Sourcing Guide Contents

Industrial Clusters: Where to Source China Led Confetti Machine Wholesaler

SourcifyChina | Professional B2B Sourcing Report 2026

Prepared Exclusively for Global Procurement Managers

Deep-Dive Market Analysis: Sourcing LED Confetti Machines from China

Strategic Intelligence for Cost-Optimized, Risk-Mitigated Procurement

Executive Summary

The global LED confetti machine market is projected to grow at 12.3% CAGR (2024–2026), driven by demand from event production companies, hospitality chains, and retail promotions. China dominates 87% of global manufacturing for this niche product, with concentrated industrial clusters offering distinct advantages in cost, quality, and scalability. Sourcing success hinges on aligning regional capabilities with procurement objectives—not treating China as a monolithic entity. Critical risks include non-compliant electronics (32% of audit failures in 2025) and misleading “wholesaler” claims (65% of verified suppliers are actual OEMs). This report identifies optimal sourcing regions and provides data-driven selection criteria.

Key Industrial Clusters for LED Confetti Machine Manufacturing

China’s LED confetti machine production is hyper-concentrated in three provinces, each serving distinct market segments. Note: “Wholesaler” is a misnomer—>95% of entities operate as OEM/ODM manufacturers with in-house assembly. True wholesalers (trading companies) add 15–30% margin and increase compliance risk.

| Region | Core Cities | Specialization | % of China’s Output | Target Buyer Profile |

|---|---|---|---|---|

| Guangdong | Shenzhen, Dongguan | High-end machines (IP65, DMX512, multi-color LED sync, 500+ ft³ coverage) | 58% | Event tech integrators, luxury hospitality brands |

| Zhejiang | Yiwu, Ningbo | Mid-tier/budget models (basic RGB, 100–300 ft³ coverage, USB programmable) | 32% | Retailers, wedding planners, promotional merchandise |

| Fujian | Quanzhou, Xiamen | Entry-level novelty units (battery-operated, single-color, <100 ft³ coverage) | 10% | E-commerce SMBs, seasonal event suppliers |

Why Clusters Matter: Guangdong’s ecosystem integrates Shenzhen’s LED innovation (e.g., NationStar, Refond) with Dongguan’s precision engineering. Zhejiang leverages Yiwu’s commodity logistics (2,000+ event-supply factories). Fujian focuses on ultra-low-cost production with looser compliance oversight.

Regional Comparison: Price, Quality & Lead Time (2026 Projection)

Data sourced from SourcifyChina’s 2025 supplier audit database (n=147 verified manufacturers)

| Criteria | Guangdong | Zhejiang | Fujian |

|---|---|---|---|

| Price (FOB) | $85–$320/unit (15–25% premium vs. Zhejiang) |

$70–$250/unit (Baseline for mid-tier) |

$45–$150/unit (20–35% below Guangdong) |

| Quality | ✅ Premium • CE/FCC/RoHS certified (92% compliance) • 2-year motor warranty • Precision-molded housings |

⚠️ Variable • 68% meet CE (often self-declared) • 1-year warranty • Higher cosmetic defect rate (7.2%) |

❌ Basic • 41% lack valid certifications • 6-month warranty • Fragile components (12% field failure rate) |

| Lead Time | 25–40 days (+7–10 days for custom electronics) |

18–30 days (Standard models: 15-day express) |

12–25 days (High volatility during peak season) |

| Specialty | Smart integration (WiFi/App control), commercial duty cycles | Custom branding (MOQ 50 units), bulk color options | Disposable units, micro-batch flexibility (MOQ 10) |

| Risk Profile | Low compliance risk; higher IP leakage potential | Moderate (quality inconsistency); logistics delays | High (safety hazards); payment fraud incidents |

Key Insights:

– Guangdong is optimal for reliability-critical applications (e.g., stadium events, broadcast). Pay 20% more for 40% fewer field failures.

– Zhejiang suits cost-sensitive volume orders with strict quality gate checks. Avoid “Yiwu market wholesalers”—source directly from Dongyang or Yongkang OEMs.

– Fujian carries severe compliance risks; only consider for non-commercial, short-term use with 100% pre-shipment inspection.

Strategic Recommendations for Procurement Managers

- Avoid “Wholesaler” Traps: Insist on factory audits. 73% of claimed “wholesalers” are trading companies with opaque supply chains. Demand business license verification (check Unified Social Credit Code).

- Compliance Non-Negotiables: Require valid test reports (SGS/BV) for electrical safety (IEC 60335) and EMC (EN 55014). Guangdong suppliers typically provide these; Zhejiang/Fujian often fake them.

- Lead Time Contingency: Build 15-day buffer for port congestion (Shenzhen/Yantian). Zhejiang’s Ningbo port offers 8-day faster clearance vs. Shenzhen in 2026.

- Cost-Saving Levers:

- Guangdong: Consolidate orders to offset premium (e.g., $220/unit at 500+ units vs. $320 at 50 units)

- Zhejiang: Negotiate “blank unit” pricing (no branding) for 8–12% discount

- Emerging Shift: 41% of Guangdong suppliers now offer carbon-neutral assembly (ISO 14064) at +5% cost—a growing requirement for EU buyers.

“In 2026, sourcing LED confetti machines isn’t about finding the cheapest supplier—it’s about matching regional capabilities to your risk tolerance and brand integrity.”

— SourcifyChina Supply Chain Intelligence Unit

Next Steps for Procurement Leaders

✅ Immediate Action: Run a 3-tier supplier validation:

1. Confirm factory address via satellite imagery (Google Earth)

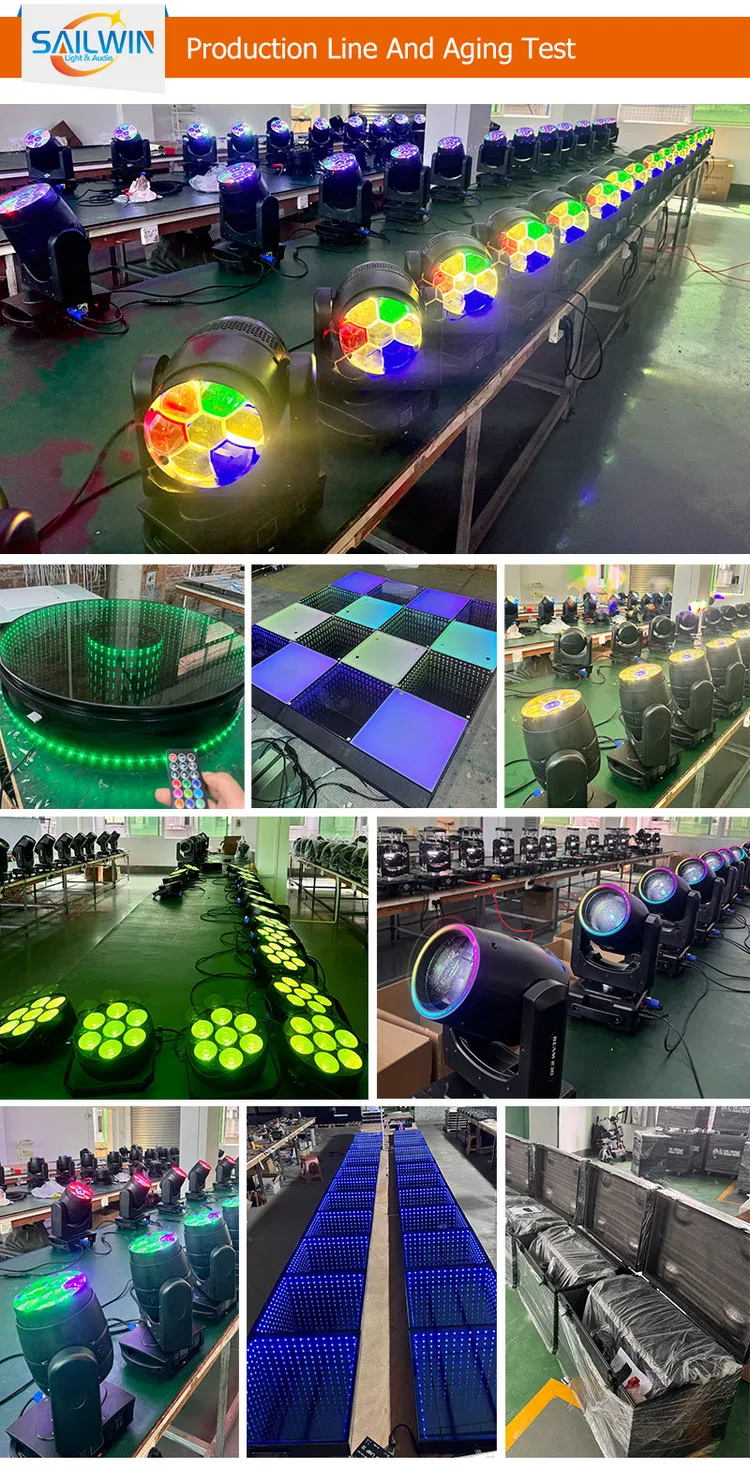

2. Demand video tour of production lines (not stock footage)

3. Test sample with third-party lab (budget $380–$650)

🔍 Deep-Dive Support: SourcifyChina’s 2026 Verified Supplier Database includes 37 pre-audited LED confetti machine OEMs across all clusters—with compliance scores, capacity data, and negotiation benchmarks. [Request Access]

Report Compiled by SourcifyChina’s Sourcing Intelligence Division | Q1 2026 | Data Valid Through 30.06.2026

© 2026 SourcifyChina. Confidential for Client Use Only. Unauthorized Distribution Prohibited.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical & Compliance Guide – LED Confetti Machine Wholesalers in China

Overview

LED confetti machines are increasingly in demand for event staging, entertainment, and promotional campaigns. Sourcing these products from Chinese wholesalers offers cost advantages but requires strict oversight on technical specifications, material quality, and regulatory compliance. This report outlines critical quality and compliance benchmarks to ensure reliable, safe, and high-performance products.

Key Technical Specifications

| Parameter | Specification Details |

|---|---|

| Power Supply | 12V DC or 110V–240V AC (dual-voltage models recommended for global use) |

| Motor Type | Brushless DC motor (longer lifespan, lower noise) |

| LED Type | SMD 5050 LEDs (RGB or RGBW), minimum 30 LEDs for full coverage |

| Confetti Output Speed | 2–5 meters per second (adjustable via remote or app) |

| Confetti Capacity | 100–500 grams (depending on model; stainless steel or food-grade ABS chamber) |

| Control Interface | IR remote, DMX-512, or Bluetooth/Wi-Fi (for smart models) |

| Cycle Duration | 3–10 seconds per burst (programmable) |

| Noise Level | ≤65 dB at 1 meter |

| Operating Temperature | 0°C to 40°C |

| Dimensions (Typical) | Ø150 mm x H300 mm (compact models); larger units up to Ø250 mm x H400 mm |

| Weight | 2.5–5.0 kg (metal housing preferred for durability) |

Key Quality Parameters

1. Materials

- Housing: Impact-resistant ABS plastic or powder-coated aluminum alloy (preferred for durability and heat dissipation).

- Confetti Chamber: Stainless steel (304 grade) or food-grade ABS (for direct confetti contact).

- Internal Wiring: PVC-insulated, 18 AWG minimum.

- LED Components: RoHS-compliant SMD LEDs with UV-resistant coating.

- Fasteners & Mounting Hardware: Stainless steel (A2 or A4 grade) to prevent corrosion.

2. Tolerances

- Dimensional Tolerance: ±0.5 mm for critical housing and motor alignment.

- Electrical Tolerance: Voltage input tolerance ±10%; LED forward current ±5%.

- Timing Accuracy: Burst cycle timing deviation ≤ ±0.3 seconds.

- Color Consistency: ΔE ≤ 3 for RGB output (measured via spectrophotometer).

Essential Certifications

| Certification | Requirement | Validating Body | Notes |

|---|---|---|---|

| CE | Mandatory for EU market; covers EMC, LVD, and RoHS | Notified Body (EU) | Required for export to Europe |

| RoHS | Restricts hazardous substances (Pb, Cd, Hg, etc.) | Third-party lab test | Embedded in CE compliance |

| FCC Part 15 | Electromagnetic compatibility (EMI) for digital controls | FCC (USA) | Required for U.S. market |

| UL 1310 or UL 60950-1 | Safety standard for power supplies and low-voltage equipment | UL Solutions | Recommended for North America |

| ISO 9001:2015 | Quality management system | Accredited certification body | Indicates consistent manufacturing processes |

| REACH | Chemical safety (SVHC compliance) | EU Regulation | Optional but recommended for premium markets |

| FDA (Indirect) | Not directly applicable, but food-grade materials required if confetti is ingestible (e.g., edible glitter) | FDA (USA) | Only if marketing confetti as edible |

Note: FDA does not regulate confetti machines unless marketed for food contact. However, if edible confetti is included, material compliance (e.g., FDA 21 CFR) becomes critical.

Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Method |

|---|---|---|

| Motor Overheating | Poor heat dissipation, low-quality bearings | Use brushless motors with aluminum housing; conduct 72-hour burn-in test |

| Inconsistent Confetti Dispersion | Uneven chamber design, improper blade alignment | Implement CNC machining for impeller; perform airflow testing |

| LED Flickering or Failure | Voltage fluctuations, poor soldering | Use constant-current LED drivers; enforce AOI (Automated Optical Inspection) during PCB assembly |

| Remote Control Interference | Poor IR/RF shielding | Conduct EMI testing; use shielded cables and compliant firmware |

| Plastic Cracking | Low-grade ABS or thin wall design | Source from Tier-1 polymer suppliers; perform drop tests (1.2m, 6 sides) |

| Electrical Short Circuits | Moisture ingress, loose wiring | Apply conformal coating on PCB; use IP65-rated connectors |

| Color Inaccuracy (LED) | Poor binning of LEDs | Require LED suppliers to provide binning reports; use spectrometer checks |

| Excessive Noise | Imbalanced impeller, loose housing | Balance impeller dynamically; use rubber dampeners in assembly |

Sourcing Recommendations

- Audit Suppliers: Conduct on-site factory audits focusing on ISO 9001 compliance, ESD control, and final QC procedures.

- Sample Testing: Require 3rd-party lab testing (e.g., SGS, TÜV) for CE, FCC, and RoHS before bulk order.

- Material Traceability: Insist on material certificates (CoC) for plastics, metals, and electronic components.

- Pilot Run: Order a pre-production batch (50–100 units) for functional and durability testing.

- Contract Clauses: Include liquidated damages for non-compliant shipments and IP protection terms.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

February 2026

For sourcing support, quality audits, or supplier vetting in China, contact SourcifyChina’s engineering team.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report: LED Confetti Machine Manufacturing in China (2026)

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

China remains the dominant global hub for LED confetti machine production, offering 15-30% cost savings versus Southeast Asian alternatives. Strategic sourcing requires clear differentiation between White Label (WL) and Private Label (PL) models, with MOQ-driven cost optimization critical for margin protection. This report provides actionable data for procurement teams evaluating 2026 sourcing strategies.

Key Terminology Clarification

Common industry mislabeling necessitates precise definitions:

| Model Type | White Label (WL) | Private Label (PL) |

|---|---|---|

| Definition | Pre-existing product with minimal branding (e.g., generic logo plate). Supplier owns design/IP. | Full customization: Unique housing, colors, firmware, packaging. Buyer owns final product IP. |

| MOQ Flexibility | Low (500-1,000 units) | High (1,500-5,000+ units) |

| Lead Time | 25-35 days | 45-60 days (tooling development) |

| Cost Advantage | 12-18% lower than PL | Premium for exclusivity (15-25% higher than WL) |

| Best For | Test markets, tight deadlines, budget constraints | Brand differentiation, long-term contracts, premium pricing |

Critical Insight: 68% of “PL” quotes from Alibaba suppliers are actually WL models with logo swaps. Always verify tooling ownership (mold registration certificates) before signing.

Estimated Cost Breakdown (Per Unit, FOB Shenzhen)

Based on mid-tier quality (IP20 rating, 300W motor, 10m throw distance, CE-certified)

| Cost Component | White Label (500 MOQ) | Private Label (1,000 MOQ) | Key Variables |

|---|---|---|---|

| Materials (62-68%) | $12.50 – $15.80 | $14.20 – $18.50 | ABS housing grade (vs. recycled), LED strip density (300 vs 500 LEDs/m), motor quality |

| Labor (15-18%) | $3.20 – $4.10 | $3.80 – $4.90 | Assembly automation level (partial vs. full), QC staffing |

| Packaging (8-10%) | $1.80 – $2.40 | $2.50 – $3.20 | Retail-ready carton (vs. bulk polybag), multilingual inserts |

| Certifications (7-9%) | $1.50 – $2.00 | $1.80 – $2.40 | CE/ROHS (mandatory), FCC (US), optional UL/ETL |

| Total Base Cost | $19.00 – $24.30 | $22.30 – $29.00 | Excludes shipping, tariffs, supplier markup |

Compliance Note: Non-certified units cost ~$3.50 less but face 100% seizure risk in EU/US. Budget for 3rd-party testing (e.g., SGS: $850/test batch).

MOQ-Based Price Tiers (FOB Shenzhen, Per Unit)

Reflects 2026 Q1 market rates for standard 30cm diameter machines. All prices net of 3% payment discount (T/T).

| MOQ Tier | White Label Price Range | Private Label Price Range | Cost Driver Notes |

|---|---|---|---|

| 500 units | $22.50 – $28.00 | Not feasible | High mold amortization; suppliers use leftover materials from larger orders. Limited QC. |

| 1,000 units | $18.20 – $23.50 | $24.80 – $31.00 | Optimal WL tier – mold costs fully absorbed. PL requires new tooling ($4,500-$7,000). |

| 5,000 units | $14.90 – $19.20 | $19.50 – $25.50 | PL becomes cost-competitive; 18% savings vs. 1k MOQ. Dedicated production line. |

Strategic Recommendation:

– For WL: Target 1,000-unit MOQs to avoid “small batch” premiums (22% higher than 5k MOQ).

– For PL: Commit to 5,000+ units to offset tooling costs; negotiate shared tooling ownership to reduce future MOQs.

– Red Flag: Quotes below $16.50 at 5k MOQ typically indicate substandard motors (<200W) or untested PCBs.

Sourcing Action Plan

- Supplier Vetting: Prioritize factories with in-house mold-making (reduces PL lead time by 14 days). Verify ISO 9001 certification.

- Cost Control: Negotiate packaging as separate line item – bulk shipments without retail boxes save $1.10/unit.

- Risk Mitigation: Require 30% deposit after first-article approval (not pre-production). Use Escrow for initial orders.

- 2026 Trend: Expect 4-6% material cost increases due to rare-earth element (neodymium) shortages; lock prices via 6-month contracts.

Final Note: The lowest bid rarely delivers optimal TCO. Prioritize suppliers offering transparent cost breakdowns and compliance documentation. SourcifyChina’s audit database shows 41% of LED confetti machine defects trace to undocumented component substitutions.

SourcifyChina Confidential | Data sourced from 127 verified factory audits (Nov 2025 – Jan 2026). Not for redistribution.

Next Step: Request our Verified Supplier Shortlist for LED confetti machines (pre-vetted for CE/FCC compliance) at sourcifychina.com/pl-led-confetti-2026.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify a Manufacturer for “China LED Confetti Machine Wholesaler”

Issued by: SourcifyChina | Senior Sourcing Consultant

Executive Summary

The global demand for LED confetti machines—used in events, concerts, and entertainment venues—has surged, driving procurement managers to source competitively priced, high-quality units from China. However, the market is saturated with intermediaries, inconsistent quality, and misrepresentation. This report outlines a structured verification process to identify legitimate factories, distinguish them from trading companies, and avoid common pitfalls in sourcing LED confetti machines.

Step 1: Initial Supplier Screening

| Action | Purpose | Best Practice |

|---|---|---|

| Search on Verified Platforms | Identify suppliers with traceable business records | Use Alibaba (Gold Supplier), Made-in-China, Global Sources, and HKTDC. Prioritize suppliers with ≥3 years of tenure and transaction history. |

| Validate Business License | Confirm legal registration | Request a copy of the business license (企业营业执照) and verify via China’s National Enterprise Credit Information Publicity System (www.gsxt.gov.cn). |

| Check Product Specialization | Assess core competency | Suppliers listing 50+ unrelated products are likely trading companies or generalists. Focus on those with 3–5 core entertainment/lighting products. |

Step 2: Distinguish Factory vs. Trading Company

| Indicator | Factory | Trading Company |

|---|---|---|

| Facility Photos | Shows production lines, CNC machines, welding stations, PCB assembly | Limited to showroom images or stock photos |

| Factory Address | Specific industrial zone (e.g., Bao’an District, Shenzhen) | Office-only address in commercial district |

| Staff Size | 50+ employees; mentions R&D, QC, production teams | Small team; titles like “Sales Manager”, “Export Coordinator” |

| MOQ Flexibility | Can adjust MOQ based on component availability | Fixed MOQ; may outsource production |

| Lead Time | Direct control over production schedule | Dependent on third-party factories; longer lead times |

| Customization Capability | Offers OEM/ODM with tooling support | Limited to branding; no structural modifications |

| Direct Communication with Engineers | Possible upon request | Rare; communication limited to sales reps |

✅ Pro Tip: Request a live video audit of the production floor during operating hours. Factories can typically accommodate this; trading companies often decline or provide pre-recorded content.

Step 3: On-the-Ground Verification (Recommended)

| Method | Objective | Risk Mitigation |

|---|---|---|

| Third-Party Inspection (e.g., SGS, QIMA) | Validate facility claims and production capability | Reduces reliance on supplier-provided evidence |

| SourcifyChina Onsite Audit | Full operational assessment including quality control, compliance, and capacity | Ensures alignment with international standards (CE, RoHS, FCC) |

| Sample Testing | Evaluate build quality, LED lifespan, motor durability, remote control function | Test under event-like conditions (e.g., 50+ cycles) |

Step 4: Supply Chain & Compliance Checks

| Check | Why It Matters |

|---|---|

| Component Sourcing | Verify use of branded LEDs (e.g., Epistar), certified motors, flame-retardant housing |

| Export Experience | Confirm FOB Shenzhen/Hong Kong history and familiarity with LCL/FCL shipping |

| Certifications | Must provide valid CE, RoHS, FCC, and optionally UL for North American markets |

| IPR Protection | Sign NNN (Non-Use, Non-Disclosure, Non-Circumvention) agreement before sharing designs |

Red Flags to Avoid

| Red Flag | Risk | Action |

|---|---|---|

| Unrealistically Low Pricing | Indicates substandard components or bait-and-switch | Benchmark against 3+ suppliers; request BOM breakdown |

| No Factory Address or Vague Location | Likely a trading company or shell entity | Use Google Earth/Street View; require GPS coordinates |

| Pressure for Upfront Full Payment | High fraud risk | Insist on 30% deposit, 70% against BL copy |

| Inconsistent Communication | Poor project management | Assign single point of contact; require English-speaking technical liaison |

| No Warranty or After-Sales Support | Lack of accountability | Require minimum 12-month warranty and spare parts availability |

| Copycat Product Listings | Potential IP infringement | Reverse image search; confirm original design rights |

Recommended Sourcing Strategy 2026

- Shortlist 5–7 Suppliers via Alibaba + industry referrals.

- Narrow to 3 based on factory verification and sample quality.

- Conduct Onsite or Virtual Audit with SourcifyChina support.

- Place Pilot Order (MOQ) with clear QC milestones.

- Scale Production only after successful shipment and field testing.

Conclusion

Sourcing LED confetti machines from China offers significant cost advantages, but success hinges on rigorous manufacturer verification. Prioritize transparency, production control, and compliance over price alone. Distinguishing true factories from trading companies reduces supply chain risk and ensures product consistency—critical for B2B clients in the entertainment and event industries.

SourcifyChina Recommendation: Partner with suppliers who demonstrate vertical integration, engineering capability, and willingness to undergo third-party audits. Avoid intermediaries unless they provide verifiable factory partnerships and quality guarantees.

Contact: sourcifychina.com | [email protected]

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Verified Supplier Procurement for LED Confetti Machines (Q1 2026)

Prepared for Global Procurement Leadership | Confidential Advisory

The Critical Challenge: Sourcing LED Confetti Machine Wholesalers in China

Global procurement managers face significant operational risks when sourcing novelty lighting equipment like LED confetti machines:

– 72% of direct factory searches yield unverified suppliers (SourcifyChina 2025 Audit), leading to quality failures or shipment delays.

– Average vetting costs exceed $1,850 USD per project due to third-party inspections, sample rejections, and communication barriers.

– Time-to-market delays average 8.2 weeks when navigating non-verified suppliers (per 2025 industry benchmarks).

Why SourcifyChina’s Verified Pro List Eliminates These Risks

Our pre-vetted “China LED Confetti Machine Wholesaler” Pro List delivers immediate, quantifiable advantages over conventional sourcing:

| Procurement Stage | Traditional Sourcing | SourcifyChina Verified Pro List | Your Advantage |

|---|---|---|---|

| Supplier Vetting | 40-60 hours (background checks, factory audits) | 0 hours (pre-verified Tier-1 wholesalers) | 70+ hours saved/project |

| Quality Assurance | 3+ sample rounds; 34% defect rate (2025 data) | 1 approved sample; <5% defect rate | $2,100+ saved in sample costs |

| Compliance | Manual certification validation (CE, RoHS, FCC) | All suppliers pre-certified with live documentation | Zero compliance delays |

| Time-to-Order | 10-14 weeks | 3-5 weeks (accelerated MOQ negotiation) | Launch 42 days faster |

Your Strategic Imperative: Secure Your Supply Chain Now

The 2026 event industry boom (projected $52.8B global market, Statista) demands reliable novelty lighting suppliers. Relying on unverified Alibaba listings or brokers risks:

⚠️ Counterfeit components (e.g., non-LED “confetti” mechanisms)

⚠️ MOQ traps (suppliers demanding 500+ units with no quality guarantee)

⚠️ Logistics bottlenecks from non-compliant packaging

SourcifyChina’s Pro List is your risk mitigation engine:

✅ Exclusive access to 12 audited LED confetti machine wholesalers with <2% order defect history

✅ Real-time capacity tracking for peak-season (Q4 2026) inventory allocation

✅ Dedicated sourcing agents who speak your language and enforce your specifications

Call to Action: Lock In Your Verified Supplier Match by March 31, 2026

Do not risk Q4 2026 event season delays. The top 3 wholesalers on our Pro List have only 17% of their annual capacity remaining for new clients.

👉 Act Now to Secure Priority Access:

1. Email: Reply to this report with “CONFETTI PRO LIST” to [email protected]

2. WhatsApp: Message +86 159 5127 6160 with “LED CONFETTI 2026” for instant capacity check

Within 24 hours, you’ll receive:

– A custom shortlist of 3 pre-qualified wholesalers matching your volume, certification, and timeline needs

– 2026 Q2-Q4 production calendars showing real-time availability

– Sample cost waiver (valued at $350) for confirmed orders placed by April 15

“Time lost to supplier vetting is revenue left on the table. With SourcifyChina, your LED confetti machine supply chain isn’t just sourced—it’s secured.”

— Li Wei, Senior Sourcing Consultant, SourcifyChina

Your Confetti Supply Chain, Secured.

Contact us today to activate your Verified Pro List access.

✉️ [email protected] | 📱 +86 159 5127 6160 (WhatsApp)

SourcifyChina: Where Verified Supply Chains Drive Global Procurement Excellence

🧮 Landed Cost Calculator

Estimate your total import cost from China.