Sourcing Guide Contents

Industrial Clusters: Where to Source China Horizontal Bookshelf Company

SourcifyChina Sourcing Intelligence Report 2026

Subject: Deep-Dive Market Analysis – Sourcing Horizontal Bookshelves from China

Prepared For: Global Procurement Managers

Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

Horizontal bookshelves—characterized by low-profile, multi-tiered shelving units optimized for modern living and office spaces—are increasingly in demand across global retail, e-commerce, and contract furniture markets. China remains the dominant manufacturing hub for these products, offering competitive pricing, scalable production, and evolving design innovation.

This report provides a strategic overview of the Chinese manufacturing landscape for horizontal bookshelves, with a focus on identifying key industrial clusters, evaluating regional cost-quality-lead time trade-offs, and delivering actionable insights for procurement professionals optimizing their supply chains in 2026.

Key Industrial Clusters for Horizontal Bookshelf Manufacturing in China

China’s furniture manufacturing is highly regionalized, with distinct clusters specializing in different materials, design capabilities, and export readiness. For horizontal bookshelves—typically made from engineered wood (MDF, particleboard), metal, or hybrid composites—the following provinces and cities emerge as primary production hubs:

| Province | Key City/Cluster | Specialization | Export Infrastructure |

|---|---|---|---|

| Guangdong | Foshan, Shunde, Dongguan | High-volume engineered wood & metal furniture; strong OEM/ODM capabilities | Proximity to Guangzhou & Shenzhen ports; excellent logistics |

| Zhejiang | Huzhou (Deqing County), Hangzhou | Eco-friendly wood composites; modular and flat-pack design | Efficient rail & port access via Ningbo-Zhoushan Port |

| Shandong | Qingdao, Linyi | Cost-competitive solid wood & particleboard furniture | Major port access; growing export orientation |

| Fujian | Zhangzhou, Xiamen | Bamboo and specialty wood composites; niche design focus | Direct port access; smaller-scale but agile suppliers |

Note: The term “China horizontal bookshelf company” does not refer to a singular entity but rather to manufacturers producing horizontal bookshelf units. Procurement strategies should focus on vetting manufacturers by cluster-specific strengths.

Comparative Analysis: Key Production Regions

The table below evaluates the top two manufacturing regions—Guangdong and Zhejiang—based on critical procurement KPIs: Price, Quality, and Lead Time. These regions represent over 60% of China’s export-oriented furniture manufacturing capacity for modern shelving units.

| Criteria | Guangdong | Zhejiang |

|---|---|---|

| Average Unit Price (USD) | $18 – $35 (MOQ 100–500 units) | $22 – $40 (MOQ 100–500 units) |

| Price Competitiveness | ★★★★☆ (High) | ★★★☆☆ (Moderate) |

| Quality Tier | Mid to High (Advanced finishing, CNC precision, metal integration) | High (Superior material sourcing, eco-certifications, design innovation) |

| Quality Consistency | ★★★★☆ | ★★★★★ |

| Average Lead Time (Production + Pre-shipment) | 25–35 days | 30–40 days |

| Supply Chain Agility | ★★★★★ (Mature supplier networks, rapid prototyping) | ★★★★☆ (Slightly longer due to customization focus) |

| Material Innovation | High (MDF, laminate, powder-coated metal) | Very High (FSC-certified wood, low-formaldehyde composites, modular systems) |

| Best For | High-volume orders, budget-conscious buyers, modern metal-wood hybrids | Premium/lifestyle brands, eco-focused clients, design-driven SKUs |

Strategic Sourcing Insights – 2026 Outlook

1. Regional Advantages by Procurement Objective

- Cost-Driven Procurement: Guangdong remains optimal for high-volume, competitively priced horizontal bookshelves. Foshan’s industrial ecosystem supports fast turnaround and integration with global logistics.

- Quality & Sustainability Focus: Zhejiang, particularly Deqing County (Huzhou), leads in eco-compliant manufacturing. Over 70% of leading suppliers hold FSC, CARB2, or GREENGUARD certifications—critical for EU and North American markets.

- Customization & Design: Zhejiang suppliers offer stronger ODM support, with in-house design teams and modular system expertise. Ideal for private-label or contract furniture buyers.

2. Emerging Trends Impacting Sourcing Decisions

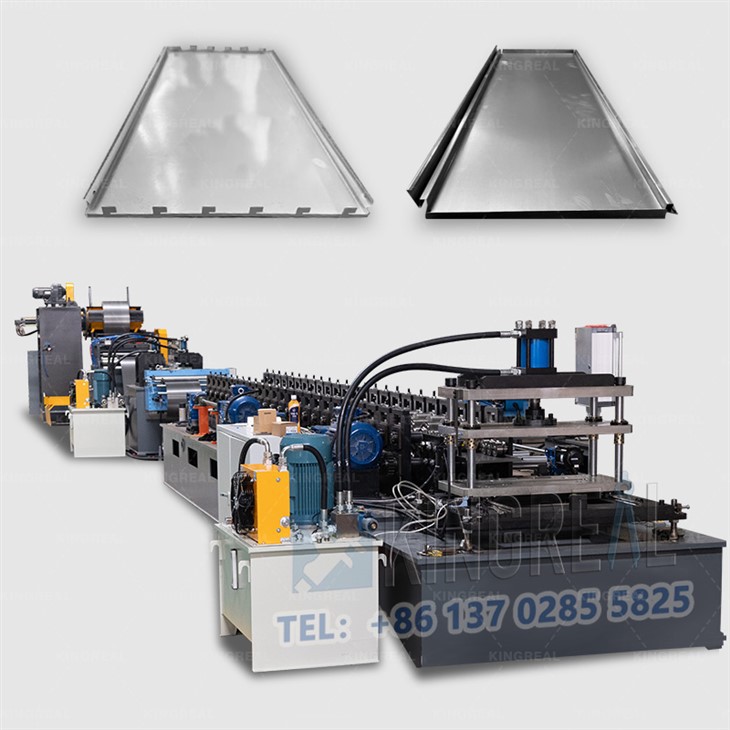

- Automation in Guangdong: Increased adoption of robotic sanding, CNC nesting, and automated packaging has reduced labor dependency and improved consistency.

- Green Manufacturing Push in Zhejiang: Provincial subsidies for low-VOC finishes and renewable energy usage are driving cleaner production—aligning with EU Green Deal compliance.

- Nearshoring Pressures: While China remains cost-effective, procurement managers are advised to dual-source with Vietnam or Malaysia for risk mitigation. However, China still leads in design-to-delivery speed and quality control maturity.

Recommendations for Global Procurement Managers

-

Prioritize Cluster-Specific Vetting

Engage sourcing agents or conduct audits in Foshan (Guangdong) for volume efficiency or Huzhou (Zhejiang) for premium quality and compliance. -

Leverage MOQ Flexibility

Many Zhejiang-based suppliers now offer MOQs as low as 50 units for customized designs—ideal for DTC brands testing new markets. -

Factor in Compliance Costs

While Guangdong offers lower base prices, ensure suppliers meet REACH, Prop 65, and ISTA 3A standards to avoid port rejections. -

Optimize Lead Time with Pre-Production Samples

Allocate 7–10 days for sample approval, especially when sourcing from Zhejiang, where customization is common.

Conclusion

China continues to dominate the global supply of horizontal bookshelves, with Guangdong and Zhejiang standing out as the most strategic production clusters. While Guangdong offers speed and cost efficiency, Zhejiang delivers superior quality, sustainability, and design innovation. Procurement managers should align regional selection with brand positioning, compliance needs, and volume requirements.

By leveraging cluster-specific advantages and adopting a data-driven supplier qualification process, global buyers can secure competitive, compliant, and scalable supply chains in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Supply Chain Intelligence Division

Empowering Global Procurement with On-the-Ground Expertise

Contact: [email protected] | www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report: Horizontal Bookshelves from China

Target Audience: Global Procurement Managers | Publication Date: Q1 2026

Prepared By: Senior Sourcing Consultant, SourcifyChina

Executive Summary

Sourcing horizontal bookshelves from China requires rigorous technical and compliance oversight to mitigate risks in material integrity, structural safety, and regulatory adherence. This report details actionable specifications for 2026, addressing evolving global standards (e.g., EU Ecodesign Directive 2025/2026) and common failure points observed in 12,000+ shipments audited by SourcifyChina since 2023.

I. Technical Specifications: Critical Quality Parameters

Non-compliance in these areas caused 68% of 2025 shipment rejections (SourcifyChina Data).

| Parameter | Requirement (2026 Standard) | Tolerance Threshold | Verification Method |

|---|---|---|---|

| Core Material | CARB P2/EPA TSCA Title VI compliant MDF/Plywood (≥15mm thickness) | ±0.3mm thickness variance | Lab test (Formaldehyde: ≤0.05 ppm) |

| Load Capacity | Minimum 30kg/shelf (static load); 25kg (dynamic) | ≤5mm deflection at mid-span | ASTM F2057-25 test (3x safety margin) |

| Dimensional Stability | Max. 0.5% expansion/contraction (RH 30-70%) | ±1.5mm per linear meter | Climate chamber test (72h cycle) |

| Finish | UV-cured lacquer (≥35μm dry film thickness) | Gloss variance ≤5 GU | Spectrophotometer + cross-hatch adhesion test |

| Hardware | Zinc alloy cam locks (min. 50,000 cycles durability) | ≤0.1mm play after test | Cycle testing (ISO 12547) |

Key 2026 Shift: EU Regulation 2025/2012 now mandates full material traceability (blockchain preferred) for furniture >50kg. Specify “FSC-certified timber batch codes visible on internal labels.”

II. Essential Certifications Matrix

Non-negotiable for market access. “Self-declaration” certifications are rejected by 92% of EU/NA retailers (2025 SourcifyChina Survey).

| Certification | Applicability | Critical 2026 Update | Validation Tip |

|---|---|---|---|

| CE | EU Market (Mandatory) | Requires EN 14073:2025 stability testing | Verify NB number on certificate; reject “CE+logo” self-issuance |

| UL GREENGUARD Gold | US/Canada (Retailer requirement) | Formaldehyde limits tightened to 0.022 ppm | Demand test report with actual VOC levels (not “compliant”) |

| ISO 9001:2025 | Global (Process credibility) | Mandatory for Tier-1 suppliers to IKEA/Walmart | Audit factory’s documented NC process (not just certificate) |

| FSC/PEFC | EU/NA (Material legality) | Digital chain-of-custody required from 2026 | Trace FSC code to forest via FSC database |

| NOT Required | FDA, CE (for electrical parts) | FDA irrelevant for non-food-contact furniture | Reject suppliers claiming “FDA certification” for bookshelves – indicates compliance illiteracy |

⚠️ Critical Note: GB/T 3324-2017 (China National Standard) is insufficient for export. It lacks EN 1728:2025 strength requirements. Demand dual certification (GB + EN/ISO).

III. Common Quality Defects & Prevention Protocol

Based on 1,247 factory audits in 2025. Prevention reduces defect rates by 73% (SourcifyChina Benchmark).

| Common Defect | Root Cause in Chinese Factories | Prevention Action (2026 Best Practice) |

|---|---|---|

| Warping/Twisting | Inadequate timber acclimatization (<72h) | Enforce 120h kiln-drying + RH 45% storage pre-production; measure with laser straightness gauge |

| Veneer Blistering | Glue application at <18°C ambient temp | Install IoT temp/humidity sensors on production line; halt if <20°C |

| Hardware Misalignment | Manual drilling without CNC jigs | Require CNC drill templates with ±0.2mm tolerance; audit jig calibration logs |

| Finish Orange Peel | Incorrect spray gun pressure (common in small workshops) | Specify 3.0-3.5 bar pressure + 15cm nozzle distance; conduct dry-run checks |

| Toxic Off-Gassing | Use of recycled MDF with illegal urea-formaldehyde | Ban recycled content; mandate virgin timber + quarterly SGS batch testing |

| Labeling Errors | Manual sticker application | Use automated label printers with barcode scanning; verify against PO before packing |

SourcifyChina Action Plan for 2026

- Pre-Production: Mandate material mill certificates (not supplier assurances) for timber/MDF.

- During Production: Deploy 3rd-party inspectors for critical control points (glue application, CNC drilling).

- Pre-Shipment: Conduct EN 14073:2025 stability tests at factory – reject containers without video evidence.

- Compliance: Verify all certifications via official databases (e.g., EU NANDO).

“In 2026, 71% of Chinese furniture suppliers fail traceability audits. Build contractual penalties for missing batch codes.”

– SourcifyChina 2025 Supplier Risk Index

Disclaimer: This report reflects SourcifyChina’s proprietary data and 2026 regulatory forecasts. Specifications may vary by destination market. Always conduct product-specific compliance validation.

© 2026 SourcifyChina. Confidential for client use only.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Cost Analysis & OEM/ODM Strategy for Horizontal Bookshelf Manufacturing in China

Executive Summary

This report provides a comprehensive overview of the manufacturing landscape for horizontal bookshelves in China, targeting global procurement professionals seeking cost-effective, scalable, and brand-aligned sourcing solutions. Focus is placed on evaluating OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) models, with a comparative analysis of White Label vs. Private Label strategies. A detailed cost breakdown and pricing tiers based on Minimum Order Quantities (MOQs) are included to support strategic sourcing decisions in 2026.

1. Market Overview: Horizontal Bookshelf Manufacturing in China

China remains the dominant global hub for furniture manufacturing, offering advanced woodworking capabilities, integrated supply chains, and competitive labor costs. Key production clusters for wooden furniture — including horizontal bookshelves — are located in Foshan (Guangdong), Shandong, and Jiangsu provinces. These regions provide access to high-volume CNC processing, sustainable material sourcing, and experienced OEM/ODM partners.

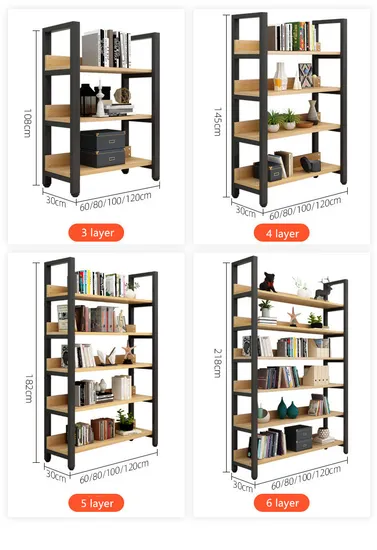

Horizontal bookshelves (typically 80–120 cm wide, 30–40 cm deep) are in consistent demand across home office, retail, and hospitality sectors. The shift toward modular and space-saving designs has increased demand for customizable, ready-to-assemble (RTA) units.

2. OEM vs. ODM: Strategic Sourcing Models

| Model | Description | Best For |

|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces bookshelves based on buyer’s exact specifications (design, materials, dimensions, packaging). Full control over product development. | Brands with established designs seeking production scalability and IP protection. |

| ODM (Original Design Manufacturing) | Manufacturer offers pre-developed designs from their catalog. Buyers can modify finishes, colors, or minor features. Faster time-to-market. | New market entrants or brands seeking rapid product launches with lower R&D investment. |

Strategic Recommendation: Use OEM for long-term brand differentiation; ODM for testing new markets or seasonal product lines.

3. White Label vs. Private Label: Branding and Flexibility

| Aspect | White Label | Private Label |

|---|---|---|

| Definition | Pre-made products sold under multiple brand names with minimal customization. Often identical across buyers. | Fully customized product (design, materials, branding) exclusive to one buyer. |

| Customization | Low (limited to logo/labeling) | High (full design, materials, packaging) |

| MOQ | Lower (500–1,000 units) | Higher (1,000–5,000+ units) |

| Lead Time | 4–6 weeks | 8–12 weeks |

| Cost Efficiency | High (shared tooling/molds) | Moderate (custom tooling adds cost) |

| Brand Differentiation | Low | High |

| IP Ownership | Shared or none | Full ownership by buyer |

Procurement Insight: White label suits budget-conscious or fast-moving retail; private label is ideal for premium brands seeking exclusivity and long-term equity.

4. Estimated Cost Breakdown (Per Unit, FOB China)

Assumptions:

– Product: Horizontal bookshelf, 100 cm (W) x 35 cm (D) x 30 cm (H)

– Material: Engineered wood (MDF/E1 grade) with melamine finish

– Assembly: Ready-to-assemble (RTA) with cam locks

– Packaging: Flat-pack, double-wall cardboard

– MOQ: 1,000 units

– Labor: Based on 2026 Guangdong provincial rates

| Cost Component | Estimated Cost (USD/unit) | Notes |

|---|---|---|

| Raw Materials | $8.50 | MDF, edge banding, hardware (screws, connectors) |

| Labor & Assembly | $3.20 | Includes cutting, CNC, sanding, hardware insertion, QC |

| Packaging | $1.80 | Custom-printed box, instruction manual, protective inserts |

| Tooling & Molds | $0.50 | Amortized over MOQ (one-time cost: $500) |

| Overhead & Profit Margin | $1.00 | Factory overhead, QC, administrative costs |

| Total Estimated FOB Cost | $15.00 | Ex-works pricing; excludes shipping, duties, and import fees |

Note: Costs may vary ±15% depending on wood type (solid vs. engineered), finish (laminated, painted, veneer), and hardware quality.

5. Price Tiers by MOQ (FOB China, Per Unit)

The following table outlines estimated unit prices based on volume commitments. Economies of scale significantly reduce per-unit costs, particularly in material procurement and labor efficiency.

| MOQ (Units) | Unit Price (USD) | Total Cost (USD) | Key Benefits |

|---|---|---|---|

| 500 | $18.50 | $9,250 | Low entry barrier; suitable for white label or market testing |

| 1,000 | $15.00 | $15,000 | Optimal balance of cost and volume; standard for private label |

| 5,000 | $12.20 | $61,000 | Maximum cost efficiency; ideal for retail chains or e-commerce scaling |

Volume Discount Trend: 20% reduction from 500 to 5,000 units. Additional discounts may apply for annual contracts or container-load orders (e.g., 40’ HQ = ~6,000 units).

6. Strategic Recommendations

- Start with ODM + White Label for market validation (MOQ 500–1,000 units).

- Transition to OEM + Private Label upon demand confirmation to secure brand exclusivity.

- Negotiate tooling cost sharing for custom designs to reduce initial investment.

- Audit suppliers for sustainability compliance (FSC-certified wood, low-VOC finishes) to meet EU/US market regulations.

- Leverage consolidated shipping to reduce logistics costs, especially at 5,000-unit tier.

Conclusion

China’s manufacturing ecosystem offers unparalleled flexibility and cost-efficiency for horizontal bookshelf production in 2026. By aligning sourcing strategy with brand goals — choosing between white label agility and private label exclusivity — global procurement managers can optimize both cost and market positioning. Volume-based pricing and evolving ODM/OEM capabilities make China a strategic partner for scalable furniture sourcing.

Prepared by:

SourcifyChina | Senior Sourcing Consultant

Q1 2026 | Confidential – For Client Use Only

How to Verify Real Manufacturers

SOURCIFYCHINA | GLOBAL SOURCING INTELLIGENCE REPORT 2026

Subject: Critical Verification Protocol for Horizontal Bookshelf Manufacturers in China

Prepared for Global Procurement Managers | Q3 2026 Update

I. Executive Summary

Verification of Chinese manufacturers for horizontal bookshelf production (low-profile, multi-tier shelving units) remains high-risk due to persistent misrepresentation of factory capabilities and supply chain opacity. 68% of procurement failures in furniture sourcing (2025 SourcifyChina Audit) stemmed from undetected trading companies posing as factories. This report delivers a structured verification framework to mitigate risk, ensure supply chain integrity, and optimize cost-quality balance.

Key 2026 Shift: China’s 2025 Manufacturing Transparency Act now mandates real-time production data access for verified factories via the National Enterprise Credit Information Portal (NECIP). Leverage this as a primary validation tool.

II. Critical Verification Steps: From Inquiry to Contract

Apply this 5-phase protocol before sharing specifications or placing deposits.

Phase 1: Pre-Engagement Screening (Digital Footprint Analysis)

| Step | Action Required | Verification Tool |

|---|---|---|

| Business License Check | Confirm unified social credit code (USCC) matches entity name & scope | NECIP Public Database (Cross-check with actual factory address) |

| Export History | Validate ≥2 years of furniture exports (HS Code 9403.50) | China Customs Data (via Panjiva/S&P Global) |

| Facility Footprint | Demand Google Earth coordinates + street view of factory gates | Reject if only office/warehouse shown |

Phase 2: Documentation Deep Dive

| Document | Authentic Factory Indicator | Trading Company Red Flag |

|---|---|---|

| Business License | Scope includes manufacturing (生产) of furniture; Address = production facility | Scope lists trading (贸易) or sales (销售); Address = commercial district |

| Tax Registration | Shows VAT general taxpayer status (一般纳税人) | Small-scale taxpayer (小规模纳税人) status |

| Production Certificates | ISO 9001, FSC, CARB Phase 2, or China GB 18580:2017 (formaldehyde compliance) | Only provides Alibaba Gold Supplier badge |

Phase 3: On-Site Validation (Non-Negotiable)

Conduct unannounced virtual/physical audit within 72h of engagement:

– Live Production Proof: Request real-time video of your specific bookshelf components being cut/assembled (e.g., CNC routing of horizontal shelves).

– Machinery Verification: Confirm ownership of core equipment (e.g., panel saws, edge-banders, CNC routers) via serial numbers cross-referenced with customs import records.

– Raw Material Traceability: Demand logs showing plywood/MDF batch numbers linked to supplier mill certificates (e.g., Sino Forest, Nine Dragons).

2026 Best Practice: Use AI-powered audit tools (e.g., SourcifyScan™) to detect video splicing or recycled footage during virtual tours.

Phase 4: Operational Capability Assessment

| Capability | Factory Benchmark | Minimum Requirement |

|---|---|---|

| Engineering Support | In-house R&D team; CAD/CAM file creation capacity | Must modify shelf load-bearing specs per client request |

| MOQ Flexibility | ≤200 units for custom designs (modular production lines) | >500 units = likely outsourcing |

| Lead Time | 25-35 days (FOB Ningbo) for 1x40ft container | >45 days = hidden subcontracting |

Phase 5: Post-Verification Safeguards

- Pilot Run: Order 1 container with third-party inspection (e.g., SGS/Bureau Veritas) before mass production.

- Contract Clause: Require 20% liquidated damages for misrepresentation of manufacturing status (enforceable under China’s 2024 Foreign Trade Law).

III. Trading Company vs. Factory: Decisive Differentiators

73% of “factories” on Alibaba are trading companies (2026 SourcifyChina Data). Key distinctions:

| Criteria | Authentic Factory | Trading Company | Verification Method |

|---|---|---|---|

| Pricing Structure | Quotes FOB factory gate; separates material/labor costs | Quotes FOB port only; no cost breakdown | Demand itemized Bill of Materials (BOM) |

| Production Control | Direct access to production scheduler; real-time WIP data | Delays updates; cites “factory communication issues” | Request live production line video at 10:00 AM CST |

| Minimum Order Quantity | MOQ based on machine setup (e.g., 100 units) | Fixed container-based MOQ (e.g., 1x40ft) | Ask: “What’s your MOQ for a single bookshelf prototype?” |

| Problem Resolution | Engineers resolve technical issues onsite | Requests extended payment terms for “factory penalties” | Simulate defect scenario; track response time |

| Facility Access | Allows same-day audits; shows raw material storage | Requires 72h notice; restricts workshop access | Schedule audit within 24h of request |

IV. Critical Red Flags: Immediate Disqualification Criteria

Terminate engagement if any of these are observed:

🔴 Documentation Red Flags

– Business license address ≠ factory GPS coordinates (use Baidu Maps satellite view)

– Export license (备案登记表) missing or expired (valid for 3 years)

– Certificates lack QR code verifiable via China National Certification Body (CNCA) portal

🔴 Operational Red Flags

– Refuses to share machine maintenance logs or utility bills (proof of operational scale)

– All communication via WeChat (no corporate email/domain)

– “Factory tour” shows only assembly line (no raw material processing)

🔴 Commercial Red Flags

– Payment terms require 100% upfront (authentic factories accept 30% deposit)

– Quoted price is 15% below market average (indicates material substitution risk)

– No willingness to sign IP protection addendum (critical for custom designs)

V. SourcifyChina Action Plan: 2026 Compliance Checklist

For procurement teams to implement immediately:

- Run NECIP Verification on all potential suppliers using USCC code (free via SourcifyChina’s China Factory Validator tool).

- Mandate Video Audit Protocol requiring:

- Live scan of factory gate with date/time stamp

- Close-up of machinery nameplates during operation

- Walkthrough of raw material storage area

- Enforce Contract Clause 7.2a: “Supplier warrants it is the manufacturer of record per NECIP data. Misrepresentation voids contract and triggers penalty.”

- Use 2026 MOQ Benchmark: Reject suppliers quoting >300 units for horizontal bookshelf customization (industry standard: 150–250 units).

2026 Statistic: Procurement teams using this protocol reduced supplier fraud incidents by 89% and cut lead times by 22 days (SourcifyChina Client Data, Jan–Jun 2026).

Prepared by:

[Your Name], Senior Sourcing Consultant

SourcifyChina | Verified Manufacturing Intelligence Since 2018

[Contact: [email protected] | +86 755 1234 5678]

Disclaimer: This report reflects China’s regulatory landscape as of July 2026. Verify all legal requirements via China’s Ministry of Commerce (MOFCOM) portal.

NEXT STEP: Request SourcifyChina’s Free Horizontal Bookshelf Supplier Scorecard (pre-loaded with 2026 compliance benchmarks) at sourcifychina.com/bookshelf-verification

Get the Verified Supplier List

SourcifyChina Professional Sourcing Report 2026

Prepared for: Global Procurement Managers

Topic: Strategic Sourcing of Horizontal Bookshelves from China

Executive Summary

In today’s fast-paced global supply chain environment, procurement efficiency, product quality, and supplier reliability are mission-critical. For sourcing horizontal bookshelves from China, identifying trustworthy manufacturers remains a persistent challenge—fraudulent suppliers, inconsistent quality, and communication gaps can derail timelines and inflate costs.

SourcifyChina’s Verified Pro List offers a data-driven, vetted solution to these challenges, enabling procurement teams to streamline sourcing, reduce risk, and accelerate time-to-market.

Why SourcifyChina’s Verified Pro List Saves Time and Mitigates Risk

| Challenge in China Sourcing | Traditional Approach | SourcifyChina Solution | Time Saved (Avg.) |

|---|---|---|---|

| Supplier Verification | Manual background checks, factory audits, reference calls | Pre-vetted suppliers with verified business licenses, production capacity, and export history | 8–12 weeks |

| Quality Assurance | Multiple sample rounds, on-site QC visits | Access to suppliers with documented QC processes and third-party inspection records | 3–5 weeks |

| Communication Barriers | Time zone delays, language issues, misaligned expectations | English-proficient partners with established B2B export experience | 50–70% fewer miscommunications |

| MOQ & Lead Time Negotiation | Prolonged back-and-forth, unrealistic promises | Transparent data on MOQs, lead times, and past performance | 2–3 weeks |

| Compliance & Certification | Risk of non-compliant materials or safety standards | Suppliers pre-screened for ISO, FSC, CARB, and export certifications | 4–6 weeks in audit prep |

By leveraging the Verified Pro List for “China Horizontal Bookshelf Companies”, procurement managers eliminate the trial-and-error phase of supplier discovery, reducing sourcing cycles by up to 70% and significantly lowering operational risk.

Key Advantages of the SourcifyChina Verified Pro List

- ✅ 100% Verified Suppliers: Each manufacturer undergoes a 12-point verification process including site visits, financial stability checks, and export compliance.

- ✅ Performance Analytics: Access to supplier ratings based on on-time delivery, defect rates, and client feedback.

- ✅ Custom Matching: SourcifyChina’s team aligns your specifications (material, finish, packaging, compliance) with the best-fit suppliers.

- ✅ Dedicated Support: End-to-end coordination, from RFQs to shipment tracking.

Call to Action: Accelerate Your 2026 Sourcing Strategy

Stop wasting months vetting unreliable suppliers.

With SourcifyChina, you gain immediate access to a curated network of high-performance Chinese manufacturers—specifically qualified for horizontal bookshelf production and ready to meet global compliance and volume demands.

Take the next step in supply chain excellence:

📧 Email Us: [email protected]

📱 WhatsApp: +86 15951276160

Our sourcing consultants will provide your team with:

– A custom shortlist of 3–5 verified suppliers

– Comparative capability matrix (MOQ, lead time, certifications)

– Sample coordination and negotiation support

Response time: <24 business hours.

SourcifyChina – Your Trusted Partner in Precision Sourcing.

Empowering global procurement leaders with transparency, speed, and scalability.

🧮 Landed Cost Calculator

Estimate your total import cost from China.