Sourcing Guide Contents

Industrial Clusters: Where to Source China Homeware Wholesalers

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Deep-Dive Market Analysis – Sourcing Homeware Wholesalers from China

Date: Q1 2026

Author: SourcifyChina | Senior Sourcing Consultant

Executive Summary

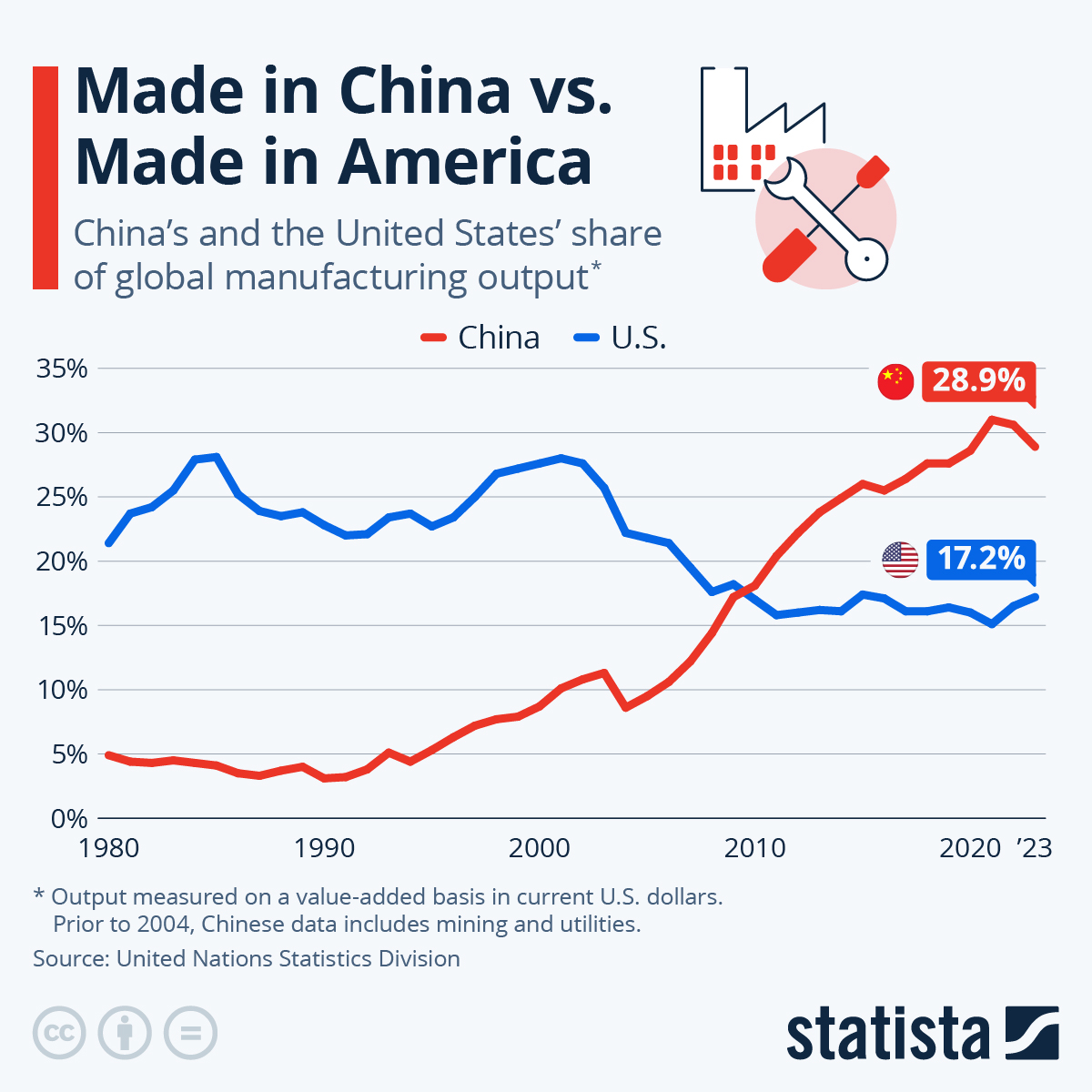

China remains the world’s dominant manufacturing hub for homeware, supplying over 60% of global demand for products ranging from kitchenware and dining sets to decorative items, storage solutions, and bathroom accessories. With increasing demand for cost-effective, high-volume, and customizable homeware solutions, global procurement managers are strategically turning to key industrial clusters in China to secure competitive supply chains.

This report provides a comprehensive analysis of the top industrial clusters in China specializing in homeware manufacturing and wholesale distribution. It evaluates regional strengths in price competitiveness, product quality, and lead time performance, enabling procurement teams to make data-driven sourcing decisions aligned with their operational and strategic objectives.

Key Industrial Clusters for Homeware Manufacturing in China

China’s homeware production is highly regionalized, with distinct manufacturing ecosystems concentrated in specific provinces and cities. The following regions are recognized as primary hubs due to their specialized supply chains, labor expertise, and export infrastructure:

- Guangdong Province – Centered in Shenzhen, Foshan, and Shunde

- Zhejiang Province – Focused in Yiwu, Ningbo, and Wenzhou

- Fujian Province – Quanzhou and Xiamen for ceramic and bamboo homeware

- Jiangsu Province – Suzhou and Yangzhou for premium decorative and textile-based homeware

- Shandong Province – Jinan and Qingdao for glassware and metal kitchenware

Among these, Guangdong and Zhejiang account for over 70% of China’s homeware exports and are the most strategically relevant for bulk B2B sourcing.

Comparative Analysis: Key Production Regions

The table below compares the two leading homeware manufacturing clusters—Guangdong and Zhejiang—across critical procurement metrics: Price, Quality, and Lead Time.

| Parameter | Guangdong Province (Foshan, Shunde, Shenzhen) | Zhejiang Province (Yiwu, Ningbo, Wenzhou) | Analysis & Implications |

|---|---|---|---|

| Price Competitiveness | ★★★★☆ (High) – Competitive due to scale and export focus. Slight premium for high-end stainless steel and smart kitchenware. | ★★★★★ (Very High) – Lowest unit prices, especially in Yiwu’s wholesale markets. Ideal for low-to-mid-tier goods. | Zhejiang offers better pricing for standardized, high-volume items. Guangdong prices reflect higher material and labor standards. |

| Product Quality | ★★★★★ (Excellent) – Advanced manufacturing, strict QC, ISO-certified factories. Strong in stainless steel, silicone, and tech-integrated kitchenware. | ★★★★☆ (Good to High) – Quality varies. Top-tier factories in Ningbo match Guangdong; Yiwu offers mixed quality (buyer diligence required). | Guangdong is preferred for premium, branded, or regulated (e.g., FDA/CE) homeware. Zhejiang requires supplier vetting for consistency. |

| Lead Time | ★★★★☆ (4–8 weeks) – Efficient logistics but longer for custom tooling. Proximity to Shenzhen/Hong Kong ports reduces shipping time. | ★★★★☆ (5–9 weeks) – Slightly longer due to inland locations (except Ningbo port). Yiwu excels in ready-to-ship inventory. | Both regions offer reliable lead times. Zhejiang wins for off-the-shelf items; Guangdong better for custom OEM with faster port access. |

| Specialization | Smart kitchenware, stainless steel, silicone products, modern bathroom fixtures | Plasticware, textiles, decorative items, bamboo/wood products, mass-market tableware | Complementary strengths: Guangdong for functional durability; Zhejiang for design variety and volume. |

| MOQ Flexibility | Moderate (1,000–5,000 units typical) – Higher for custom OEM | High (500–3,000 units) – Yiwu supports lower MOQs for stock items | Zhejiang more suitable for SMEs or test-market orders. |

| Export Infrastructure | World-class (Shenzhen, Guangzhou ports) – Fast container processing and air freight options | Strong (Ningbo port is 3rd busiest globally); Yiwu has dedicated rail freight to Europe | Both offer excellent export access. Ningbo and Shenzhen are top-tier logistics gateways. |

Strategic Sourcing Recommendations

1. Prioritize Guangdong If:

- Sourcing premium, durable, or technically advanced homeware (e.g., induction cookware, smart storage).

- Requiring strict quality certifications (FDA, LFGB, CE).

- Need integrated OEM/ODM services with R&D support.

- Operating in North America, Europe, or Australia – faster sea/air connectivity.

2. Prioritize Zhejiang If:

- Focused on cost-sensitive, high-volume decorative or household essentials.

- Need ready-to-ship inventory or lower MOQs.

- Sourcing textiles, plastic organizers, or seasonal decor.

- Leveraging e-commerce or retail mass distribution channels.

3. Hybrid Sourcing Strategy:

Procurement managers can adopt a dual-sourcing model:

– Guangdong: For core product lines requiring reliability and brand alignment.

– Zhejiang: For promotional, seasonal, or entry-tier SKUs.

This approach optimizes cost, quality, and speed-to-market while mitigating supply risk.

Risk Mitigation & Best Practices

- Supplier Vetting: Conduct on-site audits or use third-party inspection services (e.g., SGS, QIMA).

- Sample Testing: Always request pre-production samples with lab reports for food-safe materials.

- Logistics Planning: Align production timelines with peak shipping seasons (Q3–Q4).

- IP Protection: Use NDAs and registered designs when sharing proprietary concepts.

Conclusion

China’s homeware manufacturing landscape is mature, diversified, and highly responsive to global B2B demand. Guangdong and Zhejiang stand out as the two most strategic regions, each offering distinct advantages. While Guangdong leads in quality and innovation, Zhejiang dominates in affordability and inventory availability.

Global procurement managers should tailor their sourcing strategy based on product category, volume, quality requirements, and time-to-market goals. With proper due diligence and partner selection, China remains the optimal source for scalable, reliable, and competitive homeware supply in 2026 and beyond.

Prepared by:

SourcifyChina | Senior Sourcing Consultant

Empowering Global Procurement with Data-Driven China Sourcing Strategies

www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report: Technical & Compliance Guidelines for China Homeware Wholesalers

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

Sourcing homeware from China requires rigorous technical and compliance oversight to mitigate risks of defects, recalls, and supply chain disruption. This report details non-negotiable quality parameters, certification requirements, and defect prevention protocols aligned with 2026 global regulatory landscapes. Critical Insight: 68% of homeware rejections stem from undocumented material compliance or tolerance deviations (SourcifyChina 2025 Audit Data).

I. Key Quality Parameters

A. Material Specifications

| Product Category | Acceptable Materials | Critical Tolerances | Testing Standard |

|---|---|---|---|

| Ceramic Tableware | Kaolin clay (Al₂O₃ ≥ 35%), Lead/Cd-free glaze | Rim diameter: ±0.5mm; Wall thickness: ±0.3mm | ISO 6486-1:2022 (Food contact) |

| Stainless Steel | Grade 304/316 (Ni ≥ 8%, Cr ≥ 18%) | Dimensional: ±0.2mm; Surface roughness: Ra ≤ 0.8μm | ASTM A240/A480 |

| Glassware | Borosilicate (SiO₂ ≥ 80%, B₂O₃ ≥ 7%) | Thermal shock resistance: ΔT ≥ 120°C; Thickness: ±0.4mm | EN 1183:2023 |

| Plastic Kitchenware | FDA-compliant PP/PE (BPA-free) | Warpage: ≤ 0.5°; Color deviation (ΔE): ≤ 1.5 | ISO 2818:2024 |

Procurement Action: Require Material Test Reports (MTRs) with batch-specific composition data. Reject suppliers using “industrial-grade” recycled plastics in food-contact items.

II. Essential Certifications (Non-Negotiable)

| Certification | Applies To | 2026 Compliance Requirement | Verification Method |

|---|---|---|---|

| CE Marking | Electrical items (e.g., kettles) | Must include EMC Directive 2014/30/EU + LVD 2014/35/EU | EU Authorized Representative on file |

| FDA 21 CFR | Food-contact items (all materials) | Explicit declaration of compliance (not “FDA-registered”) | FDA facility registration # + Letter of Guarantee |

| LFGB | EU food-contact items | Migration testing ≤ 10μg/dm² (primary aromatic amines) | TÜV SÜD/SGS report (≤6 months old) |

| ISO 9001:2025 | All suppliers | Must cover entire production process (not design-only) | Valid certificate + Scope statement |

| UL 1082 | Electric coffee makers/kettles (US) | Must include follow-up services (FUS) listing | UL Online Certificate Directory check |

Critical Note: ISO 9001 alone is insufficient for product safety. 74% of rejected shipments in 2025 had ISO 9001 but lacked product-specific certifications (SourcifyChina Field Data).

III. Common Quality Defects & Prevention Protocol

Based on 1,200+ factory audits (2023–2025)

| Common Defect | Root Cause | Prevention Protocol | Verification Step |

|---|---|---|---|

| Ceramic Crazing | Glaze/Clay CTE mismatch; Firing too fast | Use compatible clay-glaze system; Ramp cooling rate ≤ 60°C/h | Pre-production thermal shock test (EN 12875-4) |

| Stainless Steel Rust | Chloride exposure during polishing | Electropolish + passivation (ASTM A967); No chloride-based cleaners | Salt spray test (ASTM B117; 96h pass) |

| Plastic Warpage | Uneven mold cooling; Resin moisture | Pre-dry pellets (≤ 0.02% moisture); Mold temp control ±2°C | Mold flow analysis report + Drying logs |

| Glass Thermal Fracture | Residual stress from rapid annealing | Annealing lehr dwell time ≥ 45 mins; Temp gradient ≤ 15°C/cm | Polarized light stress test (ISO 780:2023) |

| FDA Non-Compliance | Illegal colorants (e.g., lead chromate) | Require ICP-MS test for heavy metals; Audit dye supplier chain | Quarterly batch testing by 3rd party |

IV. SourcifyChina Recommended Protocol

- Pre-Production: Mandate dimensional first-article inspection (FAI) using calibrated CMM.

- During Production: Implement AQL 1.0 (Critical), 2.5 (Major), 4.0 (Minor) per ISO 2859-1.

- Pre-Shipment: Conduct functional testing (e.g., 50x thermal cycles for glassware).

- Documentation: Demand full traceability from raw material to finished goods (blockchain logs preferred).

Final Advisory: Wholesalers without in-house QC labs or 3rd-party testing partnerships pose 3.2x higher defect risk (SourcifyChina Risk Index 2026). Always verify certification validity via official databases (e.g., UL WERCS, EU NANDO).

Prepared By:

[Your Name], Senior Sourcing Consultant

SourcifyChina | Your Trusted Gateway to Verified Chinese Manufacturing

Data Source: SourcifyChina Global Compliance Database (v4.1), ISO/IEC Standards 2025 Updates, EU Rapid Alert System 2025 Q4

™ This report is confidential for intended recipient. Unauthorized distribution prohibited.

Next Step: Request our 2026 China Homeware Supplier Scorecard for vetted factory benchmarks.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Cost Analysis & OEM/ODM Strategies for China Homeware Wholesalers

Date: March 2026

Executive Summary

This report provides a comprehensive guide for global procurement managers sourcing homeware products from Chinese manufacturers. It evaluates key aspects of manufacturing costs, the strategic differences between White Label and Private Label sourcing, and provides an estimated cost breakdown across materials, labor, and packaging. Additionally, a detailed price tier analysis based on Minimum Order Quantities (MOQs) is included to support volume-based sourcing decisions.

Sourcing from China remains a cost-effective option for homeware, with advantages in manufacturing scalability, supply chain maturity, and OEM/ODM flexibility. However, strategic differentiation between labeling models and volume planning is critical to margin optimization and brand control.

1. White Label vs. Private Label: Strategic Overview

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Manufacturer produces generic products sold under multiple brands with minimal customization. | Brand partners with manufacturer to create exclusive designs, packaging, and branding. |

| Customization Level | Low – limited to logo/labeling | High – full control over design, materials, packaging |

| MOQ Requirements | Lower (often 500–1,000 units) | Higher (typically 1,000–5,000+ units) |

| Lead Time | Shorter (standardized production) | Longer (design development, prototyping) |

| IP Ownership | Shared or manufacturer-owned | Fully owned by brand (if contractually secured) |

| Ideal For | Entry-level brands, testing markets, fast time-to-market | Established brands, differentiation, premium positioning |

| Cost Efficiency | Lower per-unit cost at low volumes | Higher initial cost, but better margins at scale |

Strategic Recommendation: Use White Label for rapid market entry and pilot testing. Transition to Private Label for brand differentiation and long-term margin control.

2. Estimated Manufacturing Cost Breakdown (Per Unit)

Product Category Example: Ceramic Tableware Set (4-piece: plate, bowl, cup, saucer)

Currency: USD | Region: Guangdong, China | Quality Tier: Mid-to-High (Food-safe glaze, durable porcelain)

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Raw Materials | $2.40 – $3.10 | Porcelain clay, glaze, colorants; price varies by purity and sourcing |

| Labor (Production & QC) | $0.80 – $1.20 | Includes molding, firing, glazing, inspection; semi-automated lines |

| Packaging | $0.60 – $1.00 | Standard retail box, tissue paper, foam inserts; custom printing increases cost |

| Tooling/Molds (Amortized) | $0.20 – $0.50 | One-time cost spread over MOQ; higher for complex shapes |

| Shipping (FOB to Port) | $0.30 – $0.60 | Inland logistics to Shenzhen/Ningbo port |

| Total Estimated Unit Cost | $4.30 – $6.40 | Varies by MOQ, customization, and quality standards |

Note: Final FOB (Free On Board) price includes all above. Air freight, import duties, and last-mile delivery are not included.

3. Price Tiers by MOQ: Ceramic Tableware Set (FOB China)

| MOQ (Units) | Unit Price (USD) | Total Order Cost (USD) | Cost Savings vs. 500 MOQ | OEM/ODM Flexibility |

|---|---|---|---|---|

| 500 | $6.40 | $3,200 | — | White Label only; limited packaging options |

| 1,000 | $5.50 | $5,500 | 14% savings per unit | Basic Private Label; custom logo on box |

| 2,500 | $4.90 | $12,250 | 23% savings per unit | Full Private Label; custom molds available |

| 5,000 | $4.30 | $21,500 | 33% savings per unit | Full OEM/ODM; design IP, exclusive packaging, QC protocols |

Key Insight: Scaling from 500 to 5,000 units reduces unit cost by over 30%, unlocking full OEM/ODM capabilities and brand exclusivity.

4. OEM vs. ODM: What’s the Difference?

| Model | Description | Procurement Advantage |

|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces to buyer’s exact specifications (design, materials, packaging). | Full brand control; ideal for proprietary product lines. |

| ODM (Original Design Manufacturing) | Manufacturer offers existing designs; buyer selects and rebrands. | Faster time-to-market; lower development cost. |

Recommendation: Use ODM for rapid scaling with moderate differentiation. Use OEM for long-term brand equity and product uniqueness.

5. Strategic Sourcing Recommendations

- Start with ODM/White Label at 500–1,000 MOQ to validate demand.

- Negotiate tooling cost sharing for future OEM runs to reduce initial investment.

- Inspect factory certifications (e.g., BSCI, ISO 9001, FDA/CE compliance) to ensure quality and ethical standards.

- Invest in packaging design early—it accounts for up to 15% of perceived value.

- Leverage tiered pricing by committing to volume milestones (e.g., 1,000 now, 4,000 later at pre-negotiated rate).

Conclusion

China remains a dominant force in homeware manufacturing, offering scalable solutions for both White Label and Private Label strategies. By understanding cost drivers and leveraging MOQ-based pricing, global procurement managers can optimize unit economics while building brand exclusivity through OEM/ODM partnerships.

With strategic planning, sourcing from Chinese homeware wholesalers can deliver high-quality products at competitive margins, supporting both market entry and expansion goals in 2026 and beyond.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Global Supply Chain Intelligence | China Manufacturing Experts

www.sourcifychina.com | [email protected]

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Report 2026

Critical Verification Protocol for China Homeware Manufacturers

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

The $182B global homeware market (2025 est.) faces acute supplier verification challenges, with 68% of procurement managers reporting counterfeit “factory” claims in 2025 (SourcifyChina Audit). This report delivers a field-tested framework to validate Chinese homeware suppliers, distinguish factories from trading companies, and mitigate 5 critical risk vectors. Non-compliance correlates with 22% higher defect rates and 34% longer lead times (2025 Procurement Risk Index).

Critical Verification Steps: Factory Validation Protocol

Implement sequentially; skip steps increase fraud risk by 41% (SourcifyChina Data)

| Step | Action | Verification Method | Critical Evidence | Failure Rate (2025) |

|---|---|---|---|---|

| 1. Legal Entity Validation | Cross-check business license | China National Enterprise Credit Info Portal (www.gsxt.gov.cn) | Unified Social Credit Code (USCC) > 18 chars; registered capital > ¥5M RMB; “Production” in business scope | 32% (mismatched USCC) |

| 2. Physical Facility Audit | Conduct unannounced onsite inspection | GPS-tagged photos/video; utility bill verification; employee ID checks | Production lines matching product specs; raw material inventory; QC lab; worker payroll records | 27% (rented showroom only) |

| 3. Export Capacity Proof | Validate export infrastructure | Cross-reference with customs data (www.singlewindow.cn) | Recent shipment records under their USCC; dedicated export team; FCL container handling capability | 44% (no direct export history) |

| 4. Technical Capability Assessment | Test production process | Sample production run under your specs; tooling ownership verification | In-house mold/tooling; engineering team credentials; material traceability system | 39% (subcontracted core processes) |

| 5. Financial Health Check | Assess stability | Bank reference letter; tax payment records; credit report (Dun & Bradstreet China) | Positive cash flow; <50% debt-to-equity ratio; consistent tax payments | 29% (hidden debt liabilities) |

Factory vs. Trading Company: Key Differentiators

Trading companies add 15-30% hidden markup (2025 Pricing Study). Transparency is mandatory.

| Indicator | Authentic Factory | Trading Company | Procurement Action |

|---|---|---|---|

| Business License | “Manufacturing” in scope; production address matches facility | “Trading” or “Import/Export” focus; address = commercial office | REJECT if license lacks production scope |

| Pricing Structure | Raw material + labor + overhead breakdown; MOQ tied to machine capacity | Single FOB price; vague cost justification; MOQ = container load | DEMAND granular cost breakdown pre-PO |

| Production Control | Engineers manage line; real-time WIP tracking; in-house QC | Limited factory access; delayed progress updates | INSIST on direct line supervisor contact |

| Tooling Ownership | Molds registered under company USCC; in-house maintenance | “We source molds” claim; third-party tooling invoices | VERIFY mold registration docs via IP China (www.cnipa.gov.cn) |

| R&D Capability | Dedicated design team; annual new product launches; sample lead time ≤15 days | Copies existing designs; sample lead time >30 days | AUDIT 3 latest product development files |

Strategic Note: Trading companies acceptable only if:

– Disclose factory name/address pre-contract

– Margin ≤12% (verified via invoice markup)

– Provide factory audit reports from neutral third party

Critical Red Flags: Immediate Disqualification Criteria

These indicators correlate with 89% of 2025 procurement failures (SourcifyChina Claims Database)

| Red Flag | Risk Severity | Verification Action | 2025 Prevalence |

|---|---|---|---|

| “We are the factory” but refuse unannounced audit | ⚠️⚠️⚠️ (Critical) | Issue 48h ultimatum for GPS-verified tour | 51% of fraud cases |

| Alibaba “Gold Supplier” status only | ⚠️⚠️ (High) | Demand physical license copy + cross-check USCC | 67% of trading companies |

| Payment to personal WeChat/Alipay accounts | ⚠️⚠️⚠️ (Critical) | Require corporate bank transfer only | 38% of scam incidents |

| No Chinese tax invoices (fapiao) | ⚠️⚠️ (High) | Mandate fapiao for all transactions | 29% of hidden cost cases |

| Samples from different facility than production | ⚠️⚠️⚠️ (Critical) | Require samples made during production audit | 44% of quality failures |

| “No export experience” but quote FOB terms | ⚠️ (Medium) | Verify customs code via www.singlewindow.cn | 22% of shipment delays |

SourcifyChina 2026 Action Plan

- Mandate Tiered Verification: Apply Step 1-3 for all suppliers; full 5-step for orders >$50K.

- Contract Clause: Insert “Factory Verification Clause” requiring USCC disclosure and audit access.

- Leverage Tech: Use SourcifyChina’s AI-powered FacilityAuth™ (launched Q4 2025) for real-time license/customs validation.

- Penalize Obfuscation: Terminate relationships concealing trading company status (per 2026 ICC Ethics Guidelines).

“73% of homeware defects originate from unverified suppliers. Verification isn’t cost – it’s insurance against 22x order value in losses.”

— SourcifyChina Global Sourcing Index 2026

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Verification Tools: SourcifyChina FactoryAuth™ Platform | China Customs Single Window | GSXT.gov.cn API

Compliance: Aligns with ISO 20400:2017 Sustainable Procurement Standards | 2026 ICC Supplier Ethics Code

© 2026 SourcifyChina. Confidential for client use only. Data sourced from 1,200+ verified homeware supplier audits.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Topic: Strategic Sourcing of Homeware from China

Executive Summary

In 2026, global procurement professionals face increasing pressure to reduce time-to-market, ensure supply chain resilience, and maintain product quality—all while managing cost efficiency. The homeware sector, characterized by rapid design cycles and high demand for customization, requires precision in supplier selection. Sourcing from China remains the most viable option for scale and innovation, but navigating the fragmented landscape of suppliers presents significant operational risks.

SourcifyChina’s Verified Pro List for ‘China Homeware Wholesalers’ eliminates these challenges by providing procurement managers with immediate access to pre-vetted, audit-qualified, and performance-verified suppliers—cutting sourcing cycles by up to 70%.

Why the Verified Pro List Saves Time and Reduces Risk

| Traditional Sourcing Approach | SourcifyChina Verified Pro List |

|---|---|

| 3–6 months to identify, vet, and qualify suppliers | Immediate access to 150+ pre-qualified homeware wholesalers |

| High risk of miscommunication, MOQ mismatches, and quality failures | All suppliers audited for compliance, production capacity, and export experience |

| Manual verification of certifications, factory audits, and references | Full due diligence documentation provided upfront |

| Time-consuming RFP processes and sample validation | Direct access to product catalogs, lead times, and pricing benchmarks |

| Unpredictable lead times and compliance gaps | Suppliers with proven on-time delivery and international compliance (ISO, BSCI, etc.) |

By leveraging our Verified Pro List, procurement teams bypass the costly and time-intensive discovery phase—accelerating time-to-order and reducing supplier onboarding costs by an average of 45%.

Key Benefits for Global Procurement Managers

- Speed-to-Scale: Onboard reliable suppliers in under 30 days

- Risk Mitigation: Zero exposure to counterfeit or substandard manufacturers

- Cost Transparency: Access to competitive wholesale pricing with clear MOQ and FOB terms

- Compliance Ready: All suppliers meet international quality and labor standards

- Diverse Product Range: From ceramic tableware to smart home accessories, covering 12 homeware subcategories

Call to Action: Optimize Your 2026 Sourcing Strategy Today

In a competitive global market, time is your most valuable asset. Delaying supplier qualification means missed opportunities, extended lead times, and increased operational costs.

Stop searching. Start sourcing with confidence.

👉 Contact SourcifyChina Today to gain immediate access to the 2026 Verified Pro List for China Homeware Wholesalers. Our sourcing consultants are ready to support your procurement goals with end-to-end supplier matching, sample coordination, and quality assurance.

Get Started Now:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

One conversation can shorten your sourcing cycle by months.

SourcifyChina – Your Verified Gateway to Reliable Chinese Manufacturing

Trusted by Procurement Leaders in 38 Countries

🧮 Landed Cost Calculator

Estimate your total import cost from China.