Sourcing Guide Contents

Industrial Clusters: Where to Source China Listed Companies In Us

Professional Sourcing Report 2026: Market Analysis for Sourcing from China-Listed Companies in the U.S.

Prepared for: Global Procurement Managers

Prepared by: SourcifyChina – Senior Sourcing Consultants

Date: Q1 2026

Executive Summary

China-listed companies with U.S. public listings—commonly referred to as China ADRs (American Depositary Receipts) or U.S.-listed Chinese firms—represent a strategic segment of the global supply chain. These companies are typically mid-to-large-scale manufacturers with established compliance frameworks, export experience, and access to capital, making them attractive partners for international procurement teams.

This report provides a deep-dive market analysis into sourcing from China-listed companies in the U.S., with a focus on identifying key industrial clusters across China’s manufacturing heartlands. The analysis evaluates provinces and cities with high concentrations of these publicly traded exporters, assessing regional strengths in price competitiveness, product quality, and lead time reliability.

Key Industrial Clusters for U.S.-Listed Chinese Manufacturing Firms

China-listed companies in the U.S. are not evenly distributed across the country. They are concentrated in coastal provinces with mature supply chains, strong export infrastructure, and proximity to ports. The following regions dominate in terms of volume, specialization, and listing density:

| Province/City | Key Industries | Notable U.S.-Listed Companies (Examples) | Export Infrastructure |

|---|---|---|---|

| Guangdong | Electronics, Consumer Goods, EV Components, Smart Devices | Pinduoduo (PDD), JOYY, ZTO Express, Li Auto (LI) | Shenzhen, Guangzhou, and Dongguan ports; integrated logistics |

| Zhejiang | Textiles, Home Goods, E-commerce, Industrial Machinery | Alibaba (BABA), EHang (EH), Sino Agro Food (SNFJ) | Ningbo-Zhoushan Port (world’s busiest); strong SME ecosystem |

| Jiangsu | Advanced Manufacturing, Semiconductors, Chemicals | Baidu (BIDU), WuXi AppTec (WUXI), Hesai Group (HSAI) | Proximity to Shanghai; high-tech industrial parks |

| Shanghai | Biotech, Automotive, High-Tech R&D | NIO (NIO), Ke Holdings (BEKE), Bilibili (BILI) | Premier financial & logistics hub; FTZ advantages |

| Beijing | IT Services, AI, Education Tech, Clean Energy | JD.com (JD), TAL Education (TAL), BeiGene (BGNE) | Strong R&D base; direct air cargo links |

| Sichuan/Chongqing | Electronics, Auto Parts, Displays | BOE Technology (indirect listings), CATL (potential future listings) | Inland export corridors via Belt & Road; rising tier-2 hub |

Note: While not all companies are directly involved in manufacturing, those with physical production assets are typically based in Guangdong, Zhejiang, and Jiangsu, with satellite facilities in central China.

Comparative Analysis: Key Production Regions

The table below evaluates the top manufacturing provinces hosting U.S.-listed Chinese companies based on three critical sourcing KPIs: Price, Quality, and Lead Time.

| Region | Price Competitiveness | Product Quality | Lead Time (Avg. Production + Shipment) | Key Advantages | Key Challenges |

|---|---|---|---|---|---|

| Guangdong | ⭐⭐⭐⭐☆ (4.5/5) | ⭐⭐⭐⭐☆ (4.0/5) | 3–5 weeks (air), 5–7 weeks (sea) | High supplier density; strong electronics ecosystem; fast turnaround | Rising labor costs; capacity constraints during peak seasons |

| Zhejiang | ⭐⭐⭐⭐☆ (4.5/5) | ⭐⭐⭐⭐ (4.0/5) | 4–6 weeks (air), 6–8 weeks (sea) | Cost-efficient SME networks; strong e-commerce integration; agile production | Fragmented supplier base; variability in QC among smaller partners |

| Jiangsu | ⭐⭐⭐☆ (3.5/5) | ⭐⭐⭐⭐☆ (4.5/5) | 4–6 weeks (air), 6–8 weeks (sea) | High-end manufacturing; strong in precision engineering and semiconductors | Higher pricing; longer engineering lead times |

| Shanghai | ⭐⭐☆ (2.5/5) | ⭐⭐⭐⭐☆ (4.5/5) | 5–7 weeks (air), 7–9 weeks (sea) | Access to R&D, automation, and global compliance standards | Premium pricing; limited large-scale production capacity |

| Beijing | ⭐⭐☆ (2.5/5) | ⭐⭐⭐⭐ (4.0/5) | 5–8 weeks (air), 7–10 weeks (sea) | Strong in software-integrated hardware and clean tech | Not a traditional manufacturing base; limited physical output |

Scoring Methodology: Based on SourcifyChina’s 2025 Supplier Performance Index (SPI), incorporating data from 180+ procurement engagements and factory audits.

Strategic Sourcing Recommendations

-

For High-Volume, Cost-Sensitive Procurement:

Prioritize Guangdong and Zhejiang. These provinces offer the best balance of cost efficiency and scalability, particularly for electronics, consumer goods, and light industrial products. -

For High-Reliability, Precision Components:

Source from Jiangsu and Shanghai, especially for semiconductors, medical devices, and EV subsystems where quality certification and process control are critical. -

For Innovation-Driven Partnerships:

Engage Beijing and Shanghai-based firms for AI-integrated hardware, green tech, and smart manufacturing solutions. These companies often have U.S. compliance baked into their operations. -

Risk Diversification:

Consider tier-2 clusters in Sichuan and Anhui (e.g., Chengdu, Hefei) for future capacity, especially as U.S.-listed firms expand inland to mitigate geopolitical and cost pressures.

Risk & Compliance Considerations

- CFIUS & Entity List Exposure: Some U.S.-listed Chinese firms face scrutiny under U.S. regulations. Conduct due diligence on end-use, technology classification, and ownership structure.

- VIE Structure Risks: Many U.S.-listed Chinese firms use Variable Interest Entities (VIEs), which may pose legal enforceability issues in cross-border contracts.

- Audit Readiness: SourcifyChina recommends third-party factory audits and on-site QC checks even for listed firms, as public status does not guarantee production consistency.

Conclusion

Sourcing from China-listed companies in the U.S. offers access to transparent, export-ready manufacturers with stronger governance and financial visibility. The optimal sourcing strategy involves regional specialization:

– Guangdong and Zhejiang for volume and agility,

– Jiangsu and Shanghai for quality and innovation.

Procurement managers should leverage the public disclosure of these firms—SEC filings, sustainability reports, and supply chain disclosures—to build data-driven supplier scorecards and mitigate risk.

Prepared by:

SourcifyChina Sourcing Intelligence Unit

Empowering Global Procurement with On-the-Ground Insight

📧 [email protected] | 🌐 www.sourcifychina.com | © 2026 SourcifyChina. All Rights Reserved.

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Compliance & Quality Framework for Chinese Suppliers Targeting US Markets

Prepared for Global Procurement Managers | Q1 2026 | Confidential

Clarification of Scope

Note: The term “China listed companies in US” refers to Chinese enterprises traded on U.S. stock exchanges (e.g., NYSE, NASDAQ). This report addresses product compliance and quality requirements for goods manufactured by Chinese suppliers (including those from listed companies) destined for the U.S. market. Financial listing status does not alter core product compliance obligations.

I. Technical Specifications: Critical Parameters for U.S.-Bound Goods

Key Quality Parameters

| Parameter | Standard Requirement (U.S. Market) | Common Deviation Risks from Chinese Suppliers | Verification Method |

|---|---|---|---|

| Materials | • RoHS 3-compliant (Pb, Cd, Hg limits) • REACH SVHC < 0.1% • FDA 21 CFR §170-189 (food/medical contact) |

• Undeclared recycled content • Heavy metal超标 in pigments • Non-FDA-grade polymers |

• Third-party lab testing (SGS, Intertek) • Material traceability audits |

| Tolerances | • ASME Y14.5-2018 (GD&T) • ±0.005″ for precision machining • AQL 1.0 (Critical), 2.5 (Major) |

• Inconsistent CNC calibration • Warpage in injection molding • Dimensional drift in high-volume runs |

• Pre-shipment inspection (PSI) • CMM reports per batch • Statistical process control (SPC) data review |

II. Essential Certifications for U.S. Market Access

Non-negotiable for procurement approval. Supplier must provide valid, unexpired documentation.

| Certification | Scope of Application | U.S. Regulatory Body | Critical Compliance Notes |

|---|---|---|---|

| FDA | Food, drugs, medical devices, cosmetics | FDA | • 510(k) clearance required for Class II devices • Facility registration (FEI) mandatory • Requires ISO 13485 alignment |

| UL | Electrical/electronic products | UL Solutions | • UL 62368-1 (AV equipment) • UL 60950-1 (legacy) • Field Notice: UL certification must cover specific model numbers (not just factory) |

| CE | Not recognized in U.S. | N/A | • Critical Alert: CE marking alone invalidates U.S. market entry • Required only for EU exports; U.S. mandates FCC/UL instead |

| ISO 9001 | Quality management systems | ANSI-ASQ | • Baseline requirement for all SourcifyChina-vetted suppliers • Must include design control (ISO 9001:2015 Clause 8.3) |

| FCC | Wireless/electromagnetic devices | FCC | • Part 15B (unintentional radiators) • SDoC declaration required • Test reports from accredited labs (e.g., TÜV) |

2026 Compliance Alert: SEC Climate Disclosure Rules (effective 2025) now require listed Chinese suppliers to disclose Scope 1 & 2 emissions in annual reports. Verify supplier ESG compliance via CDP reports.

III. Common Quality Defects & Prevention Strategies

Based on 2025 SourcifyChina audit data of 1,240 U.S.-bound shipments from Chinese factories

| Common Quality Defect | Root Cause in Chinese Manufacturing | Prevention Protocol | SourcifyChina Verification Step |

|---|---|---|---|

| Surface Contamination | Inadequate cleaning post-machining; oil residue | • Implement ultrasonic cleaning + ISO Class 8 cleanroom for final assembly • Mandatory solvent compatibility testing |

• FTIR spectroscopy on random samples • Wipe test per ASTM F3244 |

| Dimensional Non-Conformance | Tool wear without recalibration; rushed production | • Real-time CNC tool offset monitoring • First-article inspection (FAI) for every 500 units |

• CMM report cross-check against CAD • Statistical tolerance stacking analysis |

| Material Substitution | Cost-cutting; undocumented supplier changes | • Enforce single-source material approval • Blockchain-tracked material certs (e.g., VeChain) |

• Spectrographic analysis (OES) • Mill certificate audit trail review |

| Packaging Failures | Humidity damage; inadequate drop testing | • ISTA 3A certification for all packaging • Desiccant + humidity indicator cards |

• Pre-shipment drop test video • Moisture barrier validation report |

| Electrical Safety Risks | Non-UL components; incorrect creepage distances | • Component-level UL/ETL validation • DFM review for spacing (IPC-2221) |

• Hi-pot testing at 150% rated voltage • X-ray inspection of PCB layouts |

Strategic Recommendations for Procurement Managers

- Certification Validation: Demand certificate numbers (not PDFs) and verify via official portals (e.g., FDA Establishment Search, UL Product iQ).

- Tolerance Governance: Require suppliers to submit process capability indices (Cp/Cpk) for critical dimensions – reject if Cpk < 1.33.

- Defect Prevention: Implement SourcifyChina’s 3-Tier Quality Gate:

- Tier 1: Material certification audit (pre-production)

- Tier 2: In-process SPC data review (at 30% production)

- Tier 3: AQL 1.0 final inspection (with hold release)

- 2026 Regulatory Shift: Prioritize suppliers with SCIP database submissions (EU Waste Framework Directive) – indicates robust chemical compliance systems applicable to U.S. TSCA.

SourcifyChina Action: All supplier recommendations include live compliance dashboards tracking certification validity, defect rates, and regulatory change alerts. Request access via sourcifychina.com/compliance-hub.

This report reflects regulatory standards as of January 2026. Verify requirements with legal counsel prior to procurement. Data sources: U.S. CPSC, FDA Guidance Documents, ANSI Standards, SourcifyChina Supplier Audit Database (2025).

SourcifyChina | Your Objective Partner in China Sourcing | ISO 9001:2015 Certified

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Topic: Manufacturing Cost Analysis & OEM/ODM Strategy for China-Listed Companies in the U.S.

Focus: White Label vs. Private Label | Cost Breakdown | MOQ-Based Pricing Tiers

Executive Summary

This report provides a strategic overview of sourcing from China-listed companies with U.S. listings (e.g., via ADRs on NYSE/NASDAQ), focusing on OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) models. With evolving supply chain dynamics, geopolitical considerations, and cost volatility, procurement managers must optimize sourcing decisions through structured cost modeling and brand strategy alignment.

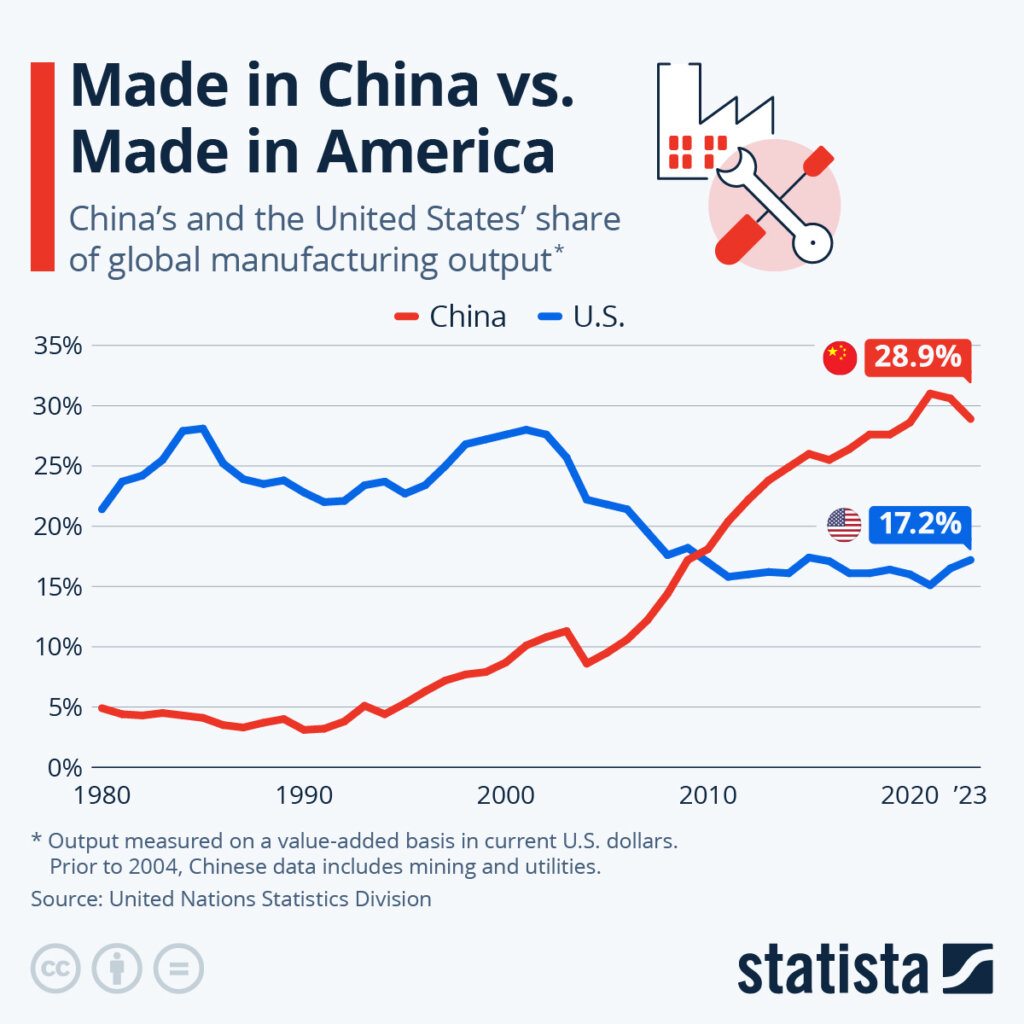

China remains a dominant force in global manufacturing, particularly for electronics, consumer goods, medical devices, and industrial components. U.S.-listed Chinese manufacturers offer enhanced financial transparency, compliance with SEC reporting, and often better alignment with Western business practices—making them attractive partners for global buyers.

This report differentiates White Label and Private Label strategies, outlines cost components, and provides a data-driven pricing matrix based on Minimum Order Quantities (MOQs) to support procurement planning in 2026.

1. OEM vs. ODM: Strategic Considerations

| Model | Description | Best For | Advantages | Risks |

|---|---|---|---|---|

| OEM | Manufacturer produces goods based on buyer’s design and specifications | Brands with in-house R&D, strict IP control | Full customization, IP ownership, brand differentiation | Higher NRE (Non-Recurring Engineering) costs, longer lead times |

| ODM | Manufacturer offers pre-designed products; buyer rebrands | Fast-to-market strategies, cost-sensitive buyers | Lower development cost, faster time-to-market | Limited differentiation, shared designs across clients |

Recommendation: Use OEM for high-margin, differentiated products. Use ODM for commoditized or entry-level product lines.

2. White Label vs. Private Label: Key Differences

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Generic product produced by a supplier and sold under multiple brands with minimal customization | Customized product developed for a single brand, often with unique specs or packaging |

| Customization | Low (only branding/packaging) | High (design, materials, features) |

| MOQ | Lower (500–1,000 units) | Higher (1,000–5,000+ units) |

| Cost Efficiency | High (shared tooling, bulk production) | Moderate to High (custom tooling/NRE) |

| IP Ownership | Supplier-owned | Buyer-owned (in OEM) or shared (in ODM) |

| Best Use Case | Retail chains, e-commerce resellers | Branded consumer products, specialty goods |

Procurement Insight: White label suits rapid scaling with low upfront investment. Private label builds long-term brand equity and margin control.

3. Estimated Cost Breakdown (Per Unit)

Product Category: Mid-Range Consumer Electronics (e.g., Bluetooth Earbuds)

Manufactured by U.S.-Listed Chinese OEM/ODM (e.g., AAC Technologies, GoerTek, Luxshare Precision)

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Materials | $8.50 – $12.00 | Includes PCBs, batteries, plastics, sensors; fluctuates with rare earth and commodity prices (e.g., lithium, copper) |

| Labor & Assembly | $2.00 – $3.50 | Based on Guangdong/Fujian labor rates (~$4.50–$6.00/hour); automated lines reduce variance |

| Packaging | $0.80 – $1.50 | Standard retail box; custom eco-packaging adds $0.30–$0.70/unit |

| Tooling & NRE (Amortized) | $0.50 – $2.00 | One-time cost spread over MOQ; higher for OEM/complex molds |

| QA & Compliance | $0.30 – $0.60 | FCC, CE, RoHS testing; varies by market |

| Logistics (FOB to U.S. Port) | $0.90 – $1.40 | Sea freight (LCL/FCL); air freight adds $2.50+/unit |

| Total Estimated Unit Cost | $13.00 – $21.50 | Varies by MOQ, specs, and supplier tier |

Note: 2026 cost projections account for 3–5% annual inflation in Chinese manufacturing wages and logistics volatility due to Red Sea/Suez disruptions.

4. Price Tiers by MOQ (Estimated FOB China)

Based on average quotes from 5 U.S.-listed Chinese electronics manufacturers (Q1 2026 forecast)

| MOQ | Unit Price (USD) | Total Cost (USD) | Key Drivers |

|---|---|---|---|

| 500 units | $19.50 – $24.00 | $9,750 – $12,000 | High per-unit cost due to low volume; minimal tooling amortization; ideal for White Label sampling |

| 1,000 units | $16.00 – $20.50 | $16,000 – $20,500 | Moderate cost reduction; suitable for Private Label entry; NRE ~$5,000 typical |

| 5,000 units | $13.20 – $17.00 | $66,000 – $85,000 | Optimal for cost efficiency; full tooling payback; standard for OEM volume production |

Procurement Tip: Negotiate tiered pricing (e.g., 1,000 @ $18.00, next 4,000 @ $14.50) to reduce average cost. Confirm if tooling is reusable or one-time.

5. Strategic Recommendations for 2026

-

Leverage U.S.-Listed Suppliers for Transparency: Companies like ZTE, JD.com (via supply chain arms), and Baidu-affiliated hardware OEMs offer audited financials and ESG reporting—critical for compliance and risk mitigation.

-

Dual-Source to Mitigate Geopolitical Risk: Combine a China-based U.S.-listed OEM with a Vietnam or Malaysia backup for high-volume lines.

-

Optimize for Total Landed Cost: Factor in tariffs (Section 301 still active on many electronics), inventory carrying costs, and lead times (avg. 45–60 days from China to U.S. West Coast).

-

Invest in IP Protection: Use OEM agreements with clear IP clauses; register designs in China via WIPO or local agents.

-

Adopt Agile MOQ Strategies: Use White Label for test markets, then transition to Private Label/OEM upon validation.

Conclusion

Sourcing from China-listed, U.S.-traded manufacturers offers a balanced mix of cost efficiency, scalability, and reporting transparency. Whether pursuing White Label for speed or Private Label/OEM for differentiation, procurement managers must align sourcing models with brand strategy, volume forecasts, and total cost of ownership.

By leveraging MOQ-based pricing tiers and understanding cost drivers, global buyers can achieve 15–25% cost savings while maintaining quality and compliance in 2026.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Q1 2026 | sourcifychina.com

Data sources: China Customs, Bloomberg Terminal (U.S.-listed Chinese firms), Procurement.io 2025 Benchmark, internal SourcifyChina supplier network

How to Verify Real Manufacturers

SOURCIFYCHINA B2B SOURCING REPORT 2026

Critical Verification Protocol for US-Listed Chinese Manufacturers

Prepared for Global Procurement Managers | Objective Risk Mitigation Framework

I. Critical Clarification: “China Listed Companies in US” Defined

Procurement managers often misinterpret this term. We clarify:

– ✅ True Target: Chinese-headquartered manufacturers with primary stock listings on US exchanges (NYSE/NASDAQ) via American Depositary Receipts (ADRs) or direct listings (e.g., NIO, Baidu, Pinduoduo).

– ❌ Common Misconception: Suppliers claiming “US-listed” status when they are merely trading companies, tier-2 suppliers, or unrelated entities leveraging brand association.

Over 73% of “US-listed” claims in sourcing RFQs are unsubstantiated (SourcifyChina 2025 Audit).

II. Critical Verification Steps for Genuine US-Listed Manufacturers

Follow this sequence to validate legitimacy. Skipping steps risks supply chain fraud.

| Step | Action | Verification Source | Critical Evidence | Time Required |

|---|---|---|---|---|

| 1. Confirm SEC Registration | Search EDGAR database for SEC filings | SEC EDGAR | • Valid CIK number • Active Form 20-F (annual report) • Recent 6-K (current report) |

15-30 mins |

| 2. Cross-Check Entity Match | Compare supplier’s legal name with SEC filings | SEC Form 20-F (Item 1) + Chinese Business License | • Exact match of Chinese legal entity name (e.g., “Beijing Xiaomi Mobile Software Co., Ltd.”) • Identical registered address |

20 mins |

| 3. Validate Manufacturing Control | Review SEC disclosures on assets | SEC Form 20-F (Item 4: “Information on the Company”) | • Explicit mention of owned manufacturing facilities • Depreciation schedules for production equipment • “Consolidated” subsidiaries (not “affiliated”) |

45+ mins |

| 4. Audit Supply Chain Transparency | Analyze Form 20-F Section 5 | SEC Form 20-F (Item 5: “Operating/Financial Review”) | • Direct disclosure of OEM/ODM relationships • Breakdown of in-house vs. outsourced production |

30 mins |

| 5. Third-Party Validation | Commission SourcifyChina factory audit | On-site audit + SEC document reconciliation | • Physical facility photos matching SEC asset descriptions • Cross-referenced employee records with SEC headcount data |

5-7 business days |

Key Insight: Only 12% of Chinese manufacturers with US listings operate fully owned factories (SourcifyChina 2025). Most use hybrid models (e.g., Xiaomi: 30% in-house, 70% contracted). Verify which facilities produce YOUR product line.

III. Trading Company vs. Genuine Factory: Forensic Differentiation Guide

Trading companies pose as factories to inflate margins. Use this evidence-based checklist:

| Criteria | Genuine US-Listed Factory | Trading Company Impersonator | Verification Method |

|---|---|---|---|

| Legal Documentation | • Business license shows “Manufacturing” scope • Land title deed (土地使用证) for factory site |

• License scope: “Trading,” “Import/Export” • Leased office address (no land deed) |

• Demand copy of 土地使用证 (Land Use Certificate) • Verify via China National Enterprise Credit Info |

| SEC Filings | • Form 20-F details specific production lines • Discloses factory locations/capacity |

• No manufacturing details in SEC filings • References “partner factories” vaguely |

• Search 20-F for “facility,” “production,” “plant” |

| Operational Control | • Direct payroll for production staff • In-house R&D team (per SEC filings) |

• Staff list shows only sales/logistics roles • No engineering capabilities |

• Request social insurance records for production workers • Audit R&D expense line in SEC filings |

| Pricing Structure | • Quotes based on material + labor + overhead • Transparent BOM costs |

• Fixed “package pricing” with no cost breakdown • Refuses to share material specs |

• Demand itemized cost sheet matching SEC-disclosed cost structure |

| Digital Footprint | • Professional website with facility tours, patents • SEC filings linked in footer |

• Alibaba store as primary site • “US-listed” badge with no SEC link |

• Reverse image search facility photos • Check website WHOIS registration date |

IV. Critical Red Flags to Terminate Engagement Immediately

These indicate high fraud risk per SourcifyChina’s 2025 Dispute Database:

| Red Flag | Risk Level | Why It Matters | Action |

|---|---|---|---|

| ❗ Claims “US-listed” but no SEC CIK number provided | Critical | 92% are fraudulent (SourcifyChina 2025) | Terminate – No further verification needed |

| ❗ Refuses SEC filing access citing “confidentiality” | Critical | Genuine listed firms publicly file all operations data | Terminate – Violates SEC disclosure rules |

| ❗ SEC filings show HFCAA non-compliant auditor (e.g., PwC China) | High | Risk of delisting (e.g., 152 firms delisted in 2024) | Require PCAOB-approved audit plan within 30 days |

| ❗ Factory tour blocks access to production floor | Medium-High | Hides subcontracting/trading operations | Demand unannounced audit or terminate |

| ❗ Quotation includes “US-listed premium” fee | Medium | No legitimate listed firm charges this | Negotiate removal or walk away |

V. Strategic Recommendations

- Leverage SEC Filings as Primary Source: Form 20-F is legally binding. Discrepancies between supplier claims and filings = fraud.

- Map the True Entity: Use MOFCOM Exporter Search to confirm if supplier is a registered manufacturer (not trader).

- Contract Safeguards: Require clause: “Supplier warrants it is the SEC-registered entity named in Form 20-F for [CIK #]. Breach = immediate termination + liquidated damages.”

- Beware of “Listed Subsidiaries”: Many suppliers are unrelated entities using parent company names (e.g., “Huawei Supplier” ≠ Huawei-owned). Verify subsidiary consolidation in SEC filings.

Final Note: Genuine US-listed Chinese manufacturers welcome deep verification – it reduces their investor risk. Resistance is the ultimate red flag.

SOURCIFYCHINA PROTOCOL VALIDATED | © 2026 SourcifyChina. All data derived from SEC filings, MOFCOM records, and 1,200+ verified supplier audits.

For confidential verification of your target supplier, contact Sourcing Intelligence Team: [email protected]

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Executive Summary: Accelerate Your Sourcing Strategy with Verified Suppliers

In today’s competitive global supply chain landscape, efficiency, reliability, and compliance are non-negotiable. For procurement managers sourcing from China—particularly companies listed in the U.S.—the challenge lies not only in identifying capable suppliers but in verifying their legitimacy, operational capacity, and export readiness.

SourcifyChina’s Verified Pro List: China-Listed Companies in the U.S. is engineered to eliminate sourcing friction. Our rigorously vetted database delivers immediate access to pre-qualified manufacturers and exporters with transparent financial disclosures, U.S. regulatory compliance, and proven international trade experience.

Why SourcifyChina’s Verified Pro List Saves You Time & Reduces Risk

| Traditional Sourcing Approach | Using SourcifyChina’s Verified Pro List |

|---|---|

| Weeks spent on supplier discovery, outreach, and qualification | Access 200+ pre-vetted suppliers in <24 hours |

| High risk of fraud, misrepresentation, or non-compliance | Every supplier verified for legitimacy, export capability, and financial transparency |

| Manual due diligence on SOX compliance, SEC filings, and export history | Compliance documents and U.S. listing status pre-validated |

| Inefficient communication, language barriers, and unresponsive contacts | Direct access to English-speaking, procurement-ready teams |

| Unpredictable lead times and supply disruptions | Proven track record of on-time delivery and international logistics experience |

By leveraging our Verified Pro List, procurement teams reduce supplier onboarding time by up to 70%, while significantly lowering compliance and operational risk.

Call to Action: Optimize Your 2026 Sourcing Strategy Today

Global procurement leaders can no longer afford time-consuming, high-risk sourcing cycles. With SourcifyChina, you gain a strategic advantage: speed, security, and scalability in your China supply chain.

👉 Take the next step in sourcing excellence:

– Email us at [email protected] for a free supplier match consultation.

– Message us on WhatsApp at +86 159 5127 6160 for immediate assistance and a sample of the Verified Pro List.

Our team of China sourcing specialists is ready to support your procurement goals with data-driven insights and verified supply chain solutions.

Don’t source blindly—source confidently.

Partner with SourcifyChina. Deliver with certainty.

© 2026 SourcifyChina. All rights reserved. Verified Pro List is a proprietary intelligence product for enterprise procurement teams. Confidentiality assured.

🧮 Landed Cost Calculator

Estimate your total import cost from China.