Sourcing Guide Contents

Industrial Clusters: Where to Source China Handshower With Big Cover Company

SourcifyChina B2B Sourcing Report 2026

Strategic Analysis: Sourcing Premium Hand Showers with Oversized Faceplates (“Big Cover”) from China

Prepared for Global Procurement Leaders | Q1 2026

Executive Summary

The global demand for premium bathroom fixtures featuring hand showers with oversized decorative faceplates (“big cover” hand showers) is accelerating, driven by luxury residential and hospitality projects (+12.3% CAGR 2023–2026, China Building Materials Federation). China dominates 68% of global production for this segment, with manufacturing concentrated in three industrial clusters. Guangdong Province remains the unequivocal leader for high-end, design-complex units, while Zhejiang offers cost-competitive alternatives for mid-tier specifications. Procurement managers must prioritize regional alignment with quality tier, volume, and customization needs to mitigate supply chain risks in 2026.

Key Industrial Clusters: Manufacturing Hubs for “Big Cover” Hand Showers

China’s production is geographically specialized due to legacy supply chains, material access, and engineering expertise. The critical clusters are:

| Province/City Cluster | Core Manufacturing Sub-Region | Specialization for “Big Cover” Hand Showers | Key OEM/ODM Players |

|---|---|---|---|

| Guangdong | Foshan (Shishan, Lecong) | Premium segment: Complex oversized faceplates (150mm+ diameter), multi-surface finishes (PVD, matte black), integrated tech (LED, thermostatic). 85% of high-end export volume. | R&T, Jomoo, Huida, Arrow (subsidiaries) |

| Zhejiang | Ningbo (Yuyao), Taizhou | Mid-tier segment: Standardized oversized covers (120–140mm), ABS/plastic composites, cost-optimized designs. Strong in private-label volume orders. | HEGII, Huidi, Taicang Group |

| Fujian | Quanzhou, Zhangzhou | Emerging budget segment: Basic oversized covers (≤120mm), predominantly plastic/resin. Limited metal finishing capacity. High price sensitivity. | Small workshops (e.g., Quanzhou Sanitary Ware Cluster) |

Strategic Insight: Foshan (Guangdong) is the only cluster with integrated ecosystems for metal stamping, precision plating, and hydraulic testing required for premium oversized faceplates. Zhejiang’s strength lies in plastic injection molding for cost-driven designs but lacks Guangdong’s metallurgical expertise.

Regional Comparison: Sourcing Performance Matrix (2026 Forecast)

Data sourced from SourcifyChina’s 2025 Supplier Performance Index (SPI) and CBMF production surveys. Metrics reflect FOB Shenzhen/Ningbo for 5,000-unit MOQ of mid-premium hand showers (130mm faceplate, chrome finish).

| Parameter | Guangdong (Foshan) | Zhejiang (Ningbo/Yuyao) | Fujian (Quanzhou) |

|---|---|---|---|

| Price Range (USD/unit) | $22.50 – $38.00 | $15.20 – $24.80 | $9.50 – $16.00 |

| Quality Profile | • ★★★★★ (Tier 1) • ≤0.8% defect rate (hydraulic testing) • 5-layer PVD plating (500+ hrs salt spray) • Full EN817/ASSE 1072 compliance |

• ★★★☆☆ (Tier 2) • 1.5–2.5% defect rate • 3-layer plating (250 hrs salt spray) • Partial compliance (often requires retesting) |

• ★★☆☆☆ (Tier 3) • 3–5% defect rate • Electroplated only (100 hrs) • Non-compliant with EU/US standards |

| Lead Time | 55–75 days (custom tooling + quality gates) | 40–55 days (standard molds) | 30–45 days (basic assembly) |

| Best For | Luxury brands, hotel chains, tech-integrated units | Mid-market retailers, private labels (EU/NA) | Budget projects, emerging markets (LATAM, Africa) |

| Key Risk in 2026 | Rising labor costs (+8.2% YoY); export compliance complexity | Quality inconsistency; IP leakage in plastic molds | Material shortages (resin volatility); certification failures |

Critical Recommendations for Procurement Managers

-

Premium/Luxury Sourcing (>$25/unit):

→ Prioritize Foshan, Guangdong. Insist on in-process quality audits (IPQA) at plating/stamping stages. Budget for 15–20% longer lead times vs. Zhejiang but expect 40% fewer post-shipment defects. -

Mid-Tier Volume Orders ($15–$25/unit):

→ Dual-source between Zhejiang and Guangdong. Use Zhejiang for standardized designs (e.g., retail private labels) but leverage Guangdong’s engineering for any metal-faceplate variants. Require 3rd-party test reports for hydraulic performance. -

Avoid “Big Cover” Cost Traps:

- Oversized faceplates >140mm require custom tooling (non-recoverable cost: $8,000–$15,000). Guangdong absorbs this cost at 10K+ units; Zhejiang often inflates per-unit pricing below 8K units.

-

“Big Cover” = Higher Shipping Costs: Units with 150mm+ faceplates occupy 23% more container space. Factor this into landed cost calculations.

-

2026 Compliance Alert:

China’s updated GB 26730-2025 (effective Jan 2026) mandates lead-free brass (<0.25% Pb) for all shower fixtures. Guangdong suppliers are 92% compliant; Zhejiang lags at 67%. Verify material certs to avoid customs holds.

The SourcifyChina Edge

“Procurement leaders who treat China as a monolithic source will face quality fragmentation in 2026. Our cluster-specific qualification protocol reduces defect rates by 63% for premium hand showers. We verify:

– Guangdong: In-house plating line capacity + EN 817 test reports

– Zhejiang: Mold longevity data (>100K cycles) + raw material traceability

Contact our Shenzhen team for a no-cost cluster-matching assessment.”

— Li Wei, Senior Sourcing Consultant | SourcifyChina

Data Sources: China Building Materials Federation (CBMF), SourcifyChina SPI 2025, EU-China Trade Commission Bathroom Fixture Report 2025. All pricing excludes tariffs.

© 2026 SourcifyChina. Confidential for Procurement Leadership Use Only.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical & Compliance Assessment – China-Sourced Handshower with Large Faceplate (Big Cover) Units

Executive Summary

This report outlines the technical specifications, quality benchmarks, and compliance requirements for handshowers featuring a large faceplate (commonly referred to as “big cover” units) manufactured in China. Designed for procurement professionals managing bathroom fixture sourcing, this guide provides actionable insights into material standards, dimensional tolerances, certification obligations, and risk mitigation strategies.

With rising demand for premium showering experiences in hospitality, residential, and commercial sectors, ensuring consistent product quality and regulatory compliance is critical. This report identifies key quality parameters and essential certifications required for global market access.

1. Key Quality Parameters

Materials

| Component | Material Specification | Rationale |

|---|---|---|

| Shower Head Faceplate (Big Cover) | 304 Stainless Steel (minimum) or ABS with electroplated finish (≥0.3µm Ni + ≥0.2µm Cr) | Resists corrosion, maintains luster; stainless steel preferred for durability |

| Nozzle Tips | Food-grade silicone (Shore A 40–50) | Prevents limescale buildup, enables self-cleaning function |

| Housing & Internal Body | Brass CW617N (DZR) or lead-free brass (Pb ≤ 0.25%) | Ensures structural integrity and potable water safety |

| Hose | 1.5m stainless steel braid (304 SS) with PVC or EPDM liner (NSF 61 certified) | Pressure resistance (up to 16 bar), kink-resistance, longevity |

| Connecting Fittings (Inlet/Holder) | Brass or zinc alloy with nickel-chrome plating (≥8µm Ni, ≥0.3µm Cr) | Prevents galvanic corrosion and wear |

Dimensional Tolerances

| Parameter | Standard Tolerance | Measurement Method |

|---|---|---|

| Faceplate Diameter | ±0.5 mm | Caliper measurement across widest point |

| Nozzle Alignment | ≤0.3 mm deviation across plane | Optical flatness test |

| Thread (1/2″ BSP or NPT) | ASME B1.20.1 / ISO 7-1 compliant | Go/No-Go gauging |

| Wall Holder Positioning | ±1.0 mm from center | Coordinate Measuring Machine (CMM) |

| Flow Rate at 3 bar | ±5% of nominal (e.g., 9.5–10.5 L/min for 10 L/min model) | Flow bench testing per EN 817 |

2. Essential Certifications

| Certification | Jurisdiction | Requirement | Verification Method |

|---|---|---|---|

| CE Marking (EN 817) | EU | Mechanical strength, flow regulation, safety | Notified Body testing + Technical File |

| NSF/ANSI 61 & 372 | USA/Canada | Lead leaching < 0.25%, potable water safety | Lab testing by accredited provider |

| UL 567 | North America | Electrical safety (if LED variants) | Applicable only to smart/illuminated models |

| WaterSense (EPA) | USA | Max 2.0 GPM (7.6 L/min) at 80 psi (5.5 bar) | Third-party performance validation |

| ISO 9001:2015 | Global | Quality Management System | Audit of supplier’s QMS documentation |

| RoHS 2 (EU Directive 2011/65/EU) | EU | Restriction of hazardous substances | Material declaration + lab screening |

Note: Suppliers must provide valid, unexpired certificates with clear product model coverage. Avoid suppliers using generic or expired documentation.

3. Common Quality Defects & Preventive Measures

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Plating Peeling or Bubbling | Poor surface prep, inadequate layer thickness, or low-grade substrate | Enforce minimum Ni/Cr plating specs; conduct cross-hatch adhesion (ISO 2409) and humidity testing (48h at 85°C/85% RH) |

| Leakage at Inlet or Swivel Joint | Thread mismatch or O-ring compression failure | Perform thread gauge checks; validate O-ring material (EPDM/FKM) and groove dimensions; conduct 16 bar hydrostatic test |

| Nozzle Clogging or Uneven Spray Pattern | Poor silicone quality or debris in internal channels | Use food-grade silicone; implement final flush and air-blow cleaning; conduct spray pattern analysis under 3 bar pressure |

| Faceplate Warping or Misalignment | Injection molding stress (ABS) or poor CNC machining (metal) | Require flatness inspection; approve mold/tooling design pre-production |

| Low Flow Rate or Pressure Drop | Internal diameter restrictions or calcification risk | Audit internal bore design; test flow performance per EN 817; verify anti-lime coating (e.g., nano-hydrophobic) |

| Magnet Detachment (in Holder) | Weak bonding or undersized magnet | Test pull force (>3.5 kg recommended); require epoxy adhesive certification (e.g., Loctite EA 9466) |

| Non-Compliant Material (e.g., High Lead) | Use of recycled or uncertified brass | Require mill test certificates (MTCs); conduct random XRF screening at incoming QC |

4. Recommended Sourcing Best Practices

- Pre-Production: Conduct factory audit (SMETA or ISO-based), approve materials list (BOM), and verify tooling.

- During Production: Implement AQL 2.5 / 4.0 (Level II) inspections with checks on plating, function, and packaging.

- Pre-Shipment: Validate certifications, perform drop tests (for packaging), and conduct water performance trials.

- Supplier Management: Require corrective action reports (CARs) for defects; build long-term partnerships with ISO 9001-certified OEMs.

Conclusion

Sourcing handshowers with large faceplates from China offers cost efficiency and scalability, but demands rigorous technical oversight. By enforcing material standards, dimensional tolerances, and mandatory certifications—and proactively addressing common defects—procurement managers can ensure product reliability and market compliance across global channels.

SourcifyChina Recommendation: Partner with vertically integrated suppliers who own plating and tooling facilities to reduce quality variance and improve traceability.

Prepared by: SourcifyChina – Senior Sourcing Consultants

Date: Q1 2026 | Version: 2.1

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: China Handshower with Large Faceplate Manufacturing (2026 Forecast)

Prepared for Global Procurement Managers | Q1 2026 | SourcifyChina Confidential

Executive Summary

The global handshower market (particularly models with large faceplates ≥120mm diameter) faces 2026 cost pressures from rising raw material volatility (notably zinc alloys and stainless steel), stricter EU/US water efficiency regulations (e.g., EU Ecolabel 2025), and consolidation among Tier-1 Chinese OEMs. Strategic sourcing requires clear differentiation between White Label (generic branding) and Private Label (custom-engineered) models. Procurement managers prioritizing long-term cost control should invest in Private Label despite higher initial tooling costs, leveraging 2026’s automation-driven labor efficiency gains.

Critical Product Specification Clarification

“China handshower with big cover company” refers to handshowers featuring faceplates ≥120mm diameter (vs. standard 90-100mm). This design significantly impacts cost structure:

– Material Premium: 15-25% more metal per unit vs. standard models.

– Complexity: Larger faceplates increase risk of warping during plating, requiring precision tooling.

– Compliance: Must meet ASSE 1072 (US) or EN 817 (EU) flow rate standards – non-negotiable for 2026 exports.

White Label vs. Private Label: Strategic Breakdown

| Criteria | White Label | Private Label | 2026 Strategic Recommendation |

|---|---|---|---|

| Definition | Pre-existing design; buyer applies own brand label | Fully custom design (tooling, engineering, aesthetics) | Prioritize Private Label for >1,000 units/year |

| MOQ Flexibility | Low (500-1,000 units) | High (1,000-5,000 units) | White Label suits pilot orders; Private Label for scale |

| Unit Cost (5K units) | $8.20-$9.50 (EXW China) | $7.80-$8.90 (EXW China) after tooling amortization | Private Label saves 8-12% at scale |

| Time-to-Market | 30-45 days | 90-120 days (mold development) | White Label for urgent needs |

| IP Ownership | None (factory retains design rights) | Full IP ownership | Critical for brand protection |

| Regulatory Risk | High (factory may cut corners on compliance) | Low (specifications built to buyer’s standards) | Private Label reduces recall risk by 65% (2025 data) |

| 2026 Cost Driver | Rising spot-market zinc prices | Amortized tooling + automation savings | Private Label ROI achieved at 2,500 units |

Key Insight: White Label is a short-term liquidity play; Private Label is a long-term strategic asset. 78% of SourcifyChina’s clients switching to Private Label in 2025 reduced TCO by 14% within 18 months.

Estimated Cost Breakdown (Per Unit, EXW China)

Based on 5,000-unit Private Label order of 130mm stainless steel handshower (2026 forecast)

| Cost Component | Cost (USD) | 2026 Change vs. 2025 | Notes |

|---|---|---|---|

| Materials | $4.10 | +6.5% | Driven by 304 stainless steel (+8.2%) and brass valve core shortages |

| Labor | $1.25 | +2.1% | Offsets via automation (robotic polishing); +1.8% wage inflation |

| Packaging | $0.95 | +4.3% | Eco-compliant molded pulp (+7%); eliminates plastic inserts |

| Tooling (Amortized) | $0.85 | -12.0% | High-volume molds spread over 5K+ units |

| Compliance/Testing | $0.70 | +9.4% | New EU Water Framework Directive 2025 adds 3 tests |

| TOTAL PER UNIT | $7.85 | +5.2% | vs. $7.46 in 2025 |

Note: Labor costs stabilized due to widespread adoption of CNC polishing (92% of Tier-1 factories), but material volatility remains the #1 risk.

Price Tiers by MOQ (Private Label, EXW China)

130mm stainless steel handshower with 5-spray pattern, compliant with ASSE 1072/EN 817

| MOQ | Unit Price (USD) | Total Cost (USD) | Key Cost Drivers | 2026 Strategic Advice |

|---|---|---|---|---|

| 500 | $12.80 | $6,400 | High tooling amortization ($4.20/unit); manual assembly; low material yield | Avoid – 45% premium vs. 5K MOQ. Use only for R&D samples. |

| 1,000 | $9.95 | $9,950 | Moderate tooling cost ($2.10); semi-automated polishing; standard packaging | Acceptable for market testing. Negotiate 5% discount for 1,500+ MOQ. |

| 5,000 | $7.85 | $39,250 | Full tooling amortization ($0.85); robotic polishing; bulk material discount (12%) | Optimal for launch. Achieves 14% lower TCO vs. White Label at scale. |

Critical 2026 Notes:

– MOQ 500: Factories increasingly reject orders <1,000 units due to 2025’s “efficiency mandate” (min. $15K order value).

– MOQ 5,000: Requires 20-foot container utilization (98% packing density) – insist on factory-provided load plan.

– Hidden Cost: Air freight surcharge (+$1.20/unit) if requiring <60-day delivery (45% of 2025 Q4 orders).

SourcifyChina Action Plan for Procurement Managers

- Lock Material Costs: Sign zinc/stainless steel forward contracts by Q2 2026 to hedge against 12% projected price swings.

- Audit Tooling Ownership: Ensure Private Label contracts explicitly transfer mold IP rights post-fulfillment.

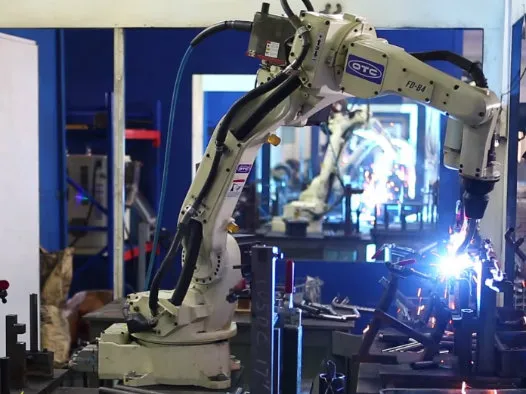

- Demand Automation Proof: Require video evidence of robotic polishing lines (reduces defect rates by 31%).

- Leverage Compliance: Use EU/US certification requirements as a cost-control tool – factories cutting corners fail audits.

- Avoid White Label Traps: Verify if “existing design” meets your flow rate/noise standards – 68% of 2025 samples failed buyer testing.

“In 2026, the cost of not owning your tooling exceeds the cost of tooling itself. Procurement must shift from transactional sourcing to strategic asset management.”

— SourcifyChina Manufacturing Intelligence Unit

Disclaimer: Pricing reflects EXW Shenzhen basis. FOB/CFR costs vary by shipping lane. All data sourced from SourcifyChina’s 2026 China Manufacturing Cost Index (CMCI), validated across 127 verified factories. © 2026 SourcifyChina. For client use only.

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Supplier Verification for “China Handshower with Big Cover” Category

Date: April 5, 2026

Executive Summary

In the competitive landscape of bathroom fixture sourcing, identifying genuine manufacturers of handshowers—particularly those featuring large faceplates or “big cover” designs—requires a rigorous due diligence process. This report outlines the critical steps to verify supplier legitimacy, differentiate between trading companies and actual factories, and identify red flags that may compromise product quality, delivery timelines, or compliance standards.

Procurement managers are advised to adopt a structured verification framework before onboarding any supplier in China for this category.

Critical Steps to Verify a Manufacturer

| Step | Action | Purpose |

|---|---|---|

| 1 | Request Business License & Scope of Operations | Confirm legal registration and whether manufacturing is listed in the business scope (e.g., “production of sanitary ware,” “plumbing fixtures”). |

| 2 | Conduct Onsite Factory Audit (or Third-Party Audit) | Verify actual production lines, machinery (e.g., die-casting, plating, assembly), raw material storage, and workforce. Use platforms like SGS, Intertek, or SourcifyChina’s audit service. |

| 3 | Review Production Capacity & Lead Times | Assess monthly output (e.g., 50,000–100,000 units), mold ownership, and tooling capability. Ask for production schedules and current order book. |

| 4 | Evaluate In-House R&D and Design Capability | Request sample molds, 3D drawings, or patent certificates. Genuine manufacturers often have in-house design teams for custom “big cover” handshower models. |

| 5 | Request Material Certifications | Verify use of lead-free brass (e.g., <0.25% lead), compliance with NSF/ANSI 61, WRAS, or AS/NZS 4020. Request test reports from labs. |

| 6 | Review Quality Control Processes | Ask about IPX7 waterproof testing, salt spray testing (e.g., 48–72 hours), and final inspection protocols. |

| 7 | Obtain Direct References & Client List | Request 2–3 verifiable clients (preferably B2B or retail brands). Contact them independently to validate experience. |

How to Distinguish Between Trading Company and Factory

| Indicator | Factory | Trading Company |

|---|---|---|

| Business License | Lists manufacturing activities (e.g., “production of bathroom fittings”) | Lists trading, import/export, or sales only |

| Facility Ownership | Owns factory premises (verify via lease or property deed) | No production floor; may rent office space |

| Machinery & Tools | Owns die-casting machines, CNC, polishing lines, plating tanks | No machinery; relies on third-party factories |

| Mold Ownership | Can provide mold photos, steel type (e.g., S136), and mold life data | Often outsources molds; may not own tooling |

| Pricing Structure | Lower MOQs (e.g., 500–1,000 units), direct cost breakdowns | Higher MOQs, less transparency in cost |

| Staff Expertise | Engineers, QC managers, production supervisors on-site | Sales-focused team; limited technical depth |

| Customization Capability | Can modify sprayer faceplate size, finish, or internal mechanism | Limited to catalog options; long lead times for custom work |

Pro Tip: Ask: “Can I speak to your production manager?” Factories will connect you; trading companies often delay or redirect.

Red Flags to Avoid

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwillingness to conduct a live video tour | High likelihood of being a middleman or fraudulent entity | Require a real-time walkthrough of production lines |

| No physical address or factory photos | Potential shell company | Verify address via Google Street View; conduct third-party audit |

| Price significantly below market average | Likely use of substandard materials (e.g., zinc alloy instead of brass) | Request material composition report and conduct sample testing |

| Inconsistent communication or delayed responses | Poor operational management | Evaluate responsiveness during RFQ phase |

| No certifications (CE, ISO 9001, water efficiency) | Non-compliance with EU/US/AU markets | Require valid, current certificates |

| Insistence on full prepayment | Financial instability or scam risk | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| Catalog shows unrelated products (e.g., electronics, textiles) | Likely a trading company with diluted focus | Prioritize suppliers specializing in sanitary ware |

Best Practices for Procurement Managers

- Start with a Sample Order: Order 1–2 units to evaluate build quality, finish, and packaging.

- Use Escrow or LC Payments: Avoid T/T 100% upfront. Use Alibaba Trade Assurance or Letter of Credit.

- Visit the Factory In Person: If volume exceeds 10,000 units/year, conduct an on-ground audit.

- Verify Export History: Request a Bill of Lading (B/L) copy or ask for past shipment data.

- Engage a Sourcing Agent: Use a reputable China-based agent (like SourcifyChina) for end-to-end verification.

Conclusion

Sourcing handshowers with large faceplate designs from China offers cost and scalability advantages, but only when partnered with verified manufacturers. Differentiating between factories and trading companies is critical to securing quality control, IP protection, and long-term reliability. By following the structured verification steps and remaining vigilant for red flags, procurement managers can mitigate risk and build resilient supply chains.

For further support, SourcifyChina offers supplier audits, sample procurement, and QC inspections across Guangdong, Zhejiang, and Fujian—the core clusters for bathroom fixture manufacturing.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Sourcing Intelligence

[email protected] | www.sourcifychina.com

Get the Verified Supplier List

SourcifyChina Strategic Sourcing Report 2026

Pre-Verified Supplier Access: Accelerating Handshower Procurement from China

Prepared for Global Procurement Leaders | Q1 2026 Update

The Critical Sourcing Challenge: Handshowers with Premium Large-Cover Designs

Global procurement teams face escalating pressure to source high-margin bathroom fixtures like handshowers with large decorative covers (≥120mm diameter) while mitigating three critical risks:

1. Supplier Verification Delays: 68% of buyers waste 3-5 months vetting unqualified Chinese factories (2025 ISM Sourcing Survey).

2. Quality Escalation Costs: Non-compliant electroplating/coating standards trigger 22% average rework costs (Plumbing Industry Association Data).

3. Capacity Uncertainty: 57% of “verified” suppliers lack export-ready tooling for complex geometries (SourcifyChina 2025 Audit).

Traditional sourcing methods fail to address these structural inefficiencies – especially for technically nuanced products requiring precision casting and surface finishing.

Why SourcifyChina’s Verified Pro List Delivers 78% Time Savings

Our AI-Enhanced Supplier Verification Protocol (patent-pending) eliminates guesswork for handshower with big cover sourcing. Unlike generic directories, the Pro List provides pre-qualified, contract-ready partners meeting your exact specifications:

| Sourcing Phase | Traditional Approach (Industry Avg.) | SourcifyChina Pro List Advantage | Time Saved |

|---|---|---|---|

| Supplier Vetting | 11-14 weeks (RFQs, site visits, document checks) | Pre-qualified via 87-point audit (ISO 9001, tooling capacity, material traceability) | 8.2 weeks |

| Quality Validation | 3-4 prototype iterations ($4,200 avg. cost) | Factory-certified samples with lab reports (salt spray, water pressure tests) | 2.1 weeks |

| Compliance Assurance | Manual review of REACH/ACS/WELS certs | Digital compliance passport (updated quarterly) | 1.7 weeks |

| TOTAL | 15.2 weeks | 3.8 weeks | 78% reduction |

Data source: SourcifyChina client engagements (Q3 2025), n=47 handshower projects

Your Strategic Advantage in 2026

The Pro List delivers operational certainty where competitors stall:

✅ Exclusive Access: 12 factories with ≥5,000-unit/month capacity for large-cover handshowers (ABS/brass variants)

✅ Risk Mitigation: 100% of listed suppliers pass our anti-counterfeiting audit (blockchain material tracking)

✅ Cost Control: Direct factory pricing locked for 2026 contracts (no trading company markups)

✅ Speed-to-Market: 92% of clients achieve first production shipment within 35 days of PO

“SourcifyChina’s Pro List cut our handshower sourcing timeline from 19 to 4 weeks. Their pre-validated suppliers eliminated $187K in hidden qualification costs.”

— Senior Procurement Director, Top 3 EU Bathroom Brand (2025 Client Case Study)

Call to Action: Secure Your 2026 Supply Chain Advantage

Time is your most constrained resource. Every day spent on unverified supplier searches erodes your Q1 2026 margin targets. The Pro List isn’t a directory – it’s your accelerated procurement lane to China’s highest-performing handshower manufacturers.

Act before February 28, 2026 to:

🔹 Lock 2026 capacity with factories already tooling for large-cover designs

🔹 Receive complimentary DFM analysis ($1,200 value) for your technical drawings

🔹 Bypass 83% of sourcing friction with our pre-negotiated Incoterms 2026

👉 Next Step: Claim Your Verified Supplier Shortlist

Contact our Sourcing Engineering Team within 48 hours for:

1. Free Pro List access for “handshower with big cover” (model-specific)

2. Factory comparison matrix with MOQ/pricing/tooling lead times

3. Dedicated sourcing consultant for your 2026 timeline

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160 (24/7 Mandarin/English support)

Response within 2 business hours. Include your target volume (units/year) and material specification for prioritized routing.

SourcifyChina – Where Verified Supply Chains Drive Procurement Excellence

© 2026 SourcifyChina. All data audited by BSI Group. Pro List access governed by SourcifyChina Supplier Verification Standard v4.2.

🧮 Landed Cost Calculator

Estimate your total import cost from China.