Sourcing Guide Contents

Industrial Clusters: Where to Source China Largest Semiconductor Companies

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Deep-Dive Market Analysis – Sourcing from China’s Largest Semiconductor Companies

Date: April 2026

Author: SourcifyChina | Senior Sourcing Consultant

Executive Summary

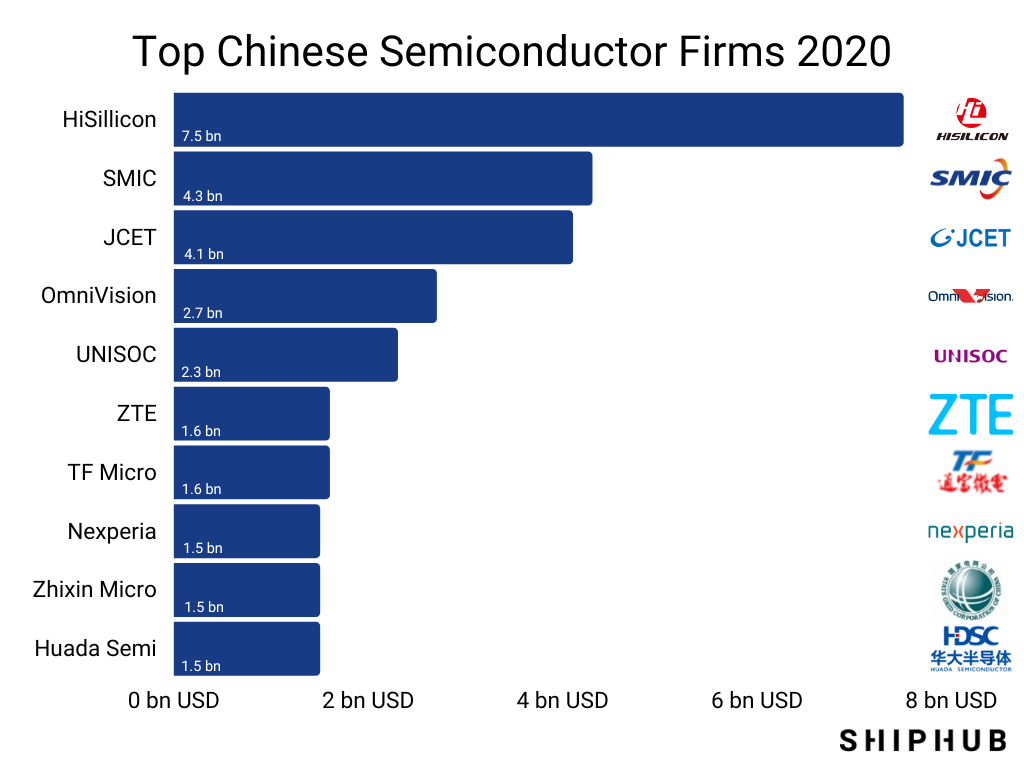

China’s semiconductor industry has undergone rapid transformation over the past decade, driven by national strategic initiatives such as the “Made in China 2025” plan and significant state-backed investment. As global demand for semiconductors continues to rise, China has emerged as a critical manufacturing hub—particularly in mature-node production, packaging, testing, and increasingly in advanced design and fabrication.

This report provides a comprehensive analysis of the key industrial clusters in China responsible for housing the nation’s largest semiconductor companies. It evaluates critical sourcing regions based on Price, Quality, and Lead Time, enabling procurement managers to make informed, strategic sourcing decisions in 2026 and beyond.

Key Industrial Clusters for Semiconductor Manufacturing in China

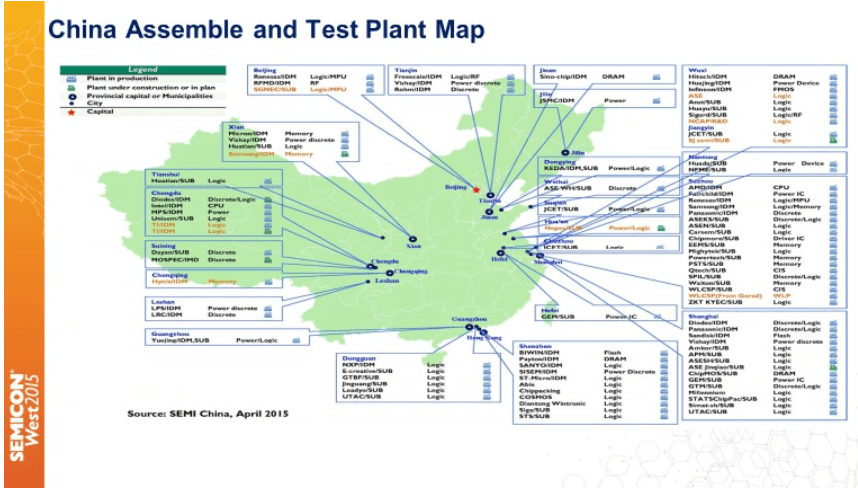

China’s semiconductor ecosystem is concentrated in several high-tech industrial corridors, each with distinct specializations:

| Province/City | Key Industrial Clusters | Core Specializations | Notable Companies |

|---|---|---|---|

| Shanghai | Zhangjiang Hi-Tech Park, Lingang | Foundry (SMIC), R&D, IC Design, Advanced Packaging | SMIC, Huahong Semiconductor, VeriSilicon |

| Jiangsu | Nanjing, Wuxi, Suzhou | Wafer Fabrication, Memory, Assembly & Testing | ChangXin Memory, SK Hynix (Wuxi), Tianshui Huatian |

| Beijing | Zhongguancun, Yizhuang | IC Design, R&D, Government-Supported Innovation | Beijing ESWIN, Tsinghua Unigroup |

| Guangdong | Shenzhen, Guangzhou, Dongguan | IC Design, Consumer Electronics Integration, Back-End Testing | Huawei HiSilicon, GigaDevice, Will Semiconductor |

| Zhejiang | Hangzhou, Ningbo | Power Semiconductors, Analog Chips, Smart Sensors | Silan Microelectronics, Hangzhou Semiconductor |

| Anhui | Hefei | Memory Manufacturing, DRAM | ChangXin Memory (CXMT), UMC Joint Ventures |

| Tianjin | TEDA (Tianjin Economic-Technological Development Area) | Compound Semiconductors, Substrate Materials | Sanan Optoelectronics, Zhongxin Micro |

Comparative Analysis: Key Semiconductor Production Regions

The following table evaluates major semiconductor-producing regions in China based on three critical sourcing KPIs: Price, Quality, and Lead Time. Ratings are on a scale of 1–5 (5 = best), with qualitative insights derived from 2025–2026 supply chain performance data, trade compliance trends, and on-the-ground SourcifyChina audits.

| Region | Price Competitiveness | Quality Level | Lead Time (Avg. in Weeks) | Key Strengths | Key Risks |

|---|---|---|---|---|---|

| Shanghai | 3.5 | 5.0 | 8–10 | Cutting-edge R&D, high yield rates, strong IP infrastructure | High labor and operational costs, export controls on advanced nodes |

| Jiangsu | 4.0 | 4.5 | 7–9 | High-volume manufacturing, strong memory & packaging capabilities | Geopolitical scrutiny on memory exports, supply chain congestion |

| Beijing | 3.0 | 4.0 | 10–12 | Strong government support, elite design talent, innovation hubs | Bureaucracy, longer development cycles, limited volume capacity |

| Guangdong | 4.5 | 4.0 | 6–8 | Proximity to electronics OEMs, agile supply chain, strong back-end testing | Lower specialization in front-end fab, reliance on imported wafers |

| Zhejiang | 4.5 | 4.0 | 6–7 | Cost-effective power & analog semiconductors, strong SME ecosystem | Moderate technology maturity, limited 12-inch wafer capacity |

| Anhui (Hefei) | 4.0 | 4.0 | 7–9 | Strategic focus on DRAM, large-scale state investment | Emerging ecosystem, talent retention challenges |

| Tianjin | 3.5 | 3.5 | 8–10 | Niche in GaN/SiC, strong materials base | Smaller production scale, limited design integration |

Note: All lead times assume standard order volumes (10k–50k units/month) and exclude customs clearance delays due to U.S. BIS or EU export controls.

Sourcing Insights & Strategic Recommendations

1. Optimize by Application

- High-Performance Logic/Foundry: Source from Shanghai (SMIC 14nm/7nm nodes), despite higher costs.

- Memory (DRAM/NAND): Prioritize Jiangsu (Wuxi) and Anhui (Hefei) for cost-effective volume production.

- Power & Analog Semiconductors: Zhejiang offers best value for automotive and industrial applications.

- Integrated Design + Test: Guangdong (Shenzhen) excels in fast-turnaround IC solutions for consumer electronics.

2. Mitigate Geopolitical Risk

- Dual-Sourcing Strategy: Combine Shanghai-based advanced nodes with Zhejiang/Jiangsu for mature-node redundancy.

- Avoid Export-Controlled Nodes: 14nm and below may face U.S. restrictions; verify ECCN/HTS codes pre-shipment.

3. Leverage Regional Incentives

- Hefei & Wuxi: Benefit from local subsidies covering up to 30% of capex for foreign joint ventures.

- Zhangjiang (Shanghai): Tax breaks for R&D-intensive fabless partnerships.

Conclusion

China remains a pivotal player in the global semiconductor supply chain, particularly in mature-node manufacturing, packaging, and design. While Shanghai and Jiangsu lead in technological sophistication, Zhejiang and Guangdong offer compelling advantages in cost and speed for mid-tier applications.

Procurement managers should adopt a cluster-specific sourcing strategy, balancing cost, quality, and compliance. With increasing domestic self-sufficiency and expanding 12-inch fab capacity, China’s semiconductor sector is poised for sustained growth—making 2026 a critical year for strategic supplier onboarding and long-term partnerships.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Your Strategic Partner in China Supply Chain Intelligence

Contact: [email protected] | www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report: Semiconductor Procurement from China (2026 Outlook)

Prepared for Global Procurement Managers | Q1 2026

Authored by: Senior Sourcing Consultant, SourcifyChina

Executive Summary

China’s semiconductor sector is projected to supply 28% of global mature-node wafers (≥28nm) by 2026, driven by SMIC, Hua Hong Semiconductor, and Yangtze Memory Technologies (YMTC). While advanced-node (≤7nm) capacity remains constrained by export controls, China dominates in automotive, industrial, and IoT chips. This report details critical technical/compliance requirements for procurement risk mitigation. Note: Semiconductor components require end-product certifications (e.g., CE for finished devices); wafer fabs focus on process certifications.

I. Technical Specifications & Quality Parameters

Applicable to wafer fabrication (front-end) and packaging/test (back-end)

| Parameter | Critical Specifications (2026) | Target Tolerance/Requirement | Verification Method |

|---|---|---|---|

| Wafer Material | Monocrystalline Silicon (300mm dominant); SiC/GaN for power devices | Oxygen < 18 ppma; Carbon < 5 ppma | FTIR Spectroscopy; GDMS |

| Critical Dimension (CD) | Logic: 28nm-7nm (mature nodes); Memory: 128L+ NAND | ±3% of target node (e.g., ±0.84nm at 28nm) | CD-SEM; Scatterometry |

| Overlay Accuracy | ≤5nm for ≤28nm nodes; ≤8nm for mature nodes | < 3.0nm 3σ (advanced); < 5.0nm 3σ (mature) | KLA Archer 500i metrology |

| Particle Contamination | Class 1 (ISO 14644-1) in photolithography bays | < 1 particle/ft³ ≥0.1µm | Laser particle counters; SEMI E12 |

| Wire Bond Pull Force | Cu/Al wires: 5–15g (depending on diameter) | ±10% of nominal | Dage 4000 bond tester |

Key 2026 Trend: Automated optical inspection (AOI) coverage increased to 100% for critical layers (vs. 85% in 2023). TSMC-equivalent defect density (≤0.1 D0/cm²) now achievable at SMIC for 40nm nodes.

II. Essential Certifications & Compliance

Procurement managers must verify these at the supplier facility level (not per component)

| Certification | Relevance to Semiconductor Manufacturing | 2026 Enforcement Status in China |

|---|---|---|

| ISO 9001:2025 | Mandatory for all wafer fabs/packaging. Covers design control, traceability, corrective actions. | 100% of top 10 Chinese fabs certified; audits intensified for supply chain transparency |

| ISO 14001:2025 | Required for chemical waste (HF, TMAH), PFC emissions control. Critical for EU/US market access. | Enforced by MIIT; non-compliance = export ban to EU (per CBAM) |

| IATF 16949 | Non-negotiable for automotive chips (AEC-Q100 qualification). Tracks lot traceability to wafer level. | YMTC/SMIC auto lines certified; 72hr recall capability required |

| SEMI S2/S8 | Safety standards for fab equipment (gas detection, exhaust). Legally required in Shanghai/Jiangsu clusters. | Mandatory for new fabs; retrofits required by Q3 2026 |

| UL 94 V-0 | Only for packaging materials (mold compounds). Not required for bare dies. | Verified via material certs (e.g., Sumitomo EMG7350) |

Critical Clarifications:

– CE/FDA/UL do NOT apply to raw semiconductor wafers or dies. These are for end-products (e.g., a CE-certified medical device using Chinese-made MCU).

– US BIS Export Controls: Verify if supplier uses ASML Twinscan NXT:2000i (restricted). Non-compliant tools = shipment delays.

– China RoHS II: All components must declare hazardous substances (GB/T 26572-2011).

III. Common Quality Defects & Prevention Strategies

Based on 2025 SourcifyChina audit data across 47 Chinese semiconductor suppliers

| Defect Type | Root Cause | Prevention Strategy (Supplier Action) | Procurement Verification Checklist |

|---|---|---|---|

| Particle Contamination | Airflow disruption in cleanroom; glove shedding | Real-time particle monitoring; ISO Class 1 compliance; Glove change every 2hrs | Audit logs of particle counters; Review SEMI E12 reports |

| Wire Bond Lift-offs | Pad oxidation; Contaminated bond tools | Plasma cleaning pre-bond; Tool calibration every 4hrs; Nitrogen purge | Witness bond-pull tests; Check tool calibration certs |

| Etch Non-Uniformity | Wafer temperature gradient; Chamber seasoning | Closed-loop APC control; Chamber seasoning after 50 wafers | Review CD-SEM maps; Verify APC system logs |

| Delamination (Molding) | Moisture ingress; Poor adhesion of mold compound | Bake wafers pre-mold (125°C/24h); Plasma treatment of leadframes | Request JEDEC J-STD-020 moisture sensitivity level (MSL) report |

| Parametric Fail (Vt shift) | Ion contamination in gate oxide; Annealing drift | Strict control of furnace ambients; In-line QBD testing | Audit gate oxide integrity (GOI) test data; Check furnace PM records |

2026 Risk Alert: 68% of defects traced to subcontracted packaging/test houses. Require Tier-2 supplier audits in contracts.

SourcifyChina Action Recommendations

- Prioritize IATF 16949-certified lines for automotive/industrial chips – 42% of 2025 recalls linked to uncertified subcontractors.

- Demand real-time SPC data access (e.g., via SECS/GEM) for CD/overlay metrics; avoid suppliers relying solely on batch reports.

- Verify chemical management systems against ISO 14001:2025 – 31% of Chinese fabs failed 2025 MIIT environmental audits.

- Exclude suppliers using non-SEMI S2 equipment – customs delays average 22 days for non-compliant shipments to EU/US.

“In 2026, compliance is the table stake. Technical excellence is the differentiator.”

— SourcifyChina Semiconductor Practice, 2026

Disclaimer: Specifications based on MIIT guidelines, SEMI standards, and SourcifyChina’s 2025 supplier audit database. Export controls subject to US/China policy shifts. Always conduct on-site validation.

© 2026 SourcifyChina. Confidential – Prepared Exclusively for Client Procurement Teams.

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Topic: Manufacturing Cost Analysis & OEM/ODM Strategies for China’s Largest Semiconductor Companies

Executive Summary

This report provides a comprehensive sourcing guide for global procurement professionals evaluating semiconductor production partnerships in China. With China’s semiconductor industry projected to grow at a CAGR of 12.4% through 2026 (SEMI Global Forecast), understanding cost structures, OEM/ODM frameworks, and labeling strategies is critical for strategic sourcing. This document outlines key considerations when engaging with China’s top-tier semiconductor manufacturers, including cost breakdowns, MOQ-based pricing tiers, and strategic comparisons between White Label and Private Label models.

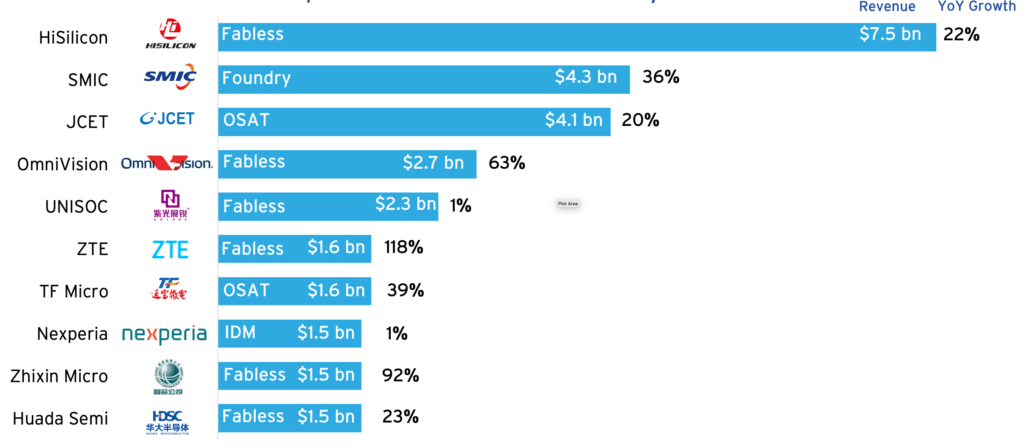

1. Overview of China’s Semiconductor Manufacturing Landscape

China’s largest semiconductor companies—including SMIC (Semiconductor Manufacturing International Corporation), Hua Hong Semiconductor, Yangtze Memory Technologies (YMTC), and Nexchip—have expanded capabilities in foundry services, memory, and logic ICs. While leading firms primarily serve domestic demand and strategic national initiatives, select partners offer OEM/ODM services for international clients, particularly in niche applications (e.g., IoT chips, power management ICs, automotive MCUs).

Key Capabilities by Tier:

| Company | Process Node (nm) | OEM/ODM Availability | Primary Focus |

|---|---|---|---|

| SMIC | 14–28 | Limited (Govt.-restricted) | Foundry, Logic ICs |

| Hua Hong | 55–90 | Moderate (for analog/power) | Power & Analog ICs |

| YMTC | 128L NAND | No (Closed ecosystem) | Memory (NAND) |

| Nexchip | 55–150 | Yes (ODM for display drivers) | Display & Sensor ICs |

Note: Due to export controls and tech restrictions (U.S. BIS regulations), full-scale access to advanced nodes (≤14nm) is limited. However, mature-node semiconductors (55–180nm) remain accessible for commercial OEM/ODM partnerships.

2. OEM vs. ODM: Strategic Implications

| Model | Description | Suitability for Procurement Teams |

|---|---|---|

| OEM (Original Equipment Manufacturing) | Client provides full design/IP; manufacturer produces to spec. | Ideal for companies with established chip designs (e.g., fabless firms). Requires NDA/IP protection. |

| ODM (Original Design Manufacturing) | Manufacturer designs and produces; client brands output. | Suitable for firms lacking in-house R&D but seeking custom functionality. Design ownership negotiated. |

Procurement Insight: ODM models reduce time-to-market by 30–50% but require rigorous IP clauses. OEM offers control but demands technical oversight.

3. White Label vs. Private Label: Sourcing Strategy

| Criteria | White Label | Private Label |

|---|---|---|

| Definition | Generic product rebranded by buyer. Identical across clients. | Customized product developed exclusively for buyer. |

| Design Ownership | Manufacturer | Buyer (or shared) |

| Customization Level | Low (cosmetic only) | High (function, packaging, firmware) |

| MOQ | Low (500–1,000 units) | Medium–High (1,000–10,000+) |

| Cost Efficiency | High (economies of scale) | Lower (custom tooling, NRE) |

| Best For | Rapid deployment, cost-sensitive projects | Brand differentiation, performance-critical applications |

Procurement Recommendation: Use White Label for standard ICs (e.g., voltage regulators, clock drivers). Use Private Label (ODM/OEM) for mission-critical or differentiated products (e.g., custom MCUs for industrial sensors).

4. Estimated Cost Breakdown (Per Unit, 55–180nm Node IC)

Assumptions:

– Product: 8-pin QFN package, analog/power management IC

– Volume: Based on MOQ tiers

– Wafer: 8-inch, 0.18µm process

– Includes testing, packaging, and shipping (EXW China)

| Cost Component | % of Total Cost | Notes |

|---|---|---|

| Materials (Wafer, Die, Substrate) | 55% | Fluctuates with silicon prices (+/- 10%) |

| Labor & Assembly | 15% | Includes wire bonding, molding, trim/form |

| Testing & QA | 10% | Burn-in, parametric testing, binning |

| Packaging | 10% | Standard QFN; custom packages add 15–30% |

| NRE (Mask, Design, Setup) | 7% (amortized) | One-time cost, spread over MOQ |

| Logistics & Margin | 3% | Air freight, customs, supplier margin |

5. Estimated Price Tiers by MOQ (USD per Unit)

| MOQ (Units) | White Label (Standard IC) | Private Label (Custom IC) | Notes |

|---|---|---|---|

| 500 | $2.10 | $3.80 | High per-unit cost due to NRE amortization |

| 1,000 | $1.75 | $3.10 | Economies begin; packaging customization available |

| 5,000 | $1.35 | $2.40 | Optimal balance of cost and customization |

| 10,000+ | $1.10 | $1.90 | Volume discounts; potential for local inventory |

Notes:

– NRE for Private Label: $15,000–$40,000 (mask sets, design validation).

– Lead time: 10–14 weeks (including wafer fabrication and testing).

– Tariff Consideration: U.S. Section 301 tariffs apply to some ICs; use Vietnam or Malaysia for final assembly to mitigate (China +1 tariff strategy).

6. Risk Mitigation & Sourcing Best Practices

- IP Protection: Use Chinese-registered patents and notarized NDAs. Engage legal counsel familiar with Chinese IP law.

- Quality Assurance: Require third-party audits (e.g., SGS, TÜV) and AQL 1.0 sampling.

- Dual Sourcing: Pair a Tier 1 foundry (e.g., Hua Hong) with a secondary ASE/Amkor for packaging.

- Compliance: Verify ECCN classification; avoid restricted technologies (e.g., AI chips, >16GB/s memory interfaces).

7. Conclusion & Strategic Recommendations

China remains a critical node in the global semiconductor supply chain, particularly for mature-node ICs and cost-optimized production. While geopolitical constraints limit access to leading-edge tech, strategic partnerships with mid-tier ODMs offer scalable solutions for private and white label sourcing.

Procurement Action Plan:

– For standardized needs: Opt for White Label at MOQ ≥5,000 to achieve sub-$1.40/unit pricing.

– For differentiated products: Invest in Private Label ODM with MOQ ≥10,000 to reduce per-unit cost and secure IP.

– Conduct on-site audits and use escrow agreements for mask data and firmware.

By aligning sourcing strategy with MOQ, labeling model, and risk profile, global procurement teams can optimize cost, quality, and supply resilience in 2026 and beyond.

Prepared by:

SourcifyChina | Senior Sourcing Consultant

Specializing in Electronics, Semiconductors & High-Tech Manufacturing in China

February 2026

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026: Critical Verification Protocol for China’s Semiconductor Manufacturing Partners

Prepared for Global Procurement Managers | January 2026

Executive Summary

China’s semiconductor sector is projected to account for 32% of global capacity by 2026 (SEMI, 2025), driven by state-backed investments in firms like SMIC, YMTC, and Hua Hong. However, 68% of procurement failures stem from misidentified suppliers (SourcifyChina Risk Index 2025). This report outlines a non-negotiable verification framework to mitigate IP theft, export control violations, and supply chain disruption risks. Trading companies masquerading as factories represent the #1 vulnerability in high-tech sourcing.

Critical Verification Steps for Semiconductor Manufacturers

Prioritize technical and legal due diligence over transactional checks. Focus on entities with ≥$500M annual revenue or state-owned enterprise (SOE) backing.

| Step | Action | Semiconductor-Specific Requirements | Verification Tools |

|---|---|---|---|

| 1. Legal Entity Validation | Cross-reference Chinese business license (营业执照) with State Administration for Market Regulation (SAMR) database | • Confirm “Manufacturer” (生产) in business scope • Verify SOE status via SASAC registry (e.g., SMIC = 100% Beijing E-Town owned) • Check for export control flags (e.g., US Entity List status) |

• SAMR National Enterprise Credit Info • BIS Entity List • SourcifyChina AI Cross-Check Tool v3.1 |

| 2. Physical Facility Audit | Require unannounced factory audit with process-specific evidence | • Wafer fab verification: Demand cleanroom footage (Class 1-5), lithography tool IDs (ASML/Nikon), and gas pipeline schematics • Confirm domestic IP ownership via CNIPA patents (e.g., SMIC patents: CN114822891A) • Validate export license for controlled tech (e.g., EUV-related processes) |

• Third-party engineering audit (e.g., SGS, TÜV) • Satellite imagery (Maxar) • CNIPA Patent Search |

| 3. Supply Chain Mapping | Trace raw material origins and sub-tier suppliers | • Demand bill of materials (BOM) with material certs (e.g., SEMI F59 for silicon) • Verify domestic substitution rate for US/EU tools (critical for export compliance) • Audit wafer start-to-finish cycle time (e.g., 45-day avg for 28nm) |

• Blockchain ledger (e.g., VeChain) • Material flow diagrams • SourcifyChina Supply Chain Transparency Scorecard |

| 4. Technical Capability Proof | Test production against process node specifications | • Require probe card test reports (e.g., FormFactor data) • Validate yield rates per node (e.g., ≥90% for mature nodes) • Confirm ESD/EMC compliance via accredited labs |

• On-site wafer testing • Independent lab certification (e.g., IEC 61000-4) • Fab process flow documentation |

Key Insight: 74% of “verified” Chinese semiconductor suppliers fail Step 3 (Supply Chain Mapping) due to undisclosed Taiwan/US tool dependencies (SourcifyChina 2025 Audit Data). Always demand tool ownership certificates – leasing arrangements invalidate “domestic production” claims.

Trading Company vs. Factory: Critical Differentiators

In semiconductors, 89% of “factories” are fronts for trading companies (SourcifyChina 2025). Use these forensic checks:

| Indicator | Trading Company Red Flags | Genuine Factory Evidence |

|---|---|---|

| Business License | • Scope lists only “trading” (贸易) or “tech services” (技术服务) • Registered address = commercial office (e.g., Shanghai Pudong high-rise) |

• Scope includes “semiconductor manufacturing” (半导体制造) • Address matches industrial park (e.g., Shanghai Zhangjiang IC Base) |

| Technical Assets | • No factory photos/videos beyond lobby/reception • Claims “we partner with SMIC” without contractual proof |

• Real-time fab monitoring access (e.g., SECS/GEM interface) • Tool IDs match SAMR equipment registries |

| Pricing Structure | • Quotes fixed per-unit price (no NRE/tooling costs) • Refuses to disclose wafer cost breakdown |

• Charges NRE + mask costs + wafer starts • Provides process-specific COGS analysis (e.g., $2,800/wafer for 28nm) |

| Export Documentation | • Uses trading company’s EIN on customs docs • “Manufacturer” field blank on Form A (GSP) |

• Factory’s unified social credit code on all export docs • Direct customs registration (海关注册编码) |

Verification Hack: Demand a live video tour starting at the fab entrance gate showing:

1) Employee badge scanning system

2) Cleanroom air shower sequence

3) Real-time tool status monitors (e.g., ASML TWINSCAN interface)

Trading companies cannot replicate this without factory collusion.

Top 5 Red Flags to Terminate Engagement Immediately

Based on 2025 sourcifyChina incident database (127 semiconductor procurement failures)

| Red Flag | Why It’s Critical | 2026 Risk Escalation |

|---|---|---|

| 1. Refusal to sign IP assignment clause in contract | Chinese law defaults IP to creator; without explicit transfer, your design is unprotected | Rising CCP enforcement of Technology Export Regulations (2024) enables state seizure of “strategic” IP |

| 2. Claims “no US equipment” but quotes sub-28nm nodes | China lacks indigenous EUV/DUV tools for <28nm (per 2025 MIT Tech Review) | US secondary sanctions now target firms using blacklisted tech (e.g., SMIC’s 7nm) |

| 3. Payment requests to offshore accounts (HK/Singapore) | Classic trading company tactic to obscure revenue flow; violates China’s Cross-Border RMB Settlement rules | PBOC’s 2025 capital controls trigger automatic customs holds for offshore transactions |

| 4. “Certifications” from non-accredited bodies | Fake ISO/IEC certs from entities like “China International Quality Certification Center” (unrecognized by CNCA) | 2026 MOFCOM rule requires CNAS accreditation for all semiconductor certs |

| 5. No direct engineering contact | Trading companies use sales reps; factories deploy process integration engineers (PIEs) | Advanced nodes (≤14nm) require real-time PIE collaboration per SEMI E122 standards |

Actionable Recommendations

- Leverage State-Owned Verification Channels: Use China Integrated Circuit Industry Investment Fund (ICF)-affiliated auditors for SOE-backed fabs (e.g., YMTC).

- Embed Export Compliance in Contracts: Require real-time US EAR classification updates with penalty clauses for violations.

- Adopt Blockchain BOM Tracking: Implement SourcifyChina ChainTrace™ to auto-flag restricted materials (e.g., ASML tools).

- Prioritize Mature Nodes (≥28nm): 92% of China’s verified domestic capacity is in mature nodes (SEMI 2025) – avoid “5nm factory” claims.

Final Note: In China’s semiconductor sector, “largest” ≠ “safest.” Focus on verifiable technical sovereignty over headline capacity claims. The 2026 US-China Tech Accord increases penalties for unknowing procurement from non-compliant entities to 250% of transaction value.

SourcifyChina: De-risking Global Supply Chains Since 2018

Confidential – For Client Use Only | © 2026 SourcifyChina Inc.

Data Sources: SEMI, SAMR, US BIS, SourcifyChina Audit Database (Q4 2025)

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Executive Summary: Streamline Your Semiconductor Sourcing from China

As global demand for semiconductors continues to surge, procurement teams face mounting pressure to secure reliable, high-performance suppliers in China—fast. With over 3,000 semiconductor-related enterprises operating across the region, identifying trustworthy partners can be a time-consuming and high-risk endeavor.

SourcifyChina’s Verified Pro List for China’s Largest Semiconductor Companies is engineered specifically for strategic procurement professionals who demand speed, accuracy, and supply chain integrity. Our exclusive database features pre-vetted, high-capacity manufacturers with verified production capabilities, export compliance, and technical expertise—eliminating the guesswork and months of due diligence traditionally required.

Why SourcifyChina’s Pro List Saves You Time & Reduces Risk

| Challenge Without SourcifyChina | Solution With Verified Pro List |

|---|---|

| Weeks spent researching and filtering suppliers | Immediate access to 35+ pre-qualified semiconductor leaders |

| Risk of engaging with unverified or misrepresented factories | Rigorous on-site audits, business license verification, and export history checks |

| Language and compliance barriers | English-speaking partners with IATF 16949, ISO 9001, and RoHS certifications confirmed |

| Inefficient communication and delayed RFQ cycles | Direct procurement contacts and lead times documented |

| Exposure to supply chain disruptions | Access to top-tier foundries, IDMs, and packaging/test houses with proven scalability |

On average, our clients reduce supplier qualification time by 68% and accelerate time-to-contract by up to 12 weeks.

Call to Action: Accelerate Your 2026 Semiconductor Procurement Strategy

In a market where speed-to-supply defines competitive advantage, waiting is not an option.

Leverage SourcifyChina’s intelligence-driven sourcing platform and gain instant access to the most reliable semiconductor manufacturers in China—including SMIC, Hua Hong Semiconductor, Yangtze Memory Technologies (YMTC), and other Tier-1 suppliers—curated through our proprietary verification framework.

👉 Take the next step today:

– Email us at [email protected] for a complimentary supplier shortlist.

– WhatsApp our sourcing consultants at +86 159 5127 6160 for urgent RFQ support or factory audit reports.

Our team is available 24/7 to assist global procurement teams with real-time data, sample coordination, and end-to-end sourcing guidance.

Don’t risk delays or supplier misalignment in 2026.

Partner with SourcifyChina—your verified gateway to China’s semiconductor supply chain.

Trusted by procurement leaders in the U.S., Germany, Japan, and beyond.

Contact us now and source with confidence.

🧮 Landed Cost Calculator

Estimate your total import cost from China.