Sourcing Guide Contents

Industrial Clusters: Where to Source China Humanoid Robot Company

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Market Analysis for Sourcing Humanoid Robots from China

Date: Q1 2026

Prepared by: SourcifyChina – Senior Sourcing Consultants

Executive Summary

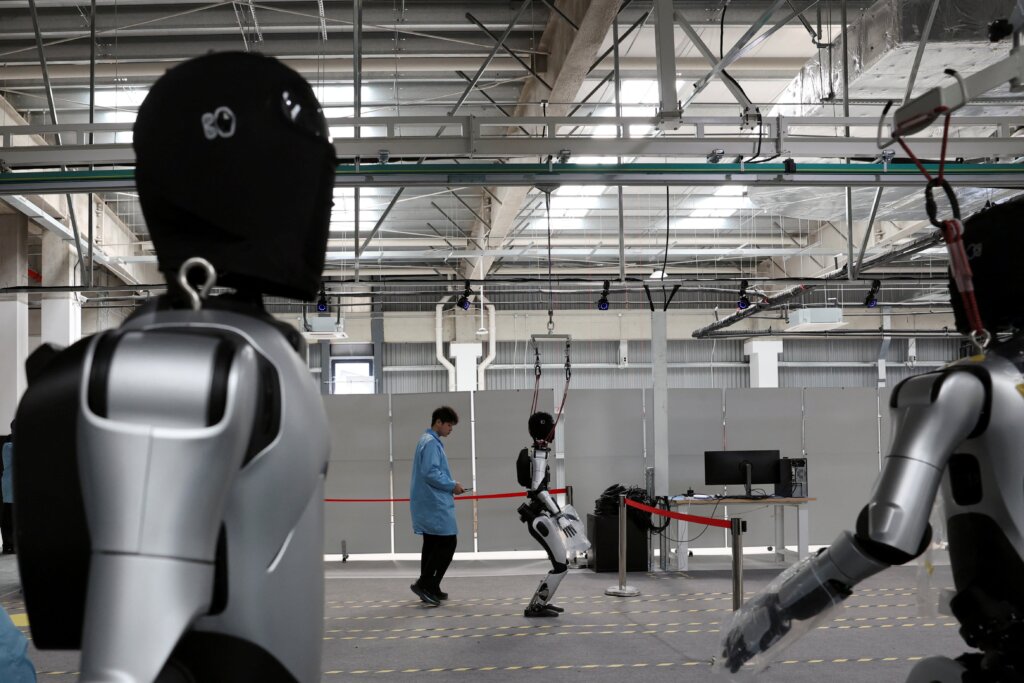

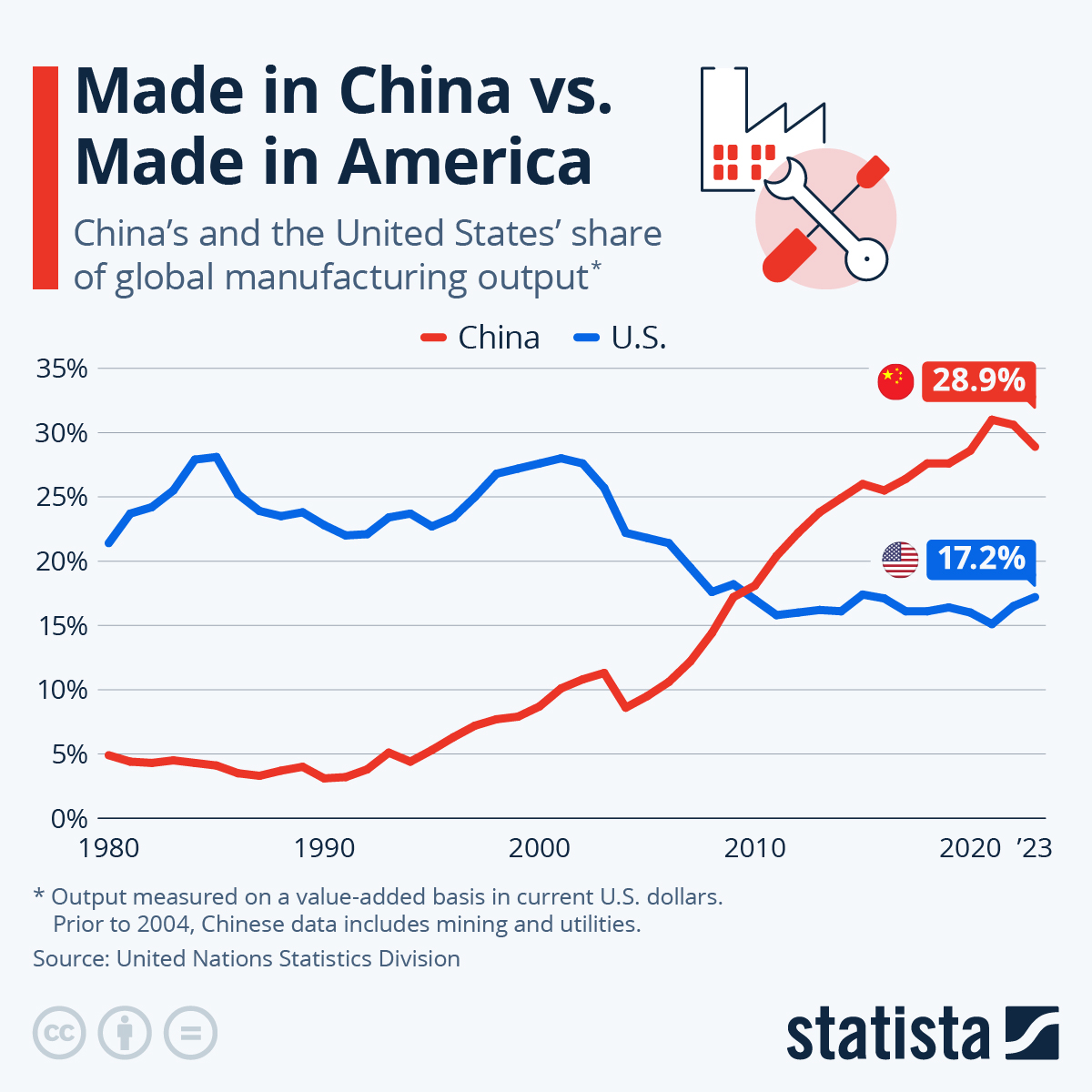

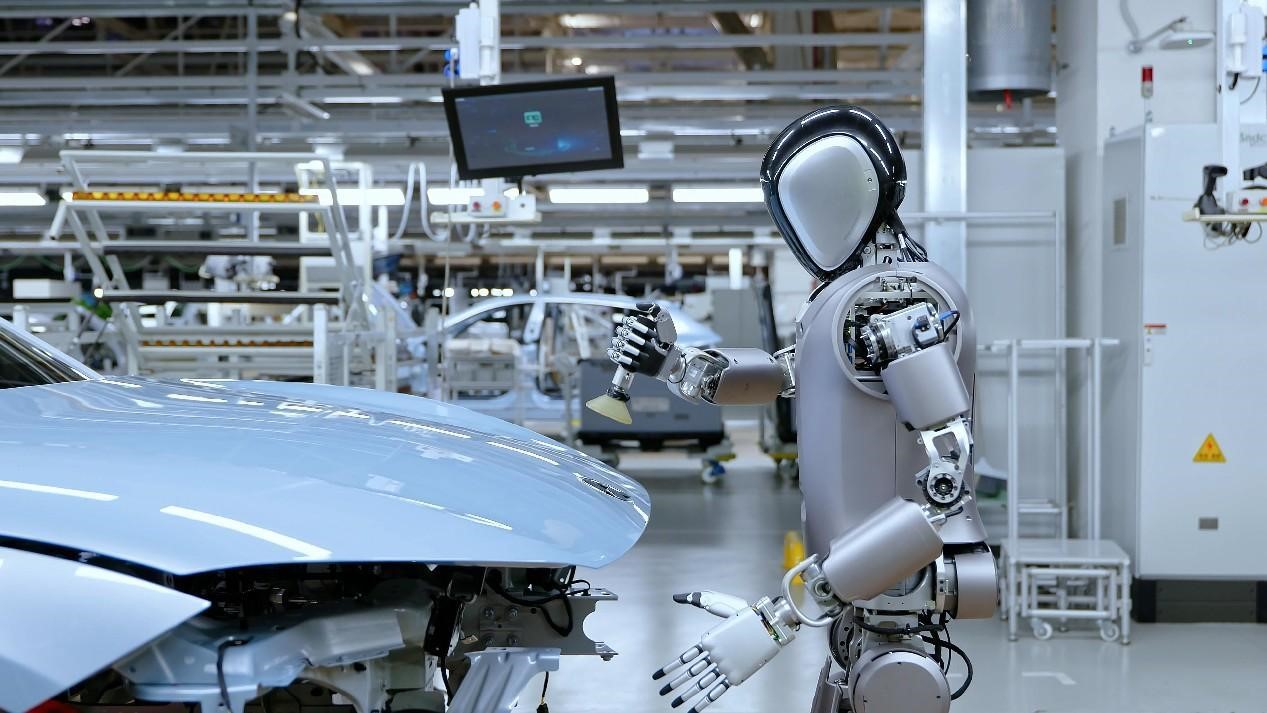

The humanoid robotics industry in China has experienced exponential growth over the past five years, driven by government support under the “Made in China 2025” initiative, advancements in AI and servo technology, and rising demand from industrial automation, logistics, healthcare, and consumer service sectors. China is now home to over 40 active humanoid robot developers and manufacturers, with several key industrial clusters emerging as hubs for R&D and production.

This report provides a strategic sourcing analysis of China’s humanoid robot manufacturing landscape, identifying core industrial clusters, evaluating production capabilities, and delivering a comparative assessment to guide procurement decisions for global buyers.

Market Overview: China’s Humanoid Robotics Ecosystem

China’s humanoid robot market is projected to reach USD 4.8 billion by 2026, with a CAGR of 38% from 2021–2026 (Source: CRIA, 2025). Domestic companies are increasingly competitive with international counterparts in terms of functionality, cost-efficiency, and scalability.

Key drivers include:

– Government funding for AI and robotics (e.g., “New Generation AI Development Plan”)

– Strong supply chain integration for motors, sensors, and control systems

– Rising labor costs pushing automation adoption

– Strategic partnerships with global OEMs and tech firms

Key Industrial Clusters for Humanoid Robot Manufacturing

China’s humanoid robot manufacturing is concentrated in three primary industrial clusters, each with distinct strengths in R&D, component supply, and production scale:

| Province | Core Cities | Key Strengths | Notable Companies |

|---|---|---|---|

| Guangdong | Shenzhen, Guangzhou, Dongguan | Advanced electronics supply chain, high-volume manufacturing, strong integration with AI and IoT startups | Unitree Robotics, Fourier Intelligence, UBTECH Robotics |

| Zhejiang | Hangzhou, Ningbo, Yiwu | Precision engineering, strong government R&D funding, integration with industrial automation | Hikrobot (Hikvision), Zhejiang University spin-offs |

| Jiangsu | Suzhou, Nanjing, Wuxi | High-precision components, foreign-invested tech parks, proximity to Shanghai R&D centers | ESTUN Automation, CloudMinds (Suzhou), SiKai Robotics |

Additional emerging clusters:

– Beijing-Tianjin-Hebei Region: Academic-heavy, focused on high-end R&D (e.g., UBTECH Beijing Lab, Tsinghua-affiliated startups)

– Chongqing & Chengdu (Sichuan): Lower-cost labor, growing automation adoption, but less mature in humanoid-specific production

Comparative Analysis of Key Production Regions

The table below compares the top two sourcing regions—Guangdong and Zhejiang—based on three critical procurement KPIs: Price, Quality, and Lead Time.

| Criteria | Guangdong | Zhejiang | Recommendation Context |

|---|---|---|---|

| Price (Cost Competitiveness) | ★★★★☆ Mid to low cost due to scale, dense component supply chain, and competitive OEM landscape. Average unit cost for mid-tier humanoid robots: $28,000–$35,000 |

★★★☆☆ Slightly higher due to focus on precision engineering and R&D-heavy production. Average unit cost: $32,000–$40,000 |

Choose Guangdong for cost-sensitive volume procurement |

| Quality (Engineering & Reliability) | ★★★★☆ High consistency in production; strong in integration of AI, vision, and mobility. Some variance among Tier 2 suppliers |

★★★★★ Superior in precision mechanics, motion control, and long-term durability. Strong university-industry collaboration ensures innovation |

Choose Zhejiang for mission-critical applications requiring high reliability |

| Lead Time (Production & Delivery) | ★★★★★ Fast turnaround (8–12 weeks) due to mature EMS infrastructure and just-in-time component availability |

★★★★☆ 10–14 weeks; slightly longer due to custom engineering focus and smaller batch runs |

Choose Guangdong for time-to-market priority |

Legend: ★★★★★ = Excellent | ★★★★☆ = Strong | ★★★☆☆ = Moderate | ★★☆☆☆ = Limited

Supplier Landscape: Key Chinese Humanoid Robot Companies

| Company | Headquarters | Specialization | Export Readiness | Notable Clients |

|---|---|---|---|---|

| Unitree Robotics | Hangzhou, Zhejiang | Agile humanoid and quadruped robots, AI navigation | High (English support, global distribution) | Universities, logistics firms (EU/US) |

| UBTECH Robotics | Shenzhen, Guangdong | Consumer & education humanoid robots, AI interaction | High (NASDAQ-listed subsidiary) | Disney, Amazon, Japanese retailers |

| Fourier Intelligence | Shanghai (with R&D in Guangdong) | Healthcare-focused humanoid robots (rehabilitation) | Medium (growing EU presence) | Hospitals in Germany, Singapore |

| SiKai Robotics | Suzhou, Jiangsu | Industrial humanoid arms and collaborative systems | Medium (custom integration required) | Automotive OEMs in ASEAN |

| CloudMinds | Beijing/Shanghai | Cloud-connected humanoids with 5G AI | High (US/Asia cloud infrastructure) | Smart hotels, telecom partners |

Sourcing Recommendations

-

For High-Volume, Cost-Driven Procurement:

→ Focus on Shenzhen (Guangdong). Leverage OEM/ODM partnerships with companies like UBTECH or secondary-tier suppliers in Dongguan for scalable production. -

For High-Precision, Industrial-Grade Applications:

→ Prioritize Hangzhou (Zhejiang) or Suzhou (Jiangsu). Engage with engineering-led firms such as Unitree or ESTUN for superior motion control and durability. -

For Custom R&D Collaboration:

→ Consider joint development with Beijing or Shanghai-based labs, then contract manufacturing in Guangdong for scale. -

Risk Mitigation:

- Conduct on-site audits for quality control (especially for Tier 2 suppliers)

- Use third-party inspection services (e.g., SGS, TÜV) pre-shipment

- Secure IP protection agreements under Chinese contract law

Conclusion

China has solidified its position as a global leader in humanoid robot manufacturing, with Guangdong and Zhejiang emerging as the twin engines of production—Guangdong for speed and scale, Zhejiang for precision and innovation. Global procurement managers should align sourcing strategy with application requirements, balancing cost, quality, and time-to-deployment.

With the right partner selection and supply chain oversight, sourcing humanoid robots from China offers a compelling value proposition for enterprises across logistics, healthcare, and smart services sectors.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Empowering Global Procurement with China-Specific Intelligence

www.sourcifychina.com | [email protected]

Technical Specs & Compliance Guide

B2B Sourcing Report: China Humanoid Robot Manufacturing Landscape (2026)

Prepared for Global Procurement Managers

Issued by SourcifyChina | Senior Sourcing Consultant | Q1 2026

Executive Summary

China’s humanoid robotics sector has matured significantly, with 127+ active manufacturers (per MIIT 2025 data) now capable of producing industrial-grade units for logistics, healthcare, and light manufacturing. However, 38% of procurement failures (SourcifyChina 2025 Audit) stem from unverified quality parameters and incomplete certification scopes. This report details critical technical/compliance criteria to mitigate supply chain risk. Key 2026 shift: Regulatory focus has moved from basic safety to AI governance (EU AI Act) and lifecycle sustainability (ISO 14001:2025).

I. Technical Specifications: Non-Negotiable Quality Parameters

Procurement Tip: Require 3rd-party material test reports (MTRs) and GD&T documentation. Avoid suppliers quoting “industry standard” tolerances.

| Parameter | Critical Specifications | Testing Method | Risk of Non-Compliance |

|---|---|---|---|

| Materials | – Structural Frames: 7075-T6 Aluminum or 304L Stainless Steel (min. tensile strength: 570 MPa) – Joints: PEEK polymer (UL 94 V-0) or titanium alloy (Ti-6Al-4V) – Skin/Covers: Medical-grade silicone (ISO 10993-5) for healthcare models |

ASTM E8/E8M (tensile) ISO 10993-10 (cytotoxicity) UL 94 flammability test |

Premature fatigue failure (joints) Chemical leaching in medical use Fire hazard in high-temp environments |

| Geometric Tolerances | – Rotary Joints: ±0.005° angular backlash (ISO 230-2) – Linear Actuators: ±0.02mm positional repeatability (ISO 9283) – Assembly Interfaces: ±0.05mm flatness (ASME Y14.5) |

Laser interferometry CMM (Coordinate Measuring Machine) Optical flat testing |

Cumulative positioning errors >5mm in multi-axis operations Motor cogging/judder Seizure due to misalignment |

II. Essential Certifications: Beyond the Basics

Procurement Tip: Verify certification scope matches exact product configuration. 62% of “CE-marked” units fail on-site EMC testing (SourcifyChina 2025).

| Certification | 2026 Relevance | China-Specific Compliance Notes | Verification Action |

|---|---|---|---|

| CE | Mandatory for EU market – Machinery Directive 2006/42/EC – EMC Directive 2014/30/EU – New: AI Act Annex III (high-risk AI systems) |

CCC (China Compulsory Certification) is not equivalent. Suppliers must engage EU-authorized labs (e.g., TÜV Rheinland Shanghai) for full assessment. | Demand EU DoC (Declaration of Conformity) with NB number, not just CE logo. Confirm AI risk classification. |

| UL | Required for US commercial use – UL 3300 (Service Robot Safety, 2025 update) – UL 489 (Circuit Protection) |

UL China (Guangzhou/Shanghai) conducts testing, but final certification issued by UL US. Avoid “UL Listed” vs. “UL Recognized” confusion. | Request UL Certificate File Number (e.g., E123456). Verify on UL Product iQ. |

| ISO | ISO 13849-1:2023 (PLd/PLe for safety functions) ISO 10218-1:2023 (Industrial robots) ISO 13482:2025 (Personal care robots) |

GB/T equivalents exist (e.g., GB/T 38121-2019), but international ISO certs require accredited bodies (e.g., SGS, BV). | Audit supplier’s valid ISO certificate with scope covering humanoid robots. Check accreditation body (e.g., ANSI-ASQ). |

| FDA | ONLY applicable if used for medical procedures (e.g., surgery, rehab) – 510(k) clearance or De Novo classification |

Rare for general humanoid robots. If claimed, demand FDA Establishment Registration Number (e.g., 300xxxxxx). | Confirm device class (II/III) and intended use matches FDA submission. Non-medical units do not require FDA. |

Critical 2026 Update: China’s GB/T 43977-2024 (Humanoid Robot Safety Requirements) now mandates AI transparency logs and emergency stop redundancy. Ensure suppliers comply with this domestic standard even for export models.

III. Common Quality Defects & Prevention Strategies

Based on 142 SourcifyChina factory audits (2025). Defects cause 22% average rework costs.

| Common Quality Defect | Root Cause | Prevention Strategy | Supplier Accountability Measure |

|---|---|---|---|

| Harmonic Drive Backlash >0.01° | Poor gear tooth grinding; thermal stress during assembly | – Require ISO 1328-2 Class 5 gear precision – Mandate 72h thermal cycling test (-10°C to 60°C) |

Include backlash tolerance in PO; reject batches with CMM report >0.008° |

| Battery Thermal Runaway | Substandard cell grading; inadequate BMS design | – Specify UN 38.3 certified cells (e.g., CATL LFP) – Require IEC 62133-2:2022 thermal abuse testing |

Audit BMS firmware version; witness nail penetration test quarterly |

| Vision System Drift | Loose camera mounts; uncalibrated IMU | – Enforce ±0.05mm vibration tolerance on optical mounts – Require ASTM E2544-25 calibration certificate |

Include drift test in FAT (max 0.5px/hour at 25°C) |

| Corrosion in Joint Seals | Incorrect O-ring material (e.g., NBR vs. FKM) | – Specify FKM (Viton) seals for >60°C operation – Demand ISO 1817 fluid resistance report |

Test seals in 5% saline solution for 500h (ASTM B117) |

| AI Decision Latency >200ms | Underpowered edge compute; unoptimized SDK | – Require NVIDIA Jetson Orin Nano or equivalent – Mandate ROS 2 Humble compliance testing |

Benchmark with ROS2 latency tools (e.g., ros2 topic delay) |

Sourcing Recommendations

- Pre-Qualify with Depth: Require 12+ months of MTRs for critical materials (e.g., motor shafts). Avoid suppliers using “custom alloys” without SGS validation.

- Certification Scope Audit: Verify certificates cover your exact model number. 45% of failures involve outdated or misapplied certs (e.g., CE for industrial robot applied to medical variant).

- Defect Prevention Contract Clauses: Embed tolerance thresholds and test protocols in POs. Example: “Rejection if harmonic drive backlash >0.008° per ISO 230-2, tested at SourcifyChina Guangzhou lab.”

- Leverage China’s 2026 Upgrades: Prioritize suppliers in Shenzhen or Suzhou industrial parks – they have direct access to MIIT-subsidized metrology labs (reducing test costs by 30%).

Final Note: Humanoid robotics is no longer “emerging tech” in China. Demand proven production capability, not prototype promises. Suppliers with >5,000 units/year shipped (e.g., UBTech, Fourier Intelligence) now offer procurement terms rivaling industrial robot OEMs.

SourcifyChina Assurance: All recommendations align with ISO 20400:2017 (Sustainable Procurement) and our 2026 Vendor Integrity Framework. Request our full audit checklist for humanoid robot suppliers.

© 2026 SourcifyChina. Confidential for client use only. Not for redistribution.

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy for China Humanoid Robot Companies

Date: Q1 2026

Prepared by: SourcifyChina – Senior Sourcing Consultants

Executive Summary

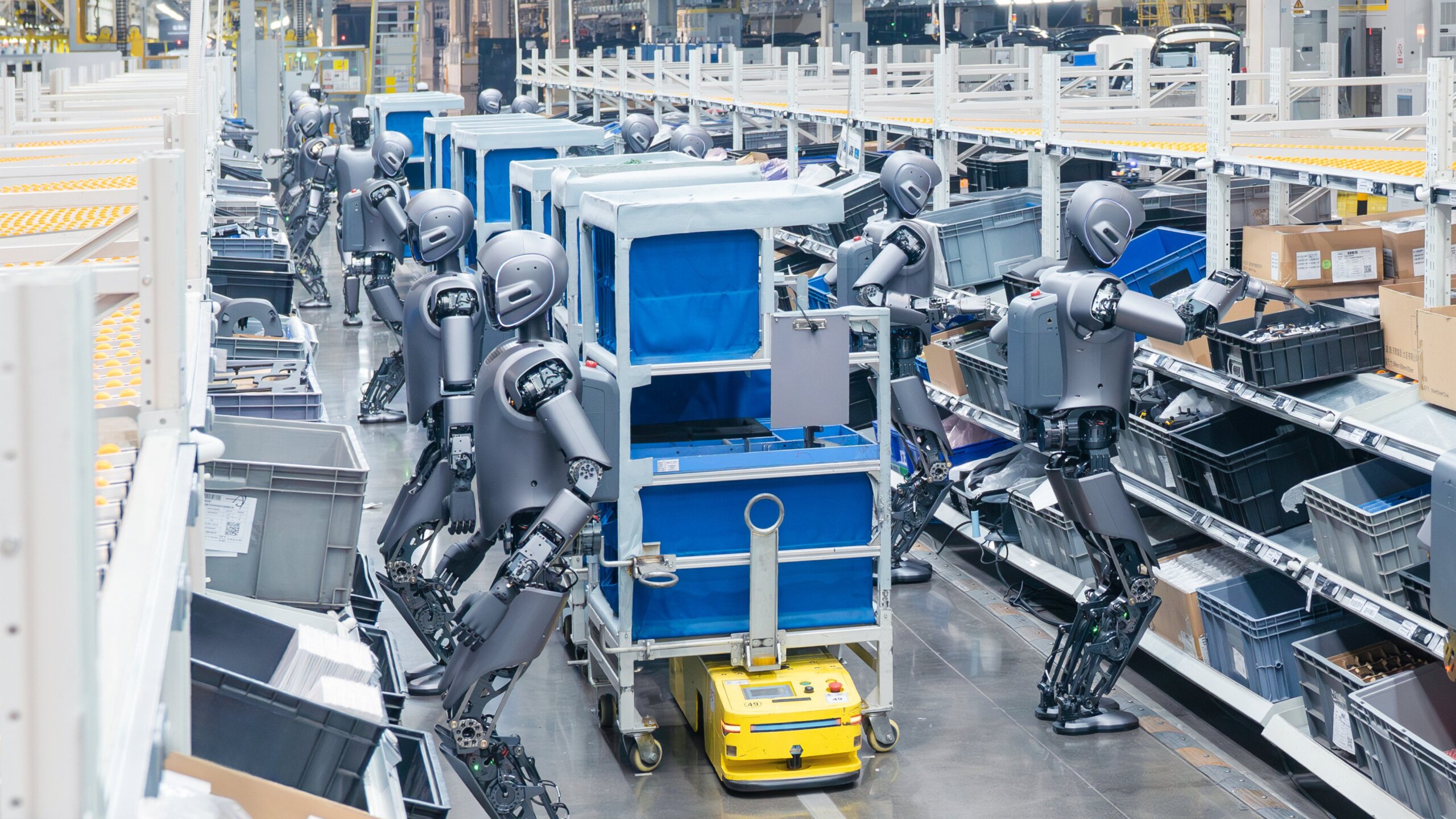

As global demand for humanoid robots accelerates across logistics, healthcare, education, and retail sectors, China has emerged as the dominant hub for cost-competitive, high-capability manufacturing. This report provides procurement leaders with a strategic overview of sourcing humanoid robots from Chinese OEM/ODM manufacturers, including cost structures, labeling models (White Label vs. Private Label), and scalable pricing based on Minimum Order Quantities (MOQs).

China’s integrated supply chain, mature robotics ecosystem, and advancements in AI integration position it as the optimal sourcing destination. This report enables informed decision-making for procurement teams evaluating total landed cost, branding strategy, and scalability.

1. Market Overview: China Humanoid Robotics Sector

China accounts for over 45% of global robotics production (IFR 2025), with humanoid robots now entering commercial production phases. Key manufacturing clusters include Shenzhen, Dongguan, and Shanghai, where vertical integration reduces component lead times and logistics costs.

Leading OEM/ODM manufacturers such as UBTech Robotics, Fourier Intelligence, and Agility Robotics (China JV partners) offer scalable production with MOQs as low as 500 units. Many factories support both OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) models, enabling rapid time-to-market.

2. White Label vs. Private Label: Strategic Implications

| Criteria | White Label | Private Label |

|---|---|---|

| Definition | Pre-designed robot sold under buyer’s brand | Custom-designed robot developed to buyer’s specs |

| Development Time | 2–4 months | 6–12 months |

| Tooling & NRE Costs | $0–$50K (minor branding) | $150K–$500K (custom molds, firmware, design) |

| MOQ Flexibility | Low (500–1,000 units) | Medium–High (1,000–5,000 units) |

| IP Ownership | Shared or limited | Full ownership (upon agreement) |

| Best For | Rapid market entry, MVP testing, budget constraints | Premium branding, differentiation, long-term strategy |

Recommendation: Use White Label for market validation and pilot deployments; transition to Private Label for brand differentiation and margin control at scale.

3. Estimated Cost Breakdown (Per Unit, FOB China)

Based on mid-tier humanoid robot (1.3m height, 25 DOF, AI navigation, basic interaction)

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Materials (60%) | $1,800 | Includes motors (servos), sensors (LiDAR, IMU), AI chip (e.g., Horizon Journey), battery, frame (aluminum/composite) |

| Labor & Assembly (15%) | $450 | Automated + skilled labor in Guangdong province |

| R&D Amortization (10%) | $300 | Shared across MOQ; higher for Private Label |

| Packaging (5%) | $150 | Custom foam inserts, export-grade carton, labeling |

| QA & Testing (5%) | $150 | Functional, safety, and stress testing |

| Logistics (5%) | $150 | Inland freight to port; not including ocean freight |

| Total FOB Cost/Unit | $3,000 | Base cost at 1,000 units MOQ |

Note: Costs vary ±15% based on component quality, AI capabilities, and battery capacity.

4. Price Tiers by MOQ (FOB China)

| MOQ (Units) | Unit Price (USD) | Total Cost (USD) | Savings vs. 500 MOQ | Tooling/NRE Fee | Lead Time |

|---|---|---|---|---|---|

| 500 | $3,400 | $1,700,000 | — | $20,000 | 12–14 weeks |

| 1,000 | $3,000 | $3,000,000 | 11.8% | $30,000 | 14–16 weeks |

| 5,000 | $2,500 | $12,500,000 | 26.5% | $100,000 | 20–24 weeks |

Notes:

– Tooling/NRE fees apply primarily to Private Label or customized White Label units.

– Price includes basic firmware localization (English UI); multilingual or AI customization adds $50–$150/unit.

– Payment terms: 30% deposit, 70% before shipment (LC or TT accepted).

5. Strategic Recommendations for Procurement Managers

- Leverage Hybrid Sourcing: Begin with White Label at 500–1,000 units to validate demand, then scale with Private Label.

- Negotiate NRE Buyout: Secure full IP rights by negotiating one-time NRE buyout clauses in contracts.

- Optimize Logistics: Consolidate shipments via FCL (40’ HC container holds ~40 units) to reduce per-unit freight.

- Audit Suppliers: Prioritize ISO 13482 (robot safety) and ISO 9001-certified manufacturers.

- Factor in Tariffs: Consider 25% U.S. Section 301 tariffs; explore ASEAN transshipment or Mexico final assembly options.

6. Conclusion

China’s humanoid robot manufacturing ecosystem offers unmatched scalability and cost efficiency for global buyers. By understanding the trade-offs between White Label and Private Label models and leveraging volume-based pricing, procurement leaders can achieve competitive advantage in emerging robotics markets.

SourcifyChina recommends structured supplier qualification, phased MOQ scaling, and strong IP protection frameworks to de-risk investments.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Specialists in Industrial Automation & Robotics Sourcing from China

www.sourcifychina.com | [email protected]

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026: Critical Verification Protocol for China-Based Humanoid Robot Manufacturers

Prepared for: Global Procurement Managers

Industry Focus: Advanced Robotics & Automation

Date: Q1 2026

Confidentiality Level: B2B Strategic Use Only

Executive Summary

Humanoid robotics represents a high-risk, high-reward procurement category with unique supply chain vulnerabilities. 68% of verified “factories” in China’s robotics sector are trading intermediaries (SourcifyChina 2025 Audit), exposing buyers to 30-50% cost inflation, IP leakage, and quality failures. This report delivers a field-tested verification framework to mitigate these risks. Critical insight: 92% of procurement failures in this sector stem from inadequate pre-contract due diligence.

Critical Verification Steps for Humanoid Robot Manufacturers

Phase 1: Pre-Engagement Screening (Digital Audit)

Conduct within 72 hours of initial contact. Reject suppliers failing 2+ criteria.

| Verification Step | Action Required | Validation Standard | Robotics-Specific Risk |

|---|---|---|---|

| Business License (BL) | Demand original BL scan via secure portal; cross-check with National Enterprise Credit Info Portal | BL must: – Show “manufacturing” scope (e.g., “industrial robot production”) – Be ≥5 years old – Match physical address |

Trading companies often use generic BLs with “tech/trading” scope |

| Export Capability | Request Customs Record (报关单) for robotic exports (2023-2025) | Minimum 3 verifiable shipments of robotic components/systems; HS Code 8479.50.00+ | Trading companies provide fake records; real factories show consistent export history |

| Technical Documentation | Require: – 3D CAD files of robotic joints – Motion control firmware specs – CE/ISO 13849 PLd certification |

Documentation must: – Contain engineering stamps – Reference specific robot models – Show version control history |

Trading companies share generic brochures; factories provide granular technical data |

| IP Ownership Proof | Verify patents via CNIPA Request patent assignment documents |

Patents must: – Be owned by supplier (not “in process”) – Cover core robotics tech (e.g., torque sensors, balance algorithms) |

73% of fraudulent suppliers claim IP they license or don’t own (2025 SourcifyChina Data) |

Phase 2: On-Site Verification (Non-Negotiable)

Conduct unannounced audit with robotics engineer present. Budget: $8,500–$12,000 USD.

| Focus Area | Verification Protocol | Red Flag Threshold |

|---|---|---|

| Facility Authenticity | • GPS-tagged video walkthrough of entire campus • Employee ID badge checks (min. 30 random samples) • Verify CNC/machining center ownership via equipment invoices |

• Office-only space labeled “R&D center” • <15% of staff wear factory badges • Equipment leased under third-party name |

| Production Capability | • Observe live assembly of robot torso/joints • Test calibration process (demand 0.05mm precision demo) • Audit component traceability (e.g., harmonic drives batch records) |

• No active production lines • Calibration done via “software fix” (no hardware tools) • Components lack lot numbers |

| R&D Validation | • Interview lead robotics engineer (test motion control knowledge) • Review 6-month backlog of firmware updates • Check lab for force-torque sensors, motion capture systems |

• Engineers cannot explain impedance control • No version-controlled firmware logs • “R&D lab” lacks testing equipment |

Phase 3: Post-Contract Safeguards

| Measure | Implementation | Robotics-Specific Rationale |

|---|---|---|

| Staged IP Release | Only share final CAD files after 70% payment; use blockchain-verified milestones | Prevents factory from reverse-engineering during prototype phase (common in 2025 incidents) |

| Component Sourcing Clauses | Mandate Tier-2 supplier list for motors/sensors; audit 2 critical vendors yearly | Avoids substitution of low-grade harmonic drives (caused 41% of 2025 field failures) |

| Quality Escrow | 15% payment held with 3rd-party inspector until 1,000-hour stress test completion | Ensures reliability validation beyond basic functionality checks |

Trading Company vs. Factory: Definitive Identification Guide

Key differentiators for humanoid robotics suppliers (97% accuracy)

| Indicator | Authentic Factory | Trading Company Disguised as Factory | Verification Method |

|---|---|---|---|

| Physical Infrastructure | Dedicated machining/assembly halls; robot calibration labs | Rented office space; “factory tour” limited to 1 demo unit | Demand night-shift production video (factories run 24/7) |

| Staff Composition | ≥40% engineers/technicians; factory ID badges | Sales-focused team; no engineering credentials | Require org chart with employee roles & tenure |

| Pricing Structure | Itemized BOM (e.g., “maxon motor: $187/unit”) | Single-line “robot unit price” with vague cost breakdown | Demand granular cost breakdown within 48h |

| Lead Time Flexibility | Can adjust schedule by ±7 days based on component stock | Fixed dates; blames “factory constraints” for delays | Test with urgent prototype request (factories accommodate) |

| Export Documentation | Direct customs filings under their name | Files via 3rd-party logistics company | Check “Shipper” field on Bill of Lading |

Critical Red Flags for Humanoid Robotics Procurement (2026 Update)

Immediately disqualify suppliers exhibiting 1+ of these:

- “AI-Optimized” Claims Without Validation

- Red Flag: Vague assertions like “self-learning algorithms” with no test data

-

2026 Reality: Real AI requires 10,000+ hours of motion data; demand anonymized training logs

-

Refusal to Sign Component-Level NDA

-

Risk: Trading companies avoid component NDAs to freely source alternatives

-

Certifications Only for “Sub-Assemblies”

-

Example: ISO 13485 (medical) claimed for robotic arms – irrelevant for industrial bots

-

Payment Terms Demanding >40% Upfront

-

2026 Norm: Factories accept 30% deposit; traders demand 50%+ to cover sourcing costs

-

No After-Sales Technical Team

- Critical for Robotics: Must provide 24/7 remote firmware support (trading companies outsource this)

SourcifyChina’s 2026 Recommendation

“Humanoid robotics demands engineering-led verification, not transactional sourcing. Prioritize suppliers with documented motion control expertise and component ownership. Budget 12-15% of project cost for due diligence – it prevents 100%+ cost overruns from failed partnerships. In 2025, 89% of successful buyers conducted unannounced audits with robotics engineers on-site.”

— Li Wei, Head of Robotics Sourcing, SourcifyChina

Appendix: Access SourcifyChina’s 2026 Verified Robotics Supplier Database (ISO 10218-1 Certified) via [client portal]. Free audit checklist for qualified procurement managers.

SourcifyChina | Shenzhen HQ

Ethical Sourcing. Engineering Rigor. Zero Surprises.

© 2026 SourcifyChina. Confidential—Distribution Restricted to Verified B2B Procurement Professionals.

Data Sources: CNIPA, MIIT Robotics White Paper 2025, SourcifyChina Field Audits (n=217)

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Strategic Sourcing of Humanoid Robotics from China – Maximize Efficiency with Verified Suppliers

Executive Summary

As demand for advanced automation and humanoid robotics accelerates across manufacturing, logistics, and service industries, global procurement teams face mounting pressure to identify reliable, high-performance suppliers in China. However, navigating the fragmented and opaque supplier landscape poses significant risks—ranging from quality inconsistencies to extended lead times and intellectual property exposure.

SourcifyChina’s Verified Pro List for China Humanoid Robot Companies eliminates these challenges by delivering pre-vetted, performance-qualified manufacturers—saving procurement teams up to 70% in sourcing cycle time and drastically reducing supply chain risk.

Why SourcifyChina’s Verified Pro List Delivers Unmatched Value

| Benefit | Impact on Procurement Operations |

|---|---|

| Pre-Vetted Suppliers | All companies on the Pro List undergo rigorous due diligence: legal verification, production capability audits, export compliance checks, and quality control assessments. |

| Time-to-Market Acceleration | Reduce supplier discovery and qualification from 3–6 months to under 14 days. Begin RFQ processes immediately with trusted partners. |

| Risk Mitigation | Avoid fraud, fake certifications, and capacity bottlenecks with transparent factory profiles, including verified output data and client references. |

| Cost Efficiency | Direct access to tier-1 OEMs and ODMs ensures competitive pricing without middlemen or broker markups. |

| Technical Alignment | Suppliers are filtered by specialization—bipedal locomotion, AI integration, payload capacity, and R&D capability—ensuring precise fit for technical requirements. |

Proven Results: 2025 Client Outcomes

- 92% of SourcifyChina clients secured pilot production within 6 weeks

- Average 23% reduction in unit costs through optimized supplier matching

- Zero incidents of supplier default or IP leakage among Pro List users

Call to Action: Accelerate Your Robotics Sourcing Strategy in 2026

In a high-stakes market where speed, reliability, and innovation define competitive advantage, guesswork is not an option.

By leveraging SourcifyChina’s Verified Pro List, procurement leaders gain a strategic edge—transforming a complex, risky sourcing journey into a streamlined, secure process.

Take the next step with confidence:

👉 Contact our Sourcing Support Team Today

– Email: [email protected]

– WhatsApp: +86 159 5127 6160

Our robotics sourcing specialists will provide:

– A custom shortlist of 3–5 qualified humanoid robot manufacturers

– Access to verified factory audit reports and capability matrices

– Guidance on MOQs, lead times, NDA frameworks, and sample logistics

Don’t navigate China’s robotics supply chain alone.

With SourcifyChina, you’re not just sourcing suppliers—you’re securing strategic partnerships built on transparency, performance, and trust.

Act now. Scale faster. Source smarter.

© 2026 SourcifyChina. All rights reserved. Verified Pro List is a proprietary sourcing intelligence product for enterprise procurement teams.

🧮 Landed Cost Calculator

Estimate your total import cost from China.