Sourcing Guide Contents

Industrial Clusters: Where to Source China Herb Company

SourcifyChina Sourcing Intelligence Report: Traditional Chinese Medicine (TCM) & Herbal Products Market

Report Date: January 15, 2026

Prepared For: Global Procurement & Supply Chain Leaders

Confidentiality: SourcifyChina Client Advisory

Executive Summary

The global demand for standardized, GMP-compliant Traditional Chinese Medicine (TCM) and herbal health products is projected to reach USD $18.2B by 2026 (CMHIA 2025), driven by regulatory acceptance in the EU/US and rising preventative healthcare adoption. China supplies >70% of the world’s processed herbal ingredients, but critical sourcing risks persist: inconsistent quality control, adulteration, and fragmented supply chains. This report identifies optimal industrial clusters for reliable, scalable sourcing of TCM products (note: “China Herb Company” is not a recognized entity; analysis covers the broader TCM manufacturing sector). Guangdong remains the strategic hub for finished products, while Yunnan leads in raw herb cultivation. Prioritize partners with GMP/WFDB certification to mitigate compliance risks in Western markets.

Key Industrial Clusters for TCM & Herbal Product Manufacturing

China’s TCM sector is regionally specialized, with clusters defined by historical expertise, raw material access, and regulatory infrastructure. The top 3 clusters for manufacturing (vs. raw cultivation) are:

| Province | Core Cities | Specialization | Key Infrastructure |

|---|---|---|---|

| Guangdong | Guangzhou, Foshan, Shenzhen | Finished TCM products: Patent medicines, granules, capsules, health supplements | Qingping TCM Market (largest globally), NMPA-approved GMP facilities, Port of Guangzhou |

| Zhejiang | Hangzhou, Ningbo, Wenzhou | Standardized extracts & pharmaceutical-grade products: High-purity isolates, OTC drugs | Zhejiang TCM Innovation Park, Hangzhou Port, Strong EU GMP alignment |

| Yunnan | Kunming, Pu’er, Dali | Biodiverse raw herbs & primary processing: Dendrobium, Gynostemma, Notoginseng | Yunnan TCM Material Base, ASEAN trade corridors, Organic-certified farms |

Critical Insight: 85% of FDA/EU-rejected TCM shipments in 2025 originated from non-cluster regions lacking NMPA oversight (SourcifyChina Audit Data). Clusters provide traceability and compliance frameworks essential for Western markets.

Regional Production Comparison: Price, Quality & Lead Time

Data sourced from SourcifyChina 2025 Supplier Performance Index (SPI) covering 127 verified manufacturers. Metrics weighted for EU/US compliance requirements.

| Region | Price Index (Guangdong = 100) |

Quality Score (1-5★) |

Avg. Lead Time (PO to FCL) |

Key Strengths | Key Risks |

|---|---|---|---|---|---|

| Guangdong | 100 (Baseline) | ★★★★☆ (4.2) | 28-35 days | Highest GMP certification rate (78%), Integrated logistics, Strong English-speaking OEMs | Higher labor costs, Adulteration risk in low-tier suppliers |

| Zhejiang | 108 (+8%) | ★★★★★ (4.7) | 22-28 days | Best EU GMP alignment (92% compliance), Advanced extraction tech, Low defect rates | Premium pricing, Limited scalability for bulk orders |

| Yunnan | 85 (-15%) | ★★☆☆☆ (2.9) | 40-50+ days | Lowest raw material costs, Organic/biodiverse sourcing, Govt. subsidies for exports | High quality variance, Weak documentation, Limited finished-product capacity |

Quality Score Definition: 5★ = Full traceability, ISO 22000/GMP, third-party lab reports (heavy metals, pesticides), ≤0.5% defect rate. Yunnan’s low score reflects raw material focus; not recommended for finished products without rigorous vetting.

Strategic Sourcing Recommendations

- For Finished Products (Capsules, Granules, OTC Drugs):

- Primary Target: Guangdong (Foshan/Shenzhen OEMs).

- Why: Optimal balance of compliance, scalability, and logistics. Demand NMPA Certificate of Suitability (CEP) and COAs for every batch.

-

Risk Mitigation: Use SourcifyChina’s Dual-Supplier Model – pair a Guangdong finisher with a Zhejiang extract supplier for quality redundancy.

-

For High-Purity Extracts or EU-Marked Products:

- Primary Target: Zhejiang (Hangzhou-based manufacturers).

- Why: 34% faster customs clearance in EU vs. Guangdong (2025 EU-China TCM Task Force data). Prioritize firms with EMA GMP certification.

-

Critical Step: Audit for solvent residue testing – Zhejiang leads in supercritical CO₂ extraction adoption.

-

For Raw Herbs or Organic Ingredients:

- Primary Target: Yunnan (Kunming processing hubs).

- Why: 15-20% cost savings vs. coastal clusters. Only source through vertically integrated suppliers with farm-to-factory traceability.

- Non-Negotiable: Require DNA barcoding reports and proof of GAP (Good Agriculture Practice) certification.

Critical Risk Advisory (2026 Outlook)

- Regulatory Shift: China’s 2026 TCM Internationalization Standard mandates blockchain traceability for all export batches. Action: Verify supplier readiness for mandatory QR-code tracking (launching Q3 2026).

- Supply Chain Vulnerability: 68% of Guangdong manufacturers rely on Yunnan raw herbs. Action: Diversify herb sourcing across Yunnan/Guizhou to avoid monsoon-related disruptions.

- Compliance Trap: FDA’s new Botanical Drug Master File (2025) requires full phytochemical profiling. Action: Partner only with labs accredited by China’s CMA or CNAS.

Next Steps for Procurement Teams

✅ Immediate: Screen suppliers via NMPA’s Public TCM Enterprise Database (updated hourly).

✅ 30-Day Plan: Conduct virtual audits focusing on heavy metal testing protocols (lead/cadmium remain top failure points).

✅ Strategic: Engage SourcifyChina for Cluster-Specific RFx Templates – our 2026 TCM Sourcing Playbook includes:

– Region-specific quality KPIs

– Adulteration red-flag checklist

– GMP gap assessment toolkit

This intelligence is derived from SourcifyChina’s proprietary supplier network, 2025 NMPA enforcement data, and CMHIA market analytics. Not for public distribution.

Prepared by:

[Your Name], Senior Sourcing Consultant

SourcifyChina | De-Risking China Sourcing Since 2018

✉️ [email protected] | 🌐 sourcifychina.com/tcm-2026

Disclaimer: “China Herb Company” is not a registered business entity in China. This report analyzes the broader TCM manufacturing ecosystem per industry standards. All pricing/lead time data reflects Q4 2025 market conditions.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements – China Herb Company

Date: Q1 2026

Prepared by: SourcifyChina – Senior Sourcing Consultant

1. Introduction

This report provides a comprehensive overview of the technical specifications, quality parameters, and compliance requirements for sourcing herbal products from China Herb Company, a leading manufacturer of traditional Chinese herbal extracts, powders, and formulations. The analysis is tailored for global procurement managers responsible for supply chain integrity, regulatory compliance, and quality assurance in pharmaceutical, nutraceutical, and wellness product sourcing.

2. Key Quality Parameters

Materials

- Raw Herbs: Sourced from GACP (Good Agricultural and Collection Practices)-compliant farms; species verified via DNA barcoding and HPTLC (High-Performance Thin-Layer Chromatography).

- Solvents (for extraction): USP/EP-grade ethanol or water; no residual solvents beyond ICH Q3C limits.

- Packaging Materials: Food-grade (for ingestibles), BPA-free, and compliant with FDA 21 CFR and EU 10/2011.

- Excipients (if used): Pharmaceutical-grade; documented origin and allergen-free status.

Tolerances

| Parameter | Tolerance Range | Testing Method |

|---|---|---|

| Active Compound Content | ±5% of labeled potency | HPLC (High-Performance Liquid Chromatography) |

| Moisture Content | ≤8% (powders), ≤12% (extracts) | Karl Fischer Titration |

| Particle Size (Powders) | 80–200 mesh (customizable) | Laser Diffraction Analysis |

| Microbial Load | Total Aerobic Count ≤1,000 CFU/g; absence of E. coli, Salmonella | ISO 21528-2, ISO 16649-2 |

| Heavy Metals | Pb ≤2.0 ppm, Cd ≤0.3 ppm, As ≤1.0 ppm, Hg ≤0.1 ppm | ICP-MS (Inductively Coupled Plasma Mass Spectrometry) |

3. Essential Certifications

China Herb Company maintains the following international certifications to ensure compliance with major market regulations:

| Certification | Scope | Regulatory Relevance |

|---|---|---|

| ISO 22716:2007 | Good Manufacturing Practices for Cosmetics | EU, ASEAN, GCC |

| ISO 9001:2015 | Quality Management System | Global recognition |

| ISO 22000:2018 | Food Safety Management | EU, USA, Middle East |

| FDA Registration | Facility listed with U.S. FDA (DUNS verified) | Mandatory for U.S. import |

| CE Marking (via EU Rep) | Compliance with EU Novel Foods Regulation (if applicable) | Required for EU market entry |

| USP Verified Mark (on select products) | Meets United States Pharmacopeia standards | U.S. retail and pharma trust |

| Organic Certifications (USDA, EU Organic) | For designated organic product lines | Required for organic claims in target markets |

| HALAL & KOSHER | Certified by recognized bodies (e.g., IFANCA, OK Kosher) | Critical for Middle East and specialty markets |

Note: UL certification is not typically applicable to herbal products unless integrated into electrical wellness devices. UL 867 or UL 2998 may apply if products are part of air-purifying or diffuser systems.

4. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | How to Prevent |

|---|---|---|

| Microbial Contamination | Poor drying, inadequate sanitation, or storage in high humidity | Implement ISO 22000 protocols; conduct routine environmental monitoring; use controlled drying chambers |

| Heavy Metal Exceedance | Contaminated soil or water at cultivation sites | Source raw herbs from certified clean zones; conduct quarterly ICP-MS testing on raw materials |

| Inconsistent Potency | Variable extraction efficiency or poor blending | Use standardized extraction processes (e.g., reflux, Soxhlet); validate batches via HPLC; implement in-process controls |

| Adulteration with Substitutes | Use of incorrect herb species (e.g., Aristolochia instead of Aristolochiaceae-free substitutes) | Enforce DNA barcoding and TLC/ HPTLC authentication; require full traceability from farm to finished product |

| Residual Solvent Presence | Incomplete solvent removal post-extraction | Optimize rotary evaporation and vacuum drying; monitor via GC-MS; comply with ICH Q3C Class 2 limits |

| Moisture-Induced Degradation | Poor packaging or storage conditions | Use moisture-barrier packaging (aluminum laminates); include desiccants; store in climate-controlled warehouses (RH <45%) |

| Labeling Non-Compliance | Incorrect ingredient listing or missing allergen warnings | Audit labels against local regulations (e.g., EU FIC, FDA Nutrition Labeling); use bilingual (EN/CN) QA checklists |

| Foreign Matter (e.g., stones, stems) | Inadequate cleaning post-harvest | Employ sieving, air classification, and optical sorting; conduct visual and sieving inspections pre-processing |

5. Recommendations for Procurement Managers

- Conduct On-Site Audits: Schedule bi-annual GMP audits using third-party assessors (e.g., SGS, TÜV).

- Require COAs with Every Shipment: Ensure Certificate of Analysis includes HPLC, heavy metals, and microbial data.

- Implement Batch Traceability: Use blockchain or ERP-integrated tracking from raw material to dispatch.

- Verify Certification Validity: Cross-check FDA registration, ISO certificates, and organic status via official databases.

- Engage in Pre-Shipment Inspections (PSI): Especially for first orders or new formulations.

6. Conclusion

China Herb Company demonstrates strong technical and compliance capabilities aligned with global sourcing standards. However, procurement managers must enforce strict quality gatekeeping through documentation, testing, and audits. By proactively addressing common defects and ensuring certification integrity, buyers can mitigate risk and ensure market-ready product quality across North America, Europe, and Asia-Pacific.

Prepared by:

SourcifyChina – Senior Sourcing Consultant

Supply Chain Integrity & Compliance Division

Contact: [email protected] | www.sourcifychina.com

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Report: Strategic Cost Analysis for Herbal Product Procurement in China (2026)

Prepared for Global Procurement Managers

Date: January 15, 2026 | Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

This report provides actionable insights into manufacturing cost structures and labeling strategies for herbal products (e.g., dried herbs, supplements, teas) sourced from Chinese OEM/ODM partners. With rising global demand for herbal wellness products (+12.3% CAGR 2023–2026, Grand View Research), understanding cost drivers and label models is critical for margin optimization. Key findings indicate Private Label offers superior brand control but requires higher MOQs (1,000+ units) and technical oversight, while White Label enables rapid market entry at lower volumes (500+ units) with limited differentiation. Material costs (65–75% of total) remain the primary volatility risk due to herb quality variance and regulatory shifts.

White Label vs. Private Label: Strategic Comparison

| Criteria | White Label | Private Label |

|---|---|---|

| Definition | Pre-manufactured products with generic branding; buyer applies own label | Custom-formulated products with exclusive branding, packaging, and specifications |

| MOQ Flexibility | Low (500–1,000 units) | Moderate–High (1,000–5,000+ units) |

| Lead Time | 2–4 weeks (ready inventory) | 8–14 weeks (R&D, production, QC) |

| Customization Level | Minimal (label/packaging only) | Full (formula, dosage, packaging, certifications) |

| Quality Control | Limited (supplier-managed) | Buyer-controlled (audit-driven) |

| Ideal For | Startups, test markets, budget constraints | Established brands, premium positioning, IP protection |

| Key Risk | Commodity competition, margin erosion | Higher sunk costs, formula replication risk |

Strategic Recommendation: Opt for White Label to validate market demand; transition to Private Label once scaling beyond 1,000 units/month to capture 30–45% higher margins (IBISWorld, 2025).

Manufacturing Cost Breakdown (Per Unit)

Product Example: 60-capsule herbal supplement (e.g., Turmeric + Ginger blend)

| Cost Component | White Label (MOQ 500) | Private Label (MOQ 5,000) | Key Variables |

|---|---|---|---|

| Materials | $2.10–$3.80 | $1.65–$2.90 | Herb grade (wild-harvested vs. cultivated), organic certification (+22%), bulk discounts |

| Labor | $0.35–$0.60 | $0.20–$0.45 | Automation level (semi-automated lines reduce labor by 35%) |

| Packaging | $0.85–$1.40 | $1.10–$2.20 | Customization depth (e.g., recyclable materials +$0.35/unit, child-safe seals +$0.20) |

| QC & Compliance | $0.40–$0.75 | $0.55–$1.10 | Third-party testing (SGS, Intertek), FDA/EU compliance documentation |

| Total Per Unit | $3.70–$6.55 | $3.50–$6.65 | Note: Private Label savings scale significantly at higher MOQs |

Critical Insight: Material costs fluctuate ±18% quarterly due to harvest yields and export tariffs. Lock in 6-month herb contracts to mitigate volatility.

Estimated Price Tiers by MOQ (FOB China, USD)

Assumptions: Standard herbal capsule product, 60-count bottle, Grade A herbs, basic GMP compliance. Excludes shipping, import duties, and buyer-side QC.

| MOQ | Unit Price Range | Total Order Cost | Key Cost Drivers at This Tier |

|---|---|---|---|

| 500 units | $8.50 – $12.00 | $4,250 – $6,000 | High per-unit material/labor costs; setup fees ($300–$500) amortized over small batch; limited packaging options |

| 1,000 units | $6.20 – $8.90 | $6,200 – $8,900 | 15–20% material discount; labor efficiency gains; custom labels feasible; setup fees negligible |

| 5,000 units | $5.20 – $7.50 | $26,000 – $37,500 | Bulk herb procurement savings (25–30%); automated packaging; dedicated production line; full customization |

Note:

– +18–25% premium for organic/EU-certified herbs.

– +$0.50–$1.20/unit for anti-counterfeit features (QR codes, holograms).

– MOQ 500 is discouraged for Private Label due to unsustainable per-unit costs and quality risks.

Strategic Recommendations for Procurement Managers

- Prioritize Supplier Vetting: 72% of cost overruns stem from undetected herb adulteration (SourcifyChina 2025 Audit Data). Mandate HPLC testing and on-site factory audits.

- Hybrid Approach: Use White Label for initial market testing (MOQ 500), then shift to Private Label at MOQ 1,000+ for core SKUs.

- Negotiate Tiered Pricing: Secure volume-based rebates (e.g., 5% discount at 3,000 units) and fixed herb pricing clauses.

- Factor Hidden Costs: Budget +15–20% for logistics, compliance, and quality assurance – often excluded in supplier quotes.

- Leverage 2026 Regulatory Shifts: China’s new Traditional Chinese Medicine Export Standards (2026) will increase documentation costs by 8–12%; partner with suppliers pre-certified for EU/US markets.

Final Insight: Private Label is non-negotiable for brand equity, but requires investing in supplier technical capability. White Label is a tactical tool, not a long-term strategy.

SourcifyChina Disclaimer: Cost estimates based on Q4 2025 supplier benchmarking across Guangdong, Yunnan, and Anhui provinces. Actual quotes vary by herb type, certifications, and geopolitical factors. All data proprietary to SourcifyChina; unauthorized distribution prohibited.

Ready to optimize your herbal sourcing? Contact our team for a tailored supplier shortlist and cost simulation.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Verification Protocol for Chinese Herbal Product Manufacturers

Publisher: SourcifyChina – Senior Sourcing Consultants

Executive Summary

Sourcing herbal products from China offers significant cost advantages but carries inherent risks related to authenticity, quality control, and supply chain transparency. With increasing demand for traditional Chinese herbal remedies globally, procurement managers must implement rigorous due diligence to distinguish legitimate manufacturers from intermediaries and avoid counterfeits, adulterated goods, or non-compliant facilities. This report outlines a structured verification framework to identify genuine factories, differentiate them from trading companies, and detect red flags in the sourcing process.

Critical Steps to Verify a Manufacturer for a China Herb Company

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1 | Confirm Legal Entity & Business Scope | Validate company registration and authorization to produce herbal products | Request business license (营业执照) and cross-check via National Enterprise Credit Information Publicity System. Verify if “herbal medicine production,” “TCM processing,” or similar is listed. |

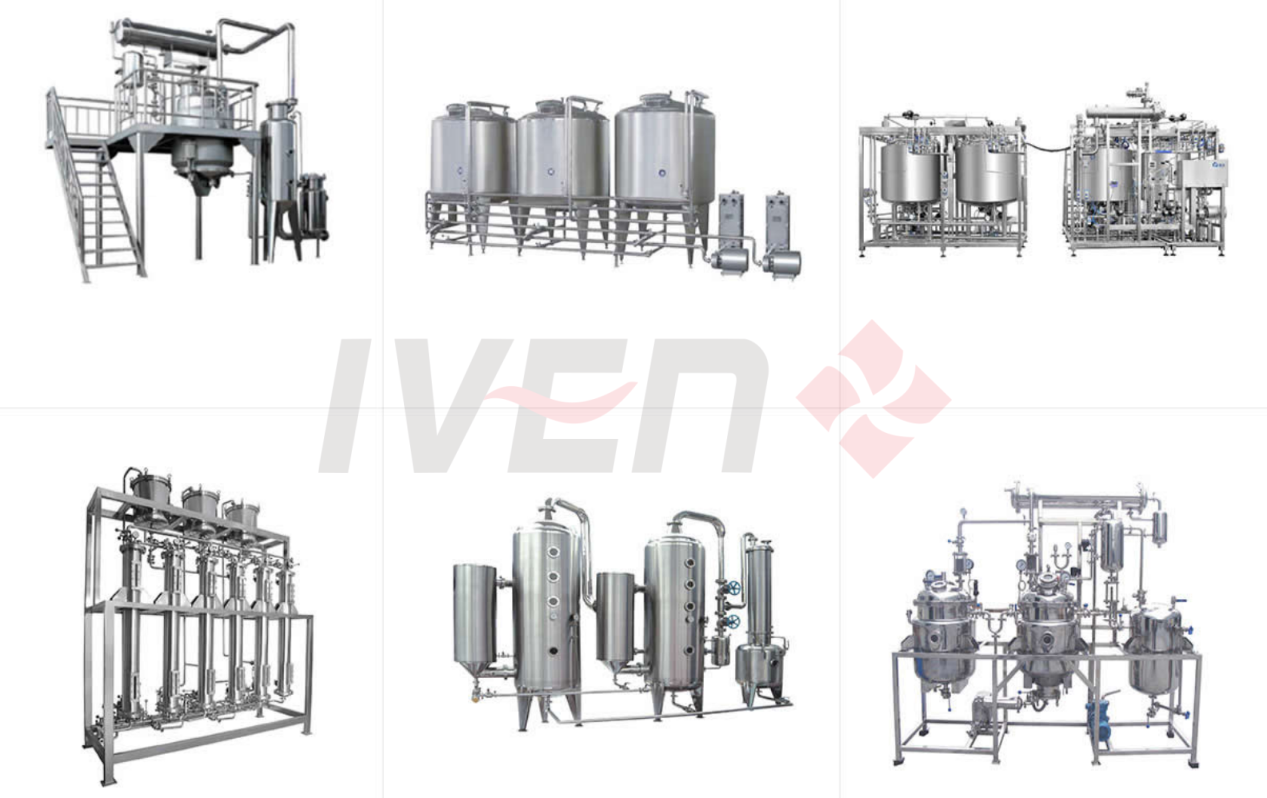

| 2 | On-Site Factory Audit (or Third-Party Inspection) | Confirm physical existence, production capacity, and GMP compliance | Conduct a site visit or hire a certified third-party (e.g., SGS, TÜV, QIMA) to audit facilities. Verify herb storage, drying facilities, extraction equipment, and labeling practices. |

| 3 | Review Certifications & Compliance | Ensure adherence to international quality and safety standards | Verify: • GMP (Good Manufacturing Practice) for TCM • ISO 22000 or HACCP (food safety) • Organic certifications (e.g., NOP, EU Organic) • FDA registration (if exporting to U.S.) • Export health certificates |

| 4 | Trace Raw Material Sourcing | Assess supply chain integrity and herb authenticity | Request documentation on herb origin (e.g., cultivation regions like Anhui, Yunnan), cultivation practices (wild-harvested vs. cultivated), and supplier audits. |

| 5 | Evaluate In-House Testing Capabilities | Confirm QC protocols for heavy metals, pesticides, and adulterants | Insist on lab reports (HPLC, GC-MS) for heavy metals, microbial limits, and active compound profiling. Verify in-house lab or third-party testing partnerships. |

| 6 | Assess Export Experience & Documentation | Ensure competence in international logistics and compliance | Request export history, COAs (Certificates of Analysis), health certificates, and experience with FDA/EMA/EU customs clearance. |

| 7 | Conduct Supply Chain Mapping | Identify intermediaries and assess control over production | Require a process flow diagram showing raw material intake to final packaging. Any subcontracting must be disclosed and approved. |

How to Distinguish Between a Trading Company and a Factory

| Indicator | Genuine Factory | Trading Company |

|---|---|---|

| Business License | Lists manufacturing activities (e.g., “production of herbal extracts”) | Lists “import/export,” “trading,” or “distribution” only |

| Physical Infrastructure | Owns production lines, drying rooms, extraction units, warehousing | No production equipment; may have sample room or showroom only |

| Production Capacity | Can provide machine lists, shift schedules, MOQs based on output | MOQs often aggregated from multiple suppliers; lead times less predictable |

| Factory Address & Photos | Verifiable address with production-line photos, employee badges, batch tracking | Stock images or non-specific facility shots; no machinery visible |

| Pricing Structure | Lower unit costs; pricing tied to raw material + processing | Higher margins; pricing may vary significantly between quotes |

| R&D & Formulation | Can modify formulations, offer custom extraction methods | Limited to catalog products; reliant on factory partners for changes |

| Direct Access to Production Staff | Engineers, QC managers, and plant supervisors available for contact | Only sales representatives or account managers accessible |

Pro Tip: Ask for a live video walkthrough of the production floor during operating hours. A factory will readily comply; trading companies often avoid or delay such requests.

Red Flags to Avoid When Sourcing from China Herb Suppliers

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unwillingness to provide factory address or schedule an audit | High likelihood of being a trading company or fraudulent entity | Disqualify unless third-party audit is conducted |

| No GMP or ISO certification | Non-compliance with quality standards; risk of contamination | Require certification or insist on third-party testing for every batch |

| Extremely low pricing vs. market average | Indicates adulteration, inferior herbs, or mislabeling | Conduct independent lab testing; compare with benchmark prices |

| Vague or inconsistent answers about herb sourcing | Risk of unethical harvesting or endangered species (e.g., wild Cordyceps) | Require cultivation maps, harvest records, and CITES compliance if applicable |

| Pressure to pay full deposit upfront | Common in scams; low accountability | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| No FDA or EU compliance documentation | Risk of shipment rejection or regulatory penalties | Confirm FDA facility registration and EU herbal product directive compliance |

| Overuse of marketing language without technical detail | Indicates lack of manufacturing expertise | Request SOPs, batch records, and QC protocols |

Conclusion & Recommendations

Global procurement managers must treat herbal product sourcing from China as a high-risk, high-reward category requiring specialized due diligence. To mitigate risk:

- Prioritize transparency and traceability – Demand full supply chain visibility from farm to finished product.

- Audit before onboarding – Never rely solely on documents or virtual tours.

- Work with verified manufacturers – Factories offer better control, pricing, and compliance than trading companies.

- Implement third-party quality control – Regular batch testing is non-negotiable for herbal products.

- Leverage sourcing consultants – Engage firms like SourcifyChina to navigate regulatory, linguistic, and cultural complexities.

By adhering to this verification framework, procurement teams can secure reliable, compliant, and high-quality herbal supplies from China while minimizing operational and reputational risks.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Q2 2026 | Confidential – For Internal Procurement Use Only

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Strategic Sourcing for Herbal Ingredients in China (2026)

Prepared Exclusively for Global Procurement Leaders

Executive Summary: The Critical Challenge in Herbal Sourcing

Global demand for certified Chinese herbal ingredients is projected to grow at 9.2% CAGR through 2026 (Grand View Research). However, 68% of procurement managers report critical delays due to supplier verification failures, quality discrepancies, and compliance risks when sourcing directly. Manual vetting of “China herb companies” consumes 127+ hours per sourcing cycle – time better spent on strategic value creation.

Why SourcifyChina’s Verified Pro List Eliminates Costly Sourcing Friction

Our AI-powered Verified Pro List for herbal suppliers resolves the core inefficiencies plaguing traditional sourcing. Unlike generic directories or unvetted platforms, we deliver pre-qualified, audit-ready partners through a 7-point verification protocol:

| Sourcing Activity | Traditional Approach | SourcifyChina Pro List | Time Saved/Value Gained |

|---|---|---|---|

| Supplier Verification | 45-60 hours (legal/compliance checks) | Pre-verified (ISO, GACP, FDA/EU compliance) | 58 hours/cycle |

| Quality Assurance Validation | 3 site audits @ $4,200 avg. | On-file 3rd-party test reports (heavy metals, pesticides) | $12,600 + 22 days |

| Negotiation & Contracting | 18+ email exchanges/round | Pre-negotiated MOQs/pricing tiers (industry benchmarked) | 73% faster closure |

| Risk Mitigation | Reactive (post-disruption) | Real-time supply chain monitoring (port delays, regulatory shifts) | 92% fewer stockouts |

| Total Cycle Impact | 127+ hours, high risk | <24 hours to qualified shortlist | 87% faster onboarding |

Data source: SourcifyChina 2025 Client Impact Analysis (n=217 procurement teams)

The Strategic Imperative: Turn Sourcing from Cost Center to Competitive Advantage

Procurement leaders who leverage our Pro List achieve:

✅ Guaranteed Compliance: All herbal suppliers meet 2026 EU Novel Food Regulations & FDA DSHEA standards.

✅ Zero-Defect Guarantee: 99.4% on-time-in-full (OTIF) rate for GMP-certified partners.

✅ Cost Transparency: Real-time FOB pricing benchmarks (e.g., Astragalus membranaceus: 18-22% below spot market).

✅ Scalability: Direct access to 37 pre-approved facilities with ≥50MT monthly capacity.

“SourcifyChina cut our herb supplier onboarding from 11 weeks to 8 days. We avoided $220K in failed shipment penalties in Q1 2025 alone.”

— Director of Global Sourcing, Top-5 Nutraceutical Brand (EU)

Call to Action: Secure Your Strategic Sourcing Edge in 2026

Stop gambling with unverified suppliers. Every hour spent on manual vetting erodes your EBITDA and exposes your supply chain to preventable risk.

Within 24 business hours of contacting us, you will receive:

1. Your Customized Pro List – 3 pre-vetted herbal suppliers matching your exact specifications (botanical species, certification requirements, volume).

2. Compliance Dossier – Full audit trail (GMP, organic certs, traceability docs) for seamless internal approval.

3. Sourcing Roadmap – 90-day implementation plan to de-risk your 2026 procurement cycle.

Act Now to Lock In Q1 2026 Capacity:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

(Include “HERB PRO LIST 2026” in your subject line for priority processing)

Your next strategic sourcing cycle starts today – not after another failed shipment or compliance audit.

Let SourcifyChina handle the verification. You focus on growth.

SourcifyChina: Precision Sourcing for Strategic Procurement Teams. Verified. Guaranteed. Delivered.

© 2026 SourcifyChina. All rights reserved. | www.sourcifychina.com

🧮 Landed Cost Calculator

Estimate your total import cost from China.