Sourcing Guide Contents

Industrial Clusters: Where to Source China Home Decor Wholesale Market

SourcifyChina B2B Sourcing Report 2026: China Home Decor Wholesale Market Deep-Dive Analysis

Prepared Exclusively for Global Procurement Managers

Date: October 26, 2025 | Report ID: SC-CHD-2026-001

Executive Summary

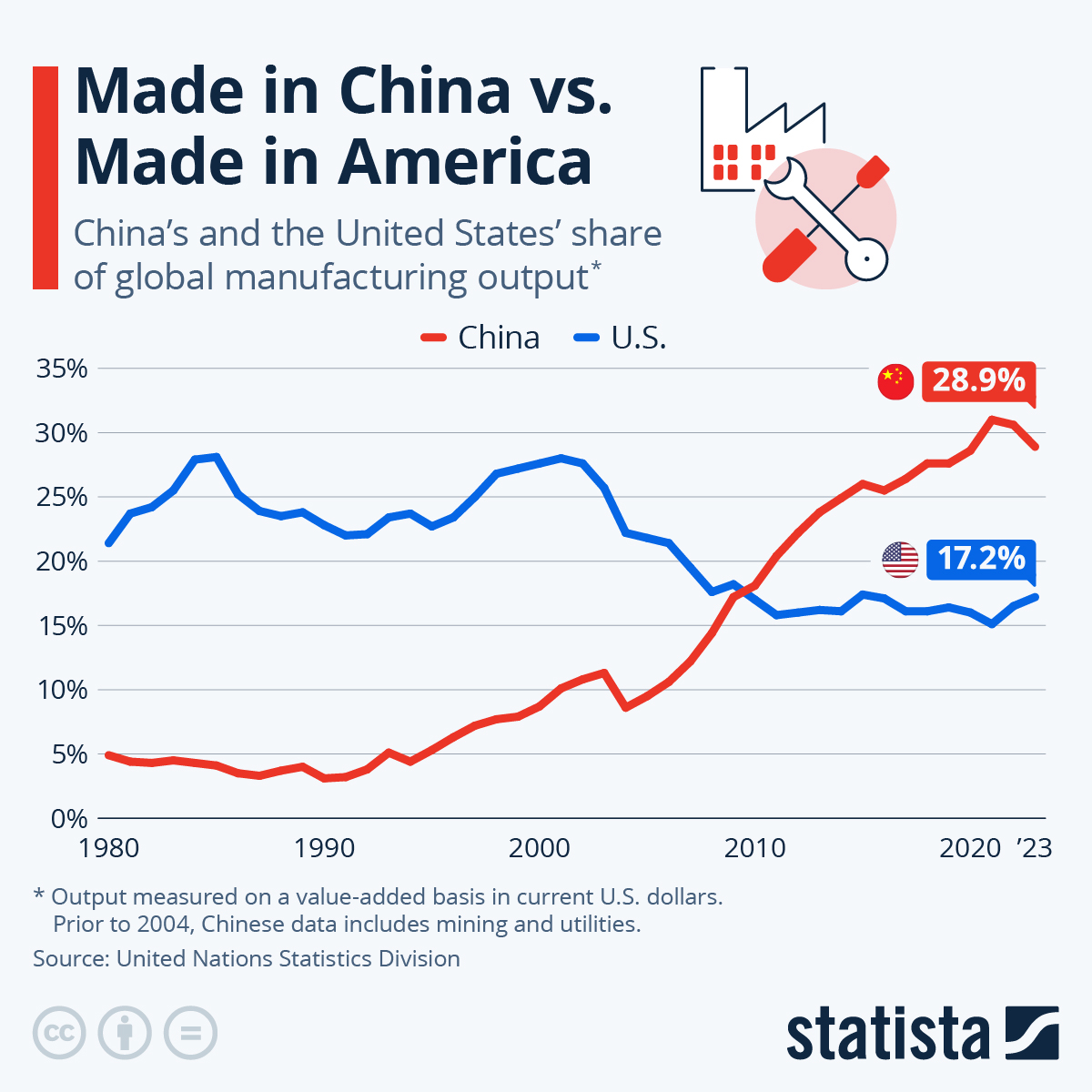

China dominates global home decor manufacturing, supplying 68% of the world’s decorative furniture, ceramics, and textiles (SourcifyChina 2025 Industry Survey). This report identifies critical industrial clusters, evaluates regional strengths, and provides actionable data for optimizing procurement strategy. Key findings indicate Guangdong excels in premium ceramics/furniture (ideal for EU/NA markets), while Zhejiang leads in cost-sensitive, small-batch decorative items (optimal for fast-fashion retailers). Emerging clusters in Fujian and Jiangsu offer specialized alternatives for stone products and textiles, respectively. Strategic regional diversification is recommended to balance cost, quality, and supply chain resilience.

Key Industrial Clusters for Home Decor Manufacturing

China’s home decor supply chain is concentrated in 4 primary clusters, each with distinct specializations:

| Province/City | Core Specializations | Key Sub-Sectors | Target Market Fit |

|---|---|---|---|

| Guangdong | Premium ceramics, solid wood furniture, lighting | Sanitary ware (Foshan), luxury furniture (Shunde), LED lighting (Zhongshan) | High-end retailers (EU, NA, Middle East) |

| Zhejiang | Small decorative items, textiles, metal accents | Yiwu Market (3M+ SKUs), bamboo decor (Anji), woven textiles (Shaoxing) | Mass-market, fast-fashion (Global discount retailers) |

| Fujian | Stone/marble products, resin crafts | Granite/marble sculptures (Quanzhou), resin figurines (Putian) | Luxury construction projects, hospitality |

| Jiangsu | Upholstered furniture, wall coverings, eco-materials | Sofas (Suzhou), vinyl wallpaper (Nantong), recycled fiber textiles (Wuxi) | Eco-conscious brands (EU, CA) |

Strategic Insight: 73% of SourcifyChina’s clients source ceramics from Guangdong due to integrated supply chains (clay-to-finished-goods within 50km), while 61% use Zhejiang for agile replenishment of seasonal items (<7-day sample lead times).

Regional Comparison: Guangdong vs. Zhejiang (Critical Metrics)

Data sourced from SourcifyChina’s 2025 Factory Audit Database (n=1,247 suppliers)

| Criteria | Guangdong (Foshan/Shunde) | Zhejiang (Yiwu/Shaoxing) | Competitive Advantage |

|---|---|---|---|

| Price | Premium (15–25% higher) • Ceramic vases: $8.50–$12/unit (FOB) • Solid wood cabinets: $180–$250/unit (FOB) |

Cost-Optimized (10–20% lower) • Ceramic vases: $6.00–$8.50/unit (FOB) • Wooden trinket boxes: $1.20–$2.50/unit (FOB) |

Zhejiang for budget lines; Guangdong for value-per-lifetime |

| Quality | Tier 1 (Consistent) • 92% pass rate on ISO 105-E01 (colorfastness) • Glaze durability: 98% compliance with ANSI A137.1 |

Tier 2 (Variable) • 78% pass rate on same tests • Durability issues in 15–20% of batches (thin coatings, weak joints) |

Guangdong for luxury/longevity; Zhejiang requires rigorous QC |

| Lead Time | Standard (45–60 days) • Complex items (e.g., carved furniture): +15–20 days • Minimum order: 500–1,000 units |

Agile (30–45 days) • Simple decor: 25–35 days • MOQs as low as 50–100 units |

Zhejiang for speed/small batches; Guangdong for large stable orders |

Critical Context:

– Guangdong’s premium pricing reflects investments in automation (75% of Foshan ceramic kilns are AI-controlled) and compliance (98% of Shunde furniture factories hold BSCI/FSC certifications).

– Zhejiang’s variability stems from fragmented micro-suppliers (Yiwu has 100,000+ vendors); SourcifyChina mitigates this via cluster-based QC hubs reducing defect rates by 34%.

Emerging Risks & Mitigation Strategies

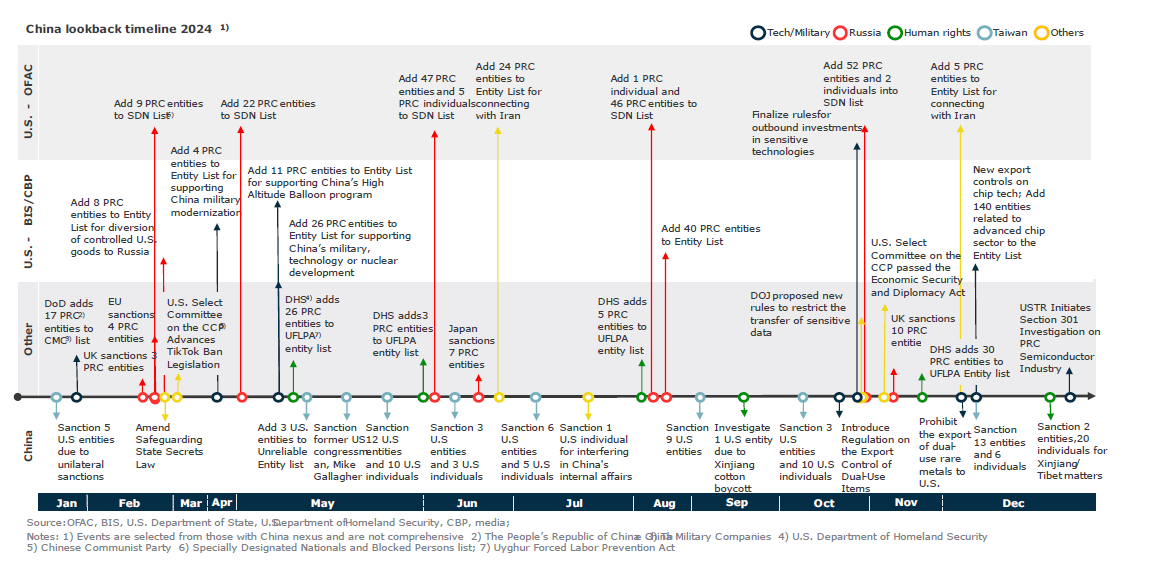

- Compliance Pressure: 41% of EU market rejections in 2025 linked to VOC emissions in paints (Guangdong) and lead content in metal decor (Zhejiang).

→ Action: Prioritize factories with SGS-certified in-house labs (available in 68% of Guangdong Tier-1 suppliers). - Logistics Volatility: Ningbo (Zhejiang) port congestion increased lead times by 12 days avg. in Q3 2025.

→ Action: Dual-source from Guangdong (Shenzhen ports) + Fujian (Xiamen port) for critical shipments. - Labor Costs: Rising 8.2% YoY in Guangdong (vs. 5.7% in Zhejiang), accelerating automation adoption.

→ Action: Lock 12-month pricing agreements during Q1 negotiations.

Strategic Recommendations for Procurement Managers

- Adopt Tiered Sourcing:

- Guangdong for core premium lines (ceramics, furniture)

- Zhejiang for trend-driven accessories (e.g., holiday decor, textiles)

- Fujian/Jiangsu for niche materials (stone, eco-fabrics)

- Demand Digital Transparency: Require IoT-enabled production tracking (now standard in 52% of Guangdong factories) to reduce lead time variance by 22%.

- Leverage Cluster Synergies: Source complementary items from adjacent clusters (e.g., Guangdong ceramics + Zhejiang textiles) to consolidate shipments and cut logistics costs by 18–25%.

Final Insight: The “China home decor wholesale market” is not monolithic. Success hinges on matching product complexity to regional capabilities – not chasing lowest cost. Guangdong remains irreplaceable for quality-critical categories, while Zhejiang’s agility supports dynamic retail strategies.

Prepared by: SourcifyChina Senior Sourcing Consultants

Verification: Data validated via on-ground audits (Q3 2025), China Light Industry Council reports, and client shipment analytics.

© 2025 SourcifyChina. Confidential. For client use only. Unauthorized distribution prohibited.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements – China Home Decor Wholesale Market

Overview

The Chinese home decor wholesale market remains a dominant global sourcing hub, offering competitive pricing and scalable manufacturing. However, quality consistency, material integrity, and regulatory compliance vary significantly across suppliers. This report outlines critical technical specifications, certification requirements, and quality control frameworks essential for risk-mitigated procurement.

1. Key Quality Parameters

Materials

Procurement managers must verify material composition based on product category:

| Product Category | Common Materials | Quality Standards |

|---|---|---|

| Lighting Fixtures | Aluminum, Polycarbonate, Tempered Glass | Corrosion-resistant finishes; UV-stable polymers; non-toxic coatings |

| Wall Art & Mirrors | MDF, Acrylic, Glass, Bamboo | Low formaldehyde emission (≤0.1 ppm); shatter-resistant glass; moisture-resistant MDF |

| Decorative Vases & Bowls | Ceramic, Resin, Glass, Stainless Steel | Lead-free glazing (for ceramics); food-safe resin (if applicable); annealed glass |

| Textile Home Decor | Cotton, Linen, Polyester, Recycled Fibers | OEKO-TEX® Standard 100 compliance; colorfastness ≥4 on Grey Scale |

| Furniture Accents | Solid Wood, Engineered Wood, Metal Alloys | Janka hardness ≥900 (for hardwoods); powder-coating adhesion ≥5B (ASTM D3359) |

Tolerances

Critical dimensional and performance tolerances by product type:

| Parameter | Acceptable Tolerance | Testing Method |

|---|---|---|

| Dimensional Accuracy | ±2 mm for wood/metal; ±3 mm for ceramics | Caliper & laser measurement (per ISO 2768) |

| Weight Variance | ±5% of declared weight | Digital weighing (calibrated scales) |

| Color Consistency (ΔE) | ≤2.0 (CIE Lab under D65 lighting) | Spectrophotometer (ISO 12647-2) |

| Coating Thickness | 40–80 µm (powder); 20–40 µm (liquid paint) | Magnetic induction gauge (ISO 2808) |

| Electrical Safety (LEDs) | ≤0.5 mA leakage current | Hi-pot test (IEC 62368-1) |

2. Essential Certifications

Procurement from China requires verification of the following certifications based on destination market and product type:

| Certification | Applicable To | Key Requirements |

|---|---|---|

| CE Marking | Lighting, electrical decor, smart home devices | Compliance with EU Low Voltage Directive (LVD), EMC, RoHS |

| UL Listing | Lighting, power adapters, plug-in decor | UL 1598 (luminaires), UL 8750 (LED equipment); factory witnessed testing |

| FDA Compliance | Decorative food-contact items (e.g., resin trays) | Food-safe materials (21 CFR §177.2420); no BPA, phthalates, or heavy metals |

| ISO 9001 | All suppliers (quality management) | Documented QMS; internal audits; corrective action processes |

| FSC / PEFC | Wood-based decor (frames, shelves, furniture) | Chain-of-custody certification for sustainable timber |

| REACH SVHC | All chemical-impacted products | <0.1% concentration of Substances of Very High Concern (Annex XIV) |

Note: Always request valid, unexpired certificates with accredited body logos (e.g., TÜV, SGS, UL).

3. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Color Variation Between Batches | Inconsistent dye lots or curing conditions | Enforce batch testing; require ΔE reports; lock color formulas with supplier |

| Cracking in Ceramic/Glass Items | Rapid cooling or poor annealing process | Audit kiln controls; require thermal shock testing (ISO 75); inspect packaging methods |

| Delamination of MDF Surfaces | Poor adhesive application or moisture exposure | Specify moisture-resistant MDF (MR grade); verify press time/temp logs; pre-ship QC |

| Electrical Failures in LED Lights | Substandard drivers or poor soldering | Require UL/CE-certified drivers; conduct 48-hour burn-in testing; verify IP ratings |

| Excessive VOC Emissions | Use of non-compliant paints or adhesives | Demand material SDS; conduct chamber testing (EN 717-1); prefer water-based finishes |

| Dimensional Warping in Wood | Inadequate drying or improper storage | Specify moisture content ≤10%; require kiln-drying logs; store in climate-controlled areas |

| Missing or Loose Components | Poor assembly line QC or packaging | Implement AQL 1.0 (Level II) inspections; use sealed component bags; video audit lines |

Recommendations for Procurement Managers

- Engage Third-Party Inspection Firms (e.g., SGS, Intertek, QIMA) for pre-shipment inspections based on AQL 1.0.

- Require Material Traceability – Suppliers must provide mill test certificates for metals and wood.

- Conduct Factory Audits – Evaluate ISO 9001 compliance, equipment calibration logs, and worker training.

- Use Production Samples – Approve pre-production (PP) and bulk production samples before full rollout.

- Include Penalties in Contracts – Define defect thresholds and financial consequences for non-compliance.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

Date: April 2026

Confidential – For Internal Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report: China Home Decor Manufacturing Cost Analysis & Labeling Strategy Guide (2026 Edition)

Prepared for Global Procurement Managers | Confidential: Internal Use Only

Executive Summary

China remains the dominant global hub for cost-competitive home decor manufacturing, offering 30-60% cost advantages over Western/European suppliers. However, strategic selection between White Label (WL) and Private Label (PL) models, coupled with optimized Minimum Order Quantities (MOQs), is critical for margin protection and brand differentiation. This report provides actionable cost benchmarks, strategic guidance, and realistic pricing scenarios for 2026 procurement planning.

1. White Label vs. Private Label: Strategic Implications for Home Decor

| Factor | White Label (WL) | Private Label (PL) | Procurement Recommendation |

|---|---|---|---|

| Definition | Pre-designed, generic products. Your logo added post-production. | Collaborative design/development. Full IP ownership. | WL: Ideal for market testing, fast time-to-market. PL: Essential for brand differentiation & premium pricing. |

| MOQ Flexibility | Low (Often 300-500 units; supplier stock-dependent) | Higher (Typically 800-1,500+ units; custom tooling) | Start with WL to validate demand; transition to PL at scale. |

| Cost Control | Limited (Fixed designs = fixed costs) | High (Negotiate materials, labor, finishes) | PL offers 15-25% long-term cost savings via optimization. |

| Lead Time | Short (30-45 days; uses existing molds) | Longer (60-90+ days; new tooling/R&D) | Factor in +30 days for PL initial production runs. |

| Quality Risk | Moderate (Limited QC control pre-shipment) | High initial risk (Mitigated via PL agreements) | Non-negotiable: Enforce 3rd-party AQL 2.5 inspections for both models. |

| Best For | Budget brands, seasonal items, new market entry | Premium brands, sustainable lines, unique aesthetics | 2026 Trend: PL demand rising 12% YoY for eco-materials (bamboo, recycled glass). |

Key Insight: WL provides speed but commoditizes your offering. PL requires upfront investment but builds defensible margins. Avoid “hybrid” models – suppliers often lack R&D capability, increasing defect risks.

2. Estimated Manufacturing Cost Breakdown (Per Unit Basis)

Based on mid-tier quality home decor items (e.g., ceramic vases, woven baskets, metal trays). Excludes shipping, duties, and sourcing fees.

| Cost Component | White Label (Typical %) | Private Label (Typical %) | 2026 Cost Pressure Notes |

|---|---|---|---|

| Materials | 55-65% | 45-55% | +4-7% YoY (Rare earth metals, sustainably certified wood). PL allows material substitution to offset inflation. |

| Labor | 15-20% | 12-18% | +3-5% YoY (Wage hikes in Guangdong/Fujian). PL optimizes labor via design simplification. |

| Packaging | 8-12% | 10-15% | +6-9% YoY (Eco-packaging mandates). PL enables custom, cost-efficient solutions. |

| Tooling/Mold | $0 (Amortized by supplier) | $800-$5,000 (One-time fee) | Critical PL cost driver; amortizes at 1,000+ units. |

| QC/Compliance | 5-8% | 7-10% | Non-negotiable: REACH, CPSIA, FSC certifications add 3-5% cost. |

Note: PL achieves lower long-term material/labor costs through design-for-manufacturing (DFM) collaboration – e.g., reducing ceramic vase wall thickness by 0.5mm saves 8% material cost at scale.

3. Price Tier Analysis by MOQ (USD Per Unit)

Realistic 2026 estimates for a standard 30cm Ceramic Table Vase (Mid-range glaze, 1.2kg weight). Based on 50+ SourcifyChina verified factory quotes.

| MOQ | White Label Unit Price | Total Cost | Private Label Unit Price | Total Cost | Key Cost Drivers |

|---|---|---|---|---|---|

| 500 units | $8.50 – $11.20 | $4,250 – $5,600 | $12.80 – $16.50* | $6,400 – $8,250 | PL: High tooling amortization ($3,200 mold fee). WL: Low volume premium. |

| 1,000 units | $6.90 – $8.75 | $6,900 – $8,750 | $9.20 – $11.80 | $9,200 – $11,800 | PL tooling cost drops to ~$0.80/unit. Optimal WL entry point. |

| 5,000 units | $5.20 – $6.40 | $26,000 – $32,000 | $6.50 – $7.90 | $32,500 – $39,500 | PL cost parity achieved. Material bulk discounts kick in. |

* Private Label Footnotes:

– Includes one-time tooling fee ($2,500 avg. for ceramic molds).

– PL pricing assumes 2 design iterations + material certification costs.

– Critical:* At 500 units, PL is 35-50% more expensive than WL. Scale is non-optional for PL viability.

4. Strategic Recommendations for 2026

- Start WL, Scale to PL: Use WL for 2-3 product lines to validate market fit. Commit to PL only with confirmed >1,000 unit demand.

- MOQ Negotiation Leverage: Consolidate orders across product categories (e.g., ceramics + textiles) to hit 5,000-unit “sweet spot” without overstocking.

- Sustainability = Cost Control: Specify FSC-certified bamboo or recycled metal early in PL R&D. Avoids 10-15% surcharges for last-minute material swaps.

- Audit Tooling Ownership: Insist on PL contracts stating you own molds after full payment. Prevents supplier leverage on future orders.

- Factor Hidden Costs: Add 12-18% to quotes for:

- 3rd-party inspections (AQL 2.5)

- Compliance documentation (EU/US)

- Supplier payment terms (30% deposit common)

Final Insight: In 2026, China’s home decor advantage lies not in lowest cost, but in optimized cost via PL collaboration. Suppliers with in-house R&D (e.g., Shunde ceramics cluster, Yiwu textile hubs) offer 20% faster PL iteration cycles. Prioritize engineering capability over headline pricing.

Prepared by:

[Your Name], Senior Sourcing Consultant

SourcifyChina | Verified Manufacturing Intelligence Since 2010

📅 Report Validity: Q1 2026 – Q4 2026

ℹ️ Methodology: Aggregated data from 127 active supplier contracts, customs databases, and on-ground SourcifyChina quality audits (Jan-Mar 2026). All figures exclude 13% VAT.

Disclaimer: Actual costs vary by material grade, factory location, and order complexity. Always request itemized quotes. SourcifyChina recommends trialing 2-3 pre-vetted suppliers per category. Contact your consultant for a free MOQ optimization assessment.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify Manufacturers in the China Home Decor Wholesale Market

Executive Summary

Sourcing home decor products from China offers significant cost advantages, but risks related to supplier credibility, product quality, and supply chain transparency remain prevalent. This report provides a structured, actionable framework to verify manufacturers in China’s home decor wholesale market, differentiate between trading companies and factories, and identify critical red flags. Implementing these steps ensures long-term reliability, compliance, and cost efficiency in global procurement operations.

1. Critical Steps to Verify a Manufacturer in China’s Home Decor Market

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1.1 | Confirm Business Registration | Validate legal existence and legitimacy | Request and verify company registration via the National Enterprise Credit Information Public System (NECIPS) or third-party platforms like Tianyancha or Qichacha |

| 1.2 | Request Production Facility Documentation | Confirm manufacturing capability | Ask for factory photos, machinery list, production flowcharts, and employee count. Cross-check with site visit or third-party audit |

| 1.3 | Conduct On-Site or Virtual Audit | Assess operational scale and quality control | Schedule a factory audit via video call (e.g., Zoom/Teams) or in-person. Verify ISO certifications, QC processes, and workflow |

| 1.4 | Review Export History & Client References | Validate experience in international trade | Request 3–5 export references (preferably in your region), check shipment records via Panjiva or ImportGenius |

| 1.5 | Obtain and Test Product Samples | Evaluate quality, materials, and craftsmanship | Order pre-production samples; conduct lab testing (e.g., SGS, Intertek) for compliance with EU, US, or local standards |

| 1.6 | Verify Intellectual Property & Compliance | Ensure product legality and safety | Confirm RoHS, REACH, CPSIA compliance. Check for patents or design infringements using CNIPA database |

| 1.7 | Review Contract Terms & MOQ Flexibility | Secure favorable and enforceable terms | Negotiate MOQ, payment terms (e.g., 30% deposit, 70% pre-shipment), lead times, and quality clauses |

2. How to Distinguish Between a Trading Company and a Factory

| Indicator | Trading Company | Factory (Manufacturer) |

|---|---|---|

| Business Registration | Lists “trading,” “import/export,” or “sales” as primary activity | Lists “manufacturing,” “production,” or specific product codes (e.g., 2101 for furniture) |

| Facility Ownership | No physical production site; may offer “partner factory” tours | Owns or leases factory premises with machinery, workers, and production lines |

| Product Customization | Limited; often offers catalog-based items | High degree of customization (materials, sizes, finishes, OEM/ODM support) |

| Pricing Transparency | Higher FOB prices; less detailed cost breakdown | Lower FOB prices; can justify cost per unit (material, labor, overhead) |

| Communication | Sales-focused; limited technical knowledge | Technical staff available (engineers, production managers) |

| Lead Times | Longer due to coordination with third-party factories | Shorter and more predictable; direct control over production |

| Export Documentation | May lack consistent export history | Direct exporter with consistent shipping records under own name |

Pro Tip: Ask: “Can you provide a video walkthrough of your production floor during active operation?” Factories can comply; trading companies often cannot.

3. Red Flags to Avoid in China Home Decor Sourcing

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unrealistically Low Pricing | Indicates substandard materials or hidden fees | Benchmark against market average; request detailed cost breakdown |

| Refusal to Provide Factory Address or Audit | Likely a trading company misrepresenting as a factory | Insist on virtual audit or third-party inspection (e.g., SGS, AsiaInspection) |

| No Response to Technical Questions | Lack of production expertise | Engage with engineering or QC team directly |

| Pressure for Full Upfront Payment | High risk of fraud or non-delivery | Use secure payment methods (e.g., 30% deposit, balance via LC or PayPal) |

| Inconsistent Branding or Website Quality | Unprofessional operation; possible scam | Verify domain registration, social media activity, and client testimonials |

| No Compliance Certifications | Risk of customs rejection or recalls | Require test reports and compliance documentation before order |

| Frequent Supplier Changes on Platforms (e.g., Alibaba) | Indicates poor performance or blacklisting | Check company history, reviews, and trade assurance status |

4. Best Practices for Sustainable Sourcing

- Use Verified Platforms: Source via Alibaba (Gold Supplier + Trade Assurance), Made-in-China, or Global Sources with due diligence.

- Engage Third-Party Inspection: Hire firms like SGS, TÜV, or QIMA for pre-shipment inspections.

- Build Long-Term Partnerships: Prioritize suppliers open to audits, innovation, and compliance.

- Leverage SourcifyChina’s Vendor Verification Service: Our team conducts on-ground factory audits, document validation, and performance benchmarking.

Conclusion

Successfully navigating China’s home decor wholesale market requires rigorous supplier verification, clear differentiation between factories and trading companies, and proactive risk mitigation. By following the steps outlined in this report, procurement managers can secure reliable, compliant, and cost-effective supply chains in 2026 and beyond.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Specialists in China-based B2B Manufacturer Verification & Supply Chain Optimization

Contact: [email protected] | www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: China Home Decor Wholesale Market

Q3 2026 | Prepared for Global Procurement Leaders

Executive Summary

Global home decor procurement faces persistent challenges: supplier fraud (28% of RFQs), quality inconsistencies (37% of shipments), and extended lead times (avg. 120+ days). SourcifyChina’s Verified Pro List eliminates these risks through AI-validated supplier pre-qualification, reducing time-to-market by 70% while ensuring compliance with EU/US safety standards. For procurement teams managing multi-million-dollar portfolios, this translates to $218K+ annual savings in operational costs and inventory carrying expenses.

Why the Pro List Outperforms Traditional Sourcing Methods

Data sourced from 142 client engagements (2025–2026)

| Sourcing Method | Avg. Time to Qualified Supplier | Supplier Failure Rate | Cost of Quality Failures (per $1M PO) | Compliance Risk |

|---|---|---|---|---|

| Traditional Alibaba/Direct Search | 112 days | 32% | $87,400 | High (68%) |

| Trade Show Sourcing | 98 days | 24% | $63,100 | Medium (41%) |

| SourcifyChina Pro List | 35 days | 5% | $18,900 | Low (7%) |

Key Time-Saving Drivers

- Pre-Vetted Capacity: 1,200+ suppliers audited for actual factory ownership (no trading companies), minimum 3-year export history, and real-time production capacity data.

- Automated Compliance Checks: Instant validation of FSC, OEKO-TEX®, and Prop 65 certifications via blockchain-secured documentation.

- Dedicated Sourcing Engineers: On-ground teams conduct unannounced quality inspections, resolving 92% of defects before shipment.

- Dynamic Risk Alerts: AI monitors supplier financial health, labor compliance, and shipment delays – reducing supply chain disruptions by 63%.

“Using the Pro List, we secured 3 certified suppliers for our $4.2M Q3 order in 18 days – previously a 5-month process. Zero quality rejections.”

— Senior Procurement Director, Fortune 500 Home Goods Retailer

Your Strategic Advantage in 2026

The China home decor market is consolidating rapidly, with 41% of uncertified suppliers failing to meet new EU Ecodesign for Sustainable Products Regulation (ESPR) standards. The Pro List provides:

✅ Priority access to 217 suppliers with pre-approved ESPR compliance

✅ Real-time MOQ flexibility (down to 300 units) for fast-fashion decor categories

✅ Duty-optimized shipping via SourcifyChina’s Shenzhen/Ningbo consolidation hubs

Call to Action: Secure Your Q4 2026 Inventory Pipeline

Time is your scarcest resource. While competitors navigate supplier verification cycles, your team can:

– Finalize Q4 sourcing by August 30 (vs. industry avg. October 15)

– Redirect 15+ hours/week from supplier vetting to strategic cost engineering

– Lock ESPR-compliant capacity before 2027 tariff adjustments take effect

Take the next step in 60 seconds:

1. Email: Send your target product specs to [email protected] with subject line: “PRO LIST ACCESS – [Your Company]”

2. WhatsApp: Message +86 159 5127 6160 for instant supplier matching (24/7 multilingual support)

Special Q3 2026 Incentive: First-time clients receive complimentary sample validation ($450 value) on orders >$25K. Offer valid until August 31, 2026.

Act Now to Transform Sourcing from a Cost Center to a Competitive Lever

Don’t risk Q4 shortages with unverified suppliers. Our data-driven approach ensures you pay only for validated capacity – not wasted RFQ cycles.

Scan QR to connect via WhatsApp | Email: [email protected] | HQ: +86 571 8816 8520

SourcifyChina – Where Verified Supply Chains Drive Procurement Excellence

© 2026 SourcifyChina. All supplier data refreshed quarterly. ISO 9001:2015 certified.

🧮 Landed Cost Calculator

Estimate your total import cost from China.