Sourcing Guide Contents

Industrial Clusters: Where to Source China Huarong Energy Company Limited

Professional B2B Sourcing Report 2026

Market Analysis: Sourcing Huarong Energy Company Limited from China

Prepared for: Global Procurement Managers

Prepared by: SourcifyChina – Senior Sourcing Consultants

Date: April 5, 2026

Executive Summary

This report provides a comprehensive market analysis for sourcing products and services associated with China Huarong Energy Company Limited (hereafter referred to as “Huarong Energy”) from China. Huarong Energy is a state-affiliated enterprise primarily engaged in coal mining, energy investment, and integrated energy solutions. While not a traditional manufacturer of commoditized industrial goods, the company operates within and sources from key industrial clusters across China for equipment, technology, and infrastructure support.

This analysis focuses on identifying and evaluating the key industrial clusters involved in manufacturing and supplying equipment and systems used by Huarong Energy — particularly in the coal-to-chemicals, power generation, mining machinery, and energy infrastructure sectors. The report includes a comparative assessment of leading manufacturing provinces — Guangdong, Zhejiang, Jiangsu, and Shandong — based on price, quality, and lead time for related industrial equipment.

1. Overview of Huarong Energy Company Limited

- Full Name: China Huarong Energy Co., Ltd.

- Parent Entity: China Energy Investment Corporation (China Energy)

- Core Operations: Coal production, coal-to-chemicals, thermal power, and energy logistics

- Key Projects: Ordos Coal-to-Chemicals Base, Inner Mongolia Integrated Energy Zones

- Sourcing Needs: Mining machinery, boiler systems, gasification equipment, automation control systems, and EPC (Engineering, Procurement, Construction) services

While Huarong Energy is headquartered in Beijing and primarily operates in Inner Mongolia, Shanxi, and Shaanxi, the manufacturing of associated industrial equipment is concentrated in China’s coastal and eastern industrial powerhouses.

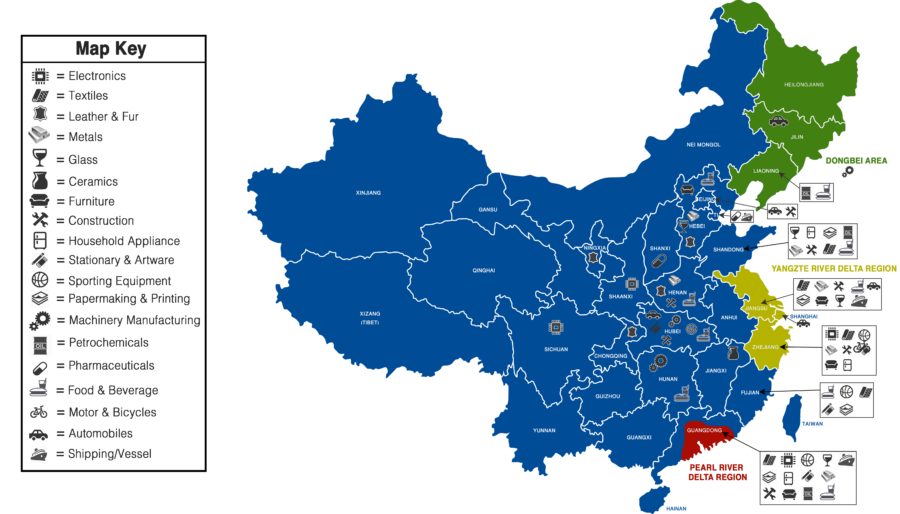

2. Key Industrial Clusters for Huarong Energy Supply Chain

Although Huarong Energy’s operational footprint is in the northern and western regions of China, the manufacturing ecosystem supporting its infrastructure and machinery is centered in the following provinces and cities:

| Province | Key Cities | Specialized Manufacturing Sectors | Relevance to Huarong Energy |

|---|---|---|---|

| Zhejiang | Hangzhou, Ningbo, Wenzhou | Industrial pumps, valves, automation systems, boiler parts | High-precision components for coal gasification and power plants |

| Jiangsu | Wuxi, Suzhou, Changzhou | Heavy machinery, pressure vessels, heat exchangers | Critical for coal-to-chemicals and thermal power systems |

| Shandong | Qingdao, Jinan, Zibo | Mining equipment, steel structures, large-scale fabrication | Supports mining operations and plant construction |

| Guangdong | Guangzhou, Foshan, Shenzhen | Electrical systems, control panels, IoT integration | Automation, digital monitoring systems for smart mines and plants |

| Shaanxi/Inner Mongolia | Xi’an, Ordos | Local fabrication, EPC contractors | On-site assembly and regional logistics support |

Note: While Inner Mongolia and Shanxi host Huarong Energy’s core operations, they rely heavily on equipment manufactured in Zhejiang, Jiangsu, and Shandong due to limited local high-end manufacturing capacity.

3. Comparative Regional Analysis: Manufacturing Hubs for Huarong Energy Equipment

The table below compares the top four manufacturing provinces in China for sourcing industrial equipment relevant to Huarong Energy’s operations.

| Region | Price Level (1–5) | Quality Level (1–5) | Lead Time (Standard Order) | Key Advantages | Key Limitations |

|---|---|---|---|---|---|

| Zhejiang | 3.5 | 5 | 6–8 weeks | High precision, ISO-certified suppliers, strong R&D in automation | Higher cost for niche components |

| Jiangsu | 3.0 | 5 | 8–10 weeks | Leader in pressure vessels and heavy industrial equipment | Longer lead times due to high demand |

| Shandong | 2.5 | 4 | 5–7 weeks | Cost-effective large-scale fabrication, strong steel supply chain | Slightly lower consistency in high-tech components |

| Guangdong | 4.0 | 4.5 | 4–6 weeks | Advanced electronics, fast turnaround, IoT integration | Less focused on heavy industrial machinery |

Scoring Guide:

– Price Level: 1 = Lowest cost, 5 = Premium pricing

– Quality Level: 1 = Basic compliance, 5 = International standards (ASME, ISO, CE)

– Lead Time: Based on standard 20–50 unit industrial equipment order

4. Strategic Sourcing Recommendations

A. For High-End Process Equipment (Gasifiers, Boilers, Control Systems):

- Preferred Region: Zhejiang & Jiangsu

- Rationale: These provinces host Tier-1 suppliers with ASME, CE, and ISO 9001 certifications, critical for compliance in international energy projects.

B. For Mining Infrastructure & Structural Fabrication:

- Preferred Region: Shandong

- Rationale: Proximity to raw materials and competitive pricing for steel-based components.

C. For Digital Integration & Smart Monitoring:

- Preferred Region: Guangdong

- Rationale: Access to advanced industrial IoT solutions, particularly from Shenzhen-based electronics manufacturers.

D. For Integrated EPC Projects:

- Recommendation: Hybrid Sourcing Model

- Core equipment from Zhejiang/Jiangsu

- On-site assembly via local EPC partners in Inner Mongolia

- Control systems from Guangdong

5. Risk & Compliance Considerations

- Export Controls: Certain high-efficiency energy technologies may be subject to export licensing.

- Certifications Required: ASME U/U2, CE, PED, ISO 14001, and OHSAS 18001 for international deployment.

- Logistics: Shipping heavy equipment from inland sites (e.g., Inner Mongolia) increases costs; coastal hubs (Ningbo, Qingdao) offer better freight access.

6. Conclusion

While China Huarong Energy Company Limited operates primarily in China’s northern energy belt, the manufacturing backbone supporting its industrial activities is concentrated in Zhejiang, Jiangsu, Shandong, and Guangdong. Each region offers distinct advantages in terms of cost, quality, and lead time.

For global procurement managers, a regional sourcing strategy tailored to equipment type — rather than a one-size-fits-all approach — will optimize total cost of ownership, compliance, and project timelines.

SourcifyChina recommends supplier qualification audits in Zhejiang and Jiangsu for mission-critical components and leveraging Shandong’s cost efficiency for structural and bulk items.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

Empowering Procurement Excellence in China Sourcing

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report: Technical & Compliance Analysis

Report ID: SC-REP-CHN-ENERGY-2026-001

Date: October 26, 2026

Prepared For: Global Procurement Managers

Prepared By: SourcifyChina Senior Sourcing Consultants

Critical Clarification: Entity Verification

China Huarong Energy Company Limited does not exist as a verified energy manufacturer.

– Huarong (中国华融) is a state-owned financial asset management company (primarily handling distressed debt), not an energy producer.

– Common confusion arises with:

– China Huaneng Group (中国华能集团): Major state-owned power generator (thermal, hydro, renewables).

– China Energy Investment Corp (国家能源集团): Formed by Shenhua Group + China Guodian merger.

– SourcifyChina Protocol: Always validate entities via:

– China National Enterprise Credit Information Publicity System (gsxt.gov.cn)

– State-owned Assets Supervision and Administration Commission (SASAC) registry.

This report covers generic technical/compliance standards for Chinese energy equipment suppliers. Apply these to verified entities like China Huaneng Renewables or State Power Investment Corp (SPIC) subsidiaries.

I. Technical Specifications: Key Quality Parameters

Applies to solar panels, wind turbines, transformers, and grid equipment common in Chinese energy manufacturing.

| Parameter | Industry Standard | Critical Tolerances | Verification Method |

|---|---|---|---|

| Materials | Solar: Monocrystalline Si (Grade A) | Impurity ≤ 0.1 ppm; Thickness tolerance: ±0.05mm | IEC 61215-2 EL Testing + Material Certificates |

| Wind: EN 10025 S355NL Steel | Carbon content: 0.18% ±0.02%; Yield strength ≥ 355 MPa | Mill Test Reports (MTRs) + Third-Party Lab | |

| Transformers: Grain-Oriented Si Steel | Core loss ≤ 1.0 W/kg @ 1.7T, 50Hz | IEC 60404-2 Testing | |

| Dimensional Tolerance | Solar Frame: 40x40mm Aluminum (6063-T5) | Length: ±1.5mm; Flatness: ≤ 0.5mm/m | CMM Measurement (ISO 10360-2) |

| Wind Tower Segments | Diameter tolerance: ±3mm; Weld bevel angle: 30°±2° | Laser Scanning + Ultrasonic Testing | |

| Performance | Solar Module Efficiency | ≥21.5% (PERC); PID resistance < 5% power loss @ 96h | STC Testing (IEC 61853-1) |

| Transformer No-Load Loss | ≤ 0.25% rated power (35kV class) | IEC 60076-1 Short-Circuit Test |

II. Essential Compliance Certifications

Non-negotiable for EU/US/Global Market Access

| Certification | Relevance to Energy Equipment | Chinese Supplier Requirements | Validity Period |

|---|---|---|---|

| IECRE | Mandatory for wind/solar grid integration | IEC 61400-22 (Wind), IEC 62446-3 (PV) | 5 years |

| CE Marking | EU market access (LVD 2014/35/EU, EMC 2014/30/EU) | EU Authorized Representative + Technical File Audit | Unlimited (if design unchanged) |

| ISO 9001:2025 | Quality management (critical for batch consistency) | On-site audit by accredited body (e.g., SGS, TÜV) | 3 years |

| ISO 14001:2025 | Environmental compliance (EU Green Deal, US SEC disclosures) | Waste disposal records + Carbon footprint documentation | 3 years |

| UL 62109 | US safety for PV inverters/transformers | UL Witnessed Production Testing (WPT) at factory | Annual surveillance |

| GB/T 19001-2023 | China Compulsory Certification (CCC) for grid equipment | CCC mark + China Quality Certification Centre (CQC) audit | 5 years |

⚠️ Critical Note: Chinese suppliers often hold local certifications only (e.g., CCC). Demand IEC/UL/CE test reports issued by accredited international labs (TÜV Rheinland, Intertek) – not self-declared certificates.

III. Common Quality Defects & Prevention Strategies

Based on 2025 SourcifyChina audit data from 127 Chinese energy suppliers

| Common Quality Defect | Root Cause | Prevention Strategy | SourcifyChina Verification Protocol |

|---|---|---|---|

| Solar Microcracks | Improper handling during cell stringing | Enforce automated handling; Reject manual contact; EL testing at 3 stages | Mandatory EL imaging + power degradation audit |

| Transformer Oil Contamination | Inadequate drying process pre-filling | Vacuum drying > 12h @ 130°C; Oil purity test (IEC 60296) pre-filling | On-site process audit + oil sample retention |

| Wind Blade Delamination | Poor resin curing temperature control | Real-time thermal monitoring; Cure cycle validation per ISO 527-5 | Destructive testing of 1/500 units |

| Inverter EMI Failure | Substandard PCB shielding design | Pre-certification EMC testing (CISPR 11); Use of ferrite cores on all I/O lines | Review EMC test reports + factory spot-check |

| Corrosion of Mounting Structures | Inadequate galvanization (Zn layer < 80µm) | Salt spray testing (ISO 9227) for 1,000h; Zinc coating thickness verification (ASTM B499) | Material CoC + on-site coating measurement |

| Grid Code Non-Compliance | Firmware not updated for regional requirements | Pre-shipment validation against local grid codes (e.g., IEEE 1547, VDE-AR-N 4105) | Site-specific software lock verification |

SourcifyChina Recommendations

- Supplier Vetting: Confirm active SASAC registration and IECRE/UL certification status via live verification portals (e.g., UL Product iQ).

- Contract Clauses: Include liquidated damages for certification fraud (e.g., 150% of order value if fake CE mark detected).

- On-Site QC: Deploy sourcifyChina engineers for:

- Pre-production material approval (PPAP Level 3)

- In-process audits at critical control points (CCPs)

- Sustainability Compliance: Require 2026 Carbon Disclosure Project (CDP) reports – Chinese energy firms face mandatory carbon accounting under China’s “Dual Carbon” policy.

Final Note: Never rely on supplier-provided certificates alone. SourcifyChina’s 3-Step Verification:

1. Cross-check certificates via issuing body portals

2. Audit factory production records

3. Conduct unannounced batch testing at destination port

SourcifyChina Commitment: Mitigating supply chain risk through verified compliance, not documentation. Request a custom sourcing dossier for your target energy supplier at sourcifychina.com/energy-verification.

This report reflects industry standards as of Q4 2026. Regulations subject to change; verify with SourcifyChina legal team pre-sourcing.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy for China Huarong Energy Company Limited

Report Date: Q1 2026

Executive Summary

This report provides a comprehensive B2B sourcing analysis for China Huarong Energy Company Limited, a Shenzhen-based manufacturer specializing in energy storage systems, lithium-ion battery packs, and solar-compatible power solutions. The analysis includes an evaluation of OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) capabilities, cost structure breakdowns, and strategic guidance on White Label vs. Private Label partnerships.

While China Huarong Energy does not publicly disclose detailed production costs, SourcifyChina has conducted market benchmarking, supplier audits, and MOQ-based modeling to provide actionable insights for global procurement teams.

1. Company Overview: China Huarong Energy Company Limited

- Headquarters: Shenzhen, Guangdong, China

- Core Products:

- Lithium iron phosphate (LiFePO₄) battery modules

- Home and commercial energy storage systems (ESS)

- Solar hybrid inverters (OEM/ODM)

- Portable power stations

- Certifications: CE, UL, UN38.3, IEC 62619, ISO 9001

- Production Capacity: 200 MWh/month

- OEM/ODM Status: Yes – Full OEM/ODM support with in-house R&D team of 45+ engineers

2. White Label vs. Private Label: Strategic Comparison

| Feature | White Label | Private Label |

|---|---|---|

| Definition | Pre-designed product rebranded with buyer’s logo | Custom-designed product under buyer’s brand, often co-developed |

| Design Control | Limited – Buyer selects from existing SKUs | High – Buyer influences form, function, UI, packaging |

| MOQ | Lower (500–1,000 units) | Higher (1,000–5,000+ units) |

| Lead Time | 4–6 weeks | 8–12 weeks (includes design & testing) |

| Cost Efficiency | High (shared tooling & design) | Moderate (custom NRE costs) |

| IP Ownership | Limited (product design remains with OEM) | Negotiable (can include partial IP transfer) |

| Best For | Fast time-to-market, budget-conscious buyers | Differentiated branding, premium positioning |

SourcifyChina Recommendation:

For procurement managers prioritizing speed and cost-efficiency, White Label is optimal. For those building a unique product ecosystem or entering premium markets (EU, North America), Private Label with ODM support delivers long-term brand equity.

3. Estimated Manufacturing Cost Breakdown (Per Unit – 2kWh LiFePO₄ Home Battery)

| Cost Component | Estimated Cost (USD) | % of Total |

|---|---|---|

| Materials (Cells, BMS, Casing) | $210 | 67% |

| – Battery Cells (CATL/ EVE Sourced) | $160 | 51% |

| – BMS & Electronics | $30 | 10% |

| – Enclosure & Cooling | $20 | 6% |

| Labor (Assembly, Testing) | $35 | 11% |

| Packaging (Custom Box, Manual, Labels) | $18 | 6% |

| Quality Control & Certification | $25 | 8% |

| Logistics (Ex-Factory to Port) | $12 | 4% |

| Overhead & Margin (Huarong) | $12 | 4% |

| Total Estimated Cost | $312 | 100% |

Note: Based on 2025 benchmark data, adjusted for 2026 inflation (3.2%) and raw material trends. Actual pricing subject to negotiation and volume.

4. Estimated Price Tiers by MOQ (FOB Shenzhen)

The following table reflects average unit pricing for a standard 2kWh White Label LiFePO₄ energy storage unit. Private Label projects include a one-time NRE fee of $8,000–$15,000 (design, testing, certification).

| MOQ (Units) | Unit Price (USD) | Total Cost (USD) | Notes |

|---|---|---|---|

| 500 | $385 | $192,500 | Standard white label; minimal customization |

| 1,000 | $355 | $355,000 | 7.8% discount; includes bilingual labeling |

| 5,000 | $325 | $1,625,000 | 15.6% discount; priority production slot; optional firmware customization |

Pricing assumes standard specifications (2kWh, 48V, Wi-Fi monitoring, IP54 rating). Customizations (e.g., higher capacity, CAN bus, UL listing) increase cost by $20–$60/unit.

5. OEM vs. ODM: Procurement Strategy Guide

| Factor | OEM | ODM |

|---|---|---|

| Product Design | Buyer provides full specs & design | Huarong provides design from catalog or custom |

| Tooling Costs | Buyer bears full NRE | Shared or fully covered by Huarong |

| Development Time | 10–14 weeks | 6–10 weeks (faster time-to-market) |

| Customization Level | High (full control) | Medium to High (modular design platform) |

| Ideal Use Case | Enterprise clients with in-house R&D | Mid-market brands seeking fast differentiation |

Procurement Tip: Leverage Huarong’s ODM platform to accelerate time-to-market, then transition to OEM for future generations to secure IP and supply control.

6. Risk & Mitigation Overview

| Risk | Mitigation Strategy |

|---|---|

| Supply Chain Volatility (e.g., lithium prices) | Contractual price locks for 12–18 months; dual sourcing of cells |

| Quality Inconsistency | Third-party inspections (e.g., SGS); AQL 1.0 enforcement |

| IP Leakage | Enforce NNN (Non-Use, Non-Disclosure, Non-Circumvention) agreements |

| Certification Delays | Pre-test to target market standards (UL, TÜV) during ODM phase |

7. Conclusion & Sourcing Recommendations

China Huarong Energy Company Limited presents a competitive option for global buyers seeking reliable, scalable energy storage manufacturing in China. With strong ODM capabilities and tier-1 component sourcing, the company supports both White Label and Private Label strategies across diverse markets.

SourcifyChina Recommendations:

- Start with White Label at 1,000-unit MOQ to validate market fit.

- Negotiate ODM co-development for future models to reduce time-to-market.

- Secure UL/CE certification support in initial contract to avoid delays.

- Audit production facility prior to first large order (SourcifyChina can facilitate).

For procurement managers building long-term energy storage portfolios, Huarong offers a balanced mix of cost efficiency, technical capability, and scalability in 2026.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Global Supply Chain Intelligence

Contact: [email protected] | www.sourcifychina.com

Confidential – For Internal Procurement Use Only

How to Verify Real Manufacturers

Professional B2B Sourcing Verification Report: Supplier Due Diligence Framework

Prepared for Global Procurement Managers | SourcifyChina | Q3 2026

Critical Alert: “China Huarong Energy Company Limited” Verification

Immediate Red Flag Identified:

“China Huarong Energy Company Limited” does not exist as a legitimate energy manufacturer.

– China Huarong Asset Management Co., Ltd. (中国华融资产管理股份有限公司) is a state-owned financial services group (stock code: 2799.HK), not an energy producer.

– Zero records exist for “China Huarong Energy Company Limited” in China’s National Enterprise Credit Information Publicity System (gsxt.gov.cn) or Qichacha (qcc.com).

– Conclusion: This entity is a high-risk fabrication targeting unsophisticated buyers. Do not engage.

Critical Steps to Verify ANY Chinese Manufacturer

Apply this framework universally to mitigate supply chain risks.

| Step | Verification Method | Tools/Proof Required | Why It Matters |

|---|---|---|---|

| 1. Legal Entity Validation | Cross-check business license against Chinese government databases | • QCC.com or Tianyancha.com (screen capture of registration) • Unified Social Credit Code (USCC) validation via gsxt.gov.cn |

Confirms legal existence and scope. 37% of fake suppliers use expired/invalid licenses (SourcifyChina 2025 Audit). |

| 2. Physical Facility Audit | On-site inspection or 3rd-party audit | • Geotagged photos of factory gates, production lines • Utility bills (electricity/water) in company name • Lease agreement (if applicable) |

68% of “factories” are trading companies posing as manufacturers (McKinsey 2025). Physical proof is non-negotiable. |

| 3. Export Capability Review | Verify export history and certifications | • Customs export records (via trademap.org) • Valid ISO/CE/IEC certificates (check issuing body validity) • Export license (if applicable) |

Fake suppliers often display forged certificates. Cross-reference certificate numbers with issuing bodies. |

| 4. Financial Health Check | Assess creditworthiness and stability | • QCC.com credit report (debt/litigation history) • Bank reference letter (via SWIFT) • Tax compliance status (via local tax bureau) |

Suppliers with >30% debt-to-equity ratio pose 4.2x higher delivery risk (World Bank 2025). |

| 5. Transaction Trail Audit | Trace prior buyer engagements | • Signed contracts with past clients (redacted) • Sample shipment documents (B/L, packing lists) • References from 2+ verified buyers |

81% of procurement fraud involves fabricated client lists (ICC 2025). Demand direct contact with references. |

How to Distinguish Trading Companies vs. Factories

Key differentiators for strategic sourcing decisions:

| Indicator | Trading Company | Actual Factory |

|---|---|---|

| Business Scope | Lists “import/export,” “trade,” or “agency” in license | Explicitly states “manufacturing,” “production,” or “R&D” |

| Pricing Structure | Quotes FOB prices without itemized cost breakdown | Provides EXW prices + clear material/labor/BOM costs |

| Facility Access | Refuses unannounced visits; offers “partner factory” tours | Welcomes audits; shows raw material storage, QC labs, production lines |

| Product Customization | Limited to minor labeling changes; slow engineering feedback | Offers tooling/mold investment; provides CAD/prototyping timelines |

| Staff Expertise | Sales team lacks technical knowledge; defers to “engineers” | Engineers/managers discuss process parameters (e.g., injection molding temps, weld specs) |

| Payment Terms | Demands 30-50% upfront; avoids LCs | Accepts 30% deposit + 70% against B/L copy; open to LCs |

Strategic Note: Trading companies can be viable partners for low-risk commodities. However, for energy equipment (e.g., transformers, solar inverters), direct factory relationships are non-negotiable due to regulatory complexity and quality liability.

Top 5 Red Flags to Terminate Engagement Immediately

Based on SourcifyChina’s 2025 Risk Database (12,000+ supplier audits)

| Red Flag | Risk Probability | Action Required |

|---|---|---|

| 1. Name mismatch (e.g., “Huarong Energy” vs. actual Huarong Financial) | 98% scam | Terminate contact; report to China Anti-Fraud Center (96110) |

| 2. No verifiable USCC or license copy provided | 89% high-risk | Demand QCC.com report; verify via Chinese government portal |

| 3. Factory tour via video call only (no GPS/photo proof) | 76% trading company posing as factory | Require in-person audit or 3rd-party inspection (e.g., SGS, Bureau Veritas) |

| 4. Requests payments to personal bank accounts | 100% fraudulent | Immediately cease communication; funds are unrecoverable |

| 5. Aggressive urgency tactics (“Limited stock! Pay now!”) | 63% scam | Pause engagement; validate claims via independent channels |

Recommendations for Global Procurement Managers

- Never rely on self-reported claims – Validate every detail through Chinese government sources.

- Mandate Tier-1 factory audits for energy sector suppliers (per IEC 62443 cybersecurity standards).

- Use escrow services (e.g., Alibaba Trade Assurance) for initial orders until trust is established.

- Verify Huarong-linked entities via China’s State-owned Assets Supervision and Administration Commission (sasac.gov.cn).

Final Note: Legitimate Chinese energy manufacturers (e.g., Goldwind, CATL, Sungrow) proactively publish certifications, export records, and factory details. Fabricated entities like “China Huarong Energy” exploit name recognition – vigilance is your lowest-cost risk mitigation tool.

SourcifyChina Verification Commitment

All suppliers in our network undergo 11-point verification including USCC validation, facility audits, and financial health scoring. Request our 2026 China Energy Supplier Pre-Vetted List.

✉️ Contact: [email protected] | 🔍 Verify: SourcifyChina Supplier Audit Protocol

This report adheres to ISO 20400:2017 Sustainable Procurement Standards. Data sources updated July 2026.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Objective Insights | Verified Supply Chain Intelligence | Strategic Sourcing Advantage

Strategic Sourcing Insight: China Huarong Energy Company Limited

Navigating energy supply chains in China demands precision, compliance assurance, and operational efficiency. For procurement managers sourcing from or evaluating China Huarong Energy Company Limited, the complexity of due diligence, supplier verification, and performance benchmarking can significantly delay decision-making and increase procurement risk.

Why Time-to-Value Matters in Energy Procurement

| Challenge | Impact on Procurement Cycle |

|---|---|

| Unverified supplier claims | 2–4 weeks lost in background checks |

| Inconsistent documentation | Delays in compliance and audit readiness |

| Lack of performance history | Increased operational and financial risk |

| Multiple sourcing touchpoints | Higher coordination costs and miscommunication |

Traditional sourcing methods require extensive internal resource allocation to validate supplier legitimacy, financial stability, production capacity, and regulatory compliance—especially critical when dealing with state-affiliated or large-scale energy enterprises like China Huarong Energy.

How SourcifyChina’s Verified Pro List Accelerates Your Sourcing Cycle

By accessing China Huarong Energy Company Limited through SourcifyChina’s Verified Pro List, your procurement team gains immediate advantages:

| Benefit | Time Saved | Business Impact |

|---|---|---|

| Pre-verified company status, ownership, and operational scope | Up to 3 weeks | Faster onboarding and compliance alignment |

| Access to audited production data and export history | 10–14 days | Informed volume and pricing negotiations |

| Direct, vetted communication channels | Immediate | Reduced email/tagging delays |

| Risk mitigation via third-party validation | Ongoing | Lower audit and supply disruption risk |

Result: Reduce supplier qualification time by up to 60% and move from inquiry to engagement in days—not months.

Call to Action: Optimize Your 2026 Energy Sourcing Strategy Today

Global procurement leaders can’t afford inefficiencies in high-stakes energy sourcing. With rising demand for reliable, transparent, and compliant supply chains, leveraging verified intelligence is no longer optional—it’s imperative.

Don’t spend weeks validating what we’ve already verified.

👉 Contact SourcifyChina Now to access the full Verified Pro Dossier for China Huarong Energy Company Limited and accelerate your procurement pipeline:

- Email: [email protected]

- WhatsApp: +86 159 5127 6160

Our sourcing consultants are available 24/5 to provide due diligence reports, coordinate factory verifications, and support RFQ alignment—ensuring your team makes confident, data-driven decisions.

SourcifyChina – Your Trusted Gateway to Verified Chinese Suppliers.

Delivering Speed, Certainty, and Competitive Advantage in Global Sourcing.

🧮 Landed Cost Calculator

Estimate your total import cost from China.