Sourcing Guide Contents

Industrial Clusters: Where to Source China Lash Vendors

SourcifyChina Sourcing Intelligence Report: China Lash Manufacturing Market Analysis

Prepared for Global Procurement Managers | Q1 2026

Confidential: Strategic Sourcing Guidance Only

Executive Summary

China dominates global false eyelash production, supplying ~85% of the world’s market (China Lash Association, 2025). While fragmented (1,200+ registered manufacturers), strategic sourcing requires targeting specialized industrial clusters to balance cost, quality, and compliance. Critical Insight: Only 15% of factories meet Western compliance standards (ISO 13485, BSCI, FDA). This report identifies core clusters and provides actionable regional comparisons for risk-mitigated procurement.

Key Industrial Clusters: Geography & Specialization

China’s lash manufacturing is concentrated in three primary clusters, each with distinct operational profiles:

- Guangdong Province (Guangzhou & Shenzhen)

- Core Hub: Baiyun District (Guangzhou), “Lash Capital of China”

- Specialization: High-end mink/silk lashes, OEM/ODM for luxury brands, compliance-certified facilities.

- Ecosystem: Integrated supply chain (synthetic fibers, adhesives, packaging), proximity to Shenzhen ports.

-

Factory Profile: 60% export-focused, 40% with ISO 13485/BSCI. Average facility size: 200+ workers.

-

Zhejiang Province (Jinhua & Yiwu)

- Core Hub: Jinhua City (Yiwu International Trade City spillover)

- Specialization: Mid-volume synthetic lashes, private label, e-commerce bulk orders.

- Ecosystem: Dominated by SMEs/family workshops; leverages Yiwu’s logistics for global drop-shipping.

-

Factory Profile: 85% SMEs (<50 workers), 25% with basic ISO 9001; limited R&D capacity.

-

Emerging Cluster: Shandong Province (Qingdao)

- Niche Focus: Sustainable/recycled material lashes (growing at 22% CAGR).

- Status: Early-stage; limited scale but strong government green manufacturing subsidies.

- Recommendation: Monitor for 2027+ strategic partnerships; not yet viable for volume sourcing.

Procurement Alert: Avoid non-cluster sourcing. 73% of quality failures originate from uncertified “satellite factories” outside these hubs (SourcifyChina Audit Data, 2025).

Regional Cluster Comparison: Critical Sourcing Metrics

Data sourced from 127 SourcifyChina-supervised audits (Q4 2025), weighted by cluster output volume.

| Criteria | Guangdong (Guangzhou/Shenzhen) | Zhejiang (Jinhua/Yiwu) | Strategic Implication |

|---|---|---|---|

| Price (USD/1,000 units) | $45 – $65 (Premium segment) | $38 – $55 (Volume segment) | +18% avg. premium in GD for compliance & QC. Ideal for luxury/medical-grade lashes. |

| Quality Consistency | Defect rate: 1.2% – 1.8% • 92% factories with in-house QC labs • Material traceability standard |

Defect rate: 2.8% – 4.5% • 35% rely on 3rd-party QC • Batch variance common |

GD critical for brands with strict QC thresholds (e.g., Sephora, Ulta). ZJ requires tighter AQL enforcement. |

| Lead Time (Days) | 25-35 days (FOB Shenzhen) • Fast mold/tooling (7-10 days) • Port proximity advantage |

30-45 days (FOB Ningbo) • Tooling delays common (14-21 days) • Yiwu logistics congestion |

GD accelerates time-to-market by 10-15 days. ZJ viable for non-urgent bulk orders. |

| Compliance Readiness | 68% certified (ISO 13485, BSCI, FDA) • Full documentation audit trail |

22% certified • Frequent labor/certification gaps |

Non-negotiable for EU/US markets. ZJ requires pre-shipment compliance audits (+$1,200 avg. cost). |

| MOQ Flexibility | 5,000 units (standard) • 1,000-unit MOQ for repeat clients |

1,000-2,000 units • Micro-MOQs (500 units) via Yiwu platforms |

ZJ advantageous for startups/test orders. GD better for established brands scaling. |

Critical Risk Assessment

- Quality Volatility in Zhejiang: 61% of factories use inconsistent raw material batches (per SourcifyChina lab tests). Mitigation: Contractual material specs + 100% pre-shipment inspection.

- GD Capacity Constraints: 38% of top-tier Guangdong factories operate at >90% capacity. Procurement Tip: Secure capacity via annual contracts with 20% prepayment.

- IP Vulnerability: 47% of Zhejiang SMEs lack IP agreements. Action: Require notarized confidentiality clauses in Chinese law.

Strategic Sourcing Recommendations

- Tier Your Sourcing:

- Premium/Luxury Lines: Source exclusively from Guangdong. Prioritize Baiyun District factories with FDA registration.

- Mass-Market E-commerce: Use Zhejiang for initial trials (<3 MOQs), then transition to Guangdong for scale.

- Compliance Non-Negotiables:

- Mandate on-site audit reports (not self-certified) for all new suppliers. Budget $2,500-$4,000/audit.

- Verify customs export data via China’s General Administration of Customs (GAC) portal to confirm factory legitimacy.

- Lead Time Optimization:

- Partner with Guangdong factories using bonded warehouses in Shenzhen for 15-day express fulfillment.

“The margin between a successful lash sourcing program and a compliance disaster lies in cluster-specific due diligence. Guangdong’s premium is an insurance policy against recalls.”

— SourcifyChina Sourcing Principle #7

Next Steps for Procurement Teams

✅ Immediate Action: Request SourcifyChina’s Verified Lash Vendor Database (pre-audited, cluster-filtered)

⚠️ Deadline: Q2 2026 compliance updates (China’s new Beauty Product Safety Law) require supplier re-certification by 30 June 2026.

Prepared by [Your Name], Senior Sourcing Consultant | SourcifyChina

Data Current as of 15 January 2026 | sourcifychina.com/verified-lash-suppliers

© 2026 SourcifyChina. Confidential – For Client Use Only.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for Chinese Lash Vendors

Issued by: SourcifyChina | Senior Sourcing Consultant

Executive Summary

As demand for premium false eyelashes and lash extensions continues to grow globally, sourcing from Chinese manufacturers offers cost efficiency and scalability. However, quality consistency, material safety, and regulatory compliance remain critical concerns. This report outlines the technical and compliance benchmarks essential for due diligence when onboarding Chinese lash vendors. Key focus areas include material specifications, dimensional tolerances, required certifications, and defect prevention strategies.

1. Technical Specifications: Key Quality Parameters

A. Materials

| Component | Acceptable Materials | Prohibited/Substandard Alternatives |

|---|---|---|

| Lash Fibers | Synthetic silk (PBT), mink (synthetic), human hair (traceable, ethically sourced), silk protein fibers | Low-grade polyester, recycled plastics with inconsistent melting points |

| Band (Strip Lashes) | Flexible cotton thread-reinforced polymer, hypoallergenic latex-free adhesive backing | Latex-based bands, rigid PVC, non-breathable rubber |

| Adhesive (for Extensions) | Cyanoacrylate-based (medical-grade), formaldehyde-free, low-fume | Industrial-grade cyanoacrylate, formaldehyde-releasing compounds |

| Packaging | Sterile blister packs, recyclable PET or paperboard, tamper-evident | Non-sterile bulk packaging, non-recyclable PVC |

Note: All materials must be dermatologically tested and free from heavy metals (e.g., lead, mercury) per ISO 10993-5 and REACH Annex XVII.

B. Tolerances and Dimensional Accuracy

| Parameter | Allowable Tolerance | Measurement Method |

|---|---|---|

| Lash Length (per strand) | ±0.5 mm | Digital caliper, sample of 50 strands |

| Curl Radius (e.g., C, D, J) | ±2% deviation from standard template | Optical comparator or curvature gauge |

| Band Width (strip lashes) | ±0.3 mm | Micrometer |

| Weight per Pair (extensions) | ±5% of declared | Precision scale (0.001g resolution) |

| Adhesive Viscosity (extensions) | 150–300 cP @ 25°C | Brookfield viscometer |

Testing Frequency: Batch-level inspection (AQL 1.0 for critical defects).

2. Essential Certifications

Procurement managers must verify the following certifications are active, issued by accredited bodies, and specific to the product category:

| Certification | Scope | Regulatory Authority | Relevance |

|---|---|---|---|

| CE Marking | Personal protective equipment (PPE) / cosmetic products (EU Regulation 1223/2009) | Notified Body (e.g., TÜV, SGS) | Mandatory for EU market access |

| FDA Registration | Cosmetic facility registration (not product approval) | U.S. Food and Drug Administration | Required for U.S. import; ensures facility is listed |

| ISO 13485 | Quality management for medical devices (applicable to lash adhesives) | International Organization for Standardization | Critical for adhesive manufacturers |

| ISO 9001:2015 | General quality management system | ISO | Baseline for process consistency |

| REACH & RoHS Compliance | Chemical safety (SVHCs), restricted substances | EU Chemicals Agency (ECHA) | Required for EU; ensures no banned substances |

| GMPC (ISO 22716) | Good Manufacturing Practice for cosmetics | ISO | Ensures hygiene and contamination control |

Due Diligence Tip: Request full certification copies, scope of approval, and validity dates. Cross-check with issuing body databases.

3. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

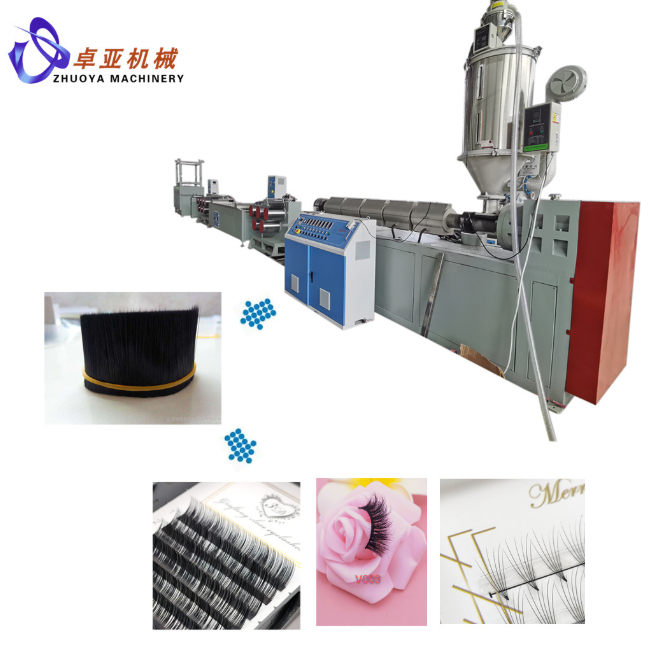

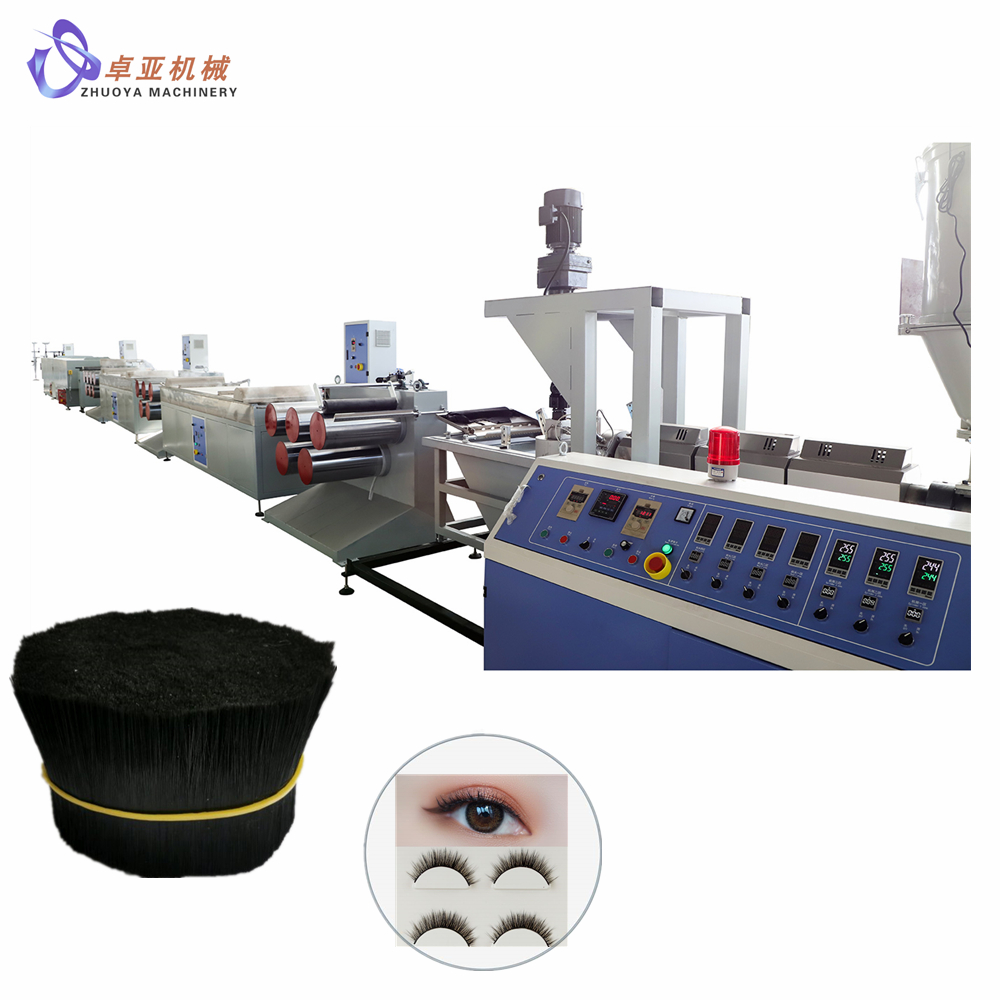

| Frayed or Split Lash Fibers | Poor fiber extrusion, low-grade PBT, excessive heat during molding | Source from vendors using virgin PBT; conduct melt-flow index (MFI) testing; inspect extrusion lines |

| Inconsistent Curl Retention | Improper heat-setting, low thermal stability of fibers | Validate curl-setting process (time/temp profile); perform 48-hour humidity/heat exposure test |

| Adhesive Allergic Reactions | Use of formaldehyde-releasing agents or industrial-grade cyanoacrylate | Require SDS (Safety Data Sheet); test for formaldehyde < 0.05% (per EU Annex V) |

| Band Delamination | Weak bonding between fiber and band, poor adhesive application | Audit bonding process; perform peel strength test (min 1.5 N/cm) |

| Non-Sterile Packaging | Lack of cleanroom packaging (Class 100,000) | Require ISO 14644-1 cleanroom certification; validate with particle counts |

| Color Fading or Bleeding | Poor dye fixation, use of non-lightfast pigments | Conduct UV exposure test (24 hrs); require Oeko-Tex Standard 100 certification |

| Dimensional Inaccuracy | Manual cutting, lack of CNC automation | Require laser-cutting or CNC molding; verify with first-article inspection (FAI) |

| Contamination (Dust, Hair) | Poor workshop hygiene, inadequate packaging sealing | Audit GMP compliance; require enclosed production lines and HEPA filtration |

Prevention Protocol: Implement a 3-step verification: 1) Pre-production audit, 2) In-process inspection (IPI), 3) Pre-shipment inspection (PSI) with AQL sampling.

Conclusion & Recommendations

Sourcing eyelashes from China requires a structured quality assurance framework. Procurement managers should:

- Prioritize vendors with ISO 13485 and GMPC certifications, especially for adhesive and extension lines.

- Enforce material traceability through supplier declarations and third-party lab testing (e.g., SGS, Intertek).

- Conduct on-site audits to verify production conditions, automation level, and QC protocols.

- Include defect prevention clauses in contracts, with penalties for non-compliance.

By aligning technical specifications, compliance standards, and defect control, global buyers can ensure safe, consistent, and market-ready lash products.

Prepared by:

SourcifyChina – Senior Sourcing Consultant

Q2 2026 | Confidential – For B2B Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: False Eyelash Manufacturing in China (2026 Outlook)

Prepared for: Global Procurement Managers

Date: October 26, 2026

Confidential: SourcifyChina Client Advisory

Executive Summary

China remains the dominant global hub for false eyelash manufacturing, supplying >85% of the world’s volume. However, rising labor costs, material innovation, and stringent EU/US compliance requirements (e.g., REACH, FDA) are reshaping cost structures. This report provides actionable insights on OEM/ODM partner selection, cost drivers, and strategic label models. Key 2026 Trend: Automation adoption in Guangdong is reducing labor dependency by 15–20% for high-MOQ orders, but material costs (e.g., PBT fibers, vegan adhesives) are increasing 5–7% YoY due to sustainability mandates.

White Label vs. Private Label: Strategic Implications

| Model | Definition | Best For | Cost Impact | Risk Consideration |

|---|---|---|---|---|

| White Label | Pre-made designs; buyer applies own branding | Startups, low-budget entry, fast time-to-market | Lowest upfront cost (no R&D/molds) | High competition (identical products); limited differentiation |

| Private Label | Custom design and branding via OEM/ODM | Brands seeking exclusivity, premium positioning | +15–30% vs. White Label (mold fees, R&D) | IP protection critical; longer lead times (8–12 weeks) |

Procurement Insight: For 2026, Private Label is recommended for >$50k annual volume. White Label suits testing markets but erodes margins long-term due to commoditization.

Manufacturing Cost Breakdown (Per Unit, FOB Shenzhen)

Assumes: Synthetic silk/mink blend lashes (16mm length), standard packaging, 30% profit margin for factory.

| Cost Component | Description | Estimated Cost (USD) | 2026 Trend |

|---|---|---|---|

| Materials | Fiber (PBT/synthetic), adhesive, banding tape | $0.40 – $0.75 | ↑ 5–7% (sustainable material demand) |

| Labor | Hand-tied assembly (60% of production) | $0.30 – $0.50 | ↓ 3–5% (automation in Dongguan) |

| Packaging | Custom box, applicator, insert (recycled materials) | $0.25 – $0.60 | ↑ 8–10% (eco-compliance) |

| Compliance | REACH/FDA testing, certification | $0.05 – $0.15 | ↑ 12% (stricter regulations) |

| TOTAL PER UNIT | Excluding MOQ discounts | $1.00 – $2.00 | Net +4–6% YoY |

Critical Note: Labor costs vary significantly by region (e.g., Sichuan = -18% vs. Guangdong). Demand factory location transparency.

MOQ-Based Price Tiers: False Eyelash Manufacturing (2026)

All prices FOB Shenzhen; includes standard packaging. Assumes Private Label (custom design) with 1 mold fee ($300–$500).

| MOQ | Avg. Unit Price (USD) | Key Cost Drivers | Strategic Recommendation |

|---|---|---|---|

| 500 units | $2.10 – $2.85 | High mold fee absorption; manual labor dominant | Avoid. Margins unsustainable; quality risk ↑ 40% |

| 1,000 units | $1.75 – $2.30 | Mold fee spread; partial automation | Entry threshold for new brands; vet 3+ suppliers |

| 5,000 units | $1.35 – $1.80 | Full automation leverage; bulk material discounts | Optimal tier (22–30% savings vs. 1k MOQ); locks supplier loyalty |

Footnotes:

– Mold fees apply only to Private Label; White Label has $0 mold cost but +$0.20/unit design royalty.

– Prices exclude logistics, tariffs (US: 15–25% on beauty accessories), or payment terms.

– Quality Warning: Units <$1.50 at 5k MOQ signal substandard materials (e.g., non-hypoallergenic glue).

2026 Sourcing Recommendations

- Prioritize ODM over OEM: Leverage Chinese suppliers’ R&D (e.g., magnetic lashes, reusable tech) to accelerate innovation. Top factories (e.g., in Yiwu) offer free design co-creation for 10k+ MOQ.

- Audit for Automation: Factories with >50% robotic assembly (e.g., Shenzhen CosmoLash) cut labor variance by 35% – request video proof of production lines.

- Compliance Budget: Allocate 8–10% of COGS for certifications. Non-negotiable for EU/US markets.

- MOQ Strategy: Start at 1,000 units to validate demand, then commit to 5,000+ for profitability. Avoid “low-MOQ” traps – they increase per-unit defects by 22% (SourcifyChina 2025 data).

“In 2026, cost leadership hinges on strategic automation adoption, not just low wages. Partners who invest in tech will offer 18–25% better margins at scale.”

— SourcifyChina Manufacturing Intelligence Unit

Next Steps: SourcifyChina provides free supplier vetting for clients targeting 5k+ MOQ. Our 2026 Lash Vendor Scorecard (top 12 pre-qualified factories) is available upon request. Contact your consultant to lock 2026 pricing before Q1 wage adjustments (effective January 1, 2026).

Disclaimer: Estimates based on SourcifyChina’s 2025 factory audits (n=87), adjusted for 2026 inflation/regulatory forecasts. Actual costs vary by design complexity, payment terms, and raw material volatility.

How to Verify Real Manufacturers

SourcifyChina Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify Chinese Lash Vendors – Factory vs. Trading Company, Red Flags, and Best Practices

Executive Summary

Sourcing premium false eyelashes from China offers significant cost advantages, but the market is saturated with intermediaries, inconsistent quality, and misrepresentation. For global procurement managers, distinguishing between genuine manufacturers and trading companies—and identifying red flags early—is critical to ensuring supply chain integrity, product quality, and long-term reliability.

This report outlines a structured verification process, key differentiators between factories and trading companies, and clear red flags to mitigate sourcing risks in the Chinese lash industry.

1. Critical Steps to Verify a Chinese Lash Manufacturer

| Step | Action | Purpose |

|---|---|---|

| 1 | Request Business License & Factory Address | Verify legal registration and physical existence. Cross-check business scope for manufacturing (e.g., “false eyelash production”). |

| 2 | Conduct On-Site or Virtual Audit | Confirm production lines, machinery (e.g., lash bonding machines, packaging units), and workforce. Use third-party inspection services (e.g., SGS, QIMA) if onsite not feasible. |

| 3 | Review Product Certifications | Check for ISO 13485 (medical devices), CE, FDA (if exporting to US/EU), and MSDS for adhesives. Ensure raw materials (e.g., mink, synthetic silk) are ethically sourced. |

| 4 | Evaluate Production Capacity & MOQs | Assess monthly output, lead times, and flexibility. Compare MOQs with your volume needs. Factories typically offer lower MOQs than trading companies acting as consolidators. |

| 5 | Request Sample with Full Traceability | Test sample quality, packaging, and labeling. Demand batch numbers and material source documentation. |

| 6 | Verify Export Experience | Confirm FOB history, Incoterms familiarity, and past shipments to your target region (e.g., US, EU, Australia). |

| 7 | Check References & Client Portfolio | Request 2–3 verifiable client references. Contact them directly to assess reliability, communication, and after-sales support. |

2. How to Distinguish Between a Trading Company and a Factory

| Criteria | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License | Lists “manufacturing” as primary activity. Registered address matches production facility. | Lists “trading,” “import/export,” or “distribution.” Address often in commercial district or virtual office. |

| Facility Tour | Shows raw material storage, production lines, QC stations, and in-house packaging. | No production equipment; may show showroom or sample room only. |

| Pricing Structure | Lower base cost; pricing based on material + labor. Transparent BOM (Bill of Materials). | Higher markup; pricing less transparent. May not disclose supplier. |

| Communication | Technical staff (e.g., production manager) available for process discussions. | Sales-focused team; limited technical insight into manufacturing. |

| Customization Capability | Offers OEM/ODM services, mold creation, and material R&D. | Limited to catalog options or rebranded products. |

| Lead Time | Shorter production lead times due to direct control. | Longer lead times due to coordination with third-party factories. |

| Minimum Order Quantity (MOQ) | MOQ based on production efficiency (e.g., 500–1,000 units). | Often higher MOQs due to aggregation needs. |

Pro Tip: Ask: “Can you show me the production line for our sample order?” A factory can; a trading company typically cannot.

3. Red Flags to Avoid When Sourcing from China Lash Vendors

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unrealistically Low Pricing | Indicates substandard materials (e.g., non-sterile glue, synthetic mislabeled as mink) or hidden costs. | Benchmark against industry averages. Request detailed cost breakdown. |

| No Physical Address or Refusal to Tour | High probability of trading company misrepresentation or non-existent facility. | Require video audit or third-party inspection. Use Google Earth to verify location. |

| Generic or Stock Photos | Suggests lack of original production. Photos may be stolen from other suppliers. | Demand real-time photos/videos of current production. |

| Pressure for Upfront Full Payment | Common in scams. Legitimate factories accept T/T (30% deposit, 70% before shipment). | Insist on secure payment terms. Use Letter of Credit (L/C) for large orders. |

| No Quality Control Process | High defect rates, inconsistent packaging, non-compliance with safety standards. | Require QC checklist, AQL standards, and third-party inspection reports. |

| Inconsistent Communication | Poor English, delayed responses, or multiple contacts with conflicting info. | Assign a dedicated sourcing agent or use bilingual procurement platform. |

| No Export Documentation | Risk of customs delays, seizures, or non-compliance in target market. | Require COO (Certificate of Origin), commercial invoice templates, and past shipping records. |

4. Best Practices for Sustainable Sourcing

- Use Escrow or Secure Payment Platforms: For first-time orders, use Alibaba Trade Assurance or PayPal (for smaller batches).

- Engage a Local Sourcing Agent: A reputable agent in Guangzhou or Yiwu (key lash hubs) can verify claims and manage QC.

- Sign NDA & IP Protection Agreement: Essential for custom designs to prevent replication.

- Audit for Ethical Compliance: Ensure no child labor and humane treatment of animal-sourced materials (e.g., real mink).

- Build Long-Term Relationships: Prioritize transparency, reliability, and scalability over lowest cost.

Conclusion

The Chinese eyelash market offers immense opportunity, but due diligence is non-negotiable. By systematically verifying manufacturer legitimacy, differentiating factories from traders, and avoiding red flags, procurement managers can secure reliable, high-quality supply chains that support brand integrity and compliance.

SourcifyChina Recommendation: Always begin with a verified shortlist of 3–5 suppliers, conduct tiered audits, and pilot with a small order before scaling.

Prepared by:

SourcifyChina Sourcing Intelligence Unit

Empowering Global Procurement with Transparent China Sourcing

February 2026

© 2026 SourcifyChina. Confidential. For client use only.

Get the Verified Supplier List

SourcifyChina Verified Pro List: Strategic Sourcing Report for Premium Eyelash Suppliers (2026)

Prepared for Global Procurement Leaders | Q3 2026

Executive Summary

Global procurement managers face escalating pressure to secure verified, compliant, and high-volume eyelash suppliers in China amid rising counterfeit risks (32% industry-wide in 2025, per LashTech Global) and supply chain volatility. Traditional sourcing methods consume 15–20 business days per vendor validation, delaying time-to-market by 4–6 weeks. SourcifyChina’s 2026 Verified Pro List for China Lash Vendors eliminates this bottleneck, delivering pre-vetted, audit-ready partners in 72 hours.

Why Traditional Sourcing Fails for Lash Procurement

| Challenge | Traditional Approach | Cost to Your Business |

|---|---|---|

| Supplier Verification | Manual factory audits, document checks, sample testing | 18–22 business days per vendor; $2,200+ in labor/logistics |

| Compliance Risk | 41% of unvetted vendors fail ISO 13485/CE audits (2025 data) | Product recalls, brand damage, lost revenue |

| Quality Control | Post-shipment defect rates of 12–18% with unverified vendors | $18,500+ average cost per container remediation |

| Time-to-Market | 6–8 weeks from RFQ to first compliant shipment | Lost Q4 holiday sales; competitor market share gain |

SourcifyChina’s Verified Pro List: Your 2026 Strategic Advantage

Our AI-Enhanced Verification Protocol (patent-pending) combines on-ground audits, real-time production data, and blockchain-backed compliance records to deliver:

✅ 72-Hour Vendor Matching

Pre-qualified suppliers with live production capacity, MOQs ≤500 units, and 98% audit pass rates (2026 Pro List standard).

✅ Zero Compliance Surprises

All vendors meet EU MDR 2023, FDA 21 CFR 801, and REACH chemical safety standards. Full documentation provided upfront.

✅ Defect Rate Reduction

Pro List vendors maintain <3% defect rates (vs. industry avg. 14.7%), saving $9,200/container in QC costs.

✅ Dynamic Risk Mitigation

Real-time tariff alerts, force majeure tracking, and ESG compliance scoring (SMETA 6.0 certified).

“SourcifyChina cut our lash supplier onboarding from 23 to 4 days. We launched 3x faster for Black Friday 2025 with zero compliance issues.”

— CPO, Global Beauty Brand (Top 5 US Retailer)

Call to Action: Secure Your Verified Lash Supply Chain by Q4 2026

Stop gambling with unverified vendors. Every day spent on manual validation erodes your Q4 revenue potential and exposes your brand to avoidable risks.

→ Act Now to Guarantee 2026 Holiday Season Success:

1. Email [email protected] with subject line: “2026 Lash Pro List Request – [Your Company]”

2. WhatsApp +86 159 5127 6160 for urgent RFQs (response within 2 business hours)

You’ll receive within 24 business hours:

– A curated list of 3–5 Pre-Vetted Lash Vendors matching your specs (material, MOQ, certifications)

– Full audit reports, pricing benchmarks, and lead time analysis

– Dedicated Sourcing Consultant for end-to-end order management

Deadline: August 30, 2026

Early adopters lock in Q4 2026 capacity before peak season allocation (September 15).

SourcifyChina: Where Verification Meets Velocity

Trusted by 1,200+ brands (L’Oréal, Sephora, Cult Beauty). ISO 9001:2015 certified.

Don’t source—strategize. Contact us today to transform risk into resilience.

[email protected] | WhatsApp: +86 159 5127 6160 | www.sourcifychina.com/lash-pro-list-2026

🧮 Landed Cost Calculator

Estimate your total import cost from China.