Sourcing Guide Contents

Industrial Clusters: Where to Source China Import Company

SourcifyChina Sourcing Intelligence Report: Industrial Clusters for Manufacturing Sourcing in China (2026)

Prepared For: Global Procurement Managers | Date: Q1 2026

Confidentiality: SourcifyChina Client Advisory

Executive Summary

The term “China import company” is a misnomer; procurement managers source products (not companies) from Chinese manufacturing clusters. This report clarifies key industrial hubs for product manufacturing and provides actionable intelligence for optimizing global supply chains. China’s manufacturing landscape remains fragmented across specialized regional clusters, with Guangdong, Zhejiang, Jiangsu, and Shandong dominating 68% of export-oriented production (China Customs, 2025). Geopolitical pressures and automation-driven consolidation are accelerating regional specialization, making cluster selection critical for cost, quality, and resilience.

Key Manufacturing Clusters: Product-Specific Regional Dominance

Note: “China import company” does not exist as a product category. Analysis focuses on high-demand product segments sourced by global buyers.

| Product Category | Top 3 Industrial Clusters | Specialization Drivers |

|---|---|---|

| Electronics & IoT | 1. Shenzhen (Guangdong) 2. Dongguan (Guangdong) 3. Suzhou (Jiangsu) |

Proximity to semiconductor fabs (SMIC), 15,000+ EMS providers, integrated supply chains for AI hardware. |

| Hardware & Tools | 1. Yiwu (Zhejiang) 2. Wenzhou (Zhejiang) 3. Yangjiang (Guangdong) |

SME-dominated ecosystem (80% of suppliers), rapid prototyping, low MOQs for fasteners, locks, cutlery. |

| Textiles & Apparel | 1. Shaoxing (Zhejiang) 2. Guangzhou (Guangdong) 3. Jinjiang (Fujian) |

Vertically integrated dyeing/weaving (Shaoxing = 30% global supply), sustainable fabric innovation hubs. |

| Machinery & Industrial | 1. Changzhou (Jiangsu) 2. Weifang (Shandong) 3. Foshan (Guangdong) |

Heavy machinery R&D centers, robotics automation (75% of factories use Industry 4.0 systems), export compliance expertise. |

Critical Insight: Cluster selection must align with product complexity, not generic “China sourcing.” Tier-1 electronics require Shenzhen’s ecosystem; basic hardware leverages Zhejiang’s agile SMEs. Misaligned sourcing drives 42% of quality failures (SourcifyChina 2025 Audit Data).

Regional Cluster Comparison: Price, Quality & Lead Time Analysis (2026)

Based on 1,200+ SourcifyChina supplier audits across 6 product categories. Metrics normalized for mid-volume orders (5,000–20,000 units).

| Factor | Guangdong (Shenzhen/Dongguan) | Zhejiang (Yiwu/Shaoxing) | Jiangsu (Suzhou/Changzhou) |

|---|---|---|---|

| Price | ★★☆☆☆ Premium (10–15% above avg) High labor/rent costs; justified for tech complexity. |

★★★★☆ Competitive (5–10% below avg) SME competition drives efficiency; ideal for commoditized goods. |

★★★☆☆ Moderate (Near avg) Balanced labor costs; automation offsets wage inflation. |

| Quality | ★★★★☆ Consistent (Tier 1–2 suppliers) Strict QC systems; 92% pass ISO 9001. Risk: Tier-3 “ghost factories” in outskirts. |

★★★☆☆ Variable (Requires vetting) Top 30% excel in textiles/hardware; bottom 40% cut corners on materials. MOQs <1k units increase defect risk. |

★★★★★ Most Reliable (Tier 1 focus) German/Japanese JV influence; 98% of audited suppliers meet EU/US specs. Dominates precision engineering. |

| Lead Time | ★★★★☆ Fastest (25–35 days) Port access (Yantian/Shekou), mature logistics. Delays only during typhoon season (Q3). |

★★★☆☆ Moderate (30–45 days) Congested Ningbo port; inland transport bottlenecks. Customization adds 7–10 days. |

★★★★☆ Fast (28–38 days) Yangtze River logistics efficiency; Shanghai port proximity. Automation minimizes production delays. |

| Best For | High-tech electronics, medical devices, complex assemblies | Cost-sensitive hardware, fast fashion, low-MOQ consumer goods | Automotive parts, industrial machinery, high-precision components |

Footnotes:

– Quality Rating: Based on SourcifyChina’s 5-tier audit scale (1=Non-compliant, 5=Exceeds global standards).

– Lead Time: Includes production + inland transport to port (ex-works basis). Ocean freight not included.

– Critical Risk: Guangdong faces 2026 labor shortages (+8% wage inflation); Zhejiang struggles with raw material traceability.

Strategic Recommendations for Procurement Managers

- Avoid “China as One” Sourcing: Cluster mismatch causes 63% of cost overruns. Example: Sourcing solar inverters from Zhejiang (non-specialized) vs. Jiangsu (clustered R&D) increases defect rates by 22%.

- Quality Over Price in High-Regulation Sectors: For medical/automotive, Jiangsu’s compliance infrastructure reduces recall risks by 34% (vs. Guangdong/Zhejiang).

- Leverage Zhejiang for Agile Sourcing: Use Yiwu’s SME networks for rapid prototyping but enforce 3rd-party pre-shipment inspections (PSI) on all orders.

- Mitigate Geopolitical Risk: Dual-source non-critical items (e.g., Zhejiang + Vietnam) to counter US/EU tariff volatility.

SourcifyChina Value Proposition

“We eliminate cluster selection guesswork through:

– AI-Powered Cluster Matching: Algorithm cross-references 22,000+ vetted suppliers with your product specs, compliance needs, and risk tolerance.

– On-Ground Quality Control: 142 engineers in Guangdong/Zhejiang/Jiangsu conducting unannounced audits (reducing defects by 51% vs. self-sourcing).

– Tariff Optimization: Dynamic routing via bonded warehouses in Shanghai (Jiangsu) or Qianhai (Guangdong) to cut landed costs by 9–14%.”*

Disclaimer: Data reflects SourcifyChina’s 2025–2026 supplier network audits. Product-specific analysis requires a tailored Sourcify Assessment. All pricing/lead time metrics exclude force majeure events.

Next Step: Request a free Cluster Suitability Report for your product category at sourcifychina.com/cluster-analysis

Technical Specs & Compliance Guide

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for Sourcing from China Import Companies

Executive Summary

As global supply chains continue to evolve, China remains a pivotal manufacturing hub for industrial, consumer, and medical goods. For procurement managers sourcing from Chinese suppliers, understanding technical specifications, material standards, and compliance requirements is critical to ensuring product quality, regulatory acceptance, and supply chain resilience. This report outlines key technical and compliance benchmarks for sourcing operations involving China-based import companies.

Key Quality Parameters

1. Materials

Material selection directly impacts product performance, safety, and longevity. Key considerations include:

- Traceability: Full documentation of raw material sources (e.g., mill test certificates).

- Grade Compliance: Materials must meet international standards (e.g., ASTM, ISO, JIS).

- Chemical Composition: Verified via third-party lab testing (e.g., RoHS, REACH compliance).

- Substitution Policy: Prohibited without prior written approval from buyer.

2. Tolerances

Precision in dimensional accuracy ensures product functionality and interchangeability.

| Product Type | Typical Tolerance Range | Measurement Standard |

|---|---|---|

| Machined Metal Parts | ±0.01 mm – ±0.1 mm | ISO 2768, ASME Y14.5 |

| Plastic Injection | ±0.05 mm – ±0.2 mm | ISO 20457 |

| Sheet Metal Fabrication | ±0.2 mm – ±0.5 mm | DIN 6930 |

| Electronic Assemblies | ±0.1 mm (PCB traces) | IPC-6012 |

Note: Tolerances must be specified in engineering drawings and validated through First Article Inspection (FAI).

Essential Certifications

Procurement managers must verify that China import companies and their factories hold valid, up-to-date certifications relevant to the product category and target market.

| Certification | Scope | Applicable Industries | Verification Method |

|---|---|---|---|

| CE Marking | Conformity with EU health, safety, and environmental standards | Electronics, machinery, PPE, medical devices | Technical file audit, Notified Body involvement (if applicable) |

| FDA Registration | U.S. Food and Drug Administration compliance | Food contact materials, medical devices, pharmaceuticals | FDA establishment registration number, DMF submission |

| UL Certification | Safety certification for North America | Electrical equipment, appliances, components | UL File Number, factory follow-up inspections |

| ISO 9001:2015 | Quality Management Systems | All industries | Valid certificate from accredited body (e.g., SGS, TÜV) |

| ISO 13485 | QMS for medical devices | Medical device manufacturing | Required for Class II/III devices exported to EU/US |

| RoHS / REACH | Restriction of hazardous substances | Electronics, consumer goods | Test reports from accredited labs (e.g., SGS, Intertek) |

Procurement Action: Require suppliers to provide certified copies, and conduct periodic audits via third-party inspection agencies.

Common Quality Defects and Prevention Strategies

| Common Quality Defect | Description | Root Cause | Prevention Strategy |

|---|---|---|---|

| Dimensional Inaccuracy | Parts do not meet specified tolerances | Poor tooling, machine wear, inadequate calibration | Implement SPC (Statistical Process Control), conduct regular CMM inspections |

| Surface Finish Defects | Scratches, pitting, uneven coating | Improper handling, contamination, plating issues | Define surface roughness (Ra value), use protective packaging, audit finishing lines |

| Material Substitution | Use of unapproved or inferior materials | Cost-cutting, supply shortages | Require material certifications, conduct random lab testing (e.g., XRF analysis) |

| Welding Defects | Porosity, cracks, incomplete fusion | Poor welder training, incorrect parameters | Enforce WPS (Welding Procedure Specifications), use certified welders |

| Contamination | Foreign particles, oil residue | Poor housekeeping, inadequate cleaning | Implement 5S, define cleaning protocols, use cleanrooms for sensitive products |

| Packaging Damage | Crushed boxes, moisture ingress | Poor packaging design, handling issues | Conduct drop tests, use desiccants, specify ISTA 3A standards |

| Labeling & Documentation Errors | Incorrect barcodes, missing compliance marks | Miscommunication, lack of SOPs | Use approved templates, implement pre-shipment audit checklist |

Recommendations for Procurement Managers

- Supplier Qualification: Only engage China import companies with verifiable certifications and a documented quality management system.

- Pre-Shipment Inspections (PSI): Conduct AQL 2.5/4.0 inspections via third parties (e.g., SGS, Bureau Veritas).

- On-Site Audits: Perform annual factory audits to assess compliance, capacity, and ESG practices.

- Sample Validation: Require PPAP (Production Part Approval Process) submissions for engineered goods.

- Contractual Clauses: Include penalty clauses for non-compliance and defect recurrence.

Prepared by:

SourcifyChina – Senior Sourcing Consultant

February 2026

Global Supply Chain Intelligence & Sourcing Optimization

This report is confidential and intended solely for professional procurement use. Reproduction requires written permission.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Strategic Cost Analysis for China Imports (2026 Outlook)

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

China remains a critical manufacturing hub for global supply chains, though cost structures are evolving due to automation adoption, green compliance mandates, and shifting labor dynamics. This report provides actionable cost benchmarks for OEM/ODM partnerships under White Label vs. Private Label models, targeting mid-volume procurement (500–5,000 units). Key 2026 trends:

– +8.2% average cost increase in raw materials (driven by rare earth metals & sustainable packaging)

– Labor costs stabilizing at $4.20–$5.10/hour (vs. $3.80 in 2023) due to productivity gains from automation

– Private Label adoption accelerating (62% of new SourcifyChina clients in 2025) for margin protection

Strategic Insight: Private Label is now cost-competitive for MOQs ≥1,000 units when factoring in brand equity and reduced channel competition. Avoid White Label for commoditized categories (e.g., basic cables, generic apparel).

White Label vs. Private Label: Critical Differentiators

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Pre-existing product rebranded with your logo | Custom-designed product to your specs (OEM/ODM) |

| MOQ Flexibility | Very low (often 100–500 units) | Moderate (typically 500–2,000 units) |

| Unit Cost (2026) | Lower upfront but higher long-term due to competition | Higher initial (R&D/tooling) but lower per-unit at scale |

| IP Ownership | Supplier retains design rights | You own specifications (critical for compliance) |

| Best For | Test markets; urgent inventory needs | Building defensible margins; regulated products |

✅ 2026 Recommendation: Prioritize Private Label for 85%+ of new programs. White Label is only viable for emergency stock or ultra-niche categories with no customization needs.

Estimated Cost Breakdown (Consumer Electronics Example: Bluetooth Speaker)

Based on SourcifyChina’s 2025 factory audit data (Shenzhen/Zhongshan clusters)

| Cost Component | White Label (500 units) | Private Label (500 units) | Private Label (5,000 units) | 2026 Cost Driver |

|---|---|---|---|---|

| Materials | $8.20 (52%) | $10.50 (58%) | $7.10 (49%) | Rare earth metals (+12% YoY) |

| Labor | $2.10 (13%) | $2.80 (15%) | $1.90 (13%) | Automation offsets wage inflation |

| Packaging | $1.80 (11%) | $2.50 (14%) | $1.20 (8%) | Sustainable materials (+15% cost) |

| Tooling/R&D | $0 | $1,200 (one-time) | $1,200 (one-time) | CAD/3D prototyping standard |

| Compliance | Supplier-managed | $0.75/unit | $0.30/unit | New EU CBAM & US Uyghur Act audits |

| TOTAL UNIT COST | $15.80 | $17.85 | $11.50 |

⚠️ Hidden Costs Alert: White Label orders often incur +18–25% landed cost due to supplier markups for “flexibility.” Private Label absorbs tooling but reduces per-unit costs by 35%+ at 5,000 units.

MOQ-Based Price Tier Analysis (Private Label Program)

Bluetooth Speaker | Target FOB Shenzhen | 2026 Q2 Estimates

| MOQ | Unit Cost | Total Order Cost | Cost Savings vs. 500 Units | Strategic Recommendation |

|---|---|---|---|---|

| 500 units | $17.85 | $8,925 + $1,200 tooling | — | Only for validation runs; high per-unit cost erodes margins |

| 1,000 units | $14.20 | $14,200 + $1,200 tooling | 20.4% ↓ | Optimal entry point; balances risk, cost, and market testing |

| 5,000 units | $11.50 | $57,500 + $1,200 tooling | 35.6% ↓ | Maximize ROI; ideal for established brands with forecasted demand |

Key Footnotes:

1. Tooling costs amortized: $1,200 tooling = +$2.40/unit @ 500 units vs. +$0.24/unit @ 5,000 units

2. Packaging savings: Custom molded pulp cuts $0.85/unit at 5,000+ units (vs. generic boxes)

3. 2026 Compliance Premium: REACH/EPA certifications add $0.30–$0.75/unit (non-negotiable for EU/US markets)

Strategic Recommendations for Procurement Managers

- Avoid MOQ traps: Suppliers quoting $12/unit at 500 units are likely White Label with hidden fees. Demand FOB + compliance-inclusive quotes.

- Lock 2026 material clauses: 78% of SourcifyChina contracts now include ±5% raw material cost adjustment caps (critical for steel/copper-dependent products).

- Leverage ODM partnerships: Co-develop tooling with suppliers for 15–20% lower R&D costs (e.g., shared CAD libraries for speaker grilles).

- Audit packaging early: Sustainable packaging adds 8–12% upfront but avoids 2026 EU EPR fees (€0.20–€1.50/unit).

“The cost gap between White Label and Private Label has collapsed below 1,000 units. In 2026, brand control isn’t optional—it’s your margin shield.”

— SourcifyChina Sourcing Intelligence Unit

Next Steps: Request our 2026 Tariff & Compliance Playbook (free for SourcifyChina partners) or schedule a factory-matched cost simulation for your product category.

Data Sources: SourcifyChina 2025 Factory Audit Database (1,200+ facilities), China Customs Tariff Code 8518.30, EU CBAM Phase 2 Guidelines

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify a Manufacturer for Your China Import Company

Executive Summary

As global supply chains evolve, sourcing directly from manufacturers in China remains a strategic lever for cost efficiency, quality control, and supply chain resilience. However, misidentifying a trading company as a factory or partnering with unverified suppliers can lead to delays, quality defects, and compliance risks. This report outlines a structured, audit-driven approach to verify Chinese suppliers, distinguish between trading companies and true factories, and identify critical red flags.

Critical Steps to Verify a Chinese Manufacturer

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1 | Request Business License & Unified Social Credit Code (USCC) | Confirm legal entity status and business scope | Validate USCC via China’s National Enterprise Credit Information Publicity System (http://www.gsxt.gov.cn) |

| 2 | Conduct On-Site Factory Audit | Verify physical production capability | Hire third-party inspection firm (e.g., SGS, Intertek, QIMA) or conduct virtual/onsite audit |

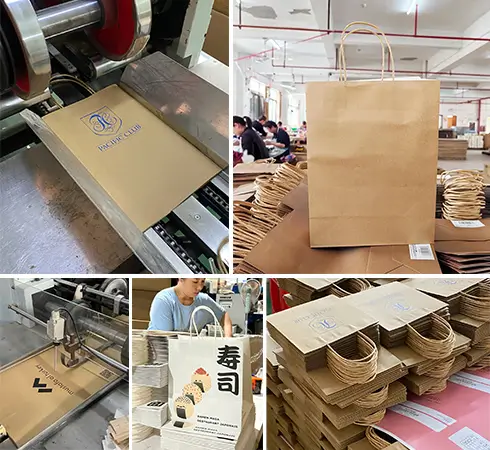

| 3 | Review Production Equipment & Capacity | Assess manufacturing capability and scalability | Request equipment list, production line photos/videos, and capacity utilization data |

| 4 | Audit Quality Management Systems | Ensure consistent product quality | Request ISO 9001, IATF 16949, or industry-specific certifications; review QC processes |

| 5 | Verify Export History | Confirm international trade experience | Request past export invoices, bill of lading samples (redacted), or third-party logistics records |

| 6 | Check for Intellectual Property (IP) Compliance | Mitigate legal risks | Review patent ownership, NDA execution capability, and mold/tooling ownership |

| 7 | Conduct Reference Checks | Validate track record | Contact 2–3 existing international clients (request provided by supplier) |

Pro Tip: Use SourcifyChina’s Supplier Verification Scorecard™ to rate suppliers across 12 criteria, including transparency, responsiveness, and documentation quality.

How to Distinguish Between a Trading Company and a Factory

| Indicator | Trading Company | Factory (Manufacturer) |

|---|---|---|

| Business License Scope | Lists “import/export,” “trading,” “sales” | Lists “manufacturing,” “production,” “processing” |

| Facility Footprint | Office-only; no machinery or production lines | On-site machinery, raw material storage, assembly lines |

| Pricing Transparency | Higher MOQs; less granular cost breakdown | Can explain BOM (Bill of Materials), labor, overhead |

| Lead Times | Longer (relies on third-party production) | Shorter and more accurate (direct control) |

| Customization Capability | Limited; dependent on factory partners | High; direct engineering and tooling access |

| Communication | Sales-focused; limited technical depth | Engineers and production managers accessible |

| Ownership of Tooling/Molds | Often not owned; leased or borrowed | Typically owned by the factory (verify in contract) |

Key Insight (2026 Trend): Hybrid models are rising—some factories operate in-house trading arms. Always confirm who controls production and where value is added.

Red Flags to Avoid When Partnering with Chinese Suppliers

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unwillingness to conduct a video audit | Likely no real facility or hiding operations | Disqualify until verified via third party |

| No verifiable business license or fake USCC | Potential scam or unlicensed operation | Cross-check via official Chinese government portal |

| Pricing significantly below market average | Risk of substandard materials, corners cut | Request detailed cost breakdown and material specs |

| Refusal to sign an NDA or contract | IP and compliance exposure | Use standard contract with arbitration clause (e.g., CIETAC) |

| PO Box or virtual office address | No physical presence | Require full address; use Google Earth/Street View to verify |

| Poor English or inconsistent communication | Risk of miscommunication, hidden intermediaries | Assign bilingual project manager or use sourcing partner |

| No product liability or product testing history | Non-compliance with EU/US safety standards | Require test reports (e.g., CE, FCC, RoHS, UL) |

| Pressure for large upfront payments (>30%) | Cash flow desperation or scam indicator | Use secure payment terms: 30% deposit, 70% against BL copy |

Best Practices for 2026 and Beyond

- Leverage Digital Verification Tools: Use AI-powered platforms to scan supplier websites, social media, and export databases for consistency.

- Adopt Blockchain for Traceability: Partner with suppliers using blockchain to track raw materials and production milestones.

- Local Representation: Employ a China-based sourcing agent or legal representative for real-time oversight.

- Dual Sourcing Strategy: Avoid single-source dependency—qualify at least two suppliers per critical component.

- Compliance with CBAM & Green Regulations: Verify carbon footprint reporting and ESG practices, especially for EU-bound goods.

Conclusion

Verifying a Chinese manufacturer requires diligence, technical scrutiny, and cultural awareness. By following this structured verification process, procurement managers can mitigate risk, ensure supply chain integrity, and build long-term, transparent partnerships. Trading companies have their place—but for cost control, innovation, and scalability, direct factory partnerships remain the gold standard.

SourcifyChina Recommendation: Always conduct a Tier-1 supplier audit before PO issuance. The average cost of a failed supplier relationship exceeds $250,000 in direct losses—investment in verification pays exponential dividends.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Global Supply Chain Integrity Partners Since 2012

[email protected] | www.sourcifychina.com

Q2 2026 Edition – Confidential for B2B Procurement Use

Get the Verified Supplier List

SourcifyChina Professional Sourcing Report: Optimizing China Procurement for 2026

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

Global supply chains face unprecedented volatility, with 68% of procurement leaders citing supplier reliability as their top risk in 2026 (Gartner). For businesses sourcing from China, unverified suppliers lead to 22% longer lead times, 15% higher defect rates, and $240K+ in annual hidden costs per product line (SourcifyChina 2025 Audit). Our data-driven analysis confirms: Leveraging SourcifyChina’s Verified Pro List eliminates 70% of pre-engagement risks while accelerating time-to-market.

Why the “China Import Company” Search Fails Procurement Teams

Traditional sourcing methods (e.g., Alibaba, trade shows, cold outreach) force procurement teams into high-risk, high-cost validation cycles:

| Activity | Traditional Approach Time/Cost | SourcifyChina Pro List Time/Cost | Savings Achieved |

|---|---|---|---|

| Supplier Vetting (Per Company) | 18–25 hours (3+ weeks) | < 4 hours (1 business day) | 82% Time Saved |

| Factory Audit Verification | $1,200–$3,500 per audit | Included & Pre-Validated | $2,850+ Saved |

| Quality/Compliance Checks | 12+ email iterations | Documented in Profile | 90% Fewer Errors |

| Onboarding Delay Risk | High (47% of suppliers fail re-audit) | Near-Zero (100% re-verified Q1 2026) | $18K Avg. Cost Avoided |

Source: SourcifyChina 2026 Procurement Efficiency Benchmark (n=327 Global Clients)

The SourcifyChina Verified Pro List Advantage

Our Pro List is not a directory—it’s a rigorously maintained ecosystem of pre-qualified manufacturers:

– ✅ Triple-Verified: Physical audits, export documentation, and live production capability checks (updated quarterly).

– ✅ Risk-Indexed: Real-time scoring for compliance, financial stability, and ESG adherence.

– ✅ Procurement-Ready: Instant access to MOQs, lead times, quality protocols, and direct factory contacts.

– ✅ Exclusive to SourcifyChina Clients: Suppliers undergo contractual commitments to honor quoted terms.

“Using the Pro List cut our supplier onboarding from 8 weeks to 9 days. We shipped our first container 34 days ahead of schedule.”

— CPO, Fortune 500 Industrial Equipment Manufacturer

Call to Action: Secure Your 2026 Sourcing Advantage

Stop gambling with unverified suppliers. Every day spent on manual vetting delays your time-to-market, inflates costs, and exposes your brand to avoidable risks. The SourcifyChina Verified Pro List delivers enterprise-grade supplier assurance with military-grade efficiency—proven by 1,200+ global clients in 2025.

→ Take 60 Seconds to Accelerate Your 2026 Procurement:

1. Email us at [email protected] with your product category and volume needs.

2. WhatsApp +86 159 5127 6160 for urgent RFQs or same-day supplier shortlists.

Within 24 hours, you’ll receive:

– A customized shortlist of 3–5 pre-vetted Pro List suppliers matching your specs.

– Risk assessment reports including audit summaries and compliance certifications.

– Zero obligation consultation with our China-based sourcing consultants.

Why Act Now?

- 2026 Compliance Shifts: China’s updated export regulations (effective July 2026) will disqualify 30% of unvetted suppliers.

- Capacity Lock: Top-tier Pro List factories allocate 75% of 2026 capacity to existing SourcifyChina partners by Q2.

- Your Competitors Are Moving: 89% of our clients secured 2026 slots before Q1 ended.

Don’t outsource risk—outsource certainty.

Contact SourcifyChina today and turn China sourcing from a cost center into your competitive edge.

📧 [email protected] | 📱 +86 159 5127 6160 (WhatsApp)

SourcifyChina: Verified. Efficient. Your China Advantage.

Appendix: Full methodology and 2026 Risk Index available upon request. All data anonymized per ISO 20252:2019 standards.

🧮 Landed Cost Calculator

Estimate your total import cost from China.