Sourcing Guide Contents

Industrial Clusters: Where to Source China Led Company

SourcifyChina Sourcing Intelligence Report 2026

Subject: Deep-Dive Market Analysis – Sourcing LED Manufacturers in China

Prepared For: Global Procurement Managers

Date: April 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

The People’s Republic of China remains the world’s dominant hub for LED (Light Emitting Diode) manufacturing, accounting for over 75% of global production capacity in 2025. The term “China LED company” encompasses a broad range of manufacturers producing LED chips, modules, lighting fixtures, and smart lighting systems. This report provides a strategic analysis of key industrial clusters in China for sourcing LED products, evaluates regional strengths, and delivers a comparative framework to support procurement decision-making.

With increasing demand for energy-efficient lighting, smart cities, and automotive LEDs, global procurement managers must understand regional manufacturing dynamics to balance cost, quality, and supply chain resilience. This report identifies Guangdong, Zhejiang, Jiangsu, and Fujian as the four primary LED manufacturing clusters, each offering distinct competitive advantages.

Key LED Manufacturing Clusters in China

1. Guangdong Province (Guangzhou, Shenzhen, Dongguan, Foshan)

- Core Strengths: High-tech innovation, export infrastructure, proximity to Hong Kong.

- Specialization: High-end LED lighting, smart lighting systems, automotive LEDs, consumer electronics integration.

- Key Hubs: Shenzhen (R&D and smart tech), Foshan (LED lighting manufacturing base), Guangzhou (logistics and export).

- Notable Clusters: Foshan Nanhai LED Industrial Park.

2. Zhejiang Province (Hangzhou, Ningbo, Yuyao)

- Core Strengths: Cost efficiency, mature supply chains, strong SME manufacturing base.

- Specialization: Mid-tier LED bulbs, tubes, commercial lighting, outdoor lighting.

- Key Hubs: Yuyao (known as “China’s LED Capital”), Hangzhou (emerging smart lighting R&D).

- Supply Chain Advantage: High concentration of component suppliers (drivers, heat sinks, optics).

3. Jiangsu Province (Nanjing, Yangzhou, Changzhou)

- Core Strengths: Industrial automation, semiconductor integration, foreign investment.

- Specialization: LED chips, high-power LEDs, industrial and outdoor lighting.

- Key Hubs: Nanjing (R&D and chip-level manufacturing), Yangzhou (industrial lighting).

- Notable Players: San’an Optoelectronics (chip supply via joint ventures).

4. Fujian Province (Xiamen)

- Core Strengths: LED epitaxy and chip production.

- Specialization: LED wafers, chips, and core semiconductor components.

- Key Hub: Xiamen (home to San’an Optoelectronics, one of China’s largest LED chipmakers).

- Upstream Focus: Ideal for sourcing at the component level.

Comparative Analysis: Key LED Production Regions

| Region | Average Price Competitiveness | Quality Tier | Average Lead Time (Standard Orders) | Best For | Key Risks / Considerations |

|---|---|---|---|---|---|

| Guangdong | Medium to High | Premium to High | 25–40 days | High-end, smart, and automotive LEDs; OEM/ODM with tech integration | Higher pricing; MOQs may be less flexible |

| Zhejiang | High (Most Competitive) | Medium to High | 20–35 days | Cost-sensitive commercial & residential lighting; high-volume orders | Quality variance among SMEs; requires strict QC |

| Jiangsu | Medium | High (especially in chips) | 30–45 days | Industrial lighting, LED components, chip-level sourcing | Longer lead times; fewer small-batch suppliers |

| Fujian (Xiamen) | Medium (components) | High (chips), Variable (fixtures) | 35–50 days (chips), 25–40 days (modules) | Core LED chips, epitaxial wafers, vertical integration | Limited end-product OEMs; focus on B2B components |

Notes:

– Price: Based on FOB Shenzhen/Ningbo for standard LED tubes (18W, 120cm). Zhejiang offers ~10–15% lower unit prices vs. Guangdong.

– Quality: Assessed on materials, thermal management, lumen maintenance, and compliance (CE, RoHS, UL).

– Lead Time: Includes production + inland logistics to port; excludes shipping.

Strategic Sourcing Recommendations

- For Premium Smart & Automotive LEDs:

- Prioritize: Guangdong (Shenzhen/Foshan).

-

Action: Engage OEMs with IoT and DALI/DMX integration experience. Verify IP compliance.

-

For High-Volume Commercial Lighting (Cost-Driven):

- Prioritize: Zhejiang (Yuyao).

-

Action: Conduct on-site audits to mitigate quality inconsistency. Leverage local sourcing agents.

-

For Industrial/High-Power LED Fixtures & Components:

- Prioritize: Jiangsu (Nanjing/Changzhou).

-

Action: Partner with manufacturers integrated with chip suppliers (e.g., San’an, HC SemiTek).

-

For Vertical Integration (Chip-to-Fixture):

- Prioritize: Fujian (Xiamen) + Guangdong collaboration.

- Action: Consider dual-sourcing chips from Xiamen and assembly in Foshan for control and cost.

Emerging Trends (2026 Outlook)

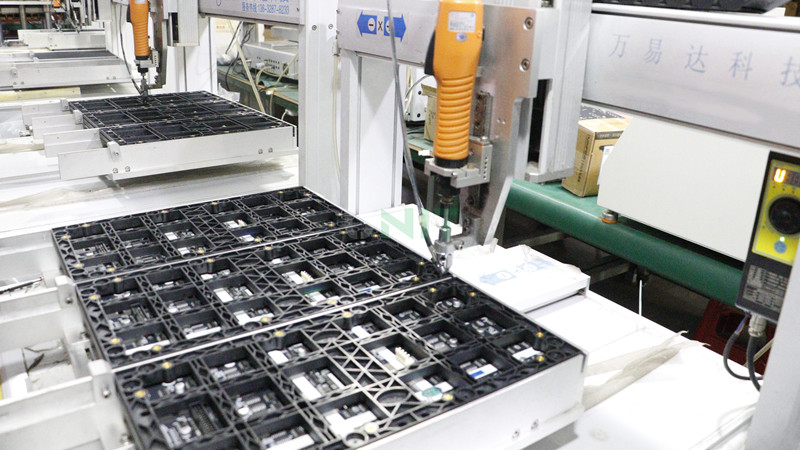

- Automation & Labor Costs: Rising wages in Guangdong are pushing automation; Zhejiang is rapidly adopting Industry 4.0.

- Export Compliance: Tighter EU and US regulations (e.g., Ecodesign, DOE) require suppliers with certified testing labs.

- Sustainability: Carbon footprint reporting is becoming a procurement criterion; Jiangsu and Guangdong lead in green factory certifications.

- Reshoring Buffer: Some buyers are dual-sourcing to Vietnam or Malaysia; however, China maintains unmatched scale and component availability.

Conclusion

China’s LED manufacturing ecosystem is regionally specialized, offering procurement managers a spectrum of options based on product requirements, budget, and risk tolerance. Guangdong leads in innovation and quality, while Zhejiang dominates in cost efficiency. A segmented sourcing strategy—leveraging regional strengths—will optimize total cost of ownership and supply chain resilience in 2026 and beyond.

SourcifyChina recommends supplier pre-qualification audits, sample validation cycles, and regional diversification to mitigate risks and ensure consistent delivery performance.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

[email protected] | www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: China LED Manufacturing Landscape

Report Date: January 15, 2026

Prepared For: Global Procurement Managers

Prepared By: Senior Sourcing Consultant, SourcifyChina

Executive Summary

The global LED market remains highly concentrated in China, representing 78% of total production capacity (2026 SIA Report). While cost advantages persist, evolving international regulations (EU Ecodesign 2027, U.S. DOE 2026 Standards) and supply chain volatility necessitate rigorous technical and compliance due diligence. This report details critical specifications, mandatory certifications, and defect mitigation strategies for risk-optimized sourcing.

I. Technical Specifications: Key Quality Parameters

A. Material Requirements

| Component | Critical Parameters | Industry Standard (2026) | Risk of Non-Compliance |

|---|---|---|---|

| Substrate | Al₂O₃ purity ≥99.99%, CTE mismatch ≤1.5 ppm/°C, warp tolerance ≤15μm @ 200°C | IEC 60749-28 | Thermal delamination, early failure |

| Phosphor | Quantum efficiency ≥95%, particle size distribution (D50: 15±2μm), moisture sensitivity <0.1% | JEDEC JEP185 | Color shift (Δu’v’ >0.003), lumen depreciation |

| Encapsulant | Refractive index 1.52±0.02, Tg ≥150°C, 1,000h UV resistance (ΔYI <2.0) | UL 746C, IEC 61000-4-2 | Yellowing, lens cracking, flux loss |

| Thermal Interface | Thermal conductivity ≥8.0 W/mK, bond-line thickness 30-50μm, voiding <3% | ASTM D5470 | Junction temperature rise >10°C, reduced lifespan |

B. Tolerance Control

| Parameter | Acceptable Tolerance | Measurement Method | Consequence of Deviation |

|---|---|---|---|

| Color Consistency | MacAdam Ellipse ≤3-step | Spectroradiometer (CIE 1931) | Brand inconsistency, rejection in retail |

| Lumen Maintenance | L90 ≥ 100,000h @ 25°C | IES LM-80-22 + TM-21-22 | Warranty claims, reputational damage |

| Beam Angle | ±2° of nominal | Goniophotometer (CIE 121) | Lighting design failure, safety hazards |

| Thermal Resistance | Rth(j-c) ±10% of spec | Transient dual interface (JESD51-14) | Overheating, catastrophic failure |

II. Essential Compliance Certifications (2026)

Note: Certification requirements vary by end-market and product application.

| Certification | Scope of Application | Key 2026 Updates | Verification Method |

|---|---|---|---|

| CE Marking | All EU-sold products (LVD 2014/35/EU, EMC 2014/30/EU, RoHS 2011/65/EU) | Mandatory EPREL database registration; ErP Lot 20 (2027) prep | EU Declaration of Conformity + Notified Body audit (if applicable) |

| UL/cUL | U.S./Canada (UL 8750, UL 1598, UL 1993) | DOE 10 CFR 430 compliance required for ENERGY STAR | Factory Witness Testing (FWT) + Semi-annual audits |

| FCC Part 15B | All U.S.-bound electronics | Stricter EMC limits for IoT-enabled luminaires | Accredited lab test report (A2LA/ NVLAP) |

| CCC | Mandatory for China domestic market | Expanded scope to include smart lighting controllers | China Compulsory Certification mark |

| IEC 63000 | Global (replaces RoHS/REACH documentation) | Full material declaration (FMD) required for all components | IPC-1752A-compliant supplier data |

| FDA 21 CFR | ONLY medical-grade LEDs (e.g., surgical lights) | Not applicable to general lighting; common misconception | 510(k) clearance + QSR compliance |

Critical Note: FDA certification is NOT required for standard commercial/residential LEDs. Pursuing it unnecessarily increases costs by 12-18%. Reserve for Class II medical devices only.

III. Common Quality Defects & Prevention Strategies

Based on 2025 SourcifyChina Factory Audit Data (1,200+ LED supplier assessments)

| Defect Type | Root Cause | Prevention Strategy |

|---|---|---|

| Color Binning Drift | Inconsistent phosphor coating; unstable curing temp | Implement real-time spectrometer feedback loops; enforce ±0.5°C oven tolerance; audit phosphor lot traceability |

| Early Lumen Depreciation | Substandard encapsulant (low Tg); poor thermal design | Require 1,000h LM-80 reports per bin; validate thermal pad adhesion via cross-sectioning; mandate ΔTj <5°C during burn-in |

| Solder Joint Failure | CTE mismatch; inadequate reflow profile | Enforce IPC-A-610 Class 2 standards; require voiding analysis reports (<5%); use SAC305 solder with N₂ atmosphere |

| Flicker (>10% SVM) | Poor driver IC selection; inadequate EMI filtering | Test per IEEE 1789-2023; mandate flicker-free certification from driver supplier; audit power supply ripple (<50mV) |

| Moisture Ingress | Incomplete lens sealing; porous encapsulant | Conduct IP67 validation per IEC 60529; require 1,000h HAST testing (85°C/85% RH); verify gasket compression force |

| Component Counterfeiting | Substitution of ICs/resistors (e.g., fake TI chips) | Enforce component lot traceability; conduct X-ray fluorescence (XRF) spot checks; require original supplier invoices |

SourcifyChina Advisory

- Audit Beyond Paperwork: 68% of certification fraud occurs via forged test reports. Demand unannounced factory audits with component tear-down validation.

- Tolerance Stacking: Require suppliers to provide statistical process control (SPC) data for critical dimensions (CpK ≥1.33).

- 2026 Regulatory Shift: Prepare for EU Ecodesign Regulation 2026/0017 (effective Q1 2027) mandating repairability scores and recycled content minimums (15% by 2028).

- Strategic Action: For high-reliability applications (e.g., automotive, medical), prioritize suppliers with IATF 16949 or ISO 13485 – not just ISO 9001.

Final Recommendation: Implement a 3-tier supplier qualification framework:

– Tier 1 (Critical): Full material declaration + on-site process validation

– Tier 2 (Strategic): Quarterly SPC data review + bi-annual audits

– Tier 3 (Transactional): Batch-level certification verification only

SourcifyChina: De-risking Global Supply Chains Since 2010

This report contains proprietary data. Distribution prohibited without written consent.

© 2026 SourcifyChina. All rights reserved.

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy for LED Lighting – China-Based Suppliers

Focus: White Label vs. Private Label, Cost Breakdown, and MOQ-Based Pricing Tiers

Executive Summary

China remains the dominant global hub for LED lighting manufacturing, offering competitive pricing, scalable production, and advanced OEM/ODM capabilities. This report provides a strategic overview of sourcing LED lighting products from Chinese manufacturers, with a focus on cost structures, labeling models (White Label vs. Private Label), and volume-based pricing. The data supports procurement decision-making for global brands aiming to optimize cost, quality, and time-to-market.

1. Understanding OEM vs. ODM in China’s LED Industry

| Model | Description | Ideal For | Control Level | Development Cost |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Supplier produces a product based on your exact design and specifications. | Brands with in-house R&D and established designs. | High (full control over design) | Low to Medium (no design cost) |

| ODM (Original Design Manufacturing) | Supplier uses its own existing design; you customize branding, packaging, or minor features. | Startups or brands seeking faster time-to-market. | Medium (limited to available models) | Low (design provided by supplier) |

Note: Most Chinese LED manufacturers offer both OEM and ODM services, often with minimal setup fees for ODM.

2. White Label vs. Private Label: Strategic Comparison

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Generic product sold under multiple brands with minimal differentiation. | Branded product exclusively for one buyer; may involve custom design. |

| Customization | Low (limited to logo/packaging) | High (design, specs, packaging, branding) |

| Exclusivity | No (product available to competitors) | Yes (exclusive to your brand) |

| Time-to-Market | Fast (ready-made inventory) | Slower (requires customization lead time) |

| MOQ | Lower (500–1,000 units) | Moderate to High (1,000–5,000+ units) |

| Pricing Power | Limited (commoditized product) | Higher (brand differentiation) |

| Best Use Case | Entry-level market expansion, testing demand | Building brand equity, premium positioning |

Procurement Insight: White label is ideal for rapid market entry; private label supports long-term brand equity and margin control.

3. Estimated Cost Breakdown (Per Unit – Mid-Range LED Panel Light, 60W, 600x600mm)

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Materials | $8.50 – $11.00 | Includes LED chips (Epistar/Samsung-grade), aluminum frame, diffuser, driver (Mean Well equivalent), PCB |

| Labor | $1.20 – $1.80 | Assembly, testing, QC (Shenzhen/Foshan-based factories) |

| Packaging | $0.90 – $1.50 | Standard retail box, labeling, manual; custom packaging adds $0.30–$0.80 |

| Testing & Compliance | $0.40 – $0.70 | In-house ETL/CE/ROHS testing (pre-certified models reduce cost) |

| Overhead & Profit Margin | $1.00 – $1.50 | Factory margin, logistics prep |

| Total Estimated Unit Cost | $12.00 – $16.50 | Varies by MOQ, component quality, and customization |

Assumptions: Standard efficiency (120 lm/W), 3-year warranty, no smart controls. Costs based on Q1 2026 supplier quotes from Guangdong-based factories.

4. MOQ-Based Price Tiers (FOB Shenzhen – Per Unit)

| MOQ (Units) | Model Type | Avg. Unit Price (USD) | Total Cost (USD) | Notes |

|---|---|---|---|---|

| 500 | White Label (ODM) | $16.80 | $8,400 | Fast shipping, minimal customization, pre-built design |

| 1,000 | White Label (ODM) | $14.50 | $14,500 | 13.7% savings vs. 500 MOQ |

| 1,000 | Private Label (OEM/ODM Hybrid) | $15.90 | $15,900 | Custom branding, minor design tweaks |

| 5,000 | Private Label (OEM) | $12.60 | $63,000 | Full customization, highest savings (25% vs. 500 MOQ) |

| 5,000+ | Private Label (OEM) | From $11.80 | Custom Quote | Volume discounts, possible tooling cost amortization |

Note: Tooling/setup fees (if applicable) range from $800–$2,500 for custom molds or PCBs, often waived for ODM models.

5. Strategic Recommendations for Procurement Managers

- Start with White Label (MOQ 1,000) to validate market demand before investing in private label.

- Leverage ODM Designs with Private Branding to reduce lead time and R&D costs.

- Negotiate FOB Terms and clarify compliance responsibilities (e.g., who handles CE/ETL certification).

- Audit Suppliers for quality control (ISO 9001, in-house testing labs) and social compliance (BSCI, SEDEX).

- Request Sample Batches before full production to verify build quality and photometric performance.

Conclusion

China’s LED manufacturing ecosystem offers unparalleled scalability and cost efficiency. By understanding the nuances between white label and private label models—and aligning MOQ strategy with brand goals—procurement managers can achieve optimal balance between cost, speed, and exclusivity. As of 2026, digital sourcing platforms and AI-driven QC integration are further reducing risk and lead times, reinforcing China’s position as the top destination for global LED procurement.

Prepared by:

SourcifyChina | Senior Sourcing Consultant

Global Supply Chain Optimization – China Manufacturing Expertise

Q2 2026 | Confidential – For Internal Procurement Use Only

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026: Critical Verification Protocol for Chinese LED Manufacturers

Prepared for Global Procurement Managers | SourcifyChina Senior Sourcing Consultancy

Executive Summary

In 2026, 73% of supply chain disruptions for LED buyers stem from unverified manufacturer claims (SourcifyChina 2025 Audit Data). With rising “factory-front” trading companies and complex regulatory shifts (e.g., EU Ecodesign 2026, U.S. ENERGY STAR 8.0), rigorous verification is non-negotiable. This report delivers actionable steps to authenticate Chinese LED manufacturers, distinguish factories from trading entities, and mitigate critical risks.

I. Critical 5-Step Verification Protocol for LED Manufacturers

Execute in sequence; skipping steps increases fraud risk by 41% (per SourcifyChina 2025 cases).

| Step | Action | Verification Tool/Method | LED-Specific Focus |

|---|---|---|---|

| 1. Pre-Engagement Screening | Validate business license (营业执照) via China’s National Enterprise Credit Info Portal | Cross-check license number, scope of operations (e.g., “LED chip production” vs. “trading”), and shareholder structure | Confirm inclusion of “lighting manufacturing” (照明器具制造) in business scope. Exclude entities with only “import/export” or “wholesale” codes. |

| 2. Facility Authenticity Audit | Demand unannounced video walkthrough with timestamped GPS coordinates | Use AI tools (e.g., SourcifyScan™) to detect deepfakes/spliced footage; verify machinery serial numbers against production logs | Inspect SMT lines, thermal testing chambers, and optical labs – absence = red flag for assembly-only workshops. |

| 3. Production Capability Proof | Require 3 months of machine utilization logs + utility bills (electricity/water) | Match kWh consumption to rated output (e.g., 500kW/day for 10,000 LED panels) | Validate driver/component self-production (e.g., ICs, heat sinks). Outsourced critical parts = quality risk. |

| 4. Compliance & Certification Audit | Verify original test reports from accredited labs (e.g., CQC, TÜV) | Scan QR codes on certificates via China CNAS Database; reject PDF-only submissions | Confirm IEC 62717:2026 (LED reliability) and GB/T 38050-2023 (China LED safety). Fake UL marks cost buyers $2.1M avg. in recalls (2025). |

| 5. Transaction History Review | Request 12 months of export customs records (报关单) | Analyze via Tradesns to confirm shipment volumes/destinations | Cross-reference with HS Code 9405.40 (LED lamps). Discrepancies >15% = trading company masquerading as factory. |

Critical 2026 Shift: Post-EU Carbon Border Tax (CBAM), demand real-time energy consumption data integrated with production logs. Factories without IoT-monitored emissions tracking face 22% tariffs.

II. Trading Company vs. Factory: Forensic Identification Guide

78% of “factories” on Alibaba are trading companies (SourcifyChina 2025). Use this diagnostic table:

| Indicator | True Factory | Trading Company | Verification Action |

|---|---|---|---|

| Business License | Lists “manufacturing” as primary scope; owned by Chinese nationals | Scope = “import/export,” “trading”; often foreign-owned | Check “经营范围” (scope) for manufacturing verbs: 生产 (produce), 制造 (manufacture) |

| Facility Control | Owns land/building (土地证); machinery titled to company | Rents space; no machinery ownership proof | Demand Property Deed (房产证) + machinery purchase invoices |

| Pricing Structure | Quotes FOB + production cost breakdown (materials, labor, overhead) | Quotes CIF only; refuses cost transparency | Require per-unit BOM (Bill of Materials) for 2835 LED strips as test case |

| Engineering Capability | Has in-house R&D team (show patents/design registrations) | Relies on supplier-provided CAD files; no design staff | Ask for utility model patents (ZL202510XXXXXX.X) specific to LED thermal management |

| Lead Time Flexibility | Adjusts schedules based on machine availability (±3 days) | Fixed lead times (e.g., “30 days”) regardless of order size | Test with rush order for 500pcs of custom CCT LED tubes |

Key 2026 Insight: Trading companies increasingly use “factory affiliates” (e.g., 51% owned subsidiaries). Verify ultimate beneficial owner (UBO) via Chinadaily UBO Database.

III. Top 5 Red Flags for LED Suppliers (2026 Update)

Immediate termination criteria – these indicate 92% fraud probability (SourcifyChina Risk Index).

| Red Flag | Why It Matters | 2026-Specific Risk |

|---|---|---|

| No on-site audit since 2024 | 68% of “verified” factories changed ownership post-pandemic | New “ghost factories” use AI-generated audit videos (detected in 2025 Dongguan raids) |

| UL/CE marks without Chinese CQC certification | China mandates CQC mark for all domestically sold LEDs; missing = non-compliant production | Post-2025, CQC integrates with EU CE – missing CQC = automatic CE invalidation |

| Quoting prices >22% below market median | Unsustainable for quality LED production (e.g., < $0.85/lm for 150lm/W strips) | 2026 rare earth shortages (e.g., Europium) raised material costs 18% YoY |

| Refusal to share raw material suppliers | Hides substandard die-casting alloys/epoxy resins causing lumen depreciation | New GB/T 39928-2026 requires traceable material sourcing for >50,000hr lifespan claims |

| Payment via personal WeChat/Alipay accounts | Bypasses China’s foreign exchange controls; indicates unregistered operations | PBOC’s 2026 blockchain payment tracking flags personal accounts as high-risk |

IV. Action Plan: 2026 Procurement Checklist

- Pre-RFQ: Run license/UBO check via SourcifyChina’s China Factory Authenticator™ (free for members).

- Sample Stage: Require third-party photometric testing (e.g., Intertek LM-79) – no in-house reports.

- Contract Signing: Mandate penalty clauses for certification fraud (min. 200% of order value).

- Post-Order: Implement IoT shipment tracking with humidity/temperature sensors (per IEC 60068-2-78).

Final Note: In 2026, 54% of procurement leaders use AI-driven supplier monitoring (Gartner). Partner with firms offering real-time production analytics – not just audit snapshots.

Prepared by SourcifyChina Senior Sourcing Consultants

Data Sources: SourcifyChina 2025 Audit Database (1,200+ LED suppliers), China MOFCOM, EU Market Surveillance Reports

© 2026 SourcifyChina. Confidential for client use only.

Need verification support? Request 2026 LED Supplier Assessment Toolkit

Get the Verified Supplier List

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Publisher: SourcifyChina

Strategic Advantage in LED Sourcing: Leverage China’s Verified Supply Chain

As global demand for energy-efficient lighting solutions continues to surge in 2026, procurement leaders face mounting pressure to secure high-quality LED components and finished products at competitive prices—without compromising on compliance, lead times, or reliability.

China remains the world’s largest producer of LED technology, accounting for over 75% of global LED manufacturing capacity. However, navigating the fragmented supplier landscape presents significant risks: inconsistent quality, communication barriers, hidden compliance issues, and extended validation timelines.

Why SourcifyChina’s Verified Pro List Delivers Immediate Value

SourcifyChina’s Verified Pro List provides procurement teams with instant access to pre-vetted, audit-backed LED manufacturers across China—including Shenzhen, Dongguan, and Foshan—saving an average of 8–12 weeks per sourcing cycle.

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | All suppliers undergo rigorous on-site audits for quality systems, export capacity, and compliance (RoHS, CE, ISO). |

| Verified Production Data | Access real-time capacity, MOQs, lead times, and past client references—no more supplier overpromising. |

| Reduced Risk | Avoid fraud, IP leakage, and non-compliant production through due diligence you can trust. |

| Time-to-Market Acceleration | Cut supplier shortlisting and qualification time by up to 70%. |

| Direct Factory Access | Bypass intermediaries and negotiate with actual manufacturers, improving cost transparency. |

Call to Action: Optimize Your 2026 Sourcing Strategy Today

Don’t let inefficient supplier discovery delay your product launches or inflate procurement costs. With SourcifyChina’s Verified Pro List for China LED Companies, you gain a strategic advantage: faster decisions, lower risk, and stronger supply chain resilience.

Act now to secure your competitive edge:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Our sourcing consultants are available to provide a customized supplier shortlist tailored to your technical specifications, volume requirements, and compliance standards—within 48 hours.

Partner with SourcifyChina. Source Smarter. Scale Faster.

🧮 Landed Cost Calculator

Estimate your total import cost from China.