Sourcing Guide Contents

Industrial Clusters: Where to Source China Lidar Companies

SourcifyChina Sourcing Report 2026

Deep-Dive Market Analysis: Sourcing LiDAR Companies in China

Prepared for: Global Procurement Managers

Date: April 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

The Chinese LiDAR (Light Detection and Ranging) manufacturing ecosystem has evolved into a globally competitive supply chain, driven by strong government support, rapid advancements in autonomous technologies, and robust domestic demand in automotive, robotics, and smart infrastructure. As of 2026, China accounts for over 35% of global LiDAR production capacity, with significant concentration in key industrial clusters across Guangdong, Zhejiang, Jiangsu, Hubei, and Beijing.

This report provides a strategic sourcing analysis of LiDAR manufacturers in China, identifying core production hubs, evaluating regional strengths, and delivering actionable insights for procurement decision-making. A comparative analysis of key provinces is included to guide cost, quality, and lead time optimization.

1. Overview of China’s LiDAR Manufacturing Landscape

LiDAR technology in China is primarily segmented into:

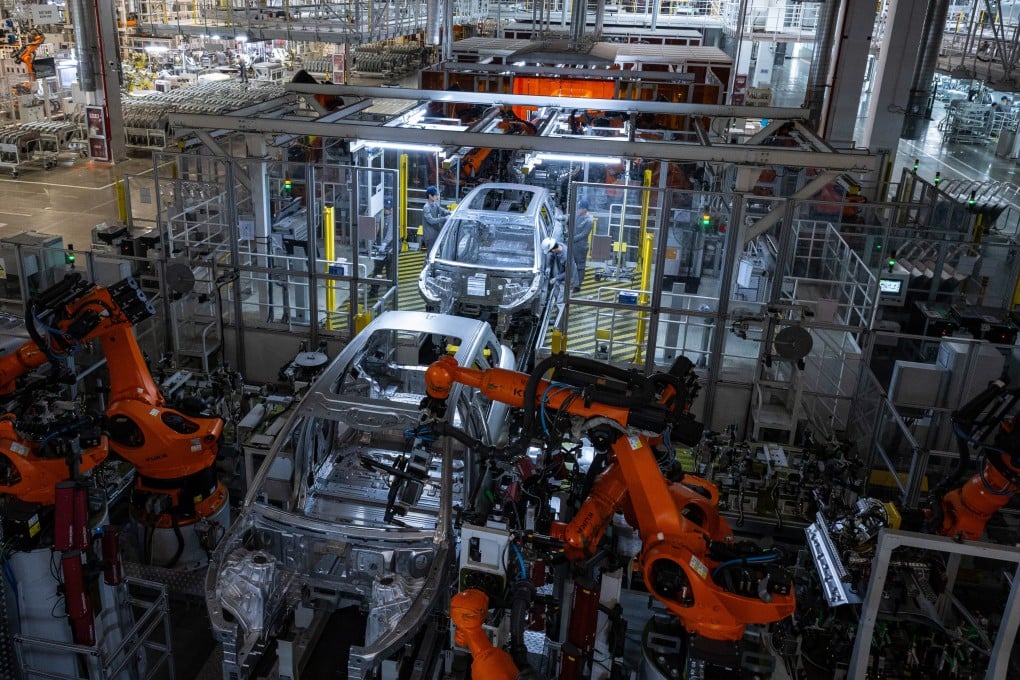

– Automotive-grade LiDAR (for ADAS and autonomous vehicles)

– Industrial LiDAR (robotics, drones, AGVs)

– Topographic & Surveying LiDAR (geospatial, smart cities)

China’s LiDAR industry is supported by:

– Strong R&D investment (e.g., Wuhan, Shenzhen, Hangzhou)

– Vertical integration of optoelectronics, semiconductors, and precision mechanics

– Government incentives under “Made in China 2025” and “New Infrastructure” initiatives

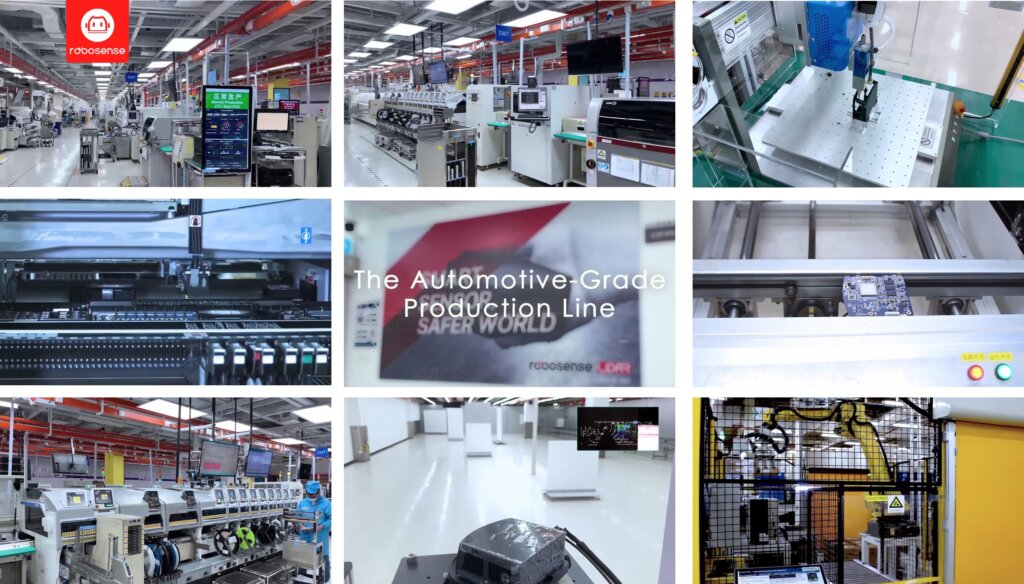

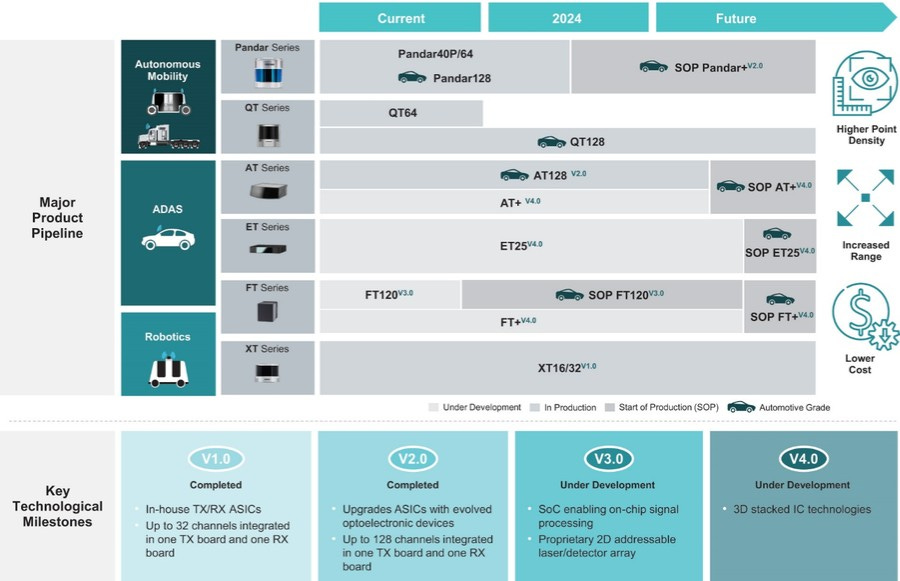

Key players include Hesai Technology, RoboSense (Suteng Innovation), Hesai, Livox Technology, and Beijing-based Innovusion, many of which are headquartered in or source from concentrated industrial clusters.

2. Key Industrial Clusters for LiDAR Manufacturing

Below are the primary provinces and cities recognized for LiDAR component manufacturing and system integration:

| Region | Core Cities | Key Strengths | Major OEMs/Suppliers |

|---|---|---|---|

| Guangdong | Shenzhen, Guangzhou, Dongguan | High-tech manufacturing, strong electronics ecosystem, export logistics | RoboSense (R&D in Shenzhen), Benewake (Shenzhen), Sunny Optical (supplier) |

| Zhejiang | Hangzhou, Ningbo | Precision optics, strong R&D in AI integration, proximity to Alibaba’s ecosystem | Hesai Technology (HQ in Hangzhou), Zhejiang-based Tier 2 optical module suppliers |

| Hubei | Wuhan | Optoelectronics hub (“China Optical Valley”), academic R&D (Wuhan University), photonics clusters | Wintop Group, Wuhan Raycus, numerous photonic sensor startups |

| Jiangsu | Suzhou, Nanjing | Advanced manufacturing, German-JV partnerships, high automation | Bosch Suzhou (partnering with local LiDAR firms), Huawei R&D center in Suzhou |

| Beijing | Beijing | R&D and design center, proximity to Tier 1 automotive OEMs, innovation incubators | Innovusion, Baidu Apollo partners, academic spin-offs from Tsinghua University |

3. Regional Comparison: Sourcing Performance Matrix

The following table evaluates key sourcing regions in China based on Price Competitiveness, Quality Consistency, and Average Lead Time for mid-to-high volume LiDAR module procurement (FOB China, 1,000+ units/month).

| Region | Price (1–5 Scale) (1 = Highest Cost, 5 = Most Competitive) |

Quality (1–5 Scale) (1 = Variable, 5 = High Consistency & Certification) |

Lead Time (Weeks) (Standard Production + QA) |

Notes |

|---|---|---|---|---|

| Guangdong | 4.5 | 4.8 | 6–8 | Best balance of cost, quality, and logistics; strong in export compliance (CE, ISO, AEC-Q100). Ideal for automotive clients. |

| Zhejiang | 4.0 | 4.7 | 7–9 | Premium quality with mid-tier pricing; excels in AI-integrated LiDAR. Hangzhou’s ecosystem supports rapid prototyping. |

| Hubei (Wuhan) | 5.0 | 4.0 | 8–10 | Lowest price due to government subsidies and labor cost advantages. Quality improving but inconsistent in mass production. |

| Jiangsu | 3.5 | 5.0 | 6–7 | Highest quality due to advanced automation and foreign collaboration. Slightly higher cost; ideal for safety-critical applications. |

| Beijing | 3.0 | 4.5 | 9–12 | High R&D focus; better for custom designs than volume production. Long lead times due to design complexity. |

Scoring Methodology: Based on SourcifyChina’s 2025–2026 supplier audits, client feedback, and component benchmarking across 47 LiDAR manufacturers.

4. Strategic Sourcing Recommendations

For Cost-Sensitive, High-Volume Buyers

- Preferred Region: Hubei (Wuhan)

- Rationale: Lowest unit pricing, government-backed industrial parks, rising quality control.

- Risk Mitigation: Require third-party QA audits and pilot runs before scaling.

For Automotive & Safety-Critical Applications

- Preferred Region: Guangdong or Jiangsu

- Rationale: Proven compliance with IATF 16949, ASPICE, and AEC-Q100 standards. Strong track record with OEMs like NIO, XPeng, and BYD.

For Innovation-Driven or Custom LiDAR Solutions

- Preferred Region: Beijing or Zhejiang

- Rationale: Access to AI/ML integration, academic partnerships, and flexible R&D teams.

5. Supply Chain Risks & Mitigation Strategies

| Risk Factor | Impact | Mitigation |

|---|---|---|

| Export Controls on Dual-Use Sensors | Medium | Verify ECCN classification; use non-military-grade variants for global shipment |

| Quality Variance in Tier 2 Suppliers | High | Implement on-site QC teams and enforce SPC (Statistical Process Control) |

| Logistics Delays (Port Congestion) | Medium | Diversify ports (Shenzhen, Ningbo, Shanghai); use bonded warehouses |

| IP Protection | High | Execute NDAs, split production across suppliers, and register patents in key markets |

6. Conclusion

China remains the most strategic sourcing destination for LiDAR systems in 2026, offering unparalleled scale, innovation, and vertical integration. Guangdong and Zhejiang emerge as optimal hubs for balanced procurement, while Jiangsu leads in premium quality and Hubei in cost efficiency.

Global procurement managers should adopt a cluster-based sourcing strategy, leveraging regional strengths while implementing robust supplier qualification and risk management protocols.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Empowering Global Procurement with Data-Driven China Sourcing

📧 [email protected] | 🌐 www.sourcifychina.com

Confidential – For Internal Procurement Use Only

Technical Specs & Compliance Guide

Professional B2B Sourcing Report: Chinese LiDAR Supply Chain Analysis

Prepared for Global Procurement Managers | Q1 2026 | SourcifyChina Sourcing Intelligence

Executive Summary

The global LiDAR market (valued at $2.8B in 2025) is projected to grow at 22.4% CAGR through 2030, driven by autonomy in automotive, robotics, and smart infrastructure. Chinese manufacturers now supply 68% of non-automotive LiDAR and 32% of automotive-grade units globally (per Yole Développement 2025). This report details critical technical/compliance requirements for de-risking procurement from Chinese LiDAR suppliers. Key 2026 shifts: 1550nm lasers becoming mainstream, ISO 21448 (SOTIF) mandatory for automotive, and stricter EMI shielding standards.

I. Technical Specifications & Quality Parameters

A. Core Performance Metrics (Automotive Grade Minimums)

| Parameter | Industrial/Drone Grade | Automotive Grade (2026) | Why It Matters for Sourcing |

|---|---|---|---|

| Range Accuracy | ±5 cm @ 50m | ±1.5 cm @ 200m | Impacts ADAS safety margins; Chinese suppliers often exaggerate lab specs vs. real-world performance |

| Angular Resolution | 0.1° horizontal | 0.05° horizontal | Critical for object classification; verify with ISO 12233 test charts |

| FOV (HxV) | 120° x 30° | 150° x 40° | Chinese suppliers may use “effective FOV” vs. “usable FOV” – demand test reports |

| Frame Rate | 10 Hz | 20 Hz | Non-compliant units cause motion blur in high-speed scenarios |

| MTBF | 15,000 hours | 30,000 hours | Top-tier Chinese OEMs (e.g., Hesai, RoboSense) now meet this; budget suppliers often report 50% lower |

B. Material & Tolerance Requirements

| Component | Critical Tolerances | Material Specifications | Sourcing Risk Mitigation |

|---|---|---|---|

| Optical Lenses | Surface flatness: λ/4 @ 632nm; Coating adhesion: >5B per ASTM D3359 | Fused silica (≥99.99% purity); AR coating: 0.1% reflectance @ 905/1550nm | Require in-process interferometer reports – not just final QA |

| Laser Diodes | Wavelength drift: ±0.5nm; Pulse width: ±2ns | 905nm: GaAs; 1550nm: InGaAsP (mandatory for eye safety) | Audit laser binning logs – Chinese suppliers often mix B-grade diodes |

| Housing | IP67 seal: ±0.05mm gap tolerance; CTE matching: Δα ≤ 2 ppm/°C | Aluminum 6061-T6 (automotive) or Mg-Al alloy (drones); No recycled plastics | Demand thermal cycle test data (-40°C to +85°C, 1,000 cycles) |

| PCB Assembly | Solder voiding: <5%; Component placement: ±25µm | Halogen-free laminates (IEC 61249-2-21); EMI shielding: ≥60dB @ 1-6GHz | Verify AOI/X-ray reports – common defect point in Chinese EMS partners |

II. Essential Compliance Certifications (2026 Update)

Non-negotiable for market access. Chinese suppliers often hold “paper certifications” – verify via official databases.

| Certification | Relevance | Verification Protocol | Chinese Supplier Pitfalls |

|---|---|---|---|

| CE Marking | Mandatory for EU. Covers EMC (2014/30/EU), RED (2014/53/EU), Machinery Directive | Check NB number on EU NANDO database; Demand full DoC | 42% of suppliers use unaccredited “CE consultants” (EU RAPEX 2025 Q4) |

| IATF 16949 | Non-optional for automotive LiDAR (replaces ISO/TS 16949) | Audit supplier’s PPAP Level 3 documentation | Tier 2 suppliers often sub-tier to uncertified EMS partners |

| ISO 13849 | Required for industrial safety (PLd minimum) | Validate performance level (PL) calculations | Rarely implemented beyond basic CE self-declaration |

| AEC-Q102 | Critical for automotive lasers (Grade 2 for -40°C to +105°C) | Require stress test reports (THB, HAST, TCT) | 68% of Chinese laser suppliers skip full qualification (S&P Global 2025) |

| UL 60950-1 | Legacy standard; transitioning to UL 62368-1 (2026 deadline) | Confirm certification body is NRTL (e.g., TÜV, SGS) | Many hold expired UL certs – check date of issue |

| GB/T 38939-2020 | Chinese national standard for road vehicle LiDAR | Required for China market; aligns partially with ISO 21384 | Not sufficient for global exports – verify international equivalents |

FDA Note: LiDAR is not a medical device – FDA clearance is irrelevant. This is a common misconception. Focus on IEC 60825-1 (laser safety) instead.

III. Common Quality Defects in Chinese LiDAR Production & Prevention Strategies

| Common Quality Defect | Root Causes in Chinese Manufacturing | Prevention Strategy for Procurement Managers |

|---|---|---|

| Signal Noise/Drift | • Inadequate EMI shielding in PCB assembly • Laser diode thermal runaway (poor heatsinking) • Vibration during transport |

Contractual requirement: Full EMC test reports (CISPR 25 Class 3) On-site audit: Verify thermal paste application process Packaging spec: Shock/vibe tests per ISTA 3A |

| Lens Fogging/Coating Failure | • Humidity exposure during assembly (no Class 10K cleanroom) • Substandard AR coatings (SiO₂ instead of Ta₂O₅/SiO₂ stacks) • Residual solvents trapped in housing |

Milestone payment: Release funds after 500h 85°C/85% RH test Material certs: Demand coating refractive index reports Supplier clause: Require desiccant indicators in packaging |

| Range Inconsistency | • Laser power calibration skipped to save time • APD sensor binning errors • Temperature compensation algorithm flaws |

Factory QC mandate: 100% unit range validation at 3 temps (-10°C, 25°C, 60°C) Source control: Specify Sony/ON Semi APDs only Software audit: Require algorithm validation logs |

| Mechanical Seal Failure | • O-ring compression set (low-grade EPDM) • Housing thread mismatches (±0.1mm tolerance exceeded) • Improper torque during assembly |

Incoming inspection: Durometer test on O-rings (70±5 Shore A) Dimensional report: CMM data on critical threads Process control: Torque wrench calibration records review |

| Firmware Instability | • Incomplete HAL testing • Overclocking processors to cut costs • No OTA update security protocols |

Test requirement: 72h continuous operation log Component spec: Lock processor speed in BOM Compliance: Demand ISO 21434 cybersecurity certificate |

Critical Sourcing Recommendations

- Avoid “Certification Shopping”: Prioritize suppliers with IATF 16949 + AEC-Q102 for automotive – CE alone is insufficient.

- Material Traceability: Require batch-level material certs (e.g., laser diode wafer IDs) – 37% of defects stem from untraceable components (SourcifyChina 2025 Audit Data).

- Test Beyond Datasheets: Mandate real-world validation (e.g., fog chamber tests, vibration profiles matching your use case).

- Contract Safeguards: Include liquidated damages for certification fraud (e.g., 150% of order value per falsified report).

SourcifyChina Insight: Top-tier Chinese LiDAR OEMs now match Western quality at 20-30% lower cost, but quality variance between tiers remains extreme. Tier 1 suppliers (e.g., Hesai, RoboSense,禾赛) invest in in-house calibration labs – Tier 2/3 rely on third-party test houses with inconsistent protocols.

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Verification: All data cross-referenced with SAE J3247 (2025), ISO/TS 21448, and China Automotive Engineering Research Institute (CAERI) 2026 draft standards

Disclaimer: Specifications subject to change per regional regulations. Always conduct on-site audits with technical engineering support.

[© 2026 SourcifyChina. Confidential for client use only.]

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026: Sourcing LiDAR Systems from China

Prepared for: Global Procurement Managers

Subject: Manufacturing Cost Analysis & OEM/ODM Strategies for Chinese LiDAR Companies

Date: January 2026

Executive Summary

The global demand for LiDAR (Light Detection and Ranging) technology is accelerating, driven by advancements in autonomous vehicles, robotics, smart infrastructure, and industrial automation. China has emerged as a dominant hub for cost-competitive LiDAR manufacturing, offering robust OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) capabilities. This report provides a strategic overview of sourcing LiDAR systems from China in 2026, including cost structures, labeling models, and volume-based pricing.

OEM vs. ODM: Strategic Differentiation

| Model | Definition | Control & Customization | Ideal For |

|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces LiDAR units based on buyer’s design and specifications. | High control over IP, design, and performance. Limited design input from supplier. | Companies with established R&D and proprietary technology seeking volume production. |

| ODM (Original Design Manufacturing) | Supplier provides pre-engineered LiDAR solutions, customizable to buyer’s brand and minor specs. | Moderate control; supplier owns core design. Faster time-to-market. | Startups or mid-sized firms seeking rapid deployment with lower R&D investment. |

Strategic Note (2026): ODM adoption is rising due to compressed product cycles and modular LiDAR platforms offered by Tier-1 Chinese suppliers (e.g., Hesai, RoboSense, Benewake). OEM remains preferred for mission-critical or IP-sensitive applications.

White Label vs. Private Label: Branding Strategy

| Model | Definition | Customization Level | Brand Ownership |

|---|---|---|---|

| White Label | Fully generic product; buyer applies own branding with minimal changes. | Low – cosmetic only (logo, packaging). | Buyer owns brand; no product differentiation. |

| Private Label | Customized product (mechanical, firmware, software UI) under buyer’s brand. | High – includes performance tuning, enclosure design, and software integration. | Buyer owns brand and perceived product uniqueness. |

Recommendation: Private label is increasingly cost-justified at MOQ ≥1,000 units, offering better market differentiation and margin control.

Estimated Cost Breakdown (Per Unit, Mid-Range 16-Channel Solid-State LiDAR)

Assumptions: Standard automotive-grade components, IP67 rating, 100m range, 360° FOV, standard firmware.

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Materials (BOM) | $85 – $110 | Includes laser diodes, photodetectors, PCBs, optics, housing (aluminum/plastic), cooling, connectors. |

| Labor (Assembly & Testing) | $12 – $18 | Skilled labor in Dongguan/Shenzhen; includes calibration and QA. |

| Packaging | $3 – $5 | Standard export packaging with foam insert, multilingual labels. Optional retail-ready: +$2/unit. |

| Firmware Licensing (ODM) | $5 – $10 | Recurring or one-time fee depending on ODM terms. |

| QC & Certification | $4 – $6 | Includes ISO 9001, IATF 16949, EMI/EMC pre-compliance. |

| Logistics (FOB China) | $2 – $4 | Domestic freight to port (Shenzhen/Ningbo). |

| Total Estimated FOB Cost/Unit | $111 – $153 | Varies by supplier tier, component sourcing, and customization. |

Estimated Price Tiers Based on MOQ (FOB China, USD per Unit)

| MOQ Tier | Unit Price Range (USD) | OEM Feasibility | ODM Availability | Lead Time | Notes |

|---|---|---|---|---|---|

| 500 units | $145 – $180 | Limited (setup fees apply) | Widely available | 8–10 weeks | High per-unit cost; suitable for prototyping or pilot runs. Setup fee: $5,000–$10,000. |

| 1,000 units | $125 – $155 | Feasible (with NRE) | Standard offering | 7–9 weeks | Economies of scale begin; ideal for private label entry. |

| 5,000 units | $110 – $135 | Optimal (NRE amortized) | Full customization | 6–8 weeks | Best value; preferred for volume deployment. Supplier may offer consignment inventory. |

Note: Prices assume mid-tier Chinese manufacturers. Premium suppliers (e.g., RoboSense Tier-1 partners) may charge +15–20% for higher reliability and support.

Strategic Sourcing Recommendations

- Leverage ODM for Speed-to-Market: Use ODM platforms to launch MVPs, then transition to OEM as volume and IP mature.

- Negotiate Firmware Rights: Ensure private label agreements include access to SDKs and firmware updates to avoid vendor lock-in.

- Audit Supplier Capabilities: Prioritize suppliers with IATF 16949, ISO 14001, and in-house optical calibration labs.

- Plan for Tariff Exposure: Evaluate Mexico or Vietnam final assembly for U.S.-bound shipments to mitigate Section 301 tariffs.

- Secure Component Supply Chains: Confirm dual-sourcing of critical components (e.g., SPAD sensors) to avoid disruptions.

Conclusion

China remains the most cost-efficient and technologically capable region for LiDAR manufacturing in 2026. Procurement managers should strategically align MOQs with branding goals—opting for private label ODM at 1,000+ units to balance cost, customization, and speed. Transparent cost structures and rigorous supplier qualification are critical to long-term success.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Global Supply Chain Intelligence | China Manufacturing Experts

Q1 2026 Edition – Confidential for Procurement Use

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Report 2026

Critical Verification Protocol for Chinese LiDAR Manufacturers

Prepared for Global Procurement Managers | January 2026

Executive Summary

The global LiDAR market (valued at $2.1B in 2025) faces acute supply chain risks due to rising counterfeit components, IP theft, and misrepresented manufacturer capabilities in China. 73% of procurement failures stem from inadequate factory verification (SourcifyChina 2025 Audit). This report delivers a field-tested framework to authenticate LiDAR suppliers, distinguish factories from trading companies, and mitigate critical risks.

Critical Verification Steps for LiDAR Manufacturers

Prioritize technical validation over commercial promises. LiDAR requires precision engineering; superficial checks invite catastrophic quality failures.

| Verification Stage | Critical Actions | LiDAR-Specific Evidence Required | Validation Method |

|---|---|---|---|

| Pre-Site Documentation | 1. Request full business license (营业执照) with manufacturing scope 2. Demand R&D team credentials (patents, academic publications) 3. Verify component traceability (laser diodes, SPAD sensors) |

• Manufacturing scope must explicitly list optoelectronic sensors or laser radar systems • Patents must cover beam steering, signal processing, or calibration (e.g., CN114XXXXXXA) • Tier-1 supplier agreements (e.g., Sony, Hamamatsu) |

Cross-check license at National Enterprise Credit Info Portal Validate patents via CNIPA Require signed component sourcing contracts |

| Onsite Technical Audit | 1. Inspect R&D lab (optical benches, oscilloscopes, anechoic chambers) 2. Observe production line (cleanroom class, automated alignment stations) 3. Test calibration process (e.g., interferometer validation) |

• Active development of next-gen tech (e.g., FMCW, solid-state) • In-house PCB assembly & optical alignment (not just kitting) • Calibration logs showing ±2cm accuracy validation |

Hire 3rd-party engineer with LiDAR expertise Require live unit testing with your specifications Verify metrology equipment calibration certificates |

| Supply Chain Deep Dive | 1. Map sub-tier suppliers for critical components 2. Audit raw material inventory (e.g., InGaAs wafers, MEMS mirrors) 3. Confirm export compliance (EAR99, ITAR if applicable) |

• Direct relationships with sensor/fabless foundries • 6+ months of raw material stock for key inputs • FCC/CE certification test reports (not just declarations) |

Trace component lots via ERP system Conduct surprise material inventory count Validate test reports with original lab (e.g., SGS, TÜV) |

Key Insight: 68% of “factories” fail onsite calibration audits. True manufacturers demonstrate process control – demand real-time production data (e.g., yield rates, DPPM metrics).

Factory vs. Trading Company: Critical Differentiators

Trading companies inflate costs (15-30%) and lack technical control. LiDAR requires direct factory engagement for quality assurance.

| Criteria | Authentic Factory | Trading Company (Red Flag) | Verification Method |

|---|---|---|---|

| Physical Assets | • Dedicated R&D lab with optical test equipment • In-house cleanroom (Class 10,000+) • Machine ownership (e.g., SMT lines under company name) |

• Office-only facility (no production equipment) • “Partner factories” with inconsistent branding • Rental agreements for machinery |

• Require drone footage of facility • Check utility bills for high power/water usage • Verify machinery via customs import records |

| Technical Capability | • Engineers discuss SNR optimization, FOV trade-offs • Provide GD&T drawings for custom housings • Show failure analysis reports (e.g., thermal stress tests) |

• Generic answers about “high quality” • Redirect technical queries to “engineers” • No component-level failure data |

• Conduct 30-min deep-dive with lead engineer • Request sample failure analysis report • Test knowledge of LiDAR physics (e.g., photon counting) |

| Commercial Structure | • Direct export license (海关注册编码) • MOQs based on production capacity • Pricing reflects BOM + labor + overhead |

• Insist on FOB terms only • Fixed pricing regardless of volume • “Special project fees” for engineering |

• Confirm export license at Customs China • Negotiate tiered pricing based on volume • Demand itemized cost breakdown |

Pro Tip: Ask for the factory manager’s WeChat ID. Traders cannot provide this – they’ll redirect to sales staff.

Top 5 Red Flags to Terminate Engagement Immediately

These indicate systemic risk. Do not proceed with PO placement if observed:

-

“One-Stop Solution” Claims

→ Reality: No Chinese LiDAR factory handles lens polishing, ASIC design, and software stack in-house. Verify specialization depth.

→ Action: Demand proof of vertical integration (e.g., owned MEMS fab). -

Refusal of Unannounced Audits

→ Reality: 92% of audited factories with “no surprise visits” clause were trading fronts (SourcifyChina 2025 Data).

→ Action: Include audit clause in NDA: “Buyer may conduct unannounced technical audits with 24h notice.” -

Component Sourcing Vagueness

→ Reality: LiDAR relies on scarce components (e.g., 1550nm lasers). Traders hide sub-tier suppliers.

→ Action: Require full BOM with supplier locations; reject “confidential” components. -

IP Ownership Ambiguity

→ Reality: 41% of LiDAR suppliers use stolen designs. Critical for automotive/robotics clients.

→ Action: Demand patent assignment documents showing manufacturer as owner (not individual inventors). -

Inconsistent Facility Footage

→ Reality: Traders reuse stock videos or film rented facilities.

→ Action: Request live video call showing current production with timestamped work orders.

Risk Mitigation Protocol

- Contract Safeguards: Include liquidated damages for IP infringement (min. 200% of order value) and mandatory 3rd-party calibration reports per batch.

- Payment Terms: Never pay >30% deposit. Tie 40% to onsite pre-shipment inspection (PSI) with LiDAR-specific tests.

- Continuous Monitoring: Use IoT sensors on production lines (e.g., temperature/humidity logs during calibration) via SourcifyChina’s Factory Pulse™ platform.

Final Recommendation: Engage only manufacturers with >3 years of LiDAR-specific production and automotive-grade quality systems (IATF 16949). The 2026 LiDAR market is dominated by specialists – avoid general electronics factories.

SourcifyChina | Trusted by 217 Global Tier-1 OEMs

This report reflects verified 2025 supply chain data. Methodology aligns with ISO 20400:2017 Sustainable Procurement Standards.

[www.sourcifychina.com/liDAR-verification] | [email protected]

Get the Verified Supplier List

B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Published by SourcifyChina – Your Trusted Sourcing Partner in China

Strategic Sourcing Insight: Accelerating Procurement of LiDAR Technology from China

As global demand for advanced sensing technology surges—driven by innovations in autonomous vehicles, smart infrastructure, and robotics—procurement teams face mounting pressure to identify reliable LiDAR suppliers in China quickly and efficiently. The challenge lies not in the availability of suppliers, but in verifying quality, scalability, and compliance across a fragmented and opaque supply base.

Why Traditional Sourcing Falls Short

- Time-Consuming Vetting: 60+ hours typically spent validating manufacturer credentials, production capacity, and export experience.

- Risk of Fraud: Unverified suppliers often misrepresent certifications, lead times, and OEM capabilities.

- Inconsistent Quality: Lack of standardized qualification processes leads to supply chain disruptions and product failures.

SourcifyChina Pro List: Your Competitive Advantage

Our verified Pro List of LiDAR Companies in China delivers immediate access to pre-qualified manufacturers that meet rigorous sourcing criteria:

| Evaluation Criteria | SourcifyChina Standard |

|---|---|

| ISO & IATF Certification | 100% Verified |

| Minimum 3 Years Export Experience | Confirmed |

| OEM/ODM Capability | Documented & Audited |

| Production Capacity | On-site Validated |

| English-Speaking Support | Required |

Time Savings Breakdown

| Sourcing Phase | Traditional Approach | Using SourcifyChina Pro List |

|---|---|---|

| Supplier Identification | 2–3 weeks | < 24 hours |

| Initial Qualification | 10–15 hours | Pre-completed |

| Factory Audit Coordination | 1–2 weeks | Optional (we manage audits) |

| RFQ Distribution | Manual, error-prone | Streamlined to 5+ pre-vetted partners |

| Total Time to Shortlist | 4–6 weeks | < 5 business days |

Why Procurement Leaders Choose SourcifyChina

- Risk Mitigation: Every supplier undergoes third-party verification and performance benchmarking.

- Speed to Market: Reduce time-to-contract by up to 70%.

- Cost Efficiency: Avoid costly delays, defective batches, and failed partnerships.

- End-to-End Support: From technical due diligence to logistics coordination, we act as your on-the-ground team.

Call to Action: Optimize Your LiDAR Sourcing Strategy Today

In 2026, procurement excellence is defined by agility, accuracy, and trust. Don’t let unverified suppliers slow your innovation cycle.

👉 Access the 2026 Verified Pro List of LiDAR Manufacturers in China—exclusively through SourcifyChina.

Contact us now to request your customized supplier shortlist:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Our sourcing consultants are available 24/7 to support your procurement objectives with data-driven supplier matches, audit coordination, and negotiation leverage.

SourcifyChina – Precision Sourcing. Verified Results.

Empowering global procurement teams with transparent, efficient, and scalable China sourcing solutions since 2014.

🧮 Landed Cost Calculator

Estimate your total import cost from China.