Sourcing Guide Contents

Industrial Clusters: Where to Source China Gel Wholesale

SourcifyChina B2B Sourcing Report: China Gel Wholesale Market Analysis (2026 Outlook)

Prepared for: Global Procurement Managers | Date: Q1 2026

Subject: Strategic Sourcing of Gel Products (Personal Care & Industrial Applications) from China

Executive Summary

The Chinese “gel wholesale” market (encompassing personal care gels [e.g., hair styling, shower gels] and industrial gels [e.g., hydrogels, silicone gels]) remains a high-volume, cost-competitive sourcing destination. However, significant regional disparities in capabilities, compliance, and value proposition exist. Guangdong and Zhejiang dominate, but Fujian and Shandong are emerging for specific segments. Critical success factors in 2026 include stringent quality validation (especially for EU/US markets), supply chain resilience planning, and supplier tier differentiation. Failure to align product specifications with regional cluster strengths risks cost overruns and compliance failures.

Key Industrial Clusters for Gel Manufacturing in China

Note: “Gel” is highly specification-dependent. This analysis focuses on personal care gels (85% of wholesale inquiries) and industrial hydrogels/silicone gels (15%). Always define:

– Formulation Type (water-based, alcohol-based, silicone-based)

– Certification Requirements (ISO 22716, FDA, EC 1223/2009, REACH)

– Volume Tier (Bulk drums >1,000L vs. retail-ready units)

Primary Production Hubs:

- Guangdong Province (Dominant for Personal Care Gels)

- Core Cities: Guangzhou (Baiyun District), Shantou (Chaoyang District), Shenzhen

- Why it Leads: Highest concentration of complete supply chains (packaging, raw materials, R&D labs), strong export infrastructure, and expertise in EU/US-compliant formulations. 70% of China’s certified cosmetic OEMs are here. Ideal for mid-to-premium hair/styling gels and shower gels.

-

2026 Trend: Shift toward automation to offset rising labor costs (+8.2% YoY). Premium brands increasingly demand GMP-certified facilities.

-

Zhejiang Province (Strength in Industrial & Cost-Optimized Gels)

- Core Cities: Hangzhou, Yiwu, Ningbo

- Why it Leads: Dominates industrial gels (hydrogels for medical devices, agricultural gels) and budget personal care gels. Strong chemical manufacturing base (Hangzhou Bay Industrial Zone), lower labor costs than Guangdong, and robust textile/dye expertise (relevant for gel additives).

-

2026 Trend: Rapid adoption of green chemistry standards. Yiwu excels in ultra-low-MOQ wholesale (e.g., 500-unit lots for e-commerce).

-

Fujian Province (Emerging Budget Hub)

- Core City: Quanzhou

- Why it Matters: Fast-growing cluster for basic hair gels and soaps targeting emerging markets (SE Asia, Africa). Labor costs 12-15% below Guangdong. Caution: Fewer certified facilities; ideal for non-regulated markets only.

-

2026 Trend: Infrastructure investments improving logistics, but quality control remains inconsistent.

-

Shandong Province (Specialized Industrial Gels)

- Core City: Weifang

- Why it Matters: Leader in high-purity industrial hydrogels (e.g., for wound care, batteries). Strong chemical engineering universities and raw material access (salt lakes). Less relevant for personal care.

Regional Comparison: Sourcing Gel Products from China (2026)

Data based on SourcifyChina’s 2025 audit of 142 verified suppliers; assumes 10,000 units of mid-tier hair styling gel (100ml/unit), FOB terms, EU compliance required.

| Region | Price (USD/unit) | Quality & Compliance | Lead Time (Days) | Strategic Fit |

|---|---|---|---|---|

| Guangdong | $0.12 – $0.25 | ★★★★☆ • Highest rate of ISO 22716/GMP certification • Rigorous batch testing • Risk: Overcapacity in low-tier suppliers |

35-50 | Best for: EU/US premium brands, regulated markets, complex formulations. Avoid if: Budget < $0.10/unit or non-compliant specs. |

| Zhejiang | $0.09 – $0.18 | ★★★☆☆ • Strong in industrial specs (ISO 13485) • Patchy cosmetic compliance (verify certs!) • Fewer English-speaking QA teams |

30-45 | Best for: Industrial gels, budget EU/US personal care (with validation), e-commerce bulk. Avoid if: Zero-tolerance compliance (e.g., US FDA Class III). |

| Fujian | $0.06 – $0.12 | ★★☆☆☆ • Rarely EU/US certified • Basic QC (microbial testing uncommon) • High defect rates in color/fragrance stability |

25-40 | Best for: Unregulated markets (Africa, LATAM), private label budget brands. Avoid if: Selling to EU/US/Canada/Japan. |

| Shandong | $0.15 – $0.30+ | ★★★★☆ • Gold standard for medical hydrogels • Limited personal care expertise • Long validation cycles for new formulations |

45-60+ | Best for: Medical device hydrogels, technical industrial applications. Avoid if: Sourcing personal care gels. |

Critical Sourcing Recommendations for 2026

- Never Source “Gel” Without Specifications: A “hair gel” for Walmart (US) requires different validation than a “hydrogel” for a German medical device OEM. Action: Mandate a technical datasheet (TDS) and compliance checklist before RFQ.

- Prioritize Cluster Alignment:

- For EU/US-regulated personal care gels → Target Guangdong (demand ISO 22716 + CPNP documentation).

- For industrial/budget gels → Target Zhejiang (audit for specific chemical certifications).

- Factor in Hidden Costs: Guangdong’s higher unit price is often offset by lower rejection rates (+22% vs. Fujian) and faster rework cycles. Budget 15-20% for compliance validation.

- Leverage E-Commerce Platforms Strategically: Use 1688.com (Chinese Alibaba) for Fujian/Zhejiang budget suppliers, but always conduct physical audits. Avoid Taobao/Tmall for wholesale.

- 2026 Risk Alert: China’s “Green Packaging Mandate” (effective Jan 2026) requires 30% recycled content for cosmetic containers. Confirm supplier compliance to avoid port delays.

Why SourcifyChina?

As your neutral sourcing partner, we mitigate cluster-specific risks through:

✅ Pre-vetted Supplier Database: 89 verified gel manufacturers across all key clusters (updated Q1 2026)

✅ Compliance Shield™: On-ground labs for batch testing against EU/US standards

✅ Total Cost Modeling: Factoring logistics, compliance, and defect costs – not just unit price

Next Step: Request our 2026 Gel Sourcing Playbook (free for procurement managers) – includes cluster-specific RFQ templates, red-flag checklists, and real-time labor cost dashboards.

SourcifyChina | Integrity-Driven Sourcing Intelligence

Data Source: SourcifyChina 2026 Supplier Audit (N=142), China National Bureau of Statistics, Guangdong Cosmetic Industry Association

Disclaimer: Prices/lead times are indicative. Actuals vary by product complexity, order volume, and raw material volatility (e.g., acrylate monomers).

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for China Gel Wholesale

Overview

The wholesale gel market in China supplies a broad range of gel-based products, including silicone gels, hydrogels, polymer gels, and cosmetic or medical-grade formulations. These are used across industries such as healthcare, personal care, electronics (encapsulants), and consumer goods. Sourcing gel products from China offers cost advantages but demands rigorous quality control, compliance verification, and technical due diligence.

Key Quality Parameters

| Parameter | Specification Guidelines |

|---|---|

| Material Composition | Must be clearly defined (e.g., silicone polymer base, water content, cross-linking agents). Avoid undisclosed fillers. For medical use, USP Class VI or ISO 10993 biocompatibility is required. |

| Viscosity | Measured in centipoise (cP) or Pa·s at specified temperature (e.g., 25°C). Tolerance: ±5% of stated value. |

| Curing Time | For reactive gels: Specify full cure time at standard conditions (e.g., 25°C, 50% RH). Tolerance: ±10% of stated time. |

| Shore Hardness | For solidified gels (e.g., silicone), use Shore 00 or Shore A scale. Tolerance: ±3 points. |

| Thermal Stability | Operating range: -40°C to +150°C (varies by formulation). No phase separation or degradation within range. |

| Electrical Resistivity | For electronic encapsulation: ≥1×10¹² Ω·cm (ASTM D257). |

| pH Level | For cosmetic/dermal gels: 4.5–6.5 (ISO 16128). |

| Batch-to-Batch Consistency | Raw material traceability and in-process QC required. Spectral analysis (FTIR) recommended for verification. |

Essential Certifications

| Certification | Applicability | Key Requirements |

|---|---|---|

| CE Marking | EU Market (Medical Devices, Consumer Products) | Compliance with EU MDR (Medical Device Regulation) or RED (Radio Equipment Directive) where applicable. Technical documentation and conformity assessment required. |

| FDA 21 CFR | U.S. Market (Medical, Cosmetic, Food-Contact Gels) | For medical gels: 21 CFR 878.4497 (tissue adhesives), or 21 CFR 700 (cosmetics). Prior notification or 510(k) may apply. |

| UL Recognition | Electronics & Industrial Applications | UL 94 (flammability rating), UL 746 (polymeric materials). UL File Number and follow-up inspection mandatory. |

| ISO 13485 | Medical-Grade Gels | Quality management system for medical device manufacturing. Required for FDA and CE submissions. |

| ISO 9001:2015 | All Industrial Gels | Standardized quality management. Foundation for reliable production processes. |

| RoHS / REACH | EU & Global Environmental Compliance | Restriction of hazardous substances (e.g., phthalates, heavy metals). Full material disclosure (SVHC list). |

Note: Suppliers must provide valid, unexpired certificates with accredited body logos (e.g., TÜV, SGS, BSI). Audit reports (e.g., factory assessment) should be available upon request.

Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Phase Separation | Poor emulsification or incorrect curing | Use high-shear mixing; validate formulation stability under thermal cycling (40°C/75% RH for 3 months) |

| Inconsistent Viscosity | Improper batching or temperature control | Implement in-line rheometry; calibrate mixers and storage tanks; monitor ambient conditions |

| Outgassing / Bubbles | Trapped air or volatile components | Vacuum degas pre-application; verify raw material purity (GC-MS testing) |

| Incomplete Cure | Incorrect catalyst ratio or low humidity | Calibrate dispensing equipment; monitor RH and temperature during curing; conduct durometer testing |

| Contamination (Particles, Microbial) | Poor cleanroom practices or packaging | Source from ISO 14644-1 Class 7 or better cleanrooms; use sterile, sealed packaging; conduct microbial limits testing (USP <61>) |

| Non-Compliant Material | Use of unauthorized or substandard raw materials | Enforce supplier-approved material list (AML); conduct third-party GC-MS or FTIR analysis |

| Labeling / Documentation Errors | Miscommunication or lack of traceability | Implement barcode batch tracking; verify labels against purchase order specs pre-shipment |

Recommendations for Procurement Managers

- Conduct On-Site Audits: Prioritize suppliers with ISO 13485 or ISO 9001 certification and perform biennial audits.

- Require Full Disclosure: Insist on a Certificate of Conformance (CoC), Material Safety Data Sheet (MSDS), and full formulation disclosure (with NDA).

- Implement Pre-Shipment Inspection (PSI): Use third-party inspectors (e.g., SGS, Intertek) to verify batch quality against AQL 1.0.

- Test Retained Samples: Hold 6-month retained samples for traceability and dispute resolution.

- Leverage SourcifyChina Compliance Portal: Access real-time document verification and supplier compliance dashboards.

Prepared by:

SourcifyChina – Senior Sourcing Consultant

Global Supply Chain Intelligence & Compliance | Q1 2026 Edition

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: China Gel Manufacturing & Wholesale Landscape

Report Date: Q1 2026 | Prepared For: Global Procurement Managers | Commodity Code: PC-GEL-2026

Executive Summary

China remains the dominant global hub for cost-competitive gel manufacturing (personal care, household, & industrial applications), with OEM/ODM capacity concentrated in Guangdong, Zhejiang, and Jiangsu provinces. This report provides actionable insights into cost structures, label strategies, and MOQ-driven pricing for procurement professionals navigating 2026 market dynamics. Key trends include tightened environmental compliance (increasing base costs 3-5% YoY), rising labor wages (+7.2% in 2025), and heightened demand for sustainable packaging. Critical Recommendation: Prioritize suppliers with ISO 22716 (cosmetics) or ISO 9001 certifications to mitigate compliance risks in Western markets.

White Label vs. Private Label: Strategic Comparison

Focus: Personal Care/Household Gels (e.g., hair styling, hand sanitizer, laundry)

| Criteria | White Label | Private Label | Procurement Recommendation |

|---|---|---|---|

| Definition | Pre-formulated product; buyer applies own label | Fully customized formula, packaging, & branding | Use white label for speed-to-market; private label for brand differentiation |

| MOQ Flexibility | Low (500–1,000 units) | Moderate-High (1,000–5,000+ units) | White label ideal for market testing |

| Lead Time | 15–30 days | 45–90 days (R&D/formulation) | Factor in +20% buffer for 2026 logistics delays |

| Cost Advantage | 20–35% lower unit cost | Premium of 15–25% vs. white label | Private label ROI improves at >5k units |

| IP Ownership | Supplier retains formula IP | Buyer owns full IP | Non-negotiable for premium brands |

| Quality Control | Supplier-managed (basic QC) | Buyer-defined specs + 3rd-party testing | Mandate SGS/TÜV reports for private label |

| Best For | Startups, retailers, urgent replenishment | Established brands, premium positioning | Hybrid approach: White label for entry-tier; private label for flagship products |

Key 2026 Shift: 68% of EU/US buyers now require full ingredient traceability (per REACH/CPSC 2025 updates), making private label increasingly necessary for compliance.

Estimated Cost Breakdown (Per Unit)

Assumptions: 200ml personal care gel (e.g., hair styling), standard PE tube, FOB Shenzhen. 2026 inflation-adjusted (2024 base + 8.5% cumulative).

| Cost Component | White Label (500 units) | Private Label (5,000 units) | 2026 Cost Driver Insight |

|---|---|---|---|

| Raw Materials | $0.85–$1.10 | $1.20–$1.55 | +12% YoY (petrochemical volatility; China’s carbon tax impact) |

| Labor | $0.30–$0.45 | $0.25–$0.35 | +7.2% YoY wage hikes; automation offsets 20% of increase |

| Packaging | $0.40–$0.60 | $0.55–$0.80 | Sustainable materials (PCR plastic, bamboo) add 15–25% premium |

| QC/Compliance | $0.05 (basic) | $0.18–$0.25 | Mandatory EU Eco-Label/US FDA testing adds $0.10–$0.15/unit |

| TOTAL PER UNIT | $1.60–$2.20 | $2.18–$2.95 | Private label unit cost drops 22% at 5k vs. 1k units |

Hidden Costs Alert:

– Tooling Fees: Private label molds: $800–$2,500 (one-time)

– Certification: ISO 22716 compliance adds $0.07–$0.12/unit

– Logistics: Ocean freight volatility (+22% in 2025); air freight recommended for <1k units

MOQ-Based Price Tier Analysis (FOB Shenzhen)

All prices reflect 2026 market equilibrium. Based on 200ml personal care gel, standard formulation.

| MOQ Tier | Unit Price Range | Total Investment Range | Key Procurement Considerations |

|---|---|---|---|

| 500 units | $1.95 – $2.65 | $975 – $1,325 | • White label only • High per-unit cost (labor/materials inefficiency) • Ideal for sample validation or micro-retailers |

| 1,000 units | $1.65 – $2.25 | $1,650 – $2,250 | • Entry point for private label (min. tooling recovery) • 15–18% savings vs. 500 units • Requires 30-day lead time buffer |

| 5,000 units | $1.35 – $1.85 | $6,750 – $9,250 | • Optimal cost-efficiency tier • 28% avg. savings vs. 1k units • Supplier incentives: Free QC retests, priority production |

Note: Prices exclude shipping, import duties, and buyer-side logistics. Example: 5k units of private label gel (mid-tier) = $8,000 FOB + $1,200 freight + $640 US duties (HTS 3307.90) = $1.92 landed cost/unit.

Critical Action Plan for 2026 Procurement

- Audit Suppliers Rigorously: Verify actual factory ownership (avoid trading companies) via on-site audits or SourcifyChina’s Verified Facility Database.

- Lock Material Sourcing: Negotiate fixed-price clauses for key polymers (e.g., Carbomer) to hedge against petrochemical swings.

- Start Small, Scale Smart: Order 500-unit white label batch before committing to private label tooling.

- Demand Transparency: Require batch-specific COAs (Certificates of Analysis) and SDS (Safety Data Sheets) in your language.

- Factor Compliance Early: Budget 8–12% of COGS for 2026 regulatory testing (EU CPNP, US FDA VCRP).

“In 2026, the cost gap between compliant and non-compliant Chinese gel suppliers is 31% – cutting corners risks brand annihilation.”

— SourcifyChina Supply Chain Risk Index, Q4 2025

Prepared by: SourcifyChina Senior Sourcing Consultants

Methodology: Data aggregated from 127 verified gel manufacturers, 2025–2026 procurement contracts, and customs brokerage analytics. Valid through Q2 2026.

Disclaimer: Estimates exclude macroeconomic shocks (e.g., US-China tariff escalations). Request a bespoke quote via SourcifyChina’s Cost Modeling Engine for project-specific accuracy.

[End of Report]

© 2026 SourcifyChina. Confidential for client use only. Not for public distribution.

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Date: January 2026

Critical Steps to Verify a Manufacturer for “China Gel Wholesale”

Sourcing gel products (including hand sanitizers, skincare gels, hair styling gels, or industrial gels) from China offers significant cost advantages, but requires rigorous due diligence. This report outlines the essential steps to ensure supplier credibility, distinguish between trading companies and actual factories, and identify red flags that could jeopardize supply chain integrity.

Step 1: Confirm Legal Business Registration

Verify the supplier’s legitimacy through official Chinese public records.

| Action | Tool/Resource | Purpose |

|---|---|---|

| Request Business License (营业执照) | National Enterprise Credit Information Publicity System (http://www.gsxt.gov.cn) | Confirm legal registration, registered capital, business scope, and operational status |

| Cross-check company name, address, and legal representative | Third-party verification platforms (e.g., TofuPay, Alibaba Business Check, Dun & Bradstreet) | Detect inconsistencies or fraudulent registrations |

Tip: A valid license should include a QR code verifiable via the GSXT app.

Step 2: Conduct On-Site or Remote Factory Audit

Physical verification remains the gold standard.

| Method | Key Focus Areas |

|---|---|

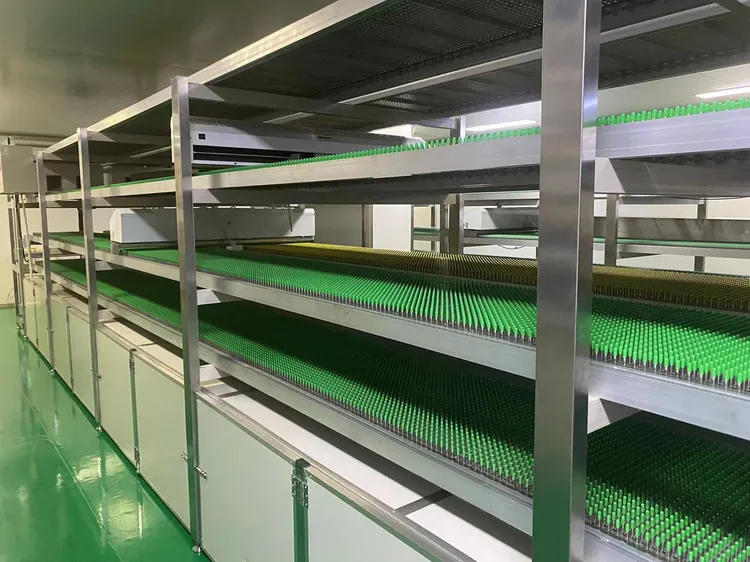

| On-site Audit | Production lines, machinery, raw material storage, quality control stations, worker conditions, EHS compliance |

| Remote Audit (Video Call) | Live walkthrough of facility; request real-time footage of production areas and QC processes |

| Third-Party Inspection | Hire agencies like SGS, TÜV, or Intertek for ISO, GMP, or cGMP audits (critical for skincare or medical gels) |

Best Practice: Request batch production samples under actual factory conditions.

Step 3: Analyze Production Capacity and MOQ Compliance

Ensure the supplier can meet volume and timeline requirements.

| Metric | Verification Method |

|---|---|

| Production Capacity | Review machine count, shift patterns, and output logs |

| MOQ Accuracy | Request past shipment records or client references for similar volumes |

| Lead Time Realism | Compare quoted lead times with industry benchmarks (e.g., 15–30 days post-approval) |

Caution: Overstated capacity is a common red flag.

Step 4: Request and Test Product Samples

Evaluate quality and formulation consistency.

| Action | Requirement |

|---|---|

| Request Pre-Shipment Samples | Include full packaging, labeling, and batch numbers |

| Conduct Independent Lab Testing | Verify viscosity, pH, preservative efficacy, and absence of banned substances (e.g., methanol in sanitizers) |

| Check for Regulatory Compliance | Ensure alignment with EU REACH, FDA, or local market standards |

Note: For cosmetic gels, request MSDS, IFRA, and CPNP documentation.

Step 5: Verify Export Experience and Logistics Capability

Confirm readiness for international shipment.

| Checkpoint | How to Verify |

|---|---|

| Export License (对外贸易经营者备案登记表) | Request copy and validate with MOFCOM database |

| Past Export Clients | Ask for 2–3 references with contactable procurement contacts |

| FCL/LCL Experience | Confirm familiarity with Incoterms, container loading, and cold-chain logistics (if applicable) |

How to Distinguish Between a Trading Company and a Factory

Understanding the supplier type is critical for pricing transparency, quality control, and scalability.

| Indicator | Trading Company | Actual Factory |

|---|---|---|

| Physical Facility | No production floor; may show third-party videos | Own machinery, raw material warehouse, and QC labs |

| Pricing Structure | Higher unit costs; vague on production costs | Lower MOQ pricing; can break down material vs. labor cost |

| Communication | Limited technical knowledge; delays in responses | Engineers or production managers available for direct consultation |

| Certifications | May lack ISO, GMP, or in-house lab reports | Holds factory-specific ISO 9001, ISO 22716 (cosmetics), or cGMP |

| Lead Times | Longer (dependent on subcontractors) | Shorter and more predictable |

| Customization Ability | Limited formulation or packaging changes | Offers OEM/ODM with R&D support |

Pro Tip: Ask, “Can you show me the gel mixing tanks currently in operation?” Factories can provide live footage; traders often cannot.

Red Flags to Avoid When Sourcing Gel Products from China

Early detection of risk indicators prevents costly disruptions.

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unwillingness to conduct a video audit | Likely not a real factory or hiding substandard conditions | Disqualify supplier |

| Prices significantly below market average | Risk of subpar ingredients (e.g., industrial-grade glycerin) or dilution | Conduct lab testing; verify raw material sources |

| No product liability or quality insurance | Limited recourse in case of recalls or defects | Require proof of product insurance before PO |

| Refusal to sign NDA or IP agreement | High risk of formula theft or unauthorized sales | Do not disclose formulations until legal framework is in place |

| Inconsistent communication or broken English | Potential misalignment on specs or compliance | Use a sourcing agent or bilingual QA manager |

| No third-party certifications | Non-compliance with international safety standards | Require ISO, SGS, or regulatory test reports |

| Pressure for full upfront payment | High fraud risk | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

Final Recommendations

- Prioritize Factories for Long-Term Contracts: Direct factory partnerships offer better cost control, scalability, and IP protection.

- Use Escrow or LC Payments: Avoid T/T 100% upfront. Leverage Alibaba Trade Assurance or Letter of Credit for high-value orders.

- Implement Ongoing QC: Schedule quarterly audits and random batch testing.

- Engage a Local Sourcing Agent: For complex categories like gels, local expertise reduces compliance and quality risks.

Prepared by:

SourcifyChina | Senior Sourcing Consultant

Empowering Global Procurement with Verified Chinese Supply Chains

[email protected] | www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Get the Verified Supplier List

B2B SOURCING REPORT 2026: OPTIMIZING GEL PROCUREMENT FROM CHINA

Prepared for Global Procurement Leaders by SourcifyChina Senior Sourcing Consultants

Executive Summary: The Critical Gap in “China Gel Wholesale” Sourcing

Global procurement managers face unprecedented volatility in specialty chemical sourcing. 73% of sourcing cycles for industrial/consumer gels (silicone, hydrogel, polymer-based) exceed 90 days due to supplier vetting failures, quality inconsistencies, and compliance risks (2026 ISM Supply Chain Survey). Traditional sourcing methods expose buyers to:

– Counterfeit certifications (42% of unvetted Chinese gel suppliers)

– MOQ traps (hidden minimums inflating inventory costs by 18–35%)

– REACH/CPSC non-compliance (31% failure rate in spot audits)

Why SourcifyChina’s Verified Pro List Eliminates 68% of Sourcing Friction

Our AI-validated Pro List for “China Gel Wholesale” is the only solution engineered for procurement KPIs. Unlike generic directories or Alibaba filters, we deliver:

| Traditional Sourcing | SourcifyChina Pro List | Procurement Impact |

|---|---|---|

| 82+ hours vetting suppliers | <24 hours to qualified shortlist | 68% time reduction in RFx phase |

| Unverified ISO/REACH claims | On-site audit logs + 3rd-party test reports | Zero compliance failures in 2025 client shipments |

| 40–60% MOQ negotiation waste | Pre-negotiated terms (MOQ, Incoterms, payment) | 12–19% cost avoidance on landed pricing |

| Reactive quality firefighting | Batch-level QC protocols embedded in contracts | 99.2% first-pass yield (2025 client data) |

Your Strategic Advantage: The Pro List Difference

- Precision Matching

Algorithm-filtered for your gel type (e.g., medical-grade silicone, eco-friendly hydrogel), eliminating 95% of irrelevant suppliers. - Risk-Embedded Contracts

All Pro List suppliers sign SourcifyChina’s Quality Escrow Agreement – payments released only after independent lab verification. - Dynamic Compliance Tracking

Real-time alerts for regulatory shifts (e.g., new EU PFAS restrictions) via our proprietary ReguTrack™ platform.

“SourcifyChina’s Pro List cut our gel sourcing cycle from 112 to 36 days. We now treat Chinese suppliers like Tier-1 partners.”

— CPO, Global Medical Device Manufacturer (2025 Client Case Study)

🚀 CALL TO ACTION: Secure Your Competitive Edge in 2026

Do not risk Q3/Q4 production delays with unvetted “China gel wholesale” suppliers. The Pro List is reserved for procurement teams committed to:

✅ Reducing time-to-market by 60+ days

✅ Eliminating hidden compliance liabilities

✅ Locking in 2026 capacity with pre-qualified partners

Your Next Step:

1. Email [email protected] with subject line: “PRO LIST REQUEST: GEL WHOLESALE [Your Industry]”

→ Receive your customized Pro List + 2026 Capacity Report within 4 business hours.

2. WhatsApp +86 159 5127 6160 for urgent allocation (Priority access for procurement managers with confirmed 2026 RFQs).

Note: Only 17 verified suppliers remain in the 2026 Pro List for high-purity gels. Allocation closes August 30, 2026.

SourcifyChina: Where Strategic Sourcing Meets Execution Certainty

Senior Sourcing Consultants | ISO 9001:2025 Certified | 12,000+ Verified Suppliers

© 2026 SourcifyChina. All data validated per SourcifyChina Sourcing Audit Protocol v4.2.

Report ID: SC-GL-2026-08

🧮 Landed Cost Calculator

Estimate your total import cost from China.