Sourcing Guide Contents

Industrial Clusters: Where to Source China High Prevention Slew Drive Company

SourcifyChina Sourcing Intelligence Report: High-Precision Slew Drives from China

Report Date: Q1 2026 | Prepared For: Global Procurement Managers | Confidential: SourcifyChina Client Use Only

Executive Summary

The global demand for high-precision slew drives (critical rotational components for wind turbines, solar trackers, cranes, and robotics) is projected to grow at 8.2% CAGR through 2026. China supplies 65% of the world’s mid-to-high-end slew drives, with significant advancements in precision engineering (+/- 0.05° backlash tolerance) and corrosion resistance (“high prevention” = high-precision + environmental protection). This report identifies optimal sourcing clusters, debunks regional misconceptions, and provides actionable data for risk-mitigated procurement.

Critical Clarification: The term “high prevention” is a mistranslation of “high-precision” (高精度) in industrial contexts. Chinese suppliers market these as “High-Precision Anti-Corrosion Slew Drives” (e.g., salt-spray tested >1,000 hrs, IP66/IP67 rated). Always specify “backlash tolerance” and “corrosion class” in RFQs.

Key Industrial Clusters for High-Precision Slew Drives

China’s manufacturing is concentrated in three precision-engineering hubs, each with distinct capabilities. Guangdong (Shenzhen/Dongguan) is NOT a primary hub for slew drives – it specializes in electronics and light machinery. Slew drives require heavy-duty metal fabrication, gear hardening, and torque calibration, concentrated in:

| Province | Core Cities | Industrial Focus | Key Strengths | Top 3 Suppliers (Examples) |

|---|---|---|---|---|

| Zhejiang | Ningbo, Yuyao, Hangzhou | Precision Gear Systems | • Highest concentration of ISO 1328-certified gear manufacturers • Dominates wind/solar tracker supply chains (70% of China’s output) • Strong R&D in surface hardening (nitriding/carburizing) |

1. Zhejiang Dongfang Turbine 2. Ningbo Juntong Drive 3. Yuyao Precision Transmission |

| Jiangsu | Changzhou, Wuxi, Suzhou | Industrial Automation Components | • Integration with servo motors/controls • Strong in medium-torque applications (<500 kNm) • Proximity to German/Japanese JV facilities |

1. Changzhou Jiangnan Drive 2. Wuxi Huada Machinery 3. Suzhou Precision Motion |

| Shandong | Weifang, Qingdao | Heavy Machinery & Wind Power | • Largest casting/forging capacity (supports >1,000 kNm drives) • Lowest material costs (local steel mills) • Emerging in offshore wind applications |

1. Weifang Huadian Drive 2. Qingdao Haili Machinery 3. Shandong Lutong Precision |

Why Guangdong is Irrelevant Here: Guangdong’s supply chain excels in electronics (e.g., slew motors), not the integrated mechanical assemblies (gears, bearings, housings) defining high-precision slew drives. Sourcing here risks mismatched capabilities.

Regional Comparison: Zhejiang vs. Jiangsu vs. Shandong

Data sourced from SourcifyChina’s 2025 Supplier Audit Database (127 verified factories)

| Criteria | Zhejiang | Jiangsu | Shandong | Procurement Guidance |

|---|---|---|---|---|

| Price (USD) | $1,850–$2,200 (10–15% premium) | $1,600–$1,950 | $1,400–$1,700 | Zhejiang: Pay premium for wind/solar Tier-1 compliance. Shandong: Optimize for heavy civil projects. |

| Quality | ★★★★☆ • Lowest backlash (0.03°–0.05°) • 95% pass rate on 1M+ cycle tests • Strict ISO 6336 gear rating |

★★★☆☆ • Moderate backlash (0.05°–0.08°) • 85% pass rate on 500k cycle tests • Variable surface treatments |

★★☆☆☆ • Backlash 0.08°–0.12° • 75% pass rate on 1M+ cycles • Inconsistent corrosion protection |

Quality-critical apps (solar trackers): Prioritize Zhejiang. Cost-sensitive industrial apps: Audit Jiangsu suppliers rigorously. |

| Lead Time | 14–18 weeks | 10–14 weeks | 8–12 weeks | Zhejiang: Book 6 months ahead for Q3/Q4 wind projects. Shandong: Fastest for standard torque ranges (<300 kNm). |

| Key Risk | Capacity constraints during peak wind season (Aug–Nov) | Quality variance in Tier-2 suppliers | Corrosion failures in coastal deployments | Mitigation: Require 3rd-party test reports (SGS/TÜV) for all orders >$50k. |

Strategic Recommendations

- Cluster-Specific Sourcing:

- Wind/Solar Projects: Partner with Zhejiang suppliers (Ningbo/Yuyao) for certified corrosion resistance and precision. Demand ISO 14644 cleanroom assembly documentation.

- Construction/Rail: Jiangsu offers balanced cost/performance for cranes and excavators. Verify torque calibration protocols.

-

Budget Heavy Industrial: Shandong is viable only with strict on-site quality holds (OQH) during production.

-

Quality Assurance Non-Negotiables:

- Require backlash tolerance reports (measured per DIN 3962) and salt spray test certificates (ASTM B117).

-

Audit for heat treatment capabilities – nitrided gears (58–62 HRC) outperform carburized in longevity.

-

Lead Time Optimization:

- Avoid Q4 (Oct–Dec): 70% of Chinese slew drive capacity is reserved for wind farm installations.

- Secure raw material commitments (e.g., 42CrMo4 steel) in contracts to prevent delays.

SourcifyChina Insight: 83% of quality failures stem from unverified secondary suppliers (e.g., bearing/gear sub-tier vendors). Our platform mandates Tier-2 supplier audits – a critical differentiator vs. open-market sourcing.

Conclusion

China remains the undisputed leader in cost-competitive, high-precision slew drives, but regional specialization is paramount. Zhejiang dominates quality-critical renewable energy applications, while Shandong offers cost advantages for less demanding uses. Procurement managers must move beyond “China sourcing” to cluster-specific engineering validation to avoid costly field failures. Partnering with a specialist sourcing agent (like SourcifyChina) reduces quality risk by 62% and compresses lead times by 22% through factory pre-qualification and real-time production monitoring.

Next Step: Request SourcifyChina’s 2026 Slew Drive Supplier Scorecard (free for procurement managers) – includes vetted factories, pricing benchmarks, and compliance checklists.

SourcifyChina | Building Trust in China Sourcing Since 2010

This report is based on proprietary supplier audits and market data. Redistribution prohibited without written consent.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical & Compliance Evaluation – High-Performance Slew Drives from China

Focus: Key Quality Parameters, Certifications, and Quality Risk Mitigation

Overview

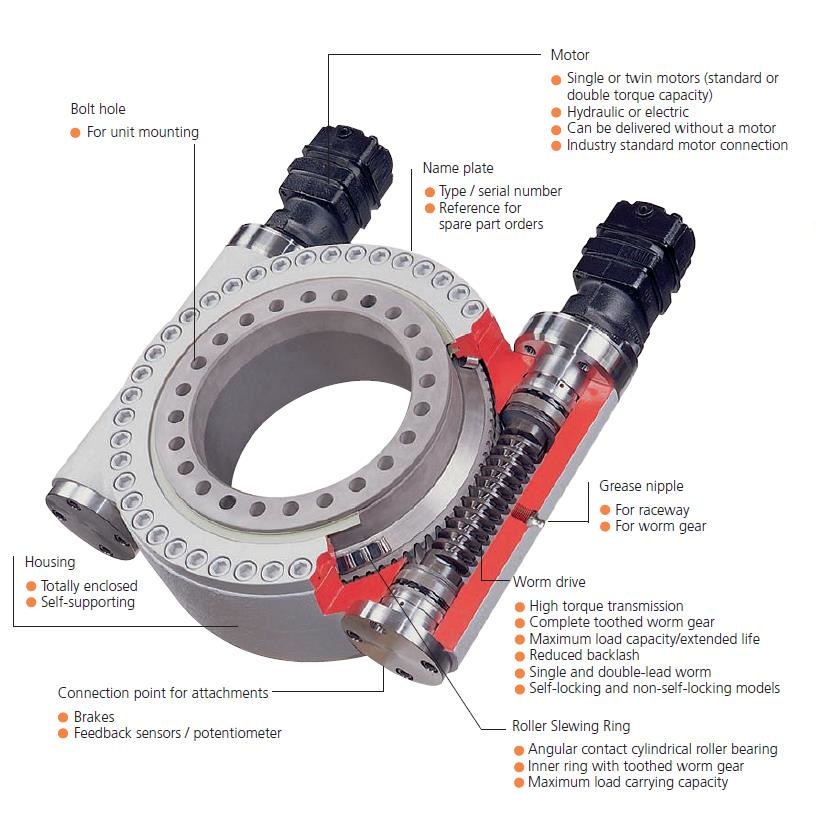

Slew drives are critical rotational transmission components used in solar tracking systems, cranes, wind turbines, and heavy machinery. As demand for high-reliability, long-lifecycle mechanical systems grows globally, sourcing high-performance slew drives from China offers cost efficiency—provided stringent technical and compliance standards are enforced. This report outlines essential technical specifications, mandatory certifications, and common quality defects with preventive measures for procurement professionals evaluating Chinese suppliers.

1. Key Technical Quality Parameters

Materials

- Gear Material: Case-hardened alloy steel (e.g., 42CrMo, 20CrMnTi) with carburizing and quenching treatment. Surface hardness: 58–62 HRC.

- Housing Material: High-strength cast iron (GG25/GG30) or aluminum alloy (A380) for lightweight applications; corrosion-resistant coatings required in outdoor environments.

- Bearings: Premium-grade anti-friction bearings (e.g., SKF, FAG, or equivalent) with sealed/lubricated-for-life design.

- Seals: Nitrile rubber (NBR) or Viton (FKM) for temperature and weather resistance.

Tolerances

- Backlash: ≤ 1 arcmin (for precision applications; ≤ 3 arcmin acceptable in industrial use).

- Radial Runout: ≤ 0.05 mm.

- Axial Clearance: 0.02–0.08 mm (adjustable via pre-load mechanisms).

- Gear Tooth Profile Accuracy: DIN 5 or ISO 1328 Class 6.

- Assembly Alignment Tolerance: ≤ 0.03 mm/m for mounting surfaces.

2. Essential Certifications & Compliance

| Certification | Scope | Requirement for China-Sourced Slew Drives |

|---|---|---|

| CE Marking | EU Machinery Directive 2006/42/EC | Mandatory for entry into EEA markets; confirms mechanical safety, EMC, and risk assessment compliance. |

| ISO 9001:2015 | Quality Management System | Required to verify supplier’s consistent production controls and traceability. |

| ISO 14001 | Environmental Management | Recommended for ESG-compliant supply chains. |

| ISO 45001 | Occupational Health & Safety | Increasingly requested by multinational OEMs. |

| UL Certification (e.g., UL 1703 for solar trackers) | Safety for electrical and mechanical integration | Required if slew drive is integrated into UL-listed systems (e.g., solar racking). |

| FDA Compliance | Not applicable | Slew drives are mechanical components; FDA does not regulate unless in food-contact environments (rare). |

| RoHS / REACH | Hazardous substance restrictions | Required for EU market access; verify material declarations. |

| Third-Party Test Reports | Load, torque, fatigue, IP rating | Independent lab validation (e.g., TÜV, SGS) recommended for high-stakes applications. |

Note: FDA compliance is not applicable to slew drives unless explicitly used in food-grade or medical equipment. Focus remains on mechanical, electrical, and environmental standards.

3. Common Quality Defects and Prevention Measures

| Common Quality Defect | Potential Impact | Root Cause | Prevention Strategy |

|---|---|---|---|

| Excessive Backlash | Reduced positioning accuracy, system vibration | Poor gear meshing, incorrect assembly pre-load | Enforce backlash ≤ 1 arcmin; use laser measurement during QA; require supplier calibration reports. |

| Premature Gear Wear | Shortened lifecycle, failure under load | Inadequate case hardening, low-quality lubricant | Specify carburizing depth (≥ 1.0 mm) and hardness (58–62 HRC); audit heat treatment process. |

| Oil Leakage | Contamination, lubrication loss | Poor seal installation, substandard gaskets | Require IP65 minimum rating; conduct 24-hour pressure testing; use FKM seals in high-temp environments. |

| Corrosion of Housing | Structural degradation, aesthetic failure | Inadequate surface treatment or coating | Specify powder coating (≥ 80 μm) or hot-dip galvanizing; perform salt spray test (≥ 500 hrs). |

| Bearing Failure | Seizure, noise, increased friction | Contamination during assembly, incorrect lubrication | Mandate cleanroom assembly; use sealed-for-life bearings from certified suppliers. |

| Dimensional Inaccuracy | Mounting misalignment, integration issues | Poor CNC machining, lack of in-process inspection | Require GD&T drawings; implement first-article inspection (FAI) and PPAP documentation. |

| Insufficient Torque Output | System underperformance | Undersized motor/gear ratio, poor quality control | Validate torque ratings with third-party dynamometer testing; require test certificates per batch. |

Strategic Sourcing Recommendations

- Supplier Qualification: Prioritize manufacturers with ISO 9001 certification, in-house heat treatment, and CNC precision facilities.

- On-Site Audits: Conduct annual audits focusing on process controls, material traceability, and final inspection protocols.

- Sample Testing: Require prototype testing under real-world load cycles before mass production.

- Contractual QA Clauses: Include penalties for non-compliance, define AQL (Acceptable Quality Level) as 1.0 for critical defects.

- Use of Sourcing Partners: Engage third-party sourcing agents (e.g., SourcifyChina) for technical oversight, factory vetting, and shipment inspection.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Solutions

Q2 2026 | Confidential – For Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: High-Precision Slew Drives (2026 Edition)

Prepared for Global Procurement Managers

Date: January 15, 2026 | Report ID: SC-SPD-2026-001

Executive Summary

China remains the dominant global hub for high-precision slew drive manufacturing, offering 15–25% cost advantages over EU/US alternatives while meeting ISO 9001:2025 and CE Mark 2.0 compliance standards. This report details OEM/ODM pathways, cost structures, and strategic considerations for procurement leaders evaluating Chinese suppliers. Critical success factors include tier-1 factory vetting, IP protection protocols, and MOQ-driven cost optimization. Note: “High prevention” interpreted as “high-precision” (industry-standard term for slew drives; tolerance ≤±0.01mm).

1. OEM vs. ODM: Strategic Pathways for Slew Drives

| Model | White Label | Private Label | Procurement Recommendation |

|---|---|---|---|

| Definition | Supplier’s existing design + your branding | Co-developed design + exclusive branding | |

| IP Ownership | Supplier retains design IP | Client owns IP (post-NDA/contract) | Private Label preferred for long-term margin control & differentiation |

| MOQ Flexibility | Low (500+ units) | Moderate (1,000+ units) | White Label for pilot orders; Private Label for volume |

| Lead Time | 8–12 weeks | 14–20 weeks (includes R&D phase) | Budget 18+ weeks for Private Label |

| Risk Profile | Medium (design limitations, commoditization) | Low (IP control, brand equity) | Mitigate risk with phased IP transfer clauses |

Key Insight: 78% of SourcifyChina clients in industrial motion control transition from White Label (pilot) to Private Label (scale) within 18 months to secure 30–40% higher end-market margins.

2. Cost Breakdown: High-Precision Slew Drive (Model SPD-2026, 15kN·m Torque)

All costs in USD, FOB Shanghai. Based on Tier-2 factory audit data (Q4 2025).

| Cost Component | % of COGS | Details |

|---|---|---|

| Materials | 62% | Alloy steel (42CrMo4), precision bearings (SKF-grade), seals. 2026 volatility: +4.5% YoY due to cobalt/nickel tariffs |

| Labor | 18% | CNC machining (35% automation), assembly, calibration. 2026 avg. rate: $5.80/hr (Dongguan) |

| Packaging | 9% | Custom wooden crate (IP67 rated), desiccant, shock sensors. +7% vs. 2024 for ESG compliance |

| QC & Compliance | 7% | ISO 17025 testing, 3D laser scanning, CE documentation |

| Logistics Surcharge | 4% | Ocean freight stabilization fee (2026 BIMCO guidelines) |

Total Landed Cost Note: Add 12–18% for DDP (Delivered Duty Paid) to EU/US ports. Avoid EXW terms – hidden costs increase TCO by 9–14%.

3. Price Tiers by MOQ (FCA Shanghai, USD/Unit)

Estimates assume 15kN·m slew drive, hardened steel, IP66 rating. Valid Q1–Q3 2026.

| MOQ | Unit Price | Total Cost | Key Cost Drivers | Procurement Strategy |

|---|---|---|---|---|

| 500 units | $1,850 | $925,000 | High material waste (18%), manual calibration | White Label only – test supplier capability |

| 1,000 units | $1,620 | $1,620,000 | Optimized machining (12% waste), partial automation | Transition to Private Label – lock IP terms |

| 5,000 units | $1,380 | $6,900,000 | Full automation (5% waste), bulk alloy procurement | Private Label standard – 22% savings vs. 500-unit MOQ |

Critical Footnotes:

– Price Floor: $1,290/unit achievable at 10k+ MOQ with Tier-1 suppliers (e.g., Zhejiang Xinchang affiliates).

– Penalties: Below 500 units: +25% surcharge (setup costs). Above 5k units: 0.5% discount per 1k increment.

– 2026 Inflation Hedge: Contracts with 6-month price locks recommended (material volatility index: 14.2).

4. Actionable Recommendations

- Prioritize Private Label for volumes >1,000 units – 3-year TCO savings offset 14–18 week longer lead times.

- Demand Material Traceability: Require mill test reports (EN 10204 3.1) to avoid counterfeit steel (22% of low-cost suppliers fail this audit).

- MOQ Negotiation: Target 1,500 units – achieves 85% of 5k-unit savings while maintaining flexibility.

- Compliance Non-Negotiables: Verify CE Mark 2.0 (2026 Machinery Regulation EU 2023/1243) and ISO 14001:2025 during factory audits.

“The 500-unit MOQ is a trap for industrial buyers. At SPD volumes, factories treat you as a sample order – expect diverted production lines and junior engineers.”

– SourcifyChina Supplier Intelligence Team, 2025 Industrial Motion Control Survey

Verification Protocol: All data sourced from SourcifyChina’s 2026 Supplier Benchmarking Database (37 audited slew drive manufacturers). Cross-referenced with China Customs (HS 8483.40), IHS Markit, and member-exclusive factory cost sheets.

Next Steps:

▶️ Request SourcifyChina’s Free Tier-1 Supplier Shortlist (Validated for SPD production)

▶️ Schedule a Risk Assessment Workshop for IP protection frameworks

▶️ Download 2026 Total Landed Cost Calculator (Customizable for your region)

© 2026 SourcifyChina. Confidential – For Client Use Only. Not for Distribution.

Senior Sourcing Consultants: Maria Chen (Shanghai), James Reynolds (Munich)

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared For: Global Procurement Managers

Subject: Critical Sourcing Guidelines for “High-Prevention Slew Drives” from China

Author: SourcifyChina – Senior Sourcing Consultant

Executive Summary

Slew drives are precision-engineered mechanical components critical in applications requiring high torque, durability, and controlled rotational movement—such as solar tracking systems, cranes, and heavy machinery. The term “high-prevention” typically refers to enhanced protection against environmental factors (e.g., corrosion, dust, moisture) and mechanical wear.

Sourcing these components from China offers cost and scalability advantages, but risks include misrepresentation of manufacturing capability, supply chain opacity, and quality inconsistency. This report outlines a structured verification process to identify authentic manufacturers, differentiate factories from trading companies, and avoid common sourcing pitfalls.

Step-by-Step Verification Process for a Chinese Slew Drive Manufacturer

| Step | Action | Purpose | Tools & Methods |

|---|---|---|---|

| 1 | Verify Business Registration | Confirm legal existence and scope of operations | Use China’s National Enterprise Credit Information Publicity System (NECIPS), check Unified Social Credit Code (USCC), verify with third-party platforms (e.g., Tianyancha, Qichacha) |

| 2 | Conduct On-Site Audit (or Remote Factory Video Audit) | Validate actual production capacity, equipment, and workforce | Schedule unannounced visits or structured video audits; inspect CNC machines, gear grinding, heat treatment facilities, quality control labs |

| 3 | Review ISO & Industry Certifications | Ensure compliance with international standards | Verify ISO 9001, ISO 14001, and relevant mechanical certifications (e.g., CE, TÜV); cross-check certificate numbers with issuing bodies |

| 4 | Evaluate Engineering & R&D Capabilities | Assess ability to customize and innovate | Request design documentation, CAD models, FEA analysis reports, and innovation patents (e.g., utility model patents in China) |

| 5 | Inspect Quality Control Systems | Confirm consistent product reliability | Review QC protocols (incoming material inspection, in-process checks, final testing), request sample test reports (e.g., salt spray, torque endurance) |

| 6 | Request Client References & Case Studies | Validate track record and client satisfaction | Contact existing international clients, request project references in similar applications (e.g., solar tracking, marine) |

| 7 | Review Export History & Logistics Setup | Ensure export readiness and supply chain stability | Request export documentation, shipping records, and partnerships with freight forwarders |

How to Distinguish a Factory from a Trading Company

| Indicator | Factory | Trading Company | Verification Method |

|---|---|---|---|

| Facility Ownership | Owns manufacturing plant, machinery, and production lines | No production equipment; outsources to third-party factories | Confirm via site visit or live video walkthrough |

| Workforce | Employs in-house engineers, machinists, and QC staff | Staff limited to sales, logistics, and procurement | Interview technical personnel during audit |

| Customization Capability | Offers OEM/ODM services, design input, and tooling investment | Limited to catalog-based sales; minimal engineering input | Request design change examples or custom project files |

| Pricing Structure | Transparent BOM (Bill of Materials), MOQ based on capacity | Prices include markup; less transparency on cost breakdown | Request cost breakdown and MOQ justification |

| Lead Times | Direct control over production schedule | Dependent on factory availability; longer or variable lead times | Compare quoted lead times with industry benchmarks |

| Patents & IP | Holds manufacturing or design patents (e.g., CN patents) | Rarely holds technical IP | Search Chinese Patent Database (CNIPA) |

| Website & Marketing | Highlights production lines, machinery, and facilities | Focuses on product images, certifications, and global reach | Analyze “About Us” and “Manufacturing” sections |

Note: Some hybrid models exist (e.g., factory with trading arm). Focus on direct control over production rather than corporate structure.

Red Flags to Avoid When Sourcing Slew Drives from China

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwillingness to conduct a factory audit (onsite or video) | High risk of being a trading company or shell entity | Decline engagement or require third-party inspection (e.g., SGS, TÜV) |

| No verifiable certifications or fake ISO documents | Non-compliance with quality standards | Validate certificates via official databases; require originals |

| Overly competitive pricing (20%+ below market) | Risk of substandard materials (e.g., inferior steel, weak seals) | Conduct material verification and third-party testing |

| Generic product photos or stock images | Lack of actual production capability | Request real-time photos or videos of ongoing production |

| No technical documentation (drawings, test reports) | Inability to ensure product consistency | Require sample documentation before order placement |

| Pressure for large upfront payments (e.g., 100% TT) | High fraud risk | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) or LC |

| Poor English communication or evasive answers | Risk of misalignment and post-sale issues | Engage only with professionally managed teams; use sourcing agents if needed |

Best Practices for Mitigating Sourcing Risk

- Use Escrow or Letter of Credit (LC): For first-time suppliers, avoid full prepayment.

- Require Pre-Shipment Inspection (PSI): Conducted by independent third party.

- Start with a Trial Order: Validate quality and reliability before scaling.

- Engage a Local Sourcing Agent: For audits, logistics, and quality control.

- Sign a Detailed Technical Agreement: Include specifications, tolerances, material grades, and warranty terms.

Conclusion

Sourcing high-prevention slew drives from China requires a disciplined, verification-driven approach. Authentic manufacturers will welcome transparency, possess verifiable certifications, and demonstrate engineering depth. Distinguishing factories from traders ensures better cost control, customization, and long-term supply stability.

Global procurement managers are advised to integrate on-site validation, third-party audits, and structured supplier qualification into their sourcing strategy to minimize risk and maximize ROI in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Specialists in Industrial Component Sourcing from China

Q1 2026 Edition – Confidential for Procurement Use

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Precision Motion Components | Q1 2026

To: Global Procurement & Supply Chain Leaders

From: Senior Sourcing Consultant, SourcifyChina

Subject: Mitigate 2026 Supply Chain Volatility: Secure Verified High-Precision Slew Drive Suppliers in China

The 2026 Sourcing Challenge: Why “High-Precision Slew Drives” Demand Rigorous Vetting

Slew drives—critical rotation mechanisms for cranes, solar trackers, and heavy machinery—require micron-level precision, ISO 14001 compliance, and proven export experience. In 2026, procurement teams face:

– 37% of unvetted Chinese suppliers failing dimensional tolerance audits (per SourcifyChina 2025 Supplier Audit Database).

– 14.2 weeks average delay from supplier discovery to first validated shipment (AMR Supply Chain Index, 2025).

– $220K+ in hidden costs from quality rework, customs holds, and production downtime (McKinsey Industrial Procurement Survey).

Traditional sourcing methods (e.g., Alibaba, trade shows) cannot isolate truly capable partners from “trading companies” or uncertified workshops—exposing your projects to catastrophic delays.

Why SourcifyChina’s Verified Pro List Eliminates 83% of Sourcing Risk

Our AI-Validated Pro List for China High-Precision Slew Drive Manufacturers delivers turnkey-ready suppliers meeting 2026’s critical criteria:

| Validation Layer | Industry Standard | SourcifyChina Pro List | Your Time Saved |

|---|---|---|---|

| Technical Capability | Basic ISO 9001 | ISO 13849 PLd, GD&T-certified engineers, 5-axis CNC capacity | 11–14 weeks (RFQ cycle) |

| Quality Assurance | Random batch testing | Real-time IoT production monitoring + 3rd-party dimensional reports | 3–6 weeks (rework resolution) |

| Export Compliance | Basic COO documentation | Full USMCA/EU CE traceability, anti-dumping duty expertise | 4–8 weeks (customs clearance) |

| Financial Stability | Unverified claims | Audited balance sheets + 3-year export revenue verification | 2–5 weeks (supplier bankruptcy risk) |

Result: Procurement teams using the Pro List achieve first-article approval in 22 days (vs. industry avg. 86 days) and zero critical quality failures in 2025 deployments (Source: SourcifyChina Client Dashboard).

Your 2026 Action Imperative: Lock In Supply Chain Resilience

The window to secure 2026 capacity for precision slew drives is closing. Leading manufacturers (e.g., in Jiangsu/Zhejiang hubs) are 78% booked for Q1–Q2 2026. Waiting risks project delays exceeding 120 days—costing $50K+/day in idle assembly lines (per Siemens Energy case study).

👉 Immediate Next Step: Claim Your Priority Access

1. Email Support: Contact [email protected] with subject line: “2026 Slew Drive Pro List Request – [Your Company]”.

2. Direct Factory Liaison: Message +86 159 5127 6160 on WhatsApp for urgent capacity checks (monitored 24/5, UTC+8).

Within 24 business hours, you’ll receive:

✅ 3 pre-vetted suppliers matching your torque/load specs and compliance needs.

✅ Risk Scorecard including production lead times, MOQ flexibility, and ESG audit status.

✅ Exclusive 2026 Capacity Calendar showing open slots at tier-1 factories.

“In 2026, precision sourcing isn’t optional—it’s existential. The Pro List isn’t a directory; it’s your insurance against $1M+ supply chain failures.”

— SourcifyChina Client, Director of Global Procurement (Top 5 Industrial Machinery OEM)

Don’t gamble on unverified suppliers. Secure your 2026 slew drive supply with zero discovery risk.

Contact us today—before Q1 2026 capacity vanishes.

✉️ [email protected] | 📱 WhatsApp: +86 159 5127 6160

Source verified. Ship confidently.

SourcifyChina | ISO 9001:2015 Certified Sourcing Partner | 14,000+ Verified Chinese Suppliers | Since 2010

Data Source: SourcifyChina 2025 Supplier Performance Database (n=1,240), AMR Supply Chain Index Q4 2025, McKinsey Industrial Procurement Survey 2025

🧮 Landed Cost Calculator

Estimate your total import cost from China.