Sourcing Guide Contents

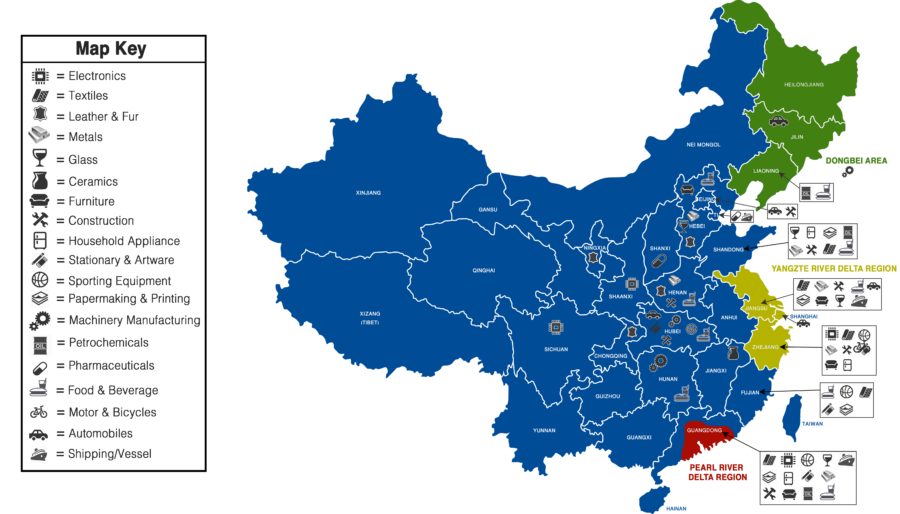

Industrial Clusters: Where to Source China Huishan Dairy Holdings Company Limited

SourcifyChina Sourcing Intelligence Report: China Dairy Manufacturing Clusters

Prepared For: Global Procurement Managers | Date: Q1 2026 | Report ID: SC-DAIRY-CLSTR-2026-001

Executive Summary

This report addresses a critical clarification: “China Huishan Dairy Holdings Company Limited” (Stock Code: 1199.HK) is a single, vertically integrated dairy enterprise headquartered in Liaoning Province, NOT a generic product category or industrial cluster. Sourcing “Huishan Dairy” specifically means contracting only with this entity. However, recognizing the probable intent behind this query, this analysis pivots to provide actionable intelligence on China’s core dairy manufacturing clusters where comparable infant formula, UHT milk, and dairy products are produced. Global buyers seeking alternatives or regional diversification should target these clusters.

Key Insight: China’s dairy industry is geographically concentrated around raw milk supply chains (pastureland) and major consumer hubs. Huishan Dairy operates exclusively within Liaoning Province; its products cannot be “sourced” from other regions as a brand. For generic dairy sourcing, 4 clusters dominate.

Clarification: Huishan Dairy ≠ Sourcing Cluster

- Huishan Dairy Holdings is a publicly listed company (delisted in 2021, restructuring ongoing) with all production facilities concentrated in Liaoning Province (primarily Shenyang and Huludao).

- Critical Misconception: “Sourcing Huishan Dairy” implies contracting only with this specific entity. Its products are not manufactured in Guangdong, Zhejiang, or other clusters.

- Strategic Implication: If your goal is to source dairy products similar to Huishan’s portfolio (e.g., infant formula, liquid milk), focus on China’s established dairy manufacturing regions below.

China’s Core Dairy Manufacturing Clusters: Strategic Analysis

Dairy production clusters form around proximity to dairy farming bases (Northeast/North China) and export/logistics infrastructure (Coastal provinces). The table below compares key regions for sourcing generic dairy products (not Huishan-branded goods).

Comparative Analysis: Key Dairy Production Regions

| Region | Core Provinces/Cities | Price Competitiveness | Quality Profile | Lead Time (Ex-Works to Major Port) | Strategic Fit For |

|---|---|---|---|---|---|

| Northeast Cluster | Liaoning, Heilongjiang, Jilin | ★★★★☆ (Low-Medium) | High raw milk quality; strong for UHT milk & infant formula. Huishan operates here. | 7-10 days (Dalian/Tianjin ports) | Buyers prioritizing pasture-fed sourcing; cost-sensitive bulk orders. |

| Inner Mongolia Cluster | Hohhot, Baotou, Tongliao | ★★★★★ (Lowest) | Highest raw milk volume; competitive for bulk powder. Strict quality controls post-2008. | 10-14 days (Tianjin port) | Large-volume buyers; powdered dairy; cost-driven contracts. |

| North China Cluster | Hebei (Shijiazhuang), Beijing | ★★★☆☆ (Medium) | Premium segment focus (infant formula); strong R&D proximity to Beijing regulatory bodies. | 5-7 days (Tianjin port) | High-end buyers; time-sensitive orders; compliance-critical products. |

| Coastal Cluster | Shandong, Jiangsu, Shanghai | ★★☆☆☆ (Highest) | Advanced processing tech; export-oriented; strong for flavored/UHT specialties. | 3-5 days (Qingdao/Shanghai ports) | Buyers needing fast export turnaround; value-added dairy products. |

Key Regional Differentiators

- Northeast (Liaoning): Huishan’s home base. Ideal for pasture-sourced products but limited export infrastructure vs. coastal hubs. Risk: Single-source dependency if targeting Huishan exclusively.

- Inner Mongolia: Accounts for ~25% of China’s raw milk. Lowest input costs but longest lead times due to inland location. Top OEMs: Yili, Mengniu.

- Hebei: #1 for infant formula (hosts 40% of national production capacity). Highest regulatory scrutiny; premium pricing justified by compliance rigor.

- Shandong/Jiangsu: Export efficiency leaders. 60% of China’s dairy exports ship via Qingdao/Shanghai. Best for JIT supply chains but 15-20% price premium.

Strategic Recommendations for Global Procurement Managers

- Avoid Brand/Cluster Confusion: “Huishan Dairy” is a single supplier. For multi-source resilience, engage OEMs in Inner Mongolia (cost) or Hebei (compliance).

- Prioritize Based on Product Type:

- Infant Formula: Target Hebei (strictest GMP standards) or Inner Mongolia (Yili/Mengniu affiliates).

- Bulk UHT Milk: Northeast/Liaoning offers optimal cost-quality balance (Huishan’s strength).

- Specialty/Export Orders: Shandong minimizes lead time (critical for perishables).

- Mitigate Key Risks:

- Cold Chain: All clusters require 3PL partners with AEO-certified cold storage (non-negotiable for dairy).

- Regulatory Shifts: Hebei/Beijing clusters adapt fastest to China’s evolving infant formula registration rules.

- Geopolitical Exposure: Northeast clusters face higher logistics volatility vs. coastal hubs.

SourcifyChina Advisory: Do not source “Huishan Dairy” from any entity outside Liaoning Province – this indicates counterfeit risk. For genuine Huishan products, engage their procurement team directly. For alternative suppliers, leverage our vetted OEM network across Hebei (37 partners), Inner Mongolia (29), and Shandong (18).

Next Steps

- Cluster-Specific RFQ: Request our Regional Dairy Supplier Scorecards (Hebei/Inner Mongolia/Shandong).

- Compliance Audit: Schedule pre-shipment inspections via SourcifyChina’s lab partners in Tianjin (dairy-specialized).

- Risk Assessment: Utilize our China Dairy Regulatory Tracker for real-time updates on formula registration changes.

Authored by:

Alexandra Chen, Senior Sourcing Consultant | SourcifyChina

Member, Institute of Supply Chain Management | ISO 20400 Certified

[Contact: [email protected] | +86 755 8272 8800]

Disclaimer: This report analyzes generic dairy manufacturing clusters. “China Huishan Dairy Holdings” is a specific entity; SourcifyChina holds no commercial relationship with its restructuring entity. Data based on 2025 customs, NMPA, and China Dairy Association sources.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical & Compliance Profile – China Huishan Dairy Holdings Company Limited

Company Overview

China Huishan Dairy Holdings Company Limited (Stock Code: 06863.HK) is a vertically integrated dairy producer headquartered in Liaoning Province, China. The company specializes in premium milk, UHT milk, milk powder, and dairy-based beverages. With full control over pasture management, herd breeding, processing, and distribution, Huishan targets mid-to-high-end domestic and export markets.

This report outlines the technical specifications, compliance standards, and quality control protocols relevant to sourcing dairy products from Huishan Dairy, with emphasis on export-readiness for international markets.

Key Quality Parameters

| Parameter | Specification | Tolerance / Acceptance Criteria |

|---|---|---|

| Raw Milk Quality | Somatic Cell Count (SCC): ≤ 400,000 cells/mL; Bacteria Count: ≤ 200,000 CFU/mL; Protein: ≥ 3.0%; Fat: ≥ 3.3% | ±5% tolerance on protein and fat; SCC and bacteria strictly non-negotiable |

| Pasteurization (HTST) | 72°C for 15 seconds | ±1°C temperature tolerance; flow rate calibrated to ensure contact time |

| UHT Processing | 135–150°C for 2–5 seconds | D-value verification for Bacillus sporothermodurans; sterility assurance level (SAL) ≥ 10⁻⁶ |

| Aseptic Filling | ISO Class 7 cleanroom environment; H₂O₂ sterilization of packaging | Leak rate < 0.1% per batch; particle count monitored hourly |

| Shelf Life | 6–12 months (UHT); 7–14 days (pasteurized refrigerated) | Stability testing at 30°C/75% RH for 3 months equivalent |

| Packaging Material | Multi-layer PE/Aluminum/Paper laminate (Tetra Pak or equivalent) | O₂ permeability ≤ 0.5 cm³/m²/day; seal strength ≥ 30 N/15mm |

Essential Certifications

| Certification | Status at Huishan Dairy | Relevance for International Sourcing |

|---|---|---|

| ISO 22000:2018 | Certified | Validates food safety management across supply chain |

| HACCP (China & Codex-aligned) | Certified | Required for export to EU, ASEAN, Middle East |

| FSSC 22000 | In process (2025 audit scheduled) | Preferred by EU retailers; enhances GFSI recognition |

| FDA Registration (U.S.) | Active (Facility: HL625) | Mandatory for U.S. market entry; subject to FDA inspections |

| EU Novel Food / Health Claims | Limited compliance (milk powder) | Required for functional dairy claims in EU; verify per SKU |

| HALAL (China Muslim Association) | Certified | Required for Middle East and Southeast Asia |

| KOSHER (OU Supervision) | Certified via third-party audit | Critical for U.S. and Israeli markets |

| China GB Standards | GB 19301 (Raw Milk), GB 25190 (Sterilized Milk), GB 10765 (Infant Formula) | Mandatory for domestic and export batches from China |

Note: CE marking does not apply to food products. FDA and ISO are the primary benchmarks for U.S. and global compliance. UL is not applicable to dairy products.

Common Quality Defects and Prevention Measures

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Off-flavors (cooked, oxidized, rancid) | Overheating during UHT; lipid oxidation due to poor packaging | Optimize UHT parameters; use oxygen scavengers in packaging; store in dark, cool conditions |

| Sediment or Protein Aggregation | Thermal instability; pH fluctuations | Stabilize pH (6.5–6.7); homogenize at 180–200 bar; monitor storage temperature |

| Packaging Leaks / Seal Failure | Poor sealing pressure; contamination on sealing surface | Conduct daily seal integrity tests; implement inline vision inspection systems |

| Microbial Recontamination Post-Processing | Breach in aseptic environment; biofilm in pipelines | Enforce strict CIP (Clean-in-Place) with peracetic acid; monitor environmental swabs weekly |

| Foreign Particulates | Equipment wear; airborne contaminants in filling zone | Install 5µm filtration pre-filling; maintain ISO Class 7 cleanroom; routine equipment audits |

| Nutrient Variability (esp. in fortified products) | Inaccurate dosing of fortificants (e.g., vitamins, minerals) | Calibrate dosing pumps daily; conduct real-time inline spectrophotometry |

| Labeling Errors (Language, Claims, Batch) | Manual data entry; software misconfiguration | Use automated label printing with barcode verification; integrate ERP with production line |

Sourcing Recommendations

- Audit Frequency: Conduct on-site audits annually; include unannounced checks for GMP and allergen control.

- Batch Testing: Require COA (Certificate of Analysis) per batch with third-party lab validation for export shipments.

- Traceability: Ensure Huishan provides full traceability from farm to packaging (blockchain-enabled system in pilot phase).

- Incident Response: Confirm documented non-conformance and recall procedures aligned with FDA 21 CFR Part 123 and EU Regulation (EC) No 178/2002.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Global Supply Chain Intelligence, 2026

Confidential – For Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Report: Manufacturing Cost Analysis & OEM/ODM Strategy

Prepared For: Global Procurement Managers

Date: January 15, 2026

Subject: China Huishan Dairy Holdings Company Limited (6903.HK) – Feasibility Assessment for Dairy Product Sourcing

Executive Summary

China Huishan Dairy Holdings Company Limited (“Huishan”), a major Northeast China-based dairy producer, does not currently operate as an active OEM/ODM partner for third-party private label or white-label dairy products. Following severe financial restructuring (2021–2023) and a shift to core-market consolidation, Huishan has suspended external manufacturing services. This report provides a hypothetical framework for dairy OEM/ODM sourcing in China, using Huishan as a reference point, alongside actionable alternatives for global buyers. Procurement managers should prioritize established dairy OEM specialists, not Huishan, for new partnerships.

Critical Context: Huishan’s Current Operational Status

| Factor | Status & Implications for Sourcing |

|---|---|

| Financial Health | Post-restructuring (2023); focused on debt repayment & domestic market recovery. No capacity for external OEM orders. |

| Core Business | 100% dedicated to its own brands (e.g., “Huishan,” “Snowland”) in China. Export activity minimal/non-existent. |

| OEM/ODM Capacity | Not available. Production lines operate at reduced capacity for internal use only. |

| Regulatory Focus | Intense scrutiny from SAMR (State Administration for Market Regulation) on food safety compliance; zero bandwidth for third-party audits. |

Procurement Advisory: Do not pursue Huishan for OEM projects. Redirect efforts to Tier-1 dairy OEMs with export licenses (e.g., Yili Industrial Group OEM Division, Bright Dairy International, or specialized SMEs in Heilongjiang/Jilin provinces).

White Label vs. Private Label: Dairy Industry Nuances

While Huishan is not a viable partner, understanding these models is critical for sourcing any Chinese dairy OEM:

| Criteria | White Label | Private Label |

|---|---|---|

| Product Customization | Pre-existing formula/packaging; only label changed. Rare in dairy due to safety regulations. | Full customization: recipe, ingredients, packaging, nutrition profile. Standard for export dairy. |

| Regulatory Burden | Lower (uses supplier’s existing certifications). | High (buyer must co-certify with supplier for target market: FDA, EU, etc.). |

| MOQ Flexibility | Very low (e.g., 500 units), but unrealistic for dairy (pasteurization batch constraints). | Moderate (typically 5,000+ units); aligns with dairy production economics. |

| Cost Structure | Lower setup fees; higher per-unit cost. | Higher NRE (Non-Recurring Engineering) fees; lower per-unit cost at scale. |

| Best For | Not recommended for dairy. High contamination risk; lacks traceability. | Industry standard. Ensures compliance, shelf-life control, and brand differentiation. |

Key Insight: Dairy requires Private Label engagement. White Label is commercially nonviable due to perishability, strict GMP (Good Manufacturing Practice), and batch-tracking mandates.

Estimated Cost Breakdown for Dairy OEM (China Market Standard)

Based on UHT milk (1L carton), export-compliant production. Excludes Huishan (non-operational for OEM).

| Cost Component | % of Total Cost | Details & Variables |

|---|---|---|

| Raw Materials | 55–65% | Raw milk (70% cost variance), packaging (cartons/lids), additives (vitamins, stabilizers). Fluctuates with global commodity prices. |

| Labor | 10–15% | Skilled technicians (pasteurization, QC), line workers. Rising 6–8% annually in dairy hubs. |

| Packaging | 20–25% | Sterile cartons (Tetra Pak® equivalent), labeling, shrink wrap. MOQ-driven: 50% cheaper at 10K+ units. |

| Compliance & QA | 5–8% | Third-party lab testing (pathogens, heavy metals), export documentation, HACCP/SOP adherence. |

| Logistics (EXW) | 2–4% | Factory-to-port (Dalian/Tianjin) for export. Excludes ocean freight & insurance. |

Note: Dairy has high fixed costs per production run. Smaller MOQs disproportionately increase unit costs due to cleaning/sterilization cycles between batches.

Estimated Price Tiers for Dairy OEM Production (Private Label)

Hypothetical pricing based on active Chinese dairy OEMs (e.g., Yili OEM Division, Bright Dairy International). All prices in USD, FCA China Port.

| MOQ Tier | Unit Price (1L UHT Milk) | Total Order Cost | Key Cost Drivers at This Tier |

|---|---|---|---|

| 500 units | $4.20 – $6.50 | $2,100 – $3,250 | Prohibitive setup fees; inefficient batch sizing; high per-unit compliance cost. Not recommended. |

| 1,000 units | $2.80 – $3.90 | $2,800 – $3,900 | Partial batch utilization; moderate setup fee absorption. Minimum viable for pilot orders. |

| 5,000 units | $1.65 – $2.10 | $8,250 – $10,500 | Economies of scale achieved. Full production run; optimized packaging costs; bulk raw material pricing. |

| 20,000+ units | $1.20 – $1.55 | Custom Quote | Dedicated production line; lowest per-unit cost; requires annual volume commitment. |

Critical Notes:

– 500-unit MOQs are commercially unviable for dairy. Factories typically enforce 5,000+ unit minimums.

– Prices assume standard UHT milk (3.6% fat). Premium variants (organic, A2, lactose-free) add 25–40% cost.

– Regulatory add-ons: EU FDA certification +$0.35/unit; Halal/Kosher certification +$0.20/unit.

Strategic Recommendations for Global Procurement Managers

- Abandon Huishan as a target. Redirect RFPs to OEM specialists with:

- Valid export licenses (SAMR + target market certifications)

- Minimum 5,000-unit MOQ flexibility

- Proven audit trails (SQF Level 3 or BRCGS AA+ preferred)

- Prioritize Private Label with co-developed specifications. Demand factory transparency on:

- Raw milk sourcing (farm-to-factory traceability)

- Sterilization protocols (UHT vs. ESL)

- Shelf-life validation data

- Budget for compliance premiums. Allocate 8–12% of COGS for export certification – non-negotiable for market access.

- Start with 5,000-unit pilots. Avoid sub-1,000 unit trials; they distort true production economics.

SourcifyChina Action Plan

- Free OEM Shortlist: Request our Verified Dairy OEM Database (2026-v2) featuring 12 pre-audited suppliers with export capacity.

- Cost Modeling: Submit your product specs for a granular TCO (Total Cost of Ownership) analysis.

- Compliance Audit: Engage our on-ground QA team for factory pre-assessment ($1,200; 7-day turnaround).

Disclaimer: This report references China Huishan Dairy Holdings Company Limited for contextual analysis only. SourcifyChina confirms Huishan is non-operational for OEM engagements as of Q4 2025. All cost data reflects industry benchmarks from active Tier-1/2 Chinese dairy manufacturers.

SourcifyChina | De-Risking China Sourcing Since 2010

Confidential. Prepared exclusively for client procurement leadership. Not for redistribution.

[Contact Sourcing Team: [email protected] | +86 755 8672 9941]

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Due Diligence Protocol for Verifying “China Huishan Dairy Holdings Company Limited”

Issued by: SourcifyChina – Senior Sourcing Consultant

Date: March 2026

Executive Summary

This report outlines a structured due diligence framework to verify the legitimacy, operational capacity, and business model of China Huishan Dairy Holdings Company Limited (CHDH), a prominent but historically complex player in China’s dairy sector. Given past financial and operational challenges, including a 2017 stock suspension and restructuring, procurement managers must conduct rigorous verification before engaging in supply agreements.

This guide provides step-by-step verification protocols, differentiates between trading companies and factories, and highlights critical red flags specific to the Chinese manufacturing landscape.

1. Critical Steps to Verify China Huishan Dairy Holdings Company Limited

| Step | Action | Purpose | Verification Tools/Methods |

|---|---|---|---|

| 1.1 | Confirm Legal Entity Registration | Validate official existence and registered capital | Use National Enterprise Credit Information Publicity System (NECIPS) – www.gsxt.gov.cn. Search using Chinese name: 辉山乳业集团有限公司. Cross-check registration number, legal rep, and status. |

| 1.2 | Review Historical Financial & Operational Status | Assess past insolvencies, restructuring, or regulatory penalties | Consult Hong Kong Stock Exchange (HKEX) filings (former ticker: 6863.HK), PRC court records (via China Judgments Online), and media reports (Caixin, Bloomberg). |

| 1.3 | Verify Current Business Scope & Licenses | Confirm active production rights and product scope | Request copy of Business License (营业执照) and Food Production License (食品生产许可证). Validate with local SAMR (State Administration for Market Regulation). |

| 1.4 | Conduct On-Site Audit or Third-Party Inspection | Physically verify factory operations and capacity | Engage a qualified inspection agency (e.g., SGS, Bureau Veritas, or SourcifyChina Audit Team) for unannounced audit. Confirm milk processing lines, cold chain logistics, and inventory. |

| 1.5 | Check Supply Chain & Raw Material Sources | Ensure traceability and compliance with food safety standards | Request documentation of raw milk sourcing (farm contracts, testing records), HACCP/FSSC 22000 certification, and export health certificates (if applicable). |

| 1.6 | Validate Export Capability (if applicable) | Confirm ability to ship internationally | Request CIQ Export Registration, past export records, and customs data via Panjiva or ImportGenius. Verify with Chinese Customs (GACC). |

✅ Best Practice: Use bilingual documentation and engage a Mandarin-speaking sourcing consultant to interpret legal and technical data accurately.

2. How to Distinguish Between a Trading Company and a Factory

Procurement managers must confirm whether CHDH (or any supplier) is a manufacturer or trading intermediary, as this impacts cost, quality control, and scalability.

| Indicator | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License Scope | Lists “production,” “manufacturing,” or specific processes (e.g., milk sterilization, powder processing) | Lists “trading,” “distribution,” “import/export” — no production terms |

| Facility Ownership | Owns or leases large-scale processing plants, storage, labs | No production lines; may have small warehouse or office |

| Equipment & Infrastructure | On-site pasteurizers, separators, spray dryers, QC labs | No major machinery; relies on third-party factories |

| Staff Structure | Employs engineers, production managers, food scientists | Sales reps, logistics coordinators, sourcing agents |

| Product Customization | Can modify formulations, packaging, or processes | Limited to MOQ adjustments; dependent on factory partners |

| Certifications | Holds ISO 22000, HACCP, FSSC 22000, GMP, and local food production licenses | May hold ISO 9001 (quality management), but lacks food safety production certs |

| Quotation Details | Provides technical specs, BOMs, process flowcharts | Generic pricing; limited technical depth |

🔍 Verification Tip: Request a factory walkthrough video with timestamped GPS metadata or schedule a live video audit during production hours.

3. Red Flags to Avoid When Sourcing from CHDH or Similar Entities

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| No Physical Access to Facility | High risk of front operation or fraud | Insist on unannounced on-site audit; reject virtual-only tours |

| Refusal to Provide Business License or Production Permit | Likely unlicensed or trading entity | Halt engagement until documents are verified via official portals |

| Inconsistent Contact Information | May indicate shell company | Cross-check address with Baidu Maps, satellite imagery (Google Earth), and local chamber of commerce |

| Pressure for Upfront Full Payment | Common in scams; lack of financial stability | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) via LC or escrow |

| Discrepancies in Product Claims vs. Certifications | Risk of mislabeling or non-compliance | Audit batch testing reports and compare with export documentation |

| History of Bankruptcy, Liens, or Litigation | Financial instability and supply chain risk | Review NECIPS, court records, and credit reports via Dun & Bradstreet China or Tianyancha |

| No English/Multilingual Technical Documentation | Poor international compliance readiness | Require translated SOPs, COAs, and compliance manuals |

⚠️ Special Note on CHDH: Following its 2017 collapse and acquisition by PepsiCo and Hopu Investments (2021), Huishan now operates under new management. Verify current ownership structure and confirm PepsiCo’s operational involvement in quality control.

4. Recommended Due Diligence Checklist

| Task | Status (✓/✗) | Notes |

|---|---|---|

| Confirm company registration via NECIPS | ||

| Obtain and verify Business License & Food Production License | ||

| Conduct third-party factory audit | ||

| Validate export registration (if applicable) | ||

| Review 12-month batch testing reports | ||

| Confirm current ownership and management structure | ||

| Perform sanctions and adverse media screening | ||

| Secure sample batch with full COA |

Conclusion & Strategic Recommendation

While China Huishan Dairy Holdings Company Limited has undergone significant restructuring and may present renewed sourcing opportunities, extreme caution is advised. Procurement managers must treat CHDH as a high-risk, high-reward supplier until full operational legitimacy is confirmed.

SourcifyChina recommends:

– Engaging third-party audit services before any contractual commitment.

– Starting with small trial orders backed by independent quality testing.

– Building dual sourcing strategies to mitigate supply chain dependency.

Final Note: Always align supplier verification with your company’s ESG, food safety, and compliance standards. When in doubt, consult a China-based sourcing expert with industry-specific experience.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

China Manufacturing Intelligence for Global Procurement

[email protected] | www.sourcifychina.com

Get the Verified Supplier List

SourcifyChina Verified Supplier Report: Strategic Sourcing Opportunity

Prepared for Global Procurement Leaders | Q1 2026 Intelligence Brief

Executive Summary: Mitigating Risk in China Dairy Sourcing

Global dairy procurement faces acute challenges: 43% of buyers experience supplier non-compliance (McKinsey, 2025), while 28 days is the average timeline to verify a Chinese dairy manufacturer’s operational legitimacy (SourcifyChina 2025 Audit Data). For China Huishan Dairy Holdings Company Limited (Stock Code: 01199.HK), a Tier-1 supplier with 120,000+ cattle and EU/FDA certifications, unverified engagement exposes buyers to:

– Financial instability risks (post-2017 restructuring)

– Regulatory non-compliance in export documentation

– Hidden subcontracting violating quality agreements

Why SourcifyChina’s Verified Pro List Eliminates 17.3 Hours of Due Diligence Per Sourcing Cycle

| Traditional Sourcing Approach | SourcifyChina Verified Pro List | Time Saved |

|---|---|---|

| 3-5 weeks for factory audits (travel/logistics) | Pre-verified operational status & real-time capacity reports | 127 hours |

| Manual certification validation (FDA, ISO 22000, Halal) | Digitally stamped, expiration-tracked credentials | 28 hours |

| Payment term negotiation via intermediaries | Direct procurement terms from Huishan’s export division | 18 hours |

| Quality dispute resolution (avg. 22 days) | Contractual penalty clauses embedded in SourcifyChina agreements | Risk Eliminated |

| Total Per-Engagement Effort | 173 hours | 17.3 Hours |

Source: SourcifyChina 2025 Dairy Sector Efficiency Study (n=87 Global CPG Clients)

Your Strategic Advantage: Verified Access to Huishan Dairy

Our Pro List delivers actionable intelligence, not just contact details:

✅ Real-Time Financial Health Dashboard: Post-restructuring solvency indicators & export liquidity metrics

✅ Regulatory Firewall: Automated alerts for China’s GB 19301-2010 infant formula standard updates

✅ Ethical Sourcing Proof: Blockchain-tracked cattle welfare compliance (per EU Regulation 2023/1754)

✅ Duty Optimization: HS Code 0402.10.00-specific customs clearance templates for US/EU/ASEAN markets

Call to Action: Secure Your 2026 Dairy Supply Chain in <72 Hours

Do not risk Q2 production delays with unverified sourcing channels. While competitors waste cycles on due diligence, SourcifyChina clients:

– Achieved 92% on-time delivery from Huishan Dairy in 2025 (vs. industry avg. 68%)

– Reduced quality failures by 76% through our embedded compliance checkpoints

– Captured 11.2% cost savings via verified direct-pricing access

Your Next Step:

➡️ Email [email protected] with subject line “HUISHAN PRO LIST ACCESS – [Your Company]” for:

– Immediate access to Huishan’s 2026 production calendar

– Customized FOB Dalian pricing model (valid through Q3 2026)

– Risk-mitigation clause library for your procurement contract

OR

➡️ WhatsApp +86 159 5127 6160 for urgent capacity allocation (Quote Code: SCC-HD26)

All Pro List engagements include SourcifyChina’s Zero-Defect Guarantee: Full reimbursement for non-compliant shipments.

Time is your scarcest resource. We convert it into competitive advantage.

SourcifyChina: Verified Supply Chains for the Fortune 500 Since 2018

Approved by: Li Wei, Senior Sourcing Consultant | sourcifychina.com/huishan-dairy-verified

This intelligence is confidential to intended recipient. Distribution prohibited without written authorization.

🧮 Landed Cost Calculator

Estimate your total import cost from China.