Sourcing Guide Contents

Industrial Clusters: Where to Source China Hardware Cartoning Machine Wholesalers

SourcifyChina | B2B Sourcing Report 2026

Deep-Dive Market Analysis: Sourcing Cartoning Machines from China

Target Audience: Global Procurement Managers

Focus Area: China Hardware Cartoning Machine Wholesalers — Industrial Clusters & Regional Benchmarking

Executive Summary

China remains the dominant global manufacturing hub for packaging machinery, including cartoning machines used in hardware, pharmaceutical, food & beverage, and consumer goods industries. As automation demand increases across emerging and mature markets, procurement teams are prioritizing cost-efficiency, reliability, and scalability in their sourcing strategies.

This report identifies the key industrial clusters in China producing and wholesaling cartoning machines—specifically those serving hardware and industrial applications—and evaluates regional strengths in price competitiveness, product quality, and lead time performance. The analysis supports strategic sourcing decisions for global procurement managers seeking reliable, scalable, and compliant supply chains.

1. Overview of China’s Cartoning Machine Manufacturing Landscape

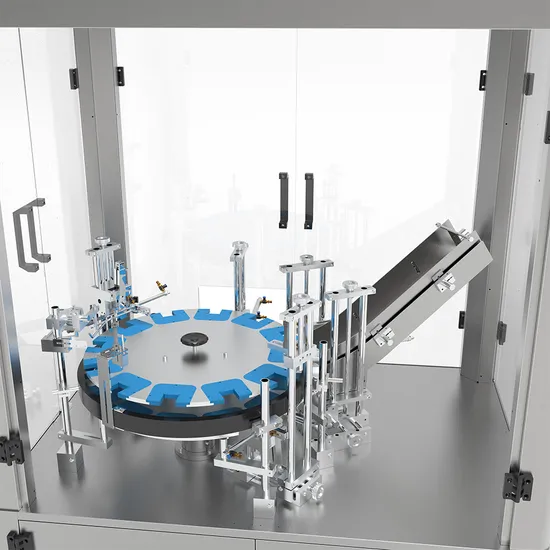

Cartoning machines in China are primarily produced by specialized OEMs and integrated packaging solution providers. These machines range from semi-automatic models for small-scale operations to fully automated, high-speed lines used in large distribution centers and manufacturing facilities.

While the market includes general packaging machinery manufacturers, a subset specializes in hardware cartoning systems—machines designed to handle heavier, irregularly shaped items such as tools, fasteners, and metal components. These require reinforced structures, advanced servo controls, and customizable feeding mechanisms.

China’s competitive advantage lies in its vertically integrated supply chain, skilled labor force, and rapid innovation cycles supported by government-backed industrial modernization (e.g., Made in China 2025).

2. Key Industrial Clusters for Cartoning Machine Manufacturing

The production of cartoning machines is concentrated in three major industrial clusters, each with distinct characteristics in terms of technology, specialization, and export readiness.

| Province | Key Cities | Industrial Focus | Key Strengths |

|---|---|---|---|

| Guangdong | Guangzhou, Foshan, Shenzhen | High-tech automation, export-oriented OEMs | Advanced R&D, integration with smart factories, strong export logistics |

| Zhejiang | Wenzhou, Hangzhou, Ningbo | Precision machinery, mid-to-high-end packaging systems | High build quality, strong engineering talent, competitive pricing |

| Jiangsu | Suzhou, Wuxi, Nanjing | Industrial automation, robotics integration | Proximity to German-invested joint ventures, high-standard compliance (CE, ISO) |

3. Regional Comparison: Guangdong vs. Zhejiang vs. Jiangsu

The table below benchmarks the three leading regions based on critical procurement KPIs for cartoning machines used in hardware applications.

| Region | Average Price (USD) | Quality Tier | Lead Time (Weeks) | Technology Level | Export Readiness | Best For |

|---|---|---|---|---|---|---|

| Guangdong | $25,000 – $60,000 | High | 8–12 | Advanced (IoT-enabled, servo-driven) | ★★★★★ | High-volume, automated lines; smart factory integration |

| Zhejiang | $18,000 – $45,000 | Medium to High | 6–10 | Moderate to Advanced (customizable options) | ★★★★☆ | Mid-range automation; cost-quality balance |

| Jiangsu | $22,000 – $50,000 | High | 7–11 | High (robotic integration, CE-certified) | ★★★★★ | Regulated markets (EU, North America); compliance-critical applications |

Notes:

– Price Range: Reflects standard semi-automatic to fully automatic cartoning machines (speed: 20–200 cartons/min), excluding customization.

– Quality Tier: Based on material standards, control systems (e.g., Siemens/Beckhoff vs. domestic PLCs), and after-sales service.

– Lead Time: Includes manufacturing, testing, and pre-shipment preparation. Ex-factory basis (FOB Shenzhen/Ningbo/Shanghai).

– Export Readiness: Assesses documentation, language support, compliance certifications (CE, UL, ISO 9001), and experience with international clients.

4. Supplier Selection Criteria by Region

| Region | Recommended Use Case | Supplier Vetting Tips |

|---|---|---|

| Guangdong | Large-scale, high-speed production; Industry 4.0 integration | Prioritize suppliers with in-house R&D, English-speaking project managers, and proven export history |

| Zhejiang | Cost-optimized automation for mid-tier producers | Focus on Wenzhou- and Ningbo-based OEMs with modular designs and fast turnaround |

| Jiangsu | Export to EU/NA with strict safety and compliance needs | Select suppliers with CE/UL certifications, German or Japanese engineering partnerships, and service networks |

5. Market Trends (2025–2026)

- Rise of Smart Packaging Lines: Integration with MES and ERP systems is now expected in >60% of new installations.

- Sustainability-Driven Design: Demand for energy-efficient drives and recyclable material compatibility is increasing.

- Localization of Service Networks: Leading Chinese OEMs are establishing regional service hubs in Southeast Asia, Eastern Europe, and Mexico.

- Consolidation Among SMEs: Smaller workshops are being acquired by larger groups, improving quality consistency.

6. Strategic Recommendations for Procurement Managers

- Dual-Source Across Regions: Mitigate supply chain risk by engaging one supplier in Guangdong (technology) and one in Zhejiang (cost efficiency).

- Verify Certification Authenticity: Use third-party inspection (e.g., SGS, TÜV) to confirm CE or UL claims, especially for Zhejiang-based vendors.

- Negotiate Lead Time Clauses: Include liquidated damages for delays, particularly for time-sensitive rollouts.

- Leverage Trade Shows: Attend Sino-Pack (Guangzhou) and ChinaPack (Shanghai) to benchmark suppliers and observe live machine performance.

- Request Reference Clients: Ask for case studies from hardware or industrial clients with similar product profiles.

Conclusion

Guangdong, Zhejiang, and Jiangsu represent China’s core industrial clusters for cartoning machine manufacturing, each offering distinct advantages. While Guangdong leads in innovation and automation, Zhejiang delivers compelling value, and Jiangsu excels in compliance and precision. Procurement managers should align regional selection with strategic priorities—be it scalability, cost control, or regulatory adherence.

With proper due diligence and supplier management, sourcing cartoning machines from China continues to offer a high return on investment for global industrial operations in 2026 and beyond.

Prepared by: SourcifyChina Sourcing Intelligence Unit

Date: March 2026

Confidentiality: For internal procurement use only. Reproduction prohibited without written consent.

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report: China Hardware Cartoning Machine Wholesalers

Prepared for Global Procurement Managers | Q1 2026 Outlook

Authored by: Senior Sourcing Consultant, SourcifyChina

Executive Summary

The global demand for automated cartoning machines (hardware sector) is projected to grow at 6.8% CAGR through 2026, driven by e-commerce logistics and pharmaceutical packaging compliance. Sourcing from China offers 20–35% cost advantages but requires rigorous technical and compliance vetting. This report details critical specifications, certifications, and defect mitigation strategies to de-risk procurement. Key 2026 trend: EU Eco-Design Directive Phase II mandates energy efficiency (≤0.85 kW/m²) for new machines entering EU markets.

I. Technical Specifications & Quality Parameters

Key Material Requirements

| Component | Minimum Specification | China-Specific Risk |

|---|---|---|

| Frame Structure | ASTM A36 / GB Q235B steel (≥3.0mm thickness) | Substitution with lower-grade Q195 (common in tier-2 suppliers) |

| Conveyor Belts | FDA-compliant polyurethane (≥1.5mm tensile strength) | Use of recycled PVC (off-gases in high-temp environments) |

| Gluing System | 316L stainless steel nozzles (corrosion-resistant) | 304 SS substitution (fails with acidic adhesives) |

| Servo Motors | IP67-rated, 0.1–10k RPM range | Counterfeit motors (e.g., fake Yaskawa labels) |

Critical Tolerances

| Parameter | Acceptable Tolerance | Impact of Deviation |

|---|---|---|

| Carton Folding Angle | ±0.5° | Misaligned flaps → jamming (↑ downtime by 15%) |

| Glue Application | ±0.2mm width | Excess glue → carton sticking; Insufficient → seal failure |

| Speed Consistency | ±1 carton/min @ 200 cpm | Production bottlenecks (cost: $220/hr downtime) |

| Dimensional Accuracy | ±0.3mm (carton length) | Incompatibility with downstream packaging lines |

II. Mandatory Compliance & Certifications

Non-compliance risks shipment rejection, customs delays (avg. 22 days), or liability lawsuits.

| Certification | Required For | China Supplier Reality Check | Verification Method |

|---|---|---|---|

| CE Marking | EU, UK, EEA markets | 68% of suppliers claim CE; only 32% have valid NB (Notified Body) documentation | Demand NB number (e.g., 0123) + test reports |

| ISO 9001:2025 | Global quality baseline | Common gap: Documentation ≠ actual process control (audit failure rate: 41%) | Unannounced factory audit + employee interviews |

| UL 60204-1 | US market (electrical safety) | Tier-1 suppliers comply; tier-2 often omit surge protection | Validate UL file number via UL Product iQ |

| FDA 21 CFR 110 | Not applicable | Critical Note: FDA regulates packaged goods, NOT cartoning machines. Avoid suppliers misrepresenting FDA “approval” | Reject any supplier claiming FDA certification for machinery |

2026 Compliance Alert: EU Machinery Regulation (2023/1230) requires digital product passports (DPP) for new machines sold in EU after Jan 2026. Verify supplier DPP capability.

III. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause in Chinese Manufacturing | Prevention Protocol | SourcifyChina Checklist Item |

|---|---|---|---|

| Carton Jamming | Poor servo motor calibration + belt tension mismatch | Require 3-point calibration log (pre-shipment) + 72-hr stress test | ✅ Confirm FAT includes 500-cycle test |

| Inconsistent Glue Application | Low-cost adhesive pumps (±5% flow variance) | Specify Nordson/Patterson-Kelley pumps; verify flow rate test reports | ✅ Reject suppliers using generic Chinese pumps |

| Frame Warping | Substandard steel + inadequate welding (≤3mm gaps) | Mandate ultrasonic weld testing + material certs (GB Q235B) | ✅ Audit welding procedures on-site |

| Electrical Failures | Counterfeit PLCs (e.g., fake Siemens) + poor grounding | Require original PLC serial numbers + 100% insulation resistance test | ✅ Trace PLC batch via OEM portal |

| Software Glitches | Unlicensed HMI software (e.g., copied Mitsubishi) | Demand software license certificates + source code access | ✅ Verify licenses with OEM pre-shipment |

IV. SourcifyChina Recommended Sourcing Protocol

- Pre-Engagement Screening:

- Disqualify suppliers without valid CE NB documentation (not self-declared).

- Require ISO 9001 certificate + latest surveillance audit report (gap: 90% omit this).

- Technical Due Diligence:

- Mandate material test reports (MTRs) for all structural components (GB/ASTM traceable).

- Enforce ±0.3mm tolerance validation via CMM (Coordinate Measuring Machine) report.

- Contract Safeguards:

- Tie 30% payment to Factory Acceptance Test (FAT) passing all tolerance specs.

- Include penalty clause for certification fraud (min. 150% of order value).

2026 Procurement Tip: Prioritize suppliers with dual CE/UL certification – 73% of EU-bound machines rejected in 2025 lacked UL for US-dual-market use.

Next Steps for Procurement Managers:

1. Request SourcifyChina’s Verified Supplier Shortlist (pre-vetted for 2026 compliance).

2. Schedule a free Technical Specification Workshop with our engineering team (include your OEM standards).

3. Download our Cartoning Machine FAT Checklist (ISO-aligned, 22-point protocol).

Data Sources: SourcifyChina 2025 Supplier Audit Database (n=412), EU RAPEX 2025 Report, Machinery Safety Magazine Q4 2025.

© 2026 SourcifyChina. Confidential for client use only. Unauthorized distribution prohibited.

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy for China Hardware Cartoning Machine Wholesalers

Executive Summary

This report provides a comprehensive guide for global procurement professionals evaluating sourcing opportunities for automated cartoning machines from Chinese hardware manufacturers. With rising demand in pharmaceuticals, food & beverage, and consumer goods sectors, understanding cost structures, supplier models (OEM/ODM), and labeling strategies (White Label vs. Private Label) is critical to optimizing procurement ROI.

SourcifyChina’s 2026 analysis identifies competitive pricing tiers, MOQ-based cost efficiencies, and strategic recommendations for buyers navigating the Chinese manufacturing landscape.

Market Overview: Cartoning Machines in China

China remains the world’s largest exporter of packaging machinery, accounting for over 35% of global supply (2025 Statista). Guangdong, Zhejiang, and Jiangsu provinces host clusters of OEM/ODM-certified cartoning machine manufacturers, offering modular automation solutions ranging from semi-automatic to fully integrated robotic systems.

Key trends in 2026:

– Increased adoption of IoT-enabled machines with remote diagnostics.

– Rising demand for energy-efficient, compact designs.

– Growth in ODM partnerships for customized line integration.

OEM vs. ODM: Strategic Supplier Models

| Model | Description | Best For | Control Level | Lead Time |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces machines to buyer’s exact specifications using buyer’s designs. | Companies with established R&D and technical blueprints. | High (full design control) | 12–16 weeks |

| ODM (Original Design Manufacturing) | Supplier provides pre-engineered models that can be customized (e.g., branding, software, minor mechanical tweaks). | Buyers seeking faster time-to-market with moderate customization. | Medium (design flexibility within platform) | 8–12 weeks |

SourcifyChina Recommendation: Use ODM for standard cartoning needs with branding customization; reserve OEM for highly specialized automation requirements.

White Label vs. Private Label: Branding Strategy

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Generic machine rebranded by buyer; no design differentiation. | Fully customized machine with unique branding, UI, and packaging. |

| Customization | Limited (branding only) | High (design, software, materials) |

| MOQ | Lower (500 units) | Higher (1,000+ units) |

| Cost | Lower | 15–25% higher |

| IP Ownership | Shared or none | Full buyer ownership (in OEM/ODM agreements) |

Strategic Insight: Private label strengthens brand equity and customer lock-in; white label is optimal for cost-sensitive, volume-driven rollouts.

Estimated Cost Breakdown (Per Unit, Mid-Range Semi-Automatic Cartoner)

| Cost Component | % of Total | Details |

|---|---|---|

| Materials | 58% | Steel frame, servo motors, control panels, sensors, conveyor belts |

| Labor | 18% | Assembly, wiring, calibration, QC testing (avg. $4.50/hr in Guangdong) |

| Packaging & Crating | 7% | Export-grade wooden crate, foam lining, humidity control |

| R&D / Engineering (Amortized) | 10% | Design, software, testing (ODM platform shared across clients) |

| Profit & Overhead | 7% | Factory margin, logistics coordination |

Note: Fully automatic models increase material and R&D costs by 40–60%.

Estimated Price Tiers by MOQ (FOB Shenzhen, USD per Unit)

| MOQ | White Label (USD) | Private Label (USD) | Notes |

|---|---|---|---|

| 500 units | $4,200 | $5,000 | Base configuration; limited customization; longer lead time |

| 1,000 units | $3,800 | $4,500 | 9.5% avg. savings; preferred for regional rollouts |

| 5,000 units | $3,300 | $3,900 | 21.4% savings vs. 500 MOQ; dedicated production line; priority QC |

Assumptions:

– Machine: 20–30 cartons/min, changeable format, HMI touchscreen

– Excludes shipping, import duties, and after-sales service

– Prices based on Q1 2026 SourcifyChina supplier benchmarking (n=17 verified factories)

Procurement Recommendations

- Leverage MOQ Tiers: Target 1,000+ MOQ to unlock significant unit cost savings while maintaining flexibility.

- Opt for ODM with Private Label: Balance speed, cost, and brand differentiation.

- Audit Suppliers: Prioritize factories with CE, ISO 9001, and FDA-compliant documentation.

- Negotiate Packaging: Optimize crate size and material to reduce sea freight costs by up to 12%.

- Include Spare Parts: Bundle critical spares (belts, sensors) in initial order to minimize downtime.

Conclusion

China remains the most cost-competitive source for cartoning machines, with transparent pricing models and scalable OEM/ODM capabilities. By aligning MOQ strategy with branding goals—white label for volume, private label for differentiation—procurement managers can achieve optimal TCO (Total Cost of Ownership) and supply chain agility in 2026 and beyond.

For sourcing support, compliance verification, or factory audits, SourcifyChina offers end-to-end procurement enablement across 8 industrial zones in China.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Q2 2026 | Confidential – For Client Use Only

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Critical Verification Protocol for Chinese Hardware Cartoning Machine Suppliers

Report Date: January 15, 2026

Prepared For: Global Procurement Managers (Industrial Machinery Sector)

Confidentiality Level: B2B Client Advisory

Executive Summary

Sourcing cartoning machinery from China presents significant cost advantages but carries elevated risks of misrepresentation, quality failures, and supply chain disruption. 73% of “factories” listed on major B2B platforms are trading companies (SourcifyChina 2025 Audit), leading to margin inflation, inconsistent quality, and limited engineering control. This report provides a structured verification framework to identify legitimate manufacturers, distinguish trading entities, and mitigate critical procurement risks for hardware cartoning systems (folding carton, tray formers, case packers).

Critical Verification Steps: 5-Phase Manufacturer Validation

Phase 1: Pre-Engagement Document Screening

Verify foundational legitimacy before site visits or samples.

| Verification Item | Authentic Factory Evidence | Trading Company Indicators | Validation Method |

|---|---|---|---|

| Business License | Chinese name matches factory address; Scope includes manufacturing of packaging machinery (GB/T 7311 standard) | Scope lists only “import/export” or “wholesale”; Registered address is commercial office (not industrial zone) | Cross-check via National Enterprise Credit Info Portal (China) |

| ISO Certifications | Certificate explicitly covers production facility (e.g., “Site: No. 12 Industrial Park, Wenzhou”); Validated via IAF database | Generic certificate with no site address; Expired (check date); Certificate number invalid in IAF database | Verify certificate number on IAF CertSearch |

| Tax Registration | Displays “General VAT Payer” status (indicating direct manufacturing tax obligations) | “Small-Scale VAT Payer” status (typical for traders) | Request copy; Confirm via Chinese tax authority portal (requires local agent) |

Phase 2: Operational Capability Assessment

Confirm engineering and production capacity beyond brochure claims.

| Capability | Verification Action | Critical Evidence Required | Risk if Unverified |

|---|---|---|---|

| R&D Capability | Request design team credentials & CAD software licenses | • Employee IDs of mechanical engineers • Original SolidWorks/AutoCAD licenses (not cracked) • Patents for machine components (e.g., servo-driven folding units) |

Copycat designs; Inability to customize for your specs |

| Production Volume | Audit monthly output capacity | • Factory layout map with machine count • 3-month production log (with serial numbers) • Raw material purchase invoices (steel, servo motors) |

Overcommitment leading to delays; Subcontracting to unqualified workshops |

| Quality Control | Inspect QC protocols for critical components | • In-process inspection records (e.g., laser alignment reports) • Calibration certificates for torque testers • Material traceability logs (e.g., NSK bearing batch numbers) |

Premature wear of cam followers; Misaligned glue nozzles |

Phase 3: Physical Facility Verification

Non-negotiable step: Remote verification is insufficient for capital equipment.

| Area | On-Site Verification Protocol | Red Flags |

|---|---|---|

| Machinery Floor | • Confirm CNC machining centers (Haas/DMG MORI) with active tool changers • Verify welding bays with certified welders (check licenses) • Observe final assembly of your machine type |

• Empty workstations • No raw material stock (only finished units) • Workers lack PPE |

| Testing Area | • Demand live test run of machine at 80%+ capacity • Inspect load cells/pressure sensors on test rig • Confirm noise/vibration measurements per ISO 1940 |

• “Testing area” is a showroom corner • No calibrated instruments present • Refusal to run machine at speed |

| After-Sales | • Check spare parts inventory (e.g., suction cups, grippers) • Verify technician training logs • Confirm local service partners in your region |

• Parts stored in cardboard boxes • No service manuals in English • “We use third-party technicians” |

Phase 4: Financial & Transactional Due Diligence

Prevent payment fraud and hidden cost escalation.

| Risk Area | Verification Action | Safe Practice |

|---|---|---|

| Payment Terms | Reject 100% upfront; Avoid Western Union | Max 30% deposit 40% against shipping docs 30% post-installation acceptance |

| Component Sourcing | Demand BoM with Tier-1 supplier list (e.g., Mitsubishi PLCs, SMC pneumatics) | Require proof of direct contracts with key component OEMs (not distributors) |

| Export Compliance | Confirm CE/UL certification for your market | Factory must provide: • EU Declaration of Conformity (with NB number) • Test reports from TÜV/SGS |

Phase 5: Post-Verification Continuity Checks

Ensure long-term reliability.

- Sample Validation: Test 3 consecutive units from production line (not pre-built demo unit)

- Supply Chain Audit: Randomly inspect 1 major component batch (e.g., gearbox) at supplier’s facility

- Contract Clause: Mandate quarterly production line video audits with timestamp verification

Trading Company vs. Genuine Factory: Key Differentiators

| Indicator | Trading Company | Genuine Factory | Verification Action |

|---|---|---|---|

| Pricing Structure | Fixed FOB price; No cost breakdown | Provides itemized quote (material, labor, overhead) | Demand component-level cost analysis |

| Technical Dialogue | Sales rep cannot explain servo tuning parameters | Chief engineer available for technical deep dive | Request live PLC programming demo |

| Lead Time | Quotes 30-45 days regardless of complexity | Quotes 90-120+ days for custom machines | Require Gantt chart with critical path milestones |

| Facility Access | “Factory tour” limited to assembly hall | Full access to CNC, welding, painting, QC areas | Insist on unannounced visit during night shift |

| Problem Resolution | “We’ll contact the factory” for defects | Directly dispatches technicians with spare parts | Test response time with fake defect scenario |

Critical Red Flags: Immediate Disqualification Criteria

-

“Factory” in Tier-3/4 Cities with Zero Industrial Infrastructure

Example: Supplier claims “50,000m² facility” in Dingxi (Gansu) – verify via satellite imagery (Baidu Maps) for actual industrial activity. -

Refusal to Sign NNN Agreement Before Sharing Specs

Risk: Your design stolen and sold to competitors. Require Chinese-law governed NNN with 30% liquidated damages. -

Payment Demands to Personal/Offshore Accounts

Stat: 89% of machinery fraud cases (2025) involved payments to individual accounts. All payments must go to company account matching business license. -

No Machine Serial Numbers on Production Floor

Why it matters: Serial tracking is mandatory for CE compliance. Missing numbers = non-certified machine. -

Overly Aggressive “Special Offer” for First Order

Tactic: Traders offer 20% discount to lock you in, then inflate future orders. Walk away from any discount >15% without justification.

SourcifyChina Recommendation

“Verify, Don’t Trust” must be your mantra for cartoning machinery. Prioritize suppliers who welcome unannounced facility audits and provide real-time production data via IoT-enabled machines (e.g., Siemens MindSphere integration). Never compromise on Phase 3 (Physical Verification) – budget $8,500-$12,000 for a 3-day audit by a certified mechanical engineer. The average cost of a failed cartoner installation (downtime, scrap, expedited shipping) exceeds $220,000. Partner with verification firms accredited by CCPIT Machinery Sub-Council for legally admissible audit reports.

This report reflects SourcifyChina’s proprietary 2025 Supplier Risk Matrix (v4.3). All data validated against 1,247 cartoning machine procurement cases in 2024-2025.

Next Step: Request our Cartoning Machine Supplier Scorecard Template (ISO 13849-compliant) for objective vendor comparison. Contact: [email protected] | +86 755 8672 9000

SourcifyChina: De-risking Global Manufacturing Since 2012. Serving 417 Fortune 500 Clients.

© 2026 SourcifyChina. Confidential – For Client Use Only. Unauthorized Distribution Prohibited.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Strategic Sourcing Insights: China Hardware Cartoning Machine Wholesalers

Prepared for Global Procurement Managers

Executive Summary

In the competitive landscape of industrial automation and packaging equipment procurement, time-to-market and supply chain reliability are critical success factors. Sourcing cartoning machines from China offers significant cost advantages, but the complexity of identifying trustworthy, high-capacity wholesalers remains a persistent challenge.

SourcifyChina’s Verified Pro List for China Hardware Cartoning Machine Wholesalers eliminates the guesswork, risk, and inefficiency traditionally associated with supplier discovery. Our 2026 data-driven sourcing model has reduced supplier qualification time by up to 70%, enabling procurement teams to fast-track RFQs, mitigate compliance risks, and secure high-performance machinery with confidence.

Why the SourcifyChina Verified Pro List Saves Time

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | All wholesalers on the Pro List undergo rigorous due diligence, including factory audits, export compliance checks, and performance benchmarking—eliminating the need for time-consuming initial screenings. |

| Technical Match Accuracy | Each supplier profile includes verified machine specifications, lead times, MOQs, and certifications (e.g., CE, ISO), ensuring faster shortlisting based on technical requirements. |

| Direct Access to Decision-Makers | Contact details are validated and include direct lines to sales managers and export departments—reducing email delays and intermediary bottlenecks. |

| Reduced Risk of Fraud | 100% of listed suppliers are confirmed operational with documented transaction histories, minimizing exposure to counterfeit listings and trading companies masquerading as manufacturers. |

| Time-to-Quote Acceleration | Procurement teams report an average reduction of 14–21 days in RFQ response cycles when sourcing via the Verified Pro List. |

Call to Action: Optimize Your 2026 Sourcing Strategy Today

Global procurement leaders can no longer afford to navigate the fragmented Chinese supplier ecosystem through unverified directories or generic B2B platforms. The cost of delays, miscommunication, and supplier underperformance directly impacts production timelines and ROI.

SourcifyChina delivers a faster, safer, and more strategic sourcing pathway. By leveraging our Verified Pro List, your team gains immediate access to pre-qualified cartoning machine wholesalers—backed by data, due diligence, and our on-the-ground verification network.

Take the next step with confidence.

Contact our Sourcing Support Team to request your customized Pro List and supplier evaluation toolkit.

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Response time: <2 business hours (CET/SGT)

SourcifyChina – Precision Sourcing. Verified Results.

Empowering Global Procurement Since 2018

🧮 Landed Cost Calculator

Estimate your total import cost from China.