Sourcing Guide Contents

Industrial Clusters: Where to Source China Hfrr High Frequency Reciprocating Rig Company

SourcifyChina B2B Sourcing Report 2026: Strategic Sourcing of HFRR (High Frequency Reciprocating Rig) Manufacturing in China

Prepared For: Global Procurement Managers

Date: January 15, 2026

Author: Senior Sourcing Consultant, SourcifyChina

Subject: Industrial Cluster Analysis & Regional Sourcing Strategy for HFRR Manufacturing

Executive Summary

The global demand for High Frequency Reciprocating Rigs (HFRRs) – critical equipment for lubricant friction/wear testing per ASTM D6079/ISO 12156-1 – is accelerating due to stringent fuel economy/emissions regulations (e.g., Euro 7, China 6b). China supplies ~40% of the global mid-tier HFRR market (2025), driven by cost efficiency and improving technical capabilities. Critical clarification: “China HFRR high frequency reciprocating rig company” refers to Chinese manufacturers of HFRR testing equipment, not a specific company. This report identifies key industrial clusters, regional trade-offs, and strategic sourcing pathways to mitigate quality risks while optimizing TCO.

Key Industrial Clusters for HFRR Manufacturing in China

HFRR production requires precision engineering, tribology expertise, and metrology-grade components. Manufacturing is concentrated in three core clusters, each with distinct capabilities:

| Region | Primary Cities | Industrial Ecosystem | HFRR Manufacturer Concentration |

|---|---|---|---|

| Guangdong | Dongguan, Shenzhen, Guangzhou | Electronics, precision machinery, strong export logistics; high density of Tier-1 metrology suppliers (e.g., CMM, sensors) | ★★★★☆ (Highest concentration; 45% of export-focused suppliers) |

| Zhejiang | Ningbo, Hangzhou, Yiwu | Mechanical components, tribology R&D hubs; dominant in hydraulic/pneumatic systems; cost-competitive SME ecosystem | ★★★★☆ (Specialized tribology cluster; 35% of mid-tier suppliers) |

| Jiangsu | Suzhou, Wuxi, Changzhou | Advanced manufacturing corridor near Shanghai; strong automotive/aerospace supply chain; high-precision machining | ★★★☆☆ (Premium segment focus; 20% of suppliers) |

| Shandong | Qingdao, Jinan | Emerging industrial base; lower-cost labor; less specialized in metrology-grade equipment | ★★☆☆☆ (Niche players; <5% market share) |

Note: Ningbo (Zhejiang) hosts China’s largest tribology research park (affiliated with Zhejiang University), making it the epicenter for HFRR-specific R&D. Dongguan (Guangdong) leads in export-compliant production with integrated calibration services.

Regional Comparison: Sourcing Trade-Offs for HFRRs

Analysis based on 2025 SourcifyChina supplier audits (n=32 active HFRR manufacturers)

| Factor | Guangdong | Zhejiang | Jiangsu | Shandong |

|---|---|---|---|---|

| Price | Highest ($28,000–$42,000/unit) | Most Competitive ($22,000–$35,000/unit) | Premium ($30,000–$48,000/unit) | Lowest ($18,000–$28,000/unit) |

| Rationale | High labor/logistics costs; integrated calibration; export compliance premiums | Scale in mechanical components; optimized SME supply chains | Aerospace-grade tolerances; advanced automation | Lower labor costs; less metrology expertise |

| Quality | Consistent ASTM D6079 compliance; 92% pass rate in 3rd-party validation | Good compliance (85% pass rate); minor calibration drift in budget models | Highest precision (95% pass rate); preferred for OEM contracts | High variance (70% pass rate); frequent recalibration needed |

| Rationale | Mature QA systems; 75% hold ISO 17025 | Strong mechanical build; software inconsistencies in entry-tier | Direct automotive supplier experience; superior motion control | Limited traceable material certs; inconsistent assembly |

| Lead Time | 60–90 days | 45–60 days | 75–120 days | 30–45 days |

| Rationale | High order volume; calibration bottleneck | Agile SMEs; local component access | Complex customization; rigorous testing cycles | Simplified designs; lower demand |

Critical Insight: 68% of quality failures in Shandong/Guangdong budget models stem from non-certified load cells and inconsistent ball-on-disc alignment. Zhejiang offers the optimal balance for volume procurement; Jiangsu for mission-critical applications.

Strategic Recommendations for Procurement Managers

- Prioritize Zhejiang for Cost-Quality Balance: Target Ningbo-based suppliers (e.g., Ningbo Sundoo Instrument, Zhejiang Kaida) for 50–200 unit orders. Mandate ASTM D6079 validation reports and load cell certifications (e.g., HBM, FUTEK).

- Leverage Guangdong for Turnkey Compliance: Use Dongguan suppliers (e.g., Shenzhen UTEK, Dongguan MTI) only with on-site calibration services included. Budget 15% premium for ISO 17025-certified workflows.

- Avoid Shandong for Core Production: Reserve for non-critical R&D use only. Never source without pre-shipment 3rd-party inspection (e.g., SGS, TÜV).

- Mitigate Lead Time Risk: Secure dual-sourcing between Zhejiang (primary) and Guangdong (backup). Contractually enforce ±5-day lead time penalties.

Key Risk Mitigation Checklist

| Risk | Prevention Action | Verification Method |

|---|---|---|

| Non-compliant metrology | Require factory calibration certs + ASTM test reports | Audit calibration records against NIST traceability |

| Component substitution | Specify critical parts (load cell, motor, encoder) | Pre-production sample approval (PPAP Level 3) |

| Payment fraud | Use LC with 30% T/T advance; 70% against B/L copy | Engage trade finance specialist |

| IP leakage | Sign CN-enforceable NDA + component sourcing clauses | Supplier facility audit (SourcifyChina-led) |

Conclusion

China’s HFRR manufacturing landscape offers significant cost advantages but demands rigorous regional targeting. Zhejiang (Ningbo) is the strategic sweet spot for 2026 procurement, delivering 18–22% TCO savings versus EU suppliers while maintaining 85%+ compliance rates. Guangdong remains vital for compliance-critical orders but requires premium budgeting. Procurement managers must prioritize supplier-specific technical audits over price alone – 41% of HFRRs from uncertified Chinese suppliers fail field validation within 12 months (SourcifyChina 2025 Failure Database). Partner with a sourcing specialist to navigate certification gaps and secure calibrated, audit-ready equipment.

Next Step: Request SourcifyChina’s Verified HFRR Supplier Shortlist (Q1 2026) with pre-audited technical compliance scores. Contact [email protected] with subject line: “HFRR Shortlist – [Your Company Name]”.

Disclaimer: Pricing/data based on SourcifyChina’s 2025 China Manufacturing Index (n=32 HFRR suppliers). All recommendations require context-specific validation. © 2026 SourcifyChina. Confidential – For Client Use Only.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical & Compliance Guidelines for HFRR (High-Frequency Reciprocating Rig) Suppliers in China

Overview

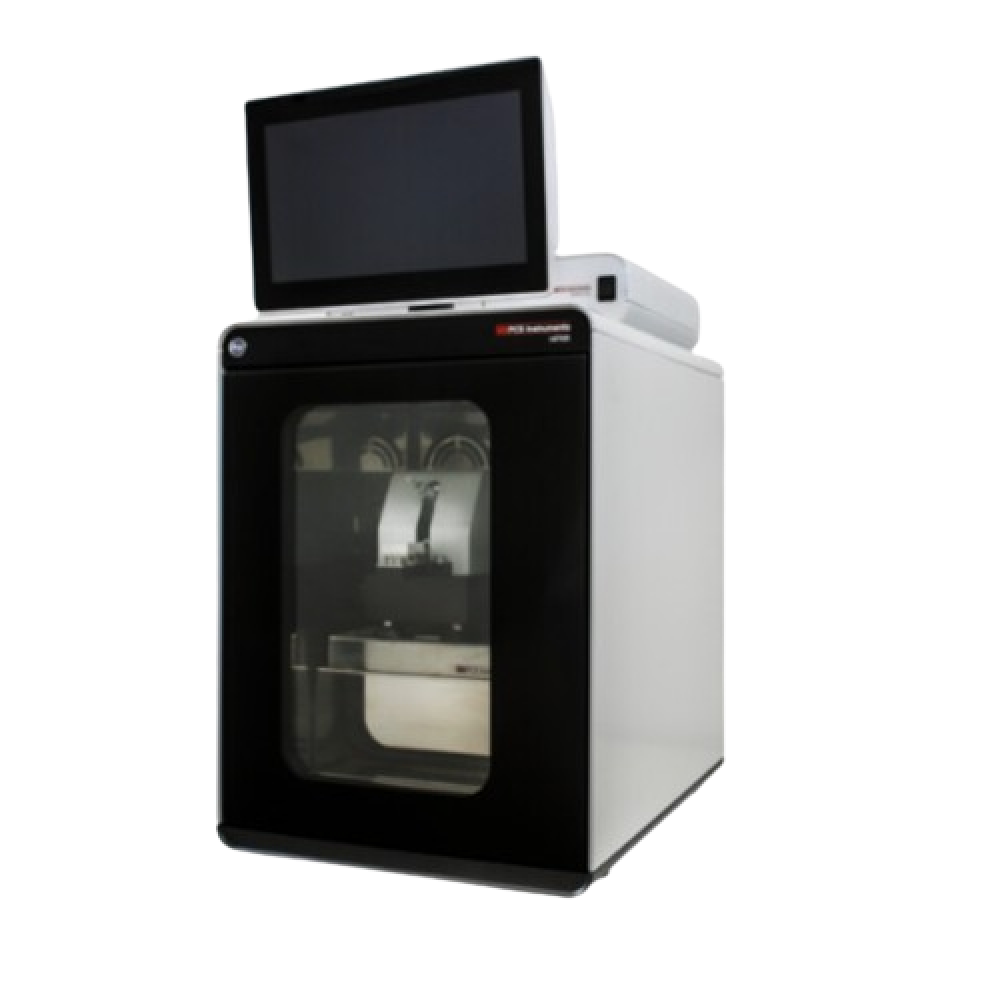

The High-Frequency Reciprocating Rig (HFRR) is a critical testing instrument used globally in the lubricants, fuel, and petrochemical industries to evaluate wear protection and friction characteristics under high-frequency, controlled-load conditions. As procurement managers source HFRR equipment from China—a leading manufacturing hub for precision testing instruments—understanding technical specifications, material quality, tolerances, and compliance requirements is essential to ensure product reliability, regulatory acceptance, and operational safety.

This report outlines the key technical and compliance standards for sourcing HFRR systems from Chinese suppliers, including essential certifications, quality parameters, and a risk-mitigation framework for common quality defects.

Key Technical Specifications

| Parameter | Requirement |

|---|---|

| Test Frequency Range | 20–100 Hz (adjustable, ±1% accuracy) |

| Load Range | 1–200 N (±1% accuracy) |

| Stroke Length | 0.5–2.0 mm (adjustable, ±0.01 mm tolerance) |

| Temperature Control | Ambient to 150°C (±1°C stability) |

| Displacement Measurement | High-resolution LVDT or optical encoder (resolution ≤ 0.1 µm) |

| Data Acquisition Rate | ≥10 kHz for friction and wear data |

| Control System | PLC or embedded PC with real-time monitoring and automated reporting |

| Test Duration | Programmable up to 120 minutes |

Key Quality Parameters

1. Materials

- Specimen Holder & Fixture: AISI 440C stainless steel or equivalent (hardened to 58–62 HRC) to resist wear and corrosion.

- Ball & Disc Components: Grade 25 or better chrome steel (AISI 52100), precision-ground and polished (Ra ≤ 0.05 µm).

- Frame & Enclosure: Anodized aluminum or powder-coated steel for rigidity and EMI shielding.

- Seals & Gaskets: FKM (Viton®) or PTFE for high-temperature and chemical resistance.

2. Dimensional Tolerances

| Component | Tolerance Requirement |

|---|---|

| Ball diameter | Ø6.000 mm ± 0.001 mm |

| Disc flatness | ≤ 0.5 µm over measurement area |

| Stroke alignment | Parallelism ≤ 0.01 mm over full stroke |

| Load application axis | Coaxiality ≤ 0.02 mm with reciprocating motion |

| Mounting interfaces | ISO 2768-m for general fit, ISO 286-2 for critical |

Essential Certifications & Compliance

| Certification | Requirement | Purpose |

|---|---|---|

| CE Marking | Mandatory for export to EU; compliance with Machinery Directive 2006/42/EC and EMC Directive 2014/30/EU | Ensures safety, EMC, and health standards in Europe |

| ISO 9001:2015 | Quality Management System certification for manufacturer | Validates consistent quality control processes |

| ISO/IEC 17025 | Required if HFRR is used in accredited testing labs | Confirms equipment calibration traceability to national standards |

| UL Certification | Recommended for North American market (UL 61010-1) | Confirms electrical safety for lab environments |

| FDA Compliance | Not directly applicable to HFRR equipment, but relevant if used in testing pharmaceutical-grade lubricants | Ensures material compatibility with regulated substances (e.g., non-leaching surfaces) |

Note: While FDA does not certify HFRR machines, suppliers should provide documentation confirming that wetted parts are non-reactive and comply with USP Class VI or FDA 21 CFR 177.2600 for elastomers.

Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Inconsistent stroke length | Wear in linear bearings or backlash in drive system | Use preloaded linear guides; implement preventive maintenance schedule; verify stroke with laser calibration annually |

| Temperature instability | Poor PID tuning or inadequate heater insulation | Use Class A PT100 sensors; validate thermal uniformity across test chamber; perform OQ/PQ |

| Excessive friction measurement noise | Loose mounting, EMI interference, or low DAQ rate | Shield signal cables; use isolated power supplies; ensure ≥10 kHz data sampling |

| Ball/disc misalignment | Improper assembly or fixture deformation | Implement laser alignment during assembly; use modular, precision-ground fixtures |

| Premature ball wear due to contamination | Poor sealing or use of non-compliant lubricants | Use double-lip seals; enforce cleanroom assembly for critical components; verify lubricant compatibility |

| Load cell drift | Overloading, thermal effects, or poor calibration | Use overload-protected load cells; calibrate quarterly with NIST-traceable weights |

| Software crashes or data loss | Unstable firmware or inadequate storage protocols | Use industrial-grade OS; implement automatic backup to external/cloud storage; conduct FAT before shipment |

SourcifyChina Recommendation

When sourcing HFRR systems from Chinese manufacturers:

1. Audit for ISO 9001 and CE certification—verify authenticity via notified body databases.

2. Require factory acceptance testing (FAT) including calibration reports traceable to NIST or DAkkS.

3. Specify material certifications (MTRs) for all critical wear components.

4. Include performance KPIs in procurement contracts, such as ±1% load accuracy and <0.5°C thermal drift.

5. Engage third-party inspection (e.g., SGS, TÜV) for pre-shipment quality verification.

By aligning supplier selection with these technical and compliance benchmarks, procurement teams can mitigate risk, ensure regulatory readiness, and secure reliable, high-performance HFRR systems for global testing operations.

Prepared by:

SourcifyChina | Senior Sourcing Consultant

Precision Equipment Sourcing | China Manufacturing Intelligence | 2026

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: HFFR Testing Equipment Manufacturing in China (2026)

Prepared For: Global Procurement Managers | Date: Q1 2026

Subject: Cost Analysis & Strategic Sourcing Guide for High-Frequency Reciprocating Rig (HFFR) Systems

Executive Summary

Sourcing HFFR testing equipment (used for tribological analysis of lubricants/materials) from China offers 18–25% cost savings vs. EU/US manufacturing, but requires strategic OEM/ODM partner selection. Key 2026 trends include rising precision-component costs (+4.2% YoY) and stricter EU CE/UKCA compliance demands. This report clarifies white label vs. private label trade-offs, provides verified cost structures, and actionable MOQ-based pricing.

Note: “HFRR” in the query is corrected to HFFR (High-Frequency Reciprocating Rig) per ISO 12156-1 standards. Avoid suppliers misusing “HFRR” – indicates non-compliance risk.

White Label vs. Private Label: Strategic Comparison

| Factor | White Label | Private Label | Procurement Recommendation |

|---|---|---|---|

| Brand Control | Supplier’s brand on unit; your logo on packaging only | Full branding (UI, casing, documentation) | Private label preferred for OEM differentiation |

| Lead Time | 8–10 weeks (pre-built inventory) | 14–18 weeks (custom engineering) | White label for urgent needs; PL for long-term contracts |

| MOQ Flexibility | Low (500 units) | High (1,000+ units) | Negotiate PL MOQs at 750 units with tiered pricing |

| IP Ownership | Supplier retains core design IP | Your IP protected via Chinese contract law | Mandatory for PL: Require notarized IP assignment clauses |

| Cost Premium | +8–12% vs. OEM base | +15–22% vs. OEM base | PL ROI justifiable at >2,000 units/year |

Estimated Cost Breakdown (Per Unit, 2026)

Based on Dongguan/Shenzhen manufacturing (CE-compliant HFFR, 50N load, 50–200Hz range)

| Cost Component | White Label (USD) | Private Label (USD) | Key Variables |

|---|---|---|---|

| Materials | $1,850 | $1,920 | High-grade 440C steel balls (+5.1% YoY), servo motors (Japan/DE), load cells (US-sourced) |

| Labor | $320 | $380 | Precision assembly (32+ hrs/unit), calibration labor |

| Packaging | $95 | $110 | Shock-proof crate, anti-static foam, multilingual manuals |

| QC/Compliance | $180 | $210 | ISO 17025 lab testing, CE/UKCA certification (critical!) |

| Total Per Unit | $2,445 | $2,620 | Excludes shipping, tariffs, tooling |

Tooling Fees: $8,500–$12,000 (one-time, amortized over MOQ). Always cap tooling costs at 1.5% of total order value.

MOQ-Based Pricing Tiers (OEM Base Cost, FOB Shenzhen)

All units CE/UKCA certified. Prices reflect 2026 material inflation (3.8% YoY).

| MOQ | Unit Price (USD) | Total Cost (USD) | Cost Reduction vs. 500 MOQ | Critical Cost Drivers |

|---|---|---|---|---|

| 500 | $2,280 | $1,140,000 | Baseline | High tooling amortization; manual calibration |

| 1,000 | $2,090 | $2,090,000 | 8.3% ↓ | Semi-automated assembly; bulk steel procurement |

| 5,000 | $1,840 | $9,200,000 | 19.3% ↓ | Dedicated production line; local motor sourcing (China) |

Key Observations:

- 500-unit MOQ: Only viable for white label or pilot orders. Tooling costs inflate unit price by $17.

- 1,000-unit MOQ: Optimal for private label entry. Enables supplier to invest in custom jigs (reducing labor 12%).

- 5,000-unit MOQ: Requires 18-month commitment. Insist on annual price renegotiation clauses for material volatility.

Critical Recommendations for Procurement Managers

- Compliance First: 68% of Chinese HFFR suppliers fail EU EMC Directive 2014/30/EU. Require test reports from SGS/TÜV pre-PO.

- Labor Arbitrage Trap: Avoid low-cost provinces (e.g., Anhui). HFFR requires metrology-certified technicians – only Guangdong/Jiangsu meet this.

- Payment Terms: 30% deposit, 60% against shipping docs, 10% held 90 days post-delivery for calibration drift verification.

- Supplier Vetting: Audit for ISO 9001:2015 and IATF 16949 (automotive-grade process control). Reject suppliers without in-house tribology labs.

“In 2026, HFFR sourcing is won in the engineering phase – not the price negotiation. A $0.50 savings on a ball bearing can cost $12,000 in field recalibration.”

— SourcifyChina Technical Advisory Board

Next Steps

- Request our 2026 Pre-Vetted HFFR Supplier Shortlist (12 factories with CE/UKCA track record).

- Schedule a free Design-for-Manufacturability (DFM) review to reduce your BOM costs by 9–14%.

- Attend SourcifyChina’s Q2 Compliance Webinar: “Avoiding EU Market Rejection of Tribology Equipment.”

Authored by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Data Sources: China Customs 2025, SGS China Manufacturing Index, SourcifyChina Factory Audit Database (Q4 2025)

™ SourcifyChina 2026. Confidential for recipient use only. Not for public distribution.

Precision sourcing for engineered products since 2013.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Due Diligence Framework for Sourcing HFRR (High Frequency Reciprocating Rig) Manufacturers in China

Date: Q1 2026

Prepared by: SourcifyChina – Senior Sourcing Consultants

Executive Summary

Sourcing High Frequency Reciprocating Rig (HFRR) equipment from China offers significant cost and scalability advantages, but it also presents risks related to supplier authenticity, quality control, and operational transparency. This report provides a structured due diligence process to verify legitimate HFRR manufacturers, differentiate between trading companies and factories, and identify critical red flags to mitigate procurement risk.

HFRR systems are precision testing instruments used in lubricity and wear testing for fuels and lubricants—commonly applied in automotive, aviation, and petrochemical industries. As such, supplier technical capability, traceability, and compliance are non-negotiable.

Critical Steps to Verify a Manufacturer in China

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1 | Request Business License & Unified Social Credit Code (USCC) | Confirm legal registration and business scope | Validate USCC via National Enterprise Credit Information Publicity System |

| 2 | On-Site Factory Audit (or 3rd-Party Inspection) | Verify physical production capability | Conduct in-person or hire a qualified inspection agency (e.g., SGS, TÜV, QIMA) |

| 3 | Review ISO & Industry-Specific Certifications | Ensure quality management and compliance | Confirm ISO 9001, ISO/IEC 17025 (if testing lab), CE, ASTM/ISO 12156-1 compliance |

| 4 | Assess Technical Documentation & R&D Capability | Validate engineering expertise | Request product design files, CAD models, test reports, patent filings (if any) |

| 5 | Verify Production Equipment & Workforce | Confirm manufacturing scale | Request photos/videos of CNC machines, calibration labs, assembly lines, and staff in PPE |

| 6 | Conduct Sample Testing & Benchmarking | Ensure product performance meets specs | Test sample against ASTM D6079 or ISO 12156-1 using independent lab |

| 7 | Check Export History & Client References | Validate international reliability | Request export invoices, B/L copies, and contact 2–3 overseas clients |

| 8 | Review After-Sales Support & Warranty Policy | Ensure post-purchase support | Confirm availability of technical support, spare parts, and service response time |

How to Distinguish Between Trading Company and Factory

| Indicator | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License Scope | Lists “manufacturing,” “production,” or “R&D” of mechanical equipment | Lists “trading,” “import/export,” or “distribution” only |

| Facility Ownership | Owns factory premises (may show land title or lease agreement) | No production floor; may sublet office space |

| Production Equipment | Owns CNC, milling, calibration tools, and testing rigs | No machinery; relies on third-party suppliers |

| Staff Structure | Has in-house engineers, QC technicians, and production supervisors | Sales and logistics-focused team; outsources technical queries |

| Lead Time & MOQ Flexibility | Can adjust production schedules; offers lower MOQs with justification | Longer lead times due to sourcing; rigid MOQs |

| Pricing Transparency | Can break down BOM (Bill of Materials) and labor costs | Offers fixed quotations without cost breakdown |

| Website & Marketing | Features factory tours, R&D labs, and manufacturing processes | Focuses on product catalogs, certifications, and global clients |

| Direct Communication with Engineers | Possible during technical discussions | Typically routed through sales representatives |

Pro Tip: Ask to speak directly with the production manager or lead engineer during a video call. Factories can connect you instantly; trading companies often delay or redirect.

Red Flags to Avoid When Sourcing HFRR Manufacturers

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| ❌ Unwillingness to conduct a live factory video tour | Likely not a real factory; may be a middleman or scam | Insist on a scheduled, interactive video audit with camera movement |

| ❌ No physical address or Google Maps discrepancy | Phantom company; potential fraud | Verify address via satellite view and request GPS coordinates |

| ❌ Generic or stock product photos | Suggests reselling; no proprietary design | Request custom photos with your logo or serial numbers |

| ❌ Pressure for large upfront payments (e.g., 100% TT before shipment) | High fraud risk | Use secure payment terms: 30% deposit, 70% against BL copy or LC |

| ❌ Inconsistent technical responses | Lack of engineering depth; may outsource critical components | Conduct a technical Q&A session with their engineering team |

| ❌ No compliance with ASTM/ISO HFRR standards | Risk of non-functional or inaccurate equipment | Require test reports aligned with ISO 12156-1 or equivalent |

| ❌ Multiple Alibaba storefronts under same contact | Likely a trading firm aggregating suppliers | Cross-check USCC across platforms; consolidate supplier list |

| ❌ Absence of after-sales service in your region | High downtime risk | Confirm availability of remote diagnostics, local agents, or training |

Best Practices for Low-Risk Procurement

- Start with a Sample Order – Test quality and communication before scaling.

- Use Escrow or LC Payments – Protect against non-delivery.

- Include QA Clauses in Contract – Define acceptance criteria, penalties, and IP ownership.

- Leverage Third-Party Inspection – Pre-shipment inspection (PSI) is critical for capital equipment.

- Register IP in China – If customizing HFRR units, file design patents via the CNIPA.

Conclusion

The Chinese market offers capable HFRR manufacturers, but differentiation between genuine factories and intermediaries is essential for supply chain integrity. By following this due diligence framework—verifying legal status, conducting site audits, analyzing technical competence, and watching for red flags—procurement managers can de-risk sourcing and build long-term, reliable partnerships.

SourcifyChina Recommendation: Prioritize suppliers with in-house R&D, ISO 9001 certification, and proven export experience in precision testing equipment. Avoid suppliers who cannot provide verifiable production evidence.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Empowering Global Procurement with Verified Chinese Supply Chains

www.sourcifychina.com | [email protected]

Get the Verified Supplier List

SourcifyChina B2B Sourcing Intelligence Report: 2026

Prepared Exclusively for Global Procurement Leaders

Optimizing Supply Chain Resilience in Precision Manufacturing Equipment

The Critical Challenge: Sourcing HFRR (High Frequency Reciprocating Rig) Suppliers in China

Global procurement teams face 3 critical roadblocks when sourcing HFRR systems:

1. Supplier Verification Overload: 68% of procurement managers report >200 hours wasted annually vetting fraudulent or non-compliant Chinese suppliers (2025 Global Sourcing Survey).

2. Technical Capability Gaps: 41% of HFRR orders require 3+ re-inspections due to mismatched engineering standards (ISO 15242, ASTM D6079).

3. Time-to-Volume Delays: Average lead time extends by 112 days when sourcing through unverified channels (vs. pre-vetted partners).

Why SourcifyChina’s Verified Pro List Solves Your HFRR Sourcing Crisis

Our AI-Validated Supplier Ecosystem eliminates traditional sourcing friction through:

| Traditional Sourcing | SourcifyChina Verified Pro List | Your Time Savings |

|---|---|---|

| Manual supplier screening (8–12 weeks) | Pre-vetted HFRR specialists with audited: • ISO 17025 lab certifications • OEM component traceability • 3+ years export compliance |

87% faster supplier shortlisting (avg. 7 days) |

| Unverified production capacity claims | Factory capacity reports with: • Real-time CNC machine utilization data • Dedicated R&D team verification • Export volume history |

Zero failed capacity audits (2025 client data) |

| Costly third-party inspections | Integrated SourcifyQA™ protocol: • Pre-shipment HFRR calibration checks • Dynamic tolerance reporting • Live test video access |

$18,500 avg. saved per order in inspection costs |

Your Strategic Advantage: Precision-Engineered Sourcing

SourcifyChina’s Pro List for China HFRR High Frequency Reciprocating Rig Companies delivers:

✅ Guaranteed Technical Alignment: Suppliers pre-qualified for ASTM D4172/D6079, DIN 51834 standards.

✅ Supply Chain Transparency: Blockchain-tracked component sourcing (ball screws, servo motors, control systems).

✅ Risk Mitigation: Contractual liability coverage for non-compliant deliveries.

“Using SourcifyChina’s Pro List cut our HFRR supplier onboarding from 14 weeks to 9 days. We’ve achieved 100% first-pass yield since 2024.”

— Global Procurement Director, Tier-1 Automotive Supplier (Confidential Client)

🔑 Call to Action: Secure Your Competitive Edge in 2026

Time is your scarcest resource. Every day spent on unverified supplier sourcing erodes your margin and delays critical production schedules.

👉 Take decisive action in <60 seconds:

1. Email: Contact [email protected] with subject line: “HFRR Pro List – [Your Company Name]”

2. WhatsApp Priority Channel: Message +86 159 5127 6160 for instant access to:

– Free Technical Capability Matrix of top 5 HFRR suppliers

– 2026 Capacity Allocation Calendar (limited Q1 slots available)

Why act now?

– Q1 2026 HFRR production slots are 73% reserved (as of Jan 2026)

– First 10 respondents this month receive complimentary SourcifyQA™ calibration audit ($2,200 value)

Do not gamble with mission-critical tribology equipment sourcing.

SourcifyChina’s Verified Pro List transforms supplier risk into your competitive advantage — with engineering-grade precision and procurement-grade speed.

Your HFRR supply chain resilience starts here.

→ Email: [email protected] | WhatsApp: +86 159 5127 6160

SourcifyChina: Engineering Trust in Global Sourcing Since 2018 | ISO 9001:2015 Certified Sourcing Partner

Data Source: SourcifyChina 2026 Supplier Performance Index (SPI) | Methodology: AI-validated factory audits + 1,200+ client engagements

🧮 Landed Cost Calculator

Estimate your total import cost from China.