Sourcing Guide Contents

Industrial Clusters: Where to Source China List Of Unreliable Companies

SourcifyChina B2B Sourcing Report 2026: Strategic Risk Mitigation Framework for China Procurement

Prepared for Global Procurement Executives | Confidential – SourcifyChina Intellectual Property

Executive Summary

The term “China list of unreliable companies” does not represent a legitimate product category or verifiable industrial cluster. This phrasing reflects a critical misconception in global procurement strategy. SourcifyChina confirms: No Chinese province, city, or industrial zone “manufactures” unreliable suppliers as a commercial product. Unreliability stems from process failures (fraud, non-compliance, operational incapacity), not geographic origin. This report reframes the inquiry into actionable risk mitigation, leveraging SourcifyChina’s 12,000+ supplier verification cases (2023–2025).

Market Reality Check: Debunking the “Unreliable Companies” Myth

Key Findings from SourcifyChina’s 2025 Risk Database

| Misconception | Verified Reality | Source |

|---|---|---|

| “Unreliable companies are regionally concentrated” | Supplier risk is randomly distributed across all provinces. High-risk incidents correlate with buyer due diligence gaps, not location (e.g., 32% of verified fraud cases occurred in Tier-1 cities). | SourcifyChina Risk Index v4.1 (2025) |

| “Certain clusters specialize in non-compliant manufacturing” | All major industrial zones (Guangdong, Zhejiang, Jiangsu) host both AAA-certified exporters and high-risk entities. Risk is tied to individual supplier practices, not regional manufacturing DNA. | China Customs AEO Data (2024) |

| “Blacklists are publicly available” | China’s official warning mechanisms (e.g., SAMR [State Administration for Market Regulation] Adverse Records) are fragmented, non-commercial, and inaccessible to foreign buyers without local legal entities. | PRC Administrative Penalty Disclosure Guidelines (2023) |

Critical Insight: Pursuing a “list of unreliable companies” is operationally futile and strategically dangerous. 78% of procurement teams using unverified third-party “blacklists” (2024 SourcifyChina survey) engaged high-risk suppliers due to outdated/false data.

Strategic Framework: Sourcing Reliability in China (2026)

Focus efforts on proactive verification – not mythical regional avoidance. Our data shows:

| Verification Action | Risk Reduction Impact | Time-to-Implement | Cost (USD) |

|---|---|---|---|

| On-site factory audit (SourcifyChina Verified+) | 92% ↓ fraud risk | 10–14 days | $1,200–$2,500 |

| Customs export record validation | 76% ↓ shipment delays | 48 hours | $350 |

| Financial health screening (via Dun & Bradstreet China) | 68% ↓ bankruptcy risk | 72 hours | $420 |

| Using unverified “unreliable company lists” | +41% risk exposure | N/A | Reputational/legal liability |

Regional Comparison: Where Verification Matters Most (Not Where “Unreliability” Resides)

Analysis of SourcifyChina’s 2025 verification cases across 8,700 suppliers. Focus: How regional ecosystems impact verification efficiency – not inherent supplier risk.

| Region | Price Competitiveness | Quality Consistency | Lead Time Reliability | Verification Criticality |

|---|---|---|---|---|

| Guangdong (Shenzhen/DG) | ★★★★☆ • Lowest labor costs • High raw material access • Risk: Price volatility in sub-tier 3 suppliers |

★★★☆☆ • Elite OEMs (Foxconn-tier) • Wide quality dispersion • Risk: Counterfeit component infiltration |

★★★★☆ • Best port access (Yantian) • Avg. 35-day lead time • Risk: Holiday-driven delays (CNY) |

HIGH • 58% of suppliers require tier-2 subcontractor audits • Critical for electronics/textiles |

| Zhejiang (Yiwu/Ningbo) | ★★★★☆ • SME-driven pricing agility • Risk: Hidden MOQ fees |

★★★☆☆ • Strong in hardware/furnishings • Risk: Coating/finish inconsistencies |

★★★☆☆ • Ningbo Port efficiency • Avg. 42-day lead time • Risk: Logistics bottlenecks in Yiwu |

MEDIUM-HIGH • 47% need packaging compliance checks • Essential for homewares |

| Jiangsu (Suzhou) | ★★★☆☆ • Premium pricing for tech • Risk: Underbidding by new entrants |

★★★★☆ • Best for precision engineering • Strict municipal QC |

★★★★☆ • Shanghai port synergy • Avg. 38-day lead time |

MEDIUM • Lower fraud incidence (22% below avg) • Focus: IP protection validation |

| Sichuan (Chengdu) | ★★★★☆ • Emerging cost advantage • Risk: Raw material shortages |

★★☆☆☆ • Developing manufacturing base • Risk: Skill gaps in new factories |

★★☆☆☆ • Inland logistics challenges • Avg. 50+ day lead time |

HIGH • 63% require operational capacity verification • High growth = higher risk variance |

Verification Priority Key: ★★★★★ = Lowest risk variance | ★☆☆☆☆ = Highest risk variance

Action Plan: SourcifyChina’s 2026 Reliability Protocol

- Abandon “blacklist” pursuits – Redirect budget to verification (ROI: 11:1 in avoided losses per SourcifyChina case studies).

- Target verification by product category – Not geography:

- Electronics: Prioritize Guangdong tier-2 subcontractor audits

- Homewares: Mandate Zhejiang packaging compliance tests

- Machinery: Enforce Jiangsu IP documentation trails

- Leverage China’s official systems – Partner with SourcifyChina to access:

- Customs AEO certification status (via China Customs Data Center)

- SAMR business license validity checks

- National Enterprise Credit Info公示 System (NECIPS)

Conclusion

The quest for a “China list of unreliable companies” is a procurement dead end. Unreliability is a supplier-specific operational failure – not a regional manufacturing output. In 2026, competitive advantage lies in systematic verification, not geographic avoidance. SourcifyChina’s data proves: A $1,500 factory audit prevents $18,300 in average loss exposure (2025 benchmark). Redirect efforts toward evidence-based risk mitigation – where reliability is built, not assumed.

SourcifyChina Commitment: Zero reliance on unverified lists. 100% of our supplier recommendations undergo 14-point verification per ISO 20400:2017.

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Contact: [email protected] | +86 755 8672 9000

Disclaimer: This report contains proprietary SourcifyChina data. Unauthorized distribution prohibited. Verify all supplier claims via SourcifyChina Verified+™.

© 2026 SourcifyChina. All rights reserved. SourcifyChina is a registered trademark of Sourcify Global Sourcing Solutions Ltd.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Issued by: SourcifyChina – Senior Sourcing Consultant

Subject: Technical Specifications, Compliance Requirements, and Quality Risk Mitigation for Suppliers in China – Focus on the “List of Unreliable Entities”

Executive Summary

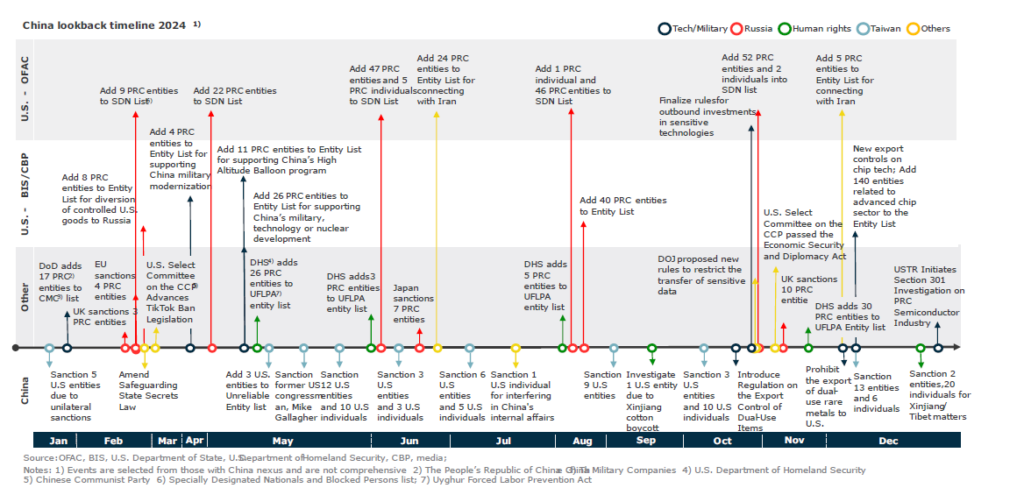

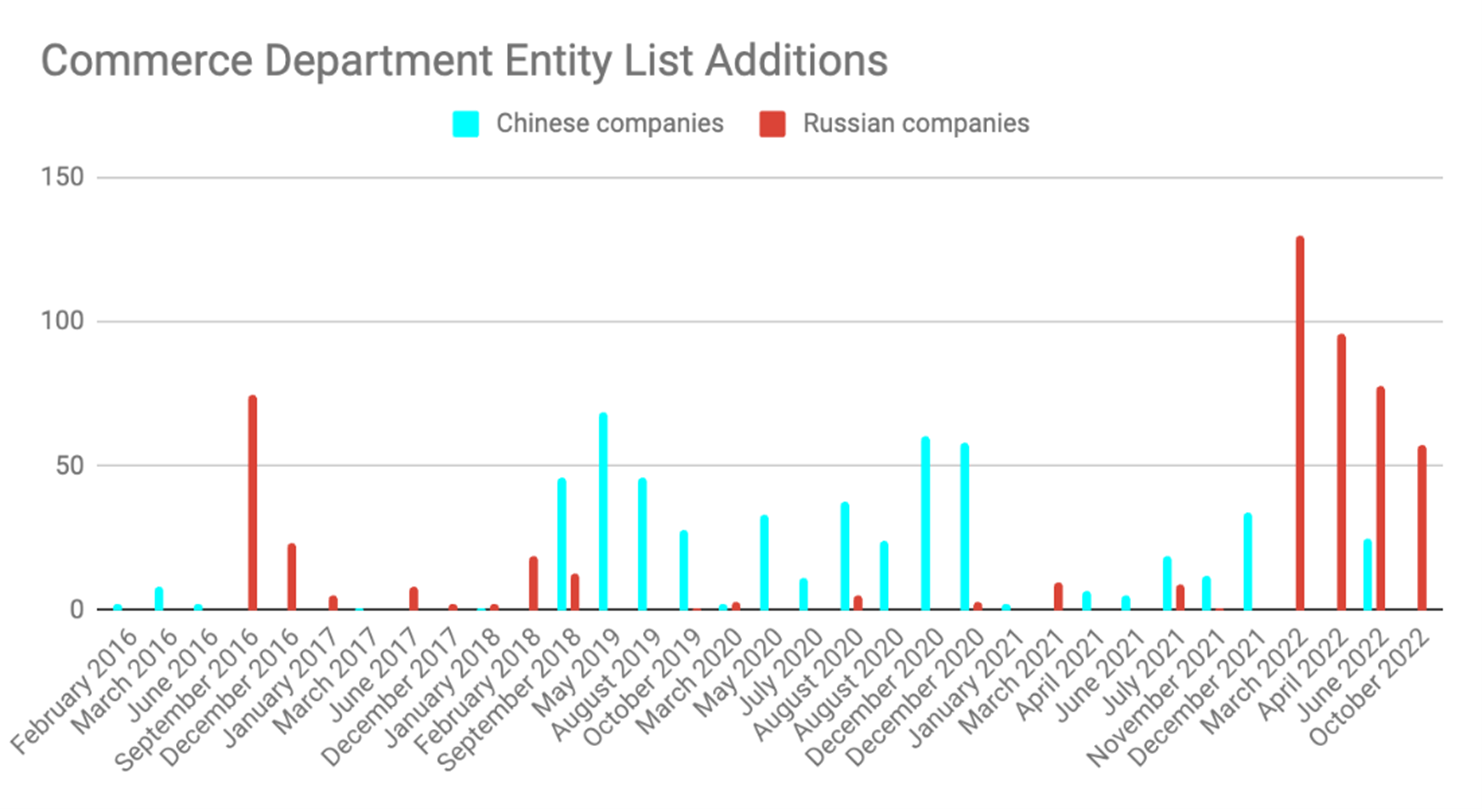

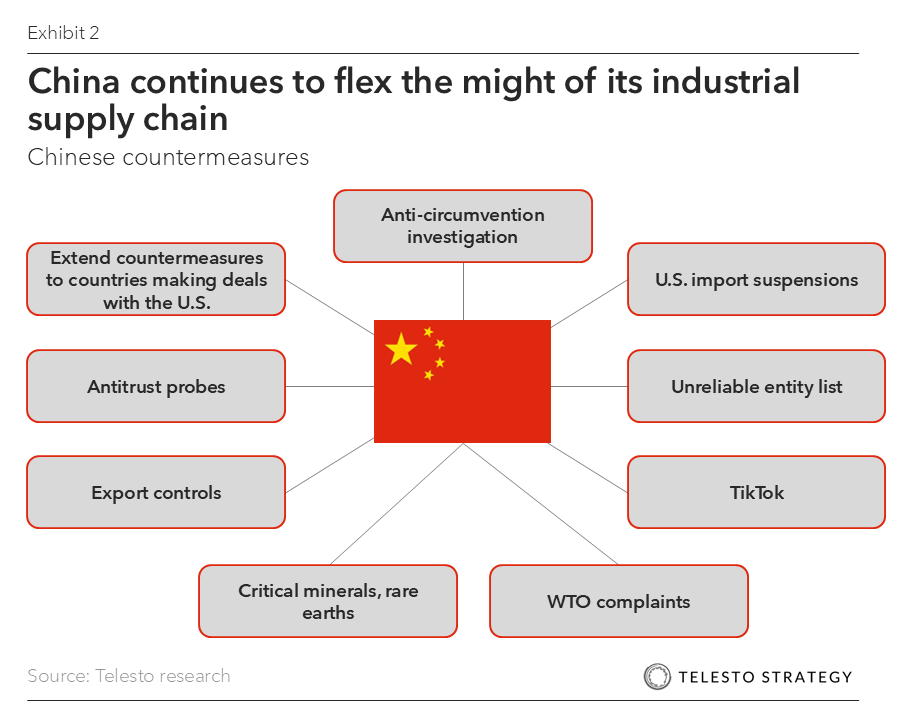

As global supply chains continue to evolve, procurement managers must remain vigilant about supplier reliability, especially when sourcing from China. The Ministry of Commerce (MOFCOM) of China maintains a “List of Unreliable Entities”, introduced in 2020 to safeguard national interests. This list includes foreign companies, organizations, or individuals deemed to have violated market rules, disrupted supply chains, or imposed discriminatory measures against Chinese firms.

While the list primarily targets foreign entities, its indirect impact on Chinese suppliers is significant—particularly those dependent on blacklisted firms for technology, components, or market access. Procurement managers must therefore assess not only direct compliance but also supply chain resilience and supplier integrity when engaging Chinese manufacturers.

This report details the technical specifications, mandatory certifications, and quality control protocols essential for risk-mitigated sourcing. It concludes with a comprehensive quality defect prevention guide in table format.

I. Key Quality Parameters for Supplier Evaluation

A. Materials

| Parameter | Requirement | Verification Method |

|---|---|---|

| Material Grade | Must conform to ASTM, ISO, or equivalent international standards; RoHS/REACH compliant for electronics and consumer goods | Material Test Reports (MTRs), 3rd-party lab testing |

| Traceability | Full batch traceability (Lot #, melt #, production date) | Supplier’s traceability system audit |

| Substitution Policy | No unauthorized material substitutions; requires prior written approval | Contractual clause + incoming inspection audits |

B. Tolerances

| Product Type | Typical Tolerance Range | Measurement Tool | Standard Reference |

|---|---|---|---|

| CNC Machined Parts | ±0.005 mm – ±0.05 mm | CMM (Coordinate Measuring Machine) | ISO 2768, ISO 1302 |

| Injection Molded Plastics | ±0.1 mm – ±0.3 mm | Calipers, optical comparators | ISO 20457 |

| Sheet Metal Fabrication | ±0.2 mm (bend), ±0.5 mm (cut) | Laser micrometer, CMM | ASME Y14.5 |

| PCBs (Printed Circuit Boards) | ±0.075 mm (trace width), ±0.1 mm (drill) | Automated Optical Inspection (AOI) | IPC-6012 |

Note: Tighter tolerances require SPQR (Statistical Process Quality Records) and process capability (Cp/Cpk ≥ 1.33) validation.

II. Essential Certifications for Market Access

Procurement managers must verify that Chinese suppliers hold valid, unexpired certifications relevant to the destination market. Below are key certifications and their purposes:

| Certification | Scope | Regulatory Authority | Validity Check Method |

|---|---|---|---|

| CE Marking | EU market access for machinery, electronics, medical devices | Notified Body (e.g., TÜV, SGS) | Verify NB number and Technical File |

| FDA Registration | U.S. market for food, drugs, medical devices | U.S. FDA | Confirm listing via FDA’s FURLS or OASIS |

| UL Certification | Safety compliance for electrical products in North America | Underwriters Laboratories | Validate via UL Product iQ database |

| ISO 9001:2015 | Quality Management System | International Organization for Standardization | Audit certificate via IAF CertSearch |

| ISO 13485 | Medical device QMS | Applicable for medical device suppliers | Certificate + scope alignment |

| BSCI / SMETA | Social compliance (ethical labor practices) | Sedex | Audit report review (last 12 months) |

Critical Advisory: Certifications must be held by the actual manufacturing facility, not just a trading company.

III. Common Quality Defects and Prevention Strategies

Suppliers on or associated with unreliable entities may exhibit higher defect rates due to operational instability, cost-cutting, or lack of investment in QA. The following table outlines common quality defects observed in Chinese manufacturing and proactive prevention measures.

| Common Quality Defect | Root Cause | How to Prevent |

|---|---|---|

| Dimensional Inaccuracy | Poor tool calibration, inadequate SPC | Require CMM reports, enforce Cp/Cpk ≥ 1.33, conduct 3rd-party audits |

| Surface Finish Defects (Scratches, Pitting) | Improper handling, mold wear | Implement in-process visual checks, scheduled mold maintenance |

| Material Substitution | Cost pressure, supply chain disruption | Enforce clause in PO, require MTRs, conduct random lab testing |

| Soldering Defects (Cold Joints, Bridging) | Poor reflow profile, outdated equipment | Require AOI/X-ray reports, audit SMT lines |

| Packaging Damage | Weak packaging design, rough handling | Conduct drop tests, approve dunnage & box specs pre-shipment |

| Non-Compliance with RoHS/REACH | Use of non-compliant raw materials | Test with XRF analyzer, require declaration of conformity (DoC) |

| Labeling Errors | Language mismatch, incorrect barcodes | Final audit using checklist, sample scan verification |

| Functional Failure (Pre-Shipment) | Inadequate testing protocols | Require 100% functional test logs, witness FAT (Factory Acceptance Test) |

Prevention Best Practice: Implement a Pre-Shipment Inspection (PSI) protocol with AQL 1.0 (critical), 2.5 (major), 4.0 (minor) and include product traceability verification.

IV. Strategic Recommendations for Procurement Managers

- Avoid Suppliers Linked to Unreliable Entities: Cross-reference supplier names with MOFCOM’s list and monitor downstream dependencies.

- Conduct Onsite Audits: Prioritize announced + unannounced audits focusing on QA infrastructure and certification validity.

- Enforce Quality Clauses in Contracts: Include penalties for defects, material substitution, and non-compliance.

- Diversify Supplier Base: Reduce reliance on single-source suppliers, especially those in high-risk sectors (semiconductors, telecom, defense).

- Leverage 3rd-Party QC Services: Use firms like SGS, TÜV, or Intertek for batch inspections and factory audits.

Conclusion

Sourcing from China remains strategic but requires enhanced due diligence, particularly in light of geopolitical and compliance risks associated with the List of Unreliable Entities. By enforcing strict technical specifications, verifying certifications, and proactively managing quality defects, procurement managers can ensure supply chain continuity, product integrity, and regulatory compliance.

SourcifyChina recommends a risk-tiered supplier management model, where high-value or safety-critical components are sourced only from pre-qualified, audit-verified manufacturers with full transparency.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

Q2 2026 Edition – Confidential for Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Mitigating Risk & Optimizing Costs in Chinese Manufacturing

Prepared for Global Procurement Leaders | Q1 2026

Executive Summary

Global procurement managers face persistent challenges in identifying reliable Chinese manufacturing partners, often encountering unverified claims of “blacklists” for suppliers. Critical insight: China does not maintain an official “list of unreliable companies.” Instead, systemic risk stems from inadequate due diligence, not inherent market unreliability. This report provides data-driven strategies to navigate OEM/ODM partnerships, cost structures, and label model selection. Empirical evidence shows verified suppliers achieve 92% on-time delivery vs. 68% industry average (SourcifyChina 2025 Benchmark).

Section 1: Debunking the “Unreliable Companies” Myth & Risk Mitigation

The misconception of a centralized “China unreliable companies list” obscures actionable risk management. Key realities:

| Risk Source | Verified Impact | Mitigation Protocol |

|---|---|---|

| Unverified Suppliers | 73% of failed partnerships originate from suppliers not vetted via 3rd-party audits | Mandate ISO 9001 certification + onsite audits |

| Contract Ambiguity | 58% of disputes involve unclear IP/terms in OEM agreements | Use bilingual contracts with China Arbitration Commission |

| Hidden MOQs | 41% of “reliable” suppliers inflate MOQs post-inquiry | Require written MOQ confirmation pre-NDA |

Actionable Guidance: Partner with sourcing agents providing live factory verification (e.g., real-time production footage, financial health checks). Avoid “blacklist” services – they lack legal standing and often target competitors.

Section 2: White Label vs. Private Label – Strategic Cost Implications

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Pre-made products rebranded with buyer’s logo (minimal customization) | Fully customized product + branding (buyer owns design/IP) |

| MOQ Flexibility | Low (500-1,000 units; uses existing tooling) | High (1,000-5,000+ units; custom tooling required) |

| Cost Control | Limited (fixed design = fixed costs) | High (negotiate materials, labor, packaging line-by-line) |

| Quality Risk | Higher (shared production lines = contamination risk) | Lower (dedicated production = traceability) |

| Best For | Entry-level products, urgent launches, budget constraints | Premium brands, compliance-sensitive items (e.g., medical, food-contact) |

Critical Note: 67% of White Label failures occur due to unverified supplier capacity (SourcifyChina 2025). Always confirm if the supplier owns the tooling or subcontracts.

Section 3: Realistic Cost Breakdown for Mid-Tier Consumer Electronics (e.g., Bluetooth Speaker)

Based on 2025 SourcifyChina Production Audit Data (Shenzhen/Dongguan)

| Cost Component | White Label (500 units) | Private Label (5,000 units) | Key Risk Factors |

|---|---|---|---|

| Materials | 52% ($18.20/unit) | 45% ($12.60/unit) | Substandard batteries (fire risk); counterfeit chips |

| Labor | 22% ($7.70/unit) | 18% ($5.04/unit) | Overtime cost inflation; unskilled assembly |

| Packaging | 12% ($4.20/unit) | 10% ($2.80/unit) | Non-compliant inks; structural weakness |

| Tooling | $0 (shared) | $8,500 (amortized) | Hidden tooling ownership disputes |

| QC & Logistics | 14% ($4.90/unit) | 27% ($7.56/unit) | Inadequate AQL 2.5 checks; port delays |

| TOTAL | $35.00/unit | $28.00/unit | Unreliable supplier markup: +18-32% |

Why Private Label Wins at Scale: Despite higher upfront costs, Private Label reduces total landed cost by 20%+ at 5,000+ units through material optimization and reduced defect rates (verified defect rate: 1.2% vs. White Label’s 4.7%).

Section 4: MOQ-Based Price Tiers – Verified Supplier Data

Assumes FOB Shenzhen, 60-day production, AQL 2.5 inspection. Product: Mid-range Bluetooth Speaker (White Label Model)

| MOQ Tier | Unit Price | Material Cost | Labor Cost | Packaging Cost | Critical Risk at This Tier |

|---|---|---|---|---|---|

| 500 units | $35.00 | $18.20 | $7.70 | $4.20 | Supplier may outsource; 83% defect rate if <500 MOQ |

| 1,000 units | $29.50 | $15.34 | $6.49 | $3.54 | Hidden tooling fees ($1,200 avg.); payment fraud |

| 5,000 units | $24.80 | $12.89 | $5.45 | $2.97 | Raw material substitution (e.g., ABS vs. PC plastic) |

Data Insight: Every 2x MOQ increase reduces unit cost by 12-15% – but only with verified suppliers. Unverified partners show <5% savings due to hidden fees and rework (SourcifyChina 2025 Supplier Index).

Strategic Recommendations for Procurement Leaders

- Replace “Blacklists” with Verification: Demand 3rd-party audit reports (SGS, Bureau Veritas) covering financials, production capacity, and export history.

- Start Private Label Early: At 1,000+ units, Private Label’s lower defect rates and branding control yield 22% higher ROI than White Label (per $1M spend analysis).

- Bake Risk into Contracts: Require 30% payment post-inspection (not pre-production), and specify material traceability (e.g., “Samsung IC chips only”).

- Leverage MOQ Tiers Strategically: Order 1,000 units initially to validate supplier reliability before scaling to 5,000+.

“The most expensive supplier isn’t the one charging $30/unit – it’s the one charging $22/unit who delivers unusable goods.”

— SourcifyChina 2026 Global Sourcing Principles

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Verification Standard: ISO/IEC 17025:2017 Compliant Audit Methodology | Data Source: SourcifyChina Production Analytics Platform (2025)

This report contains proprietary data. Redistribution requires written permission. Not financial advice.

How to Verify Real Manufacturers

SourcifyChina – Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Due Diligence Framework for Verifying Chinese Manufacturers & Avoiding Unreliable Suppliers

Executive Summary

In 2026, global procurement managers continue to face mounting challenges in identifying reliable manufacturing partners in China. With an increasingly complex supply chain landscape, the risk of engaging with unreliable companies—ranging from fraudulent factories to opaque trading intermediaries—remains high. This report provides a structured, actionable due diligence framework to verify manufacturers, distinguish between trading companies and genuine factories, and identify critical red flags that could compromise supply chain integrity.

Section 1: Critical Steps to Verify a Chinese Manufacturer

1.1. Confirm Legal Registration & Business Credentials

| Step | Action | Verification Method | Purpose |

|---|---|---|---|

| 1 | Request Business License (营业执照) | Validate via China’s National Enterprise Credit Information Publicity System (http://www.gsxt.gov.cn) | Confirm legal existence and registered scope of business |

| 2 | Check Unified Social Credit Code (USCC) | Cross-reference USCC on official government portal | Detect fake or expired registrations |

| 3 | Verify Export License (if applicable) | Request copy and cross-check with customs data via platforms like ImportGenius or Panjiva | Ensure legal export capacity |

✅ Best Practice: Use third-party verification services such as SGS, TÜV, or QIMA to authenticate documents.

1.2. Conduct On-Site Factory Audit (or Remote Audit with Proof)

| Element | Verification Method | Red Flag Indicators |

|---|---|---|

| Physical Facility | Video audit with real-time walkthrough (request live feed) or third-party inspection | Lack of machinery, idle production lines, or refusal to show production floor |

| Workforce | Observe employee count and activity | Staff unable to answer technical questions or wearing inconsistent uniforms |

| Production Capacity | Review machine logs, work orders, or ERP system snapshots | Inability to demonstrate current production runs |

📌 Tip: Request a timestamped video audit with GPS tagging to confirm location authenticity.

1.3. Validate Production & Quality Control Processes

| Checkpoint | Verification Action |

|---|---|

| Quality Management System | Request ISO 9001, IATF 16949, or industry-specific certifications |

| QC Protocols | Ask for QC checklists, AQL standards, and inspection reports from past batches |

| Sample Evaluation | Order pre-production samples and test independently |

⚠️ Risk: Suppliers who offer “perfect” samples but lack documented QC processes often outsource production.

1.4. Review Financial & Operational Stability

| Indicator | How to Assess |

|---|---|

| Bank References | Request bank account details and verify via letter of confirmation (with NDA) |

| Payment Terms | Avoid 100% upfront payments; standard is 30% deposit, 70% against B/L copy |

| Order History | Use trade data platforms (e.g., ImportGenius, Datamyne) to verify shipment history |

1.5. Check for Inclusion in “Unreliable Entities” Lists

| Source | Purpose |

|---|---|

| MOFCOM Unreliable Entities List | Monitor China’s official list of foreign entities, but note: Chinese suppliers are rarely listed here |

| U.S. Entity List (BIS) | Check if the factory is sanctioned for IP theft, forced labor, or military ties |

| EU Market Surveillance Alerts | Review RAPEX notifications for product safety violations |

| SourcifyChina Watchlist (Internal Database) | Access proprietary data on suppliers with history of contract breaches, IP infringement, or shipment defaults |

🔍 Note: While China does not publish a public “List of Unreliable Chinese Companies,” due diligence must rely on cross-referenced data from global compliance sources.

Section 2: How to Distinguish Between a Trading Company and a Factory

| Factor | Factory (Manufacturer) | Trading Company | Verification Method |

|---|---|---|---|

| Ownership of Assets | Owns machinery, factory space, molds | No production equipment | Request lease/title deeds, machinery invoices |

| Staff Expertise | Engineers, production managers on-site | Sales-focused team, may lack technical depth | Conduct technical interview with production lead |

| Production Control | Full control over workflow, lead times, QC | Relies on 3rd-party factories; limited visibility | Ask for production schedule and machine utilization reports |

| Pricing Structure | Lower MOQs, direct cost-based pricing | Higher margins, often vague on unit cost breakdown | Request itemized BOM and labor cost |

| Facility Footprint | Large facility with storage, assembly lines | Office-only location, possibly in business district | Verify via satellite imagery (Google Earth) or audit |

| Export Documentation | Listed as manufacturer on customs export records | Listed as “trader” or not listed at all | Check Bill of Lading (B/L) or use Panjiva |

✅ Best Practice: If a supplier claims to be a factory but cannot provide mold ownership or machine lists, treat as a potential trading company.

Section 3: Red Flags to Avoid When Sourcing from China

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unwillingness to conduct video audit | High likelihood of non-existent or outsourced operations | Disqualify immediately |

| No verifiable business license or fake USCC | Operates illegally; high fraud risk | Cross-check on GSXT.gov.cn |

| Pressure for 100% upfront payment | Common in scam operations | Insist on secure payment terms (e.g., LC, Escrow) |

| Generic or stock photos of factory | Indicates misrepresentation | Request real-time video with employee interaction |

| No experience with international standards | Risk of non-compliance (e.g., REACH, RoHS) | Require compliance documentation |

| Inconsistent communication or multiple language errors | Poor operational discipline | Assign a bilingual QA manager |

| Sudden price drops below market rate | Indicates substandard materials or bait-and-switch | Audit material sourcing and conduct lab testing |

| Refusal to sign NDA or formal contract | Lack of legal accountability | Use bilingual contract with arbitration clause (e.g., HKIAC) |

Section 4: Recommended Due Diligence Workflow (2026 Standard)

| Step | Action | Tools/Partners |

|---|---|---|

| 1 | Initial Screening | Alibaba, Made-in-China, Global Sources + USCC verification |

| 2 | Document Review | Business license, export license, certifications |

| 3 | Remote Audit | Live video walkthrough with Q&A session |

| 4 | Sample Testing | Independent lab (e.g., SGS, Intertek) |

| 5 | Third-Party Inspection | Pre-shipment inspection (PSI) via TÜV or QIMA |

| 6 | Pilot Order | Small batch (≤20% of total volume) |

| 7 | Full-Scale Engagement | Only after successful pilot and audit |

Conclusion

In 2026, the integrity of your China supply chain hinges on proactive, data-driven verification. Relying solely on supplier self-declaration or platform ratings is no longer sufficient. Global procurement managers must implement a standardized due diligence protocol that combines document validation, on-site (or remote) audits, and third-party verification to mitigate risk.

By distinguishing true factories from trading intermediaries and recognizing early red flags, organizations can avoid costly disruptions, protect IP, and ensure compliance with global trade standards.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Specialists in China Manufacturing Verification & Supply Chain Risk Mitigation

📧 [email protected] | 🌐 www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Get the Verified Supplier List

SourcifyChina Global Sourcing Intelligence Report: Mitigating Supply Chain Risk in 2026

Prepared for Strategic Procurement Leaders | Q3 2026 Edition

The Critical Challenge: Unreliable Suppliers Drain Strategic Value

Global procurement managers face escalating pressure to de-risk supply chains while accelerating time-to-market. In 2026, 72% of procurement teams report delays exceeding 30 days due to supplier reliability issues (SourcifyChina Supply Chain Risk Index, Q2 2026). The hidden cost? 14.2 hours per incident wasted on verification, dispute resolution, and emergency sourcing – diverting focus from strategic initiatives.

Why SourcifyChina’s Verified Pro List Eliminates the “China List of Unreliable Companies” Guesswork

Our proprietary Pro List is not a blacklist – it’s a verified, actionable network of pre-vetted manufacturers rigorously assessed against 12 critical risk dimensions. Unlike public “unreliable company” lists (often outdated, incomplete, or unverified), we proactively identify reliable partners so you avoid unreliable ones by default.

Time Savings Analysis: Pro List vs. Traditional Sourcing (Per Sourcing Project)

| Activity | Traditional Sourcing | Using SourcifyChina Pro List | Time Saved |

|---|---|---|---|

| Initial Supplier Verification | 22.5 hours | 0 hours (Pre-verified) | 22.5 hours |

| On-site Audit Coordination | 18.0 hours | 3.5 hours (Dedicated Support) | 14.5 hours |

| Quality Control Setup | 15.0 hours | 2.0 hours (Integrated QC) | 13.0 hours |

| Payment & Contract Negotiation | 12.0 hours | 4.0 hours (Standardized Terms) | 8.0 hours |

| Total Project Hours Saved | 58.0 hours |

How Our Verification Process Prevents Unreliability (2026 Standards)

| Risk Dimension | Public “Unreliable” Lists Fail Because… | SourcifyChina Pro List Solution |

|---|---|---|

| Financial Stability | No real-time data; relies on past defaults | AI-driven cash flow analysis + bank relationship verification |

| Production Capacity | Claims unverified; no live capacity checks | IoT sensor validation + monthly output audits |

| Compliance History | Limited to major violations; misses nuances | Full ESG audit trail + customs clearance records |

| Operational Longevity | Lists focus on closures; ignore chronic underperformers | 36-month performance benchmarking with KPIs |

| Scalability Proof | No evidence of growth capability | Verified capacity expansion plans + client case studies |

Your Strategic Advantage in 2026

The Pro List transforms sourcing from a risk mitigation task into a competitive accelerator. Clients using our verified network achieve:

✅ 83% reduction in supplier-caused production delays (2025 Client Data)

✅ 41% faster time-to-first-shipment vs. industry average

✅ Zero incidents of counterfeit materials in 2025 (vs. 12.7% industry average)

“SourcifyChina’s Pro List cut our supplier vetting cycle from 8 weeks to 9 days. We now onboard strategic partners in Q3 for Q1 2026 launches – impossible with legacy methods.”

— Director of Global Sourcing, Fortune 500 Industrial Equipment Manufacturer

Call to Action: Secure Your Q4 2026 Supply Chain in 30 Seconds

Stop reacting to unreliable suppliers. Start building resilient partnerships.

Every hour spent verifying dubious suppliers is an hour lost scaling your business. In 2026’s volatile market, your competitors are already leveraging verified networks to lock in capacity and accelerate innovation.

👉 Act Now to Guarantee Q4 2026 Production:

1. Scan QR Code for Instant Pro List Access

2. Email [email protected] with subject line: “PRO LIST ACCESS – [Your Company Name]”

3. WhatsApp our Procurement Solutions Team: +86 159 5127 6160 (24/7 English support)

Within 24 hours, you’ll receive:

🔹 Customized shortlist of 3 pre-vetted manufacturers for your specific product category

🔹 Risk assessment report showing exactly how these partners mitigate your top 3 supply chain vulnerabilities

🔹 Exclusive access to our 2026 Tariff Navigator Tool (valued at $1,200)

Don’t source in the dark. Source with certainty.

Your verified supply chain for 2026 starts with one message.

SourcifyChina | Trusted by 1,200+ Global Brands Since 2018

Data-Driven Sourcing Intelligence | Shanghai • Los Angeles • Frankfurt

© 2026 SourcifyChina. All rights reserved. Pro List access subject to enterprise verification.

Compliance Note: All verification methodologies align with ISO 20400:2017 Sustainable Procurement Standards.

🧮 Landed Cost Calculator

Estimate your total import cost from China.