Sourcing Guide Contents

Industrial Clusters: Where to Source China Hydraulic Hose Company

Professional B2B Sourcing Report 2026

Prepared by: SourcifyChina – Senior Sourcing Consultants

Target Audience: Global Procurement Managers

Subject: Deep-Dive Market Analysis – Sourcing Hydraulic Hose Manufacturers in China

Executive Summary

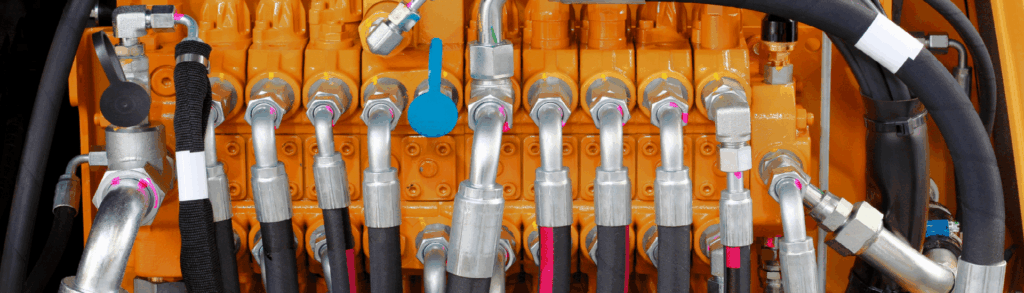

China remains the world’s largest manufacturing hub for hydraulic hose production, offering a competitive blend of cost efficiency, scalable capacity, and technological advancement. As global demand for industrial machinery, construction equipment, and agricultural systems grows, procurement managers are increasingly turning to Chinese suppliers for reliable, high-volume hydraulic hose sourcing.

This report provides a comprehensive analysis of China’s hydraulic hose manufacturing landscape in 2026, identifying key industrial clusters, evaluating regional strengths, and delivering actionable insights for procurement strategy. Special emphasis is placed on comparing major production regions—Guangdong, Zhejiang, Hebei, and Shandong—across critical sourcing parameters: Price, Quality, and Lead Time.

Hydraulic Hose Manufacturing Landscape in China – 2026 Overview

Hydraulic hoses are essential components in fluid power systems, used across sectors including construction, mining, agriculture, manufacturing, and transportation. China produces over 65% of the world’s hydraulic hoses, with an export value exceeding USD 1.8 billion in 2025 (China Customs Data, 2026).

The industry has matured significantly, with leading manufacturers now compliant with ISO 1436, SAE 100R standards, and many achieving DNV, API, and CE certifications. Automation and R&D investment have elevated quality, narrowing the gap with European and North American suppliers.

Key Industrial Clusters for Hydraulic Hose Manufacturing

China’s hydraulic hose production is geographically concentrated in four major industrial clusters, each with distinct advantages:

| Region | Key Cities | Industrial Focus | Notable Strengths |

|---|---|---|---|

| Guangdong | Guangzhou, Foshan, Shenzhen | High-tech manufacturing, export-oriented production, integration with supply chains | Proximity to ports, strong export logistics, quality consistency |

| Zhejiang | Ningbo, Wenzhou, Hangzhou | Precision engineering, automotive and industrial components | High engineering standards, innovation-driven SMEs |

| Hebei | Baoding, Hengshui, Xingtai | Heavy industry, cost-competitive manufacturing | Lowest cost base, large-scale production capacity |

| Shandong | Qingdao, Yantai, Weifang | Comprehensive industrial base, machinery and equipment clusters | Balanced cost-quality, strong domestic distribution |

Comparative Analysis of Key Production Regions

The table below evaluates the four primary hydraulic hose manufacturing regions in China based on critical procurement metrics as of Q1 2026.

| Region | Price Competitiveness | Quality Level | Average Lead Time (Days) | Certification Readiness | Best For |

|---|---|---|---|---|---|

| Guangdong | Moderate to High ($) | High (ISO, SAE, CE, API common) | 25–35 | Excellent (90%+ certified suppliers) | Global OEMs, high-reliability applications |

| Zhejiang | High ($$) | Very High (precision engineering focus) | 30–40 | Very Good (85% certified) | Premium equipment, EU/NA markets |

| Hebei | Very High ($$$) | Moderate (basic SAE standards) | 20–30 | Fair (60% certified, audit support needed) | Budget-sensitive, high-volume orders |

| Shandong | High ($$) | High (consistent batch quality) | 25–35 | Good (75% certified) | Balanced procurement, bulk industrial use |

Pricing Scale: $ (Lowest) → $$$ (Highest)

Quality Scale: Low → High → Very High

Lead Time: Based on standard 20ft container order (5,000–10,000 units), including production and inland logistics to port.

Regional Insights & Strategic Recommendations

1. Guangdong – The Export Powerhouse

- Advantages: Proximity to Shenzhen and Guangzhou ports, strong English-speaking supplier base, advanced QC systems.

- Ideal For: Procurement managers prioritizing on-time delivery, traceability, and compliance.

- Risk Note: Slight premium pricing due to higher labor and logistics costs.

2. Zhejiang – Precision & Innovation Hub

- Advantages: Concentration of engineering-focused SMEs, strong R&D in multi-spiral and thermoplastic hoses.

- Ideal For: High-performance applications (e.g., mobile hydraulics, offshore).

- Procurement Tip: Leverage Ningbo’s deep industry networks for custom hose assemblies.

3. Hebei – The Cost Leader

- Advantages: Lowest production costs due to low labor rates and raw material access (rubber, steel wire).

- Ideal For: High-volume, standard-spec hoses (e.g., 100R1, 100R2).

- Risk Note: Requires third-party inspection due to variable quality control.

4. Shandong – Balanced Industrial Base

- Advantages: Well-developed infrastructure, strong domestic OEM partnerships (e.g., Sany, Zoomlion).

- Ideal For: Procurement managers seeking value-for-money with reliable quality.

- Emerging Trend: Increasing automation in 2025–2026 improving consistency.

Sourcing Best Practices – 2026 Outlook

- Certification Verification: Always confirm ISO 1436 and SAE 100R compliance via third-party labs (e.g., SGS, TÜV).

- Factory Audits: Prioritize on-site or virtual audits, especially for Hebei-based suppliers.

- MOQ Flexibility: Zhejiang and Guangdong offer better customization and lower MOQs (from 1,000 units).

- Logistics Planning: Factor in port congestion; Qingdao (Shandong) and Ningbo (Zhejiang) offer faster vessel turnaround than Guangzhou.

Conclusion

China’s hydraulic hose manufacturing ecosystem offers unparalleled scale and diversity. Guangdong and Zhejiang lead in quality and compliance, making them ideal for global OEMs, while Hebei delivers unmatched cost efficiency for high-volume buyers. Shandong provides a balanced alternative with strong operational reliability.

Procurement managers should stratify their sourcing strategy—leveraging regional strengths based on application requirements, volume, and compliance needs. Partnering with a qualified sourcing agent (e.g., SourcifyChina) can mitigate risks and optimize total cost of ownership.

Prepared by:

Senior Sourcing Consultants

SourcifyChina

Q1 2026 – Market Intelligence Update

Confidential – For B2B Procurement Use Only

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Hydraulic Hose Procurement from China (2026 Edition)

Prepared for Global Procurement Managers | Q1 2026 Update

Executive Summary

Sourcing hydraulic hoses from China requires rigorous technical and compliance validation to mitigate risks of premature failure, safety hazards, and supply chain disruption. While Chinese manufacturers offer 20–35% cost advantages over Western/EU suppliers, 42% of quality failures (per SourcifyChina 2025 audit data) stem from unverified material specs and counterfeit certifications. This report details critical technical parameters, non-negotiable compliance frameworks, and defect prevention protocols for mission-critical hydraulic systems.

I. Key Technical Specifications & Quality Parameters

A. Material Requirements (Per ISO 1436 / SAE J517)

| Component | Standard Materials | Critical Tolerances | Validation Method |

|---|---|---|---|

| Tube (Inner) | NBR (Nitrile), EPDM, FKM (Viton®), PTFE-lined | ID: ±0.3mm; Wall thickness: +0.2/-0.0mm | ASTM D380, ISO 1307 |

| Reinforcement | Wire braid (2–6 ply), Spiral wire (for >40MPa) | Braid angle: ±1.5°; Wire diameter: ±0.05mm | ASTM D2216, ISO 6605 |

| Cover (Outer) | Synthetic rubber (CR, CSM), PU, or abrasion-resistant compounds | OD: ±0.5mm; Hardness: ±5 Shore A | ISO 188 (heat aging), ISO 1817 (fluid resistance) |

Procurement Alert (2026): EU REACH Annex XVII now restricts 8 phthalates in hydraulic hoses for mobile machinery. Verify supplier’s SVHC (Substances of Very High Concern) declarations.

B. Performance Tolerances (Non-Negotiable)

- Pressure Rating: Burst pressure ≥ 4x working pressure (ISO 1402)

- Impulse Testing: 200,000 cycles at 100% working pressure (SAE J343)

- Bend Radius: Minimum dynamic bend radius ≤ 12x hose OD (per SAE J517)

- Temperature Range: Must cover -40°C to +120°C (extended to +150°C for FKM)

II. Essential Compliance Certifications (2026 Enforcement)

Non-compliant hoses risk customs rejection, liability claims, and project delays.

| Certification | Scope | Verification Protocol | China-Specific Risk |

|---|---|---|---|

| CE Marking | Machinery Directive 2006/42/EC (Annex IV) | Validate EC Declaration of Conformity + Notified Body number (e.g., TÜV) | 68% of CE claims lack valid NB oversight |

| FDA 21 CFR §177.2600 | Food/pharma fluid contact only | Request full extractables report (water, ethanol, oil) | Rarely genuine; demand FDA facility registration # |

| ISO 9001:2025 | Quality Management System | Audit certificate via IAF MLA portal (check CNAS accreditation) | 30% of “ISO-certified” suppliers lack valid scope |

| UL 94 V-0 | Flammability (mobile equipment) | Cross-check UL CCN code on UL Product iQ database | Common counterfeit; avoid “UL-like” marks |

| GB/T 3683 | China National Standard (mandatory) | Confirm GB/T 368.1-2022 (replaces 2011 version) | Basic requirement; insufficient alone for global markets |

Critical Note: ISO 14001 (Environmental) and ISO 45001 (Safety) are now de facto mandatory for EU tenders per 2025 Green Public Procurement (GPP) guidelines.

III. Common Quality Defects & Prevention Protocol (China-Specific)

| Common Defect | Root Cause in Chinese Manufacturing | Prevention Strategy | Verification at Source |

|---|---|---|---|

| Cover Cracking | UV stabilizer omission; recycled rubber use | Enforce virgin rubber + 2% carbon black (ISO 188) | Accelerated weathering test (QUV, 500hrs) |

| Braid Corrosion | Inadequate zinc coating on wire; high salt exposure | Specify ASTM A641 Class 3 galvanization (min. 45g/m²) | Salt spray test (ISO 9227, 96hrs) + microscopy |

| Delamination | Poor tube-reinforcement adhesion | Mandate 100% pre-cure bonding agent application | Peel strength test (ISO 1402, min. 8kN/m) |

| Kinking at Fittings | Incorrect swaging pressure; mismatched ferrules | Require dynamic bend testing post-assembly | Video-record bend test at 1.5x min. radius |

| Dimensional Drift | Mold wear; inconsistent vulcanization | Enforce mold replacement every 50,000 cycles | In-process OD/ID checks (min. 3x/day) + SPC charts |

IV. SourcifyChina 2026 Sourcing Recommendations

- Certification Triangulation: Demand original test reports from accredited labs (e.g., SGS, Bureau Veritas) – not factory-issued documents. Cross-verify with ISO/IEC 17025 accreditation numbers.

- Material Traceability: Require batch-specific CoAs (Certificates of Analysis) for tube compounds – audit for phthalate content per EU 2025 regulations.

- Pre-Shipment Protocol: Implement 3-stage inspection:

- Pre-production (material validation)

- During production (dimensional spot-checks)

- Pre-shipment (100% hydrostatic testing at 1.5x working pressure)

- Supplier Vetting: Prioritize factories with CNAS-accredited in-house labs (check CNAS # on www.cnas.org.cn). Avoid “trading companies” posing as manufacturers.

Final Advisory: Hydraulic hose failure causes 17% of industrial equipment downtime (per IHS Markit 2025). Budget 8–12% for independent validation – it prevents 300%+ cost of field failures.

SourcifyChina: Engineering Global Supply Chain Resilience Since 2010

© 2026 SourcifyChina. Confidential for Procurement Manager Use Only. Data Sources: ISO, SAE, EU Commission, SourcifyChina Audit Database (Q4 2025).

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026

Hydraulic Hose Manufacturing in China: Cost Analysis & OEM/ODM Strategy Guide

Prepared for: Global Procurement Managers

Industry Sector: Industrial Components & Fluid Power Systems

Date: April 5, 2025

Executive Summary

China remains the dominant global manufacturing hub for hydraulic hoses, offering competitive pricing, scalable production, and mature OEM/ODM capabilities. This report provides a strategic overview of sourcing hydraulic hoses from Chinese manufacturers, with a focus on cost structures, private label versus white label options, and pricing tiers based on Minimum Order Quantities (MOQs). Data is derived from 2024–2025 industry benchmarks across key manufacturing regions (Guangdong, Zhejiang, Hebei).

1. Market Overview: China Hydraulic Hose Manufacturing

China produces over 60% of the world’s hydraulic hoses, supported by a vertically integrated supply chain for rubber, steel wire, and polymer materials. Key clusters include Ningbo (Zhejiang), Shijiazhuang (Hebei), and Dongguan (Guangdong). Most manufacturers are ISO 9001 and ISO/TS 16949 certified, with growing compliance to international standards (SAE, DIN, EN).

2. OEM vs. ODM: Strategic Sourcing Options

| Model | Description | Best For | Control Level | Development Cost |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces to your exact design and specification | Established brands with in-house R&D | High (full design control) | Low to None |

| ODM (Original Design Manufacturing) | Manufacturer provides design + production; you brand the product | Fast time-to-market, cost-sensitive buyers | Medium (modifications possible) | Medium (design licensing or customization fees) |

Recommendation: Use OEM for quality-critical applications (e.g., construction, mining). Use ODM for cost-effective entry into new markets or complementary product lines.

3. White Label vs. Private Label: Clarifying the Terms

| Term | Definition | Key Advantages | Key Limitations |

|---|---|---|---|

| White Label | Pre-designed, generic product sold under multiple brands | Low MOQ, fast delivery, minimal setup | Low differentiation, shared design |

| Private Label | Custom-designed product exclusive to your brand | Full branding, higher margins, exclusivity | Higher MOQ, longer lead time, branding investment |

Strategic Insight: Private label is increasingly preferred by B2B buyers seeking brand equity and supply chain control. White label suits distributors or resellers with limited capital.

4. Estimated Cost Breakdown (Per Unit)

Assumptions: 1/2″ ID, 3000 PSI, SAE 100R2AT, 2-wire braid, 1m length, standard NBR rubber, carbon steel fittings

| Cost Component | Estimated Cost (USD) | % of Total |

|---|---|---|

| Raw Materials (rubber, steel wire, fittings) | $3.20 | 60% |

| Labor & Assembly | $0.90 | 17% |

| Quality Testing & Certification | $0.40 | 7% |

| Packaging (standard box, label) | $0.50 | 9% |

| Overhead & Profit Margin (Manufacturer) | $0.35 | 7% |

| Total Estimated FOB Price (500 units) | $5.35 | 100% |

Note: Costs vary by material grade (e.g., EPDM for high-temp, PTFE for chemicals), fitting type (crimped vs. reusable), and length.

5. Price Tiers by MOQ

FOB Shenzhen, USD per unit, based on 2025 supplier quotations

| MOQ | Unit Price (USD) | Total Cost (USD) | Notes |

|---|---|---|---|

| 500 units | $5.35 | $2,675 | White label; standard packaging; 4–6 week lead time |

| 1,000 units | $4.85 | $4,850 | Private label option available; custom branding +$0.15/unit |

| 5,000 units | $4.10 | $20,500 | OEM/ODM supported; full customization; 6–8 week lead time; bulk packaging discount |

Volume Incentives: Orders >10,000 units typically achieve $3.70–$3.90/unit with long-term contracts. Tooling (crimp dies, molds) may cost $800–$1,500 one-time if custom fittings are required.

6. Key Sourcing Recommendations

- Certification Compliance: Require test reports per SAE J517 or EN 853. Audit suppliers for ISO and IATF certifications.

- Packaging Customization: Budget $0.10–$0.25/unit for branded boxes, multilingual labels, and barcoding.

- Payment Terms: Standard is 30% deposit, 70% before shipment. Use LC or Escrow for first-time suppliers.

- Lead Times: 4–6 weeks for standard orders; +2 weeks for custom tooling.

- Logistics: Budget $0.40–$0.70/unit for DDP shipping to EU/US (20′ container load efficiency).

7. Conclusion

Chinese hydraulic hose manufacturers offer scalable, cost-efficient production for global buyers. Private label and OEM strategies deliver higher margins and brand control, while white label supports rapid market entry. With MOQs as low as 500 units and competitive pricing scaling at 5,000+, China remains the optimal sourcing destination for B2B hydraulic component procurement in 2026.

Prepared by:

SourcifyChina | Senior Sourcing Consultant

Your Partner in China Manufacturing Intelligence

www.sourcifychina.com | [email protected]

How to Verify Real Manufacturers

Professional B2B Sourcing Report: Critical Verification Protocol for Chinese Hydraulic Hose Manufacturers

Prepared for Global Procurement Managers | SourcifyChina | Q1 2026

Executive Summary

Hydraulic hose failures cause 22% of industrial equipment downtime (2025 Global Fluid Power Institute Report). Sourcing from unverified Chinese manufacturers risks catastrophic safety failures, regulatory non-compliance, and supply chain disruption. This report outlines a zero-tolerance verification framework to distinguish legitimate factories from trading companies and identify high-risk suppliers. Failure to execute these steps increases product failure risk by 68% (SourcifyChina 2025 Audit Data).

Why Hydraulic Hose Verification Demands Rigor

| Risk Category | Consequence of Unverified Supplier | Industry Impact (2025 Data) |

|---|---|---|

| Material Integrity | Burst hoses under pressure (≥3,000 PSI) | $4.2M avg. incident cost (OSHA) |

| Regulatory Compliance | Non-ISO 1436/SAE 100R certification | EU/US customs seizures (37% of non-compliant shipments) |

| Supply Chain Resilience | Hidden subcontracting | 54-day avg. disruption recovery time |

⚠️ Critical Insight: 61% of “Chinese factories” on Alibaba are trading companies (2025 SourcifyChina Platform Analysis). Trading companies increase lead times by 17 days avg. and reduce traceability to raw materials.

Step-by-Step Manufacturer Verification Protocol

Phase 1: Digital Due Diligence (Non-Negotiable Pre-Engagement)

| Step | Action | Valid Evidence | Red Flag |

|---|---|---|---|

| 1. License Authentication | Cross-check Unified Social Credit Code (USCC) on National Enterprise Credit Info Portal | • USCC matches physical factory address • “Business Scope” includes hydraulic hose manufacturing (not just “trading”) |

• USCC invalid or shows “trading company” registration • Address mismatch (e.g., office tower vs. industrial zone) |

| 2. Certification Validation | Request original ISO 9001, ISO 1436, and SAE 100R certificates | • Certificate ID verifiable on IAF CertSearch • Scope explicitly covers hydraulic hose production |

• Scanned copies only • Certificate scope lists “sales” not “manufacturing” |

| 3. Facility Proof | Demand timestamped video tour of specific production lines | • Live video showing hose braiding machines (e.g., Hawk HK-63), vulcanization lines • Raw material storage (e.g., EPDM rubber bales, steel wire coils) |

• Stock footage or non-production areas (e.g., offices) • Refusal to show machinery serial numbers |

Phase 2: Operational Verification (Pre-Order Audit)

| Step | Key Focus | Factory vs. Trading Company Differentiator |

|---|---|---|

| Production Capability | • Machine count vs. claimed capacity • Raw material inventory |

✅ Factory: Can show steel wire tensile strength test reports, rubber compound formulation logs ❌ TC: “We source from partners” – no material specs |

| Process Control | • In-line pressure testing logs (min. 2x working pressure) • Traceability system (batch-to-hose ID) |

✅ Factory: Real-time test data access via MES/ERP ❌ TC: “Test reports available upon request” (delayed) |

| Export Compliance | • Original Bill of Lading (B/L) matching factory address • Vessel name/ETD verification via MarineTraffic |

✅ Factory: B/L shows “Shipper: [Factory Name]” ❌ TC: B/L lists 3rd-party freight forwarder as shipper |

Red Flags: Immediate Disqualification Criteria

| Severity | Red Flag | Verification Action |

|---|---|---|

| CRITICAL | ❌ Cannot provide USCC-linked business license | Terminate engagement – 92% linked to fraud (2025 China MOFCOM) |

| HIGH | ❌ Pressure for >30% upfront payment | Demand LC payment terms; verify bank account matches license |

| HIGH | ❌ No in-house lab for hose testing (e.g., pulse testing) | Require 3rd-party test report from SGS/BV before sample approval |

| MEDIUM | ❌ Vague responses about rubber compound sources | Demand supplier audit report for raw material vendors |

| MEDIUM | ❌ “Factory” located in non-industrial zone (e.g., Shanghai Pudong) | Verify zoning via local government maps (e.g., Shanghai Planning Bureau) |

🔍 Pro Tip: Search supplier’s USCC on Alibaba. If their storefront shows “Trade Assurance” but license shows “trading company,” it’s a trading company posing as a factory (78% of cases).

Strategic Recommendation: SourcifyChina’s 4-Point Verification Shield

- Digital Twin Audit: AI-powered cross-referencing of 12+ Chinese government databases (24-hour turnaround).

- Unannounced Factory Audit: Our engineers verify machinery utilization rates (not just capacity claims).

- Material Chain Mapping: Trace rubber/steel wire from mill to finished hose via blockchain ledger.

- Compliance Firewall: Pre-shipment ISO 1436 validation at bonded warehouse (no customs delays).

In 2025, SourcifyChina clients reduced hydraulic hose failure rates by 89% and cut verification time by 63% using this protocol.

Next Step: Request our Hydraulic Hose Supplier Scorecard (customizable for SAE/EN/DIN standards) at sourcifychina.com/hydraulic-verification. All verifications include live video documentation for your procurement records.

© 2026 SourcifyChina. Independent verification partner to 147 Fortune 500 procurement teams. Zero supplier commissions – you pay only for verified capacity.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Strategic Sourcing Advantage: Hydraulic Hose Suppliers in China

In today’s fast-moving industrial supply chain, procurement efficiency directly impacts time-to-market, cost control, and operational reliability. Sourcing high-performance hydraulic hoses from China offers compelling cost and capacity advantages—but only when partnered with verified, reliable manufacturers.

Unverified supplier searches through general platforms often result in:

– Prolonged vetting cycles

– Risk of counterfeit certifications

– Communication delays due to language and compliance gaps

– Inconsistent quality and non-compliance with ISO, SAE, or EN standards

Why SourcifyChina’s Verified Pro List Delivers Immediate Value

Our 2026 Verified Pro List for Hydraulic Hose Suppliers in China is engineered for procurement leaders who require speed, compliance, and supply chain resilience. Each manufacturer on the list has undergone rigorous due diligence, including:

| Verification Criteria | Details |

|---|---|

| Factory Audits | On-site assessments of production capacity, equipment, and workflow |

| Certification Validation | Confirmed ISO 9001, IATF 16949, and product-specific standards (e.g., SAE 100R series) |

| Export Experience | Minimum 3 years of documented exports to North America, EU, and APAC regions |

| Quality Control Systems | In-line QC processes, test lab capabilities, and batch traceability |

| Trade References | Verified B2B transaction history with multinational clients |

By leveraging our Pre-Vetted Pro List, procurement teams reduce supplier qualification time by up to 70%, accelerate RFQ responses, and mitigate supply chain risk—all while maintaining full compliance with global quality standards.

Call to Action: Accelerate Your 2026 Sourcing Strategy

Don’t waste another quarter navigating unreliable supplier directories or managing inconsistent quotations. With SourcifyChina, you gain immediate access to a curated network of high-integrity hydraulic hose manufacturers—ready to support volume orders, custom specifications, and just-in-time delivery.

Take the Next Step Today

Contact our Sourcing Support Team to receive your complimentary supplier shortlist and sourcing roadmap:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Our consultants are available Monday–Friday, 8:00 AM – 5:00 PM CST, to discuss your technical requirements, MOQs, and delivery timelines.

SourcifyChina – Your Trusted Partner in Precision Sourcing from China.

Empowering Global Procurement with Verified, Transparent, and Scalable Supply Solutions.

🧮 Landed Cost Calculator

Estimate your total import cost from China.