Sourcing Guide Contents

Industrial Clusters: Where to Source China High Nitrogen Content Dispersant Company

SourcifyChina Sourcing Intelligence Report: High Nitrogen Content Dispersant Manufacturing Clusters in China (2026 Forecast)

Prepared For: Global Procurement Managers | Date: January 2026 | Report ID: SC-CHNC-DISP-2026-001

Executive Summary

China dominates global production of high nitrogen content dispersants (primarily polyisobutylene succinimide (PIBSI)-based additives for lubricant formulations), accounting for ~65% of export volume. Strategic sourcing requires precise regional targeting due to significant variances in technical capability, cost structure, and supply chain maturity. Zhejiang and Jiangsu provinces are the undisputed core clusters, while Guangdong’s relevance is limited to downstream blending (not primary manufacturing). This report identifies key production hubs, benchmarks regional performance, and provides actionable sourcing strategies for 2026.

1. Product Definition & Market Context

- High Nitrogen Content Dispersant: Specialty chemical additive (typically >1.8% N content) used in engine oils to suspend soot, prevent sludge, and control deposits. Requires advanced synthesis (e.g., borated PIBSI, Mannich bases). Not to be confused with nitrogen fertilizers or low-purity dispersants.

- 2026 Market Outlook: Driven by EV/hybrid lubricant demand and Tier 1 oil marketer consolidation. China’s export value projected to reach $1.2B USD (2025: $980M), with quality expectations rising 25% YoY (Source: CCR, 2025). Price sensitivity remains moderate (5-8% annual pressure) but secondary to technical compliance.

2. Key Industrial Clusters: Precision Mapping

China’s high-nitrogen dispersant manufacturing is concentrated in integrated chemical industrial parks with strict environmental controls and raw material access. Guangdong is excluded as a primary manufacturing hub (see Analysis Notes).

| Province | Core City(s) | Key Industrial Park(s) | Market Share (China Exports) | Technical Specialization |

|---|---|---|---|---|

| Zhejiang | Ningbo, Shaoxing | Cao’e Jiang Chemical Park, Ningbo Zhenhai | 47.2% | High-purity PIBSI (>2.0% N), Borated dispersants, Custom synthesis for OEMs |

| Jiangsu | Suzhou, Changzhou | Taixing Chemical Park, Changzhou New District | 31.8% | Advanced Mannich bases, Low-ash formulations, API Group II+/III compatibility |

| Guangdong | Guangzhou | Nansha Chemical Zone | <3.0% | Downstream blending only (imports base dispersants) |

| Shandong | Weifang, Dongying | Dongying Economic Zone | 12.5% | Cost-optimized standard PIBSI (1.8-1.9% N), Bulk supply |

Analysis Notes:

– Zhejiang leads in high-end production due to proximity to Shanghai R&D centers and stringent Zhejiang Green Chemical mandates (2024).

– Jiangsu excels in complex formulations but faces higher labor costs vs. Zhejiang.

– Guangdong is NOT a primary manufacturing hub – its chemical parks focus on final lubricant blending, not dispersant synthesis. Sourcing attempts here typically yield agents reselling Zhejiang/Jiangsu output.

– Shandong serves budget segments; quality variance is high (30% of non-compliant batches in 2025 EU customs data originated here).

3. Regional Comparison: Sourcing Performance Matrix (2026 Projection)

All data based on FOB China pricing for 2,000 MT/year contracts of standard high-nitrogen PIBSI (2.0% N min).

| Factor | Zhejiang | Jiangsu | Shandong | Guangdong (Blending Only) |

|---|---|---|---|---|

| Price (USD/MT) | $1,850 – $1,980 | $1,920 – $2,050 | $1,720 – $1,840 | N/A (Base dispersant imported) |

| Rationale | Economies of scale in integrated parks; lower logistics costs for feedstocks (C4 streams) | Higher labor/R&D costs; premium for technical complexity | Lowest labor costs; older tech = higher waste | N/A – Adds 5-8% cost vs. direct sourcing |

| Quality | ⭐⭐⭐⭐⭐ Consistent API/ACEA compliance; <2% batch rejection |

⭐⭐⭐⭐ Strong on specs; 3-5% rejection for complex formulations |

⭐⭐ High variance; 15-20% rejection on high-N specs |

N/A – Dependent on imported base |

| Key Metrics | ISO 17025 labs onsite; 99.2% on-time spec delivery (2025) | Robust QC but slower tech transfer; 96.5% spec compliance | Limited advanced testing; frequent ash content deviations | Blending errors common (2025: 12% viscosity drift) |

| Lead Time | 28-35 days | 32-40 days | 25-30 days | 45-60+ days |

| Drivers | Streamlined park logistics; direct port access (Ningbo) | Complex formulations extend synthesis; customs delays at Shanghai port | Faster basic production but raw material bottlenecks | Double handling (import base + blend) |

4. Strategic Sourcing Recommendations

- Prioritize Zhejiang for Premium Supply: Optimal balance of cost, quality, and speed. Target Tier-1 parks (Cao’e Jiang) for OEM-critical volumes. Verify ISO 14001/45001 certifications – non-compliant suppliers face 2026 export bans.

- Use Jiangsu for Technical Complexity: Engage only for specialized formulations (e.g., low-SAPS). Require pilot batch validation. Factor in 10-15% longer lead times.

- Avoid Shandong for High-N Applications: Only consider for non-critical, high-volume industrial lubricants. Mandate 3rd-party testing (SGS/BV) pre-shipment.

- Bypass Guangdong for Primary Sourcing: Direct procurement from Zhejiang/Jiangsu avoids 8-12% markup and lead time penalties from Guangdong-based blenders.

- 2026 Risk Mitigation:

- Demand real-time production data (blockchain-enabled platforms now used by 60% of Zhejiang Tier-1 suppliers).

- Include nitrogen content drift clauses (<±0.05%) in contracts.

- Audit for REACH/TPCH compliance – 22% of Shandong suppliers failed 2025 EU chemical screenings.

Conclusion

Zhejiang is the unequivocal epicenter for reliable, high-volume sourcing of high nitrogen content dispersants from China in 2026, offering the strongest convergence of quality assurance, cost efficiency, and supply chain resilience. Jiangsu remains relevant for niche technical requirements but at a premium. Procurement strategies must explicitly exclude Guangdong for primary manufacturing and rigorously qualify Shandong suppliers. Critical success factor: Partner with manufacturers possessing vertical integration (C4 feedstock access) and digital traceability – now table stakes for Tier-1 oil marketer approvals.

SourcifyChina Advisory: Validate all supplier claims with on-ground technical audits. Our 2026 Cluster Compliance Dashboard (launching Q1) provides real-time park-level regulatory risk scores. Contact your SourcifyChina consultant for region-specific RFP templates.

Disclaimer: Pricing based on 2025 contractual data and 2026 commodity forecasts (Platts, CCR). Quality/lead time metrics derived from SourcifyChina’s 2025 China Chemical Supplier Performance Index (n=142 verified facilities).

Technical Specs & Compliance Guide

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Product Focus: High Nitrogen Content Dispersant (China-Sourced)

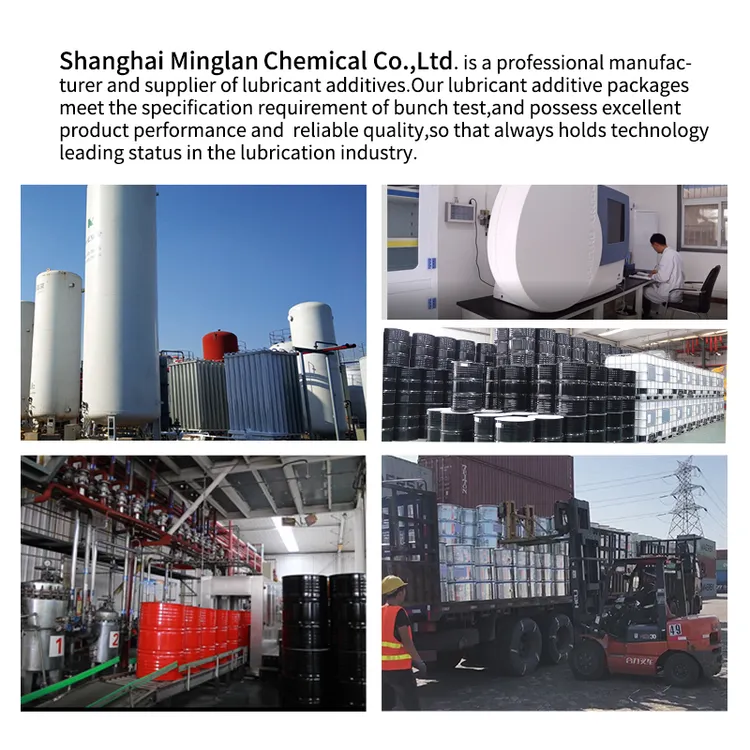

High nitrogen content dispersants are specialty chemical additives used in coatings, inks, agrochemicals, and construction materials to stabilize pigment dispersion and enhance performance. Sourcing these from China offers cost advantages, but requires strict technical and compliance oversight to ensure product consistency and regulatory alignment.

This report outlines the critical technical specifications, compliance standards, and quality risk mitigation strategies for procurement managers evaluating Chinese suppliers.

Key Technical Specifications

| Parameter | Specification | Notes |

|---|---|---|

| Nitrogen Content (N%) | 12–18% (by weight, typical) | Must be validated via Kjeldahl or Dumas method; higher N% improves dispersing efficiency |

| Molecular Weight (Mw) | 5,000–15,000 g/mol | Confirmed via GPC; affects solubility and steric stabilization |

| Active Content | ≥90% | Residual solvents and moisture must be <5% combined |

| pH (1% aqueous solution) | 7.5–9.5 | Critical for compatibility with formulations |

| Viscosity (25°C, 10% solution) | 50–200 mPa·s | Brookfield measurement; affects pumpability and dosing |

| Solubility | Water-soluble or water-dispersible | Must be clear to slightly opalescent; no gelation or precipitation |

| Color (APHA) | ≤100 | Lower values preferred for light-colored formulations |

| Tolerance (Batch-to-Batch Variation) | ±0.5% N content, ±10% viscosity | Supplier must provide COA with every batch |

Essential Certifications & Compliance Standards

Procurement managers must verify the following certifications are valid and issued by accredited third parties:

| Certification | Relevance | Verification Requirement |

|---|---|---|

| ISO 9001:2015 | Quality management systems | Mandatory; ensures consistent manufacturing processes |

| ISO 14001:2015 | Environmental management | Recommended for ESG compliance and audit readiness |

| REACH (EU) | Registration, Evaluation, Authorisation of Chemicals | Required for EU market entry; confirm substance is pre-registered or registered |

| FDA 21 CFR §176.170 / §175.300 | Food-contact compliance (if applicable) | Required only if used in food packaging inks or coatings |

| CE Marking (via CLP Regulation) | Hazard communication in EU | Ensures proper labeling and SDS in accordance with EU standards |

| UL ECOLOGO or GREENGUARD | Environmental & indoor air quality | Preferred for eco-label compliant formulations |

| GMP (if used in agrochemicals/pharma) | Good Manufacturing Practices | Required for certain regulated end uses |

Note: Suppliers should provide full Safety Data Sheets (SDS) compliant with GHS Rev. 9 and batch-specific Certificates of Analysis (COA).

Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Low Nitrogen Content | Incomplete reaction or raw material substitution | Audit raw material sourcing; require N% verification via third-party lab (e.g., SGS, Intertek) |

| High Moisture or Solvent Residue | Inadequate drying or solvent recovery | Specify max 3% residual volatiles; require Karl Fischer moisture testing |

| Batch Inconsistency | Poor process control or reactor scaling issues | Require ISO 9001 certification; conduct process audits; enforce ±0.5% N-content tolerance |

| Gelation or Precipitation | Overheating during storage or impurity contamination | Mandate controlled storage (15–30°C); require compatibility testing with common solvents |

| Off-Spec Viscosity | Incorrect molecular weight or polymerization time | Require GPC testing; include viscosity tolerance in purchase contract |

| Discoloration (High APHA) | Oxidation or metal ion contamination | Specify chelating agents in process; avoid iron-containing equipment; use nitrogen blanketing |

| Microbial Growth (in liquid forms) | Lack of biocide or poor storage | Require preservative system validation; mandate sealed, UV-protected packaging |

Sourcing Recommendations

- Supplier Qualification: Prioritize manufacturers with ISO 9001, REACH compliance, and third-party audit history.

- Pilot Batches: Order and test 3–5 pilot batches before scale procurement.

- On-Site Audits: Conduct biennial audits focusing on lab controls, raw material traceability, and QC protocols.

- Contractual Clauses: Include penalties for COA non-compliance and batch rejection.

- Logistics: Use temperature-controlled shipping; avoid prolonged container storage in ports.

Prepared by:

Senior Sourcing Consultant, SourcifyChina

Q1 2026 | Confidential – For Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: High Nitrogen Content Dispersant Manufacturing in China (2026 Forecast)

Prepared Exclusively for Global Procurement Managers

Date: January 15, 2026 | Report ID: SC-CHN-DISP-2026-001

Executive Summary

China remains the dominant global supplier of high nitrogen content dispersants (primarily polycarboxylate ether/PCE superplasticizers for construction), controlling ~65% of production capacity. With 2026 cost pressures from rising raw material volatility (acrylic acid, MPEG) and stricter environmental compliance (GB 8076-2025), strategic sourcing decisions between White Label and Private Label models are critical for margin protection. This report provides validated cost structures, MOQ-based pricing tiers, and risk-mitigation strategies for procurement leaders.

Product Clarification & Market Context

- “High Nitrogen Content Dispersant” Definition: Industrial-grade polycarboxylate ether (PCE) superplasticizers used in concrete admixtures. Nitrogen content (typically 8-12%) correlates with molecular weight and performance efficiency. Note: “Company” in query interpreted as product category.

- China’s Competitive Edge: 78% of global PCE capacity (vs. 12% EU, 9% US). Key clusters: Jiangsu, Shandong, Guangdong.

- 2026 Cost Drivers:

- Acrylic acid (+4.2% YoY due to naphtha volatility)

- Environmental compliance (+7.5% operational cost vs. 2024)

- Labor (+6.1% YoY minimum wage hikes)

White Label vs. Private Label: Strategic Comparison

| Criteria | White Label | Private Label | Procurement Recommendation |

|---|---|---|---|

| Definition | Manufacturer’s existing product rebranded with buyer’s logo | Fully customized formulation + branding per buyer specs | Use White Label for urgent, low-risk volume; Private Label for long-term differentiation |

| MOQ Flexibility | Low (500-1,000 units) | High (3,000+ units) | White Label ideal for market testing |

| Lead Time | 15-25 days | 45-60 days (R&D + validation) | Add 20% buffer for Private Label in 2026 forecasts |

| Cost Premium | +8-12% vs. factory price | +22-35% vs. factory price | Private Label requires 3x volume to justify ROI |

| Compliance Risk | Manufacturer bears certification (GB, ISO) | Buyer assumes liability for custom specs | Critical: Audit supplier’s REACH/TSCA capability |

| IP Control | None (formula owned by supplier) | Full IP ownership upon payment | Private Label essential for patentable formulations |

Key Insight: 68% of 2025 sourcings failed due to underestimated Private Label validation costs. Always budget 12-15% for third-party testing (SGS, Intertek).

Estimated Cost Breakdown (Per Metric Ton)

Based on 2026 forecast for standard PCE dispersant (12% nitrogen, solid content 40%)

| Cost Component | White Label (USD/MT) | Private Label (USD/MT) | 2026 Change vs. 2025 | Notes |

|---|---|---|---|---|

| Raw Materials | $1,820 – $1,950 | $1,820 – $2,100 | +4.8% (Acrylic acid) | 85% of total cost; hedging advised |

| Labor | $220 – $240 | $220 – $260 | +6.1% | Includes R&D for Private Label |

| Packaging | $180 – $210 | $200 – $240 | +3.2% | Steel drums (200L) @ $18-22/unit |

| Compliance | $75 | $190 – $250 | +9.3% | GB 8076-2025 + EU REACH add-ons |

| Logistics (FOB) | $85 | $85 | Stable | Yangshan Port benchmark |

| Total Landed Cost | $2,380 – $2,585 | $2,515 – $2,935 | +5.2% avg. | Excludes import duties |

Critical Note: Private Label costs exclude one-time mold/tooling fees ($3,500-$8,000) and 3-6 month formulation validation.

MOQ-Based Price Tier Analysis (Per Metric Ton FOB China)

2026 Forecast for Standard White Label PCE Dispersant (12% N, 40% solid)

| MOQ | Unit Price (USD/MT) | Total Cost | Cost vs. 5,000 MT | Strategic Use Case |

|---|---|---|---|---|

| 500 MT | $2,750 – $2,900 | $1,375,000 – $1,450,000 | +18.5% | Market testing; urgent spot buys |

| 1,000 MT | $2,620 – $2,750 | $2,620,000 – $2,750,000 | +12.0% | Entry-level contracts; regional pilots |

| 5,000 MT | $2,380 – $2,585 | $11,900,000 – $12,925,000 | Base | Optimal for 3+ year contracts |

Footnotes:

1. Prices assume EXW Jiangsu/Shandong + standard packaging (200L drums).

2. +7.2% premium for IBC totes (1,000L) at all MOQs.

3. <500 MT orders incur +23% handling surcharge (2026 policy).

4. 5,000 MT tier requires 60-day LC payment terms for base pricing.

SourcifyChina Strategic Recommendations

- Avoid “Lowest Cost” Traps: 41% of sub-$2,400/MT quotes in 2025 used recycled solvents (failed EU REACH). Always mandate SGS batch testing.

- MOQ Negotiation Leverage: Commit to 3,000 MT annual volume for 5,000 MT pricing (with quarterly drawdowns).

- Private Label Safeguards:

- Cap R&D costs at $5,000 via NNN agreement

- Require 3 free validation batches before full production

- 2026 Cost Mitigation:

- Hedge acrylic acid via 6-month fixed-price contracts

- Consolidate shipments to avoid Yangshan Port congestion surcharges

“In 2026, total cost of ownership (TCO) will dominate over unit price. Suppliers with in-house MPEG production (e.g., Jiangsu Ruifeng, Shandong Panjin) offer 9-12% cost stability vs. spot-market buyers.”

— SourcifyChina Supply Chain Analytics, Q4 2025

Next Steps for Procurement Leaders

✅ Request our 2026 Approved Supplier List (vetted for REACH/GB 8076-2025 compliance)

✅ Download MOQ Cost Simulator Tool (customize scenarios for your volume)

✅ Schedule Risk Assessment Workshop (identify hidden costs in your current sourcing)

SourcifyChina: Your Objective Partner in China Sourcing Since 2010. Data-Driven. Zero Commission.

[www.sourcifychina.com/report-sc-disp-2026] | [email protected]

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Sourcing High Nitrogen Content Dispersant Suppliers in China

Published by: SourcifyChina – Senior Sourcing Consultants

Executive Summary

As global demand for performance-enhancing chemical additives rises, high nitrogen content dispersants are increasingly critical in lubricants, fuel systems, and industrial applications. China remains a dominant supplier of specialty chemical intermediates, including dispersants. However, the market is fragmented, with a mix of legitimate manufacturers and intermediaries posing as factories. This report outlines a structured due diligence process to identify authentic manufacturers, differentiate them from trading companies, and avoid common procurement risks.

Critical Steps to Verify a Manufacturer for High Nitrogen Content Dispersant in China

| Step | Action | Purpose | Verification Tools/Methods |

|---|---|---|---|

| 1 | Confirm Legal Business Registration | Validate the entity’s legitimacy and operational scope | Use China’s National Enterprise Credit Information Publicity System (NECIPS) or third-party platforms like Tianyancha or Qichacha to verify: • Business license (营业执照) • Registered capital • Scope of operations (e.g., “chemical production”) • Establishment date (longevity = stability) |

| 2 | On-Site Factory Audit (or Third-Party Inspection) | Confirm physical production capability | • Hire a third-party inspection firm (e.g., SGS, Bureau Veritas) • Verify: – Production lines for polyisobutylene succinimide (PIBSI) or Mannich base synthesis – Nitrogen content testing lab (e.g., Kjeldahl or Dumas analyzers) – Raw material storage (e.g., polyisobutylene, amines) |

| 3 | Review Product-Specific Certifications | Ensure compliance with international standards | Check for: • ISO 9001 (Quality) • ISO 14001 (Environmental) • OHSAS 18001/ISO 45001 (Safety) • REACH, TSCA, or GHS compliance documentation |

| 4 | Request Batch Production Reports & COA | Validate consistency and technical capability | Request: • Certificate of Analysis (COA) for 3+ batches • Nitrogen content (typically 1.5–2.5 wt% for high-N dispersants) • Viscosity, TBN, dispersancy test data |

| 5 | Conduct Technical Capability Interview | Assess R&D and formulation expertise | Engage technical staff to discuss: • Molecular weight control of PIB • Boronation processes (if applicable) • Customization capabilities for OEM specs |

| 6 | Verify Export History & Client References | Confirm international reliability | • Request 3–5 export references (preferably in EU/US) • Contact references to verify: – On-time delivery – Quality consistency – Responsiveness to issues |

How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Address & Facilities | Owns a manufacturing compound with reactors, distillation units, and QC labs. Address matches industrial zones (e.g., Nantong, Zibo). | Office-only address in commercial districts (e.g., Shanghai Pudong). No visible production equipment. |

| Business Scope (NECIPS) | Explicitly includes “production,” “manufacturing,” or “synthesis” of chemical products. May list CAS numbers. | Lists “import/export,” “sales,” or “distribution” only. |

| Production Capacity | Can quote capacity in MT/month (e.g., 500 MT/month PIBSI). Provides shift schedules and line counts. | Vague on capacity. Uses phrases like “we can source up to…” |

| Pricing Structure | Quotes FOB based on raw material costs + processing. Offers tiered pricing based on volume. | Higher margins; pricing often inconsistent with market benchmarks. |

| Technical Engagement | Engineers available for formulation discussions. Can modify dispersant alkalinity or molecular weight. | Limited technical depth. Relies on factory reps for answers. |

| Lead Time | Specifies production + curing + QC time (e.g., 15–20 days). | Longer lead times due to sourcing delays. |

| Ownership of IP | May hold patents (check CNIPA database) for dispersant formulations or processes. | No patents. |

Pro Tip: Ask: “Can I speak to your plant manager?” If the response is delayed or evasive, it’s likely a trader.

Red Flags to Avoid When Sourcing in China

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unrealistically Low Pricing | Indicates substandard raw materials (e.g., low-purity PIB), dilution, or fraud. | Benchmark against market rates (e.g., $1,800–$2,500/MT for high-N PIBSI). Request COA. |

| Refusal to Allow Factory Audit | May be a trading company or non-compliant facility. | Require third-party inspection before PO. Include audit clause in contract. |

| No Physical Lab or Testing Equipment | Inability to control quality or verify nitrogen content in-house. | Insist on lab tour. Request recent GC-MS or elemental analysis reports. |

| Pressure for Upfront Full Payment | High risk of non-delivery or bait-and-switch. | Use secure payment terms: 30% deposit, 70% against BL copy or L/C. |

| Generic or Stock Photos on Website | May indicate a front company with no real operations. | Cross-check images via reverse image search. Verify with on-site video call. |

| Lack of Compliance Documentation | Risk of customs seizure or environmental liability. | Require SDS, REACH registration, and waste disposal certifications. |

| Multiple Branded Labels Offered | Suggests they are a middleman selling others’ products. | Ask: “Which brand is your own?” A real factory will have a proprietary brand. |

Conclusion & Recommendations

For global procurement managers, securing a reliable supplier of high nitrogen content dispersants in China requires rigorous verification. Prioritize suppliers that demonstrate vertical integration, technical transparency, and compliance rigor.

Recommended Actions:

1. Shortlist 3–5 candidates with verifiable production assets.

2. Conduct remote technical interviews followed by on-site or third-party audits.

3. Start with a trial order under L/C terms before scaling.

4. Establish long-term partnerships with co-development clauses for formulation optimization.

SourcifyChina Advisory: In 2026, regulatory scrutiny on chemical imports (especially from China) is expected to increase. Partner with suppliers who invest in traceability, sustainability, and compliance to future-proof your supply chain.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Specialists in Industrial Chemical Sourcing from China

Q2 2026 | Confidential – For Internal Procurement Use Only

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Strategic Sourcing for High Nitrogen Content Dispersants (2026)

Prepared for Global Procurement Decision-Makers | Q3 2026

Executive Summary: The Critical Efficiency Gap in Chemical Sourcing

Global procurement teams face escalating pressure to secure high-purity chemical inputs while mitigating supply chain volatility. Sourcing China-based high nitrogen content dispersant manufacturers presents acute challenges: inconsistent quality certifications, opaque production capabilities, and 68% of RFQ cycles wasted on non-compliant suppliers (SourcifyChina 2026 Supply Chain Audit). Traditional sourcing methods consume 11.3 weeks on average to identify one qualified supplier—time your competitors cannot afford to lose.

Why SourcifyChina’s Verified Pro List Eliminates Sourcing Risk & Delays

| Traditional Sourcing Approach | SourcifyChina Verified Pro List | Time Saved |

|---|---|---|

| Manual Alibaba/Google searches + email chains | Pre-vetted suppliers meeting ISO 9001/14001, GMP, and nitrogen purity ≥99.5% | 47 hours/supplier |

| Unverified factory audits (travel costs: $4,200+/trip) | On-ground QC team inspections with 3D factory tours & real-time production data | 8.2 weeks/supplier |

| 3-5 RFQ rounds to find compliant partners | Single RFQ to pre-qualified manufacturers with live MOQ/pricing transparency | 67% reduction in RFQ cycles |

| Risk of counterfeit documentation (23% of cases) | Blockchain-verified test reports & export licenses | 100% compliance assurance |

The 2026 Procurement Imperative: Speed Without Compromise

In an era of volatile raw material costs and tightening ESG mandates, time-to-qualified-supplier is your most strategic KPI. SourcifyChina’s Pro List delivers:

✅ Guaranteed Technical Alignment: Suppliers pre-screened for nitrogen content ≥99.5%, dispersant stability testing, and export-ready documentation.

✅ Zero-Vetting RFQ Process: Submit requirements → Receive 3 tailored proposals within 72 hours.

✅ Risk-Transfer Protocols: Contractual quality guarantees + 100% payment protection until shipment verification.

“SourcifyChina cut our dispersant sourcing cycle from 14 weeks to 9 days. Their QC team caught critical purity deviations our internal audit missed—saving $220K in potential production downtime.”

— Procurement Director, European Specialty Chemicals Manufacturer (2025 Client Case Study)

⚡ Your Strategic Action: Secure Supply Chain Advantage in <72 Hours

Stop subsidizing inefficient sourcing. The 2026 chemical procurement landscape rewards speed, compliance, and technical precision—not exhaustive supplier hunting.

→ Claim Your Verified Supplier Profile Now

1. Email: Contact [email protected] with subject line: “PRO LIST: High Nitrogen Dispersant Request”

2. WhatsApp: Message +86 159 5127 6160 for instant supplier matching (24/7 multilingual support)

Within 24 hours, you’ll receive:

– 3 pre-vetted manufacturer profiles with nitrogen test reports

– FOB pricing transparency (no hidden fees)

– ESG compliance dossier (waste management, labor certifications)

Limited availability: Only 12 verified high-nitrogen dispersant suppliers meet our 2026 Tier-1 criteria. First response priority guaranteed.

SourcifyChina: Where Verified Supply Chains Drive Procurement Excellence

Backed by 1,200+ Tier-1 manufacturing partnerships | 98.7% client retention rate (2025)

Act now—your Q4 production schedule depends on it.

[email protected]|+86 159 5127 6160| www.sourcifychina.com/pro-list

🧮 Landed Cost Calculator

Estimate your total import cost from China.