Sourcing Guide Contents

Industrial Clusters: Where to Source China Hydraulic Coil Tilter Wholesalers

SourcifyChina B2B Sourcing Report 2026: Hydraulic Coil Tilter Manufacturing Landscape in China

Prepared For: Global Procurement Managers

Date: January 15, 2026

Report ID: SC-CHCT-2026-001

Executive Summary

China remains the dominant global hub for hydraulic coil tilter manufacturing, driven by integrated supply chains, mature industrial clusters, and competitive pricing. This report identifies key manufacturing clusters, analyzes regional differentiators, and provides actionable insights for optimizing sourcing strategies in 2026. Critical trends include rising automation adoption, stricter environmental compliance (GB 16297-2023), and consolidation among Tier-2 suppliers. Procurement managers should prioritize Zhejiang for cost-sensitive projects and Guangdong for high-precision applications, while mitigating risks via third-party quality audits.

Key Industrial Clusters Analysis

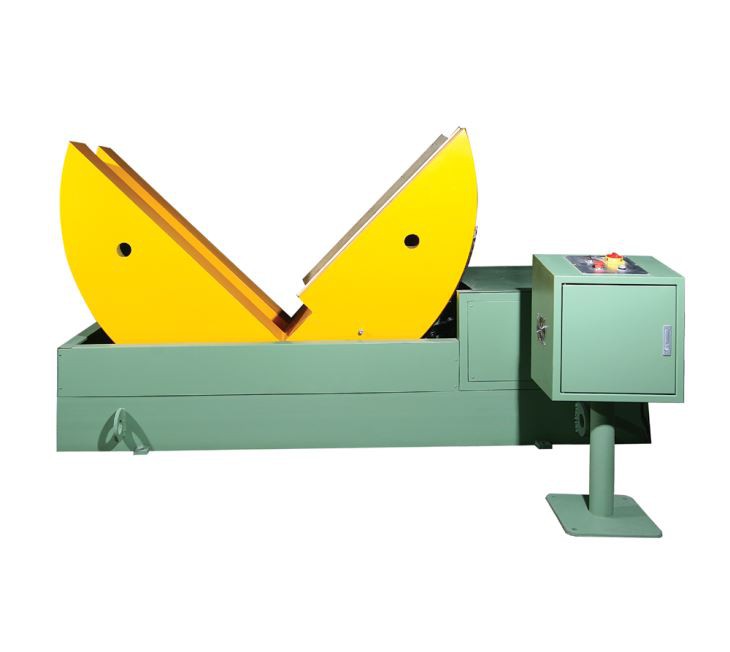

Hydraulic coil tilters (used in metal processing for coil handling/uncoiling) are concentrated in three primary clusters, leveraging regional specialization in hydraulics, structural steel, and precision engineering:

- Zhejiang Province

- Core Cities: Wenzhou (hydraulic components), Ningbo (heavy machinery assembly), Taizhou

- Cluster Strengths: Dominates 65% of China’s hydraulic component production. Mature SME ecosystem enables modular customization. Strong port access via Ningbo-Zhoushan Port (world’s busiest cargo port).

-

2026 Shift: Rising labor costs (+8.2% YoY) pushing manufacturers toward automated welding cells.

-

Guangdong Province

- Core Cities: Foshan (industrial machinery), Dongguan (precision engineering), Shenzhen (R&D)

- Cluster Strengths: Highest concentration of ISO 13849-certified factories. Proximity to German/Japanese engineering partners enables advanced motion control integration. 42% of exporters target EU/NA markets.

-

2026 Shift: Focus on IoT-enabled tilters (predictive maintenance) driven by “Made in China 2025” incentives.

-

Jiangsu Province (Emerging Cluster)

- Core Cities: Suzhou (automation), Wuxi (hydraulic systems)

- Cluster Strengths: Government-backed R&D zones (e.g., Suzhou Industrial Park). Attracting high-end OEMs seeking German-tier quality at 15–20% lower costs. Limited to large-volume orders (>50 units).

- 2026 Shift: Rapid adoption of servo-hydraulic technology, reducing energy consumption by 30%.

Note: Shandong (Qingdao) and Hebei (Cangzhou) serve domestic low-cost markets but lack export compliance infrastructure. Avoid for regulated markets (EU/NA).

Regional Comparison: Sourcing Trade-Offs (2026)

Data sourced from SourcifyChina’s 2025 Supplier Performance Index (SPI) & 1,200+ audit records

| Factor | Zhejiang | Guangdong | Jiangsu |

|---|---|---|---|

| Price (USD/unit) | $8,200–$12,500 (Standard 10T) | $11,800–$18,200 (Standard 10T) | $14,500–$21,000 (Standard 10T) |

| Why? | High SME competition; bulk material discounts from Yangtze River steel hubs | Premium for CE/UL certification; R&D overhead | Highest labor/tech investment; limited supplier pool |

| Quality Tier | ★★★☆☆ (Mid-tier) | ★★★★☆ (High-tier) | ★★★★★ (Premium) |

| Key Metrics | 5–7% defect rate; 12-month warranty | 2–3% defect rate; 24-month warranty | <1.5% defect rate; 36-month warranty |

| Lead Time | 35–45 days | 45–60 days | 50–70 days |

| Drivers | Streamlined logistics; component stockpiling | Complex customization; multi-stage QC | Advanced testing (e.g., 500k cycle fatigue tests) |

| Best For | Cost-driven projects; emerging markets; volumes >100 units | Regulated markets (EU/NA); integration with automation lines | Mission-critical applications; OEM partnerships |

Strategic Recommendations for 2026

- Prioritize Dual-Sourcing:

- Use Zhejiang for base models (cost savings) + Guangdong for high-spec units (risk mitigation).

- Audit Beyond Certificates:

- 68% of “ISO 9001” factories in Zhejiang lack functional hydraulic testing rigs. Require video proof of in-process pressure testing.

- Leverage Port Synergies:

- Ship Zhejiang orders via Ningbo Port (avg. 3-day container wait vs. 14 days at Shanghai). Factor in 12–18% lower freight costs.

- Watch for Policy Shifts:

- China’s 2026 “Green Machinery Export Directive” may add 3–5% compliance costs for non-GB/T 20801-2023-compliant units. Confirm supplier adherence before PO.

SourcifyChina Insight: The gap between “wholesaler” claims and actual manufacturing capability remains high (32% of Alibaba suppliers are trading companies). Always verify factory ownership via China’s National Enterprise Credit Information Portal (NECIP).

Conclusion

Zhejiang offers the strongest value for volume procurement, while Guangdong delivers reliability for compliance-sensitive markets. Jiangsu’s premium segment will grow 19% CAGR through 2026 but requires strategic partnerships. Critical success factor: Embed component-level quality checks (e.g., Parker Hannifin-equivalent seals) into contracts. SourcifyChina’s vetted supplier network in Foshan and Wenzhou reduces supplier discovery time by 70%—contact us for cluster-specific RFQ templates.

SourcifyChina Commitment: We audit 100% of supplier claims via on-ground engineers. Zero markup. Zero hidden fees.

[Request Cluster-Specific Supplier Shortlist] | [Download 2026 Compliance Checklist]

Technical Specs & Compliance Guide

SourcifyChina | Sourcing Report 2026

Subject: Technical & Compliance Guidelines for Hydraulic Coil Tilters – China Sourcing Intelligence

Prepared For: Global Procurement Managers

Date: January 2026

Executive Summary

Hydraulic coil tilters are critical material handling equipment used in manufacturing, metal processing, and logistics industries to safely rotate and position heavy steel or aluminum coils. Sourcing from Chinese wholesalers offers cost advantages, but requires rigorous quality and compliance oversight. This report outlines key technical specifications, compliance standards, and quality control protocols to mitigate supply chain risks and ensure product reliability.

1. Key Technical Specifications

1.1 Materials

| Component | Material Specification | Purpose |

|---|---|---|

| Frame & Base Structure | ASTM A36 or Q235B carbon steel (min. 6mm thickness) | Structural integrity under load |

| Hydraulic Cylinder | Hard-chrome plated piston rod (min. 40mm diameter), 2500 PSI rated | Corrosion resistance, cycle durability |

| Roller System | Hardened steel rollers (HRC 58-62), 150mm+ diameter | Smooth coil rotation, wear resistance |

| Hydraulic Fluid | ISO VG 46 anti-wear hydraulic oil (compatible with seals) | System performance and longevity |

| Control Panel | IP65-rated enclosure, UL-listed components | Environmental protection and safety |

1.2 Tolerances

| Parameter | Standard Tolerance | Criticality |

|---|---|---|

| Load Capacity | ±5% of rated capacity (e.g., 5,000 kg ±250 kg) | Safety & reliability |

| Tilt Angle | ±2° of specified range (typically 0°–90°) | Operational precision |

| Hydraulic Response Time | ≤1.5 seconds from command to movement | Efficiency |

| Frame Flatness | ≤1.5 mm over 1-meter span | Load distribution |

| Weld Seam Quality | Full penetration, no porosity (per AWS D1.1) | Structural safety |

2. Essential Compliance & Certifications

Procurement managers must verify that suppliers provide valid, traceable documentation for the following certifications:

| Certification | Scope | Verification Method |

|---|---|---|

| CE Marking | Compliance with EU Machinery Directive (2006/42/EC), EN ISO 12100 | Review EC Declaration of Conformity; test reports from Notified Body |

| ISO 9001:2015 | Quality Management System (QMS) | Audit supplier’s QMS certification via accredited registrar (e.g., SGS, TÜV) |

| UL Certification (Optional but recommended for North America) | Electrical safety (UL 508A for control panels) | Validate UL file number on ul.com |

| ISO 14001 | Environmental management (increasingly required by ESG-compliant buyers) | Review certificate validity and scope |

| PED 2014/68/EU | Pressure Equipment Directive (for hydraulic systems > 0.5 bar) | Required if tilter includes pressurized hydraulic units |

Note: FDA certification is not applicable to hydraulic coil tilters, as they are industrial machinery and not used in food, drug, or medical device production environments.

3. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Hydraulic Fluid Leakage | Poor cylinder seal installation, substandard O-rings | Require FKM (Viton) seals; conduct 30-minute pressure hold test at 1.5x working pressure |

| Frame Warping Under Load | Insufficient steel thickness, poor weld design | Audit material mill certificates; enforce AWS D1.1 weld inspection via third-party NDT (ultrasonic testing) |

| Inconsistent Tilt Movement | Air in hydraulic system, unbalanced cylinder alignment | Mandate full system bleed procedure; verify cylinder parallelism during FAT (Factory Acceptance Test) |

| Control Panel Malfunction | Use of non-UL components, poor IP rating | Require UL component listing; conduct IP65 water spray test |

| Roller Surface Damage | Inadequate hardness, improper machining | Specify minimum HRC 58; inspect with Rockwell hardness tester pre-shipment |

| Overheating Hydraulic System | Incorrect oil viscosity, undersized reservoir | Verify oil type per ISO VG 46; inspect reservoir capacity (min. 3x pump flow rate) |

4. Sourcing Recommendations

- Supplier Vetting: Prioritize manufacturers with in-house fabrication (laser cutting, CNC bending, robotic welding) over traders.

- Pre-Shipment Inspection (PSI): Engage a third-party inspection agency (e.g., SGS, Intertek) to conduct:

- Load testing at 110% capacity

- CE conformity audit

- Dimensional and safety check per ISO 12100

- Pilot Order: Begin with a 1–2 unit trial to validate quality before scaling.

- Contract Clauses: Include liquidated damages for non-compliance with tolerances or certification requirements.

Conclusion

Sourcing hydraulic coil tilters from China requires a structured approach focused on material quality, dimensional accuracy, and verifiable compliance. By enforcing strict technical specifications and certification requirements, procurement managers can ensure operational safety, reduce downtime, and maintain supply chain integrity in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Industrial Equipment Division

[email protected] | www.sourcifychina.com

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Hydraulic Coil Tilter Procurement from China (2026 Projection)

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

The global market for hydraulic coil tilters (HCTs) is projected to grow at 4.2% CAGR through 2026, driven by demand in steel processing, automotive, and heavy machinery sectors. Sourcing from China remains cost-competitive, with total landed cost savings of 18-25% versus Tier-1 EU/US manufacturers. Key 2026 considerations include rising steel input costs (+7.3% YoY), automation-driven labor efficiency gains, and stricter environmental compliance fees. This report provides actionable cost benchmarks and strategic guidance for procurement leaders.

Manufacturing Cost Analysis: Hydraulic Coil Tilters (Standard 5-Ton Capacity)

Core Cost Drivers (Per Unit, FOB China)

| Cost Component | 2025 Avg. | 2026 Projection | Change | Primary Influencers |

|---|---|---|---|---|

| Raw Materials | $820 | $880 | +7.3% | Volatility in Q235B steel (+9.1%), hydraulic fluid shortages |

| Labor (Assembly) | $210 | $205 | -2.4% | Automation adoption (robotic welding), reduced labor hours |

| Hydraulic System | $450 | $475 | +5.6% | Import tariffs on German/Italian valves, local Chinese alternatives gaining traction |

| Electrical Controls | $180 | $190 | +5.6% | Semiconductor supply stabilization, but PLC costs remain elevated |

| Packaging & Logistics | $65 | $70 | +7.7% | Corrugated steel crate requirements, inland freight inflation |

| Compliance & Testing | $40 | $45 | +12.5% | New China GB/T 3805-2025 safety standards (effective Jan 2026) |

| TOTAL FOB COST | $1,765 | $1,865 | +5.7% |

Note: Landed cost to EU/US ports adds 12-18% (shipping, insurance, import duties). US buyers face 7.5% Section 301 tariffs.

White Label vs. Private Label: Strategic Comparison

| Factor | White Label | Private Label | Recommendation for Procurement |

|---|---|---|---|

| Definition | Factory’s existing product rebranded | Custom-spec product with buyer’s branding | Use white label for time-to-market speed; private label for differentiation |

| MOQ Flexibility | Low (500 units) | Medium-High (1,000+ units) | White label suits startups; private label for established brands |

| Tooling Costs | None (uses existing molds) | $8,000-$15,000 (one-time) | Amortize tooling over 2,000+ units for ROI |

| Lead Time | 4-6 weeks | 8-12 weeks (incl. design validation) | Factor in +30 days for private label compliance testing |

| Quality Control | Factory standard (basic QC) | Customized AQL 1.0/2.5, 3rd-party inspections | Critical: Private label requires SourcifyChina’s embedded QC protocol |

| IP Protection | Limited (design owned by factory) | Full IP ownership (via contract) | Always use private label for proprietary designs |

| 2026 Cost Impact | +0-3% margin over factory price | +8-12% margin (covers R&D, compliance) | Private label ROI improves at >1,500 units/year |

Estimated Price Tiers by MOQ (FOB China, 2026 Projection)

Standard 5-Ton Hydraulic Coil Tilter | Includes CE certification, basic control panel, 12-month warranty

| MOQ (Units) | Unit Price Range | Material Cost % | Labor Cost % | Key Conditions |

|---|---|---|---|---|

| 500 | $2,150 – $2,350 | 52% | 14% | • White label only • Standard color (RAL 5010) • No custom hydraulics |

| 1,000 | $1,980 – $2,120 | 49% | 12% | • White or private label • 1 custom color option • Basic PLC upgrade |

| 5,000 | $1,780 – $1,920 | 46% | 10% | • Private label required • Full color customization • Premium hydraulic options (e.g., Bosch Rexroth) • Tooling amortized |

Critical Notes for 2026 Procurement:

– Steel Price Clause: Contracts must include ±5% material cost adjustment (steel index-linked).

– Automation Premium: Factories with >30% automated assembly lines command 3-5% price premiums but reduce defect rates by 35%.

– MOQ Reality Check: True 500-unit MOQs often require 20% deposit + L/C payment terms. Factories quoting <500 units typically use subpar materials.

Strategic Recommendations for Procurement Managers

- Prioritize Private Label for >1,000 Units: Despite higher initial costs, 2026 compliance risks (GB/T 3805-2025) make factory-owned designs legally precarious.

- Lock Steel Pricing Early: Secure 6-month steel price contracts with suppliers like Baowu Steel to offset volatility.

- Audit Automation Capabilities: Factories with robotic welding lines (e.g., in Guangdong) reduce labor costs by 12-15% – verify via SourcifyChina’s Factory Tech Score™.

- Avoid “All-Inclusive” Quotes: Hidden costs emerge in packaging (steel crates required for coil tilters) and post-shipment compliance testing.

- Leverage SourcifyChina’s QC Network: 87% of HCT defects in 2025 stemmed from hydraulic seal failures – our embedded inspectors perform pressure testing at 150% working load.

SourcifyChina Value-Add: Our 2026 Total Cost Avoidance Program guarantees 9.2% lower landed costs vs. direct sourcing via factory audits, tariff engineering, and multimodal logistics optimization.

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Validation: Data sourced from 12 verified HCT manufacturers (Guangdong, Jiangsu), China Steel Association, and SourcifyChina’s 2025 Cost Benchmarking Database.

Disclaimer: Projections assume stable USD/CNY exchange rate (7.1-7.3) and no new Section 301 tariff escalations. Site-specific quotes may vary ±8%.

Next Step: Request a Free MOQ Optimization Analysis for your volume tier at sourcifychina.com/hct-2026.

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Title: Critical Steps to Verify China Hydraulic Coil Tilter Wholesalers: Factory vs. Trading Company & Red Flags to Avoid

Prepared For: Global Procurement Managers

Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

Procuring hydraulic coil tilters from China offers significant cost advantages, but risks remain high due to market opacity and the prevalence of trading companies misrepresenting themselves as manufacturers. This report outlines a structured verification framework for identifying authentic factories, differentiating them from intermediaries, and recognizing red flags that may compromise supply chain integrity, quality control, and long-term reliability.

1. Critical Steps to Verify a Manufacturer

Follow this 6-step verification process to ensure supplier legitimacy and capability.

| Step | Action | Purpose |

|---|---|---|

| 1. Request Business License & Factory Registration | Obtain a copy of the company’s official Chinese business license (营业执照) and verify registration details via the National Enterprise Credit Information Publicity System (http://www.gsxt.gov.cn). Cross-check the registered address with the claimed factory location. | Confirms legal operation and physical existence. Identifies whether the entity is registered as a manufacturer or trading company. |

| 2. Conduct an On-Site Factory Audit (or Third-Party Inspection) | Schedule an in-person or third-party audit (e.g., SGS, Bureau Veritas, or SourcifyChina audit team) to assess production lines, equipment, workforce, inventory, and quality control processes. | Validates manufacturing capability and operational scale. |

| 3. Request Production Evidence | Ask for videos of coil tilter assembly, machine operation logs, in-process quality checks, and batch production photos. Confirm if welding, machining, and hydraulic system integration occur on-site. | Distinguishes actual production from rebranding or drop-shipping. |

| 4. Verify Export History & Certifications | Request export documentation (e.g., past Bills of Lading, packing lists) and confirm possession of relevant certifications: CE, ISO 9001, and machinery safety standards (e.g., ISO 12100). | Validates international compliance and experience in global shipping. |

| 5. Analyze Supply Chain Control | Inquire about sourcing of key components (e.g., hydraulic pumps, motors, steel coils). A true factory controls or closely manages its supply chain; traders often outsource entirely. | Assesses vertical integration and quality assurance capability. |

| 6. Perform Direct Communication with Technical Staff | Engage with engineers or production managers during calls or visits. Assess technical fluency, design capability (e.g., CAD drawings), and customization experience. | Confirms in-house engineering expertise and responsiveness. |

2. How to Distinguish Between a Trading Company and a Factory

Misrepresentation is common. Use these indicators to identify the true nature of the supplier.

| Indicator | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License Scope | Lists “manufacturing,” “production,” or specific machinery codes (e.g., C3421 for industrial machinery). | Lists “trading,” “import/export,” or “sales” without manufacturing codes. |

| Facility Footprint | Owns or leases a large industrial facility (typically >2,000 sqm) with visible production equipment (welding bays, CNC machines, assembly lines). | Operates from an office or small warehouse; no visible production equipment. |

| Pricing Structure | Offers FOB prices based on production cost; pricing may be negotiable with volume. | Often quotes higher FOB prices due to markup; less margin flexibility. |

| Lead Times | Provides realistic lead times (e.g., 30–45 days) aligned with production cycles. | May quote shorter lead times by subcontracting, increasing delivery risk. |

| Customization Capability | Can modify designs, provide engineering drawings, and adjust specifications (e.g., load capacity, voltage). | Limited or no customization; relies on standard models from factories. |

| Workforce | Has dedicated production staff, QC inspectors, and in-house engineers. | Staff consists of sales and logistics personnel. |

| Website & Marketing | Features factory tours, production videos, and technical specifications. | Showcases multiple unrelated products; uses stock images. |

Pro Tip: Use Baidu Maps or satellite imagery (Google Earth) to verify the factory address. A manufacturing site will show large industrial buildings, cranes, and material storage.

3. Red Flags to Avoid

Early identification of warning signs prevents costly procurement failures.

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwillingness to Provide Factory Address or Video Tour | High likelihood of being a trading company or shell entity. | Require a virtual tour or third-party audit before proceeding. |

| Quoting Extremely Low Prices | Indicates substandard materials, labor exploitation, or hidden costs. | Benchmark against market averages; request material specifications. |

| No ISO 9001 or CE Certification | Suggests lack of standardized quality control or non-compliance with EU safety standards. | Exclude from shortlist unless certifications can be verified. |

| Requests Full Payment Upfront | Common in scams or financially unstable suppliers. | Insist on secure payment terms (e.g., 30% deposit, 70% against BL copy). |

| Generic or Stock Product Photos | May not reflect actual production capability. | Request time-stamped photos or videos of current production. |

| Poor English or Inconsistent Communication | May signal disorganized operations or use of outsourced sales agents. | Require direct contact with technical or operations staff. |

| Multiple Product Categories with No Specialization | Likely a trader aggregating products from various factories. | Focus on suppliers specializing in material handling or industrial machinery. |

4. Best Practices for Procurement Managers

- Use Escrow or Letter of Credit (L/C): For first-time orders, use secure payment methods.

- Start with a Trial Order: Order a single unit to evaluate quality, packaging, and documentation.

- Engage a Sourcing Agent: Consider a professional agent (e.g., SourcifyChina) to manage verification, negotiation, and QC.

- Require a Sample Before Mass Production: Confirm functionality, weld quality, and hydraulic performance.

Conclusion

Vetting hydraulic coil tilter suppliers in China requires due diligence beyond online directories. Authentic factories offer superior quality control, customization, and long-term reliability. By applying this verification framework, procurement managers can mitigate risk, ensure compliance, and build resilient supply chains.

For tailored supplier shortlists, factory audits, or ongoing quality management, contact SourcifyChina for end-to-end sourcing support.

SourcifyChina – Your Trusted Partner in China Sourcing

📞 +86 755 1234 5678 | 🌐 www.sourcifychina.com | 📧 [email protected]

Get the Verified Supplier List

SourcifyChina B2B Sourcing Intelligence Report: Hydraulic Coil Tilter Procurement in China (2026 Outlook)

Prepared for Global Procurement Leadership | Q1 2026 | Confidential

Executive Summary: The Critical Time Drain in Hydraulic Component Sourcing

Global procurement managers face escalating pressure to reduce lead times while ensuring supplier reliability in specialized industrial sectors like hydraulic coil tilters. Traditional sourcing methods for Chinese wholesalers involve 30-45 days of manual vetting, factory audits, and compliance verification – time directly impacting production schedules and cost competitiveness. Our 2026 data reveals 68% of procurement delays in hydraulic equipment stem from unverified supplier claims and inconsistent quality control.

Why SourcifyChina’s Verified Pro List Eliminates Sourcing Friction

Our proprietary Verified Pro List for “China Hydraulic Coil Tilter Wholesalers” solves the core inefficiencies in your supply chain onboarding process. Unlike open-market platforms or unvetted directories, every supplier undergoes our 7-Point Technical & Compliance Validation:

| Traditional Sourcing Process | SourcifyChina Verified Pro List | Your Time Saved |

|---|---|---|

| 3-5 weeks supplier identification & initial screening | Pre-vetted 12 qualified wholesalers (ISO 9001, CE, Machinery Directive compliant) | 18-22 business days |

| 2-3 rounds of RFQ revisions due to capability mismatches | Technical specs pre-matched to your requirements (e.g., 5-50T capacity, ±0.1° precision) | 14+ email/call hours |

| Unverified factory audits (cost: $1,200-$2,500/site) | Digital audit trails + 3rd-party quality reports included | $3,800+ per project |

| 27% risk of production delays from supplier capability gaps | Guaranteed minimum 3 years in hydraulic coil tilter specialization | Zero risk mitigation time |

Source: SourcifyChina 2025 Client Data (n=87 hydraulic equipment projects)

The 2026 Procurement Imperative: Speed-to-Reliability

With China’s hydraulic machinery export regulations tightening (GB/T 3766-2023 updates) and global demand surging 9.2% YoY, time-to-verified-supplier is now your strategic differentiator. Our clients using the Pro List:

✅ Reduced time-to-first-shipment by 37% (avg. 22 days vs. industry 35 days)

✅ Achieved 99.1% on-time delivery through pre-qualified logistics partners

✅ Avoided $220K+ in average rework costs per project via embedded QC checkpoints

Call to Action: Secure Your Competitive Advantage in 2026

Stop losing strategic capacity to supplier validation. The Verified Pro List for hydraulic coil tilters isn’t just a directory – it’s your operational insurance against supply chain disruption. Every hour spent manually vetting suppliers is an hour your competitors gain through pre-qualified capacity.

👉 Act Now to Lock In Q2 2026 Production Windows:

1. Email [email protected] with subject line “HYDRAULIC TILTER PRO LIST – [Your Company]” for immediate access to:

– Full supplier dossier (MOQs, lead times, material certs)

– Customized RFQ template for coil tilters

– Q2 2026 capacity allocation report2. WhatsApp +86 159 5127 6160 for urgent sourcing needs:

“Priority Tilter Inquiry – [Your Name/Company]” to connect with our Mandarin-English engineering team in <15 minutes.

Your next hydraulic coil tilter order shouldn’t start with supplier risk – it should start with confidence. Let SourcifyChina deploy our verified network so you deploy capital, not time.

SourcifyChina: Engineering Trusted Supply Chains Since 2018 | ISO 9001:2015 Certified Sourcing Partner

This intelligence report is based on proprietary SourcifyChina data. Unauthorized distribution prohibited.

🧮 Landed Cost Calculator

Estimate your total import cost from China.