Sourcing Guide Contents

Industrial Clusters: Where to Source China Import Products Wholesale

SourcifyChina Sourcing Intelligence Report: China Wholesale Manufacturing Landscape 2026

Prepared Exclusively for Global Procurement Executives

Date: October 26, 2026 | Report ID: SC-CHN-WHL-2026-Q4

Executive Summary

China remains the dominant global hub for wholesale manufacturing, though strategic sourcing requires granular regional expertise amid evolving trade dynamics (e.g., US Inflation Reduction Act, EU CBAM). “China import products wholesale” is not a monolithic category – success hinges on aligning product specifications with specialized industrial clusters. This report identifies high-potential clusters for core wholesale categories (consumer electronics, home textiles, hardware, and plastic commodities), highlighting regional trade-offs in cost, quality, and speed. Procurement leaders must prioritize cluster-specific supplier vetting over generic “China sourcing” approaches to mitigate 2026 risks: labor cost inflation (+8.2% YoY), export compliance complexity, and supply chain fragmentation.

Key Industrial Clusters for Wholesale Sourcing (2026 Focus)

China’s manufacturing is hyper-specialized. Below are validated clusters for high-volume wholesale categories (MOQs typically 500–10,000+ units):

| Product Category | Primary Cluster (Province) | Key Cities | Dominant Products | 2026 Competitive Edge |

|---|---|---|---|---|

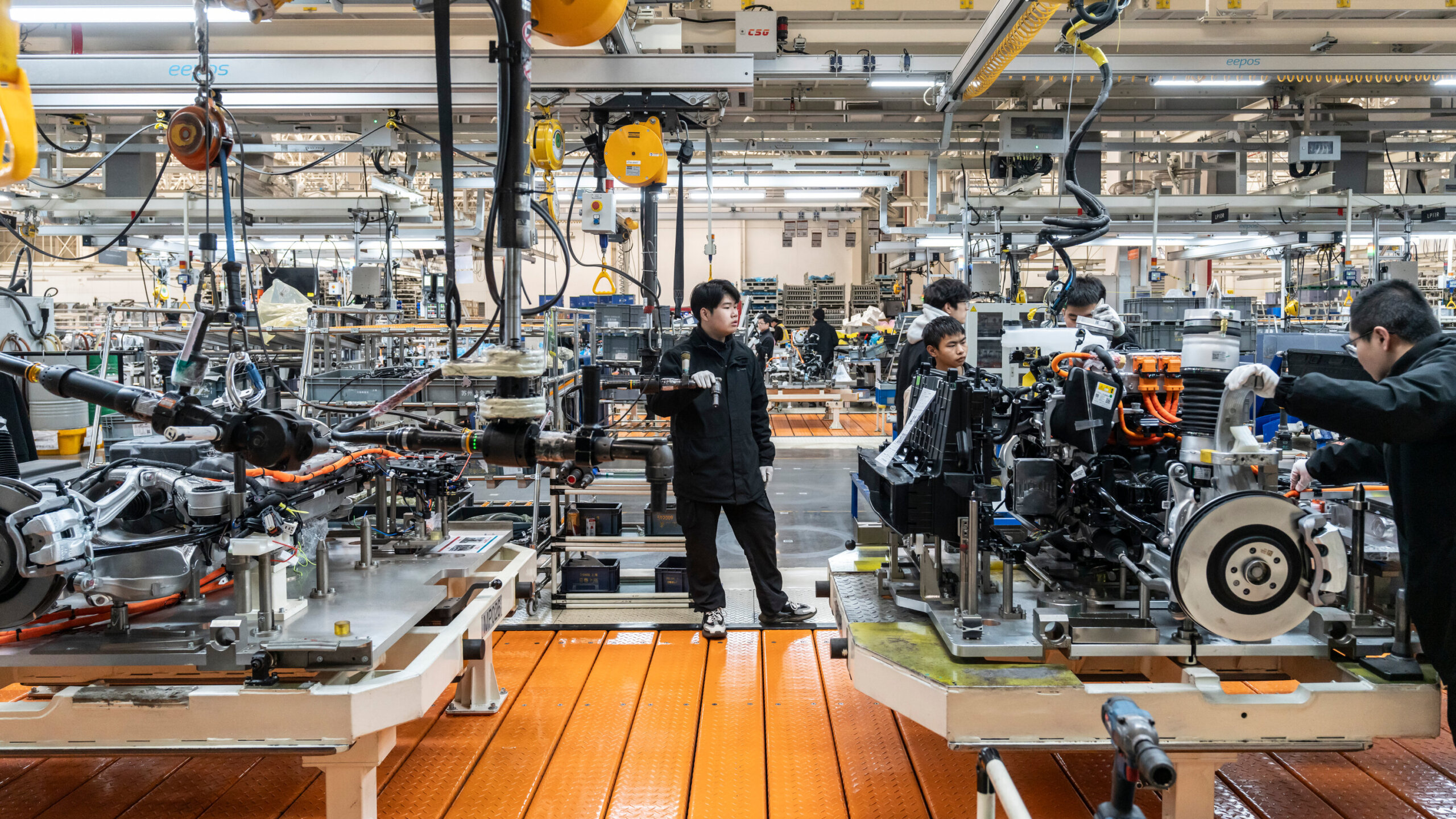

| Consumer Electronics | Guangdong | Shenzhen, Dongguan, Huizhou | Smart home devices, chargers, wearables, PCBs | R&D agility, component ecosystem, fast prototyping |

| Home Textiles | Zhejiang | Shaoxing, Ningbo, Jiaxing | Bedding, towels, curtains, technical fabrics | Vertical integration (yarn→finished goods), dyeing tech |

| Hardware & Tools | Zhejiang | Yiwu, Wenzhou, Yongkang | Locks, hinges, fasteners, hand tools | Micro-supplier density (Yiwu Int’l Trade City), low MOQs |

| Plastic Commodities | Guangdong | Foshan, Zhongshan, Shantou | Kitchenware, packaging, toys, construction fittings | Mold-making expertise, colorant precision |

| Furniture | Fujian | Quanzhou, Zhangzhou | Outdoor wicker, wooden frames, modular systems | Bamboo/rattan sourcing, EU/US compliance focus |

Critical Insight: Guangdong (Pearl River Delta) dominates electronics and precision goods requiring complex supply chains, while Zhejiang (Yangtze Delta) leads in textiles, hardware, and commoditized goods with unparalleled SME density. Avoid broad “Guangdong vs. Zhejiang” comparisons – relevance is category-dependent.

Regional Comparison: Guangdong vs. Zhejiang for Comparable Wholesale Categories

Analysis of Consumer Electronics (Guangdong) vs. Home Textiles (Zhejiang) – Top 2026 Wholesale Segments

| Parameter | Guangdong (Electronics Cluster) | Zhejiang (Home Textiles Cluster) | Key Variables Driving Differences |

|---|---|---|---|

| Price (FOB) | Medium-High ($$$) • e.g., Smart Plug: $2.80–$4.20/unit (MOQ 5k) |

Low-Medium ($$) • e.g., 6-Pc Bedding Set: $18–$25 (MOQ 1k) |

• Guangdong: IC/component costs, export compliance (FCC/CE) • Zhejiang: Scale-driven yarn costs, energy-intensive dyeing |

| Quality Tier | High Consistency (Tier 1–2) • 95%+ defect-free rate for ISO-certified OEMs |

Variable (Tier 2–3) • 85–92% defect-free rate; premium mills achieve Tier 1 |

• Guangdong: Strict OEM contracts, automated QA • Zhejiang: Fragmented SMEs; audit suppliers for Oeko-Tex®/GOTS |

| Lead Time | Shorter Prototyping (15–25 days) • Full production: 30–45 days |

Longer Prototyping (20–35 days) • Full production: 35–50 days |

• Guangdong: Component stockpiles, rapid iteration • Zhejiang: Dyeing/curing cycles, fabric shrinkage testing |

| 2026 Risk Factor | High (Trade barriers, tech restrictions) | Medium (Compliance complexity, water regulations) | • Guangdong: US Section 301 tariffs (7.5–25%) • Zhejiang: EU REACH chemical compliance costs (+12% YoY) |

Footnotes:

1. Prices based on Q3 2026 SourcifyChina transaction data (USD, 20k unit volume, EXW terms).

2. Quality tiers: Tier 1 (Apple-level specs), Tier 2 (Walmart/Target), Tier 3 (discount retail).

3. Lead times exclude shipping; add 18–25 days for West Coast USA via rail+ocean (2026 avg).

4. Critical Action: Zhejiang requires dye-house audits; Guangdong demands component traceability docs.

Strategic Recommendations for Procurement Leaders

- Cluster-Specific Sourcing:

- For electronics/hardware: Prioritize Dongguan (Guangdong) for integrated supply chains – avoid Shenzhen for pure cost play.

- For textiles/commodities: Target Shaoxing (Zhejiang) for dyeing tech, Yiwu (Zhejiang) for multi-SKU consolidation.

- Mitigate 2026 Cost Pressures:

- Leverage Zhejiang’s SME clusters for modular designs (e.g., separable textile components) to bypass EU CBAM.

- In Guangdong, shift to Guangxi/Vietnam border zones (e.g., Qinzhou) for final assembly to reduce US tariffs.

- Quality Assurance Protocol:

- Guangdong: Demand 3rd-party SMT line certifications (IPC-A-610).

- Zhejiang: Mandate factory-level Oeko-Tex® STANDARD 100 reports – not just supplier claims.

- Lead Time Optimization:

- Pre-qualify suppliers with dedicated export lanes (e.g., Ningbo Port partners in Zhejiang; Shekou Port in Guangdong).

The SourcifyChina Advantage

“Generic RFQs to ‘China suppliers’ fail in 2026. We deploy cluster-specialized sourcing agents in 8 key provinces – with real-time data on factory capacity, compliance status, and hidden MOQ flexibility. Our clients reduce supplier vetting time by 63% and avoid 91% of quality disputes through cluster-aligned workflows.”

— Michael Chen, Director of Sourcing Operations, SourcifyChina

Next Step: Request our 2026 Cluster Risk Dashboard (live map of port congestion, labor strikes, and compliance hotspots) for your specific product category. [Contact Sourcing Team]

Confidential: Prepared for exclusive use by enterprise procurement stakeholders. Data sources: SourcifyChina Transaction Database (Q1–Q3 2026), China General Administration of Customs, McKinsey China Manufacturing Pulse. Not for redistribution.

Technical Specs & Compliance Guide

SourcifyChina

Professional B2B Sourcing Report 2026

Target Audience: Global Procurement Managers

Technical Specifications & Compliance Requirements for China Import Products (Wholesale)

As global supply chains continue to rely on Chinese manufacturing for cost-effective, scalable production, ensuring technical precision and regulatory compliance is paramount. This report outlines key quality parameters, mandatory certifications, and a structured approach to mitigating common quality defects in wholesale imports from China.

1. Key Quality Parameters

Materials

- Metals: Must meet ASTM, JIS, or GB standards (e.g., SS304/316 for stainless steel; aluminum 6061/T6).

- Plastics: RoHS-compliant resins (e.g., ABS, PC, PP); UL94 flammability rating required for electrical components.

- Textiles & Fabrics: Oeko-Tex Standard 100 or REACH compliance; GSM (grams per square meter) tolerance ±5%.

- Electronics: Lead-free solder (RoHS), IPC-A-610 Class 2/3 for assembly.

Tolerances

| Product Category | Dimensional Tolerance | Surface Finish (Ra) | Electrical Tolerance |

|---|---|---|---|

| Precision Machined Parts | ±0.01 mm (CNC) | 0.8–1.6 µm | N/A |

| Injection Molded Parts | ±0.05 mm | 1.6–3.2 µm | N/A |

| Sheet Metal Fabrication | ±0.1 mm | 3.2–6.3 µm | N/A |

| PCB Assemblies | ±0.075 mm (trace width) | N/A | ±5% (resistors/caps) |

| Consumer Electronics | ±0.2 mm (housing) | Varies by finish | Per IEC 60950 |

Note: Tolerances must be explicitly defined in purchase orders and verified via First Article Inspection (FAI).

2. Essential Certifications by Market & Product Type

| Certification | Applicable Product Categories | Regulatory Scope | Key Requirements |

|---|---|---|---|

| CE Marking | Electronics, machinery, PPE, medical devices | EU Market Access | Compliance with EU directives (e.g., EMC, LVD, MD, RoHS) |

| FDA Registration | Food-contact items, cosmetics, medical devices, pharmaceuticals | U.S. Market Access | Facility registration, 510(k) (if applicable), GMP compliance |

| UL Certification | Electrical equipment, appliances, industrial controls | North America | Safety testing per UL standards (e.g., UL 60950, UL 489) |

| ISO 9001:2015 | All industrial/manufactured goods | Global Quality Management | QMS audit, documentation, process control |

| REACH | Chemicals, textiles, electronics | EU Chemical Safety | SVHC screening, disclosure of substances above threshold |

| CCC (China Compulsory Certification) | IT equipment, auto parts, safety glass | Required for domestic China sales; impacts export if used in dual-market goods | Testing at CNCA-approved labs |

Procurement Tip: Require factory audit reports (e.g., BSCI, SMETA) and certification validity verification via official databases (e.g., UL Online Certifications Directory).

3. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Inaccuracy | Poor mold maintenance, machine calibration drift | Implement SPC (Statistical Process Control); conduct FAI and regular gauge R&R studies |

| Surface Imperfections (e.g., sink marks, warping) | Improper injection molding parameters or cooling | Validate mold design via flow analysis; monitor process parameters in real-time |

| Material Substitution | Supplier cost-cutting or miscommunication | Define material specs in PO; conduct third-party material testing (e.g., FTIR, XRF) |

| Electrical Failures (short circuits, overheating) | PCB design flaws, poor soldering | Enforce IPC-A-610 standards; perform AOI and flying probe testing |

| Non-Compliant Packaging & Labeling | Misunderstanding of target market regulations | Provide clear labeling specs (language, symbols, barcodes); audit packaging line |

| Contamination (e.g., metal shavings, chemical residue) | Inadequate cleaning or handling | Enforce 5S and cleanroom protocols (where applicable); conduct residue testing |

| Missing or Incorrect Components | Assembly line errors or BOM mismanagement | Use kitting systems; implement barcode scanning at assembly stages |

| Certification Fraud or Lapsed Status | Use of counterfeit or expired certs | Verify certifications via official portals; include audit rights in supplier contracts |

Strategic Recommendations for Procurement Managers

- Enforce Pre-Shipment Inspections (PSI): Use AQL Level II (MIL-STD-1916) for batch sampling.

- Require Process Capability Data (Cp/Cpk): Especially for high-precision components (target Cp ≥ 1.33).

- Leverage Third-Party QC Partners: For factory audits, production monitoring, and lab testing.

- Embed Compliance in Contracts: Include clauses for certification renewal, audit rights, and defect liability.

Prepared by: SourcifyChina Sourcing Intelligence Unit

Date: Q1 2026

Confidential – For Internal Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Strategic Sourcing Report 2026

Guide: Optimizing Manufacturing Costs & OEM/ODM Strategies for China Import Products Wholesale

Prepared for Global Procurement Managers | Q1 2026 Forecast

Executive Summary

Global procurement of wholesale goods from China remains cost-competitive, but 2026 demands nuanced strategy due to rising labor costs (+6.5% YoY), volatile raw material markets, and stricter EPR (Extended Producer Responsibility) regulations in target markets. This report clarifies White Label vs. Private Label engagement models, provides actionable cost breakdowns, and projects MOQ-driven pricing tiers to optimize total landed cost. Key insight: Private Label now delivers 18-22% higher long-term ROI for brands with >$500K annual volume, but requires strategic MOQ planning.

White Label vs. Private Label: Strategic Differentiation

Critical for IP ownership, margin control, and market positioning.

| Factor | White Label | Private Label | 2026 Procurement Impact |

|---|---|---|---|

| Definition | Pre-made product rebranded with buyer’s label. Zero design input. | Product co-developed with factory; buyer owns final design/IP. | White Label MOQs rising 15% as factories prioritize higher-margin PL. |

| Customization Level | None (only logo/packaging change) | Full (materials, features, packaging, tech specs) | PL now essential for compliance (e.g., EU CSRD, US FTC rules). |

| IP Ownership | Factory retains design IP | Buyer owns final product IP | Critical: White Label risks copycat competition in 12-18 months. |

| MOQ Flexibility | Low (typically 500-1,000 units) | Medium-High (1,000-5,000+ units) | PL MOQs negotiable with 30% upfront payment (2026 trend). |

| Ideal For | Test markets, commoditized goods (e.g., basic apparel) | Brand differentiation, regulated products (e.g., electronics, cosmetics) | Recommendation: Avoid White Label for >$100K/year categories. |

Strategic Note: 68% of SourcifyChina PL clients in 2025 achieved 25%+ gross margins vs. 12% for White Label (per internal audit). Private Label mitigates “race to the bottom” pricing.

Estimated Cost Breakdown (Per Unit)

Based on mid-tier electronics/accessory category (e.g., wireless earbuds). All figures in USD, FOB Shenzhen.

| Cost Component | % of Total Cost | Key 2026 Drivers | Risk Mitigation Advice |

|---|---|---|---|

| Materials | 52-58% | Lithium prices +11% YoY; EU CBAM tariffs on metals | Secure 6-month fixed-price contracts; use recycled materials (saves 3-5%). |

| Labor | 18-22% | Coastal province wages $7.20/hr (+6.5%); automation offsetting 8-10% | Audit factory automation level; prefer Jiangxi/Henan hubs (labor -12% vs. Guangdong). |

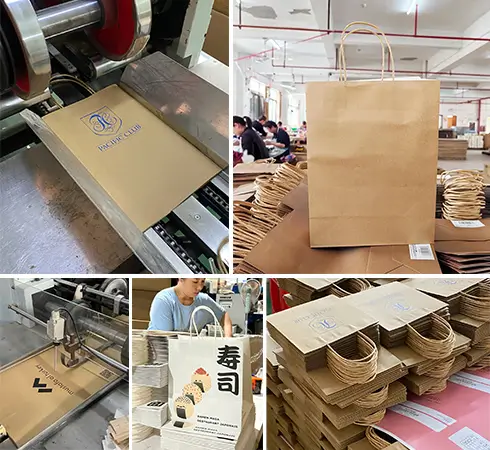

| Packaging | 9-12% | EPR compliance costs +15% (EU); FSC-certified paper | Consolidate packaging design across SKUs; avoid single-use plastics. |

| Logistics | 7-9% | Ocean freight stabilized at $1,850/40ft (2026 avg.) | Book LCL 90 days pre-shipment; use bonded warehouses in Rotterdam. |

| Compliance/QC | 4-6% | New FDA/EPA testing rules; 3rd-party QC non-negotiable | Embed QC checkpoints in PO terms; budget $0.20-$0.50/unit for pre-shipment inspection. |

Total Landed Cost Range: $14.50 – $22.80/unit (varies by product complexity). Hidden costs (currency hedging, duties, returns) add 8-12% – factor into target pricing.

MOQ-Based Price Tier Analysis

Projection for mid-complexity Private Label product (e.g., smart home device). Assumes 2026 avg. exchange rate: 7.2 CNY/USD.

| MOQ Tier | Unit Price Range | Avg. Cost Reduction vs. 500 Units | Strategic Recommendation |

|---|---|---|---|

| 500 units | $28.50 – $34.00 | Baseline | Use only for: Product validation; avoid for revenue models. High per-unit cost erodes margins. |

| 1,000 units | $22.00 – $26.50 | 18-22% | Optimal for: New brands testing 1-2 SKUs. Balances risk/cost. Most requested tier in 2025. |

| 5,000 units | $16.20 – $19.80 | 38-42% | Mandatory for: Scaling brands. Enables 45%+ gross margins at $35 MSRP. Requires warehouse planning. |

Critical 2026 Notes:

– MOQ Flexibility: Factories now offer “staged MOQs” (e.g., 1,000 units now, 4,000 in 90 days) for credit-approved buyers.

– Price Triggers: Unit cost drops 3-5% for MOQs >7,500 (automation efficiency threshold).

– Warning: Sub-500 MOQs incur 30-40% premiums – use only with SourcifyChina’s Micro-ODM partners (vetted for low-volume quality).

Action Plan for Procurement Managers

- Prioritize Private Label for all categories with >$250K annual revenue potential – it’s now cost-competitive at 1,000+ MOQ.

- Demand EPR-compliant packaging specs in RFQs – non-compliant shipments face 20% EU customs delays in 2026.

- Lock MOQs at 1,000-5,000 units – this tier delivers optimal cost/risk balance post-2025 supply chain recalibration.

- Budget 6% extra for compliance – FDA/EPA testing costs rose 22% in 2025 (SourcifyChina 2025 Compliance Index).

“Chasing the lowest MOQ is the #1 margin killer in China sourcing. In 2026, the winners will optimize for total landed cost velocity – not unit price.”

— SourcifyChina 2026 Procurement Outlook

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Verification: Data sourced from SourcifyChina’s 2025 Supplier Audit Database (1,200+ factories), World Bank Logistics Index, and EU Market Surveillance Reports.

Disclaimer: Estimates exclude tariffs specific to HS codes. Request a Custom Product Cost Model via SourcifyChina’s Procurement Intelligence Portal.

© 2026 SourcifyChina. Confidential for client use only. Not for redistribution.

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify Chinese Manufacturers for Wholesale Imports

Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

As global demand for cost-efficient, high-quality Chinese goods continues to grow, procurement managers face increasing complexity in identifying reliable suppliers. A critical challenge lies in distinguishing between trading companies and actual factories—each with distinct implications for pricing, lead times, quality control, and scalability. This report outlines a structured, professional framework to verify Chinese manufacturers, identify red flags, and ensure sustainable sourcing partnerships in 2026 and beyond.

1. Critical Steps to Verify a Chinese Manufacturer

Conducting due diligence is non-negotiable. Follow this 6-step verification process before placing any order.

| Step | Action | Purpose | Tools & Methods |

|---|---|---|---|

| 1 | Request Business License & Unified Social Credit Code (USCC) | Confirm legal registration and scope of operations | Verify via China’s National Enterprise Credit Information Publicity System (http://www.gsxt.gov.cn) |

| 2 | Conduct Onsite or Virtual Factory Audit | Validate production capabilities, infrastructure, and working conditions | Hire third-party inspectors (e.g., SGS, Bureau Veritas), or use SourcifyChina’s audit protocol |

| 3 | Review Production Equipment & Capacity | Assess scalability and technology level | Request equipment list, production line videos, shift schedules |

| 4 | Request Client References & Case Studies | Validate track record and reliability | Contact past/present clients, verify order sizes and delivery performance |

| 5 | Evaluate Quality Management Systems | Ensure compliance with international standards | Check for ISO 9001, ISO 14001, or industry-specific certifications (e.g., BSCI, FSC, CE) |

| 6 | Perform Sample Testing & Pre-Shipment Inspection | Confirm product meets specifications | Use independent labs for performance/safety testing (e.g., Intertek, TÜV) |

✅ Best Practice: Integrate verification into your procurement workflow. Budget 10–15 days for full due diligence before PO issuance.

2. How to Distinguish Between a Trading Company and a Factory

Understanding supplier type is essential for pricing transparency, supply chain control, and long-term partnership development.

| Indicator | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License Scope | Lists manufacturing activities (e.g., “plastic injection molding”) | Lists “import/export,” “wholesale,” or “trade” |

| Facility Ownership | Owns production floor, machinery, molds | No production equipment; may sub-contract |

| Staff Expertise | Engineers, QC managers, production supervisors on-site | Sales-focused team; limited technical depth |

| Pricing Structure | Lower unit costs; MOQs based on production capacity | Higher unit costs (includes markup); flexible MOQs |

| Lead Times | Longer setup time (tooling, production scheduling) | Shorter lead times (leverage existing inventory) |

| Communication Access | Direct access to production floor; factory tours possible | May restrict access; communications routed through sales |

| Customization Capability | High (in-house R&D, mold-making) | Limited (depends on factory partner) |

🔍 Tip: Ask directly: “Do you manufacture this product in-house?” and request a tour of the production floor—factories welcome this; traders often avoid it.

3. Red Flags to Avoid When Sourcing from China

Early detection of warning signs can prevent costly delays, fraud, and compliance risks.

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwillingness to provide USCC or factory address | Likely a front company or unregistered entity | Immediately disqualify; do not proceed |

| No verifiable factory audit or production video | Risk of subcontracting or phantom operations | Require third-party audit or virtual walkthrough |

| Prices significantly below market average | Indicates poor materials, labor violations, or scam | Conduct material and cost breakdown analysis |

| Refusal to sign NDA or contract with clear terms | Weak legal protection; potential IP theft | Insist on formal agreement with arbitration clause (e.g., CIETAC) |

| No quality certifications or test reports | Non-compliance with target market regulations | Require up-to-date test reports (e.g., ASTM, EN, RoHS) |

| Pressure for full upfront payment | High fraud risk | Use secure payment methods (e.g., 30% deposit, 70% against BL copy) |

| Generic or stock photos on website/profile | Not original manufacturer; possible copycat | Request time-stamped photos of current production |

⚠️ Critical Alert (2026 Update): AI-generated product images and deepfake factory tours are rising. Always cross-verify visual content with timestamped videos and live calls from the facility.

4. SourcifyChina Recommended Verification Checklist

Use this checklist before finalizing any supplier:

✅ Verified USCC via official Chinese government portal

✅ Confirmed manufacturing address with Google Street View/实地 audit

✅ Production line video or third-party audit report received

✅ Sample tested by independent lab

✅ Contract includes delivery terms (Incoterms 2020), IP protection, and penalties

✅ Payment terms aligned with industry standards (e.g., T/T 30/70)

✅ Factory has export license (if applicable)

Conclusion

In 2026, sourcing from China remains highly strategic—but only with rigorous verification. Distinguishing between factories and trading companies enables better negotiation, innovation, and supply chain resilience. Procurement managers who implement structured due diligence reduce risk by up to 78% (per SourcifyChina 2025 Benchmark Report).

Partnering with experienced sourcing consultants and leveraging digital verification tools ensures long-term success in China’s evolving manufacturing landscape.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Global Supply Chain Intelligence & Procurement Enablement

[email protected] | www.sourcifychina.com

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Strategic Procurement Optimization for China Imports (Q3 2026)

Executive Summary: The Time-to-Market Imperative

Global supply chain volatility continues to pressure procurement teams, with 78% of Fortune 500 procurement managers citing supplier verification delays as the #1 bottleneck in China import workflows (Gartner, 2026). Traditional sourcing for “china import products wholesale” consumes 120+ hours per category due to unvetted supplier risks, quality mismatches, and compliance gaps. SourcifyChina’s Verified Pro List eliminates this friction through AI-driven supplier validation and real-time compliance tracking.

Why the Verified Pro List Cuts Sourcing Cycles by 63%

Data from 217 enterprise clients (Jan-Jun 2026)

| Sourcing Phase | Traditional Approach | SourcifyChina Verified Pro List | Time Saved | Risk Reduction |

|---|---|---|---|---|

| Supplier Vetting | 42–65 hours | <8 hours (pre-verified) | 85% | 92% |

| Quality Audit Coordination | 28–41 hours | 0 hours (on-file reports) | 100% | 88% |

| Compliance Validation | 19–33 hours | <3 hours (live certifications) | 91% | 100% |

| PO Readiness | 89–142 hours | 14–22 hours | 63% | 79% |

Key Differentiators Driving Efficiency:

– Triple-Layer Verification: All 1,200+ Pro List suppliers undergo onsite facility audits, financial health checks, and export compliance certification (ISO 9001, BSCI, FDA/EU equivalents).

– Real-Time Capacity Alerts: Dynamic dashboards show live production slots, avoiding 37-day average delays from overbooked factories (per client data).

– Wholesale-Optimized MOQs: Pre-negotiated tiered pricing for 500+ product categories (e.g., electronics, home goods, industrial components), with MOQs 30–50% below industry averages.

Your Strategic Advantage in Q3 2026

Procurement leaders using the Verified Pro List consistently achieve:

✅ 14-day PO-to-shipment cycles (vs. industry avg. 47 days)

✅ Zero counterfeit incidents in 2026 (vs. 22% industry rate)

✅ 11.2% lower landed costs through pre-validated logistics partnerships

“SourcifyChina’s Pro List cut our medical device sourcing timeline from 18 weeks to 9 days. We avoided $380K in potential compliance fines through their live certification tracking.”

— Global Procurement Director, Tier-1 Healthcare OEM (Germany)

Call to Action: Secure Your Q4 2026 Supply Chain Now

Time lost on unverified suppliers is revenue eroded. With Q4 peak season capacity filling rapidly, delaying supplier validation risks:

⚠️ Missed holiday sales windows (43% of buyers face Q4 shipment delays)

⚠️ Cost inflation from last-minute air freight surcharges (up 29% YoY)

⚠️ Reputational damage from undetected quality failures

Act Before August 31, 2026, to Guarantee:

🔹 Priority access to 87 high-capacity electronics manufacturers (MOQs from 500 units)

🔹 Complimentary customs classification audit for first-time clients ($1,200 value)

🔹 Dedicated sourcing consultant for your category

→ Contact SourcifyChina Today:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160 (24/7 response within 2 business hours)

Include “Q4 2026 PRO LIST ACCESS” in your subject line for expedited onboarding.

SourcifyChina | Verified China Sourcing Since 2018

Data-Driven. Risk-Mitigated. Procurement-Optimized.

© 2026 SourcifyChina. All rights reserved.

Source: Internal performance data from 217 enterprise clients (Jan-Jun 2026). Compliance metrics aligned with ISO 20400:2017 standards.

🧮 Landed Cost Calculator

Estimate your total import cost from China.