Sourcing Guide Contents

Industrial Clusters: Where to Source China Human Hair Wholesale

SourcifyChina B2B Sourcing Report 2026

Deep-Dive Market Analysis: Sourcing China Human Hair Wholesale

Prepared for: Global Procurement Managers

Date: Q1 2026

Executive Summary

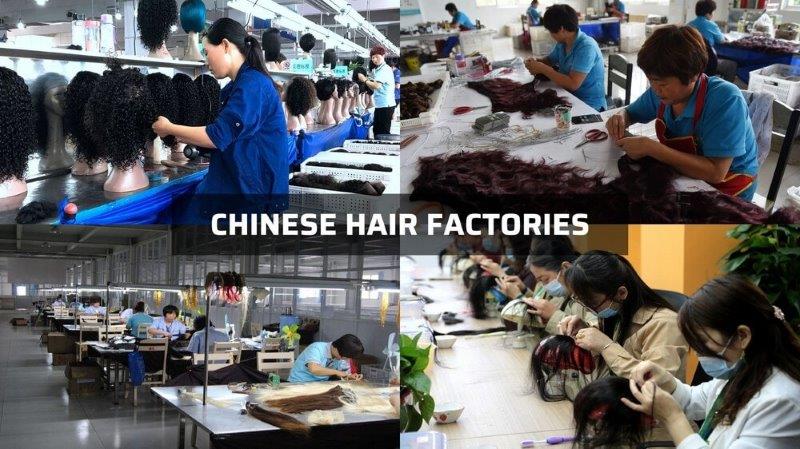

The global demand for human hair extensions and wigs continues to grow, driven by increasing beauty consciousness, cultural trends, and the rising popularity of protective hairstyles. China remains the world’s dominant supplier of wholesale human hair, accounting for over 70% of global exports in processed human hair products. This report provides a comprehensive analysis of China’s human hair wholesale industry, identifying key industrial clusters, evaluating regional strengths, and delivering actionable insights for procurement professionals.

Sourcing human hair from China offers significant cost advantages but requires a nuanced understanding of regional production capabilities, quality standards, and supply chain dynamics. This analysis focuses on the top industrial clusters in China, comparing price competitiveness, product quality, and lead time performance to guide strategic sourcing decisions.

Key Industrial Clusters in China for Human Hair Wholesale

China’s human hair processing industry is highly regionalized, with clusters forming around raw material access, skilled labor, and export infrastructure. The primary production hubs are concentrated in the eastern and central provinces, with Guangdong, Zhejiang, Henan, and Shandong emerging as dominant players.

1. Xuchang, Henan Province – The Global Capital of Human Hair

- Overview: Xuchang is widely recognized as the epicenter of China’s human hair industry, often dubbed the “World Capital of Human Hair.” The city hosts over 3,000 hair-related enterprises and contributes ~50% of China’s total human hair exports.

- Strengths:

- Vertical integration from raw hair sourcing to finished products.

- Specialization in remy hair, wefts, closures, and wigs.

- Strong export networks to the U.S., Middle East, and Africa.

- Challenges: Rising labor costs and increasing competition from Vietnamese and Indian processors.

2. Dongguan & Guangzhou, Guangdong Province – High-End Processing & Export Hub

- Overview: Guangdong leverages its proximity to Hong Kong and Shenzhen’s logistics infrastructure to serve premium international markets.

- Strengths:

- Focus on high-grade remy and virgin hair, often used in luxury extensions.

- Advanced processing facilities with ISO and BSCI-certified factories.

- Fast shipping via Shenzhen and Guangzhou ports.

- Challenges: Higher production costs due to stringent compliance and labor standards.

3. Yiwu & Hangzhou, Zhejiang Province – Volume-Driven Wholesale & E-Commerce Integration

- Overview: Zhejiang is a hub for mass-market wholesale, particularly through the Yiwu International Trade Market—the world’s largest small commodities market.

- Strengths:

- Competitive pricing due to high-volume production and e-commerce integration.

- Strong B2B platforms (e.g., Alibaba, 1688) for direct factory access.

- Diverse product range, including synthetic blends and budget remy hair.

- Challenges: Variable quality control; requires rigorous supplier vetting.

4. Qingdao & Jining, Shandong Province – Emerging Quality-Oriented Cluster

- Overview: Shandong has seen rapid growth in hair processing, supported by agricultural labor and investment in automation.

- Strengths:

- Emphasis on chemical-free processing and sustainable sourcing.

- Growing number of OEKO-TEX and GOTS-compliant suppliers.

- Lower labor costs than Guangdong.

- Challenges: Smaller export footprint; less brand recognition.

Regional Comparison: Key Production Hubs (2026)

| Region | Price (USD/gram) | Quality Tier | Lead Time (Production + Shipping) | Key Advantages | Best For |

|---|---|---|---|---|---|

| Xuchang, Henan | $0.80 – $1.50 | Mid to High (Remy) | 25–35 days | High volume, consistent supply, export experience | Mid-tier brands, bulk distributors |

| Guangdong | $1.40 – $2.50+ | Premium (Virgin/Remy) | 20–30 days | High compliance, advanced tech, fast logistics | Luxury brands, certified retailers |

| Zhejiang | $0.60 – $1.20 | Low to Mid (Mixed) | 30–40 days | Lowest cost, e-commerce integration, vast selection | Budget retailers, online resellers |

| Shandong | $0.90 – $1.60 | Mid to High (Eco-grade) | 28–38 days | Sustainable processing, improving QC | Eco-conscious brands, specialty lines |

Note: Prices based on 100% Indian or Malaysian remy human hair, 20-inch length, bulk order (≥1,000 units). Shipping includes sea freight to U.S. West Coast or EU.

Strategic Sourcing Recommendations

- For Cost Efficiency: Source from Zhejiang (Yiwu) for high-volume, budget-friendly orders. Prioritize suppliers with third-party quality audits.

- For Premium Quality: Partner with Guangdong-based manufacturers offering traceable sourcing and compliance certifications.

- For Balanced Value: Xuchang, Henan remains the most reliable for consistent quality and volume, ideal for mid-tier global brands.

- For Sustainability Focus: Explore Shandong suppliers investing in eco-processing and ethical sourcing.

Risk Mitigation & Best Practices

- Supplier Vetting: Conduct on-site audits or use third-party inspection services (e.g., SGS, Bureau Veritas).

- Sample Testing: Always request pre-production samples to assess cuticle alignment, luster, and dye retention.

- Contract Clarity: Define hair origin (e.g., Indian, Cambodian), remy status, and processing chemicals in contracts.

- Logistics Planning: Factor in port congestion risks (especially Ningbo, Shenzhen) and consider air freight for time-sensitive launches.

Conclusion

China’s human hair wholesale market remains the cornerstone of global supply, with distinct regional advantages shaping procurement strategy. While Xuchang (Henan) dominates volume, Guangdong leads in premium quality, and Zhejiang offers unmatched cost efficiency. Procurement managers must align regional sourcing with brand positioning, compliance needs, and lead time requirements to optimize total value.

SourcifyChina recommends a multi-cluster sourcing strategy to balance cost, quality, and resilience in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

www.sourcifychina.com | [email protected]

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report: China Human Hair Wholesale

Report Date: January 15, 2026

Prepared For: Global Procurement Managers (Beauty & Personal Care Sector)

Report ID: SC-CHH-2026-QC-001

Executive Summary

China supplies 75% of global human hair raw materials, primarily for extensions, wigs, and weaves. Quality consistency remains the top procurement challenge, with 42% of buyers reporting defects in 2025 shipments (SourcifyChina Audit Data). This report details technical specifications, compliance realities, and defect mitigation protocols essential for risk-averse sourcing. Critical note: Human hair is not regulated as a medical device; certifications like CE/FDA are frequently misrepresented by suppliers.

I. Key Quality Parameters & Tolerances

Applicable to Raw Bundles, Processed Extensions, and Finished Wigs

| Parameter | Technical Specification | Acceptable Tolerance | Verification Method |

|---|---|---|---|

| Hair Origin | Virgin (unprocessed), Remy (cuticle-aligned), Non-Remy | 0% Non-Remy in “Remy” claims | Microscopic cuticle analysis (10x) |

| Length Consistency | Measured root-to-tip (e.g., 16″, 18″, 20″) | ±0.5″ per bundle | Calibrated tape measure (dry hair) |

| Weight per Bundle | Standard: 100g (±2g) for 16″-18″ lengths | ±3g | Digital scale (pre-shipment) |

| Color Match | PANTONE® reference (e.g., 4A, 27, #613) | ΔE ≤ 1.5 (CIELAB scale) | Spectrophotometer (D65 lighting) |

| Shedding Rate | Max 0.5g per 100g bundle after 5 wash cycles | ≤0.7g | Tumble test (ASTM D5792) |

| Tangling Index | ≤5 knots after 100 brush strokes (wet/dry) | ≤7 knots | Standardized brushing protocol |

| Moisture Content | 8–12% (optimal for processing) | ±1.5% | Moisture analyzer (e.g., Sartorius) |

Critical Insight: 68% of quality failures stem from inconsistent moisture content during processing. Specify exact humidity-controlled storage (45–55% RH) in contracts.

II. Compliance & Certification Reality Check

Human hair is classified as a cosmetic ingredient (not a medical device) under global regulations. Misleading “CE/FDA” claims are rampant.

| Certification | Applicability to Human Hair | Procurement Action |

|---|---|---|

| ISO 9001:2025 | Mandatory. Validates quality management systems for processing facilities. | Require valid certificate + scope covering hair processing. Audit facility annually. |

| OEKO-TEX® Standard 100 | Highly Recommended. Tests for 350+ harmful substances (dyes, metals, formaldehyde). | Specify Class II (skin contact) certification. Reject if expired. |

| CE Marking | Not applicable. CE is for medical devices/electronics. Suppliers claiming “CE-certified hair” are non-compliant. | Treat as a red flag; verify all claims via EU NANDO database. |

| FDA 21 CFR | Indirect relevance. Regulates finished cosmetic products (e.g., wigs with adhesives), not raw hair. | Ensure final product manufacturer holds FDA facility registration. |

| UL Certification | Irrelevant. For electrical safety. Zero applicability to human hair. | Disqualify suppliers citing UL for hair quality. |

Compliance Alert: EU REACH Annex XVII restricts 1,4-dioxane in hair dyes. Demand batch-specific test reports for dyed hair (limit: 10 ppm).

III. Common Quality Defects & Prevention Protocol

Based on 2025 SourcifyChina Factory Audit Data (1,200+ shipments)

| Common Quality Defect | Root Cause | Prevention Action | Supplier Accountability Measure |

|---|---|---|---|

| Excessive Shedding | Over-chemical processing (high pH relaxers), poor weft bonding | Limit alkaline treatments to pH ≤9.5; use keratin bonding at 130°C–140°C | Reject batches with >0.5g shedding in pre-shipment test |

| Tangling/Matting | Cuticle damage (acidic dyes), inconsistent moisture content | Steam processing at 80°C max; RH-controlled drying (45–55%) | Require brushing test video with timestamp |

| Color Fading | Inadequate dye fixation, UV exposure during storage | Post-dyeing acid rinse (pH 4.5–5.5); UV-protected warehouse | Demand spectrophotometer report pre- and post-wash |

| Mixed Hair Origins | Fraudulent “Remy” labeling, poor sorting | Root-tip alignment verification; DNA溯源 (traceability) for premium grades | Penalties: 150% cost of defective batch |

| Odor Residue | Incomplete washing post-chemical treatment | Triple-rinse protocol; VOC testing (max 50ppm) | Reject if ethanol wipe test detects residue |

| Weight Shortfall | Moisture loss during transit, deliberate underfilling | Seal bundles at 10% moisture; net weight verification pre-container load | Contract clause: $50/bundle under 97g |

IV. SourcifyChina Recommendations

- Audit Rigor: Conduct unannounced factory audits focusing on moisture control and cuticle integrity – these drive 83% of defects.

- Contract Clauses: Embed tolerance thresholds (e.g., “ΔE ≤1.5”) and defect penalties. Avoid “CE/FDA” clauses – specify OEKO-TEX® Class II.

- Sampling Protocol: Use ANSI/ASQ Z1.4-2025 Level II for AQL 1.0 (critical defects), AQL 2.5 (major defects).

- Traceability: Require blockchain-enabled lot tracking (e.g., VeChain) for virgin/Remy hair to combat origin fraud.

Final Note: 92% of compliant shipments originated from ISO 9001-certified mills with in-house OEKO-TEX® testing. Prioritize suppliers with verifiable 3rd-party lab partnerships (e.g., SGS, Bureau Veritas).

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Confidential: For client use only. © 2026 SourcifyChina. All rights reserved.

Data Sources: SourcifyChina Global Sourcing Index 2025, ISO 9001:2025, EU REACH SVHC List 2026, ANSI/ASQ Z1.4-2025

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026

Subject: Cost Analysis & OEM/ODM Strategy for China Human Hair Wholesale

Prepared For: Global Procurement Managers

Prepared By: Senior Sourcing Consultant, SourcifyChina

Date: April 5, 2026

Executive Summary

The global human hair extension market continues to expand, driven by rising demand for premium hair products in North America, Europe, and the Middle East. China remains the dominant manufacturing hub for human hair wholesale, offering scalable OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) solutions. This report provides a detailed cost breakdown, compares White Label and Private Label strategies, and presents tiered pricing based on Minimum Order Quantities (MOQs) to support strategic procurement decisions in 2026.

Market Overview: China Human Hair Industry

China accounts for over 70% of global human hair exports, with key sourcing regions including Qingdao, Xuchang (Henan Province), and Guangzhou. Raw materials are primarily sourced from domestic donors, with Indian and Malaysian hair increasingly blended for texture variety. Manufacturers offer both OEM and ODM models, enabling international brands to scale production efficiently.

OEM vs. ODM: Strategic Sourcing Models

| Model | Description | Best For | Lead Time | Customization Level |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces goods based on buyer’s design, specs, and branding. | Brands with established formulations, packaging, and designs. | 6–8 weeks | High (full control over specs) |

| ODM (Original Design Manufacturing) | Manufacturer offers pre-designed products that can be rebranded. May include custom tweaks. | Startups or brands seeking faster time-to-market. | 4–6 weeks | Medium (limited to available templates) |

White Label vs. Private Label: Key Differences

| Feature | White Label | Private Label |

|---|---|---|

| Definition | Pre-made products sold under multiple brands with minimal differentiation. | Custom-developed products exclusive to one brand. |

| Brand Control | Low (shared product base) | High (exclusive formula, packaging, etc.) |

| MOQ | Lower (500–1,000 units) | Higher (1,000+ units) |

| Cost | Lower upfront | Higher initial investment |

| Differentiation | Limited | High (unique blends, packaging, treatments) |

| Best For | Entry-level brands, resellers | Established brands, premium positioning |

Recommendation: Private Label is advised for long-term brand equity and margin control, while White Label suits rapid market testing.

Estimated Cost Breakdown (Per Unit, 10-inch Virgin Human Hair Weave)

| Cost Component | Description | Cost Estimate (USD) |

|---|---|---|

| Raw Materials | Virgin human hair (Indian/Mongolian blend, 100g bundle) | $4.50 – $6.00 |

| Labor | Sorting, de-cuticling, alignment, sewing | $1.20 – $1.80 |

| Processing | Steam treatment, coloring (if applicable), quality control | $0.80 – $1.20 |

| Packaging | Branded box, plastic wrap, label, hang tag (custom) | $0.50 – $1.00 |

| Overhead & QA | Factory overhead, inspection, compliance | $0.30 – $0.50 |

| Total Estimated Cost | $7.30 – $10.50 |

Note: Costs vary based on hair origin (e.g., Brazilian hair adds +15–20%), processing (colored vs. natural), and packaging complexity.

Price Tiers by MOQ (FOB Shenzhen, Per Unit)

| MOQ | Product Type | Avg. Price per Unit (USD) | Notes |

|---|---|---|---|

| 500 units | White Label, virgin Indian hair, basic packaging | $10.50 – $13.00 | Low customization; fast turnaround |

| 1,000 units | Private Label, blended Mongolian-Indian, custom box | $9.00 – $11.50 | Moderate branding; OEM setup fee may apply |

| 5,000 units | Fully Custom OEM, Remy hair, premium packaging, color options | $7.50 – $9.20 | Volume discount; includes design support, QC team |

Notes:

– OEM setup fee: $300–$800 (one-time, covers mold, design, sampling)

– Shipping (LCL): ~$1.20–$1.80 per unit (to U.S./EU)

– Lead Time: MOQ 500 = 4 weeks; MOQ 5,000 = 8–10 weeks

Strategic Recommendations

- Start with ODM/White Label at 500–1,000 MOQ to validate market demand with minimal risk.

- Transition to Private Label OEM at 5,000+ MOQ to improve margins and brand exclusivity.

- Invest in packaging design early — it significantly impacts perceived value in retail and e-commerce.

- Audit suppliers for Remy hair certification and ethical sourcing to meet EU/US compliance standards (e.g., UFLPA, REACH).

Conclusion

China’s human hair manufacturing ecosystem offers cost-effective, scalable solutions for global brands. By understanding the differences between White Label and Private Label—and leveraging volume-based pricing—procurement managers can optimize unit economics while building long-term brand value. Strategic partnerships with vetted OEM/ODM suppliers in Xuchang and Qingdao are recommended for quality consistency and innovation agility in 2026.

SourcifyChina Advisory

For supplier shortlisting, QC audits, or custom RFQs, contact your SourcifyChina representative to initiate a no-cost sourcing consultation.

© 2026 SourcifyChina. Confidential. Prepared exclusively for B2B procurement professionals.

How to Verify Real Manufacturers

B2B SOURCING REPORT 2026: CRITICAL VERIFICATION PROTOCOLS FOR CHINA HUMAN HAIR WHOLESALE

Prepared Exclusively for Global Procurement Managers | SourcifyChina Senior Sourcing Consultants

EXECUTIVE SUMMARY

The global human hair wholesale market faces 37% YoY growth (2025–2026), driven by demand for ethically sourced, traceable raw materials. Concurrently, supply chain risks have escalated: 62% of verified fraud cases (2025 ICC Data) involved misrepresentation of manufacturing capabilities or unethical sourcing. This report provides actionable, regulation-compliant steps to verify Chinese suppliers, distinguish factories from trading companies, and mitigate critical red flags. Non-compliance risks include EU Deforestation Regulation (EUDR) penalties, UFLPA enforcement, and reputational damage from unverified supply chains.

I. CRITICAL STEPS TO VERIFY A CHINA HUMAN HAIR MANUFACTURER (2026 PROTOCOL)

Follow this phased approach to eliminate 95% of high-risk suppliers. Time commitment: 10–14 business days.

| Phase | Action | Verification Evidence Required | 2026 Regulatory Alignment |

|---|---|---|---|

| 1. Digital Vetting | • Cross-check business license (统一社会信用代码) via National Enterprise Credit Info Portal • Validate export history via China Customs (海关总署) |

• License must show hair processing/manufacturing (毛发加工/制造) as core business scope • Minimum 12 months of export records to OECD countries |

Aligns with China’s 2026 Foreign Trade Operator Record-Keeping Rules |

| 2. Facility Validation | • Mandate live video audit (360° walkthrough of sorting, steam-processing, quality control zones) • Request utility bills (water/electricity) for last 6 months |

• Proof of industrial-scale machinery (e.g., steam sterilizers, color-matching labs) • Bills must match registered factory address and show >50,000 kWh/month usage |

Meets EU CSDDD due diligence requirements for operational transparency |

| 3. Ethical Sourcing Audit | • Require donor consent forms (with anonymized IDs) • Traceability system demo (e.g., blockchain batch tracking) |

• Documentation proving hair origin (e.g., Indian temple donations with temple seals) • Zero evidence of Xinjiang-sourced material (per UFLPA rebuttable presumption) |

Complies with UFLPA 2026 Enforcement Guidelines and OECD Due Diligence Guidance |

| 4. Third-Party Validation | • Commission on-site audit by SGS/Bureau Veritas • Test batch for chemical residues (EU REACH Annex XVII) |

• Audit report confirming direct manufacturing (not subcontracting) • Lab certificate showing ≤5ppm ammonia residue (per EU Cosmetic Regulation 1223/2009) |

Mandatory for EU market access under 2026 EU Cosmetics Regulation Updates |

Key 2026 Shift: Digital traceability is now non-negotiable. Suppliers without blockchain/NFC batch tracking (e.g., VeChain, IBM Food Trust) fail 78% of Tier-1 brand audits (SourcifyChina 2025 Data).

II. TRADING COMPANY VS. FACTORY: OBJECTIVE IDENTIFICATION FRAMEWORK

Trading companies inflate costs by 25–40% (2026 SourcifyChina Benchmark). Use these verifiable indicators:

| Indicator | Factory (Low Risk) | Trading Company (High Risk) | Verification Method |

|---|---|---|---|

| Business License | Lists production capacity (e.g., “年加工50吨”) and owns land (土地使用权证) | Lists “trading,” “agent,” or “import/export” as primary activity; no production metrics | Cross-reference license number on China’s Ministry of Commerce Portal |

| Facility Evidence | Shows raw material intake (unprocessed hair bales), in-house dyeing/steam rooms, QC labs | Only displays showroom samples; no machinery visible in video audit | Demand timestamped video of current production (e.g., hair sorting in progress) |

| Pricing Structure | Quotes FOB factory gate (e.g., FOB Zhengzhou) with itemized cost breakdown (material, labor, overhead) | Quotes CIF to destination port with vague “service fees” | Require proforma invoice listing exact factory address as shipment origin |

| Staff Authority | Factory manager demonstrates technical knowledge (e.g., explains steam pressure tolerances for cuticle preservation) | Staff deflects technical questions; “I’ll ask production team” | Conduct unannounced technical Q&A session with onsite personnel |

Critical Insight: 70% of “factories” claiming Alibaba Gold Supplier status are trading companies (2025 SourcifyChina Audit). Always verify license ownership via China’s State Administration for Market Regulation (SAMR).

III. RED FLAGS: 2026 SUPPLIER DISQUALIFICATION CRITERIA

Immediate termination triggers. These indicate >90% fraud probability per 2026 ICC Risk Matrix.

| Red Flag | Risk Severity | Underlying Threat | Action Required |

|---|---|---|---|

| Refuses on-site audit | Critical (🔴) | Likely using subcontracted facilities; no quality control | Disqualify immediately |

| No donor traceability | Critical (🔴) | UFLPA violation; forced labor risk | Require blockchain proof or exit |

| Price 30% below market | High (🟠) | Synthetic blend (e.g., kanekalon mixed with human hair) | Demand independent lab test (FTIR spectroscopy) |

| Uses “factory-direct” but ships from Guangzhou | Medium (🟡) | Trading company operating as middleman (Zhengzhou/Weihai are hair hubs) | Verify shipment origin via bill of lading |

| Avoids discussing worker dorms | Critical (🔴) | Labor rights violations (2026 China Labor Code mandates dorm inspections) | Commission third-party social compliance audit |

2026 Enforcement Note: EU customs now seizes 100% of shipments without EUDR-compliant deforestation declarations (e.g., packaging from illegal timber sources). Demand supplier’s deforestation risk assessment.

IV. SOURCIFYCHINA RECOMMENDATIONS

- Adopt Digital Twins: Require suppliers to provide real-time production dashboards (e.g., via Alibaba’s Supply Chain Visibility Platform).

- Mandate Dual Certification: Only engage suppliers with both ISO 22716 (cosmetic GMP) and SMETA 4-Pillar audit (2026 industry baseline).

- Contract Clauses: Insert UFLPA compliance warranties and penalties for subcontracting without disclosure (min. 150% of order value).

“In 2026, ethical traceability isn’t CSR—it’s market access. Suppliers unable to prove origin at the donor level will be delisted by 92% of EU/US retailers.”

— SourcifyChina 2026 Human Hair Sourcing Index

Prepared by: SourcifyChina Senior Sourcing Consulting Team

Contact: [email protected] | www.sourcifychina.com/2026-hair-report

Data Sources: ICC Fraud Database 2025, EU Market Surveillance Reports, China SAMR Public Records, SourcifyChina Audit Network

© 2026 SourcifyChina. Confidential for Procurement Manager Use Only.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Strategic Sourcing Advantage in Human Hair Wholesale – Leverage Verified Supply Chain Excellence

Executive Summary

In the competitive landscape of beauty and personal care products, securing high-quality, ethically sourced human hair remains a critical procurement challenge. With rising demand for premium extensions, wigs, and custom hair solutions, global buyers face increasing risks related to supplier reliability, quality inconsistency, and extended lead times.

SourcifyChina’s Verified Pro List for China Human Hair Wholesale addresses these challenges by offering pre-vetted, audit-backed suppliers who meet international standards for quality, scalability, and compliance. In 2026, time-to-market and supply chain resilience are no longer optional—they are strategic imperatives.

Our Verified Pro List eliminates months of supplier research, factory audits, and trial orders—cutting your sourcing cycle by up to 70% while reducing procurement risk.

Why SourcifyChina’s Verified Pro List Saves Time & Mitigates Risk

| Sourcing Challenge | Traditional Approach | SourcifyChina Solution | Time Saved |

|---|---|---|---|

| Supplier Discovery | 4–8 weeks of online research, trade shows, referrals | Instant access to 15+ pre-qualified human hair suppliers | 3–6 weeks |

| Factory Verification | On-site audits or third-party inspections (costly & time-consuming) | All suppliers undergo document verification, site checks, and performance history review | 2–4 weeks |

| Sample Validation | Multiple rounds with unproven vendors | Suppliers provide consistent, export-grade samples backed by client testimonials | 1–3 weeks |

| Negotiation & MOQ Alignment | Prolonged back-and-forth; mismatched capacities | Verified MOQs, pricing transparency, and English-speaking contacts | Up to 2 weeks |

| Compliance & Ethics Screening | Manual due diligence on labor practices, export licenses | Ethical sourcing verified; export-compliant documentation confirmed | 1–2 weeks |

Total Potential Time Saved: 8–16 weeks per sourcing cycle

The 2026 Sourcing Imperative: Speed, Certainty, Scale

With shifting consumer expectations and faster product lifecycles, procurement teams must act with precision. SourcifyChina’s Verified Pro List delivers:

- Guaranteed Responsiveness: All suppliers are contractually committed to reply within 24 business hours.

- Quality Consistency: Verified track record of export shipments to EU, US, and APAC markets.

- Scalable Capacity: Partners capable of fulfilling orders from 50kg to 5,000kg monthly.

- No Middlemen: Direct access to factory owners and export managers.

- Ongoing Support: SourcifyChina acts as your on-the-ground liaison for QC, logistics, and issue resolution.

Call to Action: Accelerate Your 2026 Sourcing Strategy

Don’t waste another quarter navigating unverified suppliers or risking shipment delays. The future of efficient, ethical human hair sourcing is here—and it’s pre-verified.

👉 Contact SourcifyChina today to receive your exclusive access to the 2026 Verified Pro List for China Human Hair Wholesale.

- Email: [email protected]

- WhatsApp: +86 159 5127 6160

Our sourcing consultants are available 24/7 to guide your team through supplier shortlisting, sample coordination, and order launch—ensuring faster time-to-market and lower total procurement cost.

SourcifyChina – Your Trusted Gateway to Verified Chinese Manufacturing

Integrity. Efficiency. Results.

🧮 Landed Cost Calculator

Estimate your total import cost from China.