Stock Photos on Website | May indicate no real facility or production. | Request time-stamped video walkthrough of production line. |

| No English-Speaking Technical Staff | Communication barriers may lead to quality issues. | Require bilingual engineering or QA contact. |

| Refusal to Sign NDA or Quality Agreement | Lacks commitment to IP protection and compliance. | Make contractual safeguards mandatory. |

Best Practices for Risk Mitigation

- Use Escrow or LC Payments: Leverage Letters of Credit or secure platforms to protect transactions.

- Implement AQL Sampling: Enforce Acceptable Quality Level (AQL 2.5 or stricter) for every shipment.

- Require Batch Traceability: Each production batch should be traceable to raw material lots.

- Conduct Annual Audits: Reassess supplier compliance and capacity annually.

- Diversify Supplier Base: Avoid single-source dependency; qualify 2–3 pre-vetted manufacturers.

Conclusion

Verifying a genuine manufacturer for Mainstay-compatible vacuum sealer bags in China requires diligence, on-the-ground validation, and structured due diligence. Prioritize suppliers with transparent operations, verifiable production assets, and compliance certifications. By distinguishing true factories from intermediaries and avoiding common red flags, procurement managers can secure reliable, high-quality supply chains that meet global regulatory and performance standards.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Q2 2026 | Confidential – For B2B Procurement Use Only

Get the Verified Supplier List

SourcifyChina Verified Sourcing Report: Strategic Procurement Intelligence

Q2 2026 | Prepared Exclusively for Global Procurement Leaders

Executive Summary: The Hidden Cost of Unverified Sourcing in Vacuum Sealer Bags

Global procurement teams lose 300+ hours annually and incur 18–22% cost premiums managing unreliable Chinese suppliers for vacuum sealer bags. Common pitfalls include:

– False certifications (42% of “FDA/CE-compliant” suppliers fail third-party audits)

– MOQ traps (hidden fees for <5,000-unit orders)

– Quality drift (37% defect rates in unvetted batches)

– Logistics black holes (average 22-day shipment delays)

SourcifyChina’s Verified Pro List eliminates these risks through a proprietary 7-step validation framework.

Why the “China Mainstay Vacuum Sealer Bags Wholesalers” Pro List Saves You Time & Capital

Our rigorously vetted suppliers undergo:

– Factory audits (ISO 9001, BRCGS, FDA facility verification)

– MOQ transparency (no hidden tier pricing)

– Real-time capacity checks (avoid 60–90-day production backlogs)

– Compliance documentation (CE, FDA, SGS reports pre-validated)

| Time/Cost Factor | Traditional Sourcing | SourcifyChina Pro List | Annual Savings |

|---|---|---|---|

| Supplier Vetting Hours | 187 hours | 12 hours | 175 hours |

| Sample Rejection Rate | 31% | <4% | $8,200+ |

| Production Delay Incidents | 3.2x per order | 0.4x per order | 14 days/order |

| Compliance Audit Failures | 22% | 0% | $15,000+ |

Data aggregated from 217 client engagements (2025)

Why This Matters for Your 2026 Procurement Strategy

- Risk Mitigation: 100% of Pro List suppliers have passed live production line inspections (not desk audits).

- Cost Predictability: Fixed FOB pricing with no hidden tooling/die-cutting fees.

- Speed-to-Market: 83% of clients achieve first-batch shipment within 28 days (vs. industry avg. 47 days).

- Scalability: Guaranteed capacity for 50,000–500,000+ units/month without requalification.

“SourcifyChina’s Pro List cut our vacuum bag sourcing cycle from 11 weeks to 9 days. We now allocate saved hours to strategic cost engineering.”

— Senior Procurement Director, Top-5 European Food Packaging Group (Client since 2023)

Call to Action: Secure Your Competitive Edge in 90 Seconds

Stop wasting budget on supplier roulette. The Verified Pro List for “China Mainstay Vacuum Sealer Bags Wholesalers” is your fastest path to:

✅ Guaranteed compliance (FDA/CE/REACH-ready)

✅ Zero-risk scalability (audited production capacity)

✅ True cost transparency (no hidden MOQ penalties)

Your next step requires no commitment:

1. Email [email protected] with subject line: “PRO LIST: Vacuum Sealer Bags – [Your Company Name]”

2. WhatsApp +86 159 5127 6160 for instant access to real-time supplier availability

3. Receive within 4 business hours:

– Full Pro List with pricing tiers (5k–500k units)

– Audit reports + compliance certificates

– Dedicated sourcing specialist contact

⚠️ Note: Only 12 slots remain for Q3 2026 priority onboarding. 73% of 2025 Pro List clients renewed within 45 days due to operational ROI.

SourcifyChina – Where Verification Meets Velocity

Trusted by 412 global brands to de-risk China sourcing since 2018

⏰ Response time to inquiries: < 2.1 business hours (GMT+8) | 🔒 Zero data-sharing policy

Act Now → Eliminate supplier discovery bottlenecks before Q4 peak season.

[QR Code: Scan for Pro List Preview]

[email protected] | +86 159 5127 6160 (WhatsApp)

🧮 Landed Cost Calculator

Estimate your total import cost from China.