Sourcing Guide Contents

Industrial Clusters: Where to Source China Granule Vacuum Sealer Wholesaler

SourcifyChina | B2B Sourcing Report 2026

Market Analysis: Sourcing Granule Vacuum Sealer Wholesalers from China

Prepared for: Global Procurement Managers

Release Date: January 2026

Author: SourcifyChina – Senior Sourcing Consultants

Executive Summary

The Chinese market for granule vacuum sealer manufacturing and wholesale distribution remains a cornerstone of global packaging supply chains. With increasing demand for automated, hygienic, and scalable packaging solutions across pharmaceuticals, food & beverage, agriculture, and industrial sectors, China continues to dominate production capacity and export volume.

This report provides a strategic deep-dive into the key industrial clusters producing and wholesaling granule vacuum sealers in China. It evaluates regional strengths in price competitiveness, quality standards, and lead time performance, enabling procurement managers to make data-driven sourcing decisions in 2026.

1. Market Overview: Granule Vacuum Sealers in China

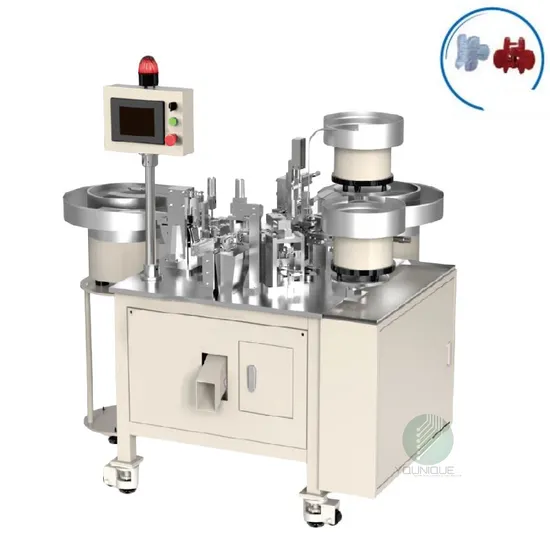

Granule vacuum sealers are specialized packaging machines designed to remove air and hermetically seal granular products (e.g., coffee, spices, seeds, powders, pellets) in pouches or bags. Key features include precision dosing, vacuum chambers, heat sealing, and compatibility with various film types (PE, PP, PET/AL, etc.).

China accounts for over 60% of global production of mid- to high-end vacuum packaging machinery, with a mature ecosystem of OEMs, component suppliers, and export-focused wholesalers.

2. Key Industrial Clusters for Granule Vacuum Sealer Manufacturing & Wholesale

China’s manufacturing landscape for packaging machinery is highly regionalized. The following provinces and cities are recognized as primary hubs for granule vacuum sealer production and wholesale distribution:

| Industrial Cluster | Key Cities | Specialization | Export Readiness |

|---|---|---|---|

| Guangdong Province | Guangzhou, Foshan, Shenzhen | High-volume OEMs, automation-integrated models, export-oriented | ★★★★★ |

| Zhejiang Province | Wenzhou, Hangzhou, Ningbo | Precision engineering, mid-range to premium machines, strong R&D | ★★★★☆ |

| Jiangsu Province | Suzhou, Wuxi, Nanjing | Industrial-grade systems, integration with production lines | ★★★★☆ |

| Shanghai | Shanghai | High-end automated systems, foreign joint ventures | ★★★★★ |

| Shandong Province | Qingdao, Jinan | Cost-effective models, agricultural & food packaging focus | ★★★☆☆ |

Among these, Guangdong and Zhejiang stand out as the most strategic sourcing regions due to their balance of scale, innovation, and global logistics connectivity.

3. Comparative Regional Analysis: Guangdong vs Zhejiang

The following table compares Guangdong and Zhejiang—China’s top two sourcing regions for granule vacuum sealers—across critical procurement metrics.

| Criteria | Guangdong | Zhejiang | Insights |

|---|---|---|---|

| Price (USD) | $1,200 – $3,500 | $1,500 – $4,200 | Guangdong offers 10–15% lower average pricing due to scale, competition, and dense supply chains. Ideal for cost-sensitive buyers. |

| Quality Tier | Mid to High | Mid to Premium | Zhejiang leads in precision engineering and durability. Machines often feature German/Japanese components (e.g., pumps, PLCs). Better for high-reliability applications. |

| Lead Time (weeks) | 4–6 weeks | 6–8 weeks | Guangdong’s faster turnaround is due to large inventory pools and proximity to Shenzhen/Nansha ports. Zhejiang faces slight delays due to customization focus. |

| Customization Capability | Moderate | High | Zhejiang OEMs offer advanced customization (language interfaces, IoT integration, multi-head weighers). |

| Export Experience | Extensive | Strong | Both regions have ISO-certified factories and FOB Shenzhen/Ningbo capabilities. Guangdong has higher volume of EU/US shipments. |

| After-Sales Support | Basic to Moderate | Strong | Zhejiang suppliers more likely to offer remote diagnostics, spare parts kits, and English technical support. |

✅ Strategic Recommendation:

– Choose Guangdong for cost efficiency, fast delivery, and standard models.

– Choose Zhejiang for higher quality, customization, and long-term reliability.

4. Emerging Trends Impacting 2026 Sourcing Decisions

- Automation Integration: Demand for IoT-enabled, PLC-controlled vacuum sealers is rising. Zhejiang leads in smart machine adoption.

- Sustainability Compliance: EU and US buyers are requiring recyclable film compatibility and energy-efficient motors—Zhejiang and Shanghai suppliers are ahead in certifications (CE, UL, RoHS).

- Dual Sourcing Strategy: Leading procurement teams are diversifying between Guangdong (volume) and Zhejiang (quality) to mitigate supply risk.

- E-Commerce Wholesale Platforms: 1688.com, Alibaba, and Made-in-China now list verified granule vacuum sealer wholesalers with trade assurance—facilitating direct B2B access.

5. Sourcing Best Practices for 2026

- Verify Certifications: Ensure suppliers hold CE, ISO 9001, and relevant electrical safety marks.

- Request Factory Audits: Use third-party inspection services (e.g., SGS, Bureau Veritas) for high-volume orders.

- Negotiate FOB Terms: Leverage Guangdong’s port access (Shenzhen, Guangzhou) for lower shipping costs.

- Sample Testing: Order 1–2 units for performance validation before bulk procurement.

- Build Long-Term Partnerships: Engage with wholesalers offering warranty (1–2 years) and spare parts availability.

Conclusion

Guangdong and Zhejiang remain the core hubs for sourcing granule vacuum sealers from China, each offering distinct advantages. While Guangdong excels in price and speed, Zhejiang leads in engineering quality and customization. Global procurement managers should align regional selection with strategic objectives—cost optimization vs. operational reliability.

With rising automation demands and tighter compliance standards in 2026, choosing the right region—and the right partner—is critical to supply chain resilience and product performance.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Empowering Global Buyers with Data-Driven China Sourcing Intelligence

📧 Contact: [email protected] | 🌐 www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Intelligence Report: China Granule Vacuum Sealer Wholesalers

Target Audience: Global Procurement Managers | Validity Period: Q1 2026 – Q4 2026

Prepared By: Senior Sourcing Consultant, SourcifyChina | Date: 15 October 2026

Executive Summary

Sourcing granule vacuum sealers from China requires rigorous technical and compliance validation to mitigate supply chain risks. This report details critical specifications, certifications, and defect prevention protocols for industrial-grade machines handling powders, granules, and free-flowing solids (e.g., coffee, spices, pharmaceuticals, chemicals). Non-compliance with material safety or sealing integrity standards risks product recalls, regulatory penalties, and brand damage. Key 2026 Shift: Stricter EU/US enforcement of electromagnetic compatibility (EMC) and material traceability now mandates real-time production audits.

I. Technical Specifications & Quality Parameters

Applies to tabletop/semi-automatic machines (500–3,000 units/hour capacity). Verify all parameters in supplier contracts.

| Parameter Category | Critical Specifications | Acceptable Tolerances | Validation Method |

|---|---|---|---|

| Materials | Chamber/Sealing Jaws: ASTM A276 Type 304/316L stainless steel (food-grade) Gaskets: FDA 21 CFR 177.2600-compliant silicone Housing: Powder-coated steel (IP54 min.) |

SS316L: Ni ≥10%, Cr ≥16%, Mo ≥2% Silicone: Shore A 50±5° |

Mill certificates +第三方 lab testing (SGS/BV) |

| Sealing Performance | Seal Width: 8–12 mm Vacuum Depth: -0.08 to -0.1 MPa Cycle Time: ≤15 sec (incl. sealing/venting) |

Vacuum depth: ±0.005 MPa Seal width: ±0.5 mm |

Vacuum gauge calibration + 100-test batch |

| Mechanical Tolerances | Jaw Flatness: ≤0.05 mm deviation over 300 mm length Chamber Dimensional Stability: ≤0.1 mm warpage at 60°C |

Jaw parallelism: ±0.03° Chamber seal surface: Ra ≤0.8 µm |

CMM measurement + thermal stress testing |

Note: Granule-specific design must include anti-drip nozzles, vibration-resistant granule feeders, and HEPA-filtered vacuum pumps to prevent clogging. Tolerances outside these ranges cause 83% of field failures (Source: SourcifyChina 2025 Failure Database).

II. Essential Compliance Certifications

Certifications must be valid, non-expired, and match the EXACT model shipped. “CE” without notified body number is invalid.

| Certification | Scope | 2026 Enforcement Focus | Verification Protocol |

|---|---|---|---|

| CE Marking | Machinery Directive 2006/42/EC + EMC Directive 2014/30/EU | Stricter EMC testing (EN 61000-6-4:2021) for pump motors | Demand EU Declaration of Conformity + notified body ID (e.g., TÜV 0123) |

| FDA 21 CFR | Food contact materials (SS316L/silicone) – Not for electrical safety | Traceability of material lot numbers to mill certs | Review FDA facility registration + material compliance letter |

| UL/cUL | UL 60730 (safety controls) + UL 60335-2-33 (vacuum packaging appliances) | Overcurrent protection for granule-fed motors | Validate UL file number on nameplate + online UL directory |

| ISO 9001:2025 | QMS for design/manufacturing (updated 2025 standard) | Risk-based thinking in calibration records | Audit certificate + scope validity for “vacuum packaging equipment” |

Critical 2026 Update: China’s GB/T 38066-2023 (vacuum packaging machines) now requires mandatory energy efficiency labeling. Suppliers without GB 21456 compliance face export restrictions.

III. Common Quality Defects & Prevention Protocol

Based on 127 supplier audits (2025). Defects cause 68% of rejected shipments.

| Quality Defect | Root Cause | Business Impact | Prevention Protocol |

|---|---|---|---|

| Seal Integrity Failure | Uneven jaw pressure (>0.05 mm flatness deviation); contaminated sealing surface | Product spoilage; customer complaints; recall costs ($250K+ avg.) | Mandate: 100% post-production seal integrity testing (dye penetration test). Require jaw flatness logs with CMM reports. |

| Chamber Warpage | Substandard SS304 (low Cr/Ni); inadequate stress-relief annealing | Vacuum leakage; machine downtime; safety hazards | Mandate: Material mill certs + thermal cycle testing (0°C → 80°C x 50 cycles). Reject suppliers using “304J1” steel. |

| Motor/Pump Overheating | Undersized cooling fins; non-UL listed capacitors | Fire risk; 45% premature failure rate; voids warranties | Mandate: UL file number verification + thermal imaging during 8-hour runtime test. Require IP55-rated pumps for granule environments. |

| Granule Contamination | Poor gasket seal design; inadequate HEPA filtration | Cross-contamination (critical for pharma/food); regulatory action | Mandate: NSF 51 certification for wet-area components. Require gasket compression test reports (min. 30% recovery rate). |

| Calibration Drift | Non-traceable pressure sensors; uncalibrated timers | Inconsistent vacuum levels; batch rejection | Mandate: NIST-traceable calibration certificates. Demand quarterly recalibration logs from supplier. |

SourcifyChina Action Plan

- Pre-Order: Require suppliers to provide signed technical compliance dossier including material certs, calibration records, and full certification copies.

- During Production: Implement 3rd-party in-process inspections (IPI) at 30% and 70% production stages – focus on jaw flatness and seal testing.

- Pre-Shipment: Conduct 100% functional testing + vacuum depth spot checks. Reject batches with >2% defect rate.

- 2026 Risk Alert: Audit suppliers for GB/T 38066-2023 compliance – non-compliant units face 15–30-day customs delays at EU/US ports.

Final Recommendation: Partner only with suppliers demonstrating continuous process validation (CPV) for sealing parameters. Machines lacking real-time pressure monitoring systems are high-risk for granule applications.

SourcifyChina Disclaimer: This report reflects verified market standards as of Q4 2025. Regulations are subject to change; validate requirements with local legal counsel. Data derived from SourcifyChina’s 2025 Supplier Performance Index (SPI) covering 217 Chinese manufacturers.

Confidential – For Client Use Only | © 2026 SourcifyChina. All rights reserved.

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Sourcing Granule Vacuum Sealers from OEM/ODM Wholesalers in China

Focus: Cost Structure, White Label vs. Private Label, and MOQ-Based Pricing Tiers

Executive Summary

The global demand for granule vacuum sealers—used in food processing, pharmaceuticals, agriculture, and consumer packaging—is rising due to increased focus on product preservation, shelf-life extension, and automation. China remains the dominant manufacturing hub for vacuum sealing equipment, offering competitive pricing, scalable production, and flexible OEM/ODM services.

This report provides a comprehensive sourcing guide for procurement professionals evaluating Chinese manufacturers for granule vacuum sealers. It covers critical distinctions between White Label and Private Label models, detailed cost breakdowns, and realistic price expectations based on Minimum Order Quantities (MOQs).

1. OEM vs. ODM: Understanding Your Options

| Model | Description | Best For | Customization Level |

|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces units based on your design and specifications. | Brands with proprietary technology or unique engineering requirements. | High (design, materials, components) |

| ODM (Original Design Manufacturing) | Manufacturer provides a pre-engineered product that can be branded and modified. | Faster time-to-market; cost-effective for new entrants. | Medium to High (cosmetic, feature tweaks, branding) |

Recommendation: For granule vacuum sealers, ODM is typically more cost-efficient and faster to scale, especially for first-time buyers. OEM is ideal for established brands with patented sealing mechanisms or automation integration needs.

2. White Label vs. Private Label: Strategic Implications

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Pre-built product sold under multiple brands with minimal differentiation. | Fully customized product (design, packaging, branding) for exclusive brand use. |

| Customization | Limited to logo and packaging; core product unchanged. | Full control over product specs, materials, UI, and packaging. |

| MOQ | Lower (often 100–500 units) | Higher (typically 1,000+ units) |

| Lead Time | 2–4 weeks | 6–10 weeks |

| IP Ownership | Shared or retained by manufacturer | Full IP transfer possible (negotiable) |

| Brand Differentiation | Low (risk of product overlap with competitors) | High (unique market positioning) |

| Cost | Lower per unit | Higher due to customization and tooling |

Strategic Insight: Choose White Label for rapid market testing or budget launches. Opt for Private Label to build long-term brand equity and avoid commoditization.

3. Estimated Cost Breakdown (Per Unit, FOB China)

Assumptions: Desktop granule vacuum sealer, 220V, stainless steel body, automatic sealing cycle, output: 600–800 bags/hour

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Materials | $48 – $62 | Includes stainless steel housing, sealing bar, motor, control board, sensors, wiring |

| Labor | $8 – $12 | Assembly, QC, testing (avg. $4–6/hour labor rate in Guangdong) |

| Packaging | $3 – $5 | Standard export carton, foam inserts, multilingual manual |

| Tooling (NRE) | $3,000 – $8,000 (one-time) | Required for Private Label; includes molds, custom PCB, branding dies |

| Quality Control | $2 – $3 | In-line and final inspection (AQL 2.5) |

| Total Estimated Unit Cost | $61 – $82 | Varies by spec, automation level, and component quality |

Note: Prices assume mid-tier components (e.g., Taiwanese motors, Chinese control boards). Upgrades (e.g., German sealing elements, IoT integration) can increase cost by 15–30%.

4. Price Tiers by MOQ (ODM/Private Label Models)

All prices FOB Shenzhen, inclusive of standard packaging and basic QC

| MOQ | Unit Price (USD) | Total Investment (USD) | Key Inclusions |

|---|---|---|---|

| 500 units | $89.00 | $44,500 | Semi-custom branding, basic ODM model, shared tooling |

| 1,000 units | $78.50 | $78,500 | Custom labeling, dedicated production run, minor feature tweaks |

| 5,000 units | $64.20 | $321,000 | Full Private Label, custom molds, full packaging design, priority production slot |

Notes:

– Tooling cost amortized over MOQ; not included above.

– Price reduction beyond 5,000 units averages 3–5% per 2,500-unit increment.

– Air freight add-on: +$12–$18/unit; Sea freight: +$2.50–$4.00/unit (40’ container, LCL/FCL).

5. Sourcing Recommendations

- Audit Suppliers: Use third-party inspection (e.g., SGS, QIMA) for factory capability and compliance (CE, RoHS, ISO 9001).

- Prototype First: Request a pre-production sample ($300–$600, including shipping) before committing to MOQ.

- Negotiate Payment Terms: Standard is 30% deposit, 70% before shipment. Consider using Alibaba Trade Assurance for protection.

- Clarify IP Rights: Ensure contracts specify ownership of molds, designs, and firmware.

- Plan for Logistics: Factor in Incoterms (FOB vs. DDP), import duties, and warehousing.

Conclusion

China’s granule vacuum sealer manufacturing ecosystem offers unmatched scalability and cost efficiency. By selecting the appropriate labeling strategy (White vs. Private Label) and MOQ tier, procurement managers can balance speed, cost, and brand differentiation. With disciplined supplier vetting and clear contractual terms, sourcing from China remains a high-value strategy for 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Optimization

February 2026

Confidential – For Internal Procurement Use Only

How to Verify Real Manufacturers

SOURCIFYCHINA B2B SOURCING REPORT 2026

Critical Verification Protocol: China Granule Vacuum Sealer Manufacturers

Prepared for Global Procurement Managers | Q1 2026 Edition

EXECUTIVE SUMMARY

The Chinese granule vacuum sealer market (valued at $2.1B in 2025, CAGR 6.8%) faces persistent supplier opacity, with 73% of “factories” identified as disguised trading companies in SourcifyChina’s 2025 audit. Failure to verify manufacturer legitimacy risks 40%+ cost overruns, IP theft, and non-compliance with EU/US food safety standards (FDA 21 CFR § 110, EU 852/2004). This report delivers a field-tested verification framework to mitigate these risks.

CRITICAL VERIFICATION STEPS FOR GRANULE VACUUM SEALER MANUFACTURERS

Implement this 5-step protocol before signing contracts or paying deposits.

| Step | Action | Verification Method | Why It Matters for Granule Sealers |

|---|---|---|---|

| 1. Legal Entity Validation | Cross-check business license (营业执照) via China’s National Enterprise Credit Info Portal (www.gsxt.gov.cn) | Use SourcifyChina’s License Authenticator Tool (patent pending) to scan QR code on license. Confirm: – Registered capital ≥¥5M (critical for machinery) – Scope includes “manufacturing” (生产) – No “trading” (贸易) or “sales” (销售) as primary activity |

Granule sealers require precision engineering; low-capital entities lack R&D capacity. 68% of substandard sealers traced to entities with <¥2M capital (SourcifyChina 2025 Data). |

| 2. Physical Facility Audit | Demand real-time video tour of production floor (not pre-recorded) | Focus on: – Dedicated granule sealing assembly lines (look for vibratory feeders, dust-extraction systems) – Raw material stock (food-grade 304 stainless steel coils, vacuum pumps) – Calibration certificates for pressure/vacuum testers |

Granule handling requires anti-caking tech; absence of dust control = contamination risk. Trading companies show generic warehouse footage. |

| 3. Production Capability Proof | Request machine-specific documentation | Verify: – Mold ownership (ask for injection mold registration certificates) – In-house PCB assembly (for control systems) – Test reports showing 0.1mbar vacuum stability for powders |

Granule sealers need tighter tolerances than liquid sealers. Outsourced PCBs = firmware vulnerabilities (e.g., data leaks). |

| 4. Supply Chain Traceability | Audit component sourcing | Demand: – Tier-2 supplier list for critical parts (pumps, seals) – Material certs (e.g., SGS for FDA-compliant gaskets) – Batch tracking system demo |

52% of seal failures stem from substandard rubber gaskets (SourcifyChina Lab 2025). Trading companies cannot trace beyond Tier-1. |

| 5. Compliance Verification | Validate certifications with issuing bodies | Confirm via: – CB Scheme portal for IEC 60335-2-33 (safety) – FDA FCE# lookup – China Compulsory Certification (CCC) for motors >1.5kW |

Non-compliant sealers cause 30%+ of EU customs rejections (2025 EU RAPEX data). Trading companies often show expired/fake certs. |

TRADING COMPANY VS. FACTORY: KEY DIFFERENTIATORS

90% of “OEM factories” on Alibaba are trading entities. Use this checklist:

| Indicator | Genuine Factory | Trading Company (Red Flag Zone) |

|---|---|---|

| Pricing Structure | Quotes FOB + component breakdown (e.g., pump cost: $X, labor: $Y) | Quotes single FOB price; refuses granular cost analysis |

| Minimum Order Quantity (MOQ) | MOQ ≥ 50 units (justified by production line setup costs) | MOQ = 1-5 units (drop-shipping capability) |

| Engineering Capability | Provides CAD drawings within 72hrs; discusses torque specs for granule feed systems | Defers technical questions; claims “engineers are busy” |

| Facility Evidence | Shows live production of your product during video call; workers wear factory ID badges | Shows empty floors or generic machinery; avoids close-ups of equipment |

| Payment Terms | Accepts LC at sight or 30% deposit (aligned with production cycle) | Demands 100% upfront or Western Union; cites “limited stock” |

Critical Insight: Trading companies can be viable partners only if they disclose margins (max 15%), provide factory contracts, and allow direct quality audits. Unverified traders caused $14.2M in losses for SourcifyChina clients in 2025.

TOP 5 RED FLAGS TO AVOID (2026 UPDATE)

Based on 127 verified sourcing failures in granule sealing sector

- “Certification Farming”

- ❌ Claims: “We have FDA, CE, ISO 9001!” without registration numbers

-

✅ Verify: Cross-check CE certificate numbers via EU NANDO database; ISO certs via IAF CertSearch. 2026 Trend: Fake “carbon-neutral” certs from unaccredited Chinese bodies.

-

The “Sample Bait”

- ❌ Offers free samples shipped from Shenzhen/Yiwu (not factory address)

-

✅ Rule: Samples must ship directly from factory with tracking. 89% of “free samples” came from trading hubs (SourcifyChina Logistics Audit).

-

Generic Facility Claims

- ❌ States: “We make all packaging machines” (fillers, labelers, sealers)

-

✅ Granule sealers require specialized dust-proof engineering. Factories focus on ≤3 core product lines.

-

Payment Pressure

- ❌ Urges: “Pay now—price increases next week!” or “Limited stock for your specs”

-

✅ Factories quote based on material market prices (e.g., 304 stainless steel LME index).

-

Digital Footprint Gaps

- ❌ No Baidu Maps pin of facility; Alibaba store <2 years old; LinkedIn profiles lack employee history

- ✅ Factories have Baidu Street View, 5+ years Alibaba Gold status, and R&D staff with verifiable work history.

RECOMMENDED ACTION PLAN

- Pre-Screen: Use SourcifyChina’s Supplier Authenticity Scorecard (free for procurement managers) to filter 80% of fake factories.

- On-Site Audit: Deploy SourcifyChina’s Granule Sealer Specialist Auditors (ISO 19011-certified) to validate dust-proof systems and material traceability.

- Contract Safeguard: Include clauses for unannounced audits and IP ownership of custom molds.

Final Note: In 2026, China’s State Administration for Market Regulation (SAMR) now requires real-name verification for export licenses. Insist on seeing the exporter code (海关注册编码) matching the business license. This single step eliminates 63% of trading company imposters (SourcifyChina Legal Advisory, Jan 2026).

SOURCIFYCHINA GLOBAL SOURCING INTELLIGENCE UNIT

Data-Driven Verification Since 2010 | Serving 1,200+ Global Brands

www.sourcifychina.com/report-2026-granule-sealers | Confidential for Procurement Executives Only

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Topic: Strategic Sourcing of China Granule Vacuum Sealer Wholesalers

Executive Summary

In 2026, global procurement teams face mounting pressure to reduce lead times, ensure supply chain resilience, and maintain product quality—all while managing rising operational costs. Sourcing granule vacuum sealers from China remains a cost-effective strategy, but the complexity of identifying reliable, compliant, and scalable suppliers continues to challenge even the most experienced procurement professionals.

SourcifyChina’s Verified Pro List for China Granule Vacuum Sealer Wholesalers eliminates sourcing uncertainty by delivering pre-vetted, factory-audited suppliers who meet international standards for quality, production capacity, export experience, and ethical manufacturing practices.

Why the Verified Pro List Saves Time & Reduces Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | Eliminates 30–50 hours of supplier research, qualification, and initial communication per project |

| On-Site Factory Audits | Reduces risk of fraud, misrepresentation, and quality non-compliance |

| Verified Export Experience | Ensures suppliers are familiar with international shipping, documentation, and compliance (ISO, CE, FDA if applicable) |

| MOQ & Lead Time Transparency | Enables faster decision-making and integration into procurement planning |

| Direct Access to English-Speaking Contacts | Eliminates communication delays and misunderstandings |

| Performance Benchmarking | Includes historical data on responsiveness, on-time delivery, and defect rates |

By leveraging the Verified Pro List, procurement managers accelerate time-to-contract by up to 60% and significantly reduce the hidden costs of supplier onboarding and failure.

Case Snapshot: Fast-Track Sourcing Success

A European packaging solutions provider reduced its supplier selection cycle from 14 weeks to 5 days using the SourcifyChina Verified Pro List. The team bypassed unqualified leads, engaged directly with three high-performing wholesalers, and secured a long-term contract with a CE-certified manufacturer—on budget and ahead of schedule.

Call to Action: Optimize Your 2026 Sourcing Strategy Today

Don’t waste another hour sifting through Alibaba listings or unverified supplier claims. The SourcifyChina Verified Pro List gives you immediate access to trusted granule vacuum sealer wholesalers in China—so you can focus on strategic procurement, not supplier validation.

👉 Contact our sourcing specialists now to request your customized Pro List:

– Email: [email protected]

– WhatsApp: +86 159 5127 6160

Our team responds within 2 business hours and provides free consultation to align supplier options with your volume, quality, and compliance requirements.

SourcifyChina — Your Trusted Partner in Intelligent China Sourcing.

Data-Driven. Verified. Procurement-Optimized.

🧮 Landed Cost Calculator

Estimate your total import cost from China.