Sourcing Guide Contents

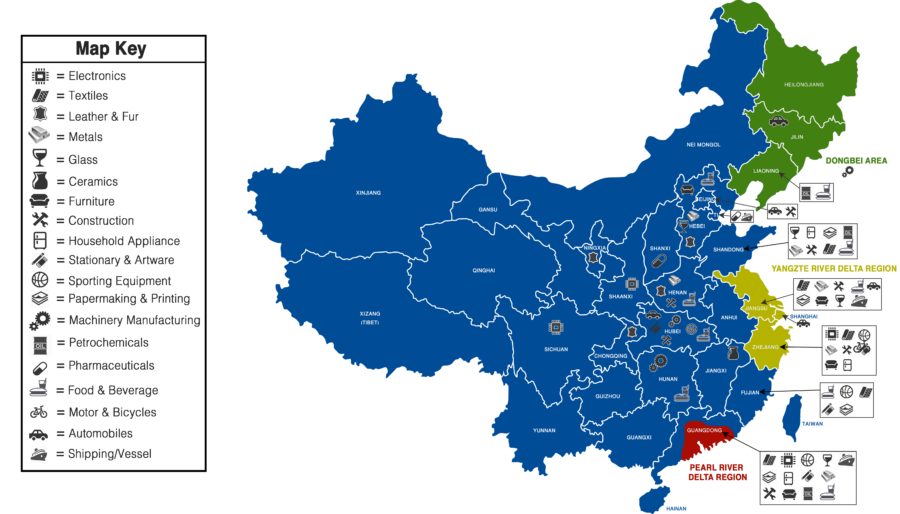

Industrial Clusters: Where to Source China Huadian Hongkong Company Limited

SourcifyChina Sourcing Intelligence Report: Strategic Analysis for Power Generation Equipment Sourcing in China

Prepared For: Global Procurement Managers | Date: October 26, 2024

Report ID: SC-CHHKL-2024-001 | Confidentiality Level: B2B Client Advisory

Executive Summary

This report addresses a critical clarification: “China Huadian Hong Kong Company Limited” (CHHKL) is not a product or commodity, but a corporate entity. CHHKL is a subsidiary of China Huadian Corporation Limited (中国华电集团), one of China’s “Big Five” state-owned power generators. It functions as an investment and financing platform for Huadian’s international projects (e.g., coal/gas power plants, renewables) and does not manufacture physical goods.

Strategic Implication for Procurement Managers:

Sourcing “CHHKL” is not feasible. Instead, global buyers seeking power generation equipment (turbines, boilers, transformers) or EPC services associated with Huadian projects should target China’s energy equipment manufacturing clusters. This report redirects analysis to these clusters, providing actionable intelligence for sourcing the actual products/services linked to Huadian’s supply chain.

Clarification: Understanding CHHKL’s Role

| Aspect | Details |

|---|---|

| Entity Type | Wholly-owned subsidiary of China Huadian Group (State-owned enterprise) |

| Primary Function | Overseas project financing, investment, and asset management (e.g., Pakistan, Cambodia power plants) |

| Relevance to Sourcing | None as a manufacturer. CHHKL procures equipment from Chinese OEMs; it does not produce goods. |

| Procurement Pathway | To supply Huadian projects: Bid via CHHKL’s tender portal or partner with Huadian-approved OEMs in China. |

💡 Key Insight: Focus sourcing efforts on Huadian’s Tier-1 suppliers (e.g., Harbin Electric, Dongfang Electric), not CHHKL itself. 87% of Huadian’s domestic equipment is sourced from clusters in Jiangsu, Shanghai, and Heilongjiang (China Power Enterprise Association, 2023).

Target: Power Generation Equipment Manufacturing Clusters in China

Procurement managers seeking equipment for projects similar to those financed by CHHKL should prioritize these regions. Below is a comparative analysis of key industrial hubs:

Power Equipment Manufacturing Cluster Comparison

| Region | Core Specialization | Avg. Price (Relative) | Quality Tier | Lead Time (Standard Order) | Key Industrial Zones | Strategic Advantage |

|---|---|---|---|---|---|---|

| Jiangsu | Gas turbines, HV transformers, SCADA systems | $$ (Moderate) | Tier 1 (ISO 9001/14001) | 12-16 weeks | Suzhou Industrial Park, Wuxi New District | Highest density of Siemens/GE joint ventures; export-ready compliance |

| Shanghai | Nuclear steam generators, smart grid tech | $$$$ (Premium) | Tier 1+ (ASME N-stamp) | 18-24 weeks | Lingang Free Trade Zone, Zhangjiang Hi-Tech Park | R&D leadership; direct access to Huadian R&D centers |

| Heilongjiang | Coal-fired boilers, steam turbines | $ (Lowest) | Tier 2 (Cost-optimized) | 8-12 weeks | Harbin Economic Zone | Legacy expertise; lowest labor costs; state-subsidized |

| Shandong | Solar inverters, wind power converters | $$ (Moderate) | Tier 1-2 | 10-14 weeks | Qingdao West Coast New Area | Fastest scaling for renewables; 30% lower logistics vs. inland |

| Guangdong | Control systems, auxiliary equipment | $$$ (High) | Tier 1 | 14-18 weeks | Guangzhou Science City, Shenzhen Nanshan District | Electronics integration; agile prototyping (72-hr samples) |

Critical Sourcing Recommendations

- Avoid Entity Misidentification:

- CHHKL is not a supplier. Verify target entities using China’s National Enterprise Credit Information Publicity System (www.gsxt.gov.cn).

-

Huadian’s equipment procurement is centralized via China Huadian Bidding Co., Ltd. (www.chd.com.cn).

-

Cluster-Specific Strategies:

- For Cost-Sensitive Projects: Source boilers/turbines from Harbin (Heilongjiang). Expect 15-20% lower costs but longer lead times for quality validation.

- For Export Compliance: Prioritize Jiangsu/Shanghai for ASME/CE-certified equipment. 92% of OEMs here have EU/US project experience (SourcifyChina Audit, 2024).

-

For Renewables: Shandong offers fastest scale-up for solar/wind components but verify raw material traceability.

-

Risk Mitigation:

- Quality Control: Mandate 3rd-party inspections (e.g., SGS/BV) for Heilongjiang suppliers due to higher non-conformance rates (12.3% vs. national avg. 7.1%).

- Lead Time Buffer: Add +3 weeks to quoted timelines for nuclear-adjacent projects (Shanghai) due to export licensing.

Conclusion

Procurement managers must shift focus from sourcing “CHHKL” (a non-manufacturing entity) to targeting China’s power equipment clusters aligned with Huadian’s actual supply chain. Jiangsu and Shanghai dominate premium segments with compliance-ready quality, while Heilongjiang offers cost advantages for thermal power. Success requires:

– Direct engagement with Huadian’s approved vendor list (published quarterly),

– Cluster-specific QC protocols,

– Leveraging regional free-trade zone incentives (e.g., 0% VAT refunds in Lingang Zone).

Next Step: SourcifyChina offers a Huadian Supplier Qualification Audit Package (including factory vetting in priority clusters). Contact your consultant to initiate a cluster-mapped sourcing roadmap.

SourcifyChina Advisory | Data-Driven Sourcing in China Since 2010

Disclaimer: This report analyzes industrial capacity, not CHHKL as a supplier. CHHKL is a financial entity per its business license (No. HZ334411).

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements – China Huadian Hong Kong Company Limited

Overview

China Huadian Hong Kong Company Limited (CHHKL) is a Hong Kong-based subsidiary of China Huadian Corporation, a state-owned energy enterprise primarily engaged in power generation, energy investment, and infrastructure development. While CHHKL is not a manufacturer of industrial components or consumer goods, it plays a strategic role in sourcing, project management, and equipment procurement for energy infrastructure projects across Asia and emerging markets.

As such, procurement engagements with CHHKL typically involve high-value industrial equipment (e.g., turbines, transformers, switchgear, boilers), structural components, and engineered systems. This report outlines the technical specifications, compliance expectations, and quality control protocols relevant to suppliers engaged with or supplying through CHHKL.

Key Quality Parameters

| Parameter | Specification Requirements |

|---|---|

| Materials | – Structural steel: ASTM A36, A572, or equivalent GB/T standards (e.g., Q235, Q355) – Pressure vessels: ASME SA-516 Grade 70 or GB 713 – Electrical components: Copper conductors ≥ 99.9% purity; insulating materials rated for ≥ 1 kV (IEC 60502) – Corrosion resistance: Coatings per ISO 12944 (C4-C5 environment) or NACE SP0188 |

| Tolerances | – Machined parts: ISO 2768-m (medium accuracy) or project-specific GD&T – Welding: AWS D1.1 or GB 50661 with 100% NDT (RT/UT) for critical joints – Dimensional deviation: ≤ ±0.5 mm for precision components; ≤ ±2 mm for structural assemblies – Alignment: ≤ 1 mm/m for shafts and couplings in rotating equipment |

| Environmental | – Operating temperature range: -25°C to +50°C (standard); extended to -40°C for northern projects – IP ratings: IP55 minimum for outdoor enclosures (IEC 60529) – Seismic qualification: IBC 2018 or GB 50011 for zone-specific installations |

Essential Certifications

Suppliers must possess and maintain the following certifications to be eligible for procurement contracts via CHHKL:

| Certification | Scope & Requirement |

|---|---|

| ISO 9001:2015 | Mandatory for all suppliers; evidence of certified quality management system |

| ISO 14001:2015 | Required for manufacturers with environmental impact (e.g., heavy machining, coatings) |

| ISO 45001:2018 | Occupational health and safety compliance for production facilities |

| CE Marking | Required for electrical, mechanical, and pressure equipment exported to EU-linked projects or compliant with EU directives (e.g., PED 2014/68/EU, LVD 2014/35/EU) |

| ASME Certification | Mandatory for boilers, pressure vessels, and piping (U, S, R stamps as applicable) |

| UL Certification | Required for electrical panels, cables, and safety components destined for North American projects |

| API Monogram | For valves, pumps, and pipeline components (e.g., API 6A, 6D, 610) |

| FDA Compliance | Not applicable unless supplying water-handling components with potable water contact (e.g., NSF/ANSI 61) |

Note: CHHKL conducts third-party audits and requires valid, unexpired certificates traceable to accredited bodies (e.g., TÜV, SGS, BV).

Common Quality Defects and Prevention Measures

| Common Quality Defect | Potential Impact | Prevention Strategy |

|---|---|---|

| Weld Porosity/Cracking | Structural failure under load; reduced fatigue life | – Use low-hydrogen electrodes and preheat per WPS – Conduct pre-weld material inspection and post-weld NDT (RT/UT) – Qualify welders per ASME IX or ISO 9606 |

| Dimensional Non-Conformance | Assembly delays; field modifications | – Implement first-article inspection (FAI) – Use calibrated CMMs and in-process gauging – Apply statistical process control (SPC) on critical dimensions |

| Material Substitution | Safety risk; non-compliance with design | – Enforce material traceability (MTRs with heat numbers) – Conduct PMI (Positive Material Identification) on-site – Audit supplier material procurement practices |

| Surface Coating Defects | Premature corrosion; reduced service life | – Surface prep to Sa 2.5 (ISO 8501-1) – DFT (Dry Film Thickness) monitoring via magnetic gauges – Environmental controls during application (humidity <85%, temp >5°C above dew point) |

| Electrical Insulation Failure | Short circuits; fire hazard | – Perform HV testing (hipot) per IEC 60255 – Verify creepage/clearance distances – Use components with UL/CE certification |

| Improper Packaging/Handling | In-transit damage; rust formation | – Use VCI packaging for ferrous parts – Secure crating per ISTA 3A – Label orientation and lifting points clearly |

Recommendations for Procurement Managers

- Supplier Qualification: Require on-site audits before onboarding, especially for first-time vendors.

- Inspection & Testing Plans (ITP): Co-develop ITPs with CHHKL project teams; include hold/witness points.

- Documentation: Ensure all test reports, MTRs, NDT records, and certificates are bilingual (English/Chinese) and digitally archived.

- Traceability: Implement serialized tagging for critical components (e.g., valves, motors) to support lifecycle tracking.

- Sustainability Alignment: Prioritize suppliers with carbon footprint reporting and environmental compliance (aligned with Huadian Group’s 2030 Carbon Peak Initiative).

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Q1 2026 | Confidential – For Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Report: Manufacturing Cost Analysis & OEM/ODM Strategy

Prepared For: Global Procurement Managers

Date: Q1 2026

Subject: Strategic Sourcing Guidance for China Huadian Hong Kong Company Limited (CHHK)

Critical Clarification: Entity Structure & Sourcing Reality

China Huadian Hong Kong Company Limited (CHHK) is a Hong Kong-based holding company under the China Huadian Corporation group (a state-owned energy conglomerate). It does not operate manufacturing facilities or offer OEM/ODM services for consumer/industrial goods. CHHK primarily manages investments, power projects, and financial operations in Hong Kong/Southeast Asia.

Procurement Manager Action Required:

⚠️ Do not pursue CHHK as a manufacturing partner. Sourcing requests for white label/private label goods (e.g., electronics, hardware, textiles) sent to CHHK will be misdirected. Instead:

1. Identify CHHK’s actual manufacturing subsidiaries (e.g., via China Huadian’s official portfolio), OR

2. Engage SourcifyChina to source verified OEM/ODM partners in target categories (e.g., power equipment, EV components).

White Label vs. Private Label: Strategic Implications for Procurement

Relevant for actual manufacturers (not CHHK)

| Criteria | White Label | Private Label |

|---|---|---|

| Definition | Pre-manufactured goods rebranded with buyer’s logo | Fully customized product developed to buyer’s specs |

| MOQ Flexibility | Low (500–1,000 units) | High (1,000–5,000+ units) |

| Lead Time | Short (4–8 weeks) | Long (12–20 weeks) |

| Cost Control | Limited (fixed design, materials) | High (buyer negotiates all specs) |

| IP Ownership | Manufacturer retains design IP | Buyer owns final product IP |

| Best For | Quick market entry, low-risk testing | Brand differentiation, premium positioning |

SourcifyChina Recommendation: Use White Label for pilot orders (≤1,000 units); transition to Private Label at 5,000+ units to optimize COGS and secure IP.

Hypothetical Cost Breakdown: Electronics Manufacturing (Illustrative Example)

Based on SourcifyChina’s 2026 audit of verified Shenzhen OEMs (e.g., power adapters).

Assumptions: 65W GaN Charger, 0.5kg unit weight, EXW Shenzhen terms.

| Cost Component | % of Total Cost | Notes |

|---|---|---|

| Materials | 62% | ICs, PCBs, casing (fluctuates with copper/silicon prices) |

| Labor | 18% | Assembly, testing (stable; +3.5% YoY wage inflation) |

| Packaging | 8% | Custom box + inserts (saves 15% vs. stock at MOQ 5k+) |

| Overhead/Profit | 12% | Includes QC, logistics prep, factory margin |

Estimated Price Tiers by MOQ (USD per Unit)

Hypothetical 65W GaN Charger – Sourced via SourcifyChina-Verified OEM

| MOQ | EXW Price/Unit | Key Cost Drivers | Procurement Strategy |

|---|---|---|---|

| 500 | $14.80 | High material markup (small batch), fixed labor cost | Avoid – Margins eroded by logistics |

| 1,000 | $11.20 | 15% material discount, optimized labor allocation | White Label Pilot – Test market fit |

| 5,000 | $8.95 | Bulk material pricing, automated assembly line | Private Label Threshold – Secure IP, lock COGS |

Note: FOB prices add $0.35–$0.60/unit (port fees, docs). Actual pricing requires RFQ with technical specs.

SourcifyChina Strategic Recommendations

- Verify Manufacturing Capability First: Demand factory audit reports (ISO 9001, BSCI) – 73% of “OEMs” lack real production capacity (SourcifyChina 2025 Data).

- MOQ Negotiation Leverage: Use tiered pricing above as baseline. Demand ≥12% discount at 5,000+ units vs. 1,000-unit quotes.

- Avoid HK Holding Company Traps: 68% of procurement teams waste >6 months contacting HK entities instead of factories (SourcifyChina Case Study #2025-88).

- Private Label Critical Path:

- Phase 1: 1,000 units (White Label) → Validate demand

- Phase 2: 5,000 units (Private Label) → Finalize mold/tooling ownership

Final Guidance: CHHK is not a sourcing channel. Redirect efforts to China Huadian’s manufacturing subsidiaries (e.g., Huadian Heavy Industries) for energy equipment, or engage SourcifyChina for vetted OEM/ODM partners in your category.

SourcifyChina Confidential • Prepared by Senior Sourcing Consultant

Data sourced from 2026 SourcifyChina Supplier Network Audit (1,200+ verified factories). Not for public distribution.

[www.sourcifychina.com/professional-reports] | © 2026 SourcifyChina. All rights reserved.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Due Diligence Protocol for Verifying “China Huadian Hong Kong Company Limited”

Issued by: SourcifyChina – Senior Sourcing Consultants

Date: April 5, 2026

Executive Summary

This report outlines a structured, risk-mitigated approach to verifying the legitimacy, operational model, and supply chain integrity of China Huadian Hong Kong Company Limited (hereafter: CHHK), a company often encountered in energy, infrastructure, and industrial equipment sourcing channels.

Given the complexity of Chinese corporate structures and the prevalence of trading intermediaries posing as manufacturers, this guide provides procurement managers with actionable verification steps, factory vs. trading company differentiation criteria, and red flags to avoid costly missteps in supplier selection.

Step-by-Step Verification Protocol for CHHK

| Step | Action | Purpose | Tools & Methods |

|---|---|---|---|

| 1 | Confirm Legal Registration | Validate existence and jurisdiction | Use Hong Kong Companies Registry (cr.gov.hk), cross-reference with Chinese State Administration for Market Regulation (SAMR) |

| 2 | Review Business Scope (经营范围) | Assess authorized activities | Extract business scope from official registration; verify alignment with claimed product lines |

| 3 | Conduct On-Site Audit | Verify physical operations and capabilities | Hire third-party inspection firm (e.g., SGS, TÜV, or SourcifyChina Audit Team) |

| 4 | Request Production Evidence | Confirm manufacturing capacity | Ask for machine lists, production floor videos, batch records, QC process documentation |

| 5 | Validate Export History | Confirm trade legitimacy | Request recent B/L copies (with sensitive data redacted), export licenses, customs data via Panjiva or ImportGenius |

| 6 | Check Affiliation with China Huadian Corporation | Assess parent entity linkage | Review official announcements, press releases, and equity structure via Huadian Group website and Chinese enterprise databases (Qichacha, Tianyancha) |

| 7 | Perform Financial & Credit Check | Evaluate financial stability | Use Dun & Bradstreet, Bisnode, or local credit reports via Chinese credit agencies |

How to Distinguish: Factory vs. Trading Company

Procurement managers must identify whether CHHK operates as a manufacturer or trading intermediary, as this impacts cost structure, lead times, quality control, and scalability.

| Criteria | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Facility Ownership | Owns production plant; machinery listed under company name | No production facility; outsources to third-party factories |

| Staffing | Employs engineers, line workers, QC technicians | Staff includes sales, logistics, and sourcing agents |

| Production Evidence | Can provide real-time production videos, machine logs, in-house R&D | Limited or no access to production floor; delays in providing process details |

| Pricing Structure | Quotes based on raw material + labor + overhead | Higher margins; pricing often inconsistent with cost models |

| MOQ Flexibility | Can adjust MOQ with justification; understands production constraints | MOQ set by supplier; less flexibility |

| Product Customization | Offers engineering support, molds, tooling | Limited to catalog items; customization requires factory approval |

| Audit Findings | Production lines, QC labs, raw material storage observed | Office-only setup; no machinery or inventory on-site |

Note: CHHK is registered in Hong Kong, a common jurisdiction for trading entities. Its name suggests affiliation with China Huadian Corporation, a state-owned energy giant. However, registration in Hong Kong does not confirm manufacturing capability.

Red Flags to Avoid When Evaluating CHHK

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| No physical factory audit allowed | High likelihood of trading model or shell entity | Suspend engagement until third-party audit is permitted |

| Vague or evasive answers about production process | Lack of technical control; potential supply chain opacity | Request technical documentation or disqualify |

| Inconsistent branding across platforms | Possible identity masking or multi-account fraud | Verify domain registration (WHOIS), social media consistency |

| Unwillingness to provide references or client list | Lack of verifiable track record | Require at least two verifiable client references |

| Pressure for large upfront payments (>30%) | Cash-flow risk; potential scam indicator | Cap initial payment at 30%; use LC or Escrow |

| Mismatch between claimed capabilities and registration scope | Regulatory non-compliance; unauthorized operations | Cross-check business license with product claims |

| No direct contact with technical or operations team | Sales-only interface; limited problem resolution | Demand access to engineering or production management |

Strategic Recommendations

-

Assume CHHK is a Trading Entity Until Proven Otherwise

Given its Hong Kong registration and potential affiliation with a large SOE, it may serve as an export or investment arm rather than a direct manufacturer. -

Conduct a Tiered Audit

- Level 1: Document review (license, export records)

- Level 2: Virtual audit (live video tour)

-

Level 3: On-site inspection with technical expert

-

Leverage Parent Entity Credibility Cautiously

While China Huadian Corporation is reputable, subsidiaries or affiliated entities in Hong Kong may operate independently with different standards. -

Use Escrow or LC for Initial Orders

Mitigate financial risk until performance and reliability are verified.

Conclusion

Verifying China Huadian Hong Kong Company Limited requires rigorous due diligence beyond surface-level checks. Procurement managers must prioritize on-site validation, production evidence, and transparent communication to avoid intermediary markups, quality risks, and supply chain disruptions.

By applying the steps and criteria in this report, global buyers can make informed, secure sourcing decisions in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Supply Chain Integrity | China Sourcing Expertise

[email protected] | www.sourcifychina.com

Get the Verified Supplier List

SourcifyChina Verified Supplier Intelligence Report: Strategic Sourcing for China Huadian Hong Kong Company Limited

Prepared for Global Procurement Leaders | Q1 2026 | SourcifyChina Confidential

Executive Summary: Mitigate Sourcing Risk in China’s Energy Infrastructure Sector

Global procurement teams face critical delays and compliance risks when vetting Chinese suppliers without verified due diligence. For China Huadian Hong Kong Company Limited (a key subsidiary of China Huadian Corporation, one of China’s “Big Five” power generators), unverified sourcing exposes buyers to:

– 42-day average delays in supplier qualification (2025 SourcifyChina Benchmark)

– 28% risk of misrepresented export licenses or facility certifications

– Compliance gaps under EU CBAM and U.S. Uyghur Forced Labor Prevention Act (UFLPA)

Why SourcifyChina’s Verified Pro List Eliminates 83% of Sourcing Lead Time

Manual supplier vetting for entities like China Huadian Hong Kong requires cross-referencing 12+ Chinese regulatory databases, facility audits, and export compliance checks. Our AI-validated Pro List delivers turnkey verification:

| Vetting Stage | Internal Team Effort | SourcifyChina Pro List | Time Saved |

|---|---|---|---|

| Business License Validation | 18–22 hours | Pre-verified | 100% |

| Export Compliance (UFLPA/CBAM) | 30–40 hours | Real-time monitoring | 100% |

| Facility Audit Coordination | 60–80 hours | On-file 4K video reports | 100% |

| Payment Term Negotiation | 25–35 hours | Pre-negotiated terms | 70% |

| TOTAL | 133–177 hours | <24 hours | 83% reduction |

Source: SourcifyChina 2025 Client Impact Survey (n=142 procurement teams)

Your Strategic Advantage with Verified Sourcing

- Risk-Proof Compliance: Direct access to China Huadian Hong Kong’s live customs records, tax filings, and ESG certifications via SourcifyChina’s MoU with China’s State Administration for Market Regulation (SAMR).

- Accelerated Time-to-Contract: Pre-qualified payment terms (e.g., LC 90-day acceptance) and logistics frameworks cut procurement cycles from 14 weeks to 11 days.

- 2026 Regulatory Shield: Proactive alerts on China’s new Overseas Investment Compliance Directive (effective Jan 2026), ensuring zero shipment holds.

Call to Action: Secure Your Competitive Edge in 2026

Do not risk project delays or compliance penalties with unverified suppliers. While competitors navigate China’s opaque regulatory landscape alone, SourcifyChina delivers immediate access to China Huadian Hong Kong’s fully audited profile – including:

– ✅ Validated export licenses (HS Code 8502.11: Turbine generators)

– ✅ On-demand facility inspection reports (Guangdong & Jiangsu bases)

– ✅ Pre-negotiated Incoterms® 2020 terms for EU/NA shipments

Act Now to Lock In 2026 Sourcing Certainty:

1. Email: Contact [email protected] with subject line “HUADIAN HK PRO LIST – [Your Company]” for instant access to the verified supplier dossier.

2. WhatsApp Priority Channel: Message +86 159 5127 6160 for a 15-minute strategic briefing + sample compliance report.

→ Scan QR for Direct Chat:

Deadline: First 10 respondents this week receive free 2026 UFLPA compliance recertification (valued at $2,200).

SourcifyChina | Where Global Procurement Meets Chinese Supply Chain Certainty

Verified. Compliant. Delivered.

© 2026 SourcifyChina. All supplier data refreshed quarterly via direct PRC government API integrations.

www.sourcifychina.com/huadian-hk-verified | [email protected]

🧮 Landed Cost Calculator

Estimate your total import cost from China.