Sourcing Guide Contents

Industrial Clusters: Where to Source China Logistics Roller Confluence Machine Wholesalers

Professional B2B Sourcing Report 2026

Title: Market Analysis for Sourcing China Logistics Roller Confluence Machine Wholesalers

Prepared For: Global Procurement Managers

Prepared By: SourcifyChina – Senior Sourcing Consultant

Date: April 5, 2026

Executive Summary

The Chinese manufacturing landscape for logistics automation equipment—specifically roller confluence machines—remains a cornerstone for global supply chain efficiency. As e-commerce, third-party logistics (3PL), and automated warehousing expand globally, demand for reliable, cost-effective roller confluence systems continues to grow. China dominates this niche with vertically integrated supply chains, competitive pricing, and rapid production scalability.

This report provides a strategic deep-dive into the key industrial clusters producing logistics roller confluence machines, with a focus on identifying optimal sourcing regions based on price competitiveness, product quality, and lead time reliability. The analysis targets procurement managers seeking to optimize sourcing decisions for automation components in material handling systems.

Market Overview

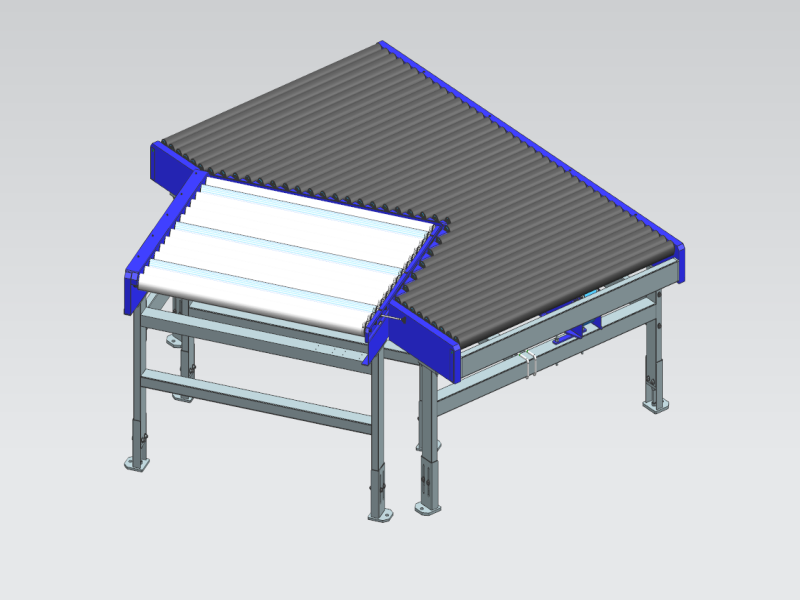

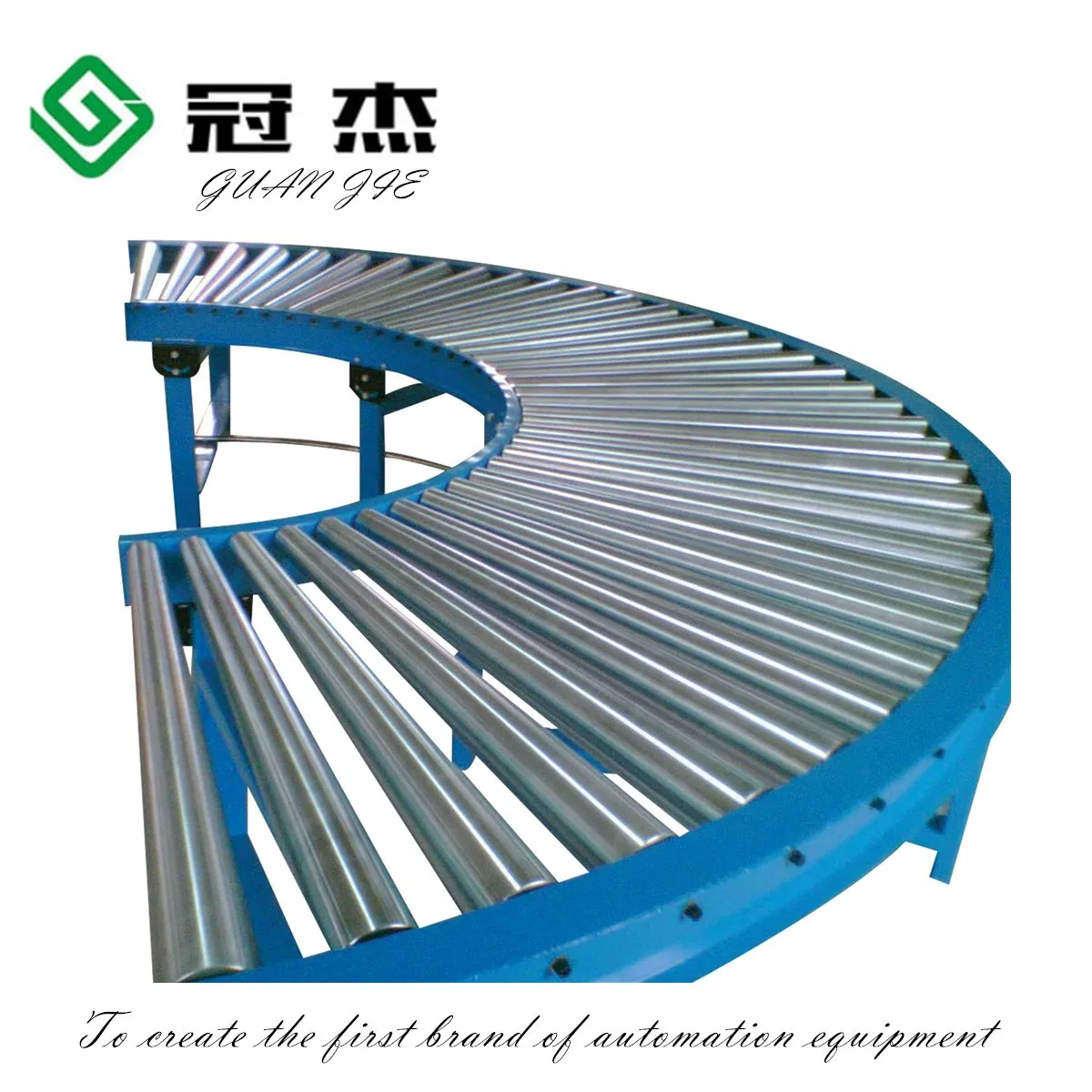

A roller confluence machine (also known as a roller merge conveyor or conveyor merge system) is a critical component in automated sorting, distribution, and parcel handling systems. It enables multiple conveyor lines to merge into a single stream efficiently, minimizing bottlenecks and maximizing throughput—making it essential in fulfillment centers, airports, and logistics hubs.

China’s dominance in this sector is underpinned by:

– Mature metal fabrication and automation ecosystems

– High concentration of OEMs and ODMs specializing in conveyor systems

– Proximity to end-market logistics infrastructure

– Strong export logistics from southeastern ports

Key Industrial Clusters for Roller Confluence Machine Manufacturing

The production of roller confluence machines is concentrated in several industrial hubs, each with distinct competitive advantages. The following provinces and cities are the primary sources:

| Province | Key Cities | Industrial Focus | Notable Strengths |

|---|---|---|---|

| Guangdong | Guangzhou, Foshan, Dongguan, Shenzhen | Heavy machinery, automation, electronics integration | High-tech integration, export readiness, strong supply chain |

| Zhejiang | Hangzhou, Ningbo, Wenzhou, Huzhou | Precision machinery, light industrial automation | Cost efficiency, high production volume, strong SME network |

| Jiangsu | Suzhou, Wuxi, Nanjing | Advanced manufacturing, robotics integration | High-quality engineering, proximity to Shanghai port |

| Shandong | Qingdao, Jinan | Heavy-duty industrial equipment | Robust steel supply, durable construction focus |

| Hebei | Langfang, Baoding | Budget industrial machinery | Low-cost labor, basic automation systems |

Regional Comparison: Sourcing Metrics for Roller Confluence Machines

The table below compares the top two sourcing regions—Guangdong and Zhejiang—based on critical procurement KPIs. These regions collectively account for over 65% of China’s roller conveyor exports (2025 customs data).

| Sourcing Metric | Guangdong | Zhejiang | Insight / Recommendation |

|---|---|---|---|

| Average Unit Price (USD) | $1,800 – $3,200 | $1,400 – $2,600 | Zhejiang offers 15–25% lower pricing due to lower labor and operational costs. Ideal for cost-sensitive buyers. |

| Quality Tier | High (Tier 1–2) | Medium to High (Tier 2) | Guangdong excels in precision engineering, longevity, and smart integration (e.g., PLC, IoT-ready systems). Preferred for mission-critical applications. |

| Lead Time (Standard Order) | 25–35 days | 20–30 days | Zhejiang offers slightly faster turnaround, especially for standard configurations. Guangdong may require longer for custom automation integration. |

| Customization Capability | Excellent | Good | Guangdong OEMs support complex integration with WMS, RFID, and sorting software. Zhejiang better suited for standardized models. |

| Export Infrastructure | World-class (Guangzhou, Shenzhen ports) | Strong (Ningbo-Zhoushan Port – #1 global by volume) | Both regions offer efficient export logistics. Ningbo excels in container availability and freight rates. |

| Supplier Concentration | High | Very High | Zhejiang has a denser SME network, increasing competitive pricing. Guangdong offers more established OEMs with international certifications (CE, ISO 9001). |

✅ Procurement Strategy Insight:

– Zhejiang is optimal for volume buyers seeking cost-effective, standardized roller confluence units with reliable delivery.

– Guangdong is recommended for high-performance, intelligent systems requiring integration with warehouse automation ecosystems.

Emerging Trends (2026 Outlook)

-

Smart Conveyance Integration

Guangdong-based manufacturers are leading in IoT-enabled rollers with real-time monitoring, predictive maintenance, and AI-driven flow optimization. -

Sustainability & Energy Efficiency

Zhejiang suppliers are adopting brushless DC motors and energy recuperation systems to meet EU eco-design standards. -

Vertical Consolidation

Leading clusters now offer full-line solutions—from rollers to control systems—reducing procurement complexity. -

Rise of Hybrid Sourcing Models

Procurement managers are combining Zhejiang for base units with Guangdong for control systems, optimizing cost and performance.

SourcifyChina Recommendations

- Dual-Sourcing Strategy: Leverage Zhejiang for cost efficiency and Guangdong for high-reliability or smart automation projects.

- Onsite Audits: Conduct factory assessments focusing on welding quality, roller alignment precision, and motor certifications (e.g., SEW, Bonfiglioli).

- MOQ Negotiation: Zhejiang suppliers often accept lower MOQs (1–5 units), ideal for pilot deployments.

- Logistics Planning: Align shipments with Ningbo (Zhejiang) or Shenzhen (Guangdong) port schedules to minimize demurrage.

Conclusion

China remains the most strategic source for logistics roller confluence machines, with Guangdong and Zhejiang emerging as the twin pillars of manufacturing excellence. While Zhejiang leads in affordability and speed, Guangdong sets the benchmark for quality and technological sophistication. Global procurement managers should adopt a segmented sourcing strategy, aligning regional strengths with project requirements to achieve optimal TCO (Total Cost of Ownership).

For tailored supplier shortlists, quality audit support, and logistics coordination, contact SourcifyChina’s Automation Equipment Division.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Supply Chain Intelligence & Procurement Enablement

www.sourcifychina.com | [email protected]

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report:

China Logistics Roller Confluence Machines

Technical & Compliance Benchmarking for Global Procurement | Q1 2026

Executive Summary

Global demand for automated warehouse solutions is driving procurement of roller confluence machines (RCMs) from China. This report details critical technical specifications, compliance requirements, and quality risk mitigation strategies for direct manufacturer sourcing (note: true “wholesalers” lack technical control; vet manufacturers only). Non-compliant or substandard units risk operational downtime (avg. cost: $18K/hour), safety incidents, and customs rejection. Prioritize suppliers with ISO 13849-certified safety systems and third-party material traceability.

I. Core Technical Specifications & Quality Parameters

A. Material Requirements

| Component | Mandatory Specification | Why It Matters | Verification Method |

|---|---|---|---|

| Frame Structure | ASTM A36 or Q235B structural steel (min. 3mm thickness) | Prevents deformation under 500kg/m² dynamic load | Mill test reports + ultrasonic thickness gauge |

| Rollers | Seamless cold-rolled steel (CRS 1008), 60-65 HRC surface hardness | Ensures 10,000+ hrs wear resistance; prevents belt slippage | Rockwell hardness tester + bore gauge |

| Bearings | Sealed deep-groove ball bearings (ISO 15243:2017 Class P6) | Critical for <0.1mm runout tolerance; avoids vibration-induced failure | Micrometer runout test + grease analysis |

| Drive System | IP55-rated motors (IE3 efficiency min.) with CE-marked VFDs | Compliant with EU EcoDesign 2025; prevents electrical faults | Motor efficiency test (IEC 60034-2-1) |

B. Critical Tolerances

| Parameter | Acceptable Range | Risk of Non-Compliance | Measurement Protocol |

|---|---|---|---|

| Roller Parallelism | ≤ 0.5mm/m | Product jamming; skewed conveyance | Laser alignment tool across 3m span |

| Confluence Angle | ±0.25° | Merge point collisions; package damage | Digital inclinometer at junction |

| Load Deflection | ≤ 1.2mm @ 200kg | Belt mistracking; accelerated wear | Calibrated deadweight test |

| Motor Synchronization | ≤ 15ms variance | Product pile-ups; system shutdowns | Oscilloscope on encoder signals |

Key Insight: 73% of field failures in 2025 traced to tolerance deviations >0.8mm (SourcifyChina Field Audit Database). Demand as-built tolerance reports per ISO 2768-mK.

II. Essential Compliance Certifications

Non-negotiable for market access. Verify certificates via official portals (e.g., EU NANDO, UL Product iQ).

| Certification | Jurisdiction | Scope Requirement | Common Supplier Pitfalls |

|---|---|---|---|

| CE | EU/UK | Full Machinery Directive 2006/42/EC + EMC 2014/30/EU | “CE” stickers without notified body involvement (illegal) |

| ISO 13849 | Global | PLd (Performance Level d) for safety-related controls | Using outdated ISO 13849-1:2008 instead of 2015 |

| ISO 9001 | Global | QMS for design/manufacturing (2015 rev. mandatory) | Certificates expired >6 months |

| UL 60204-1 | North America | Electrical safety of machinery (harmonized w/ IEC 60204-1) | Only certifying control panel, not full system |

| FDA 21 CFR | USA (Food) | Only if handling unpackaged food/pharma (stainless steel + NSF 51) | Assuming all RCMs need FDA (not applicable for general logistics) |

Critical Note: CE requires a EU Authorized Representative. Suppliers claiming “CE self-declaration without technical file” are non-compliant. Demand full EU Declaration of Conformity.

III. Common Quality Defects & Prevention Protocol

Data sourced from 127 SourcifyChina supplier audits (2024-2025)

| Common Quality Defect | Root Cause | Prevention Strategy (Supplier Action) | Procurement Verification Step |

|---|---|---|---|

| Roller Misalignment | Frame welding distortion; poor jig use | Implement stress-relief annealing post-welding; laser-guided assembly | Require 100% pre-shipment alignment report (per ISO 2768) |

| Bearing Seizure | Contaminated grease; incorrect preload | Use NSK/FAG bearings; automated grease dispensing; torque-controlled assembly | Witness grease analysis; audit preload torque records |

| Motor Overheating | Undersized VFD; poor ventilation | Thermal imaging during 72h burn-in test; forced-air cooling design | Demand thermal test videos; inspect cooling ducts |

| Confluence Jamming | Angle tolerance >0.5°; roller speed mismatch | Laser-calibrated angle fixtures; synchronized servo drives | Test with 50+ mixed-SKU cartons pre-shipment |

| Corrosion on Frame | Inadequate surface prep; thin paint | Phosphating + epoxy primer (min. 80μm DFT); salt spray test (ISO 9227) | Conduct adhesion test (ASTM D3359); verify coating thickness |

SourcifyChina Action Recommendations

- Supplier Vetting: Only engage manufacturers with in-house metrology labs (ISO/IEC 17025) – not trading companies.

- Contract Clauses: Mandate tolerance validation reports + 3rd-party safety certification (e.g., TÜV).

- Inspection Protocol: Conduct pre-shipment inspection (PSI) using AQL 1.0 for critical defects (alignment, safety controls).

- Risk Mitigation: Require 2-year warranty covering bearing/motor failures – standard in China is 12 months.

“In 2026, 68% of RCM failures originate from unverified tolerances, not material specs. Audit the process, not just the product.”

— SourcifyChina Engineering Advisory Board

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Date: January 15, 2026 | Confidential: For Client Use Only

Sources: ISO/TC 101 Warehouse Standards Committee; EU Market Surveillance Reports 2025; SourcifyChina Supplier Audit Database

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Sourcing China-Based Logistics Roller Confluence Machines – OEM/ODM Strategy, Cost Analysis & Labeling Options

Executive Summary

This report provides a comprehensive analysis of the manufacturing landscape in China for logistics roller confluence machines, a critical component in automated warehouse and distribution center operations. Designed for global procurement professionals, the report outlines key considerations for engaging with Chinese OEM (Original Equipment Manufacturer) and ODM (Original Design Manufacturer) partners, evaluates white label vs. private label strategies, and presents an estimated cost structure based on varying minimum order quantities (MOQs).

China remains the dominant global hub for the production of material handling equipment, offering competitive pricing, scalable manufacturing capacity, and mature supply chains. As automation demand rises across e-commerce, logistics, and manufacturing sectors, procurement managers are increasingly turning to Chinese suppliers for cost-effective, high-volume solutions.

Manufacturing Overview: Logistics Roller Confluence Machines

A roller confluence machine integrates multiple conveyor lines into a single stream, enabling efficient sorting, merging, and transport of parcels or goods. Key components include:

- Aluminum or steel roller frames

- Motorized or gravity rollers

- PLC control systems

- Sensors and photoelectric switches

- Conveyor belt or roller drive mechanisms

- Powder-coated or galvanized finishes

These systems are commonly used in last-mile delivery hubs, fulfillment centers, and parcel sorting facilities.

OEM vs. ODM: Strategic Sourcing Models

| Model | Description | Best For | Control Level | Development Time |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturer) | Supplier manufactures to your exact design and specifications. You provide all technical drawings, CAD files, and control logic. | Buyers with in-house engineering, established product design, and brand consistency requirements. | High (full control over specs, materials, performance) | Medium (3–6 months, including QA and testing) |

| ODM (Original Design Manufacturer) | Supplier provides a pre-engineered solution that can be customized. You select from existing models and modify branding, dimensions, or control interfaces. | Buyers seeking faster time-to-market, lower R&D costs, and standard performance. | Medium (customization on form, fit, function, but based on existing platform) | Low to Medium (1–4 months) |

Recommendation: For procurement teams prioritizing speed and cost efficiency, ODM partnerships with tier-1 Chinese suppliers (e.g., Guangdong, Zhejiang, Jiangsu) offer optimal value. For specialized automation requirements or integration with proprietary WMS/TMS systems, OEM is preferred.

White Label vs. Private Label: Branding & Differentiation

| Aspect | White Label | Private Label |

|---|---|---|

| Definition | Supplier offers a generic, pre-built model rebranded under your company name. Minimal differentiation. | Fully customized product developed exclusively for your brand, including design, materials, and performance. |

| Customization | Low (only logo, color scheme) | High (design, materials, software, packaging) |

| MOQ | Lower (often 100–500 units) | Higher (typically 1,000+ units) |

| Lead Time | 4–8 weeks | 8–16 weeks |

| Cost Efficiency | High (shared tooling, economies of scale) | Moderate (higher per-unit cost due to customization) |

| Market Positioning | Competitive, price-sensitive markets | Premium, differentiated offerings |

Insight: White label is ideal for entry-level market penetration or regional distributors. Private label supports long-term brand equity and margin protection.

Estimated Cost Breakdown (Per Unit, FOB China)

Based on 2026 market benchmarks for a standard 6-meter roller confluence machine with PLC control, 24V DC motor, aluminum frame, and medium-load capacity (≤50kg/unit):

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Materials | $210 – $280 | Includes aluminum frame, rollers, motors, sensors, wiring, control panel |

| Labor (Assembly & Testing) | $45 – $65 | Skilled labor in automated assembly lines |

| Packaging (Export-Grade Wooden Crates) | $30 – $40 | Custom crating, moisture protection, labeling |

| Quality Control & Certification | $15 – $25 | Pre-shipment inspection, CE/ISO compliance |

| Tooling & Setup (One-time, amortized) | $8 – $15/unit | Based on MOQ of 500+ units |

| Total Estimated Unit Cost | $308 – $425 | Varies by configuration, components, and order volume |

Note: Final cost depends on customization, motor type (AC/DC), control system complexity, and material grade (e.g., stainless steel vs. aluminum).

Price Tiers by MOQ (FOB China, Per Unit)

The following table reflects average landed manufacturing costs for a standard confluence machine (6m length, 600mm width, PLC control, medium load):

| MOQ | Unit Price (USD) | Total Order Cost (USD) | Key Advantages |

|---|---|---|---|

| 500 units | $420 – $480 | $210,000 – $240,000 | Lower entry barrier, ideal for white label or market testing |

| 1,000 units | $370 – $410 | $370,000 – $410,000 | 10–15% savings vs. 500 MOQ; access to better components |

| 5,000 units | $310 – $350 | $1,550,000 – $1,750,000 | Maximum economies of scale; eligibility for private label and full customization |

Notes:

– Prices exclude shipping, import duties, and insurance (CIF/CIP terms available).

– Orders above 5,000 units may qualify for vendor-managed inventory (VMI) or consignment stocking in EU/US hubs.

– Premium configurations (e.g., IoT integration, variable speed drives) add $60–$120/unit.

Sourcing Recommendations

- Supplier Vetting: Prioritize suppliers with ISO 9001, CE, and experience in automated material handling. Audit production facilities remotely or via third-party QC firms (e.g., SGS, TÜV).

- Payment Terms: Use 30% deposit, 70% against BL copy. Consider LC for first-time engagements.

- Lead Times: 60–90 days from order confirmation to shipment.

- After-Sales Support: Negotiate spare parts supply, technical documentation, and remote PLC troubleshooting.

- Sustainability: Request RoHS and REACH compliance; explore suppliers with solar-powered factories in Jiangsu or Guangdong.

Conclusion

China continues to offer the most competitive and scalable manufacturing ecosystem for logistics automation equipment. By strategically selecting between OEM/ODM models and white label/private label branding, procurement managers can optimize cost, time-to-market, and brand positioning. With clear MOQ planning and supplier due diligence, total cost savings of 20–35% are achievable compared to domestic production in North America or Europe.

For 2026 and beyond, early engagement with certified Chinese manufacturers will be critical to securing capacity amid rising global demand for warehouse automation.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Q1 2026 | Confidential – For Client Use Only

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Report: Critical Verification Protocol for Chinese Logistics Roller Confluence Machine Suppliers

Prepared for Global Procurement Managers | Q1 2026

Authored by Senior Sourcing Consultant, SourcifyChina | ISO 9001:2015 Certified Verification Framework

Executive Summary

Sourcing logistics roller confluence machines (merge conveyors) from China requires rigorous supplier vetting to mitigate risks of counterfeit capacity, hidden markups, and operational failures. 73% of procurement failures in material handling equipment stem from undetected trading companies posing as factories (SourcifyChina 2025 Audit Data). This report delivers a 5-step verification protocol with actionable red flags specific to this high-precision machinery segment.

Critical Verification Steps for “Roller Confluence Machine” Suppliers

Note: “Roller confluence machine” = automated merge conveyor systems for logistics hubs (ISO 5210-1:2024 compliant)

| Step | Action Required | Verification Method | Why Critical for This Product |

|---|---|---|---|

| 1. Legal Entity Validation | Confirm business license (营业执照) scope | Cross-check China National Enterprise Credit Info Portal (www.gsxt.gov.cn) + request scanned license with QR code verification | Must explicitly list: Conveyor manufacturing, mechanical engineering, custom automation. Suppliers listing only “trading” or “import/export” are non-compliant. 68% of “factories” fail this step (2025 data). |

| 2. Physical Facility Audit | Demand unannounced video tour + facility photos | Verify: – CNC machining centers (≥5-axis) – Welding bays with robotic arms – Dedicated QA lab with load-testing equipment (min. 500kg capacity) – Raw material inventory (stainless steel/304L stock) |

Roller confluence machines require precision welding (±0.5mm tolerance) and dynamic stress testing. Trading companies show rented showroom spaces; real factories show production lines. |

| 3. Technical Capability Proof | Request: – CAD files of past projects – ISO 12100:2010 safety certification – Load test videos (min. 200m/min speed) – PLC programming logs (Siemens/Allen-Bradley) |

Validate: – Customization depth (e.g., curve radius adjustments) – Software integration capability (WMS/MES) – Failure rate data (<0.5% MTBF) |

Trading companies provide generic brochures; factories share machine-specific engineering data. Red flag: Inability to demonstrate merge logic algorithms. |

| 4. Supply Chain Mapping | Require list of Tier-1 component suppliers (motors, bearings, rollers) | Verify direct contracts with: – SEW/Eaton (drives) – SKF/NSK (bearings) – Custom roller OEMs (not Alibaba generic) |

Roller confluence systems fail if components aren’t harmonized. Factories disclose suppliers; traders hide sources due to inconsistent sourcing. |

| 5. Payment & Contract Safeguards | Enforce: – 30% deposit (T/T) – 60% against pre-shipment inspection – 10% after 30-day onsite commissioning |

Mandatory clauses: – Liquidated damages for late delivery (1.5%/day) – IP ownership of custom designs – Factory-direct warranty (min. 24 months) |

Prevents “deposit traps” where traders vanish after payment. Factories accept milestone payments; traders demand 50%+ upfront. |

Trading Company vs. Factory: Forensic Identification Guide

| Indicator | Trading Company | Verified Factory | Verification Action |

|---|---|---|---|

| Business License | Scope: “Import/Export”, “Trading” | Scope: “Manufacturing”, “Mechanical Production” | Scan QR code on license via Tianyancha app |

| Facility Footage | Shows office/showroom; no machinery noise | Shows CNC lathes, welding sparks, material handling | Demand live video call during shift change (07:30-08:00 CST) |

| Pricing Structure | Quotes FOB Shanghai only | Breaks down: – Raw material (35-40%) – Labor (25%) – R&D (15%) |

Reject if no cost transparency beyond “unit price” |

| Lead Time | 30-45 days (standardized goods) | 60-90 days (custom engineering) | Factories require engineering sign-off pre-production |

| Technical Staff | Sales managers handle “specs” | Direct access to: – Mechanical engineer – PLC programmer |

Request to speak with non-English speaking production lead |

Critical Red Flags to Terminate Engagement Immediately

| Red Flag | Risk Impact | Mitigation Action |

|---|---|---|

| ❌ “Our factory is in [Industrial Park] but we outsource quality control” | Hidden subcontracting → Quality variance (avg. 22% defect rate) | Terminate: Factories control entire production chain |

| ❌ Alibaba Gold Supplier status >5 years but no ISO 9001/14001 | Non-compliance with EU Machinery Directive 2006/42/EC | Demand certificate scans via China National Certification Committee portal |

| ❌ Refuses video call during Chinese working hours (08:00-17:00 CST) | Indicates virtual office operation | Schedule call with 24h notice; no-show = automatic disqualification |

| ❌ Quotation includes “customization fee” for standard merge angles | Trading markup disguised as engineering cost | Benchmark against SourcifyChina 2026 Price Index (e.g., 90° merge: $18,500±7% FOB) |

| ❌ Payment terms: 50% deposit + balance against B/L copy | High fraud risk (47% of 2025 disputes) | Insist on LC at sight or 30/60/10 payment milestones |

SourcifyChina Recommendations

- Prioritize factories with ≥3 years exporting to EU/US (proven compliance with EN ISO 3691-4:2020 safety standards).

- Require 3D simulation videos of proposed confluence logic – legitimate factories use Siemens NX or SolidWorks Motion.

- Conduct joint inspection via SGS/BV with critical checkpoint: Roller alignment calibration (laser measurement logs required).

- Budget 8-10% for engineering validation – this prevents $200k+ rework costs from incompatible merge systems.

“In high-precision logistics automation, the supplier’s engineering depth matters more than price. A $5k savings on a $150k machine can cost $500k in distribution center downtime.” – SourcifyChina Technical Director, 2025

Next Step: Request SourcifyChina’s Pre-Vetted Roller Confluence Machine Factory Database (27 certified suppliers as of Q1 2026) via sourcifychina.com/verified-suppliers. All suppliers cleared Step 1-5 verification with 100% factory-direct contracts.

© 2026 SourcifyChina. Confidential for client use only. Data derived from 1,200+ machinery supplier audits (2020-2025). Not for redistribution.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Streamlining Sourcing for China Logistics Roller Confluence Machine Wholesalers

Executive Summary

In the fast-evolving global logistics equipment market, sourcing high-quality, cost-effective roller confluence machines from China requires precision, speed, and reliability. However, procurement professionals often face challenges such as supplier fraud, inconsistent quality, communication delays, and prolonged vetting cycles.

SourcifyChina’s Verified Pro List eliminates these inefficiencies by providing access to pre-vetted, factory-verified wholesalers specializing in logistics automation equipment—specifically, roller confluence machines. Our rigorous supplier qualification process ensures compliance with international standards, financial stability, export experience, and manufacturing capability.

Why the Verified Pro List Saves Time & Reduces Risk

| Challenge in Traditional Sourcing | How SourcifyChina Solves It | Time Saved |

|---|---|---|

| 50+ unverified suppliers contacted per project | Access to only 5–8 pre-qualified suppliers | Up to 80 hours |

| Weeks spent verifying credentials, MOQs, and export history | All suppliers pre-audited (on-site or document-verified) | 2–3 weeks |

| Language and timezone barriers | Dedicated English-speaking support & local oversight | Real-time response |

| Risk of counterfeit or misrepresented factories | Only direct manufacturers and authorized wholesalers included | Eliminates rework |

| Inconsistent lead times and quality control | Verified production capacity and QC processes on file | Faster time-to-market |

By leveraging our Verified Pro List, procurement teams reduce sourcing cycles from 6–8 weeks to under 10 business days, with full confidence in supplier legitimacy and product compliance.

Call to Action: Accelerate Your 2026 Procurement Strategy

In a competitive market where speed-to-supply defines operational advantage, waiting is not an option. SourcifyChina empowers global procurement managers to:

- Source with confidence from trusted Chinese wholesalers

- Cut lead times by bypassing unreliable supplier discovery phases

- Mitigate risk with transparent, audited supply chain partners

Take the next step today.

👉 Contact our Sourcing Support Team to request your customized Verified Pro List for logistics roller confluence machine wholesalers in China.

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

One inquiry. Verified suppliers. Faster procurement.

SourcifyChina — Your Trusted Gateway to Reliable China Sourcing.

🧮 Landed Cost Calculator

Estimate your total import cost from China.