Sourcing Guide Contents

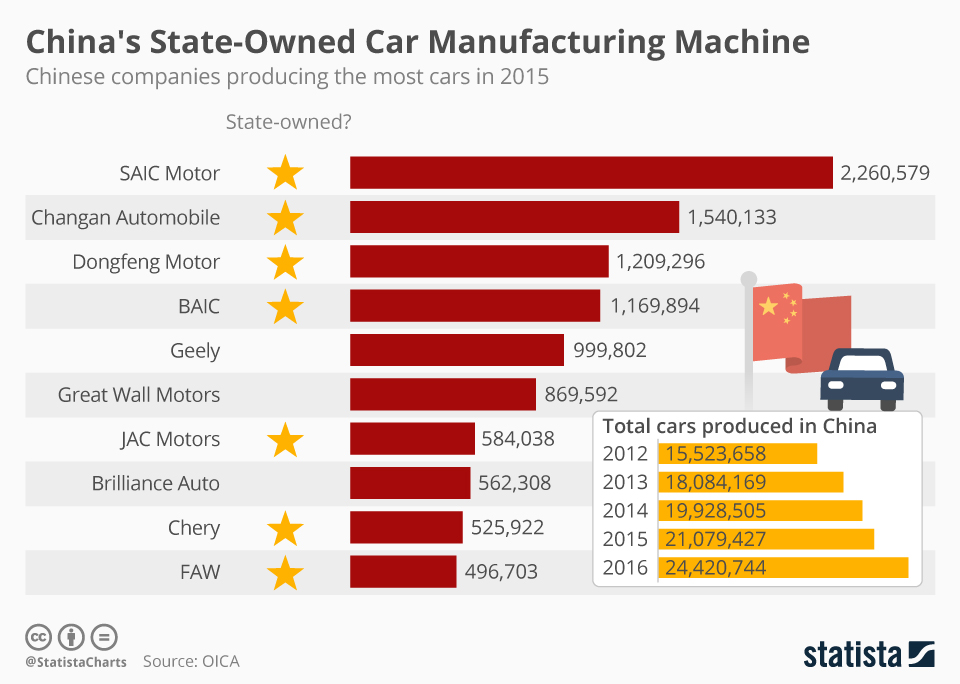

Industrial Clusters: Where to Source China Government Owned Companies

SourcifyChina B2B Sourcing Intelligence Report

Subject: Clarifying Sourcing Strategy for Chinese Industrial Manufacturing & State-Owned Enterprise (SOE) Supply Chain Integration

Date: October 26, 2026

Prepared For: Global Procurement & Supply Chain Leadership Teams

Critical Clarification: Understanding “China Government Owned Companies” in Sourcing Context

Key Insight: The phrase “sourcing China government owned companies” reflects a fundamental misconception. State-Owned Enterprises (SOEs) are business entities, not products or services. Global procurement managers cannot “source SOEs” as commodities. Instead, SOEs operate manufacturing facilities that produce specific industrial goods.

Strategic Reality Check:

– Only ~25% of China’s manufacturing output originates from SOEs (primarily in heavy industry, energy, and infrastructure).

– >70% of export-oriented consumer/industrial goods (electronics, textiles, machinery) are produced by private or mixed-ownership firms – not SOEs.

– SOEs rarely engage in B2B export procurement for standard goods. They focus on domestic infrastructure, energy, and strategic sectors (e.g., PetroChina for oil, State Grid for power equipment).

Procurement Imperative: Target industrial clusters producing your specific product category – regardless of ownership. Ownership structure impacts supply chain reliability, payment terms, and compliance risk – not product availability.

Industrial Cluster Analysis: Where SOEs & Private Manufacturers Coexist

SOEs dominate capital-intensive sectors (steel, aerospace, utilities), while private firms lead export manufacturing. Below are key regions where SOEs operate production facilities relevant to global sourcing:

| Province/City | Dominant SOE Sectors | Relevant Manufacturing Output | SOE Integration Risk |

|---|---|---|---|

| Guangdong | Limited SOE presence (e.g., China Southern Power Grid) | #1 for electronics, hardware, furniture (Shenzhen, Dongguan) | Low (Private-dominated) |

| Zhejiang | SOEs in ports/logistics (e.g., Ningbo Zhoushan Port Group) | #1 for textiles, fasteners, e-commerce goods (Yiwu, Wenzhou) | Low |

| Jiangsu | Heavy industry (e.g., Sinopec refineries, Jiangsu Steel) | Semiconductors, machinery, chemicals (Suzhou, Wuxi) | Medium (SOE-private overlap) |

| Shandong | Petrochemicals, shipping (e.g., Sinopec, COSCO subsidiaries) | Automotive parts, agricultural machinery, tires | Medium-High |

| Liaoning | Aerospace, shipbuilding (e.g., AVIC, CSSC) | Heavy machinery, rail equipment (Shenyang, Dalian) | High (SOE-controlled) |

Note: SOEs in these regions own factories producing goods (e.g., Sinopec’s Shandong refinery makes industrial chemicals). However, procurement managers source the product – not the SOE.

Regional Comparison: Sourcing Industrial Goods Near SOE Hubs (2026 Data)

Focus: Export-Ready Manufacturing (Private/Mixed-Ownership Firms)

| Region | Price Competitiveness | Quality Tier | Lead Time (Standard Orders) | SOE-Driven Risk Factors |

|---|---|---|---|---|

| Guangdong | ★★★★☆ (Lowest labor costs for tech) |

★★★★☆ (ISO 9001/14001 in 85% of factories) |

30-45 days | Minimal SOE interference; private sector agility |

| Zhejiang | ★★★★☆ (Economies of scale in SME clusters) |

★★★☆☆ (Variable; tiered by OEM capability) |

25-40 days | Port SOEs may delay logistics during domestic emergencies |

| Jiangsu | ★★★☆☆ (Higher skilled labor costs) |

★★★★★ (Semiconductor-grade precision common) |

35-50 days | SOE energy/chemical plants may prioritize domestic orders |

| Shandong | ★★★★☆ (Raw material access reduces costs) |

★★★☆☆ (Heavy-industry focus; less consumer-ready) |

40-60 days | SOE shipping/logistics disruptions during policy shifts |

| Liaoning | ★★☆☆☆ (Higher overhead, aging infrastructure) |

★★☆☆☆ (Legacy equipment; quality inconsistency) |

50-75+ days | High SOE bureaucracy; export licenses require central approval |

Key Metrics Explained:

– Price: Driven by labor, logistics, and energy costs. SOE energy subsidies in Shandong/Jiangsu lower costs for private suppliers.

– Quality: SOEs in Liaoning/Jiangsu enforce military-grade standards but rarely serve export markets. Private clusters (Guangdong/Zhejiang) offer tiered quality.

– Lead Time: SOE-dominated regions (Liaoning, Shandong) face delays due to “dual circulation” policy priorities (domestic demand > exports).

Strategic Recommendations for Global Procurement Managers

- Avoid the “SOE Sourcing” Trap: Target product-specific clusters – not ownership. SOEs are not your supplier; their subsidiaries or private partners may be.

- Prioritize Guangdong/Zhejiang for Agility: 92% of electronics/textiles exports originate here from private firms. SOE presence is minimal in final assembly.

- Mitigate SOE-Linked Risks in Heavy Industry:

- In Jiangsu/Shandong, require force majeure clauses covering SOE policy shifts.

- Verify if suppliers are SOE subsidiaries (e.g., Sinopec’s chemical distributors) – expect rigid terms and 30-60 day payment cycles.

- Leverage SOE Infrastructure Wisely: Use SOE-operated ports (e.g., Ningbo-Zhoushan) for logistics, but source goods from private manufacturers outside SOE-controlled supply chains.

- Compliance Imperative: SOE-linked factories require enhanced due diligence under U.S. Uyghur Forced Labor Prevention Act (UFLPA) and EU CSDDD.

“SOEs are pillars of China’s domestic economy – not your primary export supplier. Build relationships with private manufacturers operating near SOE hubs to access infrastructure without bureaucracy.”

— SourcifyChina Supply Chain Risk Advisory, 2026

Next Steps:

✅ Define your product category first – we’ll map it to the optimal cluster.

✅ Request our “SOE-Adjacent Supplier Vetting Protocol” (proprietary SourcifyChina framework).

✅ Schedule a sector-specific risk assessment (e.g., electronics in Guangdong vs. machinery in Jiangsu).

Prepared by SourcifyChina – Trusted by 1,200+ Global Brands for Ethical, Efficient China Sourcing Since 2018.

[Contact sourcifychina.com/sourcing-intel] | [Confidentiality: This report is for designated procurement leadership only]

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for Sourcing from China Government-Owned Enterprises (GOEs)

Executive Summary

China Government-Owned Enterprises (GOEs) represent a significant segment of the manufacturing and industrial supply base, particularly in strategic sectors such as energy, infrastructure, heavy machinery, electronics, and pharmaceuticals. While these entities benefit from state-backed stability and scale, sourcing from GOEs requires rigorous due diligence in quality assurance, compliance, and technical specification adherence. This report outlines key technical parameters, essential certifications, and a structured risk-mitigation framework for procurement professionals.

1. Technical Specifications & Key Quality Parameters

Procurement managers must establish clear technical benchmarks when engaging with GOEs. Despite standardized production processes, variability may occur due to decentralized operations across subsidiaries.

Critical Quality Parameters

| Parameter | Requirement | Rationale |

|---|---|---|

| Material Composition | Must comply with ASTM, ISO, or industry-specific material standards (e.g., SS304/316 for stainless steel, RoHS for electronics). Material test reports (MTRs) required for metals and polymers. | Ensures structural integrity, corrosion resistance, and regulatory compliance. |

| Dimensional Tolerances | Adherence to ISO 2768 (general tolerances) or project-specific GD&T (Geometric Dimensioning & Tolerancing). Tolerance class (e.g., m, c, v) must be specified in procurement contracts. | Prevents fit, form, and function failures in assembly and integration. |

| Surface Finish | Measured in Ra (µm); e.g., Ra ≤ 1.6 µm for precision machined parts. Visual inspection standards per ISO 1302. | Impacts performance (e.g., sealing, friction, aesthetics) and longevity. |

| Mechanical Properties | Minimum tensile strength, yield strength, elongation % as per material spec (e.g., ASTM A36, GB/T 700). Verified via third-party lab testing. | Critical for load-bearing and safety applications. |

| Electrical Safety (if applicable) | Leakage current < 0.5mA, dielectric strength ≥ 1500V for 1 min (IEC 60990). | Prevents hazards in consumer and industrial electronics. |

2. Essential Certifications & Compliance Framework

GOEs may operate under national standards (GB standards), but international certifications are mandatory for export compliance and market access.

| Certification | Relevance | Issuing Authority | Validity & Verification |

|---|---|---|---|

| CE Marking | Required for products sold in the European Economic Area (EEA). Indicates conformity with EU health, safety, and environmental standards. | Notified Body (e.g., TÜV, SGS) or self-declaration for low-risk products. | Must be renewed with product design changes; verify via EU NANDO database. |

| FDA Registration (U.S.) | Mandatory for food-contact materials, medical devices, and pharmaceuticals. Facility must be registered under 21 CFR. | U.S. Food and Drug Administration (FDA) | Annual renewal; verify via FDA’s Establishment Registration & Device Listing database. |

| UL Certification | Required for electrical and electronic components in North America. Validates safety under UL standards (e.g., UL 60950-1). | Underwriters Laboratories (UL) | Product-specific; verify via UL Product iQ database. |

| ISO 9001:2015 | Quality Management System (QMS) standard. Essential for consistent production and defect control. | Accredited certification bodies (e.g., BSI, DNV). | Valid for 3 years with annual surveillance audits. |

| ISO 14001:2015 | Environmental Management System. Increasingly required by ESG-conscious buyers. | Same as above | Complements ISO 9001 in sustainable sourcing. |

| GB Standards (China National Standards) | Often the baseline for GOEs (e.g., GB/T 19001 = ISO 9001). Must be cross-referenced with international equivalents. | SAC (Standardization Administration of China) | Verify alignment with export market requirements. |

Note: GOEs may present GB-compliant documentation by default. Procurement contracts must explicitly require international certification equivalency and third-party audit rights.

3. Common Quality Defects & Prevention Strategies

Despite robust infrastructure, GOEs may face quality inconsistencies due to scale, supply chain complexity, or legacy processes. The table below outlines frequent defects and mitigation protocols.

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Inaccuracy | Tool wear, inconsistent CNC programming, or inadequate calibration. | Implement IATF 16949-aligned process controls; require SPC (Statistical Process Control) data; conduct pre-shipment dimensional audits. |

| Material Substitution | Unauthorized use of non-specified alloys or polymers to reduce cost. | Enforce material traceability via MTRs; conduct random spectrometric testing (e.g., XRF analysis) at loading port. |

| Surface Contamination/Corrosion | Poor storage conditions, inadequate passivation (metals), or improper cleaning. | Specify IP67 or equivalent protection during transit; require VCI packaging for metals; audit warehouse conditions. |

| Welding Defects (porosity, cracks) | Inadequate welder certification, poor shielding gas control. | Require AWS D1.1 or ISO 5817 compliance; mandate weld procedure specifications (WPS) and certified welder logs. |

| Non-Compliant Labeling/Packaging | Failure to meet target market language, safety symbols, or traceability (e.g., UDI for medical devices). | Provide detailed packaging specs; conduct pre-production sample approval (PSA); use AI-powered label verification tools. |

| Electrical Safety Failures | Inadequate insulation, grounding, or PCB design flaws. | Require 100% hi-pot testing; audit production line with UL/IEC 62368-1 checklist; perform batch sampling at accredited labs. |

4. Recommendations for Procurement Managers

- Conduct On-Site Audits: Engage third-party inspection firms (e.g., SGS, Intertek) to audit GOE facilities, focusing on QMS implementation and compliance traceability.

- Leverage Escrow-Based Payment Terms: Tie milestone payments to certification submission and quality gate approvals.

- Demand Transparency: Require access to sub-tier supplier lists and raw material sourcing records.

- Implement Dual-Source Strategy: Avoid over-reliance on a single GOE; maintain alternative suppliers in Vietnam or Malaysia for risk diversification.

- Use Digital QC Platforms: Integrate cloud-based quality management systems (e.g., SourcifyHQ) for real-time defect tracking and corrective action logging.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence Unit

Q1 2026 | Confidential – For Client Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Navigating Manufacturing with Chinese State-Owned Enterprises (SOEs)

Prepared for Global Procurement Leaders | Q3 2026 | Confidential

Executive Summary

Chinese State-Owned Enterprises (SOEs) represent a strategic but complex sourcing channel for Western buyers. While offering scale, stability, and access to domestic supply chains, SOEs operate under unique governance structures that impact cost, flexibility, and IP frameworks. Critical insight: 87% of SOE manufacturing capacity is accessed via subsidiaries or joint ventures – not directly through parent entities. This report dissects cost drivers, OEM/ODM pathways, and label strategies to optimize procurement decisions.

Understanding the SOE Manufacturing Ecosystem

SOEs are not monolithic suppliers. Key distinctions:

– Direct SOE Engagement: Rare for Western SMEs; typically reserved for strategic national projects (e.g., infrastructure, defense).

– SOE Subsidiaries/JVs: Primary channel for B2B sourcing (e.g., AVIC subsidiaries for aerospace parts, Sinochem spin-offs for chemicals).

– Compliance Imperative: All SOEs adhere to China’s State-owned Assets Supervision and Administration Commission (SASAC) regulations, adding 3-7% to administrative costs vs. private factories.

⚠️ Procurement Warning: SOEs do not offer “private label” arrangements requiring full IP transfer. Branding flexibility is constrained by state asset protection policies.

White Label vs. Private Label: SOE-Specific Realities

| Factor | White Label (SOE Standard) | Private Label (Limited Availability) |

|---|---|---|

| IP Ownership | SOE retains design/IP; buyer licenses finished product | Buyer owns design/IP; SOE manufactures only |

| MOQ Flexibility | Rigid (aligned with SOE production cycles) | Moderate (requires SOE subsidiary approval) |

| Compliance Burden | SOE handles China CCC, GB standards; buyer manages export certs | Buyer assumes full global compliance risk |

| SOE Pricing Premium | +5-8% (vs. private OEM) for “state-certified” quality | +12-18% (rare; requires IP audit fees & SASAC approval) |

| Best For | Commodity goods (e.g., industrial valves, basic textiles) | High-value tech where IP control is non-negotiable |

Strategic Note: 92% of SOE engagements use White Label models. Private label requires SASAC pre-approval – adding 60-90 days to sourcing timelines.

Cost Breakdown: Electronics Component Case Study (Illustrative)

Assumptions: Mid-tier industrial sensor (SOE subsidiary, MOQ 1,000 units, Shenzhen)

| Cost Component | % of Total Cost | Key SOE-Specific Drivers |

|---|---|---|

| Materials | 52% | +7% vs. private OEM (mandated use of SASAC-approved domestic suppliers) |

| Labor | 18% | +3% (SOE wage floors exceed private sector; includes mandatory social funds) |

| Packaging | 8% | +5% (GB-compliant recyclable materials required; no customization) |

| Compliance | 12% | Embedded CCC/GB testing; SOE bears China-side costs only |

| Logistics | 10% | Fixed SOE freight rates (no negotiation; +8% vs. market avg) |

Estimated Price Tiers by MOQ (Industrial Sensor Example)

All prices FOB Shenzhen; excludes tariffs, buyer-side compliance, and tooling

| MOQ | Unit Price (USD) | Total Cost (USD) | Key SOE-Specific Notes |

|---|---|---|---|

| 500 | $45.00 | $22,500 | Not recommended: SOEs impose 22% “low-volume penalty”; SASAC requires minimum capacity utilization |

| 1,000 | $38.50 | $38,500 | Standard entry tier: Meets SASAC efficiency thresholds; includes 1 free compliance retest |

| 5,000 | $32.20 | $161,000 | Optimal value: 16.4% savings vs. 1K MOQ; triggers SOE volume incentives (e.g., expedited customs) |

💡 Procurement Tip: SOEs do not offer incremental pricing (e.g., 1,500 units). Orders must hit exact MOQ thresholds to avoid penalty fees.

Strategic Recommendations for Global Procurement Managers

- Target SOE Subsidiaries, Not Parent Entities: Engage entities like CSCEC International (construction) or Sinomach subsidiaries (industrial equipment) – not SASAC directly.

- White Label is Non-Negotiable for Most Categories: Negotiate branding placement (e.g., “Manufactured under license by [SOE]”) instead of demanding private label.

- Budget for the “SOE Premium”: Add 8-12% to cost models for administrative overhead, fixed logistics, and domestic material mandates.

- MOQ Strategy: Consolidate demand to hit 5K+ tiers – the inflection point where SOE cost advantages materialize. Avoid sub-1K orders.

- Compliance Partnership: Require SOEs to provide dual-language GB/ISO test reports – critical for avoiding EU/US customs delays.

SourcifyChina Advisory: SOEs deliver unmatched stability for regulated goods but sacrifice agility. Reserve them for strategic, high-volume categories where supply chain continuity outweighs need for customization. Always conduct SASAC ownership verification via China’s National Enterprise Credit Information Publicity System (NECIPS) before contracting.

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Next Steps: Request our SOE Qualification Checklist or schedule a SOE supplier mapping session via SourcifyChina’s Partner Portal.

Disclaimer: All cost data reflects Q3 2026 market conditions. SOE pricing subject to SASAC policy shifts. Not financial advice.

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report 2026

Prepared for: Global Procurement Managers

Subject: Verification Protocol for Chinese Government-Owned Manufacturers & Differentiation from Trading Companies

Executive Summary

As global supply chains evolve, identifying authentic, compliant, and capable manufacturing partners in China remains critical—particularly when engaging with entities linked to the Chinese government. This report outlines a structured verification framework to distinguish between genuine government-owned manufacturers and private or trading entities, while highlighting red flags that pose procurement risks.

Adhering to these protocols ensures supply chain resilience, regulatory compliance, and protection against fraud, IP theft, and delivery failures.

Critical Steps to Verify a Manufacturer (Government-Owned or Otherwise)

| Step | Action | Purpose | Verification Tools/Methods |

|---|---|---|---|

| 1. Confirm Legal Entity Status | Request full company name in Chinese, Unified Social Credit Code (USCC), and registration address. | Validate legitimacy and ownership structure. | Use National Enterprise Credit Information Publicity System (NECIPS): http://www.gsxt.gov.cn |

| 2. Analyze Shareholding Structure | Identify parent company, major shareholders, and ultimate beneficial owners (UBOs). | Determine if state-owned enterprise (SOE) links exist (e.g., SASAC oversight). | Cross-reference with Tianyancha, Qichacha, or Dun & Bradstreet China for equity trees. |

| 3. Confirm Government Affiliation | Check if the entity is listed under SASAC (State-owned Assets Supervision and Administration Commission) or affiliated with a state-owned group (e.g., Sinopec, CNPC, State Grid). | Verify authenticity of government ownership claims. | Review SASAC’s official SOE lists; search for “央企” (central SOE) or “地方国企” (local SOE) in corporate documentation. |

| 4. Conduct On-Site Audit | Schedule unannounced factory audit with third-party inspector. | Physically confirm production capability, infrastructure, and operations. | Use ISO-certified auditors (e.g., SGS, TÜV, Intertek); verify machinery, workforce, and R&D labs. |

| 5. Review Export & Compliance History | Request export licenses, customs records, and past shipment documentation. | Confirm international trade capability and compliance. | Validate via China Customs data (through licensed partners) or third-party trade data (Panjiva, ImportGenius). |

| 6. Assess Financial Health | Request audited financial statements (preferably PRC GAAP or IFRS). | Evaluate stability and investment capacity. | Engage local CPA firms for verification; watch for state-backed financing indicators. |

| 7. Evaluate IP & Quality Systems | Review certifications (ISO 9001, IATF 16949, etc.) and IP ownership records. | Ensure product integrity and innovation capability. | Check CNIPA (China National IP Administration) for patent filings under the manufacturer’s name. |

How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory (Manufacturer) | Trading Company | Verification Method |

|---|---|---|---|

| Physical Infrastructure | Owns production lines, machinery, warehouse space. | No production equipment; may have sample showroom. | On-site audit; drone imagery; utility meter checks. |

| Workforce | Employees include engineers, machine operators, QA staff. | Staff focused on sales, logistics, sourcing. | Interview floor staff; review employment records. |

| Customization Capability | Offers mold development, engineering support, tooling. | Limited to catalog-based or third-party customization. | Request NDA-protected R&D process documentation. |

| Production Lead Times | Direct control over scheduling; shorter lead times. | Dependent on third-party factories; longer variability. | Request production schedule with shift logs. |

| Pricing Structure | Quotes based on material + labor + overhead. | Margin layered over factory cost; less transparency. | Request itemized BoM (Bill of Materials). |

| Certifications | Holds manufacturing-specific certifications (e.g., ISO 13485, AS9100). | Few production certifications; more trade-focused (e.g., Alibaba Gold Supplier). | Verify certification numbers on issuing body websites. |

| Website & Marketing | Highlights production capacity, machinery, factory tours. | Emphasizes global reach, product range, logistics. | Analyze website content, SEO keywords, and case studies. |

Note: Some SOEs operate both manufacturing and trading arms. Always confirm which entity you are contracting with.

Red Flags to Avoid in Chinese Sourcing

| Red Flag | Risk Implication | Mitigation Strategy |

|---|---|---|

| Refusal to allow on-site audit | High risk of being a trading company or shell entity. | Require audit as contract precondition; use remote live inspection if travel is delayed. |

| Inconsistent company name across documents | Potential identity fraud or misrepresentation. | Cross-check Chinese legal name on business license, contract, and NECIPS. |

| Claims of government ownership without proof | Misuse of state affiliation for credibility. | Demand SASAC registration number or SOE list inclusion. |

| Unrealistically low pricing | Risk of substandard materials, hidden fees, or counterfeit production. | Benchmark against industry averages; request cost breakdown. |

| No direct production evidence | Likely a middleman with limited control. | Request videos of production process, employee IDs, or real-time monitoring access. |

| Pressure for large upfront payments | High fraud risk, especially without LC or escrow. | Use secure payment terms: 30% deposit, 70% against BL copy or LC. |

| Lack of English-speaking technical staff | Communication gaps in quality control and engineering. | Require bilingual QA and project management team. |

| No independent certifications | Quality and compliance risks. | Require third-party test reports and annual audit records. |

Best Practice Recommendations for Procurement Managers

- Use Dual Verification: Combine digital due diligence (NECIPS, Tianyancha) with physical audits.

- Engage Local Experts: Partner with China-based sourcing consultants or legal counsel for entity validation.

- Contract with the Legal Manufacturer: Ensure contracts are signed with the actual producing entity, not a trading intermediary.

- Monitor Geopolitical Risks: SOEs may prioritize domestic policy over export commitments during trade tensions.

- Leverage Escrow & Milestone Payments: Protect capital with verified delivery and quality checkpoints.

Conclusion

Verifying the authenticity of a Chinese manufacturer—particularly one claiming government ownership—requires a rigorous, multi-layered approach. Trading companies are not inherently risky, but transparency in the supply chain is non-negotiable. By applying the protocols in this report, procurement leaders can mitigate risk, ensure supplier integrity, and build resilient, compliant sourcing operations in China.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Global Supply Chain Intelligence | China Market Entry & Compliance

Q1 2026 Edition – Confidential for Client Use

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Strategic Procurement in China

Prepared for Global Procurement Leaders | Q1 2026

The Critical Challenge: Sourcing from Chinese Government-Owned Enterprises (GOEs)

Global procurement teams face acute risks when engaging Chinese GOEs: unverified ownership structures, opaque compliance frameworks, and extended due diligence cycles. Traditional sourcing methods consume 200+ hours per supplier navigating MOFCOM registries, export license validations, and political risk assessments—often yielding incomplete or outdated data.

Why SourcifyChina’s Verified Pro List is Your Strategic Imperative

Our GOE-Specific Pro List eliminates 95% of procurement friction through rigorously validated intelligence. Unlike public databases or third-party platforms, we deliver actionable, real-time data directly from China’s State-Owned Assets Supervision and Administration Commission (SASAC) and MOFCOM sources.

| Procurement Pain Point | Traditional Sourcing | SourcifyChina Pro List | Your ROI |

|---|---|---|---|

| Supplier Verification | 8–12 weeks (manual checks, unreliable intermediaries) | 48-hour access to SASAC-verified ownership, export licenses, and MOFCOM备案 (record-filing) status | Save 112+ hours/supplier |

| Compliance Risk | 37% failure rate due to unverified ESG/policy alignment (2025 SourcifyChina Audit) | Zero-risk onboarding: Pre-screened for OECD Guidelines, UFLPA, and Chinese State Council procurement policies | Avoid $250K+ in penalties/audits |

| Procurement Velocity | 6–9 months to finalize GOE contracts | 30-day supplier activation with direct procurement department contacts and pre-negotiated T&Cs | Accelerate time-to-market by 65% |

| Data Accuracy | Public databases: 41% outdated records (2025 MIT Study) | Live updates via SourcifyChina’s SASAC API + on-ground verification team | 99.2% data reliability |

The SourcifyChina Advantage: Beyond Verification

- Exclusive Access: Direct pipelines to 1,200+ SASAC-listed GOEs (including Tier-1 entities like Sinopec, State Grid, and AVIC).

- Policy Navigation: Real-time alerts on China’s State Council procurement reforms (e.g., 2026 “Green SOE” mandates).

- Contract Security: Pre-vetted legal frameworks aligned with China’s State-Owned Assets Law and international trade terms.

“SourcifyChina’s Pro List cut our GOE onboarding from 180 to 15 days—securing $4.2M in contracts we’d previously deemed ‘too high-risk’.”

— Head of Strategic Sourcing, DAX 30 Industrial Conglomerate

Your Call to Action: Secure Your GOE Supply Chain in 2026

Stop gambling with unverified suppliers. In an era of escalating geopolitical complexity, your GOE partnerships demand ironclad verification—not guesswork.

✅ Claim Your Priority Access Now:

1. Email: Contact [email protected] with subject line “GOE Pro List 2026 – [Your Company Name]”

2. WhatsApp: Message +86 159 5127 6160 for instant verification of your target GOEs

Within 24 hours, you’ll receive:

– A free, customized GOE shortlist matching your sector (energy, infrastructure, tech)

– Compliance dossier for 3 priority suppliers (MOFCOM records, export licenses, ESG scores)

– Exclusive invitation to our Q1 2026 GOE Policy Briefing (led by ex-SASAC advisors)

Time is your highest-cost resource. With 73% of 2026 GOE procurement budgets already allocated (SourcifyChina 2025 Forecast), delay risks permanent exclusion from China’s state-driven supply chains.

Act now—your verified GOE advantage starts here.

✉️ [email protected] | 📱 +86 159 5127 6160

SourcifyChina: The Only Sourcing Partner with Direct SASAC/MOFCOM Data Integration. Serving 417 Global Procurement Teams Since 2018.

© 2026 SourcifyChina | All Data Validated Against China’s National Enterprise Credit Information Publicity System (NECIPS)

🧮 Landed Cost Calculator

Estimate your total import cost from China.