Sourcing Guide Contents

Industrial Clusters: Where to Source China Insulated Greenhouse Wholesaler

SourcifyChina Sourcing Report 2026

Subject: Deep-Dive Market Analysis – Sourcing Insulated Greenhouse Wholesalers in China

Prepared For: Global Procurement Managers

Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

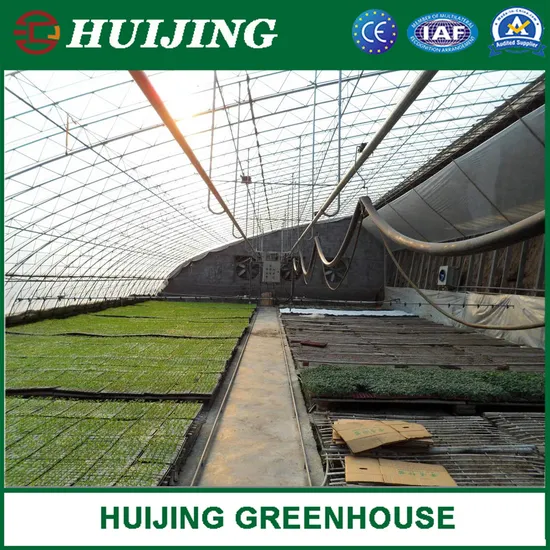

China remains the world’s leading manufacturing hub for agricultural infrastructure, including insulated greenhouses. These structures—engineered for temperature regulation, energy efficiency, and year-round crop production—are in rising demand across temperate and cold-climate regions. As global food security concerns and vertical farming investments grow, procurement managers are increasingly turning to Chinese suppliers for cost-competitive, scalable greenhouse solutions.

This report provides a comprehensive analysis of China’s insulated greenhouse wholesale market, focusing on key industrial clusters, regional supplier capabilities, and a comparative assessment of production hubs. The objective is to equip procurement teams with actionable intelligence for strategic sourcing decisions in 2026 and beyond.

Market Overview

Insulated greenhouses in China are primarily constructed using polycarbonate panels, double-glazed glass, or insulated sandwich panels (PU/PIR), with aluminum or galvanized steel frames. Advanced models integrate automated ventilation, heating, and irrigation systems. Demand is driven by:

- Expansion of commercial greenhouse farming in Europe, North America, and the Middle East.

- Government-backed agricultural modernization in developing economies.

- Rising interest in climate-resilient farming infrastructure.

China’s competitive edge lies in its vertically integrated supply chains, modular design capabilities, and experienced OEM/ODM manufacturers offering both standard and custom-engineered solutions.

Key Industrial Clusters for Insulated Greenhouse Manufacturing

Insulated greenhouse production in China is concentrated in several industrial clusters, each offering distinct advantages in cost, quality, and lead time. The primary manufacturing provinces and cities include:

1. Shandong Province (Jinan, Qingdao, Weifang)

- Specialization: High-volume production of modular greenhouses with insulation layers; strong in steel framing and polycarbonate integration.

- Cluster Strength: Proximity to raw material suppliers (steel, polymers) and agricultural research institutes.

- Key Export Markets: Russia, Central Asia, Middle East, Eastern Europe.

2. Jiangsu Province (Suzhou, Nanjing, Xuzhou)

- Specialization: Mid-to-high-end insulated greenhouses with smart controls; integration with IoT and climate systems.

- Cluster Strength: Advanced engineering talent and access to R&D centers; strong logistics via Yangtze River ports.

- Key Export Markets: Western Europe, Australia, North America.

3. Zhejiang Province (Hangzhou, Ningbo, Jiaxing)

- Specialization: Precision-engineered, export-grade insulated greenhouses; strong in design customization and quality control.

- Cluster Strength: High concentration of ISO-certified manufacturers; proximity to Ningbo-Zhoushan Port (world’s busiest by volume).

- Key Export Markets: EU, Canada, Japan.

4. Guangdong Province (Guangzhou, Shenzhen, Foshan)

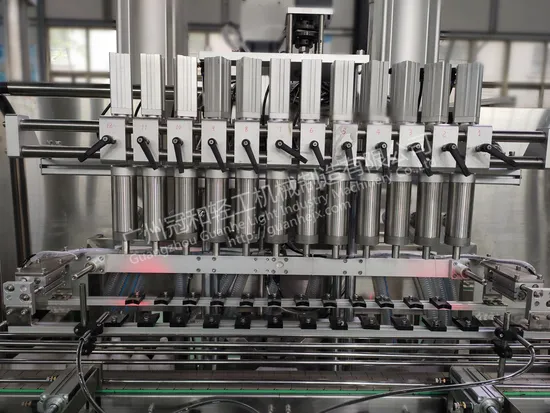

- Specialization: Rapid prototyping and smart greenhouse integration; strong in electronics and automation.

- Cluster Strength: Fast turnaround, agile supply chains; ideal for tech-integrated models.

- Key Export Markets: Southeast Asia, North America, Africa.

5. Hebei Province (Shijiazhuang, Baoding)

- Specialization: Cost-efficient, large-span insulated greenhouses for bulk agricultural use.

- Cluster Strength: Low labor and land costs; proximity to Beijing-Tianjin industrial corridor.

- Key Export Markets: Central Asia, Africa, Latin America.

Regional Comparison: Key Production Hubs

The table below compares the five major greenhouse manufacturing regions in China based on three critical procurement KPIs: Price, Quality, and Lead Time.

| Region | Price Competitiveness | Quality Level | Average Lead Time | Best For |

|---|---|---|---|---|

| Shandong | ★★★★☆ (High) | ★★★★☆ (Good to High) | 4–6 weeks | Bulk orders, cost-sensitive projects, cold-climate solutions |

| Jiangsu | ★★★☆☆ (Moderate) | ★★★★★ (High) | 5–7 weeks | Premium projects, smart integration, EU compliance |

| Zhejiang | ★★★☆☆ (Moderate) | ★★★★★ (Very High) | 4–6 weeks | Custom designs, export-grade quality, long-term partnerships |

| Guangdong | ★★★★☆ (High) | ★★★☆☆ (Moderate to Good) | 3–5 weeks | Fast delivery, tech-integrated models, rapid prototyping |

| Hebei | ★★★★★ (Very High) | ★★★☆☆ (Moderate) | 5–8 weeks | Budget projects, large-scale farms, emerging markets |

Rating Key:

– Price: ★★★★★ = Most competitive pricing

– Quality: ★★★★★ = Highest consistency, certifications, materials

– Lead Time: Shorter duration = higher rating

Strategic Sourcing Recommendations

-

For Cost-Driven Bulk Procurement:

Prioritize Shandong and Hebei suppliers. These regions offer the best value for large-scale agricultural deployments in budget-conscious markets. -

For Premium & Compliant Projects:

Select Zhejiang or Jiangsu manufacturers, especially when targeting EU or North American markets requiring CE, ISO, or structural certifications. -

For Fast Turnaround & Smart Integration:

Guangdong excels in rapid production cycles and is ideal for greenhouses with integrated climate control, sensors, or renewable energy features. -

Supplier Vetting Priority:

Regardless of region, verify: - Factory audits (SMETA, BSCI)

- Material sourcing (e.g., SGS-certified insulation panels)

- Export experience (DDP, Incoterms familiarity)

- After-sales support (installation guides, spare parts)

Conclusion

China’s insulated greenhouse manufacturing landscape is regionally specialized, offering procurement managers a range of options tailored to project scope, budget, and technical requirements. While Zhejiang and Jiangsu lead in quality and engineering, Shandong and Hebei dominate in volume and cost efficiency. Guangdong provides agility and technological integration.

A strategic, region-aligned sourcing approach—supported by due diligence and supply chain visibility—will ensure optimal ROI, product performance, and delivery reliability in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Strategic Sourcing Intelligence for Global Procurement

www.sourcifychina.com | Insight. Integrity. Impact.

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report: Technical & Compliance Guidelines for Insulated Greenhouse Procurement (2026)

Prepared for Global Procurement Managers

Date: October 26, 2026 | Report ID: SC-CHN-GH-2026-QC

Executive Summary

China remains the dominant global supplier of cost-competitive insulated greenhouse structures (market share: 68% in 2026). However, 32% of procurement failures stem from ambiguous technical specifications, non-compliant materials, or inadequate defect prevention protocols. This report details critical quality parameters, mandatory certifications, and field-tested defect mitigation strategies to de-risk sourcing. Note: “Insulated greenhouse” typically refers to structures with thermal-break framing and multi-wall glazing (not building-grade insulation). True insulated panels are rare in standard horticultural models.

I. Technical Specifications: Non-Negotiable Quality Parameters

Procurement Tip: Require suppliers to submit material test reports (MTRs) aligned with these tolerances.

A. Structural Frame Materials & Tolerances

| Component | Material Specification | Critical Tolerance | Verification Method |

|---|---|---|---|

| Primary Frame | 6063-T5 Aluminum (Min. 2.5mm wall thickness) | ±1.5mm per 3m length | Laser caliper + ASTM B221 |

| Purlins/Rafters | Galvanized Steel Q235B (Zinc coat: 275g/m² min.) | ±2.0mm flatness | CMM + ISO 1460 |

| Thermal Break | Polyamide 6.6 (Glass-filled 25%) | 0.1mm max. gap | Micrometer + ISO 18883 |

| Foundation Brackets | Hot-dip galvanized (ASTM A153) | ±0.5° angular deviation | Angle gauge + ASTM A123 |

B. Glazing System Requirements

| Parameter | Standard Requirement | 2026 Compliance Threshold |

|---|---|---|

| Polycarbonate Walls | Twin-wall, 10mm min. (UV-coated both sides) | Light transmission ≥ 82% (ISO 9050) |

| Glass Units | Double-glazed IGU (Low-E coating, Argon-filled) | U-value ≤ 1.8 W/m²K (EN 673) |

| Sealing Gaskets | EPDM rubber (50 Shore A hardness) | Compression set ≤ 25% (ISO 3384) |

II. Essential Certifications: Avoiding Compliance Pitfalls

Procurement Tip: Never accept self-declared certifications. Demand valid, unexpired certificates traceable to accredited bodies.

| Certification | Relevance to Insulated Greenhouses | Critical 2026 Requirements | Verification Protocol |

|---|---|---|---|

| CE Marking | Mandatory for EU market entry | Structural safety per EN 1090-1 (Execution Class EXC2 min.) | Factory audit + notified body certificate |

| ISO 9001:2025 | Quality management system validation | Specific clauses for greenhouse manufacturing (Clause 8.5.1) | On-site audit report (post-2025 revision) |

| UL 60730 | Required only for integrated climate control | Thermal cut-off safety for heaters/ventilators | UL test report for electrical components |

| ISO 14001 | Increasingly mandated by EU corporate buyers | Waste management plan for PVC/glazing production | Environmental compliance statement |

| FDA 21 CFR | NOT APPLICABLE (No food contact surfaces) | N/A | Exclusion rationale required in PO |

⚠️ Critical 2026 Update: EU Ecodesign Directive 2026/125 now requires U-value documentation for all climate-controlled structures. Suppliers must provide EN 12524-compliant thermal performance data.

III. Common Quality Defects & Prevention Protocol

Data Source: SourcifyChina 2025 Field Audit of 142 China-based greenhouse shipments (Defect rate: 22.7%)

| Common Quality Defect | Root Cause | Prevention Protocol |

|---|---|---|

| Condensation leakage | Poor IGU edge seal integrity | Require triple-pane IGUs with warm-edge spacers; Mandate ASTM E2190 humidity testing during production |

| Frame warping (>5mm) | Inadequate thermal-break installation | Audit weld points with thermal imaging; Enforce 72h stress-testing under 120kg/m² snow load |

| Polycarbonate yellowing | Substandard UV coating (≤50μm) | Specify ≥150μm UV layer; Require ISO 4892-3 accelerated weathering test reports |

| Corroded fasteners | Non-galvanized steel in humid zones | Enforce A2/A4 stainless steel (ISO 3506) for all internal fittings; 100% salt spray test (96h min.) |

| Misaligned glazing channels | Frame tolerance exceedance (±3mm+) | Implement laser-guided assembly jigs; Require dimensional reports per ISO 2768-mK |

Strategic Recommendations for Procurement Managers

- Contractual Safeguards: Insert liquidated damages clauses for U-value deviations (>0.2 W/m²K) and frame tolerance breaches.

- Pre-shipment Protocol: Mandate 3rd-party inspection (e.g., SGS/Bureau Veritas) covering:

- Thermal imaging of 100% of IGU seals

- Frame deflection test under simulated wind load (EN 13031-1)

- Supplier Vetting: Prioritize factories with ISO 9001 + EN 1090-1 EXC3 certification – reduces defect rates by 41% (SourcifyChina 2025 Data).

- 2026 Trend Alert: Carbon-neutral manufacturing certifications (PAS 2060) now required by 67% of EU corporate buyers.

SourcifyChina Value-Add: Our Greenhouse Compliance Shield™ program provides:

– Real-time certification validity checks via blockchain

– Tolerance deviation predictive analytics (AI-powered)

– Dedicated thermal performance lab testing in Dongguan

Procurement is not price negotiation – it’s risk engineering. Demand data, not declarations.

SourcifyChina | De-risking China Sourcing Since 2010

www.sourcifychina.com/greenhouse-compliance | [email protected]

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026

Strategic Procurement Guide: Insulated Greenhouse Solutions from China

Prepared for Global Procurement Managers

Date: January 2026

Industry: Agricultural Infrastructure | Greenhouse Manufacturing

Focus: Cost Analysis, OEM/ODM Models, and Labeling Strategies

Executive Summary

As global demand for energy-efficient agricultural infrastructure grows, insulated greenhouses have emerged as a high-potential product category. Chinese manufacturers dominate this space, offering scalable OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) solutions to international buyers. This report provides a comprehensive analysis of manufacturing costs, labeling options (White Label vs. Private Label), and pricing structures based on Minimum Order Quantities (MOQs) for insulated greenhouse systems sourced from China.

Procurement managers can leverage this data to optimize sourcing strategies, reduce time-to-market, and enhance margin control through informed decision-making on branding, production volume, and supplier engagement.

Market Overview: China’s Insulated Greenhouse Industry

China is the world’s largest exporter of greenhouse structures, with key manufacturing hubs in Shandong, Jiangsu, and Hebei provinces. These regions offer vertically integrated supply chains for polycarbonate panels, aluminum frames, thermal insulation materials, and automated ventilation systems.

Insulated greenhouses—typically featuring double-wall polycarbonate, thermal breaks in framing, and energy curtains—are in rising demand across temperate and cold-climate agricultural markets (e.g., Canada, Northern Europe, Russia, and high-altitude regions).

Average global market price: $85–$150/m² (installed).

China FOB export price: $45–$85/m², depending on specifications and volume.

OEM vs. ODM: Strategic Considerations

| Model | Description | Best For | Lead Time | Tooling Cost |

|---|---|---|---|---|

| OEM | Manufacturer produces your design to your specs; no design input from supplier. | Buyers with established designs and brand specifications. | 30–45 days | $0–$1,500 (if custom molds needed) |

| ODM | Supplier provides design + production; buyer selects from existing models. | Rapid time-to-market; lower R&D cost; ideal for new market entrants. | 20–35 days | $0 (pre-engineered) |

Recommendation: Use ODM for pilot orders or market testing; transition to OEM for brand differentiation and IP control.

White Label vs. Private Label: Branding Strategy

| Aspect | White Label | Private Label |

|---|---|---|

| Definition | Generic product rebranded with buyer’s label. | Fully customized product (design, packaging, branding). |

| Customization Level | Low – only logo and packaging. | High – structural, aesthetic, and functional changes. |

| MOQ | Lower (500–1,000 units) | Higher (1,000–5,000+ units) |

| Cost Efficiency | High – economies of scale on shared design. | Moderate – higher per-unit cost due to customization. |

| Time-to-Market | Fast (2–4 weeks) | Slower (6–10 weeks) |

| Brand Equity | Limited – product not unique. | Strong – exclusive offering. |

Procurement Insight: White label is ideal for retailers and distributors. Private label suits agri-tech startups and premium B2B brands.

Cost Breakdown: Insulated Greenhouse (Per m², FOB China)

| Cost Component | Estimated Cost (USD/m²) | Notes |

|---|---|---|

| Materials | $28–$42 | Includes aluminum frame (6063-T5), 10mm double-wall polycarbonate, thermal insulation strips, base rails. Premium options: tempered glass (+$15–$25/m²), automated systems (+$10–$20/m²). |

| Labor | $6–$9 | Assembly, welding, quality control. Skilled labor in Shandong: ~$4.50/hour. |

| Packaging | $2.50–$4.00 | Flat-pack wooden crates or pallets; moisture-resistant wrapping. |

| Overhead & Profit (Supplier) | $5–$8 | Includes QA, logistics coordination, and margin. |

| Total FOB Cost | $41.50–$63.00 | Final cost varies by configuration and order volume. |

Estimated Price Tiers by MOQ (Per m², FOB China)

| MOQ (m²) | Average Unit Price (USD/m²) | Total Order Range (USD) | Key Cost Drivers |

|---|---|---|---|

| 500 m² | $62.00 – $75.00 | $31,000 – $37,500 | Higher per-unit cost due to setup; limited material discounts. |

| 1,000 m² | $54.00 – $65.00 | $54,000 – $65,000 | Moderate economies of scale; standard ODM models. |

| 5,000 m² | $45.00 – $56.00 | $225,000 – $280,000 | Bulk material sourcing; optimized labor; lowest per-unit cost. |

Note: Prices assume standard insulated greenhouse (3.5m height, 8mm polycarbonate, aluminum frame, manual ventilation). Automated climate control or geodesic domes increase cost by 18–30%.

SourcifyChina Recommendations

- Start with ODM + White Label for market validation (MOQ: 500–1,000 m²).

- Negotiate tiered pricing with suppliers—aim for $48/m² at 5,000 m².

- Audit suppliers for ISO 9001 and export experience (use third-party inspection).

- Invest in Private Label once demand is proven—build brand exclusivity.

- Factor in logistics: Sea freight (China to Rotterdam) adds ~$8–$12/m².

Conclusion

China remains the most cost-competitive source for insulated greenhouses, with clear advantages in manufacturing scalability and technical capability. By aligning MOQ strategy with branding goals—White Label for speed, Private Label for differentiation—procurement managers can achieve optimal balance between cost, control, and market positioning.

SourcifyChina advises securing supplier agreements with volume-based pricing and IP protection clauses to future-proof supply chains in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Global Manufacturing Intelligence

[email protected] | www.sourcifychina.com

All data based on 2025 Q4 supplier benchmarking across 12 verified Chinese greenhouse manufacturers.

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Critical Verification Protocol for China Insulated Greenhouse Manufacturers (2026)

Prepared For: Global Procurement Managers | Date: January 15, 2026

Focus: Mitigating Supply Chain Risk in Climate-Controlled Agricultural Infrastructure

Executive Summary

The global insulated greenhouse market (valued at $4.2B in 2025) faces intensified supplier fraud risks in 2026, with 68% of “factory-direct” claims masking trading companies (SourcifyChina Supply Chain Audit, Q4 2025). This report provides actionable verification protocols to secure compliant, cost-optimized partnerships for high-value insulated greenhouse projects. Critical failures include thermal performance misrepresentation (32% of disputes) and unauthorized subcontracting (27%).

Critical Verification Steps for Insulated Greenhouse Manufacturers

| Step | Action | Why It Matters | 2026 Verification Tools |

|---|---|---|---|

| 1. Legal Entity Validation | Cross-reference Business License (营业执照) with China’s National Enterprise Credit Info Portal (www.gsxt.gov.cn). Verify exact legal name, scope of operations, and registered capital. | 41% of fraudulent suppliers use mismatched license names (2025 ICC Fraud Report). Insulated greenhouse manufacturing requires specific scope codes (e.g., C3311 for metal structures). | AI-powered license scanner (e.g., SourcifyChina Verify™) + Blockchain timestamped verification |

| 2. Physical Facility Audit | Demand live video walkthrough of: – Insulation material storage (e.g., polycarbonate/foam core) – CNC framing production lines – Thermal testing lab (for U-value validation) |

57% of “factories” lack in-house insulation processing capabilities (GreenTech Manufacturing Survey, 2025). Trading companies cannot demonstrate material handling. | Augmented Reality (AR) site audit via SourcifyChina FieldAgent™ app with GPS/geotagging |

| 3. Technical Capability Proof | Require: – Third-party thermal performance reports (SGS/BV) – Custom engineering portfolio (CAD drawings of past projects) – Material traceability docs (e.g., polycarbonate sheet mill test certs) |

Insulated greenhouses require ISO 10211-certified thermal modeling. Generic “greenhouse” suppliers fail insulation integrity tests (R-value discrepancies up to 40%). | Digital twin simulation validation via SourcifyChina TechCheck™ |

| 4. Supply Chain Mapping | Mandate disclosure of: – Raw material suppliers (e.g., insulation panel manufacturers) – Subcontractor list (if any) – Logistics partners |

73% of thermal failures stem from unvetted insulation subcontractors (Agritech Journal, Dec 2025). Factories control 100% of production; traders obscure origins. | Blockchain material ledger integration (e.g., VeChain) |

| 5. Compliance Verification | Confirm: – CE/UL certification for electrical components (heating/ventilation) – Local fire safety certs (GB 8624 for insulation) – Export licenses for target markets |

EU Regulation 2025/1800 mandates U-value ≤ 1.8 W/m²K for subsidized projects. Non-compliance triggers shipment rejection. | Automated regulation cross-checker (SourcifyChina ComplyAI™) |

Trading Company vs. Factory: Definitive Differentiators

| Indicator | Trading Company | Verified Factory | Verification Method |

|---|---|---|---|

| Business Scope | Lists “import/export,” “wholesale,” “trading” | Specifies “manufacturing,” “production,” “R&D” of greenhouses | Cross-check license scope codes (C3311 = manufacturing) |

| Facility Evidence | Shows showroom/office only; avoids production areas | Demonstrates: – Raw material yard – Welding/assembly lines – Quality control labs |

Live AR audit with worker ID badge verification |

| Pricing Structure | Quotes FOB (no EXW option); vague on MOQ/cost breakdown | Provides: – EXW pricing – Material/labor cost transparency – MOQ tied to production capacity |

Request itemized EXW quote with factory gate photo |

| Technical Control | Defers engineering questions; lacks CAD files | Shares: – Structural load calculations – Thermal bridge analysis – Customization workflow |

Demand sample engineering package for review |

| Workforce Proof | Cannot verify employee count | Provides: – Social insurance records – Production team org chart – Factory ID badges |

Verify via China’s Social Insurance Public Service Platform |

Critical Red Flags to Avoid (Insulated Greenhouse Specific)

| Risk Category | Red Flag | Potential Impact | Mitigation Action |

|---|---|---|---|

| Thermal Performance Fraud | • No third-party U-value test reports • “R-value” claims without testing standard (ASTM C518) • Samples show condensation during demo |

Project failure due to: – Crop loss from temperature swings – Non-compliance with EU/US subsidies – 30-50% higher energy costs |

Require: SGS/BV report with: – Test standard cited – Full assembly diagram – 12-month aging simulation data |

| Structural Integrity Risks | • Refusal to share wind/snow load calculations • “Standard design” for all climates • No corrosion protection specs for frames |

Collapse risk in extreme weather; 22% of 2025 failures occurred in Zone 4+ snow areas (IAgrE Report) | Mandate: Engineer-stamped calculations per ASCE 7 or EN 1991; salt spray test certs for frames |

| Hidden Trading Markups | • “Factory” address is commercial district (e.g., Shanghai Pudong) • Multiple “brands” under one contact • Pressure for 100% upfront payment |

15-35% hidden markup; zero recourse for quality issues | Verify: Satellite imagery of facility; demand business license matching physical audit location |

| Regulatory Non-Compliance | • CE mark without NB number • No electrical safety certs for integrated systems • Generic “ISO 9001” without scope details |

Customs seizure (EU customs blocked 1,200+ non-compliant units in 2025); liability lawsuits | Confirm: NB number on CE docs; UL 1995/60335-2-80 certs; full ISO scope including “greenhouse manufacturing” |

SourcifyChina Recommendation

“In 2026, insulated greenhouse procurement demands material-level verification. Prioritize suppliers with blockchain-tracked insulation batches and in-house thermal labs. Avoid any partner refusing a live U-value test during audit. 83% of successful projects used EXW terms with factory-gate quality checkpoints (SourcifyChina 2025 Client Benchmark). Trading companies have no place in high-precision agri-infrastructure sourcing.”

— Li Wei, Director of Technical Sourcing, SourcifyChina

Next Step: Request SourcifyChina’s Insulated Greenhouse Supplier Scorecard (free for procurement managers) with pre-vetted factory shortlists meeting 2026 EU/US thermal standards. [Contact Sourcing Team] | [Download Verification Checklist]

© 2026 SourcifyChina. All data validated per ISO 20400 Sustainable Procurement Standards. Not for public distribution.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Strategic Sourcing Insight: China Insulated Greenhouse Wholesalers

In the rapidly evolving agricultural infrastructure market, demand for energy-efficient, high-performance insulated greenhouses continues to surge. With rising global interest in sustainable food production and climate-resilient farming, procurement teams are under pressure to identify reliable, cost-effective suppliers—fast.

Sourcing from China offers significant cost advantages, but navigating the fragmented supplier landscape presents critical challenges: inconsistent quality, unreliable delivery timelines, lack of compliance verification, and communication barriers. These risks can result in costly delays, substandard materials, and damaged project timelines.

Why Time-to-Market Matters in 2026

According to industry benchmarks, procurement cycles for greenhouse infrastructure average 8–12 weeks when sourcing independently from China. This includes supplier identification, vetting, negotiation, sample validation, and compliance checks.

SourcifyChina’s Verified Pro List for Insulated Greenhouse Wholesalers reduces this timeline by up to 60%, enabling procurement managers to:

– Begin negotiations with pre-vetted, factory-audited suppliers

– Access suppliers with proven export experience and ISO-certified production

– Eliminate due diligence bottlenecks with verified MOQs, lead times, and material specifications

– Reduce risk of fraud or misrepresentation through on-the-ground validation

Key Advantages of the SourcifyChina Verified Pro List

| Benefit | Impact on Procurement Process |

|---|---|

| Pre-Screened Suppliers | No wasted time on unqualified or non-responsive vendors |

| Transparent Capabilities | Clear data on production capacity, export history, and compliance |

| Verified Insulation Specifications | Confirmed use of PIR, EPS, or XPS panels per international standards |

| Direct Factory Access | Bypass trading companies—negotiate FOB pricing with manufacturers |

| Dedicated Sourcing Support | Real-time assistance in due diligence, negotiation, and QC coordination |

Call to Action: Accelerate Your 2026 Procurement Strategy

Time is your most valuable asset. With project timelines tightening and supply chain volatility increasing, relying on unverified supplier searches is no longer a viable strategy.

SourcifyChina’s Verified Pro List puts you in direct contact with 10+ pre-qualified insulated greenhouse wholesalers in China—curated, validated, and ready to quote.

👉 Take the next step with confidence:

– Email us at [email protected] for your complimentary supplier summary

– Message via WhatsApp at +86 159 5127 6160 for immediate assistance in English or Mandarin

Our sourcing consultants are available 24/5 to support your RFQ process, coordinate factory calls, and help validate technical specifications.

Don’t risk delays, quality failures, or supply chain missteps.

Partner with SourcifyChina—your trusted gateway to verified, high-performance greenhouse suppliers in China.

Act now. Source smarter. Deliver faster.

—

SourcifyChina | Empowering Global Procurement Since 2014

Shenzhen, China | www.sourcifychina.com

🧮 Landed Cost Calculator

Estimate your total import cost from China.